Industry News

National Alliance of Commercial Loan Brokers LLC Back in Roglieri’s Hands

February 5, 2026The United States Bankruptcy Court ordered the Roglieri Estate return its interest in the National Alliance of Commercial Loan Brokers LLC back to Roglieri himself. The order was dated January 30, 2026. That interest includes all the assets and liabilities attached to the National Alliance of Commercial Loan Brokers LLC. The Trustee’s reasoning was that management over the business had become burdensome to the Roglieri Estate.

Nearly two years ago, Roglieri declared in a bankruptcy filing that National Alliance of Commercial Loan Brokers LLC (often referred to as NACLB) was valued at $1 million.

Roglieri is currently imprisoned at the Rensselaer County Correctional Facility. He pleaded guilty to wire fraud conspiracy this past November. His sentencing hearing is scheduled for March 11 and he is facing up to 20 years in prison.

Several Businesses that Belonged to Kris Roglieri Are Being Returned to Him for Free

January 30, 2026A United States Bankruptcy Court has ordered that the following businesses be released from the bankruptcy estate of Kris Roglieri and returned to Roglieri:

- National Alliance of Commercial Loan Brokers

- Commercial Capital Training Group

- Digital Marketing Training Group

- FUPME, LLC

- Shark Ventures LLC

The order is dated today, 1/30/26. The trustee’s reasoning for release is that the continued retention of these non-debtor interests are burdensome to the estate.

For full disclosure, the parent company of deBanked, Raharney Capital, LLC, had made a bid for two of the above entities and/or assets but withdrew it after the Trustee placed conditions on a sale that it would not agree to. Raharney Capital had also previously won the auction conducted for the Commercial Capital Training Group trademark but the sale was rescinded by the Trustee after claiming it had been auctioned off in error. The trademark (not the business) for National Alliance of Commercial Loan Brokers was apparently successfully sold off to a third party.

Roglieri had claimed in a March 22, 2024 bankruptcy declaration that the National Alliance of Commercial Loan Brokers business was valued at $1 million and that the Commercial Capital Training Group business was valued at $500,000. His interest in those businesses are now being returned to him by the Trustee at no cost.

Roglieri is currently imprisoned at the Rensselaer County Correctional Facility. He pleaded guilty to wire fraud conspiracy this past November. His sentencing hearing is scheduled for March 11 and he is facing up to 20 years in prison.

deBanked MIAMI on Track for Record Event

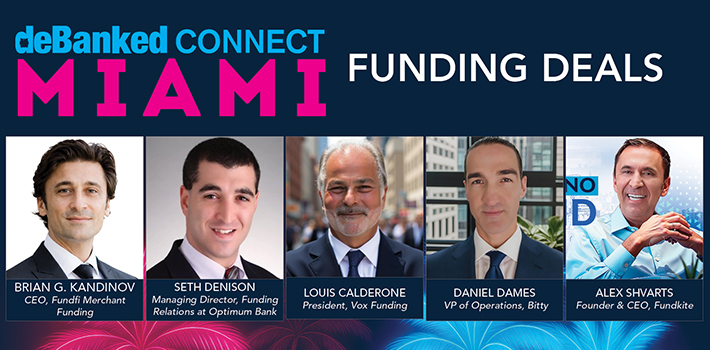

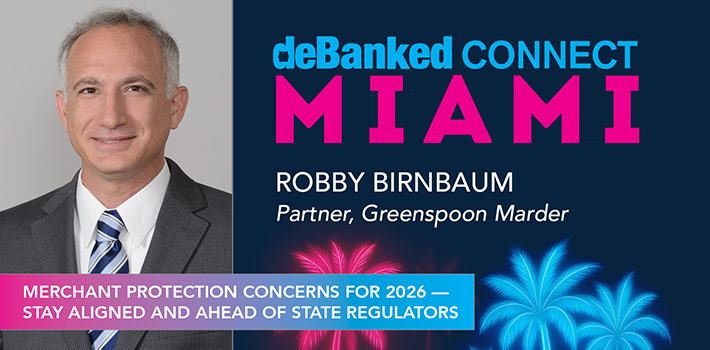

January 29, 2026deBanked CONNECT MIAMI 2026 taking place on February 12 at the Fontainebleau in Miami Beach is currently on pace for deBanked’s largest event turnout in history. If you were on the fence about going, this is the event to go to if you work in or with the small business finance industry. Due to capacity, registration could shut off in advance of the event so be sure to have your tickets already. You can REGISTER HERE.

Becoming a Successful Broker

January 22, 2026ARE YOU READY FOR DEBANKED CONNECT MIAMI 2026?!

Check out the full agenda for February 12th at the Fontainebleau.

There will also be tech demos happening non-stop on the show floor. This event is one you won’t want to miss.

REGISTER BEFORE IT’S TOO LATE.

deBanked’s Top Stories of 2025

December 31, 2025With deBanked having closed out its 15th year (WHOA) of being online, it appears that merchant cash advance content still dominates in views. I know this because these were the top five most read stories of 2025:

#1 – Texas Passed an MCA ACH Prohibition

Without a perfected first position, Texas no longer allows commercial sales-based financing providers to automatically ACH debit a merchant’s bank account.

See: Texas Governor Signs Sales-Based Financing ACH Prohibition Into Law

#2 – Ban on Refinancing MCAs With SBAs

The world took note when the SBA stated that: “merchant cash advances and factoring agreements are not eligible for refinancing for Standard 7(a) loans, 7(a) Small loans, SBA Express loans, Export Express loans, and International Trade loans.”

See: SBA Places Restrictions on Use of Proceeds to Refinance Merchant Cash Advances and Factoring Agreements

#3 – The CFPB Proposed Removing MCAs From Section 1071

After years of preparing for a world in which MCAs would be subject to CFPB small business loan data collection rules, the agency proposed taking MCAs out.

See: CFPB Reverses Course: Now Proposes to Remove Merchant Cash Advances from Section 1071 Rule

#4 – Getting Backdoored? Try This Watermark

One of the biggest stories of 2025 was a proposed solution to the backdooring problem.

See: Getting Backdoored? Put Your Mark on the Docs

# 5- New California Law Goes into Effect on January 1, 2026

This story was posted at the very end of the year and yet managed to secure a place as the 5th most read story on deBanked in 2025. Is the industry ready for this new law???

See: Brokers and Funders – Are You Ready for Changes to California Law Effective January 1, 2026?

Indictment in the Small Business Finance Industry’s “Long Running Mysterious Fraud”

December 22, 2025 There has been a major break in the case of the industry’s Long Running Mysterious Fraud, an indictment. Less than a year after deBanked ran a story about a sophisticated scheme employed to steal millions from merchants, funders, and lenders through a network of stolen identities and cryptocurrency exchanges, a criminal complaint was quietly filed under seal on February 24, 2025 against an individual named Saul Shalev with addresses in Brooklyn and Israel. He is currently thirty-six years old. On August 20, 2025 that complaint progressed to a sealed indictment and on October 3, 2025 all the filings were finally made public.

There has been a major break in the case of the industry’s Long Running Mysterious Fraud, an indictment. Less than a year after deBanked ran a story about a sophisticated scheme employed to steal millions from merchants, funders, and lenders through a network of stolen identities and cryptocurrency exchanges, a criminal complaint was quietly filed under seal on February 24, 2025 against an individual named Saul Shalev with addresses in Brooklyn and Israel. He is currently thirty-six years old. On August 20, 2025 that complaint progressed to a sealed indictment and on October 3, 2025 all the filings were finally made public.

Shalev may still be at large. He has dual American/Israeli passports. The original criminal complaint states that he traveled to Israel in February 2019 and had not returned to the United States since. IP addresses, email accounts, and other internet data were used by law enforcement in its investigation. The criminal complaint says that the scheme was still going on earlier this year and that more than 25 victims of the scheme have already been identified.

Shalev, who is innocent until proven guilty, is charged with Wire Fraud, Money Laundering, Aggravated Identity Theft, and Aiding and Abetting.

Success and Lessons Learned From Small Business Finance Industry Vets

December 11, 2025 “In October, the company did $23 million+ and it was our best month ever,” says Eddie DeAngelis, founder and CEO of QualiFi, a full-service business loan brokerage.

“In October, the company did $23 million+ and it was our best month ever,” says Eddie DeAngelis, founder and CEO of QualiFi, a full-service business loan brokerage.

Talk to anyone in the industry and it always seems to be their best month, quarter, or year, but that’s just happenstance since those same people will also tell you—if they’ve been in it long enough—that success is not a straight shot up. They’ll also say that success is defined on their own terms, not by other people’s measures.

In DeAngelis’ case, for example, the origination figure, which comprised a mixture of LOCs, term loans, HELOCs, SBAs, and equipment financing, is all the more celebratory because the company accomplished it with just 13 funding reps at the time.

“It just shows how efficient our business model is,” DeAngelis says, “so that’s the number that I’m really proud of, which is 13 reps.”

Jared Weitz, CEO of United Capital Source, a small business finance marketplace, had a similar perspective, sharing that at one point he had 27 employees and now operates with 17—but the 17 are producing the same output as the 27.

“Ten less people, less expenses, same numbers, higher net margin and profit,” Weitz says. He explained that he spent time dissecting his P&L, structures, and systems to maximize efficiencies to get where he wants to be.

“I’ve always viewed it as ‘am I profitable every year?’” Weitz says. “‘Do I have concentration where, if 3,4, 5, [lenders] in my portfolio go out, am I screwed? Can I grow without body count? Can I create more efficiencies in my business through automations, technologies, different marketing and grow without body count?’ I’ve done that very well.”

Zach Ramirez, CEO of Calldrive, a pay-per-call marketing and consulting company, also has experience running brokerage shops.

“I found that my skillset, I was great at sales. I still am good at sales, but I think my real skill is building operations. I’ll be honest, one of my weaknesses is I’m not really that great at managing big groups of people,” Ramirez says.

In this regard, Ramirez also thought deeply about maximizing efficiencies rather than maximizing headcount, and says that “I found that what I do enjoy doing is building the infrastructure, the marketing, the sales processes, all the metrics and KPIs, and building the CRM and all the automations.”

Between that and his mountain of firsthand experience working at and operating brokerages, Ramirez is often called upon these days as a consultant for ISOs to help fix or improve all of those things.

Chad Otar, CEO of Lending Valley, a revenue-based financing provider, shrugs at the milestone benchmarks some of his competitors tout and explains that it’s not a race for publicity but rather a marathon of good economics. Otar, for example, says his company funds from its own self-funded balance sheet and has no incentive to be anything less than prudent.

“I’m not looking for market share,” Otar says. “I’m just looking for, you know, a calm, collected life at the end of the day.”

Through all the years Otar has been working in the industry, he says he’s seen the cycle of jaw-dropping deals that, while they may still be more expensive than a bank loan, are unlikely to yield a financial incentive for him to risk participating in.

“And I’m like, no, no. I’ll just stick to what I know, stick to what I like,” he says.

All four executives have the benefit of experience under their belts. Otar has worked in the industry for 19 years, Weitz for 20, Ramirez for 16, and DeAngelis for 12.

What they all have in common is a deep love for the game.

“It’s a delight, I love this #$@&*!-ing industry,” Ramirez says.

“I wouldn’t trade it for the world. I love this industry a lot,” echoes DeAngelis.

Weitz and Otar expressed similar sentiments.

DeAngelis, who had a couple of decades’ worth of experience as a traditional business owner in screenprinting and designer fragrance wholesaling, says that he loves talking to business owners, overseeing operations, and building relationships with partners.

Weitz says it’s been a joy to watch long-term members of his team go through their own life milestones, like going from an apartment to marriage to a home to kids.

“They’ve seen growth also, which really also means we’ve shown growth to not just our clients but our staff,” Weitz says. “These are really good recognition signs that we’re doing pretty good, which is also how I define success.”

If you’re earlier on in your career or entrepreneurial journey, know that there are going to be rough times—especially in this industry.

“My very first job selling finance was for [a mentor],” says Ramirez. “I was probably 19 or something, or 20, and he always said, ‘when you build your business, put your blinders on and only focus on your business and you’ll be instantly rich in 20 years.’”

Ramirez says that the march toward success is kind of like going to the gym. There are people who give up on a routine after three months because they think they’ve put in enough time to judge the final outcome and never truly follow through. And then there are those who stick with a routine, realize that they’re incrementally moving toward their goal, and eventually get there. Ramirez says he has been guilty of surrendering too soon in the past and has also fallen victim to shiny object syndrome. In one example of the latter, he said his previous ISO became overly caught up with selling Employee Retention Tax Credits (ERTC/ERC) during COVID, to the point where it overwhelmed and negatively impacted what had been a well-run business.

“It was a waste of time and energy more than anything, but also cash, because I didn’t remain true and focused to my major core expertise or my core area of competency,” Ramirez says. “I think we lost probably over a full year. We went the wrong direction.”

Otar, meanwhile, says he has felt the pressure as a funder in an increasingly competitive environment with demanding brokers. In one example, he says that while he normally sticks to his principles about not doing same-day fundings, he became convinced to make an exception—and it came back to bite him.

“I did a same-day funding and the next morning on the first Decision Logic, there’s four different positions in there already.”

In his view, that completely changed the risk profile of the deal and produced immediate regret. “That’s why I’m not advocating for same-day funding. I am not advocating for [online] checkouts,” he says. “I’m not doing any of that. I’m still sticking to what I know best, and it’s the reason why I have longevity in this industry.”

Otar adds that he is still employing automation, tools, and systems, and running a modern operation, but he thinks very carefully about each decision.

For Weitz, one of the big defining moments in his business was realizing that concentration risk can be existential. In an industry that prides itself on strong relationships, putting too many eggs in one basket can produce unforeseen consequences if a lender or funder disappears. And what are the odds? High enough that it happened to him. In the early days of United Capital Source, two large funding partners ceased operations at the same time, one of which comprised nearly half of his company’s entire portfolio. That not only jeopardized renewals but also the valuable volume bonus relationships he had with both.

“I know plenty of large brokers who make their profits solely from volume bonuses,” Weitz says. Fortunately, he recovered—and it gave him the chance to refactor his strategy to mitigate future fallout.

DeAngelis says that things can go from great to not good at all in a very short time. In one example, he said that six months after being featured positively in a deBanked story in early 2023, his company QualiFi hit such a snag that he had to temporarily take himself off payroll.

“We just ran into this down spurt where we had a really bad month,” DeAngelis says. “We’ve been there before, right? Another month, another really bad month. ‘Okay, so now back-to-back months. What’s going on? June, July, another bad month. Now it’s a bad quarter,’ and we just were spiraling down, like revenues dropping 30%, we’re starting to stress with the bills, like, ‘what the hell’s going on?’”

They knew they didn’t forget how to execute, but they made tweaks where they could. Like Ramirez’s gym analogy, DeAngelis said they didn’t completely change what they were doing—they stayed the course.

“Our answer was to just keep our heads down, just keep pushing, make some changes and start watching what we’re spending and just barrel through and push through,” DeAngelis says. “And then when we got to October [2023], is when things started to turn for us.”

Two years later, that recent $23 million funding month is a milestone that arose from going through the bad to get to the good. The last several months have also come in at over $15 million.

Some founders try to leverage milestones into additional growth before they’re ready, but DeAngelis—who has been down this road before, including with a previous company he started that was acquired by Nav—says it’s become important to look at each portion of the business as its own business. Hiring and onboarding, for example, has become its own structured operation.

“Before when we lost a rep or we needed to hire someone, we’d hire like the first two to come through the door and just put them on the phones, right?” DeAngelis says. “Those days are done. So the hiring process, we’re super selective. We want to make sure it’s a really good fit for the candidate, as much as this is for us, for long-term sustainability.”

DeAngelis has added a few more reps since the earlier-mentioned 13 and is being cautious about how they approach growth from here.

Ramirez, meanwhile, says that sometimes it helps to look at a problem in reverse. A common gripe these days is that the small business finance market is getting too crowded and squeezing margins (and ethics).

“If I look at everything from the perspective of, ‘I’m an ISO, and there’s more ISOs coming in,’ I understand why they would feel threatened,” Ramirez says. “Because… we’re all fighting for the same pool of merchants, essentially. I would respond with, ‘well, why don’t you help them?’ Instead of being fearful, then why don’t you help them? Why don’t you find these other smaller ISOs and help them do business the right way. Consult with them, charge them for that.”

Ramirez’s outlook embraces the spirit that success in the industry is not limited to being the best broker or the best lender, but about spotting opportunities and being brave enough to capitalize on them.

For Weitz, that meant diversifying early on beyond just one product. United Capital Source offers LOCs, HELOCs, SBA loans, term loans, revenue-based financing, equipment financing, and more. The result is long-term client relationships that shift between products as needs evolve—some going back to the company’s inception 15 years ago. Weitz also notes that not all new competition is real competition: his team conducts themselves with a level of expertise and best practices that they believe clearly distinguishes them.

For Otar, seeing a crowd rush into something doesn’t necessarily indicate a real opportunity, at least not economically. Unless the play is for market share or another specific objective, he considers patience and vigilance his advantages.

“I’ve been through the ringer,” Otar says. “I started this a long time ago. I was an opener, I was an originator, I was a collection guy, I was an underwriter, I’ve seen it all. I don’t think there’s one area in this industry that I haven’t been able to cover yet.”

“I’m here for the long run, not overnight,” Otar adds. As part of that, he prides himself on relationships not only with brokers but with every merchant he funds.

“My mom, when I first started, she had said this, ‘there’s three things that you don’t mess around with in people’s lives: their money, their spouse, and their car.’”

Realizing that his business involves one of those three, he has made it his mission to manage it with care.

“If you look at Lending Valley’s reviews, we’re at 5.0 right now, every single one of them. You could give them a call and they’ll be like, ‘Chad is amazing,’ because I try to keep them on with me.”

For DeAngelis, part of success is giving back. For example, they recently started a charity drive in the office where each month a different employee selects a charity and the company donates to it.

“We started with a small donation of like $500 a month,” DeAngelis says. “And it started really catching on, and I loved it, and got everybody involved. And we talk about it every month. Somebody picks a charity, tells us why it’s special to them, and then they give us some updates on it.”

“I just want to say that ever since we started doing that, even when we were struggling, our business just literally made a skyrocket transformation,” DeAngelis adds. “Over the last year, we’ve doubled and tripled and almost quadrupled our fundings and our revenues.”

For Ramirez, he says that “Last year was one of the best financial years of my life.” He used some of the earnings from it to acquire a small telecom company, which has become another valuable component of his overarching strategy. For younger people entering the space, he’s certain that this business is here to stay.

“The industry is not going anywhere,” he says. “Is it going to fluctuate? Is it going to change? Absolutely.”

Weitz, now two decades in, also concludes that by any rational measure, this business will continue to provide opportunities—as long as one evolves with the times.

“People are always going to need homes,” Weitz explains. “People are always going to borrow against assets. Businesses will never go away, ever, ever, ever, and they will also never, ever, ever have enough capital to grow themselves. They’re always going to need an outside source. This is the way the world has worked for a thousand years. So that won’t change. How people access it will change. The cost will change. The products will change. The need will not. So as long as you’re shifting with that, you’re in an industry where that need is still abundant.”

Otar says, “At the end of the day, I’m very happy with what I do every day. It makes me excited to wake up and actually want to go to work. It’s like I don’t have a job per se. They say, ‘if you have something that you love to do every day, it’s not a job.’ It just becomes a habit at this point. And I enjoy my habit.”

Thanksgiving Day Music Tracks Rock the Industry

November 26, 2025Shortly after deBanked dropped the dopest music track of 2025 to-date, Lendini swung back with their own video on the day before Thanksgiving to top all the charts and snatched the title of the illest of all time.

deBanked’s 12 Funding Days of Christmas:

Lendini’s Thanksgiving Funding Song:

These videos are all in good fun and memes are a tradition every Thanksgiving! It’s possible that AI was involved in the creation of both! 😉