Business Lending

Hidden Tax Liabilities: Assessing Small Business Borrower Risk Before, During, and After The Pandemic

May 19, 2020How lenders assess the risk of small business borrowers is changing and one important factor that no one will be able to ignore is tax liabilities. Hansen Rada, CEO of Tax Guard, told deBanked that outstanding tax liabilities are not always readily apparent in the form of a lien. Tax Guard can fill in the blanks on what lenders normally wouldn’t be able to see.

I asked Rada what tax liabilities even meant for a small business, especially in today’s environment.

“Tax liability is not the disease,” Rada said. “It’s a symptom of the disease. The disease is cash flow.”

In this 17 minute Q&A, I asked Rada many questions that underwriters all over the country are probably thinking about right now. Watch it below:

The Latest With OnDeck

May 18, 2020A Week after OnDeck reported Q1 earnings, the company experienced its first early amortization event brought on by the COVID-19 crisis.

The news was publicized in a May 11th filing with the SEC:

On May 7th, an early amortization event occurred with respect to the Series 2019-1 notes issued by OnDeck Asset Securitization Trust II LLC, or ODAST II as a result of an asset amount deficiency in that Series. Beginning on the next payment date under the ODAST II Agreement, all remaining collections held by ODAST II, after payment of accrued interest and certain expenses, will be applied to repay the principal balance of the Series 2018-1 notes and the Series 2019-1 notes on a pro rata basis.

The company also revealed that it had amended a debt facility “so that no borrowing base deficiency shall occur during the period from April 27, 2020 to July 16,2020.”

The company also revealed that it had amended a debt facility “so that no borrowing base deficiency shall occur during the period from April 27, 2020 to July 16,2020.”

On May 15th, OnDeck notified shareholders of additional events and maneuvers through a new filing published after the closing bell. The filing stated that:

On May 12th, a similar event happened with the 2018-1 notes as had happened with the 2019-1 notes.

On May 14th, OnDeck modified the terms of a debt facility so that “from March 11, 2020 to August 31, 2020, receivables granted temporary relief in response to the COVID-19 pandemic will generally not be considered delinquent […] so long as such receivable is paying in accordance with its modified terms.”

Also on May 14th, OnDeck obtained a temporary waiver on another debt facility. “Under the waiver, the lenders temporarily waived the occurrence and existence of reported borrowing base deficiencies and any failure to cure such deficiency amount, in each case, until the close of business on May 19, 2020.” OnDeck accepted the waiver with the understanding it would enter into a broader amendment to remain in compliance with performance and other criteria in light of increased delinquency and other portfolio dynamics that result from COVID-impacted loans. “If such an amendment is not entered into or if the borrowing base deficiency is not otherwise cured, the borrowing base deficiency would constitute an event of default under the ODAF II Facility at close of business on May 19, 2020.”

The 19th is tomorrow.

A similar waiver was obtained for another debt facility. The company has until May 20th to enter into a broader amendment to remain in compliance on that one.

The company is in a fight for its survival. In late April, OnDeck “suspended nearly all new term loan and line of credit originations and previously ceased all equipment finance lending.” The company reported that it is “focused on liquidity and capital preservation and expects there will be a significant portfolio contraction, reflecting an 80% or more reduction in the second quarter origination volume.”

The stock closed at 64 cents on Friday and a market cap of only $37.3M. Shares had traded over $4 earlier in the year.

On May 7th, shareholders voted overwhelmingly in favor of keeping CEO Noah Breslow on the company’s board of directors.

Ireland’s Alternative Finance Industry and the Coronavirus

May 18, 2020 As the effects of the coronavirus continue to slow down the American economy, around the world, many countries remain in lockdown, with their businesses having been halted. Be it to the north, south, east, or west, of the United States, the results are the same: money has stopped flowing. As such, we took the opportunity to follow up with some of the businesses that featured in our coverage of alternative finance in Ireland last Fall, hoping to see what differed and what was the same in their responses to the pandemic.

As the effects of the coronavirus continue to slow down the American economy, around the world, many countries remain in lockdown, with their businesses having been halted. Be it to the north, south, east, or west, of the United States, the results are the same: money has stopped flowing. As such, we took the opportunity to follow up with some of the businesses that featured in our coverage of alternative finance in Ireland last Fall, hoping to see what differed and what was the same in their responses to the pandemic.

Despite differing in size and range of variety when compared to their North American counterparts, the Irish alternative finance and fintech industries have largely felt the same impacts from covid-19. Certain funders have stopped operations, others have become very cautious, and just like here, some businesses have turned to the government for help.

LEO, or Local Enterprise Offices, is an advisory network for small and medium-sized businesses, which provide guidance as well as offer capital. The Irish government has pointed to these as the point of contact for small businesses owners, with LEO providing microfinance loans of up €50,000. This figure being upped from the pre-coronavirus maximum of €25,000.

Rupert Hogan, the Managing Director of brokering company BusinessLoans.ie, explained that some businesses would be better going with LEO over banks and even some non-banks. Noting that non-bank lenders can’t compete with the rates offered by LEO and, just like in the US, banks can’t act with the speed that these business owners need.

Hogan, who describes the current situation as “The Great Lockdown,” said that banks “aren’t too helpful, even in the good times,” due to the high rejection rates that SMEs experience when looking for loans. In regards to merchant cash advances, he’s expecting, when the MCA companies reopen, that they’ll be funding at reduced rates, some doing as much as 50% less than their pre-coronavirus amounts.

Hogan, who describes the current situation as “The Great Lockdown,” said that banks “aren’t too helpful, even in the good times,” due to the high rejection rates that SMEs experience when looking for loans. In regards to merchant cash advances, he’s expecting, when the MCA companies reopen, that they’ll be funding at reduced rates, some doing as much as 50% less than their pre-coronavirus amounts.

Jaime Heaslip, Head of Brand Marketing at the MCA company Flender, explained that before the virus, the company was experiencing a period of productivity, with lending activity and amounts deposited being up from previous years. And despite the virus disrupting commerce, the former international rugby player noted that business owners are still coming to Flender for funds.

“We provide flexibility for people, there’s a lot of people coming to us to get contingency funds together,” he said over a phone call, commenting that as well as this, many businesses are looking for financing to move their operations online. “We’re trying to help SMEs get through this and provide as much help as possible.”

Beyond merchant cash advances, business continues to run, says Spark Crowdfunding’s Chris Burge. Being an investment platform, Spark is still active with businesses looking to get off the ground.

“We’ve actually found that we’ve still got a large amount of inquiries coming through,” the CEO and Co-Founder said. “Our pipeline of companies wanting to go onto the platform is very strong, and we’ve been engaging with them all and they’re very keen. They all need money, which, of course, hasn’t changed from before there was a crisis. And they still are needing money, they need that to expand as opposed to survive.”

When asked about changes made because of covid-19, Burge explained that their investor evenings have been disrupted. Previously an opportunity for the investors and investees on the digital platform to meet up personally and pitch each other, these 100-person gatherings are no longer an option. Instead, virtual webinars and assemblies are what Spark has started using to keep up communication between parties.

And on the subject of fundraising, Trezeo’s Garrett Cassidy said that it has become a nightmare under the pandemic. Disrupted communication channels and the inability to pitch to someone in the same room as you have been hurdles, but besides that, Cassidy assured me that Trezeo is still going strong.

Offering payment structures and benefit bundles to freelancers and the self-employed, Trezeo has seen some of its customer base drop off as unemployment sky-rocketed in the UK, its prime market. Despite this, as more and more people are beginning to go back to work, Cassidy says numbers are rising.

Offering payment structures and benefit bundles to freelancers and the self-employed, Trezeo has seen some of its customer base drop off as unemployment sky-rocketed in the UK, its prime market. Despite this, as more and more people are beginning to go back to work, Cassidy says numbers are rising.

“Now we’re starting to see earnings pick back up again, some of them were the ones who were off work who are now coming back to work. So it’s been interesting watching that but the reality is that they’re also scared. They’re out working every day delivering parcels or food, depending on which, and just working really hard. It’s the most important ones who are paid the least and that have the least protection.”

Looking ahead, Trezeo has been working with the UK’s Labour Exchange to establish a new program that would see the creation of channels to help pre-qualify workers for certain positions. These workers would be pooled, and employers would be able to choose from them, streamlining the hiring process for both sides.

“They need money in their pockets, somehow, quickly,” Cassidy said of workers, whether that be by returning to work safely, or through some government assistance program, the CEO is adamant that people need to stay solvent.

Altogether, Ireland’s alternative finance industry, like others the world over, has been hit hard by the coronavirus’s economic effects. With the country’s phased lifting of the lockdown being plotted out over the course of the summer, the island nation may not see as quick a return to commerce as certain American states, but its fintechs and non-banks hope to stick around, by hook or by crook, as the Irish say, by any means possible.

$100 Million in PPP Fees

May 12, 2020 $100 million. That’s the gross revenue floor that Ready Capital reported yesterday will be earned from its PPP loan origination efforts. PPP lenders earn between 1% to 5% of the loan amount in the form of a fee from the SBA and Ready Capital was the 15th largest PPP lender by dollars in the first round alone.

$100 million. That’s the gross revenue floor that Ready Capital reported yesterday will be earned from its PPP loan origination efforts. PPP lenders earn between 1% to 5% of the loan amount in the form of a fee from the SBA and Ready Capital was the 15th largest PPP lender by dollars in the first round alone.

The SBA pays 5% for loans under $350,000, 3% for loans between $350,000 and $2 million, and only 1% on loans over $2 million. With the majority of Ready Capital’s loans being for less than $350,000, the pure volume of loans originated (40,000+), translates into significantly larger fee income against a lender who may have originated the same dollar amount but with a much larger average loan size. JPMorgan’s average PPP loan size in Round 1, for example, was $515,000 (an average of a 3% fee) versus Ready Capital’s $73,000 (an average of a 5% fee).

Ready Capital clarified that on a net basis of those fees, they will take home substantially less, since the economics of those fees were in many cases split with referral agents and other partners that contributed in the process. Without committing to a firm figure, they estimated that their net revenue on PPP originations is actually going to be in the neighborhood of 35%-50% of the gross ($35 million to $50 million).

That is so far. Ready approved $3 billion in loans and has so far only funded $2.1 billion of them. The company said it expects that a large percentage that remain will still be funded and they will earn additional fee income respectively from those.

The company also addressed funding delays that had been reported across social media. “While there have been some challenges outside our control that have caused some delays in the distribution of funds, we have facilitated the funding of 2.1 billion through last Friday and are actively working through the remaining population to disperse funds as quickly as possible.”

Ready’s exposure on the loans themselves may be limited. The company said “we do not expect to carry much of the production on the balance sheet at all. So a very small portion will remain on the balance sheet. The majority of it will now be sold off balance sheet.”

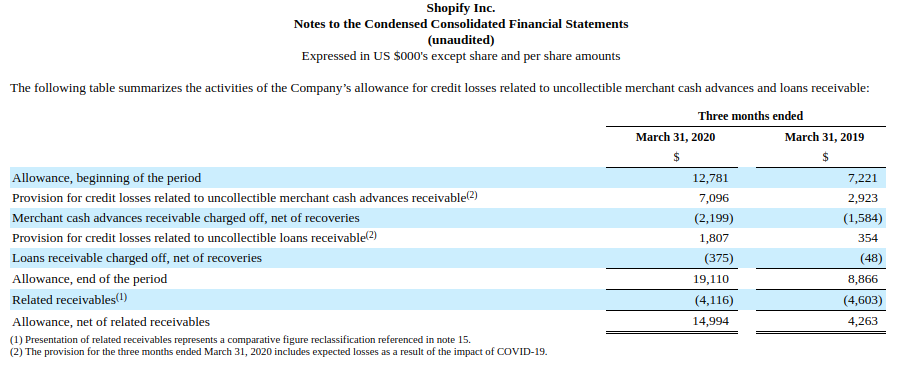

Shopify Shows Strength in Q1 Results, Issues $162.4M in MCAs and Loans

May 6, 2020eCommerce platform Shopify, 2nd only to Amazon in retail eCommerce sales, issued $162.4M in merchant cash advances and business loans in Q1, up from $115.9M in the previous quarter. The statistic pushed them past the $1 billion threshold of funds cumulatively issued since inception.

The company’s provision and allowance for loan losses ticked up from significantly from the same period the prior year but Shopify at that time was originating 50% less volume.

The company reported a GAAP net loss of $31.4M on $470M in revenue. Shopify also has approximately $2.36B in cash and cash equivalents on its balance sheet.

The company reported an increase of monthly recurring revenue, thanks to an increase in the number of merchants joining the platform, strong app growth, and Shopify Plus fee revenue growth.

Shares of Shopify (NYSE: Shop) jumped by more than 5% after the announcement.

Round Two of PPP Is Targeting Much Smaller Businesses

May 4, 2020 $79,000. That’s the average loan size reported in Round Two of the PPP so far. The figure is about a third of the average size approved in Round 1. Some of that is by the SBA’s design. On April 29th, the SBA disabled submission access to all lenders whose assets exceed $1 billion to prioritize small lenders and their small business customers.

$79,000. That’s the average loan size reported in Round Two of the PPP so far. The figure is about a third of the average size approved in Round 1. Some of that is by the SBA’s design. On April 29th, the SBA disabled submission access to all lenders whose assets exceed $1 billion to prioritize small lenders and their small business customers.

Though the pause button for big lenders was only in effect for eight hours that day, it was recognition that the playing field had not been level in the first round. JPMorgan Chase, the largest lender in round 1, for example, had an average PPP loan size of $515,304 in that round.

It’s a competitive process for limited dollars. 5,400 direct PPP lenders have already participated in the second round. More than 80% of those have less than $1 billion in assets. Senator Marco Rubio, a champion of PPP, called the latest figures released by the SBA as “all good news.”

Square Capital, meanwhile, has taken small to the extreme. Their average PPP loan approval as of April 29th was just $16,000, according to stats published by Square Capital head Jackie Reses on twitter. But only 2,711 of the 38,000+ approved had received the funds so far.

Still, that average is significantly smaller than the average loan size of $73,000 approved by Ready Capital in Round 1, a non-bank lender that got widespread attention for approving more PPP loans than any other lender in the country. Those record-breaking numbers, however, led to delays in borrowers receiving their funds to the point where as of April 30th, the responsibility of funding those loans had reportedly transferred to Customers Bank.

OnDeck has also played a role in the PPP, though only as an agent despite being approved by the SBA to lend. That news, which was revealed last week in the company’s quarterly earnings call, is likely due to the company’s current predicament brought on by government-mandated shutdowns.

Enova On Their Small Business Lending Exposure

April 30, 2020Enova’s exposure to the small business lending crisis is limited, the company said during its earnings call yesterday. The Business Backer and Headway Capital are two of the international consumer lending company’s small business lending divisions.

In terms of their overall loan book, small business loans only make up a percentage worth in the teens. “It’s very much manageable for us,” CEO David Fisher said. Fisher also said that they did not have large exposures to entertainment, hospitality and restaurants in their small business loan portfolio and were well diversified.

“Defaults […] have not increased anywhere near as much as we would have expected. Lots of payment deferrals and modifications, but with the PPP checks coming in and states opening back up, we are somewhat encouraged that we haven’t seen very high levels of default yet.”

Enova reported a consolidated Q1 net income of $5.7M.

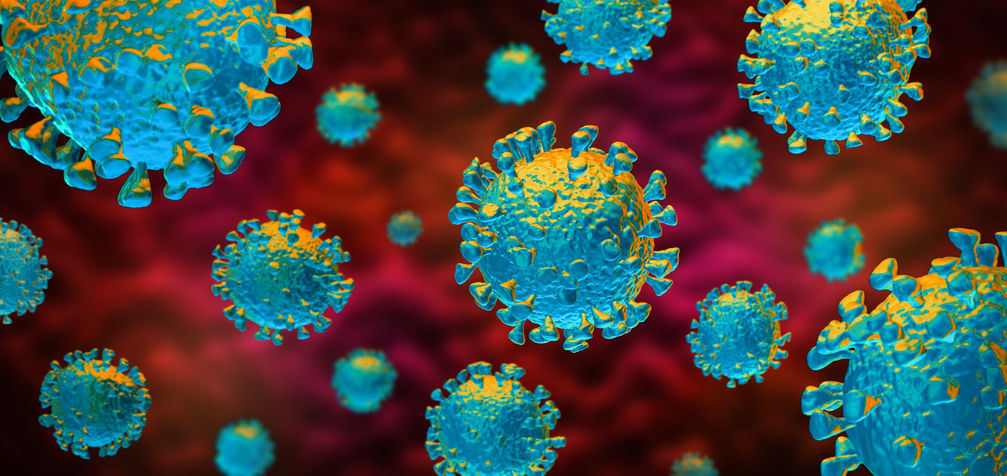

OnDeck Reports Q1 Net Loss of $59M, Suspends Non-PPP Lending Activities

April 30, 2020O nDeck has suspended the funding of its Core loans and lines of credit to new or existing customers (unless the loan agreement has already been executed).

nDeck has suspended the funding of its Core loans and lines of credit to new or existing customers (unless the loan agreement has already been executed).

The company has also suspended its pursuit of a bank charter. The company has instituted a 15% pay reduction for its full-time employees, a 60% pay reduction for part-time employees, and furloughed additional employees that will receive benefits but no salary. OnDeck CEO Noah Breslow and members of the Board took a 30% pay reduction.

The company said that PPP funding has not really reached real small businesses like the ones they serve and as such only a handful of their customers have received PPP funds. While OnDeck is approved to operate as a PPP lender themselves, they have been acting as an agent of them in the interim and will dedicated their resources almost entirely to this endeavor. The company anticipates that originations of its own products could contract by 80% or more in Q2.

The company has not tripped any covenants or triggers with its own lenders as of yet but is currently in discussions with them on a path forward in this environment.

OnDeck reported a Q1 net loss of $59M on Thursday morning. The first quarter loss was driven by an increase in the Allowance for credit losses to reflect the increase in expected credit losses related to the COVID-19 pandemic. Provision for credit losses was $107.9 million. The Allowance for credit losses increased to $206 million at March 31, 2020, up $55 million or 36.1% from year-end and $58 million or 39.5% from a year ago. The 15+ Day Delinquency Ratio increased to 10.3% from 9.0% the prior quarter and 8.7% a year-ago reflecting a broad-based decline in portfolio collections since mid-March.

OnDeck reported a Q1 net loss of $59M on Thursday morning. The first quarter loss was driven by an increase in the Allowance for credit losses to reflect the increase in expected credit losses related to the COVID-19 pandemic. Provision for credit losses was $107.9 million. The Allowance for credit losses increased to $206 million at March 31, 2020, up $55 million or 36.1% from year-end and $58 million or 39.5% from a year ago. The 15+ Day Delinquency Ratio increased to 10.3% from 9.0% the prior quarter and 8.7% a year-ago reflecting a broad-based decline in portfolio collections since mid-March.

Noah Breslow, chief executive officer, is quoted in the announcement:

“In the span of several weeks, the spread of COVID-19 led to government-mandated lockdowns for small businesses both in the US and globally, placing our customers under unprecedented economic stress.After a successful and rapid transition to remote work, we effected immediate changes to our business to preserve liquidity, support our customer base, manage our loan portfolio and reduce costs. With an uncertain timetable for the reopening of the economy, and the effectiveness of government stimulus for small businesses unclear, we will be reducing debt balances in the second quarter and focusing on managing our portfolio, delivering government stimulus to our customer base and ensuring the company has the runway to scale operations again when the economy reopens.”

The company fully utilized its initial $50 million share repurchase authorization in the first quarter of 2020. On February 10, 2020, the Board authorized the company to repurchase up to an additional $50 million of common shares, and the company has approximately $23 million of remaining capacity under that authorization. The company suspended share repurchases late February but maintains authorization to resume purchases at its sole discretion.

For 2020, OnDeck expects:

- Portfolio contraction reflecting an 80% or more reduction in second quarter origination volume

- Increased delinquency and charge-offs stemming from COVID-related economic deterioration

- Reduced Net Interest Margin reflecting a lower portfolio yield

- Reduced operating expenses, on pace to cut second quarter expenses by approximately 25%.

The company had been on a modestly positive trajectory as of year-end 2019.

The company’s stock had a somewhat minor rally on Wednesday, closing at $1.61. That’s still substantially down from where it stood on February 20th at $4.22. It hit a low of 66 cents on March 18th. The share price dropped by nearly 19% after earnings were released on Thursday morning.

This story will be updated as the information becomes available.