Brokers

United Capital Source Partners with Brex to Offer Deal on Card

February 21, 2020U nited Capital Source has partnered with Brex on a deal that will see UCS customers receive bonuses upon sign-up for a Brex Corporate Card. Such rewards include 100,000 points in statement credit and waived card fees for life.

nited Capital Source has partnered with Brex on a deal that will see UCS customers receive bonuses upon sign-up for a Brex Corporate Card. Such rewards include 100,000 points in statement credit and waived card fees for life.

“We really wanted to start to offer business credit cards to our clientele. We believe that as we’re helping people solve their lending or funding issues, it’s also helpful to solve any problems that they face when running their day-to-day business,” UCS Founder and CEO Jared Weitz told deBanked in a call. “The key point that we really love about Brex which we’re offering to our clients is a 60-day, no-interest float on expenses. And that’s really helpful for folks when you’re making weekly and bi-weekly payrolls, when you’re purchasing inventory, and when you have folks that pay you every 30 or 45 days.”

The news comes as companies from various backgrounds are beginning to offer debit, credit, and charge cards. Apple, BlueVine, and challenger banks such as N26 and Varo are now all offering cards of some kind to their customers.

In Weitz’s view, this is the next step for the industry. With tech becoming more and more ingrained in finance, the convergence between the two fields is inevitable and ultimately beneficial for brokers.

“They’re already doing it on the personal side. And I think that once these tech-enabled companies start to get business data on their clients’ trends in their business account, they’ll be able to offer other products to them as well. For me, as a broker, if someone says, ‘Hey, does that make you nervous?,’ honestly, I don’t believe so. Because I think it opens up the sources for me to send deals to … I’m not a lender, so I’m not competing against them. I’m someone that would send them business. So when I look at them, I say this is just a new potential partner for me, a new opportunity.”

deBanked CONNECT MIAMI 2020 Photos

January 21, 2020View a selection of deBanked CONNECT MIAMI photos here

View every official deBanked CONNECT MIAMI 2020 photo on facebook

Ready for deBanked’s biggest event of the year? Broker Fair returns to New York City on May 18th

United Capital Source Placed $199M In Deals In 2019

January 5, 2020 United Capital Source, a commercial finance brokerage based in New York, placed 3,883 deals in 2019 for a grand funding total of $199.3 million. Company CEO Jared Weitz said on LinkedIn of the milestone, “Our employees all saw growth (again) this year both professionally and personally. As we come into 2020 we are going into our 10th year of business!!!!! I cannot wait to see what these next year(s) hold for us. I’m so thankful for our Funding Partners and most of all our wonderful staff.”

United Capital Source, a commercial finance brokerage based in New York, placed 3,883 deals in 2019 for a grand funding total of $199.3 million. Company CEO Jared Weitz said on LinkedIn of the milestone, “Our employees all saw growth (again) this year both professionally and personally. As we come into 2020 we are going into our 10th year of business!!!!! I cannot wait to see what these next year(s) hold for us. I’m so thankful for our Funding Partners and most of all our wonderful staff.”

Weitz is scheduled to speak at deBanked CONNECT MIAMI on January 16th at the Loews Hotel on a panel discussion about how to make money in 2020.

For ISOs Only — How To Develop Your Factoring Brokerage Business (Part 2)

December 12, 2019In Part 2, we’re going to focus on 3 major areas:

(1) What is Factoring and How Does it Work?

(2) What Are the Costs?

(3) How Do You Qualify?

We’re also going to touch on HOW TO find factoring funders.

What is Factoring and How Does it Work?

What is Factoring and How Does it Work?

Factoring actually dates back to 2000 BC but got going in the US during the 1600s when colonists sought “advance payments” on tobacco, cotton, etc., shipped across the Atlantic to England. Today, it’s a TRILLION DOLLAR INDUSTRY worldwide, involving commercial banks, asset-based lenders, Fintech companies, and private hedge funds all over the world. And a million years later the purpose of factoring is the same; speed up cash flow by leveraging receivables, while waiting to get paid.

In a nutshell, much like an MCA, factoring is an advance against “future invoice proceeds.”

However, unlike an MCA where the advance is largely based on bank statements, with factoring, advances are based on the number of confirmed invoices the merchant has outstanding with their approved B2B customers. The invoice(s), which is the asset, serves as COLLATERAL.

So, while an MCA funder “looks backwards” at bank statements to help determine eligible amount, the factoring funder “looks forward” to determine eligible amount based on approved invoices.

Factoring advance rates typically range from 70% to 90% of the invoice face value, and are based on volume, industry type, etc.

There are two major elements required for factoring to work. The first is the merchant must be doing business with a credit-worthy B2B customer. Approval isn’t based on the financial strength of the merchant, but on their customer, i.e. the company paying the bill.

The second major element is that, in addition to being credit-worthy, the customer must agree to send invoice payments DIRECTLY to the funder. This provides the funder with an assurance of payment and substantially reduces the risk of re-payment or default.

So, unlike an MCA where payment is on a daily or weekly basis, the factoring advance has NO PAYMENTS, and actually pays itself off once the invoice has been paid. The funder then deducts the advance along with their fee and wires the balance to the merchant.

With no payments and invoice proceeds automatically paying off the advance, I refer to this as a “SELF LIQUIDATING LOAN”. It’s also “ELASTIC”, which means the more confirmed invoices the merchant has outstanding, the more funding they are eligible to draw. It’s like having a revolving LOC with no payments………of course unless the customer doesn’t pay, right? Good question!

So, here’s the answer: There’s actually two types of factoring; (1) RECOURSE FACTORING, which means if a customer doesn’t pay the invoice, the Merchant is financially responsible for the advance, and (2) NON-RECOURSE FACTORING, which means they’re not.

Here’s the process in a nutshell: Merchant submits app and doc checklist for preliminary underwriting approval. Funder issues term sheet, and if accepted by Merchant, underwriting and due diligence is completed. A closing and funding docs package are submitted to the merchant, and upon execution, the funder is prepared to start confirming and funding invoices.

How long does it take from start to finish? Depends on how much hair there is on the file. A clean file can take as little as 5 to 7 business days. A file with a lot of hair can take much longer. We actually had a $13 million file funded in 48 hours! That guy was pretty happy and so was I. It was an acquisition with a deadline. So, here’s what to tell your merchants with regards to timing: “funding is not calendar-related, but event related”. In other words, once the required events are completed then funding can occur.”

What Are the Costs?

There are several major factors that determine cost, rate, terms. volume, invoice size and funding frequency, industry type, risk, etc. Every funder has their own respective rate and fee schedule. Some charge application/due diligence fees while others don’t. Some charge origination and/or admin fees, while others don’t.

Some funders base their pricing on APR, with rates as low as Prime + 3 to 5%, while others have all-in rates typically ranging from 1.5% to 3% per month. After the first 30 days, monthly rates are typically broken down in 10 or 15 day increments (pro-rating). As a result, the ACTUAL COST of factoring in dollars and cents, is based on the amount of time the advance is outstanding, from the funding date to the date the invoice payment is received by the funder.

Here’s an alternative perspective on cost: Factoring is like “renting money on a daily basis,” where the funder essentially takes “equity in the transaction” versus equity in the business. Comparing the bottom-line cost with the bottom-line benefits is the key. But at the end of the day, “the highest price you pay for money is the price you pay for the LACK of it”.

Just like with MCAs, make sure you understand the rate structure, terms, and fees charged by your factoring funder, and how to calculate the cost in dollars and cents as well.

How Do You Qualify?

Factoring approvals have 3 components: The first is the merchant. Again, every funder has their own approval criteria and document checklist. Some require minimal info, while others ask for EVERYTHING including a pint of blood. While most only require one month bank, approval is not based on deposits, or how well they manage their account. Remember their primary focus is on assessing the quality of the receivables, determining if they have sufficient gross profit margins, ensure they are in good standing, and address any “deal killers”, i.e. tax liens, judgments, or UCC filings in first position, which is where they need to be, in most cases. (We actually have funding partners who will factor in second and third positions)

The second factoring approval is the merchant’s customer(s), typically referred to as the debtor. This is determined by the funder who looks at things like D&B, PAYDEX Scores, and other proprietary industry databases. In some instances, a lack of secondary financial/credit information on the customer can be offset through their payment history with the merchant. In other instances, the funder may require bank and trade references if no history exists. Candidly speaking, best practices by the merchant says they should already be doing the same thing; i.e. credit qualifying their customers, whether they need funding or not, unless it’s a large, well established company or government agency. The fact is, extending terms to someone you don’t know can be risky because ‘all businesses may not be good businesses.’ Let’s face it, it’s all about getting paid, right?

Ever heard this horror story; “I need an MCA because I got burned by one of my customers who strung me out and never paid me!” Too bad. They should have picked up that $100 bill off the street! Just kidding!

The third factoring approval is on the deal itself, i.e. the purchase order or contract the merchant has with the debtor. There are over 15 different things the funder will look at to identify existing or potential funding issues. Here’s an example. I recently got a referral for a client who had 63 different purchase orders going to 63 different locations for the same large customer, but BEFORE he started shipping, half the orders had already passed the CANCELLATION DATE! What do you think the chances are of the deal being approved for funding? Don’t know yet. Will let you know when I get to part 3 of the series. Keep your fingers crossed and so will I.

Typical things the funder looks at are payment terms, default clauses, customer signature, offset clauses, just to name a few. If you’d like a complete list, just shoot me over an email.

How to Find Funders

Finding factoring funders is easy. Just google FACTORING and you’ll get a whole bunch. What’s NOT so easy is determining the “best fit” for YOUR merchant because one size does not fit all. Over the years, some of the biggest horror stories I’ve heard from both funders and clients was a relationship that went bad because it was not the best fit. But remember this; “just because you picked the wrong spouse doesn’t mean getting married is a bad idea.” Determining the best fit is one of the key functions for your factoring brokerage business.

Some funders you will find specialize by industry, i.e. transportation, medical, staffing, construction, while others don’t. Some can move quickly while others take two weeks. Some are more flexible than others. Some focus on A-credit Merchants and have the lower rates, while others work with start-ups. Always find out UPFRONT their approval criteria and constraints. Shoot over an email and I’ll send our list of the Top 10 Questions to Ask Before Selecting a Factoring Funder.

The Broker: Funding Businesses The Irish Way

October 10, 2019 I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

I’m sitting in the lobby of The Marker Hotel, a 5-star 7-story property on the edge of Dublin’s Grand Canal Dock. Here in Ireland’s major tech hub, I’m waiting for a self-identified corporate finance broker by the name of Rupert Hogan, the managing director of BusinessLoans.ie. Outside of our email exchanges, I don’t really know what to expect. I’ve met brokers from the US, Canada, Mexico, UK, and Hong Kong, but never Ireland.

When he arrives, he doesn’t disappoint. Hogan is full of energy and enthusiasm. He has a natural charisma and friendly manner that’s well-suited for a relationship-based business. It just so happens that SME finance in Ireland is still heavily reliant on person-to-person contact and Hogan is at the forefront of helping potential borrowers look beyond the bank for their financing needs.

SMEs are looking for speed and ease in the loan process, Hogan says. Historically, business owners would call on their bank for financing, invoking the sanctity and reliability of decades-old personal relationships, but Hogan explains that relationships between SMEs and banks just aren’t what they used to be. “[SMEs] feel like they’re going to get the runaround,” he says.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

That’s where he comes in. And it could be any kind of business, he explains. Hogan jumps from a call with an import/export business to one in retail, followed by one with an agricultural equipment company. He has to understand a bit about them all no matter what it is, to figure out a proper financial solution. BusinessLoans.ie doesn’t charge for their service but they do receive a commission from the financial company if a deal closes.

“Corporate” finance may evoke images of big city corporations engaged in international commerce but Hogan’s company can connect SMEs with as little as €5,000 through an unsecured business loan or merchant cash advance. Invoice Financing, leasing, and trade finance are also tools at his disposal. It’s not all small, however, as he hands me a rate sheet for one lender that will go up to €25M. Interest rates on these products when compared with their American and UK brethren are quite reasonable, and suggest also that the target clientele is not subprime.

As we sit there drinking coffee, Americano style in my honor, an executive for a local SME lender happens to spot him while passing by. After they exchange pleasantries, Hogan explains to me that he submits deals to that lender through their online broker portal. And so I ask him if doing everything online has become the standard in Ireland.

“It’s getting there,” he says, while acknowledging there’s still a ways to go with the population that’s conditioned to handling their financial dealings offline. The company’s domain name is perhaps perfectly positioned to capture that transitioning audience. When businesses decide to look for a loan online, he explains, “I hope they go to BusinessLoans.ie”

“Do It Better Than How You Learned It”: How Paul Pitcher Came To Be In Canada

June 27, 2019 Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Growing up in Annapolis, Maryland, the Managing Partner at First Down Funding and SharpShooter Funding studied at Severn School and immersed himself in sport. Under the eye of his father, Pitcher began playing basketball and baseball at the age of 4. Golf came later, and it followed him into his young adult life as he played at a collegiate level while enrolled at the University of Tampa, where he studied International Marketing and Finance. And upon graduation, Pitcher landed a job in Washington D.C., working in sales for the Washington Wizards and Capitals.

Sports accompanied him in each phase of his life, so it comes as no surprise that it is entwined with his current business ventures.

After leaving the Regional Sales Manager position he held with the Wizards and Capitals, Pitcher became a broker, eventually establishing First Down in 2012 – seeing it as a solution to a problem many business owners across the country face: acquiring capital. Offering funds via merchant cash advances, First Down provides financial aid to small and medium-sized businesses.

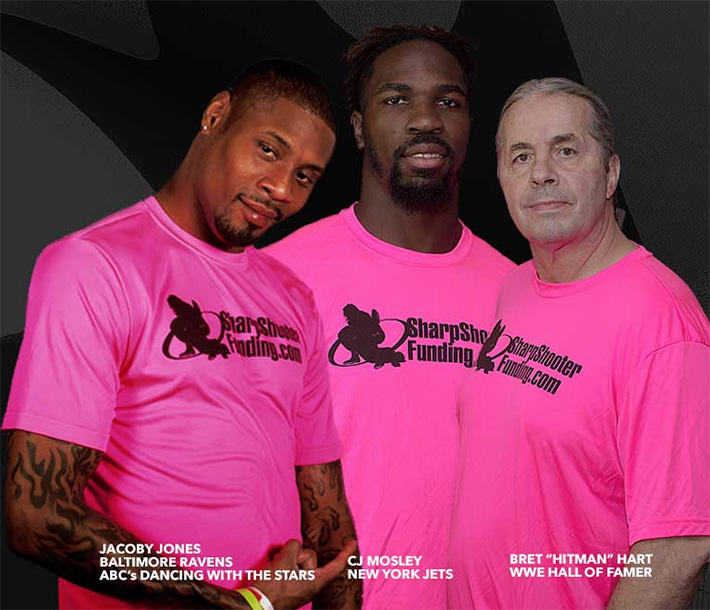

And after enjoying success in the United States, lightning struck on June 6th, 2015. Out of the blue, over 25 Canadian business owners applied for funding from First Down. Chalking it up to ads First Down had placed across social media, Pitcher decided to dive into the new, northern market, but only after consulting with the only Canadian he knew, WWE Hall of Famer Bret ‘Hitman’ Hart.

Having met the wrestler in 1993, Pitcher gambled on Hart remembering the 10-years-old kid in the Looney Toons t-shirt that he took a photo with two decades ago. And it paid off. Following discussions of what First Down did and how it met the needs of the Canadian market, Hart partnered with the company and now serves as commissioner to SharpShooter, the Canadian arm of First Down.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

Noting that the spirit and culture of sport has definitely bled into First Down and SharpShooter from both his own personal life as well as the lives of those athletes that are partnered to it, Pitcher affirms that healthy competition is integral to both sport and business.

Believing that it’s just as important to win as it is to develop the environment you are in, Pitcher is in the funding market for the long-run. And it is exactly this that attracts him to Canada. Comparing it to Baltimore in his home state, he sees the Great White North as a region that is less saturated with funding firms like you would find in New York or Chicago, in other words, he sees it as a place of opportunity, where there is room to grow.

Of course, with such opportunity there are growing pains, like the populace’s level of product knowledge as well as the building of trust between business owners and SharpShooter, but Pitcher welcomes it. Emphasizing his love for competition, he calls for more firms like his to enter the market, be they big or small, as according to him, it could only help build upon the culture of non-bank funding that has taken root in Canada.

“Whatever you do, do it better than how you learned it,” are among the final words Pitcher leaves me with, and with the other closing remarks hinting at further expansion beyond Canada, the Managing Partner seems to be living by this maxim. Be it the education he picked up in Tampa, the lessons learnt in sales, or even a chance encounter with a childhood hero, Pitcher appears to be aiming to continually build and expand upon what he has experienced.

Paul Pitcher is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SEO Consultant Paul Teitelman.

Learn From Josh Feinberg and Will Murphy in Person at Broker Fair

April 16, 2019You’ve seen them on social media. Now you can see them in person. Josh Feinberg and Will Murphy of Everlasting Capital will be doing a joint presentation on how to scale your broker shop at Broker Fair on May 6th at The Roosevelt Hotel in New York City.

Limited tickets are still available. Register now at Brokerfair.org

The Everlasting Capital co-founders will be presenting at 3:15pm on May 6th in the Promenade Suite. To view the full agenda, CLICK HERE.

-

Brokers

Access to the conference as a broker - Full access to the May 6th conference

- Complimentary access to the post-event cocktails on the rooftop of The Roosevelt Hotel

- Your conference badge will identify you as a broker

-

Funders/Lenders

Access to the conference as a capital provider - Full access to the May 6th conference

- Complimentary access to the post-event cocktails on the rooftop of The Roosevelt

- Your conference badge will identify you as a direct capital provider

-

General Admission

Access to the conference as a third party - Full access to the May 6th conference

- Complimentary access to the post-event cocktails on the rooftop at The Roosevelt

What Am I?

Broker

- You are employed by a non-bank business financing Broker/ISO — OR — You are an independent sales agent

- You are NOT employed by a direct lender or direct funder

- Broker Fair reserves the right to verify your selection.

- Your conference badge will identify you as a broker

Funder/Lender

- You are employed by a direct capital provider whether it’s loans, merchant cash advances, factoring, or other products

- Your conference badge will identify you as a direct capital provider

General Admission

- You are not employed by a broker/ISO or direct capital provider

- Your conference badge will not display a specific business model designation

- You will have the same conference access as a funder/lender does

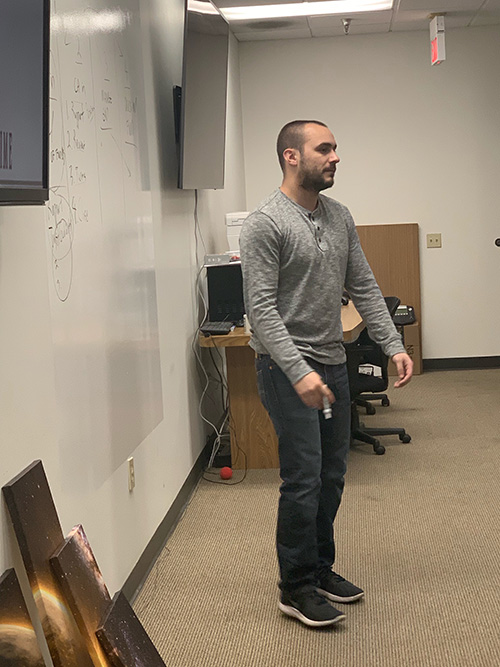

How One Broker Moved from One-Man Home Office to 23 Person Shop

January 7, 2019Zach Ramirez started the brokerage company ZR Consulting from his home in Orange County, CA in June 2018. He was generating leads and making phone calls, often in a hushed voice because he was also looking after his six month old daughter.

“That was difficult, having a baby and with my life savings in the business,” Ramirez said.

But he had three brokers working remotely for him and things were working pretty smoothly. That number was growing by the time deBanked profiled him in August.

His fledgling business was manageable until he got to six brokers. At this point, the 29 year-old Ramirez said his home office was starting to feel like a call center.

“All day, I was answering calls to help them,” Ramirez said. “‘Zach, I have a question about this merchant, Zach, can you help me close this deal?’ It gave me a ton of anxiety.”

Ramirez realized that it would be much easier to manage employees from a brick and mortar space. So he found the company an office.

“Technically, we could have stayed at home,” Ramirez said.

“Technically, we could have stayed at home,” Ramirez said.

And he acknowledges that some brokers can make a nice living working from home.

“But I want to have the biggest ISO,” Ramirez said.

With this as his goal, he said it makes the most sense to have everyone under one roof. If he’s having a large meeting, he wants to know that everyone is paying attention and not driving or playing a video game as they could on a conference call.

“It was difficult to manage salespeople and to track everything, like how many leads we generated in one day? How many leads does it take for me to fund one deal? How much money does the average deal bring me?”

Having his brokers work remotely made keeping track of these numbers even harder. Ramirez still has a couple of people who work for him remotely, but he said that 95% of his employees, or 23 people, now work at their office in Anaheim, CA. Ramirez said that the office was much too big for them with just six people at the beginning.

“We could hear echoes bouncing off the walls,” he recalled.

But now with 23 people, mostly brokers and some support staff, Ramirez is actually planning to expand into an office next door.

“[As we grew in the office,] we just re-invested every penny we earned back into the company,” Ramirez said. “We upgraded our computers and furniture and we put people on W-2s. We gave our employees a 401k right away. I think it’s important to really treat your people right.”

Ramirez acknowledged that he can’t make changes to the business as quickly as he used to. With more than 20 people, he said that costs go up dramatically and therefore decisions have to be much more calculated.

“It takes time to move the ship,” Ramirez said, “and if you’re not careful, everyday can be consumed by the small stuff.”

That’s why he stresses the importance of delegating roles to others.

“It’s the only way to free up your time so you can focus on the bigger picture,” he said.

Now, he said that he very rarely speaks to funders anymore. He has two processors on staff whose job is to organize the paperwork from the brokers and send it to the funders. They organize the company pipeline, he said.

Ramirez said that it can be quite difficult to find the right mix of funders.

“Some funders who you think will be great turn out not to be and other funders who you’ve never heard of turn out to be real diamonds in the rough,” Ramirez said.

And like many brokers feel, Ramirez agrees that when it comes to funders, less is more.

“Having a very precise and small list of funders is incredibly important…because it simplifies your process [and] having a simple process is one of the keys to scaling your business,” Ramirez said.

Ramirez said that a common mistake brokers make is to test out a bunch of brokers all at once. He said that brokers need to try working with new funders intelligently, which means one at a time.

“When you bring on a new lender, you carefully watch every submission to them,” Ramirez said. “You want to make sure they’re not backdooring you. So usually you want to put your phone number and your email address in the contact info so you can catch them if they’re trying to be sneaky. [If they are,] they’ll call asking for the client and you know you only sent that deal to one lender.”

He’ll sometimes then pretend he’s interested and record the call. On about three occasions, he said that he has sent recordings like this to the backdooring lender and he’ll write “this is why I don’t send deals to you.”

Ramirez’s small group of trusted funders are OnDeck, National Funding, BFS, and Orange Advance.

As Ramirez expands, he says he only hires brokers by referral. He said that 90% of his business is short term business loans and MCAs, and 10% is SBA loans and real estate transactions.

Ramirez said that so far, ZR Consulting has originated $15 million in deals since inception and has earned $1.5 million in revenue.