New Law Benefits Small Banks

May 24, 2018 President Trump signed into law today the Economic Growth, Regulatory Relief and Consumer Protection Act, which pares down Dodd-Frank regulations for thousands of small and medium-sized American banks. Dodd-Frank refers to the 2010 Dodd-Frank Act, which instated laws to regulate the risky behaviors of banks that led to the 2008-2010 financial crisis.

President Trump signed into law today the Economic Growth, Regulatory Relief and Consumer Protection Act, which pares down Dodd-Frank regulations for thousands of small and medium-sized American banks. Dodd-Frank refers to the 2010 Dodd-Frank Act, which instated laws to regulate the risky behaviors of banks that led to the 2008-2010 financial crisis.

Among the changes this new law makes to Dodd-Frank is reducing the number of banks that are subject to strong government oversight because they are considered “systemically important.” Banks with assets of $50 billion or more had been considered “systemically important.” As of today, only banks with assets of $250 billion or more will get that moniker and be subject to the strictest government regulations.

In addition to this, small banks – generally with assets of $10 billion or less – will now be much freer to originate residential mortgages. And they will have to comply with fewer regulations in general.

“There are simplifications in [this law] that change the capital costs for smaller banks,” said Dodd-Frank expert and Senior Counsel at Morrison & Foerster, Oliver Ireland. “By lowering the cost structure of the bank, you may facilitate lending at either lower rates, or more lending.”

Ireland said that there is no way to quantify this, but acknowledged that small banks will be in a stronger position with this new law in place. As for the effect of the new law on alternative lenders, Ireland didn’t predict anything at all dramatic.

Still, he said, “There are a number of provisions in here that make the cost of being a small bank somewhat less. That may put them in a better position to compete with non-bank lenders.”

Why Small Businesses Sought Financing in 2017, and Why They Were Denied

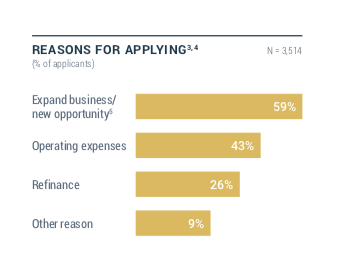

May 24, 2018 Nearly 60 percent of small businesses applied for financing in 2017 because they wanted to expand their business or pursue new opportunities, according to the latest report by the Federal Reserve. Forty-three percent of small businesses sought financing for operating expenses while 26 percent sought capital for refinancing. Nine percent had a different reason.

Nearly 60 percent of small businesses applied for financing in 2017 because they wanted to expand their business or pursue new opportunities, according to the latest report by the Federal Reserve. Forty-three percent of small businesses sought financing for operating expenses while 26 percent sought capital for refinancing. Nine percent had a different reason.

Of course, not all applications are funded. Forty-six percent of small businesses received all the financing they sought, 12 percent received most (more than 50 percent) of it, 20 percent received some (less than 50 percent) of the financing they desired and 23 percent were denied financing altogether.

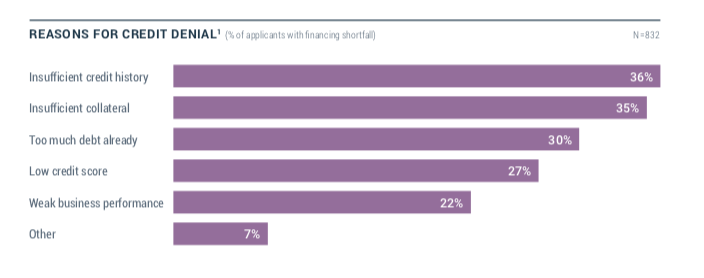

Of the reasons why merchants were denied funding, “Having insufficient credit history” ranked number one, according to the report. A very close second was “Having insufficient collateral,” followed by “Having too much debt already.” After that, in descending order, came “Low credit score,” “Weak business performance” and “Other.”

The “Having insufficient collateral” category does not apply for MCA financing, but the other categories do. According to Nick Gregory, founding partner at Central Diligence Group, which provides MCA underwriting services, “Having too much debt already” is perhaps the main reason why merchants seeking cash advances get declined.

“A lot of times the merchants are overleveraged,” Gregory said.

He explained that if a merchant also has something like two MCA arrangements (or positions) already, that merchant likely has taken on too many contractual obligations which will often be a reason to decline the application. In Gregory’s experience, another common reason for declining an MCA financing application is “Weak business performance.”

Contradictory to the Federal Reserve report’s top reason for denying financing to a small business borrower, Gregory said that “Having insufficient credit history” is seldom a reason to deny MCA financing. This disconnect likely comes from the fact that the report includes all types of small business financing, with MCA accounting for just seven percent. The number maybe seem small, but it continues to increase while small business applications for factoring have decreased.

BFS Co-founder Returns as Temporary CEO

May 23, 2018 Chairman and co-founder of BFS Capital Marc Glazer has assumed the role of Interim CEO. The former CEO, Michael Marrache, is no longer at the company.

Chairman and co-founder of BFS Capital Marc Glazer has assumed the role of Interim CEO. The former CEO, Michael Marrache, is no longer at the company.

“We’re on a nationwide search to find an individual that we feel will be an excellent candidate to continue BFS’s track record as a market leader and help grow the company,” Glazer said.

Founded in 2001, BFS is a veteran in the merchant cash advance industry. More than five years ago, the company began offering a business loan product, which now accounts for more than half of its revenue.

Glazer told deBanked that when BFS started offering its loan product, it widened its customer base significantly such that a sizable percentage of its customers are now business to business companies. Glazer said that MCA funding would not work for these kinds of customers because many of them get paid by check or get paid in larger amounts, but not on a daily basis.

Glazer said that working with ISO partners has always been a critical part of the BFS business model. What does Glazer look for in an ISO?

“Ultimately, you want to work with ISOs that view the relationship with not only the funder, but the merchant, [in mind,]” he said. “We look at ourselves as a responsible funder and put out offers that we not only think help the merchant, but that have payment terms that the merchant can afford. And the ISOs that we look for are ones that do the same kind of matching with the merchant.”

BFS has funded 400 different types of merchants, from florists to nail salons. But Glazer said that a big portion of the company’s customer base comes from either the hospitality industry or parts of the construction industry, including plumbing. To date, BFS has delivered more than $1.75 billion in total financing to small and mid-sized businesses, including $300 million funded in 2017. Loans are typically offered through the company’s banking partner, Bank of the Internet, according to Glazer.

BFS is headquartered in Coral Springs, FL and has an office in New York and one in southern California. It also includes a wholly owned subsidiary in the UK called Boost Capital. Altogether, BFS employs about 200 people with the majority of employees at its Florida office.

Panelists Share Marketing Advice at Broker Fair

May 20, 2018

Jennie Villano, Vice President of Business Development at Kalamata Advisors, opened Broker Fair’s “Marketing Your Business” panel by stressing the importance of being personable on LinkedIn. She said that while LinkedIn is certainly a professional platform, warmth and congeniality go a long way. And so does thinking creatively by presenting yourself outside of your professional box.

For instance, about two months ago, Villano started a cooking show video series on her LinkedIn page called “Cooking with Kalamata,” in reference to her company’s name. In each video, she invites a different guest to cook something with her in an informal home kitchen setting.

Villano acknowledged that cooking has nothing to do with lending. But it doesn’t matter, she said. The cooking shows allow potential clients to see her in a casual, non-business environment so that even if she hasn’t met many of her LinkedIn contacts, they can feel like she’s a personal friend. And people want to do business with their friends, she said.

The “Cooking with Kalamata” video posts, which are two to four minutes long, have received thousands of views and Villano said that she has seen an increase in business in just the few months after she started making these videos.

Tom Gricka, founder and president of Bablyon Solutions, a marketing and technology company that services the alternative lending industry, spoke about the importance of communication among different teams within a company.

If a company has a bad month, Gricka said that often brokers will blame the marketing team for bad leads and the marketing team will blame the brokers for not selling well. Gricka said that usually neither party is correct. Instead, he said that brokers should be communicating with lead generators about what they’re hearing on the phone and what kinds of leads they would like to be getting more or less of. Likewise, marketers/lead generators need to listen to what the salespeople are saying so that they can produce more targeted leads.

Finally, CEO of Reliant Funding Adam Stettner spoke about the importance of testing marketing efforts online. And he said to make sure that you’re only testing one variable at the same time.

Reliant Funding started by using direct mail marketing, but Stettner said that if he had to do it over again, he would have started with online marketing. And he recommended starting out with online marketing particularly for companies or individuals with small budgets because online marketing is less expensive and can be more easily adjusted.

Andrew Smith Named Director, FTC’s Bureau of Consumer Protection

May 20, 2018 On Wednesday, Andrew Smith, former partner of the law firm Covington & Burling, was named the Federal Trade Commission’s Director of the Bureau of Consumer Protection.

On Wednesday, Andrew Smith, former partner of the law firm Covington & Burling, was named the Federal Trade Commission’s Director of the Bureau of Consumer Protection.

This is not Smith’s first role in government. From 1997 to 2000, Smith worked as a lawyer for the Securities and Exchange Commission. And from 2001 to 2005, he worked as a lawyer for for the Federal Trade Commission (FTC), where he will now be returning.

Since leaving the FTC, Smith served as a partner at Morrison & Foerster and most recently at Covington & Burling. Smith’s recent appointment garnered criticism from government officials who pointed out that Smith has represented egregious offenders of consumer rights. Of the five FTC commissioners, the two Democratic commissioners voted against his appointment.

But a recent New York Times article, which stressed the fact that Smith has represented violators of consumer rights, also acknowledged that he is “regarded as a hard-working and knowledgeable lawyer even by critics.”

Chairman of the FTC Joe Simons, who appointed Smith, expressed dismay over his colleagues’ rejection of Smith.

“I am disappointed that two of my new colleagues have chosen to turn Mr. Smith’s appointment into a source of unnecessary controversy,” Simon said in an FTC statement. “I am highly confident that Mr. Smith will be an effective leader of the Bureau of Consumer Protection. He is widely respected as one of our country’s best and most experienced consumer protection lawyers.”

Smith has recently represented Facebook, Uber and Equifax, all companies with cases before the FTC. Because of this, it is most likely that Smith will recuse himself from these cases. Critics of Smith’s appointment, including Democratic U.S. Senators Elizabeth Warren, Richard Blumenthal and Brian Schatz believe that this makes him unfit to be director of the bureau. But Simon strong disagrees.

“When a political appointee is recused, the Commission relies even more heavily on these seasoned career professionals to allocate resources and tee up recommendations for the Commissioners, who are the ultimate decision makers,” Simon said in an FTC statement. “When Mr. Smith is recused on a matter, I know [the bureau’s] career managers and staff will ensure that American consumers are still well protected.”

Fundbox Partners with Eventbrite to Provide Credit to Event Organizers

May 17, 2018 Today Fundbox announced an integration with Eventbrite that will give small business event creators access to capital.

Today Fundbox announced an integration with Eventbrite that will give small business event creators access to capital.

Fundbox Chief Business Officer Sebastian Rymarz told deBanked that event planners for small businesses often have to lay out a lot of money up front – to secure a venue, rent equipment or pay for a performer – before they get paid through ticket sales later.

“There’s this mis-timing between expenses and revenue,” Rymarz said. “There’s an acute need and we’re able to serve [event creators] by providing them with capital to fund those events.”

Funding a company as it anticipates future earnings sounds akin to factoring. But this solution for event creators is not a factoring product. In fact, Rymarz said that Fundbox does not have a factoring product. Instead, this new solution is a new application of what the company calls its Fundbox Line product. This is a line of credit that is paid back weekly over 12 to 24 weeks, regardless of when an invoice is paid, or when tickets are sold.

Fundbox doesn’t purchase invoices. It doesn’t even verify if an invoice exists. Instead, the company relies on its technology. Once an application is submitted, its proprietary system reveals a company’s payment history, its clients, vendors and other information that paints a picture of its creditworthiness. The data system, which Rymarz calls a “ledger graph,” is a web of thousands of small and medium-sized businesses that contains information about the businesses’ relationships to one another.

“Every customer that applies makes our algorithms smarter,” Rymarz said.

He also explained that Fundbox does not employ a single underwriter. Rather, the company invests heavily in developing technology, like its ledger graph. Rymarz said that of the company’s roughly 170 employees, 60 percent of them are either machine learning experts, data scientists or engineers.

The company, co-founded in 2013 by CEO Eyal Shinar, is headquartered in San Francisco and has a research and development team in Tel Aviv.

LendingPoint Secures Facility of up to $600 Million

May 17, 2018 LendingPoint announced today that it has closed on a credit facility for up to $600 million, arranged by Guggenheim Securities. The direct consumer lender secured a facility in September 2017 for $500 million, bringing its recent combined credit facility to $1.1 billion, in just nine months.

LendingPoint announced today that it has closed on a credit facility for up to $600 million, arranged by Guggenheim Securities. The direct consumer lender secured a facility in September 2017 for $500 million, bringing its recent combined credit facility to $1.1 billion, in just nine months.

LendingPoint Chief Marketing Officer Mark Lorimer told deBanked that he was thrilled about the new facility for a number of reasons.

“But what I’m most excited about is the fact that we need it,” he said.

In the first quarter of 2018, LendingPoint processed more than 850,000 applications from borrowers requesting more than $9.2 billion in loans. These numbers are up from a year ago and also up from the fourth quarter of last year.

This rapid increase in demand has mostly been for the company’s primary loan product, a consumer loan for people with credit scores between 580 and 700, which LendingPoint calls “near prime.” These loans are between $2,000 and $26,500 with terms of 24 to 48 months.

“While our competition will occasionally dip down [to our level], they tend to be more comfortable in the 680 and up type of range, and that means that many of [the near prime] customers will come to us.”

With LendingPoint’s acquisition of merchant onboarding company LoanHero in December 2017, LendingPoint started offering a point of sale product to merchants at the begin of 2018. This loan product offers between $500 and $15,000 to consumers making specific purchases and these loans (with terms from from 12 to 60 months) have also been in very high demand, according to Lorimer.

This product has only been offered for six months, but Lorimer said that he would not be surprised if it becomes the larger contributor to overall originations within the next few years. For now, though, the company’s direct consumer loan product is responsible for the lion’s share of originations.

Since company issued its first loan in 2015, LendingPoint has originated more than 50,000 loans totaling more than $500 million. Headquartered in Kennasaw, GA, outside of Atlanta, the company employs about 160 people.

Strategic Funding Announces Securitization

May 12, 2018

Strategic Funding received preliminary ratings from Kroll Bond Rating Agency on four classes of Series 2018-notes that can be sold to investors. The notes are composed of Strategic Funding’s receivables, packaged together based on quality.

“It’s certainly exciting to be able to meet the requirements of a securitization,” said Strategic Funding CEO Andrew Reiser. “Kroll is a very responsible agency and they put you through a lot of rigor to be able to meet [their] requirements and have a rated bond.”

Reiser told deBanked that although their securitization starts at $100 million, it gives the company the ability to ramp up to $500 million.

“A securitization allows you to continue to grow without having to constantly find who’s the next source of capital,” Reiser said.

He spoke of a securitization in contrast to a warehouse line of credit, which is a short-term revolving credit facility.

“A warehouse line requires banks to bring on more banks [which] is more tedious. With a securitization, it’s a very seamless process. It makes growth easier.”

Only Kabbage and OnDeck have a securitization in the alternative lending space, Reiser said.

The notes will be secured by a pool of the company’s receivables consisting of business loans and merchant cash advances. This securitization is particularly unique as it is uncommon to securitize merchant cash advances since the timing of a cash advance receivable is uncertain. (The securitizations for Kabbage and OnDeck are not backed by merchant cash advances as those companies don’t provide this product.)

The four classes of notes, valued at $100 million, received the following ratings by Kroll:

A- notes ($65,394,000), BBB- notes ($19,131,000) BB notes ($5,777,000) and B notes ($9,698,000).

Founded in 2006, Strategic Funding is headquartered in New York, with other offices in Boca Raton, FL, Arlington, VA, and Rockwell, TX, outside of Dallas.