Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Jonathan Braun Has Checked In To Prison

January 2, 2020 Jon Braun, who Bloomberg Businessweek profiled in a 2018 story series, checked into FCI Otisville on Thursday. He was sentenced to 10 years in prison on May 28th for drug related offenses he committed a decade ago. He was originally scheduled to surrender on August 25th but he successfully delayed the date until today, January 2nd.

Jon Braun, who Bloomberg Businessweek profiled in a 2018 story series, checked into FCI Otisville on Thursday. He was sentenced to 10 years in prison on May 28th for drug related offenses he committed a decade ago. He was originally scheduled to surrender on August 25th but he successfully delayed the date until today, January 2nd.

I have not attempted to contact Mr. Braun since the day of his sentencing. But purely by chance I shared an elevator with him in the Brooklyn Federal Courthouse on May 28th just mere minutes after he had been handed ten years. Given the opportunity, I asked him how he felt about what just happened.

“I hope it goes by quick,” he replied stoically.

The End Of An Era – deBanked Through The Decade

December 30, 2019

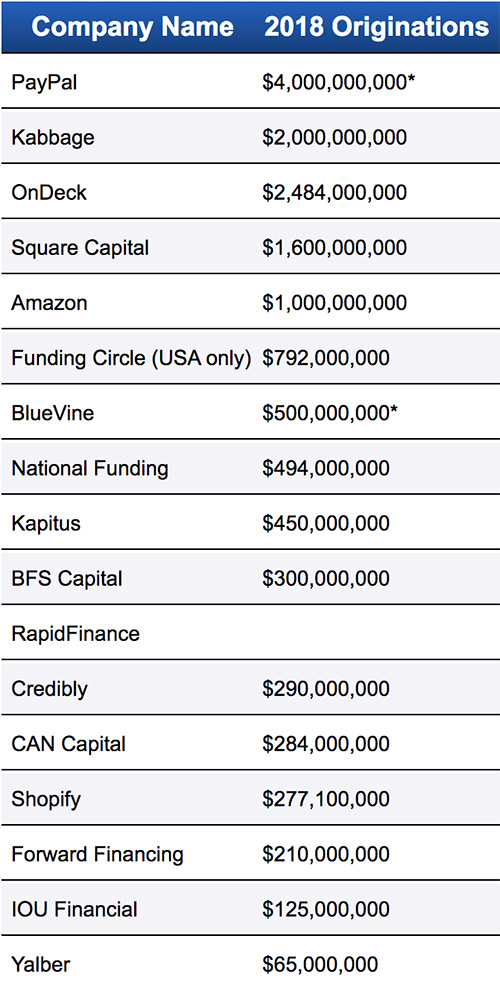

deBanked estimated that approximately $524 million worth of merchant cash advances had been funded in 2010.

In 2019, merchant cash advances and daily payment small business loan products exceed more than $20 billion a year in originations.

First Funds

Merchant Cash and Capital

Business Financial Services

AmeriMerchant

Greystone Business Resources

Strategic Funding Source

Fast Capital

Sterling Funding

iFunds

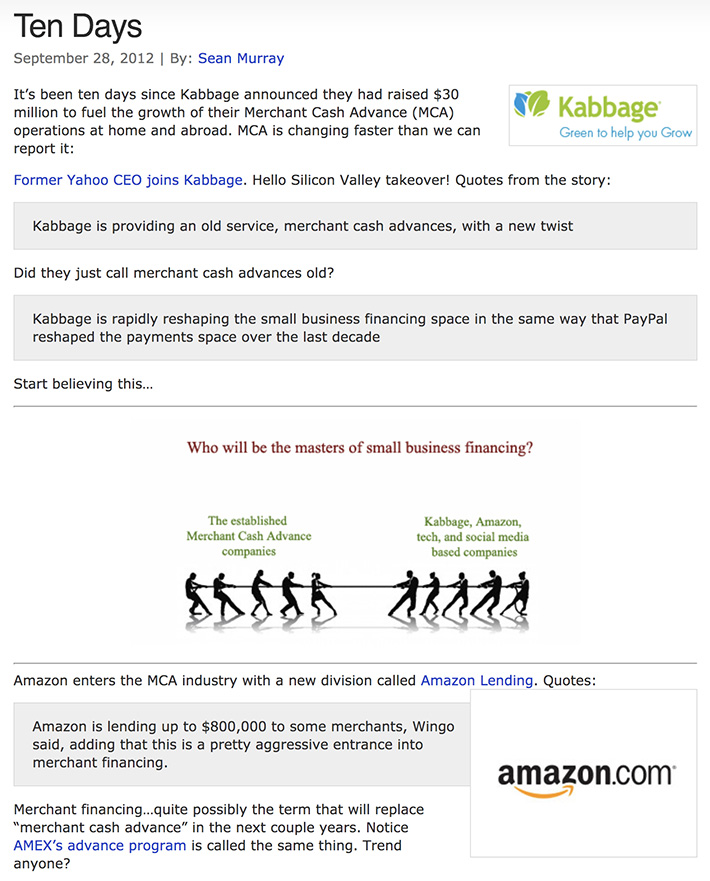

Kabbage

OnDeck

Square Capital

Amazon Lending

Funding Circle USA

Yellowstone Capital

Entrust Cash Advance

Merchants Capital Access

Merchant Resources International

American Finance Solutions

Nations Advance

Bankcard Funding

Rapid Capital Funding

Paramount Merchant Funding

How GRID Finance’s Cash Advances Are Building Stronger Irish Communities

December 27, 2019

Five years ago, a small company in Dublin put Ireland’s fintech scene on the map by advising local SMEs to “get on the GRID.” GRID Finance, founded by Derek F Butler, introduced a peer-to-peer lending model to Irish businesses at a time when the industry was just beginning to form. From the beginning, the company’s secret sauce was the GRID Score, a proprietary credit score system that enabled the company to take on the difficult task of assessing the risk of SMEs.

Butler, who I sat down with in September at the company’s headquarters alongside Chief Marketing Officer Andrea Linehan, says the GRID Score is an SME’s “passport to the economy.”

It’s the upper tier that GRID caters to while providing a unique product within Ireland known as a cash advance. The setup is similar to Square and PayPal in the US in that the loans are repaid via a percentage of an SME’s credit/debit card transactions on a daily basis. The term of the loan is fixed and the costs are reasonable.

“The reality is that small business funding and financing is a high risk,” Linehan says.

“There’s no subprime market here,” Butler adds. “We’re trying to build a prime cash advance market versus a subprime one in the US.”

Like GRID’s competitors in the industry, Linehan believes that finance in Ireland will transition online. “Ireland is still dominated by two banks,” she says, referring to Bank of Ireland and AIB. The company, therefore, believes it has a good head start on the impending shift. But in the meantime, they’ve learned how important it is to be embedded in the local communities. To that end, GRID has an office in Limerick, Ireland’s third largest city with 95,000 people that’s located about 200km away from its headquarters in Silicon Docks.

Like GRID’s competitors in the industry, Linehan believes that finance in Ireland will transition online. “Ireland is still dominated by two banks,” she says, referring to Bank of Ireland and AIB. The company, therefore, believes it has a good head start on the impending shift. But in the meantime, they’ve learned how important it is to be embedded in the local communities. To that end, GRID has an office in Limerick, Ireland’s third largest city with 95,000 people that’s located about 200km away from its headquarters in Silicon Docks.

And their mission goes beyond providing funds. “If we can help get [SMEs] ready by giving them the tips to improve their financial health right now, let’s try and do that,” Butler says. “We want them to understand their financial health versus their cost of capital.”

While the company has sustained modest growth, Business Post reported earlier this month that GRID plans to raise €100 million in 2020 to provide even more loans through its platform.

Butler likens GRID’s mission to the MetLife Foundation, promoting financial health and building stronger communities. “We do a lot of work with the MetLife foundation because of the impact they have,” he says. “It’s why I launched GRID Finance.”

deBanked Throwback Thursday

December 26, 2019As we count down the end of the decade, I thought you might want to take a glimpse of how the decade started here at deBanked. Below is a snapshot of the main merchant cash info page that was on our site in December 2010!

When 2010 ended, I published the following predictions for 2011:

- Businesses will increasingly face pressure on past due taxes and as a consequence would face smaller funding offers with higher costs.

- Credit card processors will venture into funding their own clients rather than rely on 3rd party MCA companies.

- Brokers will increasingly begin to fund their own deals.

- Increasing competition will create downward pressure on costs.

- It will become harder for desperate businesses to obtain funds from anywhere, including MCAs.

Might some of that be true of the recent years?????

deBanked’s Top Ten Things of 2019

December 20, 2019In this video, I break down deBanked’s Top Ten Things of 2019. Happy holidays and have a Happy New Year from all of us at deBanked!

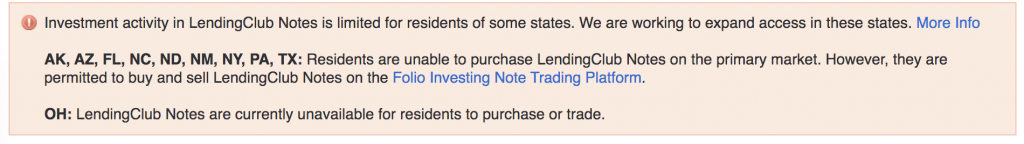

LendingClub Retail Investors Still Frozen Out In Several States After Sudden Restriction

December 5, 2019 On September 23, retail investors on the Lending Club platform in 5 states received strange news, they had been temporarily restricted from buying notes because of the state they lived in. No further information was provided.

On September 23, retail investors on the Lending Club platform in 5 states received strange news, they had been temporarily restricted from buying notes because of the state they lived in. No further information was provided.

74 days later, investors in New York, Florida, Texas, Arizona, and North Dakota (the affected states) are still frozen out from buying notes. Restrictions in a handful of other states have existed for years.

Lending Club was asked about this by Wedbush Securities analyst Henry Coffey on the November 5th Q3 earnings call and CEO Scott Sanborn explained that it was due to a review of their state licensing requirements that was conducted in their pursuit of a bank charter. “As part of our overall preparation for the bank charter, we did an updated review of our licensing requirements,” Sanborn said. “We identified some that we have that we don’t need and some that we believe we need that we don’t have, and that’s what you’re seeing.”

Sanborn went on to describe the overall impact of temporarily losing those investors to their bottom line as immaterial and that they were working quickly to restore investing access.

A month later, the restriction persists. 58 comments on the subject have piled up on a LendAcademy blog post discussing the matter, many of them unhappy. Investors in those states can still trade notes on the secondary market, but that is not really a consolation.

It may not matter. Lending Club stopped relying on individual retail investors as a significant funding source long ago.

StreetShares Discontinues Major Segment of Its Financing Business

December 3, 2019 StreetShares quietly discontinued a major part of its financing business on November 15, a new disclosure filed with the SEC revealed. “For new customers, the Company is no longer offering to factor invoice receivables,” the letter signed by General Counsel and Chief Compliance Officer Lauren Friend McKelvey says.

StreetShares quietly discontinued a major part of its financing business on November 15, a new disclosure filed with the SEC revealed. “For new customers, the Company is no longer offering to factor invoice receivables,” the letter signed by General Counsel and Chief Compliance Officer Lauren Friend McKelvey says.

The company had purchased more than $112 million in receivables since it began offering this product in December 2016, had serviced 40 customer accounts, and had advanced as much as $7 million on a single invoice as recently as Fiscal Year 2019.

The company has only facilitated $180 million in funding to small businesses since inception in 2014. That would indicate that the invoice factoring portion was roughly half of the company’s funding volume.

As of November 15, the company said it only had one customer remaining that was still using this product and no new ones would be accepted. Instead it would continue to offer only loans and lines of credit.

StreetShares relied heavily on individual retail investors to purchase receivables, their publicly filed financials show. 98.28% of all funds advanced on invoices in FY19 came from the retail investor segment whereas it was only 50.22% in FY18.

The company had also recently reported a heavy net loss and soaring costs.

Flender Makes BIG Mark in Ireland’s SME Lending Market

November 26, 2019 Ireland can seem like a small place, so much so that on my way to meeting with Colin Canny, Flender’s Head of Partnerships, I quite literally bumped into Flender’s co-founder & CEO Kristjan Koik who was walking through Dublin’s Silicon Docks. I recognized Koik from the who’s who catalogue of executives I had compiled before traveling abroad to explore the Irish fintech scene. He was cordial and polite. And yet through his demeanor I sensed there was more, that there was a story to be told even if it was not ready to be shared.

Ireland can seem like a small place, so much so that on my way to meeting with Colin Canny, Flender’s Head of Partnerships, I quite literally bumped into Flender’s co-founder & CEO Kristjan Koik who was walking through Dublin’s Silicon Docks. I recognized Koik from the who’s who catalogue of executives I had compiled before traveling abroad to explore the Irish fintech scene. He was cordial and polite. And yet through his demeanor I sensed there was more, that there was a story to be told even if it was not ready to be shared.

The following month Flender would reveal remarkable news, a new €75 million funding line, bringing their total to €109 million raised since the company’s founding in 2015. The company is backed by Eiffel Investment Group, Enterprise Ireland, entrepreneur Mark Roden and former Ireland rugby player Jamie Heaslip.

This large amount of funding, even by UK or US standards, makes Flender stand out, and so when I finally meet with Canny on that warm Fall day in September, I’m pretty thankful he afforded me the time.

Flender, Canny explains, is derived from Flexible Lender. The pamphlet he produces and hands to me says that their idea is simple, to provide businesses with the funding they need and ensure the application process is fast, easy, and transparent.

Application details for products like term loans and merchant cash advances require the usual stips like historical bank statements, a profit & loss statement, and a balance sheet. But there’s also a section quintessentially Irish, that is that it can be beneficial to submit your last 2 years herd numbers if you’re a farmer, complete with your last 12 months Milk Reports and property acreage figure.

Canny explains that Flender is not a high-risk fall-back lender, but rather the opposite. “Our credit process is extremely tight,” he says, “in line with banks.” And with good rationale, seeing that the company is still somewhat reliant on a peer-to-peer funding model. More than half of individual peers on the platform are Irish but Canny says that it’s not unusual for non-residents including Americans to lend on the platform as well.

Canny explains that Flender is not a high-risk fall-back lender, but rather the opposite. “Our credit process is extremely tight,” he says, “in line with banks.” And with good rationale, seeing that the company is still somewhat reliant on a peer-to-peer funding model. More than half of individual peers on the platform are Irish but Canny says that it’s not unusual for non-residents including Americans to lend on the platform as well.

Canny says the Irish market is very “community based.” The transparency of the marketplace aligns with that characterization. Like other peer-to-peer small business lenders in Ireland, borrower identity is publicly accessible on the platform, as are the terms of the loan. Anyone can view the business name of a prospective borrower on the website, the address, a bio, and even their “story.”

Flender taps several marketing channels like Google Adwords, radio, direct sales, and even brokers. Canny says they generate an underwriting decision in as quick as 4-6 hours and fund a business in as little as 24 hours. Borrowers like the product so much that many renew. Seventy percent of the SMEs in the country are peer-to-peer bankable, Canny explains, creating a wide playing field to target.

Meawnwhile, CEO Kristjan Koik told the Irish Times that the top 3 banks in Ireland have 92 percent of the SME lending marketshare so there is still a ton of opportunity for non-banks like Flender to grab hold of.

As for how the massive credit line impacts them going forward? Koik told the Times that they would be cutting interest rates by up to 1 percent across their various loan products. Interest rates now start as low as 6.45% and terms range up to 36 months.

As Canny and I part ways I present one final question, will Flender be expanding abroad? I get no definitive answer. He was cordial and polite, and yet I sensed through his demeanor that there was more, perhaps even a story in the works that was not yet ready to be shared.