Archive for 2010

P2P Merchant Cash Advance Model Already Exists

December 23, 2010Posted on December 23, 2010 at 6:02 PM

Just a few weeks ago, we covered a story on how the Merchant Cash Advance(MCA) industry was evolving towards the Peer 2 Peer Lending Model. Apparently we were very right. We envisioned a future live marketplace that resembles Prosper.com and today discovered the closest thing so far: the Colonial Funding Network(CFN). http://www.colonialmgmt.biz/ready.html. Our site authors have no connection to CFN and we hope this reivew is not received as a gimmicky advertisement.

So why is CFN a highly evolved Merchant Cash Advance marketplace?

• You(meaning anyone) can pick the business to fund

• You can put up the capital

• You can contribute just a part of the capital

• You can have control over the funding terms

• You don’t do the underwriting

• The pay back and setup is serviced by the market maker (Strategic Funding Source)

• Businesses have already been funded using this model

An excerpt from their site:

“Ready to be a player? Take advantage of our world class capabilities! Colonial Funding Network is the answer for you. You find the merchant, invest the cash, and Colonial Funding does the rest.

Colonial will handle every detail of fulfilling and managing your merchant cash advance. From providing underwriting data, to administration… including filings, bookkeeping,reporting and disbursements… we do it all. Through our state-of-the-art Merchant Funding web portal, you’ll have real-time information on your clients… anytime you want it!”

Sounds very much like P2P is already staking its claim in the Merchant Cash Advance world. I wonder how far it will go….

deBanked

Financing Business Startups: What ISOs Should Know

December 22, 2010This is the exact title of an article published in December’s issue of The Green Sheet. It informs the merchant processing industry that businesses have several financing options available to them and wait for it…. wait for it….. it talks all about bank loans. Thank you Green Sheet for neglecting to state the most feasible, obvious solution for both businesses and merchant processing reps, Merchant Cash Advance (MCA).

The author advises that ISOs should partner up with bankers to help their merchants obtain loans and then contradicts his argument by saying that partnering up with banks is a far fetched idea that isn’t likely to work. An excerpt: “One of the best contacts you can cultivate as an ISO or MLS is a local lender who specializes in Small Business Administration financing. Generally, this will be a “community bank,” typically a small, local financial institution. A small business will almost always start at a community bank and only graduate to a larger bank because it needs a line of credit that is bigger than the bank’s legal lending limit. But even a community bank SBA officer may not be able to make a loan happen…”

So what is a processing rep to do? The article reads; “Find one that does these loans – and does them well. The bank has to “sell” loans to the nearest SBA district office, and banks get a semi-permanent reputation there for either understanding or not understanding credit risk. Required documents include a written document stating the reason for the loan request, history of the business, lease agreements, percentage ownership breakdown, estimated profits and cash flows, and projected opening day balance sheet. An existing small business applying for an SBA loan needs to include three years’ financials, aging of accounts receivable and accounts payable, and debt schedules. Keep in mind that most small businesses do not want to pay taxes, so they minimize profit – not good when you are applying for a loan. For the same reason, they will not have audited financials.”

That can be summarized as “Go find someone who can help and helps you well.” Not very informative, nor does the rest of the paragraph inspire any confidence in being able help solidify financing for your merchant.

The Green Sheet is very familiar with the MCA Industry. Therefore the idea that MCA would be left out of a small business funding discussion for processing reps was hopefully an intentional omission. The article seems to be one overextended segue to promote “The Receivables Exchange,” a live online marketplace for Accounts Receivable factoring. Not that we have anything against it, but if the article is going to be titled What ISOs Should Know, then they Should Know that MCA is the the easiest, fastest, and most flexible financing product you can offer to a merchant.

A relationship with a community bank is great but if you can’t leverage that relationship to actually get your client the capital, you’re not adding any value. A MCA carries no fixed payment terms or collateral. The underwriting process is quick and credit is not a major factor.

You may now think that our long winded bashing of The Green Sheet article was just a segue to promote the Merchant Cash Advance industry. Ironically you’re right, but then again if you’re in the merchant processing industry and need to know about financing young businesses, then MCA is What ISOs Should Know.

deBanked

https://debanked.com

The Direct Funder Model is Sooo 2009

December 1, 2010Originally posted on Dec. 1, 2010

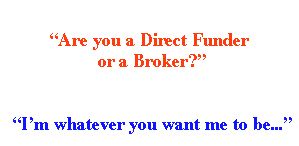

We touched on this in a previous post and think it’s important to expand on it. The Merchant Cash Advance industry has evolved over the last several years. The clear line between Broker and Funder is becoming incredibly blurred.

Many Direct Funding companies are now offering brokers the opportunity to contribute their own funds towards an advance and share in the profits(And the risk!). On the same token, many big name brokers seem to have filed a handful of UCCs as a secured party, an indication that they have funded accounts all by themselves.

Some industry vets have taken things to another level and are calling on multiple parties to share in a single advance. For example: A broker contacts several other brokers/funders and requests if they want to all chip in. One firm usually takes the lead and services the account to reap a management fee. This collaborative group financing acts like a mini hedge fund but we believe this signals an evolutionary move towards the Peer 2 Peer(P2P) Lending model. In essence a P2B model that looks like this:

This is an an altered picture of the Prosper.com P2P Lending Site.

Prosper boasts of having funded $210,000,000 since their inception. The Merchant Cash Advance industry has put out more than that in just the previous 6 months. So the concept is similar and it fits the mold. Merchants submit documents and an application to a P2B Network. The Network posts the business profile, processing history, personal credit score, reference information, and publicize it on the site. Anyone can then peruse businesses and choose which to contribute funds towards. Once the total advance amount that the P2B Network recommends has been raised, the P2B Network converts the processing, transfers funds to the merchant, and maintains the account for a fee.

While we don’t anticipate the entire industry to convert to this model, nor do we predict if it will actually work, this will inevitably become a segment of the market. The Merchant Cash Advance industry received much criticism back in 2007 and 2008 but the tone has changed dramatically. The phrase “banks aren’t lending” is so worn out that people should be fined for saying it. Self regulating industry practices, the recent mass exodus of devilish sales brokerages, and the banking problem, have not only brought the Merchant Cash Advance industry legitimacy but also made it one of the preferred and most credible funding options available to small business.

A P2B network could do all of the underwriting, complete with a final say on approvals or they could present a business as is and allow everyone in America to be their own underwriter and make the determination themselves. How tempting would be it to invest $100 to a business in your community and buy a percentage of their future credit card sales? We like the concept and the industry is halfway there. Who’s going to start this first?

– An Opinion by the Merchant Cash Advance Resource

https://debanked.com/merchantcashadvanceresource.htm

============

UPDATE 12/23: P2P MARKETPLACE FOR MERCHANT CASH ADVANCE FOUND ALREADY TO EXIST, READ HERE

Most Small Business Owners Have Never Heard of a Merchant Cash Advance

November 5, 2010

Sales representatives within the industry report on a whole that the Merchant Cash Advance program has to be explained from the ground up quite often with potential clients. Ranging from ‘not understanding how it works’ to ‘having never heard of it before’, all signs seem to indicate that there is a vast market still unaware of this powerful source of capital. New businesses are born every day, adding to the list of prospects that will eventually find out banks are not there to help them… We hope business owners can find some information here and as always, choose your funding source wisely.

Merchant Cash Advance and Startup Businesses

October 20, 2010 Kudos to the entrepreneurs taking a chance in the worst economic period of modern times. Starting a business is already a truly challenging task in itself but before we shower you with praise for being the ultimate warrior of capitalism, let’s put everything into perspective.

Kudos to the entrepreneurs taking a chance in the worst economic period of modern times. Starting a business is already a truly challenging task in itself but before we shower you with praise for being the ultimate warrior of capitalism, let’s put everything into perspective.

Risk takers are a minority in today’s startup community. A persistently high rate of unemployment is breeding a culture of survivalists; Individuals that have been pushed to the limit via pay cuts, layoffs, and robo-signing foreclosing bankers. It’s resumé rejection, employer double talk, and anger at how Wall Street bankers continue to live. The new entrepreneurs are a resounding chorus of “If I can’t get a job, I’ll make my own job!” These people are going for it on 4th Down and Long and running it up the middle for a touchdown. It’s as if Charles Darwin spiked their Corn Flakes.

Startup survivalists are just as inspiring as their risk taking counterparts. Both groups have the drive and that’s essential. But you can’t forego some basic tools. Financing is a must. No capital, no business. Unless you are fortunate to start with deep pockets, you need access to cash.

New businesses are not likely to be offered credit terms by vendors, nor can you push back overhead expenses such as rent, until you’re generating revenue. If unforeseen demand overwhelms your capacity, a cash shortage can do irreparable damage to your success.

Rather than spew rhetoric about the importance of funds, and shortchange you with a bullet point list of vague sources whom in reality are so illiquid, they’re not actually viable, we’ll offer our real 2 cents.

Banks. For a startup? Not happening. Angel Investors and Venture Capitalists? Slim to no chance. Unless these private investors live in your community, they’re not going to invest in your business. More than 90% of startups fail. For an investor to take that much risk, they’re going to do some hands on management or want to follow you around and critique how you’re spending their money. That’s not necessarily a bad thing. It just means that one can’t reasonably expect a return on their investment without intimate knowledge of the demographics and community the business is situated in.

Looking for private investors over the internet? Don’t. Your pro forma financial statements, data research, and business plan won’t help. Do you know how many businesses fail to open even after they incorporate, sign a lease, purchase inventory, advertise, and make preliminary hires? An astounding number are eclipsed by failed health inspections, license/permit rejections, and building code violations. This reasserts that unless an investor is personally intimate with your progress, the odds are stacked against them.

Lastly, you need not pay to get approved for capital. We’ve spoken with many start ups over the last year and are flabbergasted by the amount of new businesses that are convinced they have to pay a $3,000 upfront fee to get approved for a loan. The ones that actually pay are quick to learn what town the lender is based in; It’s called Scam City.

Real Option? Merchant Cash Advance. A Merchant Cash Advance offers a business with a lump sum of capital upfront. In return, a piece of every sale the business makes will go towards paying it back plus a predetermined fee. There is no due date or set term for repayment. That means if sales are slow to get off the ground, then funds will be repaid slower and with no penalty.

A Merchant Cash Advance provider entrusts you with their capital because of the unique security the repayment method offers. The business itself must accept credit cards as a form of payment. The credit card processing company will automatically deduct the agreed percentage piece of each sale transacted and forward it to the Merchant Cash Advance provider on your behalf for repayment.

A startup can qualify with as little as 1 week in business. As long as you open, you can get funding. Credit can play a limited factor and the cost can be hefty, but the access to capital is unmatched. From the date you apply, funds can be received in as little as 5 days.

Purchase inventory, pay the rent, advertise, hire, or seize an opportunity. Whichever shortcoming you face, it can be overcome with a Merchant Cash Advance. Industry experts project that funding is on pace to reach over $600 Million for 2010 alone. With advances ranging from as small as $1,000 to as high as $500,000, there is proof that numerous deals are being made every day.

We’ve seen the same books, guides, and expert advice columns that you’ve seen and all of them seem to be a reprint of useless suggestions like the SBA and searching for angel investors online. These people earn a living writing. Whether or not the money expert column in your newspaper actually helps you, makes no difference to them. We have many years experience in the Merchant Cash Advance industry and we make careers out of funding you, not telling you about funding.

We try not to promote any one company over another. There is no harm in enlisting the service of a middleman or reseller for one of the direct funding sources. It may actually benefit you. If you are open for business, you can obtain a Merchant Cash Advance. If you have been in business for a long time, a Merchant Cash Advance is still a fantastic option.

It’s 4th Down and Long. You’re ambitious, focused, and ready. You are the ultimate warrior of capitalism. A Merchant Cash Advance will supply the cash. Grow, take risks, survive, and don’t be surprised if your Corn Flakes taste funny.

Merchant Cash Advance Industry Funded $254 Million in First Half of 2010

October 16, 2010

The Merchant Cash Advance Resource estimates that approximately $254 Million dollars in Merchant Cash Advances were funded in the first 6 months of 2010.

Using anonymous inside connections, we were able to determine precise monthly funding volume from some of the top 20 major funding firms. Using existing UCC filing research, private data, and mathematical analysis, we were able to come up with the closest estimate of the industry’s activity. We will however give our figure a margin of error of $20 Million.

Our research also determined that funding volume increased by 35% in the 2nd quarter over the 1st quarter. This comes as no surprise as retail activity in January – March is traditionally weak.

Given the likely strength of the 4th quarter, the industry aims to hit approximately $600 Million for the year.

– The Merchant Cash Advance Resource

October Kicks Off Merchant Cash Advance Rush for Holiday Inventory Stock

October 15, 2010Every October, retailers eagerly plan their strategy to capitalize on the impending holiday consumerism. 2010 is much like last year or worse. The long lasting recession has caused wholesalers and distributors to eliminate much needed payment terms for inventory purchases. It has become extremely challenging for retailers to purchase the amount of inventory required for the holidays when Cash on Delivery is the only policy.

The profit on the sales will more than pay for the costs paid but if the cash isn’t there to buy the inventory in the first place, there’s a problem. Hence a major cash flow problem is inevitably created even for the most robust business.

That being said, Merchant Cash Advance companies will experience application overflow and marathon work hours. It is much like what accountants experience during tax season. The Merchant Cash Advance underwriting process tends to slow significantly in late November.

Business owners!: Poor credit, fair credit, good credit? There are options for all of you with a Merchant Cash Advance. From Starter Advances to Platinum programs. The next 4 weeks is a great time to look into and apply for funds before it may be too late!

We wish you all the best as the peak retail season approaches and as always, make sure you choose one of the reputable firms.

– deBanked

Direct Merchant Cash Advance Funders / Lenders

October 10, 2010Many ISOs are dabbling with funding their own merchants these days. The industry is maturing into a whole new generation of Broker/Funding hybrids. A great $10,000 deal might be worth your own private investment. 😀

The Merchant Cash Advance Resource has been compiling a directory of actual funding sources and invite you to be listed on our site. There is no cost and this site merely serves as an impartial central hub for industry information. This site receives over 100 visitors every day from ISOs, Funders, Merchants, Financial Firms, Processors, etc. Your company will receive widespread positive exposure to all the right people. If your company has a blog, we will link the feed right to your profile.

To be added, you must be an actual direct funder capable of showing us 5 recent UCC filings as evidence of your advances. We will also seek to verify your status with other insiders in the industry. Hybrid firms are acceptable as long as you also provide your own capital to clients. To be added, please e-mail us at merchantprocessingresource@gmail.com

If you enjoy our site and wish to share information, stories, or news about the Merchant Cash Advance industry, you can submit your articles here to share with others.