|

Phone: 888-851-8859 Learn More |

Since: July 2016 Since: July 2016 | |

Registered sales-based financing provider in VA Registered sales-based financing provider in VA |

Stories

BRIEF: Legend Funding Secures $3 million Debt Facility

June 14, 2016New York City-based merchant cash advance company Legend Funding secured a $3 million debt facility from Houston-based investment investment banking firm Ango Worldwide.

Legend provides working capital financing to businesses in the USA and Canada and the company plans to use the funds for expansion. The deal gets Ango some equity and a seat on the board.

“The merchant cash advance industry is experiencing exciting growth and we felt that the legend management team are strongly positioned to take advance of this opportunity,” said Ango CEO John Carson in a news release.

All Registered Sales-based Financing Providers in Virginia (As of 3-29-23)

April 2, 2023Is the revenue-based financing provider you do business with registered to operate in Virginia? On July 1, 2022, Virginia’s commercial financing disclosure law went into effect and with that the necessity to register one’s business. As of March 29, 2023, 101 companies had registered. This is the official list of registered sales-based financing providers as of that date (yellow means it has been added since our last update):

- Advance Servicing Inc.

- Accredited Business Solutions LLC dba The Accredited Group

- Advance Funds Network LLC dba Advance Funds Network

- AdvancePoint Capital LLC dba advancepoint

- Ally Merchant Services LLC

- Alpine Funding Partners, LLC

- Business Capital LLC

- Byzfunder NY LLC dba Tandem dba Nano-FI

- Bridge Capital Services, LLC

- CFG Merchant Solutions, LLC

- Clarify Capital II LLC dba Clarify Capital

- Cloudfund VA LLC dba Cloudfund LLC

- Capflow Funding Group Managers LLC

- Clear Finance Technology (U.S.) Corp. dba Clearco

- Coast Premier LLC dba Coast Funding

- Commercial Servicing Company, LLC

- Corporate Lodging Consultants, Inc.

- Crown Funding Source LLC dba Crown Funding Source

- Diesel Funding LLC

- Direct Capital Source Inc.

- Dealstruck Capital LLC

- EBF Holdings, LLC

- Essential Funding Group Inc

- Errant Ventures LLC

- FC Capital Holdings, LLC FundCanna

- Fidelity Funding Group LLC

- Front Capital LLC

- Finova Capital, LLC

- Fintegra, LLC

- First Data Merchant Services LLC

- First Path Capital Ventures LLC dba First Path Capital

- FleetCor Technologies Operating Company, LLC

- Flexibility Capital Inc.

- Fora Financial East LLC

- Forward Financing LLC

- Fox Capital Group Inc.

- Fundamental Capital LLC

- Funding Metrics, LLC dba Quick Fix Capital

- Good Funding, LLC

- Granite Merchant Funding, LLC

- Invision Funding LLC

- Itria Ventures LLC

- Jaydee Ventures, LLC dba 1 West Capital dba 1 West Commercial

- Kapitus LLC

- Knight Capital Funding III, LLC

- Lexington Capital Holdings Ltd

- LG Funding LLC

- Legend Advance Funding II, LLC dba Legend Funding

- Liberis US Inc.

- Libertas Funding, LLC

- Liquidibee 1 LLC dba Liquidibee LLC dba Altfunding.com

- Loanability, Inc.

- Millstone Funding Inc.

- National Funding, Inc.

- Nav Technologies, Inc.

- Orange Advance LLC

- Pearl Alpha Funding, LLC

- Pearl Beta Funding, LLC

- Pearl Delta Funding, LLC

- Proto Financial Corp.

- PWCC Marketplace, LLC

- Parafin, Inc.

- PayPal, Inc.

- Payability Commercial Factors, LLC

- Pinnacle Business Funding LLC dba Custom Capital USA dba EnN OD Capital

- Platform Funding LLC

- Prosperum Capital Partners LLC dba Arsenal Funding

- QFS Capital LLC

- RFG USA Inc.

- Rival Funding, LLC

- Riverpoint Financial Group Inc.

- Rocket Capital NY LLC

- ROKFI LLC

- Ruby Capital Group LLC

- Rapid Financial Services, LLC

- Reliant Services Group, LLC

- Retail Capital LLC dba Credibly

- Revenued LLC

- Rewards Network Establishment Services Inc.

- Secure Capital Solutions Inc.

- Sky Bridge Business Funding, LLC

- SMB Compass LLC dba SMB Compass

- Sunrise Funding LLC

- Santa Barbara Tax Products Group, LLC

- SellersFunding Corp.

- Sharpe Capital, LLC

- Shine Capital Group LLC

- Shopify Capital Inc.

- Shore Funding Solutions Inc.

- Streamline Funding, LLC

- Stripe Brokering, Inc.

- The LCF Group, Inc.

- Unique Funding Solutions LLC

- United Capital Source Inc.

- Upfront Rent Holdings LLC

- Upper Line Capital LLC

- Vader Servicing, LLC

- Velocity Capital Group LLC

- Vivian Capital Group LLC

- Vox Funding, LLC

- ZING Funding I, LLC

All Registered Sales-based Financing Providers in Virginia (List)

March 11, 2023Is the revenue-based financing provider you do business with registered to operate in Virginia? On July 1, 2022, Virginia’s commercial financing disclosure law went into effect and with that the necessity to register one’s business. As of March 8, 2023, this is the official list of registered sales-based financing providers:

- Advance Servicing Inc.

- Accredited Business Solutions LLC dba The Accredited Group

- Advance Funds Network LLC dba Advance Funds Network

- AdvancePoint Capital LLC dba advancepoint

- Ally Merchant Services LLC

- Alpine Funding Partners, LLC

- Business Capital LLC

- Byzfunder NY LLC dba Tandem dba Nano-FI

- Bridge Capital Services, LLC

- CFG Merchant Solutions, LLC

- Clarify Capital II LLC dba Clarify Capital

- Cloudfund VA LLC dba Cloudfund LLC

- Capflow Funding Group Managers LLC

- Clear Finance Technology (U.S.) Corp. dba Clearco

- Coast Premier LLC dba Coast Funding

- Commercial Servicing Company, LLC

- Corporate Lodging Consultants, Inc.

- Crown Funding Source LLC dba Crown Funding Source

- Diesel Funding LLC

- Direct Capital Source Inc.

- Dealstruck Capital LLC

- EBF Holdings, LLC

- Essential Funding Group Inc

- Errant Ventures LLC

- FC Capital Holdings, LLC FundCanna

- Fidelity Funding Group LLC

- Front Capital LLC

- Finova Capital, LLC

- Fintegra, LLC

- First Data Merchant Services LLC

- FleetCor Technologies Operating Company, LLC

- Flexibility Capital Inc.

- Fora Financial East LLC

- Forward Financing LLC

- Fox Capital Group Inc.

- Fundamental Capital LLC

- Funding Metrics, LLC dba Quick Fix Capital

- Good Funding, LLC

- Granite Merchant Funding, LLC

- Invision Funding LLC

- Itria Ventures LLC

- Jaydee Ventures, LLC dba 1 West Capital dba 1 West Commercial

- Kapitus LLC

- Knight Capital Funding III, LLC

- Lexington Capital Holdings Ltd

- LG Funding LLC

- Legend Advance Funding II, LLC dba Legend Funding

- Liberis US Inc.

- Libertas Funding, LLC

- Liquidibee 1 LLC dba Liquidibee LLC dba Altfunding.com

- Loanability, Inc.

- Millstone Funding Inc.

- National Funding, Inc.

- Nav Technologies, Inc.

- Pearl Alpha Funding, LLC

- Pearl Beta Funding, LLC

- Pearl Delta Funding, LLC

- Proto Financial Corp.

- PWCC Marketplace, LLC

- Parafin, Inc.

- PayPal, Inc.

- Payability Commercial Factors, LLC

- Pinnacle Business Funding LLC dba Custom Capital USA dba EnN OD Capital

- Platform Funding LLC

- Prosperum Capital Partners LLC dba Arsenal Funding

- QFS Capital LLC

- RFG USA Inc.

- Rival Funding, LLC

- Riverpoint Financial Group Inc.

- Rocket Capital NY LLC

- ROKFI LLC

- Ruby Capital Group LLC

- Rapid Financial Services, LLC

- Reliant Services Group, LLC

- Retail Capital LLC dba Credibly

- Revenued LLC

- Rewards Network Establishment Services Inc.

- Secure Capital Solutions Inc.

- Sky Bridge Business Funding, LLC

- SMB Compass LLC dba SMB Compass

- Santa Barbara Tax Products Group, LLC

- SellersFunding Corp.

- Sharpe Capital, LLC

- Shine Capital Group LLC

- Shopify Capital Inc.

- Shore Funding Solutions Inc.

- Streamline Funding, LLC

- Stripe Brokering, Inc.

- The LCF Group, Inc.

- United Capital Source Inc.

- Upfront Rent Holdings LLC

- Upper Line Capital LLC

- Vader Servicing, LLC

- Velocity Capital Group LLC

- Vivian Capital Group LLC

- Vox Funding, LLC

- ZING Funding I, LLC

Who’s Got Swag?

January 10, 2023 There’s a rush of excitement at Broker Fair and deBanked Connect. Behind the scenes there is also a fun creative process that sponsors get to prepare for right before every event. SWAG! It can be challenging to think of anything other than pens and Post-its to jazz up one’s table with memorable tchotchkes so here is some unforgettable swag from over the years:

There’s a rush of excitement at Broker Fair and deBanked Connect. Behind the scenes there is also a fun creative process that sponsors get to prepare for right before every event. SWAG! It can be challenging to think of anything other than pens and Post-its to jazz up one’s table with memorable tchotchkes so here is some unforgettable swag from over the years:

Broker Fair 2019 in the Roosevelt Hotel, as some might recall, had a live basketball hoop by Rapid Finance. LoanMe brought out squeezable stress relievers and what better way to relieve it than squeezing a money wad. Silver sponsor Cooper Asset had special bags that came in handy when collecting all that swag.

At deBanked Connect San Diego 2019, PIRS Capital gave out mouse pads, great for guests to use at work with a constant reminder of where they got it from. Bitty Advance had reusable water containers, smart to stay hydrated while bouncing from sessions to the sponsor showcase room. BFS Capital had a bowl of candy on their table and who doesn’t love a sweet treat after endless meet and greets.

At deBanked Connect Miami 2019, SOS Capital was looking out for everyone by having a bowl of mints out for grab. And if one can’t calculate large numbers without a calculator handy, RTR Recovery had guests covered with that.

After having a virtual Broker Fair in 2020, Lendini stepped it up a notch with a hand-rolled cigar station at the pre-show party in 2021. If one didn’t have a pen and notepad to take down information, Velocity Capital Group made sure to have plenty available. Velocity also had a mini massage station to loosen everyone up after a tense year in quarantine.

Although Covid took some time away from events, the deBanked Connect Miami 2022 sponsors were more ready than ever to show off their swag. FundFi played it safe with hand sanitizers and the LCF Group knew everyone would need a ChapStick throughout the event after talking all day. FinTap got creative with their very own Staples easy-button that said ‘funded.’ Legend Funding had mini piggy banks, ROC Funding Group had cigar cutters, and Lendini had flasks and raffled off a Gucci duffle bag.

Broker Fair 2022 swag was a blend of the practical with the innovative. THOR Capital had shot glasses and if one needed a coaster for that Lifetime Funding had your back. Now that everyone has moved on to wireless headphones, Dedicated Financial GBC brought back wired headphones, which are perfect for flying. Beyonce said it best, “I got hot sauce in my bag swag,” and everyone could too because IOU Financial had mini hot sauce bottles. Following the tradition of raffling their most-wanted Gucci duffle, Lendini also had mini tool kits and Magic 8 Balls that fortuned all good news surrounding the event.

At deBanked events, sponsors always come through with original swag ideas. With Miami 2023 right around the corner, we are excited to see what will be there this year.

Money2020 Kicks Off – With part of last year’s prophecy fulfilled

October 23, 2016

The industry’s biggest conference by attendance kicks off today at The Venetian in Las Vegas. With more than 10,000 attendees and 3,000 speakers, topics range from payments to financial services innovation.

During last year’s conference, alternative lenders appeared to be waiting for a shakeout. Has that happened?

It’s starting to. Since then, online lender Vouch Financial shut down and CircleBack Lending announced that they are no longer issuing loans. Lending Club’s founder resigned in a scandal, the pure marketplace lending model died and no other alternative lenders managed to IPO in 2016. Even a handful of merchant cash advance firms have quietly exited the market.

Valuations are down as well, perhaps more in line with reality. Robert Greifeld, the CEO of Nasdaq, warned attendees about the validity of private market valuations of fintech companies at Money2020 last year. “A unicorn valuation in private markets could be from just two people,” he said. “whereas public markets could be 200,000 people.” And the public markets have been tough. Lending Club’s stock has fallen by 67% since then while OnDeck’s has dropped by 52%.

And yet much of alternative lending is still standing and still raising capital. Over the summer, Fundry secured a new $75 million credit line, Bizfi secured a $20 million investment from Metropolitan Equity Partners, Pearl Capital secured $20 million from Arena Investors, and Legend Funding secured a $3 million debt facility from Ango Worldwide.

We’ll see what happens this week at The Venetian.

Confidence Down, But Not Out On Continued Success of Small Business Finance, Survey Reveals

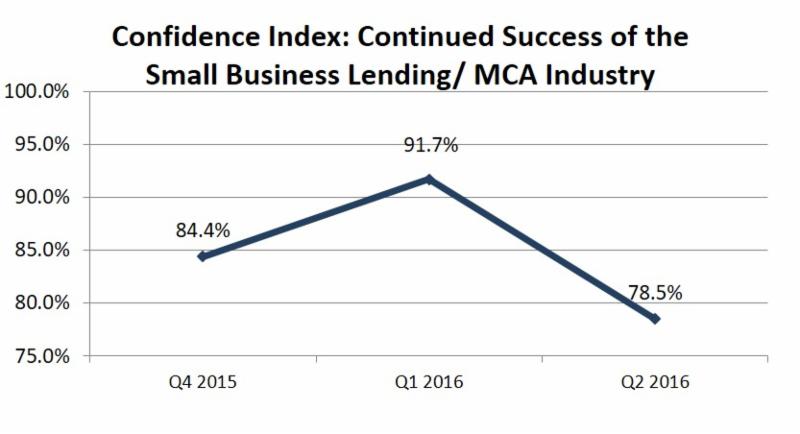

July 19, 2016 A joint Bryant Park Capital/deBanked survey of chief executives in the small business lending and merchant cash advance space showed a decline in confidence in the industry’s continued success, down from 91.7% in Q1 to 78.5% in Q2.

A joint Bryant Park Capital/deBanked survey of chief executives in the small business lending and merchant cash advance space showed a decline in confidence in the industry’s continued success, down from 91.7% in Q1 to 78.5% in Q2.

Respondents were not asked to explain the reasons behind their confidence levels, but increased competition is likely one contributing factor. No doubt some of the creeping pessimism is also spillover from the adjustments occurring in consumer lending, namely declining loan volumes, layoffs and the events that took place at Lending Club.

Decreased confidence may have been the reason that attendance at AltLend last week was down compared to last year. AltLend is an alternative small business lending conference hosted each year at the Princeton Club in NYC. deBanked has been a media partner of the event for the last two years.

On Forbes, Lendio CEO Brock Blake wrote that “2014 and 2015 brought an unhealthy amount of euphoria characterized by huge growth rates, hundreds of millions of dollars in venture capital, enormous valuations, high-flying IPOs, new lenders sprouting (almost) daily, and yield-hungry hedge funds chasing the newest, sexiest cash-producing asset.” But he added that “the industry is maturing and the future for online lending remains bright.”

Notably, 78.5% isn’t even bearish territory, but rather just a step down from the highs Blake described that have catapulted the industry for some time. Even as executives come to grips with the increasing regulatory scrutiny, non-bank small business financing companies have come to view themselves as in it for the long haul. That’s because growth in this sector has been less about refinancing credit cards to a lower interest rate for evermore narrow yields like on the consumer side, and more about fulfilling a role with small businesses that banks have been reluctant to take on for some time.

“Small business lending provides the fuel for small businesses across the country, and the fundamentals are still in place for this to be a formidable industry,” Blake wrote. “I am confident the supply of capital will continue to come from online lenders using technology to minimize risk and streamline processes.”

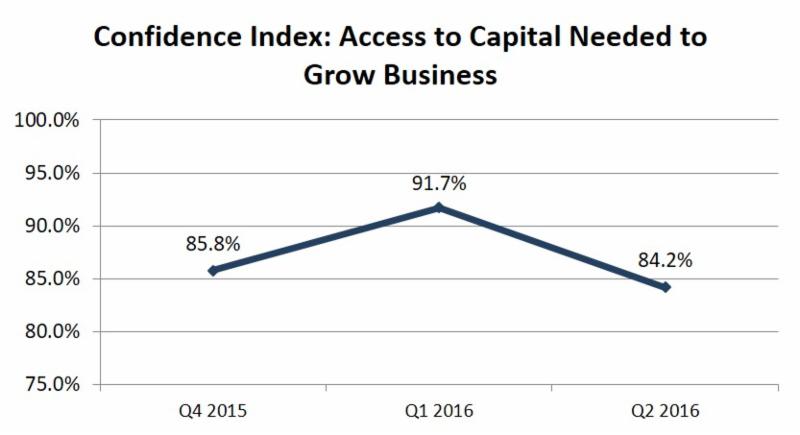

To his point, June and early July were a bright spot for companies raising capital. Fundry, Bizfi, Pearl Capital and Legend Funding all announced deals. The BPC/deBanked survey showed that industry optimism in this endeavor hasn’t shrunk by much, decreasing only from 91.7% in Q1 to 84.2% in Q2.

Fundry Secures $75 Million Credit Line, Confirming That This Niche Is Still Hot

July 5, 2016

Fundry has secured a new $75 million credit line, according to the company’s CEO Isaac Stern. The transaction was facilitated by Brean Capital and Pi Capital.

Fundry is commonly known by one of their subsidiary companies, Yellowstone Capital. According to a document obtained by deBanked, the company did more than $40 million in deals last month, with the vast majority funded in-house. The positive announcement follows their recent big move from NYC’s financial district to Jersey City, NJ, after being wooed to the state with tax incentives in return for creating jobs.

While confidence has retreated from online consumer lending after the scandals at Lending Club, specialty tech-enabled commercial finance companies, some of whom specialize in merchant cash advance, are still finding enthusiasm from institutional investors. Just over the last three weeks, Bizfi secured a $20 million investment from Metropolitan Equity Partners, Pearl Capital secured $20 million from Arena Investors, and Legend Funding secured a $3 million debt facility from Ango Worldwide. That’s $118 million invested into a very specific niche industry in less than a month.

Fundry alone, facilitated $422 million in funding to small businesses just last year.

The Merchant Marketplace Announces Its New Launch with Industry Powerhouse Executive

September 19, 2022 BALDWIN, NEW YORK SEPTEMBER 19, 2022 – The Merchant Marketplace, a leading fintech platform provider of direct financing to small and midsize businesses, announced today the launch of its new leadership with backing from industry powerhouse executives. The company’s new leadership team brings over 75 years of collective financial, technology, and business experience within its core leadership group: Adam Schwartz as CEO and Kevin Harrington, the Original Shark Tank Investor, will serve as a Strategic Partner. This partnership will revolutionize how merchants and independent sales organizations (ISO’s) obtain capital for growing their merchant’s businesses, changing the game for entrepreneurs throughout the United States.

BALDWIN, NEW YORK SEPTEMBER 19, 2022 – The Merchant Marketplace, a leading fintech platform provider of direct financing to small and midsize businesses, announced today the launch of its new leadership with backing from industry powerhouse executives. The company’s new leadership team brings over 75 years of collective financial, technology, and business experience within its core leadership group: Adam Schwartz as CEO and Kevin Harrington, the Original Shark Tank Investor, will serve as a Strategic Partner. This partnership will revolutionize how merchants and independent sales organizations (ISO’s) obtain capital for growing their merchant’s businesses, changing the game for entrepreneurs throughout the United States.

“We are looking to change the industry by using a true fintech platform to facilitate transactions amongst ISO’s, merchants, and the Merchant Marketplace,” said Merchant Marketplace CEO Adam Schwartz. “We understand the challenges many small business owners face when trying to secure financing to help make their dreams a reality. The Merchant Marketplace is happy to be a resource for entrepreneurs by providing them access to capital so they can build a successful business.”

The Merchant Marketplace created a proprietary syndication platform that offers real time data and full transparency. In most instances, the company will offer ISO’s a two percent syndication as bonus for every deal that it funds, with the ability to syndicate more funding if needed. ISO’s can earn another stream of income by being vested in every deal they fund with the Merchant Marketplace, as well as earn a referral fee. The platform also offers a profit-sharing program and technology tutorials to show ISO’s how to engage with the platform to help achieve the best end results.

“The merchant cash advance market has been witnessing an escalation in growth over the past few years with the help of innovation. Our technology integrates with over 25 different third parties to give us complete insights into our merchants, giving us the ability to make offers with lightning speed and efficiency. We understand the needs of our clients and we want them to be part of the process. We do not want to be seen as just another funder; we want to be seen as a business partner for our ISO’s,” said Merchant Marketplace Director of ISO Relations, Justin Strull.

For questions on the service and to sign up as an ISO, contact Justin Strull at 516-980-4932 or email in to justin@merchantmarketplace.com

About Kevin Harrington

As an original “shark” on the hit TV show Shark Tank, the creator of the infomercial, pioneer of the As Seen on TV brand, and co-founding board member of the Entrepreneur’s Organization, Kevin Harrington has pushed past all the questions and excuses to repeatedly enjoy 100X success. His legendary work behind the scenes of business ventures has produced more than $5 billion in global sales, the launch of more than 500 products, and the making of dozens of millionaires. He’s launched massively successful products like The Food Saver, Ginsu Knives, The Great Wok of China, The Flying Lure, and many more. He has worked with amazing celebrities turned entrepreneurs including, Billie Mays, Tony Little, Jack LaLanne, and George Foreman to name a few. Kevin’s been called the Entrepreneur’s Entrepreneur and the Entrepreneur Answer Man, because he knows the challenges unique to start-ups and he has a special passion for helping entrepreneurs succeed.

See Post... legend funding, why not the belesis bros?... |

See Post... legend funding. legend does 1st positions, wise does the high risk/stacks.... |

See Post... legend funding?? we always respond, we provide balance statements, etc. to merchants within minutes! did i also mention that we send out commissions to brokers the day after fu... |