Related Headlines

| 03/12/2018 | Interview with Evan Marmott of CanaCap |

Stories

Making it Work: CanaCap and the Case for Canada

July 5, 2019 What leads an alternative financer to establish their own business in Canada? For Evan Marmott and his partner Adam Benaroch, it was the level of opportunity that the country offered in comparison to United States, where the alternative funding industry had become bloated and saturated with funders and brokers alike by 2017, when the pair established CanaCap.

What leads an alternative financer to establish their own business in Canada? For Evan Marmott and his partner Adam Benaroch, it was the level of opportunity that the country offered in comparison to United States, where the alternative funding industry had become bloated and saturated with funders and brokers alike by 2017, when the pair established CanaCap.

Holding over 30 years of experience in alternative finance between them, Marmott and Benaroch founded CanaCap with the intention of capitalizing off interested Canadian merchants that were much more receptive to the message of brokers and funders. Not being bombarded by constant emails and advertisements for quick loans, Marmott says, leads Canadian business owners to be more open-minded to discussing alternative funding with brokers, resulting in both a better understanding of the conditions of the financing as well as more time on the phone to make deals. And on top of this, the lack of a dominant player within the alternative funding world of Canada leads to a divided market share, allowing small and large firms alike to succeed.

Accompanying this advantage of time and space within the market is the quality of merchants found in Canada. Claiming that Canadian merchants generally perform better than American business owners when repaying debts, Marmott explains that funders operating north of the border can expect to have a “cleaner” portfolio.

And lastly, the level of product knowledge amongst potential customers appeared to be just right to Marmott and Benaroch. With the former noting how CanaCap is unique in its willingness to offer second positions to Canadian businesses, Marmott highlights how his company benefits from larger financers, such as OnDeck, who many of their customers would go to first, learn about the funding process, be denied funds, and then be picked up by CanaCap after further researching the industry.

With offices in both Montreal and New York, the latter of these being for CapCall, the American counterpart to CanaCap, Marmott is well-attuned to the differences between the two markets. And while he concedes that the downside of brokering in the Great White North is the 30% that is clipped from commissions due to currency exchange, he affirms that the savings from reduced marketing costs, providing better return on investment rates, offset this loss.

Altogether, the CEO makes a convincing case for why one should consider alternative financing in Canada. Taking the tack that the country provides a fresh slate of sorts to financers, where merchants have yet to be inundated with offers, promotions, and horror stories about the industry, Marmott and Benaroch have enjoyed success with their model of approving over 90% of their applicants and streamlining the application process as to increase turnaround times.

With plans to stay put for the foreseeable future, Marmott says that he’s “looking forward to funding small businesses” as his company continues to service the entire country and the alternative finance industry in Canada develops. A plan that doesn’t sound too bad, especially with signs pointing towards increased growth and further interest from merchants.

deBanked CONNECT Toronto Kicks Off Today

July 25, 2019Welcome to The Omni King Edward Hotel |

|

|

Don’t be late! Registration and networking starts at 1:30pm at The Omni King Edward Hotel in Toronto.

Schedule of events:

Be sure to introduce yourselves to each of our sponsors and listen to our great speakers. |

||||||

|

|

||||||

|

|

Canada’s Alternative Financing Market Is Taking Off

May 20, 2019

Canadians have been slow out of the gate when it comes to mass adoption of alternative financing, but times are changing, presenting opportunities and challenges for those who focus on this growing market.

Historically, the Canadian credit market has traditionally been dominated by a few main banks; consumers or businesses that weren’t approved for funding through them didn’t have a multitude of options. The door, however, is starting to unlock, as awareness increases about financing alternatives and speed and convenience become more important, especially to younger Canadians.

Indeed, the Canada alternative finance market experienced considerable growth in 2017—the latest period for which data is available. Market volume reached $867.6 million, up 159 percent from $334.5 million in 2016, according to a report by the Cambridge Centre for Alternative Finance and the Ivey Business School at Western University. Balance sheet business lending makes up the largest proportion of Canadian alternative finance, accounting for 57 percent of the market; overall, this model grew 378 percent to $494 million in 2017, according to the report.

Industry participants say the growth trajectory in Canada is continuing. It’s being driven by a number of factors, including tightening credit standards by banks, growing market demand for quick and easy funding and broader awareness of alternative financing products.

To meet this growing demand, new alternative financing companies are coming to the market all the time, says Vlad Sherbatov, president and co-founder of Smarter Loans, which works with about three dozen of Canada’s top financing companies. He predicts that over time more players will enter the market—from within Canada and also from the U.S.—and that product types will continue to grow as demand and understanding of the benefits of alternative finance become more well-known. Notably, 42 percent of firms that reported volumes in Canada were primarily headquartered in the U.S., according to the Cambridge report.

To meet this growing demand, new alternative financing companies are coming to the market all the time, says Vlad Sherbatov, president and co-founder of Smarter Loans, which works with about three dozen of Canada’s top financing companies. He predicts that over time more players will enter the market—from within Canada and also from the U.S.—and that product types will continue to grow as demand and understanding of the benefits of alternative finance become more well-known. Notably, 42 percent of firms that reported volumes in Canada were primarily headquartered in the U.S., according to the Cambridge report.

To be sure, the Canadian market is much smaller than the U.S. and alternative finance isn’t ever expected to overtake it in size or scope. That’s because while the country is huge from a geographic standpoint, it’s not as densely populated as the U.S., and businesses are clustered primarily in a few key regions.

To put things in perspective, Canada has an estimated population of around 37 million compared with the U.S.’s roughly 327 million. On the business front, Canada is similar to California in terms of the size and scope of its small business market, estimates Paul Pitcher, managing partner at SharpShooter, a Toronto-based funder, who also operates First Down Funding in Annapolis, Md.

Nonetheless, alternative lenders and funders in Canada are becoming more of a force to be reckoned with by a number of measures. Indeed, a majority of Canadians now look to online lenders as a viable alternative to traditional financial institutions, according to the 2018 State of Alternative Lending in Canada, a study conducted by online comparison service Smarter Loans.

Of the 1,160 Canadians surveyed about the loan products they have recently received, only 29 percent sought funding from a traditional financial institution, such as a bank, the study found. At the same time, interest in alternative loans has been on an upward trajectory since 2013. Twenty-four percent of respondents indicated they sought their first loan with an alternative lender in 2018. Overall, nearly 54 percent of respondents submitted their first application with a non-traditional lender within the past three years, according to the report.

Like in the U.S., there’s a mix of alternative financing companies in Canada. A number of companies offer factoring and invoicing and payday loans. But there’s a growing number focused on consumer and business lending as well as merchant cash advance.

Some major players in the Canadian alternative lending or funding landscape include Fairstone Financial (formerly CitiFinancial Canada), an established non-bank lender that recently began offering online personal loans in select provinces; Lendified, an online small business lender; Thinking Capital, an online small business lender and funder; easyfinancial, the business arm of alternative financial company goeasy Ltd. that focuses on lending to non-prime consumers; OnDeck, which offers small business financing loans and lines of credit; and Progressa, which provides consolidation loans to consumers.

By comparison, the merchant cash advance space has fewer players; it is primarily dominated by Thinking Capital and less than a dozen smaller companies, although momentum in the space is increasing, industry participants say.

“The U.S. got there 10 years ago, we’re still catching up,” says Avi Bernstein, chief executive and co-founder of 2M7 Financial Solutions, a Toronto-based merchant cash advance company.

OPPORTUNITIES ABOUND

In terms of opportunities, Canada has a population that is very used to dealing with major banks and who are actively looking for alternative solutions that are faster and more convenient, says Sherbatov of Smarter Loans. This is especially true for the younger population, which is more tech-savvy and prefers to deal with finances on the go, he says.

Because the alternative financing landscape is not as developed in Canada, new and innovative products can really make a significant impact and capture market share. “We think this is one of the key reasons why there’s been such an influx of international companies, from the U.S. and U.K. for example, that are looking to enter the Canadian market,” he says.

Just recently, for example, Funding Circle announced it would establish operations in Canada during the second half of 2019. “Canada’s stable, growing economy coupled with good access to credit data and progressive regulatory environment made it the obvious choice,” said Tom Eilon, managing director of Funding Circle Canada, in a March press release announcing the expansion. “The most important factor [in coming to Canada] though was the clear need for additional funding options among Canadian SMEs,” he said.

OnDeck, meanwhile, recently solidified its existing business in Canada through the purchase of Evolocity Financial Group, a Montreal-based small business funder. The combined firm represents a significantly expanded Canadian footprint for both companies. OnDeck began doing business in Canada in 2014 and has originated more than CAD$200 million in online small business loans there since entering the market. For its part, Evolocity has provided over CAD$240 million of financing to Canadian small businesses since 2010.

“There is an enormous need among underserved Canadian small businesses to access capital quickly and easily online, supported by trusted and knowledgeable customer service experts,” Noah Breslow, OnDeck’s chairman and chief executive, said in a December 2018 press release announcing the firms’ nuptials.

There are also a number of home grown Canadian companies that are benefiting from the growth in the alternative financing market.

2M7 Financial Solutions, which focuses on merchant cash advances, is one of these companies. It was founded in 2008 to meet the growing credit needs within the small and medium-sized business market at a time when businesses were having trouble in this regard.

But only in the past few years has MCA in Canada really started picking up to the point where Bernstein, the chief executive, says the company now receives applications from about 200 to 300 companies a month, which represents more than 50 percent growth from last year.

“We’re seeing more quality businesses, more quality merchants applying and the average funding size has gone up as well,” he says.

NAVIGATING THROUGH CHALLENGES

Despite heightened growth possibilities, there are also significant headwinds facing companies that are seeking to crack the Canadian alternative financing market. For various reasons, some companies have even chosen to pull back or out of Canada and focus their efforts elsewhere. Avant, for example, which offers personal loans in the U.S., is no longer accepting new loan applications in Canada at this time, according to its website. Capify also recently exited the Canadian business it entered in 2007, even as it continues to bulk up in the U.K. and Australia.

One of the challenges alternative lenders face in Canada is distrust of change. Since Canadians are so used to dealing with only a few major financial institutions to handle all their finances, they are skeptical to change this behavior, especially when the customer experience shifts from physical branches to online apps and mobile devices, says Sherbatov of Smarter Loans. He notes that adoption of fintech products in Canada has lagged in recent years, partially because there has been a lack of awareness and trust in new financial products available.

One way Smarter Loans has been working to strengthen this trust is by launching a “Smarter Loans Quality Badge,” which acts as a certification for alternative financing companies on its platform. It is issued to select companies that meet specified quality standards, including transparency in fees, responsible lending practices, customer support and more, he says.

The Canadian Lenders Association, whose members include lenders and merchant cash advance companies, has also been working to promote the growing industry and foster safe and ethical lending practices. For example, it recently began rolling out the SMART Box pricing disclosure model and comparison tool that was introduced to small businesses in the U.S. in 2016.

The Canadian Lenders Association, whose members include lenders and merchant cash advance companies, has also been working to promote the growing industry and foster safe and ethical lending practices. For example, it recently began rolling out the SMART Box pricing disclosure model and comparison tool that was introduced to small businesses in the U.S. in 2016.

Another challenge that impacts alternative lenders in the consumer space is having restricted access to alternative data sources. Because of especially strict consumer privacy laws, access is “substantially more limited” than it is in any other geography,” says Jason Mullins, president and chief executive of goeasy, a lending company based in Mississauga, Ontario, that provides consumer leasing, unsecured and secured personal loans and merchant point-of-sale financing.

From a lending perspective, goeasy focuses on the non-prime consumer—generally those with credit scores of under 700. Mullins says the market consists of roughly 7 million Canadians, about a quarter of the population of Canadians with credit scores. The non-prime consumer market is huge and has tremendous potential, he says, but it’s not for the faint of heart.

Another issue facing alternative lenders is the relative difficulty of raising loan capital from institutional lenders, says Ali Pourdad, co-founder and chief executive of Progressa, which recently reached the $100 million milestone in funded loans for underserved Canadian consumers. “The onus is on the alternative lenders to ensure they have good lending practices and are underwriting responsibly,” he says.

What’s more, household debt to income ratios in Canada are getting progressively worse, with Canadians taking on too much debt relative to what they can afford, Pourdad says. As the situation has been deteriorating over time, there is inherently more risk to originators as well as the capital that backs them. “Originators, now more than ever, have to be cautious about their lending practices and ensure their underwriting is sound and that they are being responsible,” he says.

On the small business side of alternative lending, getting the message out to would-be customers can be a challenge in Canada. In U.S. there are thousands of ISOs reaching out to businesses, whereas in Canada, most funders have a direct sales force, with a much smaller portion of their revenue coming from referral partners, says Adam Benaroch, president of CanaCap, a small business funder based in Montreal.

He predicts this will change over time as the business matures and more funders enter the space, giving ISOs the ability to offer a broader array of financing products at competitive rates. “I think we’re going to see pricing go down and more opportunities develop, and as this happens, the business is going to grow, which is exactly what has happened in the U.S,” he says.

Generally speaking, Canadian businesses are still somewhat skeptical of merchant cash advance and require considerable hand-holding to become comfortable with the idea.

“You can’t wait for them to come to you, you have to go to them and explain what the products are,” says Pitcher of SharpShooter, the MCA funding company.

While Pitcher predicts more companies will continue to enter the Canadian alternative financing market, he doesn’t think it will be completely overrun by new entrants—the market simply isn’t big enough, he says. “It’s not for everyone,” he says.

Competition Steps Up in Canadian Small Business Lending Market

March 11, 2019 Last week’s announcement by Funding Circle that it will establish an operation in Canada later this year is part of a trend of large non-Canadian funders entering or expanding into the Canadian market, according to Adam Benaroch, President of CanaCap, a small business funder based in Montreal.

Last week’s announcement by Funding Circle that it will establish an operation in Canada later this year is part of a trend of large non-Canadian funders entering or expanding into the Canadian market, according to Adam Benaroch, President of CanaCap, a small business funder based in Montreal.

Funding Circle started in the UK and expanded outwards to the US, Germany, and The Netherlands, but the UK still comprises of more than 60% of their global origination volume. Their foray into Canada is a good thing for small business owners and lenders, according to Paul Pitcher, founder and CEO of SharpShooter, a funder based in Toronto.

“I see it as win-win,” Pitcher said.

He said that a win for Canadian small business owners is a win for SharpShooter because it means more potential merchant clients. Pitcher said that he loves OnDeck, a rival, is in Canada, in part because OnDeck’s marketing has helped educate Canadian merchants about alternative lending products.

Similarly, Benaroch said he thinks that big companies entering the Canadian market will affect CanaCap positively. For instance, Benaroch said that CanaCap hopes to capture companies that get turned down from OnDeck. And perhaps CanaCap can also capture merchants that are declined by Funding Circle.

Funding Circle’s loan originations by country by year

Funding Circle’s loan originations by country by year

Benaroch noted that not all outside funding companies have succeeded in Canada, often because they never established a physical presence there. But Funding Circle will be opening a physical office in Toronto.

“We have been evaluating options for expansion over the last year,” said Tom Eilon, who will be Managing Director of Funding Circle Canada. “Canada’s stable, growing economy coupled with good access to credit data and a progressive regulatory environment, made it the obvious choice. The most important factor [in coming to Canada] though was the clear need for additional funding options among Canadian SMEs.”

Funding Circle’s announcement comes on the heels of OnDeck’s December 2018 acquisition of Evolocity Financial Group, a small business funder based in Montreal. While OnDeck started operating in Canada as early as 2015, CanaCap’s Adam Benaroch said that the acquisition of Evolocity is a significant step for OnDeck because Evolocity has an ISO channel in Canada. That runs counter to Funding Circle’s model of mainly going direct to merchant, at least in the US.

OnDeck Expands Canadian Business with Merger

December 5, 2018 OnDeck announced today that it has entered into an agreement to merge its Toronto-based Canadian business with Evolocity Financial Group (Evolocity), an online small business funder headquartered in Montreal. OnDeck will have majority ownership of Evolocity and the combined entity will be rebranded as OnDeck Canada.

OnDeck announced today that it has entered into an agreement to merge its Toronto-based Canadian business with Evolocity Financial Group (Evolocity), an online small business funder headquartered in Montreal. OnDeck will have majority ownership of Evolocity and the combined entity will be rebranded as OnDeck Canada.

“The combination of OnDeck’s Canadian operations with Evolocity will create a leading online platform for small business financing throughout Canada and represents a significant investment in the Canadian market,” said Noah Breslow, Chairman and CEO of OnDeck. “There is an enormous need among underserved Canadian small businesses to access capital quickly and easily online.“

According to the announcement, “the transaction will combine the direct sales, operations, and local underwriting expertise of the Evolocity team with the marketing and business development capabilities of the OnDeck team.”

As part of the merger, Neil Wechsler, who is the CEO of Evolocity, will become the CEO of OnDeck Canada. And the management team will include Evolocity co-founders David Souaid as Chief Revenue Officer and Harley Greenspoon as Chief Operating Officer. OnDeck Canada will be governed by a Board of Directors chaired by Breslow and composed of existing OnDeck and Evolocity management.

Currently, OnDeck offers a variety of loans up to $500,000 and lines of credit up to $100,000. Evolocity offers small business loans and an MCA product, from $10,000 to $300,000. deBanked inquired with OnDeck to see if OnDeck Canada will retain the MCA product from Evolocity, but has yet to hear back. Since OnDeck entered the Canadian market in 2014, it has originated over CAD $200 million in online small business loans there. Evolocity has provided over CAD $240 million of financing to Canadian small businesses since 2010.

Currently, OnDeck offers a variety of loans up to $500,000 and lines of credit up to $100,000. Evolocity offers small business loans and an MCA product, from $10,000 to $300,000. deBanked inquired with OnDeck to see if OnDeck Canada will retain the MCA product from Evolocity, but has yet to hear back. Since OnDeck entered the Canadian market in 2014, it has originated over CAD $200 million in online small business loans there. Evolocity has provided over CAD $240 million of financing to Canadian small businesses since 2010.

Investment in online small business lending in Canada is growing. IOU Financial, a Montreal-based small business funder that primarily funds American small businesses, told deBanked last month that they made a concerted marketing effort in the third quarter to reach Canadian small business owners. Meanwhile, Thinking Capital, a Canadian online small business funder, announced in July the launch of BillMarket, a service that provides Canadian small businesses with a credit grade (A through E), making it easier for them to get funded.

“BillMarket represents a cash flow revolution for the Canadian small business market,” said Jeff Mitelman, CEO of Thinking Capital, which has roughly 200 employees between its Toronto and Montreal offices.

According to a recent Canadian government report cited by OnDeck in its announcement today, there are 1.14 million small businesses in Canada that represent 97.9 percent of all businesses in the country. Also, small businesses employed over 8.2 million people in Canada, or 70.5 percent of the total private workforce.

According to a recent Canadian government report cited by OnDeck in its announcement today, there are 1.14 million small businesses in Canada that represent 97.9 percent of all businesses in the country. Also, small businesses employed over 8.2 million people in Canada, or 70.5 percent of the total private workforce.

Evan Marmott, founder of Canadian small business funder, Canacap, told deBanked earlier this year that unlike the saturated small business market in the U.S., the Canadian small business market is still ripe for growth. Not only this, he said that while the market is smaller in Canada, the default rates are generally lower and he found that Canadian merchants do less shopping around. He also said he has seen less fraud in Canada than in the U.S.

“For brokers, while commissions are lower, you could actually speak to business owners who are not being bombarded with calls [as they are in the U.S.] and have a much higher closing rate,” Marmott said.

Evolocity has 70 full-time employees and offices in Montreal, Vancouver and Marham, in the Toronto area. OnDeck has funded over $10 billion to small businesses and became a public company (NYSE: ONDK) in 2014. OnDeck is headquartered in New York.

“We are excited to join forces with OnDeck…to enhance our best in class digital financing solutions to small businesses across Canada,” said Wechsler, Evolocity CEO. “Additionally, this transaction will augment our data science and analytics capabilities to help deliver an unparalleled merchant experience.”

Grooming The Best Sales Reps

August 22, 2018The best sales reps have a lot in common – they’re smart, honest, likable, well-organized, thick-skinned and hungry for success. They navigate the difficult early days of their careers in the alternative small-business funding community by persevering despite long hours, countless outbound telephone calls and meager commissions.

“Persistency is really, really the key – putting in the time,” says Evan Marmott, CEO of Montreal-based CanaCap and CEO of New York-based CapCall LLC. “It’s not always easy, but you’ve got to stay late, make the phone calls, send the emails and do the follow-ups. It’s a numbers game.”

Being relentless counts not only when pursuing merchants but also when matching merchants with funders, Marmott emphasizes. “If they can’t get an approval one place, they’re going to shop it out until they get approval someplace else so they can monetize everything that comes in,” he says.

“It’s all mindset and work ethic,” in sales, according to Joe Camberato, president at Bohemia, N.Y.-based National Business Capital. His company works to create a culture that supports the right mindset by working with a firm called “Delivering Happiness.” Together, they forge to a set of core values based on integrity, innovation, teamwork, empathy, and respect for fellow employees, clients and clients’ businesses.

National Business Capital employees learn to live those ideals by working and playing together on the company volleyball team, through work with local and national charities, and at company mixers and staff picnics, Camberato maintains. “We adapt and change, and we’re committed to helping small businesses grow,” he says of the company culture, “and we have fun while doing all that.”

Likeability helps build relationships with customers, says Justin Thompson, vice president of sales for San Diego-based National Funding. “People will do business with people they like and trust,” says Thompson. “It’s really about establishing a relationship first and then establishing quality discovery.” From there, presentation and execution become paramount, he says.

Methodology can make the difference between success and failure in sales, observes Justin Bakes, co-founder and CEO of Boston-based Forward Financing LLC. “Have a defined process and stick to it,” he advises. A well-organized approach inspires trust among clients, establishes and maintains a great reputation; and fosters understanding of the customers’ needs, wants and business operations that help the rep choose the right financing option and appropriate funder. Using technology to wrangle multiple leads and high volume counts for a lot, too, he says.

It’s all part of the consultative approach to sales, says Jared Weitz, CEO of Great Neck, N.Y.-based United Capital Source. Long ago, sales reps may have succeeded by mimicking carnival barkers, sideshow pitchman and arm-twisting medicine-show peddlers. Thankfully, those days have ended – if they ever really existed. Most of today’s successful salespeople earn clients’ respect by becoming knowledgeable, trusted business consultants, says Weitz.

THE CONSULTATIVE SALE

“Someone calls, and there are two ways of handling a deal, right?” Weitz asks rhetorically. Using one method, a salesperson can say, “We’ll fund you this much at this rate today – are we good?” he says. The other way calls for understanding the client’s business – how long has it been open, does it make more cash deposits or credit card deposits, would it be best-served by an advance, a loan, an equipment lease or a line of credit, how much can it afford in monthly payments?

Establishing how the merchant intends to use the funding plays a crucial role in the consultative sale, Marmott agrees. Objections can arise when a merchant learns that receiving $100,000 this week will require paying back $150,000 in four or five months, he notes. So it’s essential to demonstrate that using the money productively will more than pay for the deal. A trucking company can realize more income if it deploys two more trucks, or a restaurant can increase revenue by placing another bar outside for the summer, he says by way of example.

“A lot of salespeople ask a business owner what they need the money for,” observes Thompson. “The merchant says, ‘Inventory,’ and the rep stops right there. I train my reps at National Funding to go two or three clicks deeper.” Examples abound. When does the merchant need the inventory? From whom do they order it? How long does it take to ship? How long does it take to turn it over? What are the shipping terms?

The consultative approach can require salespeople to pose a lot of open-ended questions that can’t be answered yes or no, according to Thompson. Ideally, the conversation should adhere to the 80-20 rule, with the client talking 80 percent of the time and the sales rep speaking 20 percent, he asserts, adding that “a lot of times it’s reversed in this industry.”

Sometimes, however, salespeople should set aside the time-consuming consultative approach and instead find funding for a merchant as soon as possible. That’s true when the business owner can make an opportune purchase of inventory or when it’s time to acquire a competitor quickly. More often, however, it pays to take the time to understand the merchant’s needs and search out the best type of funding for that particular case, top sales people maintain.

Much of the alternative small-business finance industry has caught on to the importance of the consultative approach to sales as the array of available alternative financial products has grown beyond the industry’s initial offerings of merchant cash advances, according to Weitz. The days of scripted pitches and preplanned rebuttals to objections have ended, he says. Today, management trains reps for success.

THE RIGHT TRAINING

Are top salespeople born that way? “Some people hit the ground running, but sales can be taught – that’s for sure,” Weitz says. “The tougher thing to teach is integrity.” Much of the training process focuses on learning the products to enable a rep to make a consultative sale and shoulder financial responsibility, he maintains.

Believing that some people are born to sell provides a crutch to avoid learning what really works, according to Bakes. Training can teach a smart, motivated person how to succeed, he maintains. They don’t have to be born that way.

However, some people do seem born to exert influence, which can translate into sales prowess, says Thompson. Still, those born with a strong work-ethic can overcome other deficiencies, he notes. The work ethic drives them to “come in every day,” he notes. “They’re organized and disciplined. They follow the National Funding philosophy, and they make a ton of money.”

National Funding trains salespeople to view their craft as being defined by two broad elements – art and science, Thompson continues. The science proves easier to master and includes asking the right questions to learn about the customer and the deal. The hard part, the art of the sale, consists of getting to know the business owner, building a relationship and demonstrating expertise. In one example, that’s based on learning how many trucks are in the fleet, whether they’re long-haul or short haul and whether they use dumpsters versus box trailers, he says.

Beyond those important basics, training should be ongoing because selling techniques change slightly as new products and systems emerge, according to Weitz. “One of the things I like about being a broker is the ability to pivot and add another arrow to your quiver,” he says.

Salespeople at United Capital Source talk sales among themselves almost nonstop, which amounts to daily sales training, Weitz observes. That can take the form of describing a challenge and explaining how to overcome it, he notes. A particularly good idea merits an email to the group to share the new piece of wisdom. It’s a matter of constantly refining the approach.

Training can help sales reps understand the businesses their clients run, according to Marmott. Knowing the margins in a restaurant, for example, can help the salesperson explain that the increase in revenue from an expansion will quickly pay the cost of capital, he notes.

Training should teach new employees how business works because common elements arise in enterprises ranging from dog grooming to asphalt paving, Thompson notes. There’s inventory, marketing, employee expense, payroll taxes, insurance and 401k’s in almost any business. “We teach all that to the reps,” he says. Then after conversations with thousands of merchants, reps have a solid foundation in the workings of businesses.

National Business Capital’s formal two-week classroom training usually lasts three hours a day, focusing on systems, guidelines, product, general business principles and the company’s processes, says Camberato. Teachers include the sales management team, company culture leaders and the managers of IT and Tech, Marketing, Processing, and Human Resources.

National Business Capital’s formal two-week classroom training usually lasts three hours a day, focusing on systems, guidelines, product, general business principles and the company’s processes, says Camberato. Teachers include the sales management team, company culture leaders and the managers of IT and Tech, Marketing, Processing, and Human Resources.

New hires spend much of their time working with mentors for the first six months and a team leader who works with them indefinitely, Camberto continues. The company sometimes hires in groups and sometimes hires individually, he notes.

National Funding provides three eight-hour days of regimented classroom training on the fundamentals to each of the four groups of 12 to 17 hired each year, says Thompson. The classes cover processes, sales strategy, marketing and the lender matrix. Next comes three months of working with a sales manager dedicated to working with the class. After a total of nine to 12 months, management knows which reps will succeed.

Some shops operate on the opener-closer model, with less experienced salespeople qualifying the merchant by asking questions like how long they’re been in business and how much revenue they bring in monthly, Marmott says. If the merchant qualifies, the newer salesperson who’s working as an opener then hands off the call to an experienced closer to complete the deal. Good openers become closers, but opening isn’t easy because it requires lots of calls, he notes.

National Funding doesn’t use the opener-closer approach because the company believes reps should Participate “from cradle to grave,” Thompson says. “They hunt the business down, build the relationship and handle the transaction from A to Z.” East Coast shops often focus on cold calling and use the opener-closer model, while West Coast shops tend to invest more in marketing and reject the opener-closer method, he noted.

But where do these top salespeople come from?

THE RIGHT BACKGROUND

Prospective sales reps who have just finished college should have a grounding in communications or business, Weitz believes. Experience in sales and a familiarity with dealing with merchants helps prepare reps, he notes. Job history doesn’t have to be in the finance industry. Someone who’s sold business services in a Verizon store or worked for a payroll company, for instance, has been dealing with small-business owners and may succeed more quickly than those without that background.

Sales experience in other industries counts, Bakes agrees, especially in businesses that require dealing with a large number of leads. “Organization and process is just as important as being born with the traits of a salesperson,” he opines.

Life experience that breeds a positive attitude can prove vital, says Marmott. That’s especially important in the beginning when a new rep might take home a paltry $300 in the first month. Later, when the rep has a $50,000 month, he or she will see that their optimism wasn’t misplaced, he declares.

GUYS WHO ARE HUNGRY”

“The biggest thing I look for is guys who are hungry,” Marmott maintains. I don’t need somebody with a doctorate or a master’s degree or even a degree,” he says. “I need somebody who is going to put the work in.” Of a roomful of 25 new reps, two or three will succeed and stay on the job, he calculates. “You get to eat what you kill. If you’re not killing anything, you don’t get to eat.”

“We look for potential candidates who come from backgrounds of rejection,” says Thompson. Their previous sales experience has taught them not to take the answer “no” personally. “It’s part of the business and you continue to move on.”

Although most regard the financial services industry as a white-collar pursuit, “it has blue collar written all over it,” Thompson says, referring to the work ethic required for success. But it’s not just the volume of work. Sixty good phone calls generate more business than 300 mediocre calls, he emphasizes.

GETTING UP TO SPEED

Succeeding at sales requires taking the time to form relationships, understand guidelines, become familiar with lenders and acquire a working knowledge of how clients’ businesses operate, Camberato says. How long does it take? “It’s a solid year,” he contends while conceding that most who succeed operate at a fairly high level before then.

Others disagree about what constitutes being up to speed and how much time’s necessary to achieve it. “I’ve seen it take 30 days, and I’ve seen it up to 120 days,” says Weitz. “The hope is that it’s within 60.”

A salesperson should start feeling better after 30 days and should start feeling good after 60 days, Marmott says. Management can usually identify the strong and the week reps within two to three weeks, he says. “You get the lazy ones that drop out, the guys who aren’t making any money, the ones who aren’t putting the effort in,” he says. “The first two weeks are the toughest because you’re learning the product and how to sell it.”

“It depends on the person,” Bakes says of the time needed to begin selling successfully. “It takes time. It is not something that will just happen overnight.” About six months should suffice to become confident as a closer, he estimates.

Even when sales reps hit their stride, some outsell others, Marmott notes, citing the 80-20 rule that 80 percent of the business comes from 20 percent of the salesforce. Outbound sales to merchants who may feel beleaguered by offers of funding requires more effort than when a merchant makes an inbound call to seek funding, he adds.

And even the best salespeople need great marketing and tech support from the their companies, sources agree.

INVESTING IN SALES

A shop just starting out might have a marketing budget as low as $2,500 a month, which won’t do much more than pay for direct mail pieces that might prompt a few potential clients to pick up the phone, Weitz says. With a little more money to spend, a shop can begin buying leads, he notes. “Don’t break the bank before you understand what formula works for you,” he advises.

“The key to sales is marketing,” says Marmott. “You can be the best sales guy but if you don’t have anything qualified to call or follow up with, it’s a waste of time.” Social media doesn’t work as well for business-to-business contact as it does for business-to-consumer marketing, he says. Pay per click and key words have become more expensive and isn’t as cost-effective as it once was, especially for smaller shops, he contends. Mailers can work but require heavy volume and repetition, he says, adding that could mean at least 25,000 pieces and at least three mailings.

Besides allocating marketing dollars, companies can invest in sales by paying new sales staffers a salary instead of forcing them to rely on commissions to eke out subsistence during the tough early days. National Business Capital pays a salary at first and later switches reps to commissions and draw, Camberato says. “An energetic person interested in sales can plug into our platform, get trained and do very well,” he continues. “We believe in you, as long as you believe in us.”

National Funding provides recruits with a salary and commissions so that they have enough income to get by and still reap rewards when they help close a deal, Thompson says.

Investment in technology can help salespeople set priorities, eliminate some of the drudge work in the sale process, measure the sales staff member’s success or lack of success, and provide a consistent experience for customers, notes Bakes. “Because of the way our technology is set up we can hold people accountable,” he adds.

Every salesperson and every shop should organize the workflow by using a lead-management system or customer relationship management tool (CRM) – such as Zoho or Salesforce –instead of operating with just a spreadsheet, Weitz says.

Brokers can invest in sales through syndication, which means putting up some of the funds involved in a deal. Forward Financing favors syndication in some cases because it aligns the salesperson and the funder, thus demonstrating the sales rep’s belief in the validity of the deal and ensuring a willingness to continue servicing that customer, Bakes says.

Some shops offer monthly bonuses for outstanding sales results, but Weitz believes awarding incentives weekly makes more sense. With a monthly cycle, some reps tend to slack off for the first week or so because they believe they can make up for lost time later. With weekly rewards, there’s not much room for downtime, he notes.

Whatever form investment takes, it can help build a sterling reputation and a free-flowing “pipeline.”

THE RIGHT REPUTATION

“Reputation is huge,” especially for repeat business and referrals, Marmott says. Once a merchant has received funding, a blizzard of sales call can follow. Treating customers right by maintaining ethical standards and helping them during hard times can guard against defection to a competitor touing low prices, he says.

Reputation requires differentiation, which usually occurs online, by email or over the phone, notes Bakes. Factors that enhance reputation include referrals by satisfied customers and real-world testimonials from actual customers and good ratings on social media sites, he says.

While it’s still uncertain what role social media plays in the industry’s reputation-building efforts, it appears that text messages elicit quick responses if the client has agreed to communicate with the company via that format, Bakes says. He notes that unwanted text messages won’t work. Email messages provide more information than text messages but seem less likely to prompt response, he says.

THE RIGHT GOAL

So, where does the effort to succeed at sales lead? It’s the foundation for building “the pipeline” – the name given to the flow of renewals, referrals and leads that makes every day not just busy, but busy in a productive and profitable way. As a rep’s pipeline takes shape, the cost of acquiring new business also goes down, Marmott says. “It just grows from there,” he says of the successful salesperson’s endeavors at building a pipeline of business. It’s what successful salespeople seek.

Welcome to Broker Fair

May 13, 2018Update: Thanks to everyone who attended, participated, and sponsored!

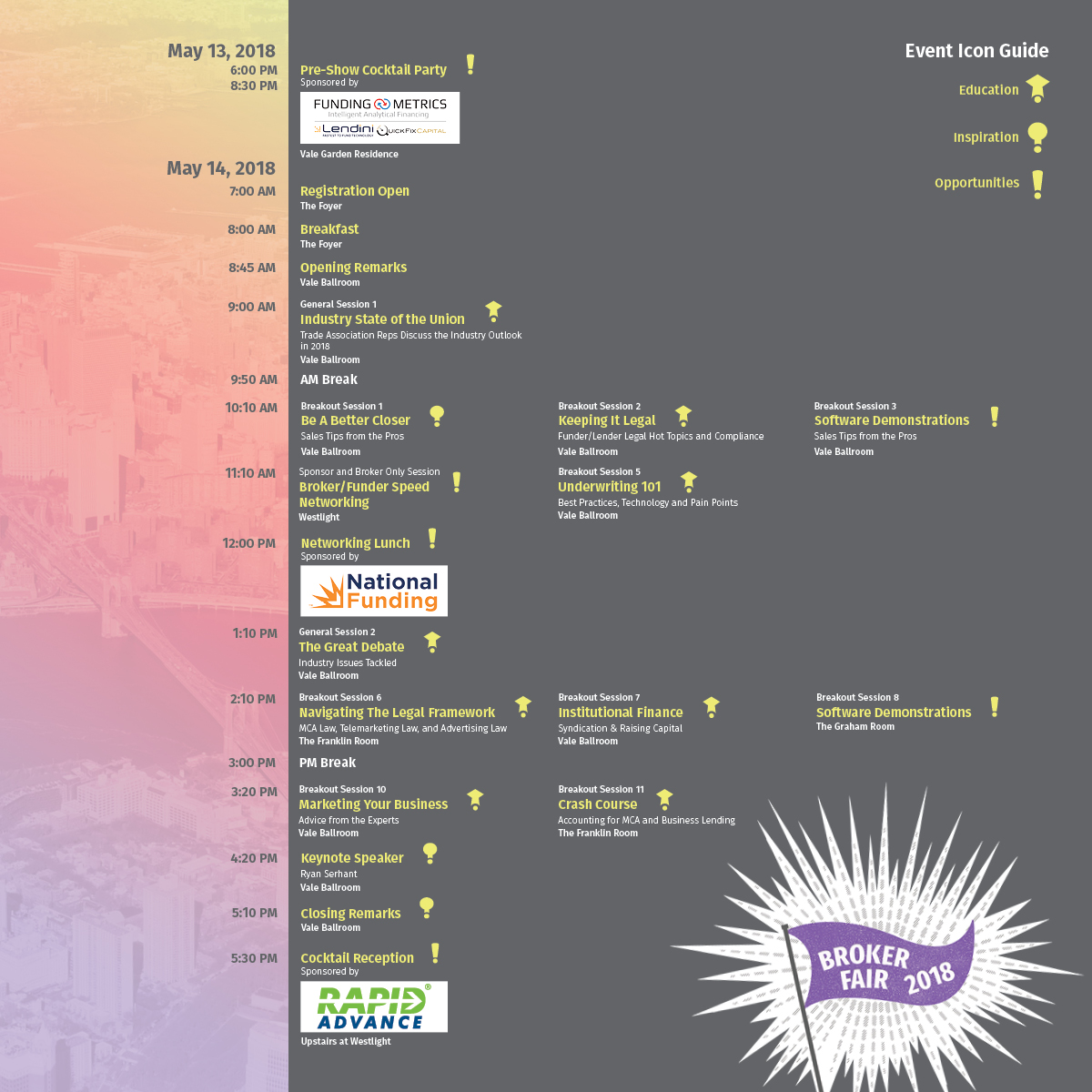

Registration on Monday starts at 7am where you will be able to pick up your badge. The continental breakfast will be available at 8am and the opening remarks begin at 8:45am.

Registration on Monday starts at 7am where you will be able to pick up your badge. The continental breakfast will be available at 8am and the opening remarks begin at 8:45am.

The lunch, sponsored by National Funding, begins at 12. There will be a kosher option available.

Later at the end of the day, the cocktail reception at Westlight, which is upstairs on the 22nd floor, will begin at 5:30pm. Westlight offers amazing outdoor views of the Manhattan skyline. That event is sponsored by RapidAdvance and all you need to enter is your Broker Fair badge.

The agenda will also be available on the backside of your badge.

Thank you also to our Gold Sponsors: National Business Capital, CFG Merchant Solutions, BFS Capital, and CanaCap

Broker Fair 2018 On Pace for Major Success

April 4, 2018 Broker Fair 2018 is on pace to be a major success!

Broker Fair 2018 is on pace to be a major success!

Companies still wishing to become a sponsor of Broker Fair 2018 have until Friday, April 6th to do so. After that, no additional sponsors will be accepted.

The coming May 14th conference in Brooklyn, NY has already sold out of funder/lender and general admission level tickets. Only ISOs, brokers and those employed by them can continue to register!

The inaugural event has lined up dozens of awesome speakers and sponsors from around the MCA and small business lending industry. In addition to the 31 confirmed speakers and 50 sponsors, TV sales celebrity Ryan Serhant will be the keynote speaker of the event and will offer the audience sales tips. Serhant’s new TV show, Sell It Like Serhant premieres on April 11th.

Salespeople will also be in for a treat with the Be A Better Closer panel featuring Jared Weitz (United Capital Source), Joe Camberato (National Business Capital), Ed Tucker (Yellowstone Capital), Evan Marmott (CanaCap), and Justin Bakes (Forward Financing) as Moderator and the Marketing Your Business panel with Jennie Villano (Kalamata Advisors), Adam Stettner (Reliant Funding), and Tom Gricka (Babylon Solutions).

Industry captains will also teach you how they underwrite deals and tips for ISOs to succeed. Attorneys will walk you through the ins and outs of telemarketing law and legal advertising. There’s more of course, like networking with the funders, tips to raise capital, debates on industry issues, and checking out industry CRMs.

Afterwards, all attendees are invited to network upstairs at Westlight sponsored by RapidAdvance, while enjoying free food and drinks. Westlight offers full views of the Manhattan skyline from Brooklyn’s William Vale.

To date, there’s never been anything like it. I hope to see you at Broker Fair.

See Post... canacap, cmca, cornell funding, iou financial, merchant growth, sharpshooter funding, thinking capital... |

See Post... canacap... |

See Post... canacap, greenbox funds in canada too... |