Related Headlines

| 12/30/2020 | S5470B - signed, sealed, delivered |

Related Videos

Ep 29: S5470B - Signed, Sealed, and Delivered |

Stories

New York DFS Publishes New Proposal on Commercial Financing Disclosure Law

September 15, 2022 The New York regulator in charge of rolling out the commercial financing disclosure law, published a new draft of the rules in the State Register yesterday.

The New York regulator in charge of rolling out the commercial financing disclosure law, published a new draft of the rules in the State Register yesterday.

In it, the New York Department of Financial Services (DFS) also gave its own assessment of the comments received from potentially covered parties.

“Some commenters are opposed to the basic purpose of the Commercial Finance Disclosure Law (“CFDL”), Financial Services Law (“FSL”) sections 801-811, and accordingly are opposed to the regulation,” DFS said. “Most commenters acknowledge the need for the rule to implement the CFDL and made comments intended to improve the regulation from their perspective.”

Thus, with all of the feedback previously received, the new proposal is out. The public now has until October 31st to provide further feedback to it.

New York’s Commercial Financing Disclosure Law to Undergo Further Comment and Review

January 4, 2022 Implementation of the New York Commercial Financing Disclosure law originally intended to go into effect four days ago, is now subject to another delay on top of the existing one, with no official date on when compliance will be required.

Implementation of the New York Commercial Financing Disclosure law originally intended to go into effect four days ago, is now subject to another delay on top of the existing one, with no official date on when compliance will be required.

Seeing as the New York Department of Financial Services (DFS) was still accepting comments on the proposed regulation through December 20th, DFS had originally granted covered companies a six-month reprieve on compliance. But after having reviewed the comments, DFS determined that it’s actually back to the drawing board on a regulatory proposal. Sometime “early in the new year,” DFS said, it will publish a revised proposal for further public comment.

“Given the complexity of the disclosures required by the CDFL (Commercial Financing Disclosure Law), we believe the Legislature intended that the Department first provide regulatory guidance regarding the standardized disclosures required to be provided under the CDFL,” said Serwat Farooq, a Deputy Superintendent at DFS, in a published statement. “Waiting to commence CDFL obligations until implementing regulations are in place will ensure that the disclosures are made in a consistent, standardized fashion. This will help businesses understand the terms and conditions of the various forms of credit being offered to them, the very intent of the CDFL.”

Congress Introduces New Restrictive Small Business Financing Bill

November 19, 2021 A new bill introduced by Rep. Nydia M. Velázquez, the Chairwoman of the House Small Business Committee, and Senator Robert Menendez (D-NJ), hopes to “stop predatory small business loans” by applying broad consumer protections to small business borrowers nationwide.

A new bill introduced by Rep. Nydia M. Velázquez, the Chairwoman of the House Small Business Committee, and Senator Robert Menendez (D-NJ), hopes to “stop predatory small business loans” by applying broad consumer protections to small business borrowers nationwide.

This would be done by including small businesses as a covered party under the already existing Truth in Lending Act (TILA).

The proposal, if successful, would arguably become more restrictive than New York’s recently passed commercial financing disclosure law.

Among the supporters of the bill are LendingClub and Funding Circle. No republican members of congress are listed among the sponsors in the official announcement.

The bill is similar to one introduced last year that failed to advance, the Small Business Lending Disclosure and Broker Regulation Act of 2020. That bill never made it out of the House Financial Services Committee. The makeup of Congress now, however, is different than it was last year.

Miami May Become the New Small Business Funding Hub

September 22, 2021 At least two funding companies have told deBanked off the record that they plan on opening offices in the Miami area in the new year.

At least two funding companies have told deBanked off the record that they plan on opening offices in the Miami area in the new year.

It seems that South Florida, particularly Miami, is where the small business finance industry may be moving for a fresh start, and with that potentially ditching the suit and tie for flip flops and shades in the process. The social, political, and economical elements of South Florida make it a well-suited landing spot for an industry that is looking to evolve with the shifting environment.

One catalyst to the potential industry-wide migration could be the S5470B regulations that go into effect in New York on January 1. The new law will require funding companies to navigate a complex system of disclosure to any interested small business finance prospect.

There are other benefits to Florida, of course.

Jordan Fein, CEO of Greenbox Capital, whose operated his business out of Miami since 2012, prides his choice of locale on all the factors that are seemingly pushing those in New York down south. “We do not have state and city tax, we are near water and have a better lifestyle than most companies in New York, or in other areas where it gets very cold in the winter,” he said.

Fein stressed the relaxing Miami lifestyle as the reason why he has only called South Florida home to his company. “The lifestyle here is second to none. Being near the ocean, it makes it much more enjoyable to be able to go to the beach or on a boat to relax and take a load off from the busy work week. New York and other large cities seem to add more stress from [New York’s] super-fast-paced style.”

Despite his love for Miami, Fein respects New York’s ability to churn out top tier employees in the industry. “The talent pool is still among the best,” Fein said, when asked if there were any reasons he or others would ever consider maintaining a connection with the area should an exodus occur.

Fein isn’t worried about the incoming competition should offices relocate to his area. “Location of a funding company has no bearing on competition,” he said. “We all do business over the internet and the competition of funding is dependent on new companies entering the space, not on their location.”

If it is true that the industry is moving to a fully digital competitive space, the idea of a warm weather city with great tax benefits, comparatively low costs of living, and a low-stress atmosphere may be a no-brainer when it comes to finding the funding industry a much needed new home. Not to mention, the mayor of Miami also really wants small business finance companies to relocate there.

In a taped episode of deBanked TV, Miami Mayor Francis Suarez told reporter Johny Fernandez that he really wants small business lenders and MCA companies to set up shop in his city.

Watch: Miami Mayor Francis Suarez talks with deBanked in March 2021“We definitely want to make sure that small business, merchants, and lenders are able to capitalize small businesses in our community,” he said. “Miami’s a very thriving small business community. One of the things that people have criticized us for is we don’t have those big massive companies. We’re actually really built on small businesses. So for us, having fluidity of capital, liquidity of capital, access to capital are enormous things in terms of scaling. And I think that’s one of the things that we’re seeing change now is because of technologies. We’re getting a tremendous amount of access to capital that we weren’t getting before.”

New York DFS: The Commercial Financing Disclosure Requirement is Happening

September 21, 2021 New York State’s financial regulator announced that the commercial financing disclosure law is moving forward as planned for the Jan 1, 2022 deadline.

New York State’s financial regulator announced that the commercial financing disclosure law is moving forward as planned for the Jan 1, 2022 deadline.

To prepare those that will be subject to it, Acting Superintendent Adrienne A. Harris released a copy of proposed regulations that will be open to comment for 60 days.

Its length, 45 pages, demonstrates the complexity that compliance will require. Anyone involved in commercial or small business financing should take the careful time to read it.

“The Department of Financial Services will then review all received comments and issue a final regulation,” the announcement says.

New York’s New Governor

August 10, 2021Now that Governor Cuomo is leaving office early, the Lieutenant Governor, Kathleen Hochul, will become his replacement. This detail is relevant given that New York’s landmark legislation (SB 5470) for the small business finance industry is slated to go into effect on January 1st.

Hochul served as Erie County Clerk and as a member of Congress. She’s also long been an advocate of small business.

While running on Cuomo’s ticket in 2018 for Lieutenant Governor, she criticized her opponent in a controversial campaign ad by saying that he couldn’t be trusted to manage the state budget because he had defaulted on a small business loan.

SB 5470 is expected to be so restrictive, that at least one small business finance provider has already fled the state.

Double Dipped: What’s Next For New York’s Small Business ‘Truth in Lending’ Act

January 11, 2021 Last year, when the Small Business ‘Truth in the Lending’ bill came through the New York State Senate Banking Committee, Senator George M. Borrello said he and other members went to work. Their job: to write a version everyone would like, which fell apart when the bill passed in July and it was signed into law just before Christmas.

Last year, when the Small Business ‘Truth in the Lending’ bill came through the New York State Senate Banking Committee, Senator George M. Borrello said he and other members went to work. Their job: to write a version everyone would like, which fell apart when the bill passed in July and it was signed into law just before Christmas.

“I’m a small business owner myself, but I also come from local government, and in local government, the committee is where the work gets done,” Borrello said. “We had the opportunity to fix this in committee. By the time it got to the floor, the governor basically reversed all the things I presented that were flaws, and he signed it.”

That’s the story of how S5470B came to be in Albany. Instead of ironing out the kinks in committee, Borrello said he watched as the bill with all its problems passed over the summer. There was a process to clean it up afterwards to make it suitable for Governor Andrew Cuomo’s signature, since it’s said that even he himself had expressed reservations about the language. But then he signed the original version and all the edits were discarded.

Politics are suspected to have played a role in that.

Politics are suspected to have played a role in that.

“When the governor finds something is flawed, he usually vetoes and sends it back,” Borrello said. “It concerns me that there is an underlying political angle that has nothing to do with the Truth in Lending.”

Steve Denis, the executive director of the Small Business Finance Association, said that he doesn’t think that the signed bill that is up on the state senate website will be the final version.

“It is so poorly drafted that even companies that support the bill have liability and will be the first to get sued,” Denis said. “The SBFA will be a lot more aggressive; the legislature has a lot to work on in the next session. It has been a wake-up call, unifying the industry. We will be more aggressive to create a more favorable version.”

Denis has attested to the harm the bill will do to the SMB finance industry in New York, costing billions of dollars in fines and litigation. He pointed out that major companies like PayPal have fought against the bill, and the proponents “recognized it was not a good bill, but passed it to fix it.”

Borrello said that it is common in Albany to encounter legislation written by lawmakers who don’t understand small business owners who deal with regulation every day. Borrello and his wife worked in the hospitality business for years before going into public service. Borello said he feels business owners’ pain during the pandemic, especially in the restaurant and hotel industry.

He said the end result of this new bill when it comes into effect this July: funding and lending companies will stop providing services in New York State, directly harming the small businesses the bill claims to help.

“One of my frustrations, being on the banking committee, is that we do things that ultimately make it more difficult for people to access credit and financing in New York State,” Borrello said. “You’re talking about small businesses that are already hurting, having financial difficulties accessing lines of credit. This disclosure law passing during this pandemic is one more nail in the coffin for small business.”

The Legislature, the Governor, and the Department of Financial Services (DFS) all reportedly had issues with the bill: yet it passed. Borrello said a problem with “nonsense lawmaking” comes from competition with other states. New York compares itself with California to “prove we’re the most progressive.” Borrello also pointed out that California passed its version of a lending disclosure bill more than two years ago, and their version of the DFS still cannot find a way to calculate an APR metric for factoring or MCA.

The Legislature, the Governor, and the Department of Financial Services (DFS) all reportedly had issues with the bill: yet it passed. Borrello said a problem with “nonsense lawmaking” comes from competition with other states. New York compares itself with California to “prove we’re the most progressive.” Borrello also pointed out that California passed its version of a lending disclosure bill more than two years ago, and their version of the DFS still cannot find a way to calculate an APR metric for factoring or MCA.

As the bill was argued on the legislative floor, Borrello brought up the controversial “double-dipping” term that had been inserted in the language. Borrello came to the same conclusion as Denis, that there is no double-dipping term: It was just conjured up for the bill to sound scary, negative, and damaging.

“Other than talking about potato chips, I’m not sure what you’re talking about,” Borrello said. “When you haven’t defined it, in the legislature, it comes down to a political talking point and dog whistle. You enshrine a rather vague piece of jargon in the legislation, and it shows how deeply flawed it is.”

Borrello now plans to work with the Governor, DFS, and legislature to amend and change the bill. He is also fighting for a Republican banking overhaul to provide further credit access to small businesses.

“The next step now is to go back and see what needs to be fixed,” Borrello said. “Hopefully, my role now as the ranking member of the banking committee, we can have a common-sense conversation about how to actually fix it.”

deBanked’s Top Five Stories of 2020

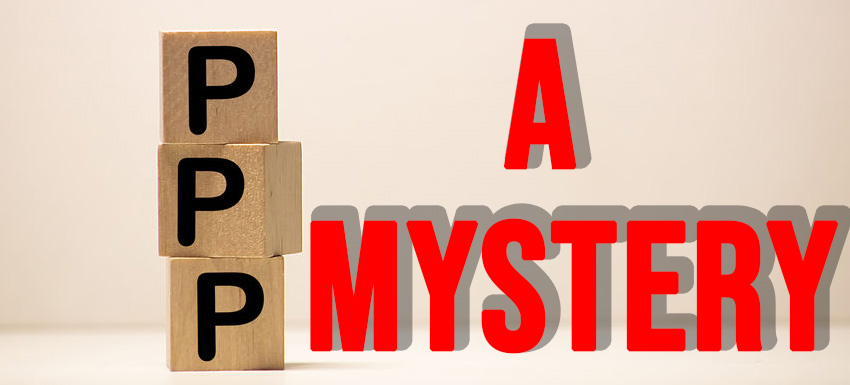

December 28, 2020DeBanked’s Top 10 most read stories of 2020 all involved the Payment Protection Program (PPP). It was by far the hottest topic in small business financial services for the year. As a result, we consolidated our most read stories into FIVE categories and this is what our readers consumed most in 2020!

1. PPP

The Payroll Protection Program saga boiled down to one major question early on in the pandemic: Who, if anybody, would be able to lend the money out on the government’s behalf? PPP Lender Requirements was the most read story on deBanked in 2020, followed by the world being curious to find out who was the biggest PPP lender. On April 22, deBanked was the first to spread the story that Ready Capital (Knight Capital‘s parent company) was the largest PPP lender in the US for Round 1.

The Payroll Protection Program saga boiled down to one major question early on in the pandemic: Who, if anybody, would be able to lend the money out on the government’s behalf? PPP Lender Requirements was the most read story on deBanked in 2020, followed by the world being curious to find out who was the biggest PPP lender. On April 22, deBanked was the first to spread the story that Ready Capital (Knight Capital‘s parent company) was the largest PPP lender in the US for Round 1.

2. NY’s Disclosure Bill

The biggest non-PPP story of the year was a bill passed in New York that was signed by the governor at Midnight on Christmas Eve. SB 5470, which some have dubbed “The Small Business Truth in Lending Act,” is slated to completely overhaul the non-bank small business lending market in the state. The bill was passed by the legislature in July.

The biggest non-PPP story of the year was a bill passed in New York that was signed by the governor at Midnight on Christmas Eve. SB 5470, which some have dubbed “The Small Business Truth in Lending Act,” is slated to completely overhaul the non-bank small business lending market in the state. The bill was passed by the legislature in July.

3. OnDeck

It’s difficult to overstate how much of a rollercoaster it was for the stalwart fintech lender in 2020. OnDeck started the year with optimism, announcing a NASCAR sponsorship in March just as the company’s stock suddenly plummeted by 30%. By the time summer rolled around, the company was no longer engaged in non-PPP lending activities and was battling in a fight for its life with its creditors. In July, OnDeck was acquired by Enova, which led to shareholder lawsuits over the terms and disclosures tied to the deal. Somehow, by year-end, OnDeck managed to pull itself back together, thanks to its new parent company. It successfully originated $148M worth of loans in Q3.

It’s difficult to overstate how much of a rollercoaster it was for the stalwart fintech lender in 2020. OnDeck started the year with optimism, announcing a NASCAR sponsorship in March just as the company’s stock suddenly plummeted by 30%. By the time summer rolled around, the company was no longer engaged in non-PPP lending activities and was battling in a fight for its life with its creditors. In July, OnDeck was acquired by Enova, which led to shareholder lawsuits over the terms and disclosures tied to the deal. Somehow, by year-end, OnDeck managed to pull itself back together, thanks to its new parent company. It successfully originated $148M worth of loans in Q3.

Wow, just wow.

4. Covid-19

The impact of Covid was a close 4th on deBanked’s top read list. In March, deBanked published a writeup of How Small Business Funders [Were] Reacting, an interesting glimpse into the pandemic as it was just unfolding. At that time, attitudes ranged from confidence in being prepared to being convinced it was time to shut everything down. One notable takeaway from the commentary is that nobody surmised that the situation would persist for the entire rest of the year.

The impact of Covid was a close 4th on deBanked’s top read list. In March, deBanked published a writeup of How Small Business Funders [Were] Reacting, an interesting glimpse into the pandemic as it was just unfolding. At that time, attitudes ranged from confidence in being prepared to being convinced it was time to shut everything down. One notable takeaway from the commentary is that nobody surmised that the situation would persist for the entire rest of the year.

Capify CEO David Goldin made an early bold prediction, however. “I would not be surprised if we learn in the next few weeks that the President of the United States has it,” he said in an interview with deBanked in mid-March. President Trump was diagnosed with Covid-19 less than six months later on October 6th.

5. Scandal

Three scandals were a near-tie for views in 2020 so we’re revisiting them all here.

Three scandals were a near-tie for views in 2020 so we’re revisiting them all here.

Brendan Ross & Direct Lending Investments – Brendan Ross, the former CEO of a very popular fintech lending hedge fund, was indicted on August 11th. Federal officials including the SEC, say that Ross defrauded investors while managing more than $1 billion in assets. Ross’s “unwinding” began in 2019 when he suddenly resigned from the firm and wrongdoing was alleged.

Jonathan Braun – Jon Braun, made infamous by a Bloomberg Businessweek profile, checked into FCI Otisville earlier this year after having been sentenced the previous May for drug related offenses. Braun resurfaced in the news this summer when the FTC announced civil charges against him for alleged acts related to a company named Richmond Capital Group, LLC. The New York State Attorney General filed its own charges against Braun and affiliates at the same time.

Par Funding – A financial services firm based in Philadelphia generated major headlines this year after the SEC filed a lawsuit against the company that ultimately resulted in it being placed in receivership. A series of stunts and accidents got the SEC’s case off to a rocky start, but the likelihood of Par ever restarting its business has diminished to almost nothing.

See Post... you folks fund defaults?, , asking for a friend, , who said anything about funding lol hes just asking for free leads... |

See Post... i agree 100 % , which is what i'm doing. - but, i still like to see whats out there., , i think you're doing it right, jake., , i'm certain that mr. s... |

See Post... how many leads does someone have to buy to get a free pair of yeezys? do you accept bitcoin?, , , hopefully you can explain this to me. , i really wou... |