Double Dipped: What’s Next For New York’s Small Business ‘Truth in Lending’ Act

Last year, when the Small Business ‘Truth in the Lending’ bill came through the New York State Senate Banking Committee, Senator George M. Borrello said he and other members went to work. Their job: to write a version everyone would like, which fell apart when the bill passed in July and it was signed into law just before Christmas.

Last year, when the Small Business ‘Truth in the Lending’ bill came through the New York State Senate Banking Committee, Senator George M. Borrello said he and other members went to work. Their job: to write a version everyone would like, which fell apart when the bill passed in July and it was signed into law just before Christmas.

“I’m a small business owner myself, but I also come from local government, and in local government, the committee is where the work gets done,” Borrello said. “We had the opportunity to fix this in committee. By the time it got to the floor, the governor basically reversed all the things I presented that were flaws, and he signed it.”

That’s the story of how S5470B came to be in Albany. Instead of ironing out the kinks in committee, Borrello said he watched as the bill with all its problems passed over the summer. There was a process to clean it up afterwards to make it suitable for Governor Andrew Cuomo’s signature, since it’s said that even he himself had expressed reservations about the language. But then he signed the original version and all the edits were discarded.

Politics are suspected to have played a role in that.

Politics are suspected to have played a role in that.

“When the governor finds something is flawed, he usually vetoes and sends it back,” Borrello said. “It concerns me that there is an underlying political angle that has nothing to do with the Truth in Lending.”

Steve Denis, the executive director of the Small Business Finance Association, said that he doesn’t think that the signed bill that is up on the state senate website will be the final version.

“It is so poorly drafted that even companies that support the bill have liability and will be the first to get sued,” Denis said. “The SBFA will be a lot more aggressive; the legislature has a lot to work on in the next session. It has been a wake-up call, unifying the industry. We will be more aggressive to create a more favorable version.”

Denis has attested to the harm the bill will do to the SMB finance industry in New York, costing billions of dollars in fines and litigation. He pointed out that major companies like PayPal have fought against the bill, and the proponents “recognized it was not a good bill, but passed it to fix it.”

Borrello said that it is common in Albany to encounter legislation written by lawmakers who don’t understand small business owners who deal with regulation every day. Borrello and his wife worked in the hospitality business for years before going into public service. Borello said he feels business owners’ pain during the pandemic, especially in the restaurant and hotel industry.

He said the end result of this new bill when it comes into effect this July: funding and lending companies will stop providing services in New York State, directly harming the small businesses the bill claims to help.

“One of my frustrations, being on the banking committee, is that we do things that ultimately make it more difficult for people to access credit and financing in New York State,” Borrello said. “You’re talking about small businesses that are already hurting, having financial difficulties accessing lines of credit. This disclosure law passing during this pandemic is one more nail in the coffin for small business.”

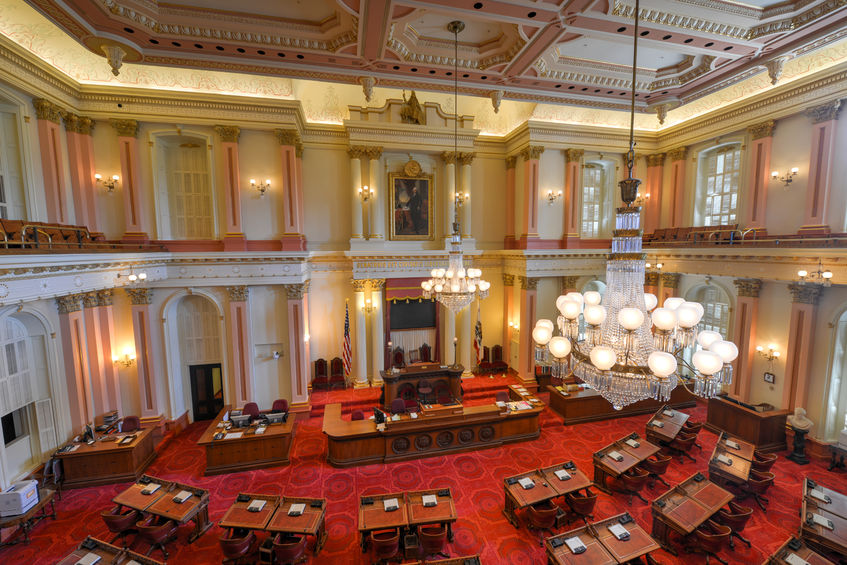

The Legislature, the Governor, and the Department of Financial Services (DFS) all reportedly had issues with the bill: yet it passed. Borrello said a problem with “nonsense lawmaking” comes from competition with other states. New York compares itself with California to “prove we’re the most progressive.” Borrello also pointed out that California passed its version of a lending disclosure bill more than two years ago, and their version of the DFS still cannot find a way to calculate an APR metric for factoring or MCA.

The Legislature, the Governor, and the Department of Financial Services (DFS) all reportedly had issues with the bill: yet it passed. Borrello said a problem with “nonsense lawmaking” comes from competition with other states. New York compares itself with California to “prove we’re the most progressive.” Borrello also pointed out that California passed its version of a lending disclosure bill more than two years ago, and their version of the DFS still cannot find a way to calculate an APR metric for factoring or MCA.

As the bill was argued on the legislative floor, Borrello brought up the controversial “double-dipping” term that had been inserted in the language. Borrello came to the same conclusion as Denis, that there is no double-dipping term: It was just conjured up for the bill to sound scary, negative, and damaging.

“Other than talking about potato chips, I’m not sure what you’re talking about,” Borrello said. “When you haven’t defined it, in the legislature, it comes down to a political talking point and dog whistle. You enshrine a rather vague piece of jargon in the legislation, and it shows how deeply flawed it is.”

Borrello now plans to work with the Governor, DFS, and legislature to amend and change the bill. He is also fighting for a Republican banking overhaul to provide further credit access to small businesses.

“The next step now is to go back and see what needs to be fixed,” Borrello said. “Hopefully, my role now as the ranking member of the banking committee, we can have a common-sense conversation about how to actually fix it.”

Last modified: January 11, 2021Kevin Travers was a Reporter at deBanked.