Archive for 2021

Funder Acquires Automated Underwriting Startup for Post Pandemic Market

July 6, 2021 In an age of changeups, the talent or tech a firm acquires has increasingly become what sets them apart from the pack.

In an age of changeups, the talent or tech a firm acquires has increasingly become what sets them apart from the pack.

Yes Lender, a funder based in Pennsylvania, recently teamed up with MCA AI underwriting startup Edge Funder. Yes bought Edge and will bring co-founders Amotz Segal and Kobi Ben Meir to the team as Vice President of Business Development and Chief Marketing Officer.

Segal, an industry vet with a decade of experience in MCA, said it was a great time to join forces and grow.

“[Yes Lender] weathered this pandemic in a pretty impressive way, I would say,” Segal said. “What they see now is an opportunity to take advantage of the post-pandemic market and the need for a more sophisticated data driven system to improve their chances to become one of the biggest names in this industry.”

Surviving the pandemic in style is something Yes Lender and Edge have in common. Back in 2019, Segal left Yalber and started an investment consulting firm. By May 2020, the pandemic had soured business, but he and his co-founder Ben-Meir saw an opportunity.

“During the pandemic, I realized fairly quickly that many of the MCA companies are going to go out of business because of the nature of the shutdown,” Segal said. “So I decided to take the opportunity and apply my experience, knowledge, and start my own platform.”

The idea was simple, he said: create something that would address the pain points of the industry. They worked with the concept of building a platform that treated business owners just as consumers are treated in consumer finance. They began generating leads directly from SMBs like a consumer funding product, though Segal said they would always be focused on working with ISOs as well.

Next, they focused on turning the application process into a seamless, automated process. While the MCA industry can fund in 24 or 48 hours, the consumer credit world still has it beat, with card applications processed in as little as 30 seconds. That is the target time for online MCA applications, Segal said.

He said they look forward to being a part of the Yes Lender team and executing that vision. Glenn Forman, CEO of Yes Lender, said in a release that the firm is fortunate to have joined forces with Edge.

“Their lead generation and direct-to-merchant funding platform are terrific complements to Yes Lender’s thriving ISO-driven sales channel,” Forman said. “Moreover, the addition of artificial intelligence to our already robust array of data-driven risk assessment tools will further strengthen our underwriting.”

Real Estate Investing For Beginners and More

July 6, 2021deBanked met with Kurtavious Ball, a physician assistant and savvy real estate estate investor in Philadelphia. Ball started small, risking about $30,000 he had set aside for a startup venture. If it didn’t work out, Ball said he was still young enough and capitalized enough to weather the loss. After doing a lot of reading and listening to gurus, Ball said the best course of action was to just plow forward and give it a try. He’s happy he did.

deBanked’s interview with Ball is part of a nationwide docuseries with business finance and real estate professionals.

Real Estate Docuseries

All Docuseries

Merchant Cash Advance Tutorials

Snapchat Acquired Mobile Shopping App Founded By Former MCA Execs

July 2, 2021 A brother and sister team formerly known throughout the merchant cash advance industry have achieved major success in another market altogether, mobile shopping.

A brother and sister team formerly known throughout the merchant cash advance industry have achieved major success in another market altogether, mobile shopping.

Recently, their app was acquired by Snapchat, according to various news outlets, and the tech has since been integrated into the Snapchat app.

Molly and Meir Hurwitz, both original stalwarts of the old Pearl Capital in New York, co-founded Screenshop in 2017, an app that integrated shopping with fashion and social media. Its initial launch received added buzz thanks to Kim Kardashian’s early involvement as an advisor. Notably, Screenshop CEO Mark Fishman was previously a Risk Manager at Pearl Capital, rounding out the former MCA crew.

“We’re No. 5 on the app store category of fashion,” Meir Hurwitz told deBanked in November 2017. “We’re just getting started.”

The success continued.

“Screenshop gives shopping recommendations from hundreds of brands when you Scan a friend’s outfit,” Snapchat wrote in a published announcement this past May.

More than 170 million Snapchatters use scan features every month, the company revealed.

“Screenshop is now a part of ‘Scan’ said Snapchat CTO Bobby Murphy during the company’s annual Partner Summit broadcast on May 20. The above screenshot is of Murphy demonstrating the Screenshop technology.

Robinhood Pays Fine, Files For IPO

July 2, 2021 Fractional retail investing app Robinhood filed for IPO on Thursday, registering for a public listing on the Nasdaq under the stock ticker HOOD. The S-1 filing shows the platform has 18 million accounts and made $7.45M last year.

Fractional retail investing app Robinhood filed for IPO on Thursday, registering for a public listing on the Nasdaq under the stock ticker HOOD. The S-1 filing shows the platform has 18 million accounts and made $7.45M last year.

The news comes days after FINRA fined Robinhood $57M and ordered the firm to pay $13M in restitution to retail investors locked out of trading during the GameStop and meme stock craze in Q1 2021. FINRA is a self-regulating brokerage industry organization that handed Robinhood its largest fine ever.

The firm also paid out $65M to settle an SEC charge that alleged the firm did not accurately disclose how Robinhood made money: the truth is they sell orders they receive to larger market-making hedge funds.

After the firm’s leadership faced questioning by Congress over allegedly disenfranchising traders, the filing shows that Robinhood has paid dearly. The filing reports the firm lost $1.4B in Q1 2021 after being forced to raise billions of dollars overnight to cover the cost of the trading explosion. While options trading ballooned prices through the roof, Robinhood found itself strapped for cash.

The firm has raised $5.5B since 2013, including a combined $3.4B during and since the meme stock craze. They plan to raise $100M from the listing, though that number is regularly used as a stand-in for public filings.

The firm said that the FINRA judgment was part of a deal to release the S-1 filing at long last, delayed by regulators and their concerns over the cryptocurrency side of the trading app. The filing said that Robinhood plans to allocate up to 35% of its shares for its platform users.

Congress Tells OCC “Nope” On True Lender Rule

June 29, 2021 In October, the OCC brought clarity to the relationships that many fintech companies enjoy with banks.

In October, the OCC brought clarity to the relationships that many fintech companies enjoy with banks.

So long as a national bank is named as the lender on the loan agreement on the date of origination or so long as it funds the loan, then the bank is considered the true lender, the OCC decided. It issued it as a rule that was published in the Federal Register last year.

The brief proclamation was viewed as necessary in light of lawsuits filed against fintech companies that have challenged who the true lender was on a loan.

National banks are generally exempt from state interest rate caps and licensing requirements. Fintech lenders, therefore, partner up with banks in such a way that the banks themselves actually make the loans so that those same exemptions carry over. The long-used practice has drawn litigation as well as outrage from certain corners of the economic and political spectrum. The OCC rule issued during the Trump era, for example, was not unanimously applauded.

Last week, Congress took the unusual step of nullifying the OCC’s rule.

Resolved by the Senate and House of Representatives of the United States of America in Congress assembled, That Congress disapproves the rule submitted by the Office of the Comptroller of Currency relating to “National Banks and Federal Savings Associations as Lenders” (85 Fed. Reg. 68742 (October 30, 2020)), and such rule shall have no force or effect.

Short and succinct.

The invalidation of the OCC rule does not mean that banks cannot collaborate with fintechs or third parties in such a way as before, but rather that the certainty of what’s acceptable and what isn’t will be relegated to further debate for years to come.

Tether is Now So Big, Its Collapse Could Disrupt the Short-Term Credit Markets

June 26, 2021 More than $62.5 billion worth of Tethers have been printed in the last few years to facilitate liquidity in the crypto markets. The system has worked because the company behind Tether had long claimed that each unit of the digital currency was backed somewhere by a real dollar in a bank account.

More than $62.5 billion worth of Tethers have been printed in the last few years to facilitate liquidity in the crypto markets. The system has worked because the company behind Tether had long claimed that each unit of the digital currency was backed somewhere by a real dollar in a bank account.

That was determined false. “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie,” wrote the New York State Attorney General in February after the regulator announced a settlement with the company. “These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

Despite the characterization, Tether has continued to be the glue that makes the global crypto market hum. And their size is now so big, that it’s no longer just a crypto problem.

According to the Federal Reserve Bank of Boston, Tether now poses a risk to all short-term credit markets. The central bank listed it as an example of “new disruptors” that pose financial stability challenges.

Eric S. Rosengren, the CEO of the Boston Fed, said “There are many reasons to think that stable coins, at least many of the stable coins are not actually particularly stable and actually have some of the same features as money market funds. The difference is prime money market funds have been losing market share but these stable coins have been growing very rapidly in part because of their use along with the cryptocurrency market.”

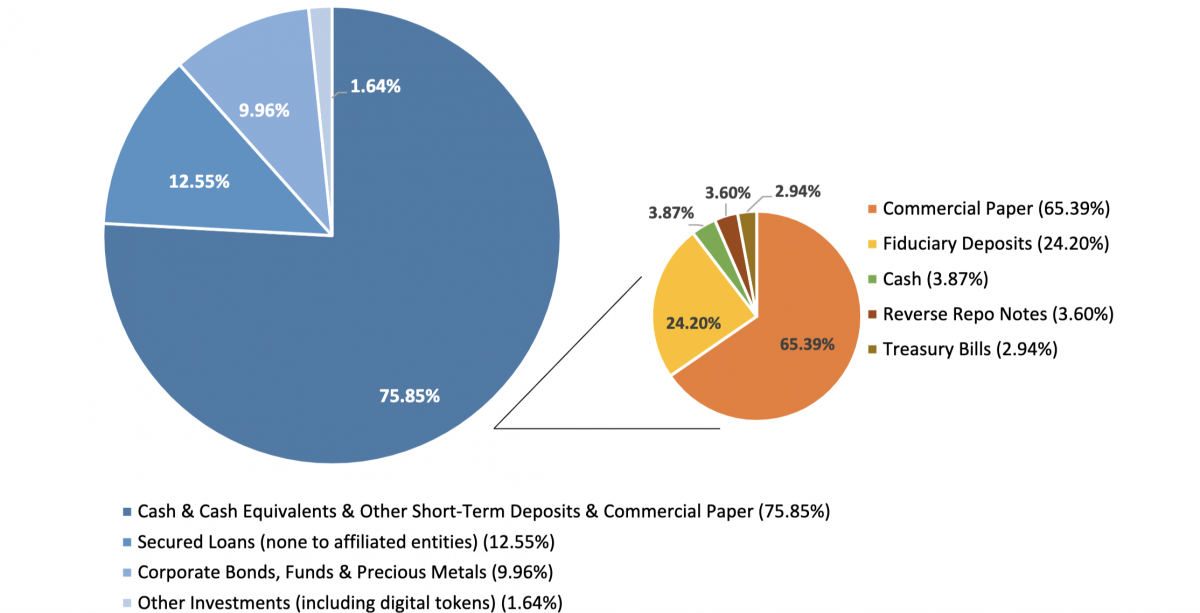

On Tether in particular, he said, “While [Tether talks] about being stable, if you look at the set of assets that are there, it includes corporate bonds, secured loans, commercial paper, in effect this is a very risky prime fund. Prime funds would not be able to hold all these assets.”

Tether has drawn enhanced public scrutiny in recent months after releasing the following breakdown of its assets. The digital asset company that once claimed all Tethers were backed by dollars, revealed that less than 3% of them were actually backed by dollars.

Tether’s riskiness was also the subject of a recent segment on Jim Cramer’s Mad Money show on CNBC:

deBanked first shed light on the Tether mystery more than two years ago in a story that questioned what drove the cryptocurrency bull market of 2017.

Virtual Fintech Meet-ups Transition Back to In-Person

June 25, 2021 In one week, there were two fintech meetups. One was a virtual network-o-thon, a chat roulette-like elevator pitching practice extravaganza put on by Money 2020 founder Anil Aggarwal. The other event was a Twitter meetup happy hour with an open bar on the roof of a building on Madison Ave, hosted by “This week in fintech” newsletter writer and Google Pay developer Nik Milanovic.

In one week, there were two fintech meetups. One was a virtual network-o-thon, a chat roulette-like elevator pitching practice extravaganza put on by Money 2020 founder Anil Aggarwal. The other event was a Twitter meetup happy hour with an open bar on the roof of a building on Madison Ave, hosted by “This week in fintech” newsletter writer and Google Pay developer Nik Milanovic.

A greater contrast of the old and the new could not have been achieved by surrounding dinosaur bones with NYC pigeons. Aggarwal’s Fintech Meetup Event was entirely online and attended primarily by professionals looking to sell their financial platforms, services, and network. It was seemingly the last virtual event of the pandemic era. Calling in from living rooms across the world, attendees paid hundreds of dollars for the opportunity to be guided by an automatic 15 minute conversation time limit.

Meanwhile, Milanovic’s meetup on the roof was attended by younger community members looking to hang out with friends and meet industry peers for a free drink after work. The tech people outnumbered the ‘fin’ representatives three to one, deBanked assessed.

The bar was packed and stocked with wine, Montauk IPAs, and Fat Tire beer. Standing room only and hard to move from one side of the roof to the other, the young networking crowd pushed elbows in.

The bar was packed and stocked with wine, Montauk IPAs, and Fat Tire beer. Standing room only and hard to move from one side of the roof to the other, the young networking crowd pushed elbows in.

Milanovic was the topic of conversation in many of the cliques forming that night. Most of the guests were readers of his newsletter and followed his work in the fintech space. After it was over, it was revealed that New York was just the first of many in-person locales Milanovic planned to host similar events, like Chicago July 15th, and LA Aug 5th.

Similarly, Aggarwal is also thinking big. His eyes are currently set on Las Vegas.

“We launched Fintech Meetup as a meetings-centric virtual event because the pandemic made it impossible to hold a comprehensive and inclusive in-person event this Spring,” Aggarwal said in a statement. “Going forward, however, our primary focus is on end-to-end tech-enabled in-person events that also include all of the traditional aspects of events–from sessions and speakers to sponsors and exhibitors.”

That next in-person event will take place in Las Vegas in March 2022.

Funding E-Commerce Businesses Helped This Startup Get Acquired Right After They Launched

June 23, 2021 Less than eight months after Yardline announced their launch in the e-commerce financing space, they were acquired by Thrasio. The blazing fast progression from launching to selling the company suggests that Yardline’s niche presents a unique opportunity.

Less than eight months after Yardline announced their launch in the e-commerce financing space, they were acquired by Thrasio. The blazing fast progression from launching to selling the company suggests that Yardline’s niche presents a unique opportunity.

“There are many companies out there that look at e-commerce businesses in the space and say, ‘there’s no barrier for entry to operate in e-commerce, they’re all drop shippers, it’s a hobby, they have no skin in the game,'” said Seth Broman, Chief Revenue Officer of Yardline. “What Yardline does is really unique: One, we obviously have a lot more information and understanding of how they operate their business, and we can really break down on a deal by deal basis, what their margins look like, to get them a more customized offering that meets their needs.”

Yardline will fund Amazon sellers, for example.

Broman said that while most MCA funders know how to look at a merchant’s fixed costs like rent, payroll, taxes, and inventory to provide funding based on a gross revenue, those same funders don’t have a risk tolerance for e-commerce.

Yardline pulls data from digital marketplaces like Amazon and online storefront platforms like Shopify to make better credit decisions, Broman said, and this was a banner year for digital shopping.

“During COVID, you were seeing such an increase of demand for e-commerce goods; Amazon, Shopify, if you look at their stock price over the last 15 months, it’s incredible,” he said. “And the reason being retails closed, everybody’s shopping from home, and the demand for all my goods is through the roof.”

Before everyone was stuck inside, e-commerce already made up 20% of consumer commerce, Broman estimated. Then everything was online-only, and demand became nearly unlimited, he said. Amazon’s third-party sellers transact 60% of all products sold on the site, and Thrasio is one of the largest consolidators of those sellers in the world, Broman said.

Now, Yardline will have access to Thrasio’s international seller network.

Now, Yardline will have access to Thrasio’s international seller network.

“We’re confident in saying that untapped ecosystem can be very profitable for ISOs if they were to start focusing on e-commerce businesses,” Broman said. “There’s less demand for it, less competition, and now they have a home for where they can get these deals done.”

Broman said after the pandemic, typical brick and mortar stores were hit hard and required PPP to keep the doors open while e-commerce flourished.

“It’s not a matter if shopping online is the future; shopping online is the present. People will continue to shop at brick and mortar, people want to eat out, just look at New York City,” Broman said. “If you look at what Amazon offers, what Walmart’s doing, what Target’s doing, what these online marketplaces are doing to make commerce quicker and easier, there’s no doubt that it’s going to continue to grow.”