Archive for 2019

ForwardLine, One of the Original Funding Companies, is Back

June 5, 2019 Steve Carlson, CEO, ForwardLine

Steve Carlson, CEO, ForwardLineForwardLine Financial originated well over $65 million in loans in 2018, according to CEO Steve Carlson. ForwardLine would not share its origination numbers, but Carlson said the company is comfortably on the deBanked list of top originators. ($65 million is the lowest origination number on the list).

Last week, the company announced that it secured a $100 million credit facility from Credit Suisse AG and Neuberger Berman private equity funds. This is the company’s largest credit facility to date. Its previous credit facility was with East West Bank and that relationship is still in place.

ForwardLine is a direct marketer that provides working capital loans of up to $200,000 to small businesses.

Carlson told deBanked that ForwardLine, which was founded in 2003, has been scaling its business dramatically over the past year and a half. This is no coincidence. Instead, Carlson said this is the result of years worth of planning following a majority investment in ForwardLine in 2015 by a private equity firm called Vistria Group.

“We spent 2016 and 2017 very thoughtfully building out a technology platform, a data infrastructure, and a management team to scale the business,” Carlson said. “We’re now actioning on that plan. So this is all part of a multi-year strategy.”

A company statement said that the company’s loan performance in 2018 was record-breaking. ForwardLine increased year-over-year total originations by over 300% in the first quarter of 2019.

Carlson said that the new facility will be used primarily to grow the business. ForwardLine is located in Woodland Hills, CA, and it employs 110 people, more than half of whom work in the sales department. Other employees include underwriters and data and analytics people.

CLA’s Credit Invisibles Event Kicks Off

June 5, 2019The Canadian Lenders Association event kicks off today in Toronto. Hosted by Perc Canada and TransUnion at Blake, Cassels & Graydon LLP, this is the second in the series on “Credit Invisibles” and “Credit Deserts.”

The CLA’s purpose is to support the growth of companies that are in the business of lending, or providing other means of credit, to small business and individuals by non-conventional or innovative means to exchange ideas and explore ways of improving the sector; encourage principled and professional practices by Innovative Lenders; educate the public at large about Innovative Lending; encourage individual potential borrowers to be informed about the appropriateness of Innovative Lending to the borrowers’ circumstance; and to advocate on behalf of, and represent the interests of Innovative Lenders.

deBanked president Sean Murray will be in attendance.

One New York COJ Bill Moves Forward

June 5, 2019A bill that would prevent companies from using Confessions of Judgment against out-of-state debtors is progressing through the New York Assembly. A07500 cleared the judiciary committee on Tuesday despite some Republican opposition. The milestone comes as no surprise as the judiciary committee chair, Assemblymember Jeffrey Dinowitz, is also the bill’s sponsor.

Assemblymembers Niou, DenDekker, Wright, Wallace, and Schimminger are bill co-sponsors.

A07500 now heads to the Codes committee.

Closers: Drink Up to 25 Cups of Coffee Per Day

June 3, 2019 Drink up closers! Research led by Professor Steffen Petersen from Queen Mary’s William Harvey Research Institute suggests that drinking coffee is not that bad for your heart.

Drink up closers! Research led by Professor Steffen Petersen from Queen Mary’s William Harvey Research Institute suggests that drinking coffee is not that bad for your heart.

The study examined more than 8,000 people across three groups of coffee drinkers, those drinking less than 1 cup per day, those drinking 1-3 cups per day, and those drinking more than 3 cups per day. Those surveyed in the 3rd group drank an average of 5 cups of coffee per day but multiple people reported drinking as much as 25 cups per day (or even more!). Even for them, “no increased stiffening of arteries was associated with those who drank up to this high limit when compared with those who drank less than one cup a day,” the report said.

Wow!

Although the report did not reveal the identities of those surveyed, deBanked suspects the individuals drinking 25 cups of coffee per day are sales closers. For one, these individuals clearly did not put the coffee down.

Dr Kenneth Fung, who led the data analysis for the research at Queen Mary University of London, said “Whilst we can’t prove a causal link in this study, our research indicates coffee isn’t as bad for the arteries as previous studies would suggest.”

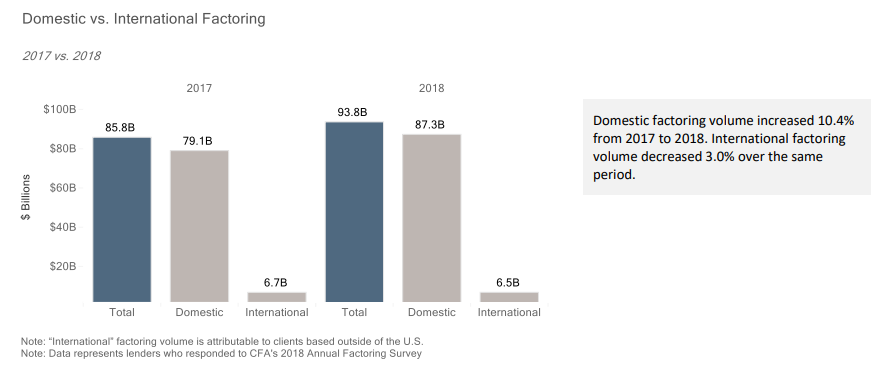

CFA Report Shows Increase in US Factoring Volume

May 30, 2019The Commercial Finance Association (CFA) recently published a report on asset-based lending and factoring which showed a 10.4 % increase in domestic factoring volume in 2018 compared to 2017. While the increase isn’t enormous, it is consistent with a gradual growth in factoring, according to Jeff Goldrich, CEO at Princeton, NJ-based North Mill Capital, which provides invoice factoring.

“It’s not a hockey stick, it’s gradual growth,” Goldrich said.

Goldrich attributed the growth, albeit moderate, to two factors. One is that, while not everywhere, he said there’s been some tightening of credit with banks, which leads companies to consider factoring.

The other is that he said large sized companies are increasingly using factoring as a financing option. While factoring is generally more expensive than taking out a bank loan, companies don’t have to worry about having stellar financial history because factors are less concerned with the financial health of the borrower and more concerned with the strength of the receivable.

Another finding in the CFA report is that Recourse factoring increased by roughly 11% in 2018 compared to 2017. Recourse factoring is when a factor has recourse if a company fails and is unable to pay a receivable to a factor’s client, according to Harvey Gross, Executive Director of the New York Institute of Credit. This is unlike the more common Non-Recourse factoring, where the factor can do nothing if the company that the owes the receivable goes out of business. Gross says that Recourse factoring is becoming more common as factors don’t want to take on as much risk.

Gross said that the older, traditional factors (which often cater to the apparel and toy industries, for example) are still Non-Recourse factors. They shoulder the loss if a company can’t pay its invoices. But at the same time, Gross said that these factors want clients with a large volume of invoices and invoices from solid companies.

BlueVine is one of the few companies that offers factoring online, where a company can get funded online without first interacting with a company representative.

“I see a continuation of factoring marrying fintech,” Goldrich said. “That’s where the big backers have interest.”

IOU Originates $32.8M in Loans in Q1

May 30, 2019IOU Financial funded $32.8M in loans in the first quarter of 2019, according to publicly filed financial statements. The company also continued its profitable streak and plans to grow originations by:

- Identifying, recruiting and partnering with business loan brokers;

- Forming new strategic partnerships with entities such as banks and small business suppliers and leveraging their relationships with small businesses to add new customers;

- Expanding its product offering to allow it to serve small businesses whose needs are not met by its current products;

- Investing in direct marketing and sales; and

- Continuing its expansion into Canada.

MCA Company Files 15 COJs Against a Medical Practice, Dispute Arises Over Alleged Forgery

May 29, 2019 A New Jersey physician was one day going about his usual business, and the next day found himself an unwitting judgment debtor for almost $2,000,000 based on more than a dozen forged Confessions of Judgment (COJs) of which he had no knowledge. That’s the scenario described in papers by the physician’s attorney suing New York-based Itria Ventures, LLC. Itria is a subsidiary of its more well known parent company Biz2Credit.

A New Jersey physician was one day going about his usual business, and the next day found himself an unwitting judgment debtor for almost $2,000,000 based on more than a dozen forged Confessions of Judgment (COJs) of which he had no knowledge. That’s the scenario described in papers by the physician’s attorney suing New York-based Itria Ventures, LLC. Itria is a subsidiary of its more well known parent company Biz2Credit.

In the span of 19 months, Itria funded a medical practice 19 times (an average of once a month), putting the practice on the hook for millions of dollars in purchased receivables. In March 2017, Itria declared one of those agreements to be in default and filed a COJ in the Supreme Court of New York, successfully securing a judgment in the amount of $245,114. Despite this, Itria continued to enter into at least 3 more funding contracts with them after defaulting.

The relationship would sour as Itria attempted to enforce its New York judgment in New Jersey with vigor. According to Court papers filed in Bergen County, Itria sought to have a judgment debtor, a doctor, arrested after he allegedly did not respond to an information subpoena or attend a deposition. In September 2018, a judge denied Itria’s application for an arrest warrant as the parties were reportedly in discussions to resolve.

When those discussions failed, Itria claimed that 14 more of the 19 contracts were also in default as they went ahead and filed 14 new COJs against the medical practice parties in March 2019. All told, Itria’s judgments add up to around $1.9 million. And just as Itria had previously, they began the procedure to enforce them.

But there’s a twist. The COJs and the contracts might have forged signatures for one of the parties.

On April 18th, Itria Ventures was sued by the very same doctor they sought to have arrested.

“Those confessions of judgment appear to bear my signature and have been filed against me but are fraudulent and forgeries because I did not sign them and the signature on them is not mine,” the plaintiff argued. Itria is a co-defendant alongside several entities that make up the medical practice, two notaries, Itria’s attorneys, and the plaintiff’s own brother, who is also a doctor.

Plaintiff’s claims of forgeries are onerous given that notaries were present, but the evidence is compelling given that on several contracts a notary attested that he appeared before her to sign it when there is surprisingly no signature there at all.

“This is a fraud even the most sophisticated lawyers would have trouble spinning in their favor. This fraud is shocking to the conscience,” the plaintiff’s attorney argued.

In instances where plaintiff’s signature is present, plaintiff alleges that his brother forged his signature and that the notaries fraudulently went along with it. In addition to the alarming variations in his signature, the plaintiff’s attorney pointed out an instance where a signature appears to be not only forged but a photocopied forgery.

Accordingly, the plaintiff is seeking to have all the judgments as they pertain to him personally, vacated.

Itria wasn’t convinced the allegations held weight given that it was the first time forgery had been raised in 2 years of communications. Documents filed appear to show there have been discussions to resolve for some time. They separately pressed forward on May 13th to have a Court appoint a post-judgment receiver over the medical practice.

Itria has relayed to deBanked that their enforcement efforts have been in compliance with all laws and court rules and that they’ve worked with these debtors in a cooperative fashion to attempt to provide them with the opportunity to resolve their financial difficulties. For example, Itria says they (a) provided these debtors with a reduced/modified payment plan, (b) provided them, for an extended period of time, with a de facto forbearance from enforcement to allow them to ‘catch their breaths,’ and to attempt to resolve their financial difficulties by seeking financing elsewhere or otherwise , and (c) at the debtor’s request, assisted them in attempting to obtain alternate financing for many of their business needs, not just to make Plaintiffs whole.

On May 29th, the judge ordered a preliminary injunction enjoining Itria from enforcing the 15 judgments against the plaintiff only and any other judgments “purportedly executed by plaintiff.” The catch is that the plaintiff must post a $1.3 million bond by June 7th. If it’s ultimately determined that the injunction was not warranted, the plaintiff will be responsible for all of Itria’s costs and damages related to the injunction. Itria is not enjoined, however, from enforcing the judgments against any of the plaintiff’s co-defendants.

The case is listed under Index Number 154067/2019 in The New York County Supreme Court.

Funding These Franchises? Read This First

May 29, 2019

United States Senator Catherine Cortez Masto is concerned with the abilities of four major franchises to repay business loans, according to a letter penned to the Small Business Administration. They include Subway, Complete Nutrition, Dickey’s Barbecue, and Experimac. The issues raised should be on the radar of every provider of capital.

For Subway, Cortez Masto cites a New York Post article that alleged Subway Restaurants is plotting to put its own franchisees out of business through the enforcement of minor handbook violations. A whopping 1,108 Subway stores closed last year alone.

For Complete Nutrition, the franchisor is reportedly dismantling its own franchise. Cortez Masto says it first raised the prices of goods, wiping out franchisee profit margins. Following that, it eliminated its franchise model altogether, took away their franchisees’ POS systems, removed their locations from the Complete Nutrition website, and informed Complete Nutrition customers that the stores had been sold and to order online going forward instead of from the stores. At least 12% of SBA loans made to Complete Nutrition locations have been charged off.

For Dickey’s Barbecue, the franchise is experiencing more stores closing than opening. Cortez Masto suspects that the franchisor is providing misleading and inaccurate information to potential franchisees, resulting in failed stores and bankrupt business owners. A franchise blogger says, “The Dickey’s business model seems odd, continually selling new franchises to replace closed units, but seemingly doing little to fix the profit structure so existing franchisees survive.”

For Experimac, Cortez Masto says that most of the SBA loans made to Experimac were originated by Celtic Bank and that to-date 23% of these loans have failed.