CFA Report Shows Increase in US Factoring Volume

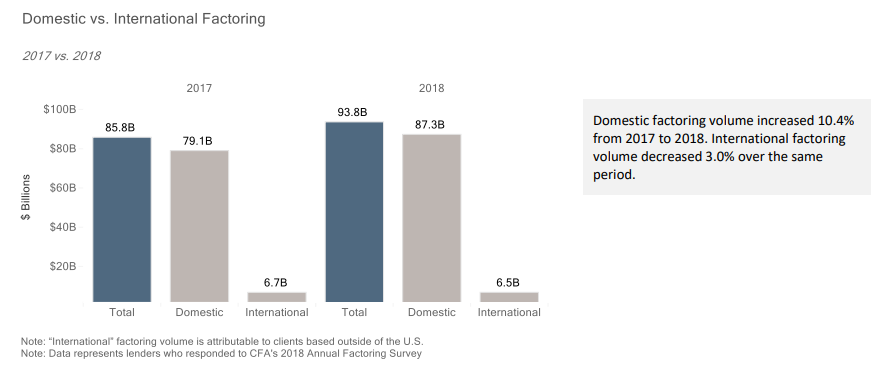

The Commercial Finance Association (CFA) recently published a report on asset-based lending and factoring which showed a 10.4 % increase in domestic factoring volume in 2018 compared to 2017. While the increase isn’t enormous, it is consistent with a gradual growth in factoring, according to Jeff Goldrich, CEO at Princeton, NJ-based North Mill Capital, which provides invoice factoring.

“It’s not a hockey stick, it’s gradual growth,” Goldrich said.

Goldrich attributed the growth, albeit moderate, to two factors. One is that, while not everywhere, he said there’s been some tightening of credit with banks, which leads companies to consider factoring.

The other is that he said large sized companies are increasingly using factoring as a financing option. While factoring is generally more expensive than taking out a bank loan, companies don’t have to worry about having stellar financial history because factors are less concerned with the financial health of the borrower and more concerned with the strength of the receivable.

Another finding in the CFA report is that Recourse factoring increased by roughly 11% in 2018 compared to 2017. Recourse factoring is when a factor has recourse if a company fails and is unable to pay a receivable to a factor’s client, according to Harvey Gross, Executive Director of the New York Institute of Credit. This is unlike the more common Non-Recourse factoring, where the factor can do nothing if the company that the owes the receivable goes out of business. Gross says that Recourse factoring is becoming more common as factors don’t want to take on as much risk.

Gross said that the older, traditional factors (which often cater to the apparel and toy industries, for example) are still Non-Recourse factors. They shoulder the loss if a company can’t pay its invoices. But at the same time, Gross said that these factors want clients with a large volume of invoices and invoices from solid companies.

BlueVine is one of the few companies that offers factoring online, where a company can get funded online without first interacting with a company representative.

“I see a continuation of factoring marrying fintech,” Goldrich said. “That’s where the big backers have interest.”

Last modified: May 31, 2019Todd Stone was a reporter for deBanked.