Story Series: COJs

Senators Marco Rubio, Sherrod Brown Renew Campaign to Ban COJs Nationwide

April 15, 2021 The Small Business Lending Fairness Act is back. Senators Marco Rubio and Sherrod Brown reintroduced a bill this week that failed to advance the two previous times it was introduced.

The Small Business Lending Fairness Act is back. Senators Marco Rubio and Sherrod Brown reintroduced a bill this week that failed to advance the two previous times it was introduced.

One of cornerstone objectives is to outlaw confessions of judgment from being used in business loan transactions nationwide.

“With this bill, we are taking another step toward protecting America’s small businesses—the foundation of our economy—by preserving the right of a business to be heard in a court of law before a potential credit default,” Rubio said. “I remain committed to protecting our small businesses from predatory, out-of-state lenders, and I urge my colleagues to join me in this effort.”

“When we let financial predators harm hardworking Americans through scams like confessions of judgment, we undermine the dignity of work,” Brown said. “This bipartisan bill would protect consumers and small business owners from predatory lenders that use legal tricks to strip away their hard earned money.”

This is not the first swipe at COJs. In 2019, New York passed a law that made it illegal to file a confession of judgment against a non-New York debtor in the New York state court system. However, this does not prevent a party from using another state’s COJ and filing the COJ in that respective state.

The federal bill was previously introduced in 2018 and 2019 and failed to advance both times. The text of the bill can be found here.

Appellate Court Affirms Decision in Merchant Funding Services, LLC v Micromanos Corporation etc.

February 1, 2020On January 29th, 2020 the Appellate Division, 2nd Department, of the Supreme Court of New York, upheld the original decision issued in Merchant Funding Services, LLC v Micromanos, etc. et al.. The case concerns a Confession of Judgment (COJ) filed following Micromanos’ default on a merchant cash advance contract. The defendants sought to vacate the COJ on the basis that the underlying agreement was allegedly a criminally usurious loan but the original judge ruled in favor of the plaintiffs.

The case was so notable that deBanked published a summary of the decision three years ago. Of particular interest is that the defendants not only lost but were accused by the judge of attempting to mislead the Court. Despite that, the defendants appealed.

The defendants have now lost again. The underlying case law they had relied on to support their arguments, Volunteer Pharmacy, was overturned the same day this decision was issued, leaving little room to wonder why the Appellate Division ruled accordingly.

One Of The Most Devastating Court Decisions Against Merchant Cash Advances Has Been Overturned

January 29, 2020 Merchant Cash Advances have sat on comfortable legal footing in New York ever since an appellate court ruled in favor of Pearl Beta Funding, LLC against Champion Auto Sales, LLC in 2018, but even so, it hasn’t stopped lawyers from trying to invalidate merchant cash advance (MCA) contracts on behalf of aggrieved customers.

Merchant Cash Advances have sat on comfortable legal footing in New York ever since an appellate court ruled in favor of Pearl Beta Funding, LLC against Champion Auto Sales, LLC in 2018, but even so, it hasn’t stopped lawyers from trying to invalidate merchant cash advance (MCA) contracts on behalf of aggrieved customers.

That’s because an MCA provided by New York-based Merchant Funding Services LLC to a business known as Volunteer Pharmacy in 2016 was ruled by New York Supreme Court Judge David F Everett to be so “criminally usurious on its face” that the normal process required to vacate a Confession of Judgment could simply be bypassed without even having to evaluate the merits of each side’s arguments and the matter automatically won in favor of Volunteer Pharmacy. The judge’s written decision, which voided the MCA contract ab initio, was replete with a scathing opinion of MFS’s business model.

The decision quietly stunned the merchant cash advance industry. MFS understandably appealed.

Dozens of lawsuits against MCA companies in the ensuing years went on to cite Judge Everett’s decision in Volunteer Pharmacy with limited success. And while the industry sat around to find out what would happen in that case, Pearl Beta Funding, a rival to Merchant Funding Services, won an appeal of its own, the landmark usury case in March 2018 that seemingly solidified once and for all the commonly held understanding that such MCA agreements were not usurious.

Despite this, the uncertainty of Volunteer Pharmacy still lingered in the background, that is until now.

On January 29th, 2020 the Appellate Division, 2nd Department, of the Supreme Court of New York, overturned Judge Everett’s decision and ruled in favor of Merchant Funding Services. The panel of judges said they need not even weigh a lot of Everett’s contentions because he was wrong on the underlying procedural issue, that a judgment by confession could be vacated in such an instance without having to go through the normal legal process.

The ruling ultimately provides clarity on the process that determines how a judgment by confession can be vacated. One major impact is that lawyers seeking to invalidate merchant cash advance agreements will no longer have Volunteer Pharmacy as a crutch to rely on.

New Jersey Firms Up Its Confession of Judgment Bill

January 13, 2020The New Jersey State legislature strengthened its Confession of Judgment (COJ) bill last week by adding language that grants the Attorney General power to enforce monetary penalties against violators.

S3581 would prohibit any provider of business financing from extending financing with a COJ. Business financing is defined as a loan, line of credit, cash advance, factoring, or asset-based transaction for a business purpose.

The bill still needs to pass the Senate and Assembly and be signed off by the Governor in order to become law. The bill’s sponsor, Senator Troy Singleton, is a Democrat, increasing the likelihood that the Democrat-controlled legislature and Democrat Governor Phil Murphy will move it forward.

New Jersey is Propelling its Own Confession of Judgment Bill

December 12, 2019 The New Jersey legislature has climbed aboard the Confession of Judgment restriction train. On Thursday, the state’s Senate Commerce Committee advanced S3581, a bill that would prohibit the use of COJs in a “business financing” contract with a New Jersey debtor. The bill was introduced in March but had not experienced movement until today.

The New Jersey legislature has climbed aboard the Confession of Judgment restriction train. On Thursday, the state’s Senate Commerce Committee advanced S3581, a bill that would prohibit the use of COJs in a “business financing” contract with a New Jersey debtor. The bill was introduced in March but had not experienced movement until today.

New Jersey’s COJ bill is similar to the bill advancing through the House of Representatives at the federal level. Meanwhile, New York’s legislature had also proposed a near-identical bill but it did not pass. Instead, New York passed a law that prohibits entering a judgment by confession in New York’s courts against a non-New York debtor.

The New Jersey bill passed through the committee without any debate. The Committee chair said on the record, however, that the New Jersey Credit Union League, an advocacy group for credit unions, was in favor of the bill.

“Predatory Lenders” Slammed as Bill to Ban Confessions of Judgment Nationwide Advances

November 14, 2019

(Bloomberg is majority owner of Bloomberg News parent Bloomberg LP)

Rep. Nydia Velázquez (D) celebrated the advancement of a bill on Thursday that aims to outlaw confessions of judgment (COJs) in commercial finance transactions nationwide. HR 3490, dubbed the Small Business Lending Fairness Act, made its way through the House Financial Services Committee on a vote of 31-23. The next step will be a floor vote.

Velázquez made direct references to a Bloomberg News story series published last year about “predatory lending” and a NY Times article about Taxi medallion loans as her basis for supporting it. Velázquez said that New York had become a breeding ground for “con artists” that relied on COJs to prey on mom-and-pop businesses. The congresswoman singled out New York because of recent taxi medallion loan outrage and the state’s alleged reputation as a “clearing house” for obtaining fast easy judgments against debtors nationwide. New York took a major step to change that practice earlier this year through a new law that only allows COJs to be filed in the state against New York residents. HR 3490 seeks to prevent them from being filed in every state, including New York.

Ironically then, the bill is at odds with the new New York law in that Velázquez’s bill, if it became federal law, would go so far as to prevent New York’s own courts from entering a COJ against New York’s own residents, if it resulted from a commercial finance transaction.

Ironically then, the bill is at odds with the new New York law in that Velázquez’s bill, if it became federal law, would go so far as to prevent New York’s own courts from entering a COJ against New York’s own residents, if it resulted from a commercial finance transaction.

While momentum in the House could be perceived as a partisan initiative unlikely to survive the Senate, the bill has in fact garnered a degree of Republican support, recently through Rep. Roger W. Marshall, a co-sponsor of the bill, and originally by Senator Marco Rubio who initially sparked the call to action in the Senate last year.

The Financial Svcs Committee approved my bill to end "Confessions of Judgment", contracts that allow for unfair, predatory small business loans & that have been linked to #taximedallion crisis in NYC.

On to the House floor!

Read More: https://t.co/xHaYnLKme4@NYTW @FSCDems

— Rep. Nydia Velazquez (@NydiaVelazquez) November 14, 2019

A co-author of the COJ-centric Bloomberg News stories was quick to take the credit for the advancement of Velázquez’s bill.

the bill was drafted in response to our series Sign Here to Lose Everythinghttps://t.co/lrfIW3P0yi

— Zeke Faux (@ZekeFaux) November 14, 2019

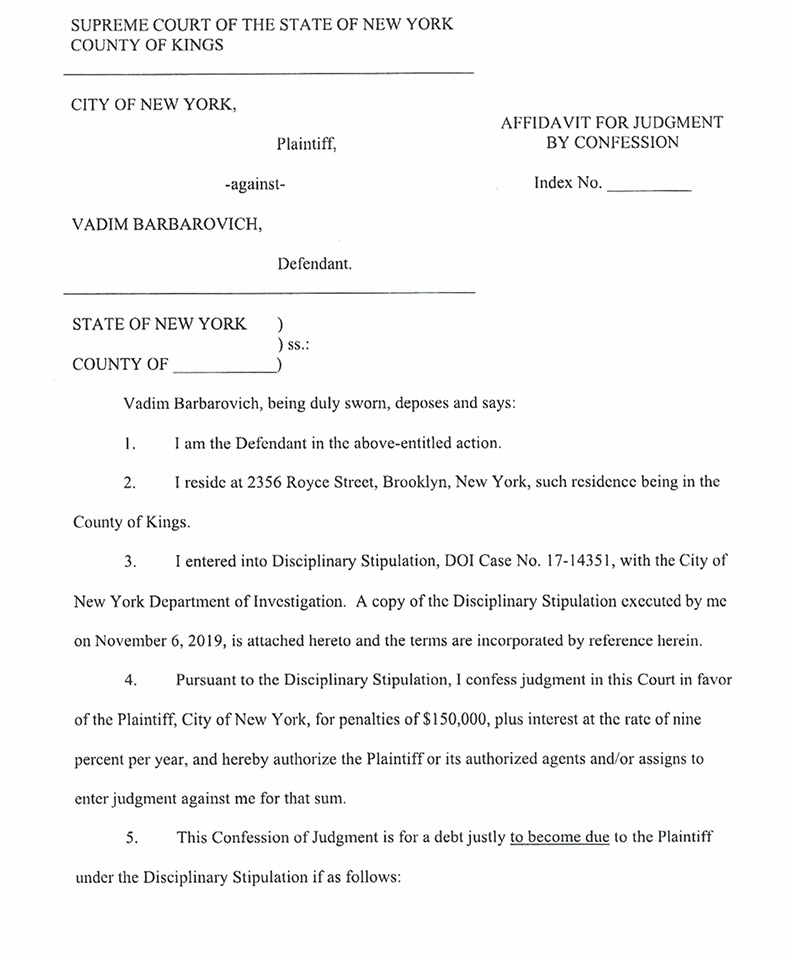

COJ Enforcer Gets COJ’d By City of New York And Is Forced to Resign NYC Marshal Position

November 7, 2019 A New York City marshal at the center of a controversial Bloomberg News story series last year about “predatory lending,” has resigned after a city probe, the City of New York announced.

A New York City marshal at the center of a controversial Bloomberg News story series last year about “predatory lending,” has resigned after a city probe, the City of New York announced.

Marshal Vadim Barbarovich was allegedly a prolific enforcer of New York judgments obtained by confession. After irregularities were discovered by the Department of Investigation with how he served levies, the City of New York formally levied penalties of their own against him that include a return of fees and poundage earned from 92 improperly served levies, his resignation, and a $300,000 fine.

The City agreed to suspend the full amount of the monetary fine provided he complies with an orderly wind-down of his business by March 20th. Barbarovich, in a twisted circumstance of irony, had to guarantee full immediate payment in the instance he did not comply…by signing a Confession of Judgment.

The investigation into Barbarovich began in May 2018, 4 months before Bloomberg News published their story, details published by the City reveal.

Earlier this year, New York State passed a law restricting COJs from being entered against non-New York state debtors.

NYC Taxi Industry Leads Charge to Ban Confessions of Judgment Nationwide

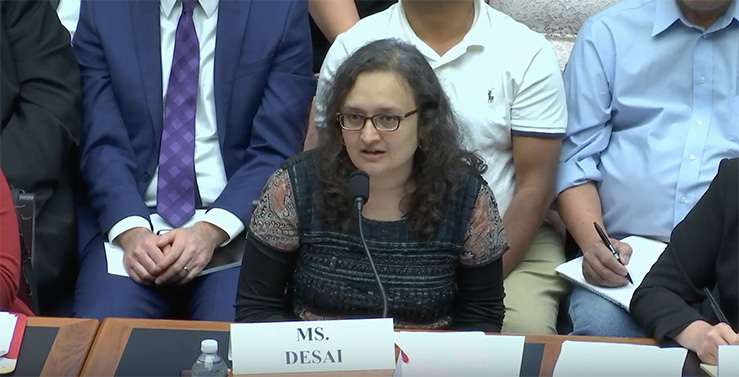

September 30, 2019 New York State may have outlawed entering confessions of judgments (COJs) against out-of-state debtors in their courts, but federal legislators want to see a ban on their use nationwide. On Thursday, the House Financial Services Committee convened for a hearing on predatory debt collection. Notably adding small businesses to the mix with consumers, COJs repeatedly came under attack.

New York State may have outlawed entering confessions of judgments (COJs) against out-of-state debtors in their courts, but federal legislators want to see a ban on their use nationwide. On Thursday, the House Financial Services Committee convened for a hearing on predatory debt collection. Notably adding small businesses to the mix with consumers, COJs repeatedly came under attack.

Testimony presented by Bhairavi Desai, executive Director of the 22,000 member New York Taxi Workers Alliance, claimed that predatory lenders are aggressively relying on COJs to “intimidate borrowers into making large sum payments towards outstanding loan balances.” Desai provided one such COJ affidavit to the Committee in which allegedly victimized defendants had confessed to judgment for nearly $600,000. The plaintiff was 160-year-old New York Community Bank, not an alternative finance company.

The NYC taxi business has moved front and center after the New York Times published a bombshell story in May that alleged lenders unfairly trapped Taxi medallion owners into loans they could not repay. The occasional reliance on COJs was vaguely mentioned but struck a nerve with critics already frothing to make them illegal.

Desai explained that unusually high suicide rates in the taxi business are rooted in part by predatory lending practices. “The real stories are the tens of thousands of drivers we see today that are really dying a slow death from despair, from stress from the crisis of this debt,” she told the Committee on Thursday. “Confessions of judgment have basically meant that when [the taxi medallion market] started to fall, drivers were told that they had to pay up the total sum of what was owed on that debt, had to produce $350,000, $400,000 overnight.”

Desai explained that unusually high suicide rates in the taxi business are rooted in part by predatory lending practices. “The real stories are the tens of thousands of drivers we see today that are really dying a slow death from despair, from stress from the crisis of this debt,” she told the Committee on Thursday. “Confessions of judgment have basically meant that when [the taxi medallion market] started to fall, drivers were told that they had to pay up the total sum of what was owed on that debt, had to produce $350,000, $400,000 overnight.”

FTC Commissioner Rohit Chopra voiced his support for a COJ ban when called upon to testify. “The FTC has unique jurisdiction to attack debt collection and discrimination issues in the small business lending market and we should look to restrict terms like confessions of judgment that the FTC banned in consumer loans ages ago.”

The Bloomberg stories that led to new legislation in New York were only mentioned during the hearing once and only in passing.

A slew of bills have been introduced to pursue the Committee’s initiatives. In addition to the Small Business Fairness Lending Act that would outlaw COJs from small business finance transactions nationwide, the Small Business Fair Debt Collection Protection Act seeks to apply the existing Fair Debt Collections Practices Act to small businesses and effectively put small business lenders under the regulatory purview of the CFPB.

You can watch the hearing below: