Small Business

Square Goes Back To The Drawing Board, Ahead of First Earnings

February 19, 2016 Square is bracing for its first milestone as a public company – its first earnings report.

Square is bracing for its first milestone as a public company – its first earnings report.

On March 9th, the payments company will present a scorecard of how it’s doing and what that means for its investors. Visa picking up a 10 percent stake in the company came as a respite for the stock which has generated close to 27 percent losses since its IPO.

But that might not be enough to prove that the seven year old company is in a sustainable business. Square has to prove that it is all a small business needs. From capital, payroll to point-of-sale, Square wants to be the one stop shop for small merchants, not relying entirely on its payments business which makes up 95 percent of its revenue.

When the company started in 2009, its strategy was to go after micro merchants that were too fragmented and small for bigger payments companies. Square started by giving these merchants a dongle to accept card payments for a flat fee. While the idea was to serve an untapped market, the company could not be shielded from the risks that these merchants bring to a business with their heterogeneity, fragmentation and smaller deals.

But ahead of its first earnings call, the company is ramping up its efforts towards bringing more businesses into its fold. Forbes reported that Square expanded its payroll product to merchants in Tennessee, New Hampshire, Nevada, South Dakota, and Alaska in addition to the existing markets of California, Texas and Florida allowing them to serve 30 percent of independent businesses in the U.S.

American Express wants to lend more to small businesses

February 10, 2016American Express hopes to tide over the bitter credit-card deal with Costco by lending to small businesses.

The two companies ended their 16-year partnership when Costco joined hands with Citi in March 2015. This June, customers will receive their Costco-brand Visa credit cards.

AmEx wants to turn its focus on what it is already familiar with — small business loans. In 2014, AmeEx cards for small businesses funded $190 billion in purchases, up from $122 billion in 2010, with enough reason to believe that there is room to grow the business.

AmEx hopes for the small-business loans to make up for the lost revenue from the Costco deal which accounts 20 percent of the company’s outstanding loans, according to a Reuters report.

The Funding Calls That Won’t Stop

November 23, 2014“Your business has been approved for a loan…”

Last week, Chicago Public Radio (WBEZ 95.1 FM) investigated a trend in the small business community, the use of merchant cash advance financing. The station called me in advance to answer some questions about merchant cash advances and I gave my best explanation of the industry and its products.

Of the discussion that lasted more than 30 minutes, only about five of my sentences made it on the air. While I clarify some of my positions below, it was sobering to learn the context of how they were used, as a defense to real life merchant complaints.

The satisfaction rate with merchant cash advances are pretty high and I say that mainly because it’s so rare to hear complaints from anyone other than journalists that can’t believe anyone would accept rates above 6% APR. And while there are indeed bad actors in the industry (as there are in any industry), the gripe one merchant had about phone solicitations that just won’t stop is a recurring theme.

It’s happening to me too.

As an account representative in 2010 calling real time leads sold to five parties at once, I did what anyone would do, I pretended to be a small business myself and inquired through the website that we bought leads from and entered my cell phone as the point of contact

Ring. Ring. Ring…

Within a half hour, representatives from four companies called me, and I learned exactly who my competition was, how they explained the product, and what they would say to win me over. Two of the four were really good and one even referenced my name personally, saying something to the effect of, “If you get a call from Sean Murray, his rates are worse than mine.” Obviously he had already done what I was doing now, which was pretend to be a small business so he could prove to the prospect he was well informed about the alternatives. He had heard my pitch already and was now throwing me under the bus by planting the seed that I was going to offer something more expensive even if it wasn’t the truth.

In the end none of them won because it was all a farce. One never called me again after the first call. Another kept at it for a week and the remaining two followed up for a month.

And then it got quiet…

I had been marked as a dead lead and forgotten about until three months later when one company sent a follow up email. “Smart,” I thought. But then a call came six months later, and then more emails, some from companies I didn’t originally engage with.

And they continued at regular intervals, every couple of months an email or call. Was it interesting? Yes. Annoying? No.

Until this year.

The volume of emails have slowed but I’ve somehow ended up on robo calling lists. “Press 1 to talk to a funding specialist or press 9 to be added to the Do Not Call list”

The volume of emails have slowed but I’ve somehow ended up on robo calling lists. “Press 1 to talk to a funding specialist or press 9 to be added to the Do Not Call list”

The press 9 option doesn’t work for me. Sure, I might be removed from that marketer’s list, but it in no way removes you from anyone else’s list. I knew that already of course because I’ve been on the other end before.

The first time I got one of these calls, I was excited to tell the sales representative who I really was, level with him, and explain that it was a really good idea to take me off the list. But much like other business loan robo call complaints, the representative wouldn’t tell me anything about himself or his company.

I got yelled at.

Every time I tried to ask a question, he’d get louder, insisting I tell him my monthly gross sales volume for the “cash advance I wanted.”

A rogue actor maybe, but I’ve since gotten additional business loan robo calls and have made no progress in getting myself removed. I just hang up now.

Call it sweet irony perhaps. Or maybe a wake up call (pun intended). I applied on a website once four years ago and the rest is history.

My experience with repeat solicitations is marginal compared to somebody that has actually used a merchant cash advance. With the filing of a public UCC-1, anyone in the industry can easily access that data and convert it into a marketing list. And they do.

Brokers that scorn UCC marketing acknowledge that these businesses could be getting called 5-10 times a day. My own clients had reported repetitive calls back when I was an account representative. And while UCC marketing is very cost effective, in today’s market where more than a thousand companies are offering similar financial products, it’s probably safe to say it’s overly saturated.

And if 5-10 calls per day were even remotely accurate, I’d surmise that level of volume is marring the industry’s reputation as a whole.

I could argue though that when customers have a great many options to choose from, they win. With more than a thousand companies offering merchant cash advances and business loans, it’s truly a buyer’s market. Play all the companies against each other and you should end up with the best possible terms. It’s a great time to seek capital.

Except we’ve got to do something about those phone calls, or at least the robo calls.

Every angry robo dial recipient becomes one less person likely to speak positively about the the nonbank financing industry. Aged leads, UCCs and phone calls might be inexpensive, but the cost to undo negative preconceived notions is immeasurable.

Do you want to be known as the company that helped small businesses or the annoying people that won’t stop calling? If merchants are taking to the air waves to complain, it will only be a matter of time before the FTC and FCC become interested.

—

Regarding my comments on the radio about APRs and daily amortization, they were pulled from a conversation that compared daily payment loans to purchases of future sales. I DO believe bad actors exist and every business owner should have an accountant, lawyer, or savvy third party review any contracts they enter into, financial or otherwise.

Are We in a $300 Billion Market?

August 7, 2014 Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.

Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.

According to Green, it’s not so much other companies that they feel they are up against but more of the broad challenge of market awareness. Their struggle is about getting people to know that there are non-bank options available and to make people aware of their existence.

It’s the same challenge merchant cash advance (MCA) companies have been dealing with for more than a decade. Notably though, there are many in the MCA industry that feel the market is saturated and thus a lot of the industry’s growth has been fostered through a turf war for the same merchants. Stacking (the practice of funding merchants multiple advances or loans simultaneously) is partially spurred by a belief that there are no more untapped businesses left to fund. The acquisition costs of a brand new untouched business that is both interested and qualified is so high, that it is not a pursuit some funders and brokers can afford to take on.

Market Size

Market Size

At present, daily funders, which are a combination of both MCA companies and lenders that require daily payments, are funding somewhere between $3-$5 billion a year. On the call Green said he believed the potential market was far larger than that, though he discredited the $200 billion figure that some independent research had predicted. That was only because LendingClub believes the potential market is substantially higher, more like $300 billion.

$300 billion?! That’s about 100x larger than the current daily funder market combined and starkly contradicts any belief that there’s no merchants out there who haven’t already gotten funded.

LendingClub’s minimum gross sales requirement is $6,250 a month and they have an upper monthly gross threshold on applicants at $830,000 a month, though they’ve had businesses apply who do even more than that. Their sweet spot as Green put it, is the segment doing $16,000 to $416,000 gross per month.

I can’t help but notice that’s the same sweet spot that daily funders have. And we mustn’t forget, LendingClub’s target business owner has at least 660 FICO. If it’s a $300 billion market for good credit applicants, then it’s got to be even bigger for the ultra FICO-lenient companies in MCA.

What’s a business?

LendingClub only needs someone with at least 20% ownership to both apply for and guarantee the loan, an unheard of stipulation in the rest of alternative business lending. One cardinal rule in MCA has been that there needs to be at least 51% or 80% ownership signing the contract. That’s had a lot to do with the fact that most MCA agreements are not personally guaranteed and the signatory is required to have absolute authority to sell the business’s future proceeds.

Summer of Fraud

In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

Knowing this firsthand, I asked LendingClub if they also take the care to verify bank statements. In the majority of cases they do not. They rely greatly on an algorithm that detects fraudulent answers on the application but the statements themselves are not scrutinized except in very high risk situations. Considering they’re wildly less expensive than MCAs, I find it odd that they are exposed to this type of risk. Fraudulent documents are the norm and in these underwriting conditions, I would expect them to charge as much or more than MCA companies, not less.

At the same time it’s important to mention that at present, business loans on their platform are only funded by institutional investors. Retail investors can only invest in consumer loans. LendingClub has been very transparent about excluding retail investors here for the very purpose of shielding them from unevaluated and unforeseen risk. My guess is that as time goes on, they will do more to validate the bank statements which is the bread and butter of assessing the risk and health of a business.

$300 billion

In a FICO flexible environment, it’s possible the potential for daily funders is at least $300 billion. If true, that would mean that for the 16 years that MCA players have been around, they barely reached even 1% of their target audience. I’ve been saying it since I’ve started this blog 4 years ago, every business owner I’ve spoken to has never heard of a merchant cash advance… which means saturation is a myth.

Tom Green was right, the real competition is public awareness. 99% of the potential market is untapped. If you’re fighting with 5 other companies over the same merchant, you gotta:

You gotta keep on looking now

Keep on looking now

You’re looking for love

In all the wrong places

Making Cents of Short Term Business Lending

June 22, 2014Where do you see yourself in 5 years? Perhaps you’ve seriously planned what you’ll be doing in mid-2019 or maybe you at least have an idea of how things will play out. It’s only a half a decade after all so how hard could it be to foresee the future?

Surely all of us saw the DOW surging 5 years ago and got rich right?

Did New Yorkers factor Hurricane Sandy into their 5 year plan back in 2009?

It’s only 5 years, what could possibly happen to a small business in that time?

As I recently logged onto LendingClub to invest in consumers loans, I began to wonder just how safe the 60 month terms were. Not that I have a lot of options since LendingClub only offers 3 or 5 year terms, but the latter is unquestionably risky. The borrower might look good now, but where in the heck will they be in 5 years? I can’t even begin to guess.

Mortgages, student loans, and car leases aside, I can think of very few reasons to use a 5 year loan from a personal perspective, mainly because that’s an extremely long commitment. For a small business, such a term far exceeds the rationale behind “working capital”, the reason oft-cited by businesses seeking less than $200,000.

The Small Business Administration’s website speaks of this:

Businesses that are seasonal or cyclical often require more working capital to stay afloat during the off season. Although your company may make more than enough to pay all its obligations yearly, you must ensure you have enough working capital at any one time to meet your short term obligations. For example, a company may do significantly more business over the holidays, resulting in large payoffs at the end of the year. However, the company must have enough working capital to buy inventory and cover payroll during the off season as well, when revenues are lower.

Working capital may come in handy for something like inventory for which the business probably expects to sell it all off in less than a year. Can you imagine still making monthly payments in 2019 for inventory you bought with a loan in 2014?

I bet this guy can’t:

And if the financial picture looks great and they have a long term need, why not go out 5 years?

Verizon replaced Washington Mutual. But a Verizon store, that will last forever…

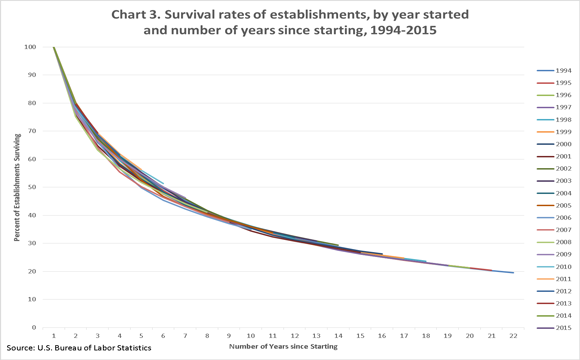

Only 41.1% of retail businesses live to experience their 5th birthday.

And even then when business types are aggregated, making it past year 5 doesn’t ensure lifelong success. Don’t confuse established with safe:

In fact, even borrowers are opting for shorter term loans with higher interest rates than long term loans with lower interest rates. Part of that is due to the lower net dollar cost paid for the loan said OnDeck Capital CEO Noah Breslow in an interview with Peter Renton:

5 years ago I used to spend way too much time on Instagram. Oh wait, no I didn’t… there was no such thing as Instagram.

What do you think is the best bet for this CD store? A 3-6 month working capital loan or a 5 year term loan?

Giving a borrower a lengthy repayment term ensures they will be able to pay you back right?

Above is the result of my $25 contribution towards a 5-year LendingClub loan issued on May 16th. They missed the very first payment. I’m really looking forward to the next 59 months…

In 2019, everything will be business as usual, won’t it Madam President…

As short term business lending critics herald the emergence of 3-5 year term business loans, I think it’s important to remember that they are catering to a market that likely has different goals. Long terms are often not appropriate for borrowers with working capital needs. The CEO of RapidAdvance, Jeremy Brown discussed this in an article he wrote for DailyFunder more than a year ago.

Our industry is based on providing working capital to merchants. By its very definition, working capital is less than 12 months. Longer term deals are permanent capital, even when they are repaid over 15-24 months.

As a borrower, the very idea of committing yourself to monthly payments 5 years from now should be considered very seriously. The average length of a marriage prior to a divorce is 8 years. For past or future divorcees, a 5 year loan is more than half as long as a marriage!

Alternative lenders should be asking themselves if they really have the data and underwriting skills necessary to make accurate predictions that far out in the future. Working capital underwriting models are not applicable as long term assessments.

If you’re going to make 5 year business loans, make sure to take advantage of Google maps. Take a look back at the business location and the ones surrounding it over the last few years. You may not feel so safe about your investment…

Access to Capital – A Dose of Reality

June 15, 2014So much for a lack of transparency… While sitting directly next to Maria Contreras-Sweet, the head of the Small Business Administration, OnDeck Capital’s CEO corrected U.S. Senator Cory Booker’s comments about the APR of their loans. High teens? Not so, said Noah Breslow who explained their average 6 month loan has an APR of 60% even while costing only 15 cents on the dollar.

Why is access to capital so expensive? Rob Frohwein, the CEO of Kabbage said that up until recently his company was borrowing funds at a net rate of more than 20% APR. In order to turn a profit, they had to lend at a rate much higher than that.

Great info about democratizing #Access2cap for #smallbiz w/ @CoryBooker @RutgersU. More info @SBAgov pic.twitter.com/qxCu2tbW4z

— Maria ContrerasSweet (@MCS4Biz) June 13, 2014

.@rohitfounder and Sen. @Corybooker at Access to Capital New Jersey #Access2cap pic.twitter.com/FRfoAH2CjU

— Biz2Credit (@biz2credit) June 13, 2014

The Access to Capital small business panel included:

Maria Contreras-Sweet – Head of the U.S. Small Business Administration

Noah Breslow – CEO, OnDeck Capital

Rohit Arora – CEO, Biz2Credit

David Nayor – CEO, BoeFly

Rob Frohwein – CEO, Kabbage

Paul Quintero – CEO, Accion East

Rohan Matthew – CEO, Intersect Fund

Jonny Price – Senior Director, Kiva Zip

Jeff Bogan – SVP, LendingClub

Steve Allocca – Global Head of Credit, PayPal

Jay Savulich – Managing Director of Programs, Rising Tide Capital

The Deal

May 25, 2014When times are tough, small businesses take chances. Last year, a family run business in Cohasset, MA made a snap decision and agreed to a $75,000 loan with infinity percent interest, literally. The principal was completely repaid in just 74 days but as per the contract, they still had to make fixed interest payments for as long as the business was open.

It wasn’t necessarily a good deal. Heck, some might think it was a really bad deal, but they got the cash when they needed it. The perpetual fixed payments kicked in after the principal was repaid because the lender structured them as royalty fees. A normal merchant cash advance will take a percentage of a merchant’s sales up until a predetermined amount has been satisfied, but this deal required a percentage forever. Is Wall Street running amok yet again? Shouldn’t people be monitoring stuff like this?

As it would turn out, about 6.5 million people were witness to this transaction. More than half of those people, most of whom are hard-working American families, cheered the business owner on. That’s because this deal had nothing to do with Wall Street and did not involve a commercial loan broker.

The business is named Wicked Good Cupcakes and it’s a deal they made on Shark Tank, a hit TV show on ABC. Kevin O’Leary loaned them $75,000 and took a percentage of every sale until he was repaid just 2.5 months later. Since then he is taking a permanent royalty of 45 cents per cupcake sold.

As quoted in the Boston Business Journal

“The royalty deal has worked great for us,” said Tracey Noonan, the CEO of the company.

Many people told her immediately following the deal that she was stupid. But today, Wicked Good Cupcakes is doing better than ever.

O’Leary, whom the business owners called an “angel in disguise” has referred to the deal as one of the most phenomenal ever made on the show. Wicked Good Cupcakes is actually on pace to do $3 million in revenue in 2014.

While it’s true that part of their success is due to the appearance on the show, nowhere does it say that entrepreneurs have to agree to take a deal if offered one. That means the owners could have walked away from O’Leary’s offer and still experienced the same post-show hysteria of celebrity. But they needed the money… and there was an offer on the table. It wasn’t the best deal, but it was A deal.

And that’s the nature of business. Everything is about circumstances. You could be flush with cash or in a pinch, growing fast or playing defense. All the while opportunities and obstacles approach from every turn.

Unlike consumers who are afforded protections from making decisions that might not be in their best interest, small businesses are free to pursue whatever strategy they want. The best part about capitalism is that you’re the master of your own destiny.

Unlike consumers who are afforded protections from making decisions that might not be in their best interest, small businesses are free to pursue whatever strategy they want. The best part about capitalism is that you’re the master of your own destiny.

The terms O’Leary offered to Wicked Good Cupcakes were not unique. Just recently in the 12th episode of Season 5, he offered a $100,000 loan to Tipsy Elves that once repaid, would still require payments in perpetuity in the form of a royalty fee for every sale. That’s an equivalent APR of infinity. In the end, they turned it down and went with Robert Herjavec’s equity offer instead.

Many viewers have taken to twitter to share their doubts about the viability of the Tipsy Elves business model, which is selling ugly Christmas sweaters. That healthy dose of skepticism is something alternative lenders are no strangers to, and as such they tend to price their deals accordingly.

Even deal making that is done on TV in front of millions of witnesses can go sour. Just ask Marcus Lemonis, the star of the TV show The Profit, who recently made a deal with a business in my own backyard, A. Stein Meat Products in Brooklyn, NY. After learning the business was on the brink of insolvency, Lemonis offered them a cash lifeline in exchange for buying their Brooklyn Burger brand at a bargain price of $190,000. In any other circumstances, that deal might not have happened.

Lemonis expeditiously wired them the cash, but never got what he paid for in return. Mora and Buxbaum, the owners, claim the funds were a loan but they have never made a payment. Defaults like these happen every day, especially in alternative business lending.

Hated to do it but here's the update on stein meats and Brooklyn burger. I tried not to but was ignored for 90 days. http://t.co/4oyYOiXK68

— Marcus Lemonis (@marcuslemonis) May 16, 2014

The entrepreneur applies for a business loan, the loan gets made, and the borrower quickly defaults. The result is that the price goes up for the next guy. That’s the risk part that lenders always talk about, the odds that they’re not going to get paid back. If every business repaid their loans, the average cost of financing in alternative business lending would probably be about 6% a year, around what an A rated personal loan costs on LendingClub, instead of the high double digit or triple digit rates that exist now.

Even Kevin O’Leary isn’t taking any chances, hence he protects himself by charging infinity percent interest, and America thanks him every Friday night for blessing entrepreneurs with an opportunity. It’s not the best deal, but it’s A deal.

Small business owners are sophisticated enough to make tough decisions all on their own. That’s the reason we can put them in the public eye, in front of more than 6 million people who either cheer for their success or literally cry out for their demise. These entrepreneurs don’t go on Rainbow & Unicorn Tank, they go on Shark Tank. Sometimes the entrepreneurs walk away with a partner, sometimes they get a loan with infinity percent interest. In the end, it’s their choice, a choice that 36,000 small businesses hoped they would have in 2012. That’s how many applied to be on the show that year.

Business is business and a deal’s a deal. The ball’s always in your court…

Quotes from Kevin O’Leary

Business is war. I go out there, I want to kill the competitors. I want to make their lives miserable. I want to steal their market share. I want them to fear me and I want everyone on my team thinking we’re going to win.

Here’s how I think of my money – as soldiers – I send them out to war everyday. I want them to take prisoners and come home, so there’s more of them.

You may lose your wife, you may lose your dog, your mother may hate you. None of those things matter. What matters is that you achieve success and become free. Then you can do whatever you like.

I’m not a tough guy. I’m just delivering the truth and only the truth and if you can’t deal with it, too bad.

Nobody forces you to work at Wal-Mart. Start your own business! Sell something to Wal-Mart!

Don’t cry about money, it never cries for you.

The only reason to do business is to make money; that’s the only reason for doing business.

Money has no grey areas. You either make it or you lose it.

Working 24 hours a day isn’t enough anymore. You have to be willing to sacrifice everything to be successful, including your personal life, your family life, maybe more. If people think it’s any less, they’re wrong, and they will fail.

I have met many entrepreneurs who have the passion and even the work ethic to succeed – but who are so obsessed with an idea that they don’t see its obvious flaws. Think about that. If you can’t even acknowledge your failures, how can you cut the rope and move on?

I don’t mind rude people. I want people that I can make money with, so if their executional abilities are good, and they’re arrogant and rude, I don’t care.

Can you handle it?

The Real Impact on Small Business

May 22, 2014 It’s not easy being in the lending business. Just talking about money can make people uncomfortable. Bringing up how much money you have, don’t have, or wish you had is like bringing up politics at Thanksgiving dinner. It’s taboo in this society. It’s even rude to ask somebody how much they make a year. That’s one of two reasons why being a lender or loan broker is so difficult, you’re forced to dive head first into emotionally charged waters.

It’s not easy being in the lending business. Just talking about money can make people uncomfortable. Bringing up how much money you have, don’t have, or wish you had is like bringing up politics at Thanksgiving dinner. It’s taboo in this society. It’s even rude to ask somebody how much they make a year. That’s one of two reasons why being a lender or loan broker is so difficult, you’re forced to dive head first into emotionally charged waters.

The second reason is telling an applicant ‘no’. It feels personal even if it’s not. “It’s just business,” the bearer of bad news will say, but it never feels that way. I know that firsthand through my experience as both a broker and an underwriter. Rejection is a painful experience for an applicant no matter how professional they are.

But sometimes you get to tell an applicant ‘yes’ and that can be an emotionally moving experience as well. Looking back, the only applicants I ever heard cry were the ones that got approved. Some of those approvals were expensive but they were given an opportunity in a world where up until that point, no one was willing to give them any opportunity at all. They were the forgotten businesses of America.

PayPal’s VP of SMB Lending recently said that he feels “blessed to be serving this higher need.” Blessed was an interesting word choice. Being able to support small businesses doesn’t just make him feel happy or hopeful or satisfied, it makes him feel blessed.

What is the real impact that alternative financing companies have on small businesses? Thanks to the funding companies who took the time to find out. Today, we can see for ourselves:

Above is just a small handful of the testimonials you can find on the websites of CAN Capital, Kabbage, RapidAdvance, Fora Financial, and Merchant Cash and Capital. Real businesses, real stories, real impact.

And there you have it…