Politics

New York’s New Governor

August 10, 2021Now that Governor Cuomo is leaving office early, the Lieutenant Governor, Kathleen Hochul, will become his replacement. This detail is relevant given that New York’s landmark legislation (SB 5470) for the small business finance industry is slated to go into effect on January 1st.

Hochul served as Erie County Clerk and as a member of Congress. She’s also long been an advocate of small business.

While running on Cuomo’s ticket in 2018 for Lieutenant Governor, she criticized her opponent in a controversial campaign ad by saying that he couldn’t be trusted to manage the state budget because he had defaulted on a small business loan.

SB 5470 is expected to be so restrictive, that at least one small business finance provider has already fled the state.

Congress Tells OCC “Nope” On True Lender Rule

June 29, 2021 In October, the OCC brought clarity to the relationships that many fintech companies enjoy with banks.

In October, the OCC brought clarity to the relationships that many fintech companies enjoy with banks.

So long as a national bank is named as the lender on the loan agreement on the date of origination or so long as it funds the loan, then the bank is considered the true lender, the OCC decided. It issued it as a rule that was published in the Federal Register last year.

The brief proclamation was viewed as necessary in light of lawsuits filed against fintech companies that have challenged who the true lender was on a loan.

National banks are generally exempt from state interest rate caps and licensing requirements. Fintech lenders, therefore, partner up with banks in such a way that the banks themselves actually make the loans so that those same exemptions carry over. The long-used practice has drawn litigation as well as outrage from certain corners of the economic and political spectrum. The OCC rule issued during the Trump era, for example, was not unanimously applauded.

Last week, Congress took the unusual step of nullifying the OCC’s rule.

Resolved by the Senate and House of Representatives of the United States of America in Congress assembled, That Congress disapproves the rule submitted by the Office of the Comptroller of Currency relating to “National Banks and Federal Savings Associations as Lenders” (85 Fed. Reg. 68742 (October 30, 2020)), and such rule shall have no force or effect.

Short and succinct.

The invalidation of the OCC rule does not mean that banks cannot collaborate with fintechs or third parties in such a way as before, but rather that the certainty of what’s acceptable and what isn’t will be relegated to further debate for years to come.

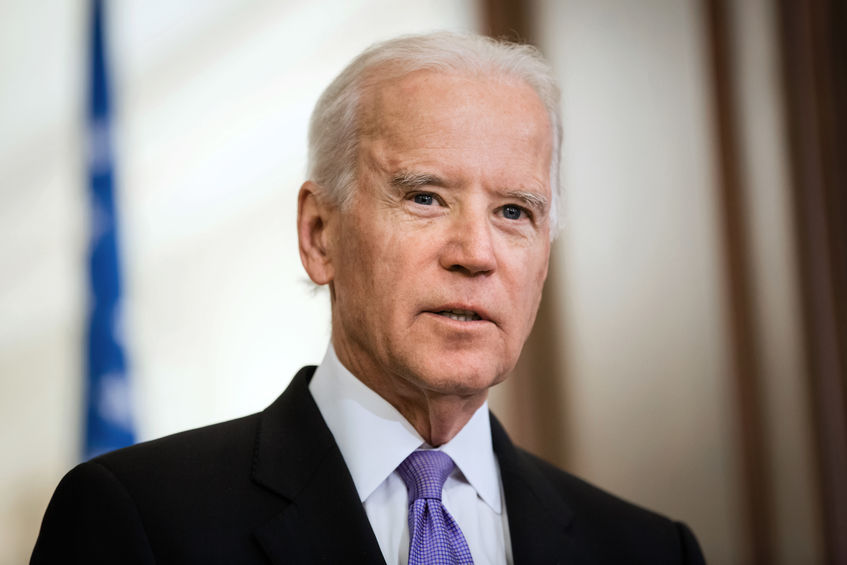

What Would a Biden White House Mean for The MCA Industry?

November 14, 2020 What do small business finance companies think about the reality of a Biden White House? Will there be dramatic regulatory changes, massive new government stimulus, or significant differences in coronavirus policy?

What do small business finance companies think about the reality of a Biden White House? Will there be dramatic regulatory changes, massive new government stimulus, or significant differences in coronavirus policy?

“Not likely,” according to the head of two funders we spoke with. The CEOs of Greenwich Capital Management and Spartan Capital Group seemed to agree that overall, not much would change.

“We don’t expect any major changes to the industry to MCA,” Frank Ebanks, Spartan Capital owner, said. “I don’t think it would be any different than what we saw and experienced under Trump. Some states, some federal organizations attempted to regulate the industry, that’s already on the way, and that might continue: I don’t see it picking up any intensity.”

Ebanks’ firm has been around for four years, funding deals of up to $2 million. In that time, Ebanks has seen states like New York and California pass lending regulation and renewed activity at the CFPB, but never a fed-wide push to take on small business lending.

Nathan Abadi of Greenwich Capital Management, believes there might be short term benefits under Biden.

“In the short term, I think it’s going to be pretty good for people in our industry because under a Biden administration, we’ll see more bailouts go to SMBs than we would in a republican administration,” Abadi said. “If small businesses get bailed out, that means they can make their payments, and everyone is winning.”

He was less optimistic in the area of regulation, however.

“It’s necessary for our industry to have some vetting process and some regulation, as you saw happen with Par recently,” Abadi said. “All these other companies are taking in private investments from multiple investors, not necessarily accredited, and the money kind of goes into a black hole.”

Abadi further said that he thought while regulation is good for those who play by the rules, Democrats can go overboard.

Ebanks, meanwhile, thinks there is saftety in being a B2B business.

“Transactions between two individual companies are hard to regulate, especially when it comes to contracts,” Ebanks said. “That will stand and be around for a long time regardless of the government or who the president is.”

Ebanks continued to point out that an incoming administration would avoid changing anything that might hurt the economy now more than ever.

“I think that the President-Elect will put teams together that will attack the coronavirus situation aggressively and will neutralize it rather than try to live with it,” Ebanks said. “It’ll be tough for a month or two. And after that, it will be sort of back to normal, with just heavy aggressive localized actions.”

Let The Games Begin

November 2, 2020 In the run-up to the 2016 election, a Capify survey recorded that small business owners felt Trump had their best interests at heart over Clinton by a 2 to 1 margin.

In the run-up to the 2016 election, a Capify survey recorded that small business owners felt Trump had their best interests at heart over Clinton by a 2 to 1 margin.

The alternative finance industry, meanwhile, was largely preparing for a Clinton administration. Then Trump won.

And a lot has changed since then.

deBanked has refrained from conducting any formal survey on the matter and takes no position on a candidate, but anecdotal conversations I’ve personally had with industry participants and a review of industry chats across social networks all lean in favor of Trump.

Those positions are drawn in part from resistance to future business shutdowns, which devastated the small business finance industry, views on taxes, and views on regulatory enforcement. All in all, it’s a business decision.

Talk about Biden has been virtually non-existent. The election is a referendum on Trump.

Once a candidate is elected, we will explore what the next 4 years could be like.

Mnuchin and Powell Defend Pandemic Aid Programs, Say Congress Needs to Agree Before They Can Give out More Money

September 23, 2020 Yesterday, Treasury Secretary Steven Mnuchin and Federal Reserve chair Jerome Powell testified on the COVID response before the House Financial Services Committee.

Yesterday, Treasury Secretary Steven Mnuchin and Federal Reserve chair Jerome Powell testified on the COVID response before the House Financial Services Committee.

They championed the largest stimulus package in the Nations’s history and said the economy was recovering well.

Mnuchin advocated for bipartisan support of targeted forgivable loans- a second PPP loan for businesses still losing revenue, funded by either a new stimulus, reusing the $130 billion still leftover, or reallocating $200 billion from the Main Street Lending program. Of course, all of that is up to Congress, he said.

“I think there’s broad bipartisan support for extending the PPP in businesses that have had revenue drops for a second check,” Mnuchin said.

Chair of the committee, Maxine Waters D-CA, led the questioning. She asked for removing the loan minimum, and noting the slow economic activity; she said 32% of renters could not pay their bills at the beginning of Sept. Other charges, like the possibility of a second wave, were leveled toward the executives.

In response to questions to the Main Street Lending Program (MSLP,) they argued the program was not designed as a stimulus but as a “backstop” and liquidity to already present loan markets.

This might explain why last month, the Congressional Oversite Committee investigated the MSLP because of its low adoption rate and found many problems.

To date, less than $2 billion of loans are “in the pipeline” out of the $600 billion allocated in April. The program is designed with non-forgivable loans supplied by 509 traditional FDIC insured lenders, at a minimum of $250,000. The majority of these lenders are not accepting new customers, unlike PPP loans facilitated by more than 5,000 lenders to mostly new clients- including fintech firms.

The Fed already lowered the minimum down from $1 million, but after questioning whether it could be lowered to under $100,000, Powell said there was very little demand for loans under $100,000. In response to Representative Andy Barr R-KY, about how the program could be improved to service smaller businesses, Powell responded that the program wasn’t created for that.

“The limit now is $250,000, and we have very little demand below a million, as I told the chair a while back,” Powell said. “We’re not seeing demand for very small loans. And that’s really because the nature of the facility and the things you’ve got to do to qualify, it tends to be larger sized businesses.”

The SBA reported findings from the third round of PPP on Aug 10th. The organization found that loans under $50k were the largest category issued. 68% of the 5,212,128 PPP loans were under $50k, and 87% were under $250k.

GOP Proposes PPP Skinny Bill, Vote Thursday

September 9, 2020 On Tuesday, Senate Republicans introduced a slimmed-down “Skinny Bill” stimulus proposal, offering $500 billion proposed aid that they believe both sides of the aisle can agree on.

On Tuesday, Senate Republicans introduced a slimmed-down “Skinny Bill” stimulus proposal, offering $500 billion proposed aid that they believe both sides of the aisle can agree on.

The Bill will extend PPP loans into the fall with $258 billion and certain small businesses will also be able to receive a second forgivable loan. If passed, the Skinny will also reintroduce weekly unemployment benefits of $300- half the $600 CARES act benefits that ended in July.

The Senate will vote on the proposed bill Thursday afternoon. The vote will test the GOP’s cohesion, which could not garner enough support for the $1 trillion HEALS act introduced in July. To pass, the Bill will need seven Democrat votes and 60 votes overall.

If it passes, it will have to survive the Democrat-controlled house. House Majority Leader Nancy Pelosi has already spoken against the Bill, saying it is filled with Republican “poison pills” that cannot pass in the House. House Dems are calling the Bill wholly political. Senate Majority leader Mitch McConnell said that if the Bill can not pass, the GOP can demonstrate that Dems are “stonewalling” aid.

Interview With Polling Expert Scott Rasmussen

May 7, 2020On Tuesday, I interviewed nationally recognized public opinion pollster Scott Rasmussen, who is the publisher of ScottRasmussen.com and is the editor-at-large for Ballotpedia, about the trajectory of the presidential race and how the current environment is affecting how people think.

Mr. Rasmussen will be a guest speaker at Broker Fair 2020 Virtual on June 11, 2020. You can watch the video interview below.

$2 Trillion Senate Relief Bill to Pass Vote, Includes Small Business Funds

March 26, 2020 Senate leaders Mitch McConnell and Chuck Schumer have come to an agreement over a stimulus package that would inject $2 trillion into the US economy. With senators debating the bill at the time of writing, it is expected to pass. Said to be the largest and most robust rescue package in American history, the bill would see $300 billion go to the SBA for its 7A loan program.

Senate leaders Mitch McConnell and Chuck Schumer have come to an agreement over a stimulus package that would inject $2 trillion into the US economy. With senators debating the bill at the time of writing, it is expected to pass. Said to be the largest and most robust rescue package in American history, the bill would see $300 billion go to the SBA for its 7A loan program.

“At last we have a deal,” McConnell said after negotiations wrapped up at 1:30am on Wednesday morning. McConnell later described the bill as “a war-time level of investment into our nation.”

According to Stephen Denis, Executive Director of the SBFA, who was closely engaged with the language being placed into the bill, certain small businesses who receive SBA loans may have their loan converted to a grant, depending upon how they aim to spend the financing. As well as this, Denis made clear that small businesses will be able to use these funds to pay any charges linked to an online small business loan or MCA.

“There’s different things that you can use the SBA money for,” Denis explained in a call. “Payroll support, obviously, including paid sick leave, medical, or family leave; costs related to health care; employees salaries; mortgage payments; rent payments; utilities. And then this is another thing that we got inserted into the bill, we wanted to make sure that businesses had the flexibility to use this funding to pay existing debt obligations that were incurred before the covered period. What this means is that if a business had taken out an MCA or a loan, that they could use this money to pay off the obligations.”

As well as allotting funds for the SBA, the bill provides for cash payments of up to $1,200 to be made available directly to individuals, $2,400 for married couples, and an additional $500 per child, which will be reduced if the individual makes more than $75,000 annually or if the couple makes over $150,000. $350 billion will also be made available to help small businesses mitigate layoffs and support payroll.

The most recent example of something akin to this bill is the Troubled Asset Relief Program (TARP) that was established to help financial institutions in the aftermath of the ’08 financial crisis. And with there being some surprise in retrospect to how TARP’s funds were ultimately used, there is concern about supervision of these funds.

When asked on Monday who would provide oversight for the program to fund businesses, President Trump replied with, “I’ll be the oversight.” However, since then White House officials have agreed in closed-door negotiations that an independent inspector general as well as an oversight committee will be instated to supervise the loans.

Despite stalling in the Senate several times throughout Wednesday, Denis is confident that the bill will be voted through the Senate, and following this, through the House.

“Never make a guarantee in Washington. That’s something I’ve learned in my career. But I think this is something that both sides, both Democrats and Republicans, recognize needs to get done right now. And I can’t imagine anymore political games after the agreement this morning.”

As well as this, Denis was eager to highlight that many funders and broker shops fall under the classification of a small business, and would be eligible for some of the funds promised by this $2 trillion bill; and that if you are wondering how you might access some of the relief package upon its passing through government, to reach out to him.