Online Lending

Don’t Forget About FastFlex

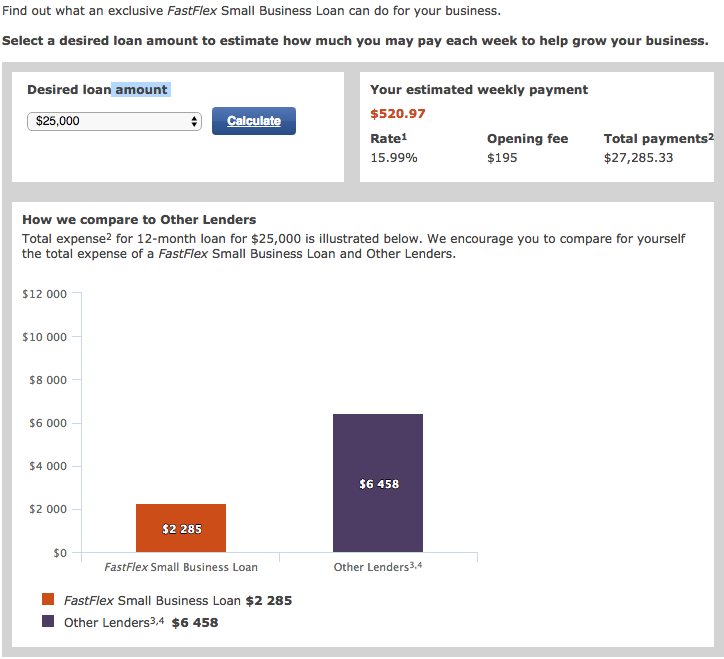

November 13, 2017 The OnDeck-Chase partnership isn’t the only game in town when it comes to fast weekly payment bank loans. Wells Fargo announced their own program, called FastFlex, in 2016 as part of a goal to lend $100 Billion to small businesses over five years.

The OnDeck-Chase partnership isn’t the only game in town when it comes to fast weekly payment bank loans. Wells Fargo announced their own program, called FastFlex, in 2016 as part of a goal to lend $100 Billion to small businesses over five years.

deBanked was shown an anonymized bank statement snippet recently of a merchant that was purportedly being debited daily by Wells Fargo. So we reached out to Wells to ask if there might be a daily payment loan product that had not yet been announced.

“[F]or Wells Fargo’s FastFlex Small Business Loan, we only offer the weekly payment option, in which required payments are made on a weekly basis automatically deducted from the customer’s business-deposit account,” they responded. “None of our Small Business loan products have daily payments.”

While the mystery remains unsolved, Wells already compares its FastFlex product to OnDeck, Kabbage, and CAN Capital on their website. Loan amounts ranging from $10,000 to $35,000 come with 1-year terms, weekly repayment, and interest rates starting at 13.99%. Their loan calculator approximates a 1.09 total cost factor on a $25,000 loan.

Their underwriting criteria comprises of cash flow history, existing credit obligations, credit experience, payment history, and relationship status with Wells Fargo. Merchants are funded the day after accepting the terms.

Users on a handful of message boards have reported that cash flow history weighs heavily in the approval.

From Ineligible to 0% APR – Los Angeles Company Monetizes Startup Leads, Combats Stacking

November 10, 2017 Merchants have no shortage of options when it comes to accessing funding in today’s climate. And while MCAs and loan products have become more pervasive, one company’s solution is to reintroduce traditional financing in a strategic manner. Seek Business Capital finds credit card offers and credit lines for the credit-worthy who may not be eligible or ideally suited for a business loan.

Merchants have no shortage of options when it comes to accessing funding in today’s climate. And while MCAs and loan products have become more pervasive, one company’s solution is to reintroduce traditional financing in a strategic manner. Seek Business Capital finds credit card offers and credit lines for the credit-worthy who may not be eligible or ideally suited for a business loan.

Roy Ferman is an Australia transplant who runs the company out of the Los Angeles headquarters, miles from the usual domicile for alternative funders of Silicon Valley, New York and Austin.

“We liked LA from a perspective of the sunshine, but we also like being away from the rest of the funding industry. It gives us the ability to put our heads down and focus on what we’re doing and not worry about what anybody else is doing,” Ferman told deBanked.

Seek Business Capital partners with MCAs and brokers on leads and recently expanded with a new hire in New York. Kunal Bhasin joined the company over the summer as vice president of business development. “We were traveling out there to meet with partners and doing redeye flights. Now someone is on the ground there training partners on how to better find opportunities to use our product,” Ferman said.

Basically, the company tells MCAs and brokers that the startup leads (those that are trying to start a business or have just started one), to send those deals to Seek Capital, instead of throwing them in the trash.

They recently adopted a fully automated underwriting product that delivers an instant decision for merchants though there’s an element of the human touch on the services side of the transaction.

“For us, the biggest driver is FICO. We take someone with a good FICO score but just started their business and we are still able to offer this person funding,” said Ferman, adding that the sweet spot is a credit score of 680 or higher. “Cash flow is always going to be a factor. For us, we’re predominantly based on FICO. Even still, FICO is one thing. That’s the body of the car. Sometimes we want to look under the hood and see what’s really going on,” said Ferman.

Economic Indicator

Seek Business Capital is industry agnostic though some of the more common sectors they work with are retail, restaurants and trucking. “What’s really interesting is we get a little bit of a sneak peek into emerging industries and local economies,” Ferman said.

For instance, when cannabis was legalized for recreational use in Colorado, they saw a spike in demand from “peripheral businesses” such as contractors that were building out the storefronts, security companies and restaurants amid a rise in tourism to the area.

A similar boom is expected in California when cannabis for recreational use becomes legal in the state in 2018 via Prop 64.

Zach Lazarus, CEO of San Diego-based A Green Alternative, a cannabis dispensary and delivery service, said: “You name it, it’s going up in California right now,” in response to Prop 64. He added there are desert towns and farm communities looking to embrace the boom, which he compares to the gold rush of 1849.

Zach Lazarus, CEO of San Diego-based A Green Alternative, a cannabis dispensary and delivery service, said: “You name it, it’s going up in California right now,” in response to Prop 64. He added there are desert towns and farm communities looking to embrace the boom, which he compares to the gold rush of 1849.

“It’s the service providers, architects, contractors, all these different niche needs are the people who are really going to benefit from the boom,” Lazarus said. Contractors especially need access to capital right away; they don’t generally get fully compensated until once the job is complete, and they need to purchase materials in the interim.

Lazarus said banks won’t loan to cannabis businesses and in his experience other lenders have been predatory in nature. He may just not have come across the right funder yet.

Anti-Stacking Tool

One of the problems that Seek Business Capital seeks to solve is that of merchants taking on too many positions. “We found two ways to provide our services. Our bread and butter and our historical performance has always been in startup funding. We’ve evolved to move more upstream with lenders and we’ve become an anti-stacking tool, if you will,” Ferman noted.

The problem with stacking is that it can put a major strain on the cash flow of the merchant and it put the first position funder at additional risk than what they originally agreed to underwrite.

“We offer 0% for the first 12 months. It’s very advantageous and we’re not crushing cash flow. We view it as an anti-stacking tool. There are few lenders and ISOs who use it, taking both our credit card position and the original term loan but protecting the merchant. The merchant gets all the money they need so they’re not interested in stacking,” said Ferman.

Seek Business Capital charges merchants a success fee of 9.9% of whatever funding they receive for them. Payment is made once the small business receives their funding and the merchant will typically choose to pay Seek Business Capital with the capital they receive from the credit extended to them.

Now they’re taking things to the next level with a data product that they plan to license to third party credit aggregators next quarter.

“We’ve seen everything from the credit profile, to income, to the approval rate, the approval score and the amount. We’ve taken all that data and analyzed $150 million worth of credit card approvals for big clients. We now have a strong indicator of which profile is going to get approved from which bank and how much,” Ferman explained.

A customer submits their details into Seek Business Capital’s decision engine, which generates an estimated approval or decline rate in real time. For instance, they might see that their approval likelihood is 25% for one card and 86% for another along with the estimated approval amount. It’s a soft credit pull so customers don’t have to worry about harming their credit. In addition to the decision engine there’s a recommendation engine that makes credit card suggestions to merchants.

Ferman said the biggest competition the company faces is a potential customer taking out a home equity line, dip into their 401(k) or borrow from friends and family.

Lending Club is Discontinuing F and G Grade Notes

November 7, 2017 Per Lending Club’s website, the company is discontinuing issuance of F & G grade notes.

Per Lending Club’s website, the company is discontinuing issuance of F & G grade notes.

According to an announcement published by the company:

We are consistently assessing the value our product delivers to our investors, and have noticed an increase in prepayment and delinquency rate in F and G grade Notes. We feel it is in the best interest of our investors to remove F and G grade Notes while we test new capabilities and refinements to the underwriting and pricing criteria and determine how to best offer a better experience for both borrowers and investors in the F and G segment.

Peers invested in previously-issued F & G grade notes will still receive their payments until maturity.

Performance played a role in their decision.

Every quarter, we review product performance. During our third quarter 2017 forward-looking analysis, we saw increases in delinquency and prepayment rates in F and G grade loans. This update allows us the opportunity to re-assess how we can best deliver value to our investors through the platform.

More information about this change can be found here.

Lending Club also published their Q3 earnings Tuesday afternoon. The company loaned $2.44B for the quarter and hit a record $154 million in revenue. The company still eeked out a $6.7 million loss, but that’s down from $19 million over the same period last year.

Dependence on retail investors or “peers” declined again. Only 10% of loan funding was sourced from the self-managed individuals category in Q3 or $249 million of the $2.44 billion funded.

Lending Club funded 9% of their own originations in the quarter or $217 million.

Catching Up With LendingPoint

November 6, 2017 At Money2020, we sat down with Chief Executive Officer Tom Burnside and Chief Strategy Officer Juan Tavares, both of LendingPoint, an online consumer lender we examined in the July/August magazine issue. Not mentioned in that story is Tavares’ background at Avanzame Latin America, a merchant cash advance company based in the Dominican Republic. Burnside, however, originally started on the consumer side at First Data, before working for 13 years at CAN Capital, until he left and launched LendingPoint.

At Money2020, we sat down with Chief Executive Officer Tom Burnside and Chief Strategy Officer Juan Tavares, both of LendingPoint, an online consumer lender we examined in the July/August magazine issue. Not mentioned in that story is Tavares’ background at Avanzame Latin America, a merchant cash advance company based in the Dominican Republic. Burnside, however, originally started on the consumer side at First Data, before working for 13 years at CAN Capital, until he left and launched LendingPoint.

The lender focuses on near prime consumers and has even trademarked the word “NEARPRIME.” Their algorithm, which processes data from dozens of APIs in 5 seconds, handles the heavy lifting, the secret sauce of which they could not disclose. “You could use 3,000 attributes but maybe actually 57 attributes could become your core,” Tavares says. Their “credit-first” mentality has allowed the company to build a healthy performing portfolio. And “credit-first” doesn’t necessarily mean FICO scores, Burnside says, it’s about “predictives” to price accordingly for the risk you take. “How you run [the variables] together, that’s the magic,” they say together.

An interesting initiative that they’re now just ramping up, Tavares says, is partnerships with hospitals that allow patients to determine their deductible expenses and obtain credit on the spot to pay for it. Fitting into their “point of need” strategy, Tavares say “We’re at the intersection between credit and payments.”

Burnside says that LendingPoint was on par to finish with $28 million in funded loans for the month of October. “Demand is not the problem,” Tavares interjects. “We’re tempering growth to make sure that we grow wisely.”

And the market to expand that growth is big despite the numerous tech companies competing in the lending space. Burnside reports the company receiving $2.5 billion worth of loan applications in September alone. 60% of their applications come in through mobile devices. Peak application hours are lunch time and late at night, sometimes as late as 1 or 2 in the morning, they say. The entire loan application process can be done on mobile without them ever having to talk to anyone. Tavares qualifies that by saying that doesn’t mean that they take shortcuts.

As to whether an IPO could be in the works, Burnside deflects and says, “we’re busy building something special right now. We’ll see what happens.”

“What I will tell you is, is that investor confidence is up,” Tavares says.

LendUp May Have a Leg-up

November 1, 2017

deBanked recently sat down with LendUp CEO Sasha Orloff and COO Vijesh Iyer at an auspicious time. The company, an online lender that provides consumers with alternatives to payday loans and credit cards, is uniquely positioned in the wake of the CFPB’s 1600+ page Payday loan rule that was issued in early October.

And that’s not exactly an accident. Orloff says the company was founded (5 years ago) with the expectation that the CFPB would issue an eventual rule. “At the time, we had no idea what it was going to be but I could imagine that if they were going to write a federal rule that it would completely change the industry,” he said.

Orloff’s journey, as he tells it, began by reading Banker to the Poor, which inspired him to move to rural Honduras nearly 15 years ago to help the Grameen Foundation, a non-profit that focuses on providing loans and education to the poorest of communities. He was only 21 at the time. After a three-year tour, he moved on to roles at The World Bank, Citi, and finally starting in 2012, LendUp.

When LendUp was being envisioned, he explains, the smart phone was making it possible for consumers to access financial services outside of what was in their neighborhood and bank technology was the last thing that was going to become modernized.

“The CFPB rule was going to make it harder for banks to work with underserved consumers,” he says. “So we said let’s start a financial services company that focuses exclusively on the people that have the least amount of options and let’s start reinventing [these] products one at a time.”

And with that, they consulted academics, educators, government officials, and people from the industry. “How do you give somebody credit in an emergency fashion that can change it from a trap into an opportunity? And so we did that and it turned out the rule looked really similar to what we did,” he explains.

“I think there’s a lot of things they got right [about the CFPB rule],” he says in regards to how to eliminate debt traps. LendUp, for example, doesn’t allow customers to roll over their loans, they have to pay off their loans in full before they can consider borrowing again. Rollovers were a big sticking point for the CFPB when they published their rule last month. Their official announcement on the matter had stated that “many borrowers end up repeatedly rolling over or refinancing their [payday] loans, each time racking up expensive new charges. More than four out of five payday loans are re-borrowed within a month, usually right when the loan is due or shortly thereafter. And nearly one-in-four initial payday loans are re-borrowed nine times or more, with the borrower paying far more in fees than they received in credit.”

One piece of the payday alternative puzzle is in the underwriting. COO Vijesh Iyer, an alumni of both Capital One and PayPal, says “we basically use a variety of data sources, both the traditional bureaus and as what we call the non-traditional bureaus.” For the credit card product, LendUp will pull credit from a traditional bureau. “For the small dollar loan product we use non-traditional CRAs,” he says. Their team of data scientists tries to extract the most significant signals out of all of the data sources they have at their disposal. “That’s really valuable when you’re dealing with a subprime customer where the reason why someone could be underserved or subprime is very different. We all have different life stories and we’re really trying to figure out the differences which we get from multiple signals, multiple data sources.”

“The easiest person to convince that we’re a better product is an existing payday user,” Orloff says. “because it’s slightly cheaper at the beginning, it gets much cheaper over time. It has a lot more flexibility. It gives people for the first time the opportunity to report to the credit bureaus. It teaches you better financial behavior. You can do it on a mobile phone. You can get alerts and reminders…”

Meanwhile, payday borrowers always have to pay the same amount, Orloff contends. The loan terms don’t improve, he says. One notable advantage a LendUp borrower might experience is that when they first run into trouble with making a LendUp loan payment, they can get a few extra days leeway at no extra charge, which usually comes as a welcome surprise.

Granted, a LendUp loan’s APR can still look pretty steep. A calculator on their website offers an example of one that is 458.86% APR. Orloff says a part of understanding that is understanding what a consumer’s options are and what the costs to process the applications are. A 220% APR might only equate to something like $30 total in fees depending on what the loan terms are, he explains. Their borrowers don’t get paid in APR though he says, they get paid in dollars. “They care about what’s the total cost of credit in terms of dollars.”

“Our customers pay more than that on overdraft fees,” Iyer adds. “Every time they have a slight overdraft, even if it’s for a dollar, even if it’s 10 cents. Even if it’s two dollars. No one ever tries to evaluate what the APR for that is. But that is their fee and this is also a fee.”

But more than anything else, it’s about whether the borrower’s and lender’s interests are aligned, Iyers contends. Right now, LendUp believes they’re doing the right thing at the right time.

—

This interview was conducted at Money2020 in Las Vegas

Q&A With Noah Breslow On Replacing ACH For Realtime Funding and More

October 25, 2017 An announcement by OnDeck, Ingo Money and Visa this week at Money2020 may be more consequential than it appeared. That’s because the partnership enables OnDeck to actually fund a merchant’s bank account (not their debit card) on days, nights, weekends, and holidays. Such a feature is not possible in the realm of ACH where funding typically takes place on the next business day and only if the transaction is submitted before a predetermined cutoff time. deBanked got to learn more about how this works in an interview with OnDeck CEO Noah Breslow on Tuesday as well as the opportunity to pick his brain about a few other things. Below is a curated excerpt of the interview that has been edited for brevity.

An announcement by OnDeck, Ingo Money and Visa this week at Money2020 may be more consequential than it appeared. That’s because the partnership enables OnDeck to actually fund a merchant’s bank account (not their debit card) on days, nights, weekends, and holidays. Such a feature is not possible in the realm of ACH where funding typically takes place on the next business day and only if the transaction is submitted before a predetermined cutoff time. deBanked got to learn more about how this works in an interview with OnDeck CEO Noah Breslow on Tuesday as well as the opportunity to pick his brain about a few other things. Below is a curated excerpt of the interview that has been edited for brevity.

deBanked: For this real time funding you announced, do you have to have a Visa debit card?

Breslow: You do not, but you have to have a debit card. 70% of small business owners have debit cards. And this will work with Visa or Mastercard.

deBanked: So you’re not actually funding a merchant’s debit card, you’re funding their bank account but using the Visa network as the mechanism?

Breslow: It’s the rails, it’s the way to get the money into a small business owner’s checking account. My prediction is that every funder in the industry is going to be doing this in a couple of years. It’s going to be faster and small businesses will start to expect it. Now instead of waiting 2 days to get the money into someone’s account, it can be done on nights, weekends, holidays, 365 days a year.

deBanked: So you can fund a merchant’s bank account on the weekend?

Breslow: Yes, it’s real time. And to be clear we partnered with Ingo Money, Visa has the rails. Ingo is our interface point, they do the PCI compliance and the rest. We looked at a bunch of different players in the market and Ingo was unique in that they had covered small business checking accounts. Some of this stuff is happening in consumer already. We’re the first lender to use these rails for either consumer or small business in the US.

deBanked: Has this already gone into effect?

Breslow: No, it’s coming out in a couple months. Early 2018.

deBanked: Does this system work with every bank already?

Breslow: It doesn’t work with every bank yet. It works with most of them, all of the major ones.

deBanked: Speaking of payments… Square. PayPal. They’re both payments companies first that went into lending. Is there a potential reverse play for OnDeck to go into payments?

Breslow: Right now our product expansion stuff is very focused on additional lending products. I still feel like we haven’t lived up to our full potential there. There’s a couple other product categories that we’ve looked at and thought about. Equipment finance is one, invoice factoring, small business credit cards. And so we look to be the best small business lender in the world with the best set of products. And then we can partner with a lot of the payments companies. But right now, no we’re not going to sell merchant processing. Never say never, but not in the near future.

deBanked: Any news on the Chase front?

Breslow: We re-upped our agreement with them in early August. The customer experience is amazing, our platform is scaling, and we’re making progress. I can’t tell you a lot of other details about it.

deBanked: I’ve heard from folks in the industry about merchants who are being debited by Chase either daily or weekly. Is that you?

Breslow: That would be our platform. Chase’s product is more or less like the OnDeck product but cheaper obviously. It’s a daily or weekly collected loan. It goes up to 24 months for $200,000.

deBanked: I want to ask you about brokers, or as you call them “funding advisors.” Do you anticipate reliance on them increasing or decreasing?

Breslow: Stable. I don’t anticipate it moving up or down. We really like the funding advisors that we have and we’re continuing to grow with them. We’re also adding some new ones.

deBanked: What makes a good broker? What can they do to do things right?

Breslow: The value equation between the merchant, the lender and yourself has to be in balance. They should also be efficient and know the credit box of the lender they’re working with. They should invest in their employees, train them, and they should become more sophisticated about their online marketing and CRMs, which we’ve been seeing.

deBanked: Everyone’s talking about blockchain at this conference. Is there a way that blockchain fits into online lending and possibly OnDeck?

Breslow: I love the technology, I’m very intrigued by it. But we’re not actively using it and it’s not like I have a secret blockchain project in the works.

deBanked: Is there a universe in which OnDeck considers making an acquisition of a company?

Breslow: So we’re not totally opposed to that. They’re might be an opportunity for a complementary product or a complementary team. I think you’re going to see a lot of consolidation in the industry in the next 3-5 years.

ID Analytics Now Has 85% Visibility Into Online Consumer Lending

October 24, 2017 At Money2020, deBanked caught up with Kevin King, Director of Product Marketing and Ken Meiser, VP of Identity Solutions for ID Analytics. The last time I crossed paths with the company was six months ago at the LendIt Conference in New York City. Since then, the company has increased its visibility into the online consumer lending market to 85%.

At Money2020, deBanked caught up with Kevin King, Director of Product Marketing and Ken Meiser, VP of Identity Solutions for ID Analytics. The last time I crossed paths with the company was six months ago at the LendIt Conference in New York City. Since then, the company has increased its visibility into the online consumer lending market to 85%.

Because so many lenders, including credit card issuers, are plugged into their system, ID Analytics can view where consumers are applying for credit across the spectrum. That’s bolstered by their visibility into where applicants are in the process with getting approved. “We’re seeing the lifecycle of that application,” said King, who added that it’s possible using their tool that a lender can know where in the process a borrower is with another lender, though without the ability to see who that lender is.

ID Analytics is not a credit bureau, but they can help lenders root out fraud by analyzing among many other factors, the “velocity” of a consumer’s credit applications. An example is the number of credit applications submitted in a short amount of time. It’s important to distinguish what kind of credit it is though, King and Meiser explained, because the way people apply for online loans can be different than how they apply for credit cards.

Meiser shared an example of something that might on its face look anomalous but is actually not, such as when someone moves and all of the sudden there are several credit applications tied to a home address never previously seen on record for that borrower. Are we talking about normal stuff like a store credit card at Home Depot to buy a refrigerator for the new house or is it for multiple loans? was the gist of a point he made.

ID Analytics won’t declare a loan application to be fraud, they just provide the lender with an ID Score®, a real-time fluid score that can signal to a lender to carry out more due diligence depending on the extremity of the score. If someone applies for five loans in one day, for example, that score could go up with each application. Their service helps root out fraud by looking at “leading indicators” rather than “trailing indicators,” they said.

“We’ve seen an interesting shift in how fraudsters are attacking,” King stated. The company is now reviewing about 1 million credit applications a day and can continuously scan for new trends. 7 out of the top 10 credit card issuers use their service, as do many online lenders and phone carriers.

Asked if their service would have anything to do with online lenders asking the occasional borrower to submit a utility bill or other document to confirm their identity all while other borrowers are not asked at all.

Lenders use a lot of their own factors, but if they’re suddenly asking for more documents to prove an applicant’s identity, there’s a good chance that could be because of us, they said.

Catching Up With Online Lending – A Timeline

October 21, 20177/17

- Online lender Upgrade, launched by former Lending Club CEO Renaud Laplanche, revealed it had already hired about 100 people

- Credit risk startup James closed $2.7M funding found led by Gaël de Boissard

7/18 – Former Bizfi COO Tomo Matsuo joined iPayment as an SVP to oversee its new merchant cash advance division

7/21 – SoFi Chief Revenue Officer Michael Tannenbaum departed the company

7/27

- Lending surpassed $500M in lifetime originations

- RealtyShares acquired marketplace platform Acquire Real Estate

7/28

- Former MB Financial Bank SVP Stan Scott became VP at Gibraltar Business Capital

- Prosper Marketplace shut down its Prosper Daily (formerly BillGuard) app

7/31 – First Associates Loan Servicing announced the opening of their new 1000-seat capacity operations center in Baja California, Mexico

8/1

- Ron Suber joined Credible.com as executive vice-chairman and a member of the board of directors

- PeerStreet integrated with Personal Capital

8/2

- Lending Loop raised $2M, launched automated investment platform

- PeerIQ secured $12M in Series A round

- OnDeck partnered with Payment Source in Canada

- Bread raised $126M in equity and debt

8/3 – Kabbage secured $250M in Series F round from SoftBank Group, was valued at more than $1.25B

8/9

- Former Capital One VP Heather Tuason became Chief Product Officer at StreetShares

- PayPal acquired Swift Capital

8/10 – Coinbase raised $100M at $1.6B valuation

8/11 – Former SoFi employee raised Brandon Charles filed a lawsuit against the company alleging among other things that he witnessed sexual harassment in the workplace

8/14

- Prosper closed $500M securitization, announced $775M in Q2 loan originations, $41.4M net loss

- Bitcoin surged past $4,000

8/15 – iPayment announced the formation of its new merchant cash advance division, iPayment Capital

8/16 – Fifth Third Bank made another equity investment in ApplePie Capital, agreed to purchase loans through the company’s marketplace

8/19 – Former CFO of Credibly became president of Western Funding

8/22 – Former SoFi employees filed a lawsuit against the company over wage issues

8/23 – Ellevest raised $32.5M

8/24 – AutoFi raised $10M in Series A

8/25 – Rep. Maxine Waters called for a congressional hearing on SoFi’s bank charter application and ILC charters in general

8/29 – Snap Finance secured $100M credit facility

8/30

- IOU Financial announced Q2 originations of $26.2M (US) and a net loss of $2.08M (CAD)

- ShopKeep launched ShopKeep Capital, a merchant cash advance service

8/31 – Bizfi wound down operations, sold servicing rights to its $250M portfolio to Credibly

9/2 – Bitcoin surpassed $5,000

9/5 – Former Chief Sales Officer of OnDEck, Paul Rosen, joined CoverWallet as COO

9/6 – Square revealed that they would apply for an ILC charter, following in the footsteps of SoFi

9/7

- Former Director of External Sales at OnDeck, Jared Kogan, joined Pearl Capital as Chief Revenue Officer

- First Internet Bank announces strategic partnership with Lendeavor, Inc.

9/11

- SoFi CEO Mike Cagney announced he had resigned as board chairman and would be resigning as CEO later in the year

- Lenda raised $5.25M Series A

9/12

- Groundfloor announced $100M loan purchase agreement with Direct Access Capital

- Orchard unveiled its Deals platform

- JPMorgan CEO Jamie Dimon called Bitcoin a fraud for stupid people

9/13 – dv01 closed $5.5M Series A

9/14 – SmartBiz surpassed $500M in lifetime SBA loan originations

9/15

- Amid more negative press, SoFi CEO Mike Cagney announced he was resigning as CEO immediately

- Enova announced $25M share repurchase program

9/20 – World Business Lenders acquired strategic assets of Bizfi including the company’s brand and marketplace

9/22 – Prosper Marketplace raised $50M in a Series G round at a 70% lower valuation of $550M

See previous timelines:

5/17/17 – 7/11/17

4/6/17 – 5/16/17

2/17/17 – 4/5/17

12/16/16 – 2/16/17

9/27/16 – 12/16/16