MPR Authored

Download Previous deBanked Magazine Issues Free

March 4, 2019Did you know that you can download previous deBanked magazine issues for free? Simply click any issue on our digital bookshelf to download it in PDF. To receive future issues in print, subscribe here.

Despite FinTech Disruptions, Many Thing Stay The Same

January 5, 2015 2014 was an unbelievable year!

2014 was an unbelievable year!

I kicked off last year by opening an account with Lending Club so that I could understand their product. Today I have tens of thousands of dollars invested on their platform and picking up new loans has become part of my daily routine. You could say I’m not surprised they went public a few weeks ago.

I also launched the industry’s first trade publication and ran it as both publisher and chief editor. We produced 6 issues and distributed more than 20,000 print copies combined. Unfortunately the publication will not be continuing further. It is wild to think that it both started and concluded in 2014 as the magazine had a cult-like following.

7 conferences in 4 cities. Las Vegas (twice), San Francisco, New Orleans, and here in New York. I spoke at two of them. Hoping for at least 1 Miami conference this year. Please??? It’s so cold here right now.

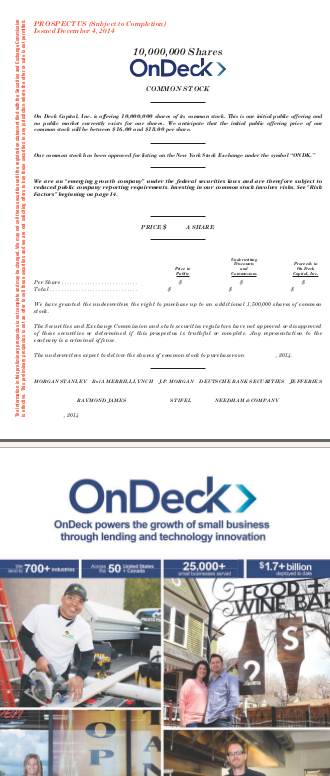

OnDeck Capital took a lot of flak in 2014 from both industry insiders and the media. They shrugged it all off and went public on December 17th. Considering they’ve operated on the fringe of the merchant cash advance industry for so long, it was one of those things you had to see to believe. I didn’t get inside the building but I saw the IPO was real from the outside.

I started off 2014 not knowing what a Bitcoin was. Now I have a copy of the entire blockchain, operate a full node (don’t worry I have port 8333 open), have 10 dedicated mining devices running 24/7, have made purchases with bitcoin, conducted countless transfers, and just finished coding a working prototype application using Coinbase’s API. And when I realized that bitcointalk.org and my cryptography books weren’t enough to satisfy my appetite, I found myself talking about bitcoin on IRC; #bitcoin and #bitcoin-pricetalk on irc.freenode.net. I also know who Satoshi Nakamoto really is now too but he made me promise not to tell anyone.

I rebranded Merchant Processing Resource to deBanked, retiring a name I’ve used for 4 years.

I interviewed former Congressman Barney Frank, one of the two architects of the Dodd-Frank Wall Street Reform and Consumer Protection Act (it was only a few questions).

I got asked by a credible movie producer if I would help him on a storyline for a script about Wall Street and the alternative business lending industry. Don’t worry I turned it down!

I jumped on the payment disruption bandwagon and used Square to process credit card transactions all year. You should know that I previously did merchant account sales. I could’ve boarded my own account and set my own fees but I went with Square anyway.

I finally got set up to syndicate on merchant cash advances.

I ran my first 5k in Central Park.

I moved to a different part of Manhattan.

Of course a whole lot more happened. It was a roller coaster year which leads me to believe that 2015 will be impossible to predict. There’s a lot more room to grow in FinTech but it might be time for fresh ideas. Everyone and their mom built an online lending marketplace platform in 2014.

Similarly, it’s also a tough time to become a loan broker or MCA ISO especially if you’re undercapitalized. The easy profit ship has sailed. Press 1s and UCCs aren’t winning business models, at least not ones that will invite outside capital or ensure survival long term.

2014 changed finance but in many ways it stayed the same.

It still takes 2-4 days to confirm an ACH didn’t reject! This is annoying all around. If I add funds to Lending Club on a Monday, it’s not accessible until Friday evening. If you debit a merchant on Monday, you won’t really know if you have it until a few days later. Believe it or not I actually mailed out more checks in 2014 than in any other year of my life. The ACH system appears to be fine until you use something that is far more advanced, something I will probably write about over the next month. Instantaneous payments, low transaction fees, no bank involvement. Yeah, it’s time for ACH to go away…

And with banks, well… I have opened business bank accounts over the last few years with 3 different banks. The one I opened in 2014 required a two hour in-person interview, a process that involved filling out forms by hand and being threatened that the government would shut everything down in a heartbeat if they found out that I so much as breathed wrong on an ATM. It was a repeat of prior account opening experiences. Although I’ve never had an account closed for doing anything wrong (because I’m not actually doing anything wrong), it is easy to see how much regulatory pressure banks are under. Swiping your debit card upside down could cause the entire bank to get an Operation Choke Point subpoena. They want your business but they’re scared to death of anything you might do with a bank account.

All the major peer-to-peer platforms of 2014 became centralized. Lending Club and Prosper don’t even fall in the p2p category anymore. The market trend has been to create a platform designed for the little guys and then hand it over to a bank or institutional money to do all the funding. In some ways it’s easier to deal with a handful of big players instead of thousands or millions of retail investors. But with the regulatory environment uncertain on so many new investment products, it’s probably also safer to deal with institutional investors, lest the regulators claim they violated a consumer protection law they thought up this morning.

Banks continue to be the biggest obstacle to innovation because at the end of the day, all payments flow through them. How can one deBank and truly disrupt?

Hopefully we’ll find out in 2015. Happy belated New Year.

Getting in on the ONDK and LC IPO

December 4, 2014According to Investopedia, “Getting a piece of a hot IPO is very difficult, if not impossible.”

The Motley fool says:

If the bankers think a stock will soar, they earmark much of the shares for their favorite institutional clients (ones that bring in the most in commissions). In a sense, brokerages use lucrative IPOs to curry favor with big clients, to win and retain their business. When brokers aren’t so confident about the company’s prospects, they will try to sell the stock to less-favored institutional clients.

Admittedly these are generalities, not unyielding truths.

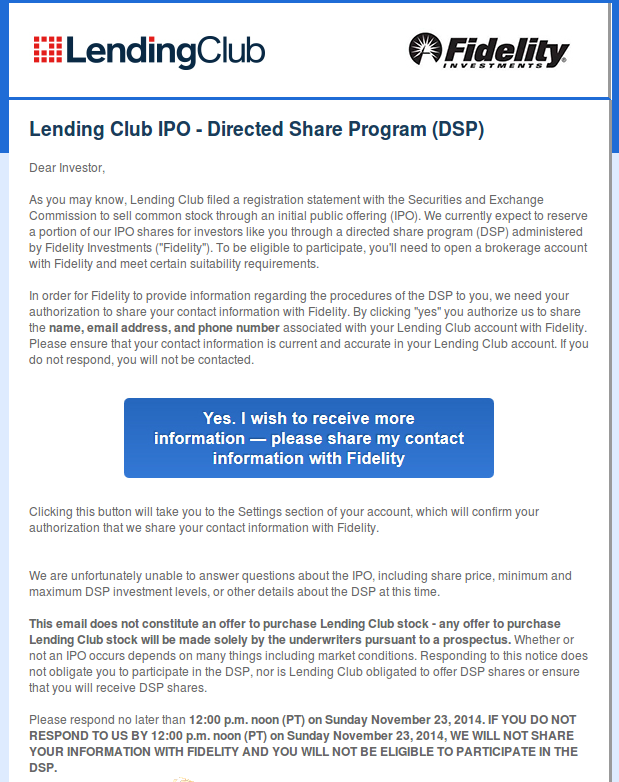

But when Lending Club mass e-mailed all their platform lenders on November 17th that they would be rewarded with a chance to get in on the IPO, people got excited. They wouldn’t just automatically get stock though, they’d be given the chance to buy it. An allocation was not guaranteed and a limit as to how much was not immediately disclosed, though it was recently revealed that platform lenders could buy up to a maximum of 350 shares.

At $10-$12 a share, that’s an opportunity to spend a max of $3,500 to $4,200 on the IPO. Getting in won’t make you a millionaire but it’s a little way for Lending Club to say thank you to all those who invest on their platform.

I got the offer and turned it down. I’m very bullish on Lending Club stock but I feel like I’m already invested enough in them as a company through platform lending to need to get even more in. For those not sure how Lending Club really works, their system is not actually peer-to-peer. Investors buy Lending Club notes that are tied to the loans they issue. You are ultimately only investing in Lending Club with every note you buy. You have no relationship or claim to the borrower.

With that being the case, my tens of thousands invested in them is enough, especially from a retail investment standpoint. But I enjoyed the proposal nonetheless because it felt like a gift for getting in on the ground floor of something huge.

I also liked telling people over the last two weeks that I could get in on the Lending Club IPO.

“You hear about Lending Club going public?” I’d ask a friend. And then brag, “Yeah, well I have a chance to get in on the IPO if I want. I could talk to my guy to try to get you in but I don’t know if I can swing it. Maybe though.”

I was pretty damn important.

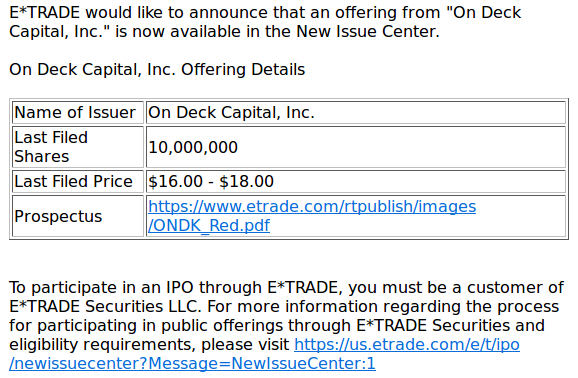

Until someone told me they could get in on the OnDeck IPO today. He apparently had an inside guy and that inside guy was E*Trade, as in he could apparently get in on OnDeck’s IPO just for having an E*Trade account.

One had to wonder why any schmo with a brokerage account was being asked to buy in. It didn’t sound good for OnDeck but I let my friend have his moment. His guy could try to get me in, etc.

The mass blanket invitation to get in might appear that brokers aren’t so confident about the company’s prospects. But actually back in January of this year E*Trade forged a “retail alliance” with middle-market investment bank Jefferies LLC. A Reuter’s story said that, “E*Trade is betting that it can score points with investors by guaranteeing access to IPOs that brokerage firms normally reserve for their best customers.”

OnDeck’s underwriters include Morgan Stanley, Bank of America Merrill Lynch, JPMorgan Chase, Deutsche Bank and Jefferies. This is in line with “giving its customers access to initial public offerings and follow-on offerings underwritten by middle-market investment bank Jefferies LLC” though I haven’t confirmed the alliance is the cause of this.

OnDeck’s underwriters include Morgan Stanley, Bank of America Merrill Lynch, JPMorgan Chase, Deutsche Bank and Jefferies. This is in line with “giving its customers access to initial public offerings and follow-on offerings underwritten by middle-market investment bank Jefferies LLC” though I haven’t confirmed the alliance is the cause of this.

Just as with Lending Club’s allocation offer, no one is guaranteed anything with OnDeck through E*Trade. There’s a required approval process which may ultimately yield nothing.

And yet it still feels a little weird, maybe because I’ve been hearing about an OnDeck IPO for years now and I just can’t grasp it’s actually happening. It’s one thing for a big banker to talk about it and another for an old college buddy, my doorman, and Jim who’s the cashier at the local hardware store ask me if I know anything about this OnDeck loan stock advance thing they heard about.

All I know is that sentiment on them is mixed but that ultimately insiders believe it’s great for the industry.

As for both of these the IPOs? I don’t know. I’m not getting in on either of them but it has nothing to do with how I feel about the companies. I can’t wait to watch this all unfold though.

Check out the 224 page OnDeck Prospectus!

Lending Club’s Site Went Down

December 3, 2014A week away from IPO day, Lending Club is undergoing a supposed unannounced mid-day prolonged “upgrade”. There is no word about it on their twitter account. As many probably know, this down time coincides with one of the day’s four normal feeding times when fresh loans are loaded onto the platform in bulk.

Are they just polishing up the old gears before IPO time or did something happen?

The 3rd revision of their S-1 registration was published two days ago.

Merchant Cash Advance Now In-Depth

December 1, 2014For quite possibly the first time ever, Google has blessed merchant cash advance with its own array of In-depth articles. What are In-depth articles? Why, they’re featured stories at the bottom of the normal search results. The In-depth feature launched in 2013 and has only worked for certain keywords.

Today it appeared for the very first time for the keyword merchant cash advance

Since Google experiments constantly and shows different results to everyone, it’s possible that you’ve been seeing this for some time already.

I had this to say about the feature 16 months ago:

If you’re wondering how websites can prepare themselves to benefit from such rich snippets, I published Schema.org Markup and Rich Snippets for the Little Guy back in August 2013.

Businessweek, NY Times, and Forbes… I’m not surprised that they’re the chosen publications. Truth be told, there may not have been enough written about merchant cash advance to implement this feature until now. Consider this a milestone.

Merchant Processing Resource is Now deBanked

December 1, 2014 Back in July 2010, I launched www.merchantprocessingresource.com as an independent resource for merchant processing and merchant cash advance. At that time I was celebrating my 4th anniversary of working in the merchant cash advance business and realized there was little to no information about the industry online.

Back in July 2010, I launched www.merchantprocessingresource.com as an independent resource for merchant processing and merchant cash advance. At that time I was celebrating my 4th anniversary of working in the merchant cash advance business and realized there was little to no information about the industry online.

For the last 4 and a half years, this website under that name has been visited by hundreds of thousands of people, many of whom were new to the business or interested in getting into it. I’ve received thousands of emails and responded to an insane amount of questions.

In 2010, 95% of all merchant cash advances relied on merchant processing. For those that remember, funding was in many ways secondary to acquiring merchant accounts. But the industry has evolved and other related financial alternatives have sprouted up around it.

Over time I found myself exploring new avenues and relaying what I’ve learned or what I knew with the rest of the world.

Merchant Cash Advances may have started off as a product for those underserved by banks but it has morphed into an option for bankable businesses that would rather skip the bank. In a sense, today’s capital-seeking merchants are deBanking.

Consumers too are turning to peer-to-peer platforms and crowdfunding campaigns instead of credit cards and bank loans.

And then there’s myself. I started buying into Lending Club loans in January of 2014, almost a year ago. The returns crush what I could earn with a savings account or CDs. The bank is the least attractive option if you want to earn a return on your money.

But it goes beyond lending and earning interest. All the big conferences this year were filled with bitcoin enthusiasts, a payment technology and currency that is not only independent of government, but of banks. Of course I gave it a look and loved it. I shared my feedback in a post titled, My Journey to Bitcoin.

Merchant Processing and Merchant Cash Advance may have kicked off this blog, but four and a half years later, it’s time to acknowledge the other forces, many of which I have already been covering for quite some time.

With 2015 right around the corner, the world is deBanking in more ways than one.

I’m deBanked.

Are you?

Income Correlates With Loan Performance

November 24, 2014 Now that I’ve bought into nearly 1,800 personal loans on Lending Club, I think I’ve got a good enough sample to start running analyses.

Now that I’ve bought into nearly 1,800 personal loans on Lending Club, I think I’ve got a good enough sample to start running analyses.

The data isn’t perfect especially since none of the loans have reached maturity yet. Most are still between two and four and a half years away from completion. But strangely, 70 loans paid off early and a good number have already defaulted or are more than 16 or 30 days late and are on their way there.

With at least that to work with, I compared three groups:

- Early payoffs

- 16+ days late or defaulted

- All others

I examined 4 initial factors and I will surely examine many more. While I saw some weak correlation regarding FICO score, it’s borrower income that really stood out.

Ignoring all other factors, the accounts that paid off early reported earning 29% more annual income than the accounts that are bad.

I had heard Peter Renton preach the high income borrower strategy and truthfully I ignored income as a factor in my decision making up until this point. On equities.com, Renton said, “I typically like more than $50,000 in annual income, although $75,000 is even better, and $100,000 is better still.”

Looking at my own sample, there is indeed correlation between the $75,000+ income earners with paying off Lending Club loans early.

Unlike some business loan products, Lending Club personal loans accrue interest rather than bake interest into a fixed total cost. That means a borrower that paid back a 5 year loan in just 3 months only paid 3 months worth of interest.

It was surprising to see that 70 borrowers repaid the loans in their entirety within a matter of months.

Regarding FICO, the score spread between bad loans and early payoffs was only 8 points, a lot smaller than I’d expect. But the portfolio is young and some loans have only just issued in the last few months. With another 2+ years left to go, the sample size of defaults will get bigger and I will be running the numbers on this again.

In in meantime, low income borrowers regardless of all other factors appear to be more risky investments. I guess you could say I’m not surprised, but it’s exciting to see data that supports a hypothesis.

The Funding Calls That Won’t Stop

November 23, 2014“Your business has been approved for a loan…”

Last week, Chicago Public Radio (WBEZ 95.1 FM) investigated a trend in the small business community, the use of merchant cash advance financing. The station called me in advance to answer some questions about merchant cash advances and I gave my best explanation of the industry and its products.

Of the discussion that lasted more than 30 minutes, only about five of my sentences made it on the air. While I clarify some of my positions below, it was sobering to learn the context of how they were used, as a defense to real life merchant complaints.

The satisfaction rate with merchant cash advances are pretty high and I say that mainly because it’s so rare to hear complaints from anyone other than journalists that can’t believe anyone would accept rates above 6% APR. And while there are indeed bad actors in the industry (as there are in any industry), the gripe one merchant had about phone solicitations that just won’t stop is a recurring theme.

It’s happening to me too.

As an account representative in 2010 calling real time leads sold to five parties at once, I did what anyone would do, I pretended to be a small business myself and inquired through the website that we bought leads from and entered my cell phone as the point of contact

Ring. Ring. Ring…

Within a half hour, representatives from four companies called me, and I learned exactly who my competition was, how they explained the product, and what they would say to win me over. Two of the four were really good and one even referenced my name personally, saying something to the effect of, “If you get a call from Sean Murray, his rates are worse than mine.” Obviously he had already done what I was doing now, which was pretend to be a small business so he could prove to the prospect he was well informed about the alternatives. He had heard my pitch already and was now throwing me under the bus by planting the seed that I was going to offer something more expensive even if it wasn’t the truth.

In the end none of them won because it was all a farce. One never called me again after the first call. Another kept at it for a week and the remaining two followed up for a month.

And then it got quiet…

I had been marked as a dead lead and forgotten about until three months later when one company sent a follow up email. “Smart,” I thought. But then a call came six months later, and then more emails, some from companies I didn’t originally engage with.

And they continued at regular intervals, every couple of months an email or call. Was it interesting? Yes. Annoying? No.

Until this year.

The volume of emails have slowed but I’ve somehow ended up on robo calling lists. “Press 1 to talk to a funding specialist or press 9 to be added to the Do Not Call list”

The volume of emails have slowed but I’ve somehow ended up on robo calling lists. “Press 1 to talk to a funding specialist or press 9 to be added to the Do Not Call list”

The press 9 option doesn’t work for me. Sure, I might be removed from that marketer’s list, but it in no way removes you from anyone else’s list. I knew that already of course because I’ve been on the other end before.

The first time I got one of these calls, I was excited to tell the sales representative who I really was, level with him, and explain that it was a really good idea to take me off the list. But much like other business loan robo call complaints, the representative wouldn’t tell me anything about himself or his company.

I got yelled at.

Every time I tried to ask a question, he’d get louder, insisting I tell him my monthly gross sales volume for the “cash advance I wanted.”

A rogue actor maybe, but I’ve since gotten additional business loan robo calls and have made no progress in getting myself removed. I just hang up now.

Call it sweet irony perhaps. Or maybe a wake up call (pun intended). I applied on a website once four years ago and the rest is history.

My experience with repeat solicitations is marginal compared to somebody that has actually used a merchant cash advance. With the filing of a public UCC-1, anyone in the industry can easily access that data and convert it into a marketing list. And they do.

Brokers that scorn UCC marketing acknowledge that these businesses could be getting called 5-10 times a day. My own clients had reported repetitive calls back when I was an account representative. And while UCC marketing is very cost effective, in today’s market where more than a thousand companies are offering similar financial products, it’s probably safe to say it’s overly saturated.

And if 5-10 calls per day were even remotely accurate, I’d surmise that level of volume is marring the industry’s reputation as a whole.

I could argue though that when customers have a great many options to choose from, they win. With more than a thousand companies offering merchant cash advances and business loans, it’s truly a buyer’s market. Play all the companies against each other and you should end up with the best possible terms. It’s a great time to seek capital.

Except we’ve got to do something about those phone calls, or at least the robo calls.

Every angry robo dial recipient becomes one less person likely to speak positively about the the nonbank financing industry. Aged leads, UCCs and phone calls might be inexpensive, but the cost to undo negative preconceived notions is immeasurable.

Do you want to be known as the company that helped small businesses or the annoying people that won’t stop calling? If merchants are taking to the air waves to complain, it will only be a matter of time before the FTC and FCC become interested.

—

Regarding my comments on the radio about APRs and daily amortization, they were pulled from a conversation that compared daily payment loans to purchases of future sales. I DO believe bad actors exist and every business owner should have an accountant, lawyer, or savvy third party review any contracts they enter into, financial or otherwise.