Loans

News from the Space

November 18, 2013 American Express recently teamed up with Heartland Payment Systems to provide split-processing loans tied to all card transactions rather than just American Express exclusively. The max loan size is $750,000. Prior to this deal American Express and other merchant cash advance companies rarely competed head-to-head. Unless a small business was processing substantial AMEX, they weren’t a candidate for American Express Merchant Financing. I expect them to make similar deals with other card processors.

American Express recently teamed up with Heartland Payment Systems to provide split-processing loans tied to all card transactions rather than just American Express exclusively. The max loan size is $750,000. Prior to this deal American Express and other merchant cash advance companies rarely competed head-to-head. Unless a small business was processing substantial AMEX, they weren’t a candidate for American Express Merchant Financing. I expect them to make similar deals with other card processors.

Lending Club got a valuation boost with a $57 million investment from Yuri Milner’s DST Global and Coatue Management LLC. They’re now worth about $2.3 billion. They are expected to go public in 2014 which will be especially significant given their plans to enter the small business lending space as early as January. Today, alternative small business lenders worth tens of millions or hundreds of millions of dollars are the big shots in the industry. Expect major disruption if Lending Club achieves an IPO valuation in the tens of billions.

Zazma put their own spin on lending by financing the purchases small businesses make. Funds are actually wired directly to the suppliers instead of to the borrower. For now they are only doing up to $5,000 at one time, which is typically the minimum sized deal for the merchant cash advance industry.

ISO&Agent published a great article about merchant cash advance titled, Taming the Wild Frontier.

The end of the year is coming and Capital Access Network, which is now CAN Capital projects they will finish with $800 million in transactions for 2013. 15 years after they started, they are still the biggest in the business.

Merchant Cash Advance Hits Shark Tank

October 26, 2013 If you missed Friday night’s episode of Shark Tank, you absolutely must catch a rerun of it. Jason Reddish and Val Pinkhasov came on the show to pitch their merchant cash advance company, Total Merchant Resources. It was one of the best few minutes in merchant cash advance history for several reasons:

If you missed Friday night’s episode of Shark Tank, you absolutely must catch a rerun of it. Jason Reddish and Val Pinkhasov came on the show to pitch their merchant cash advance company, Total Merchant Resources. It was one of the best few minutes in merchant cash advance history for several reasons:

- Mark Cuban, the 213th richest man in the U.S. feared the growing popularity of expensive short term financing would invite tough government regulation.

- Kevin O’Leary understood that there were no barriers to entry and thus anyone with money can get into the industry.

- Robert Herjavec thought the capital was too expensive for small businesses.

- Kevin O’Leary said that non-bank alternative lenders like Total Merchant Resources were necessary to keep businesses afloat.

- Jason Reddish went at the Sharks like a Shark himself.

TMR walked away with a rather small 400k valuation through the deal they made with Kevin O’Leary that gave them 200k for 50% equity. It was O’Leary’s claim that his connections and capital would blow the lid off their business that was too good to pass up.

O’Leary had a compelling argument for why his terms were non-negotiable. Anyone can be in this business. The valuation itself was moot because two guys with a relatively small operation just became partners with a famous venture capitalist worth $300 million. Had I been in their circumstances, I would’ve taken the deal as well.

O’Leary’s name in the space makes TMR relevant and a company to watch out for, but they are by no means guaranteed success. They are up against much deeper pockets. Dan Gilbert, the 126th richest man in the U.S. owns RapidAdvance (through Rockbridge Growth Equity), a firm that got an enterprise valuation of over $100 million. Google and Peter Thiel have their hand in On Deck Capital. Google also has a stake in Lending Club, a peer-to-peer lender worth $1.55 billion that threatens to disrupt the alternative business loan market with their new loan product come early 2014. Capital Access Network funds nearly three quarters of a billion dollars a year. Every day another power player swoops in and raises the stakes, putting O’Leary in a position he’s probably not used to being in himself, in the shark tank.

At the end of the day, there are a lot of profitable ISOs and small funders. Pinkhasov and Reddish did what no one else to date has done, gone on TV and pitched Mark Cuban on merchant cash advance. And for that, they will go down in history. We’ll follow their story as it develops and I invite them to e-mail me if they’d like to comment.

You can follow the thread about their appearance on the show and find the link to the video on DailyFunder.

Here Comes Lending Club

October 17, 2013 As highlighted in BusinessWeek, Lending Club has finally entered the small business lending market. Some of you might say, “bahh… so what!” but you should be paying attention. Lending Club recently got a valuation of $1.55 billion when Google bought a piece of them back in May. To put that in perspective, that’s about 15x the enterprise valuation that RapidAdvance got in its acquisition by Rockbridge Growth Equity. A monster has entered the ring and it doesn’t matter if it’s peer-to-peer lending, because they’re targeting the same market. What Lending Club does isn’t much different than what the typical merchant cash advance industry does these days anyway. Both thrive on syndication, though one relies on a handful of partners and the other relies on tens of thousands of partners. Both are bank loan alternatives and both can get you funded within days.

As highlighted in BusinessWeek, Lending Club has finally entered the small business lending market. Some of you might say, “bahh… so what!” but you should be paying attention. Lending Club recently got a valuation of $1.55 billion when Google bought a piece of them back in May. To put that in perspective, that’s about 15x the enterprise valuation that RapidAdvance got in its acquisition by Rockbridge Growth Equity. A monster has entered the ring and it doesn’t matter if it’s peer-to-peer lending, because they’re targeting the same market. What Lending Club does isn’t much different than what the typical merchant cash advance industry does these days anyway. Both thrive on syndication, though one relies on a handful of partners and the other relies on tens of thousands of partners. Both are bank loan alternatives and both can get you funded within days.

Back in 2009, the only short term financing opportunities small businesses had was merchant cash advance. There really wasn’t anything else. There were banks or there was merchant cash advance… and banks weren’t lending. Now there’s a whole spectrum of bank loan alternatives and to say that they operate in markets that don’t compete with each other is crazy.

There was a time when folks said Kabbage was not a competitor in the merchant cash advance space. Now they’re synonymous with merchant cash advance financing, have patents that specifically use the merchant cash advance terminology, and they fund brick and mortar businesses. On Deck Capital supposedly wasn’t a competitor back in 2007 because they did loans with fixed daily ACH. On Deck wanted only the high credit merchants that wouldn’t settle for a cash advance and now they compete head to head with everyone else.

The market is all over the place with pricing and structures. Factors range from 1.09s to 1.50s. Deal terms range from 6 weeks to 24 months. For those already annoyed that there has been downward pressure on rates for high quality clients because of what it has done to margins, you may have more to worry about with Lending Club.

I’ve personally referred consumer loan deals for a commission to Lending Club in the past and they went pretty smoothly. They said if they approve a loan, it will basically fund within days. They don’t have any worry about approved loans not raising enough capital to be funded from syndicates/investors/participants. They said almost every approved loan funds. They also charge between 6.5% and 29.99% APR and make loans with terms of 3-5 years. Try competing against that.

Now I don’t know what repayment time frame will be offered on their business loans, but I do know that they’re used to making loans for very low interest over a much longer term than a merchant cash advance company. Something tells me that they won’t stray too far from that and they’re going to disrupt the market (the premium market anyway) on price and time frame more than a few other companies already have.

Granted, I will admit that Lending Club on the consumer side generally only approved applicants with higher than 680 FICO and a low debt-to-income ratio and I don’t think they’ll change that. That means they won’t be a competitor initially for a large chunk of the market. Lending Club will probably butt heads with On Deck Capital, NewLogic Business Loans, and all the premium 12 month programs floating around out there.

Peer-to-peer lending is part of the broader merchant cash advance industry. Deals fund quickly, the capital is unsecured, there’s little paperwork involved, and the deals are syndicated. Hence, Lending Club is now a competitor.

Being owned by Google also can’t hurt. Lending Club is typically ranked at or near the top of the 1st page for the search query, “unsecured business loans.” Coincidence?

Get ready for Lending Club. They won’t be the last billion dollar plus company to throw their hat in the ring.

—

Note 1: An edit was made to correct Rapid’s valuation as an enterprise valuation, which one insider noted can be substantially different than a raw equity valuation. That makes Lending Club likely a lot more valuable in comparison.

Note 2: I initially reported that Lending Club owned Dealstruck.com. This is not correct. Dealstruck.com has previously been reported to be the Lending Club of the small business space in the characteristic way of how they structure deals, but they are not actually part of Lending Club. Thanks to Darrin Ginsberg of Super G Funding for pointing out my mistake.

More on DailyFunder about this topic: http://dailyfunder.com/showthread.php/451-lending-club

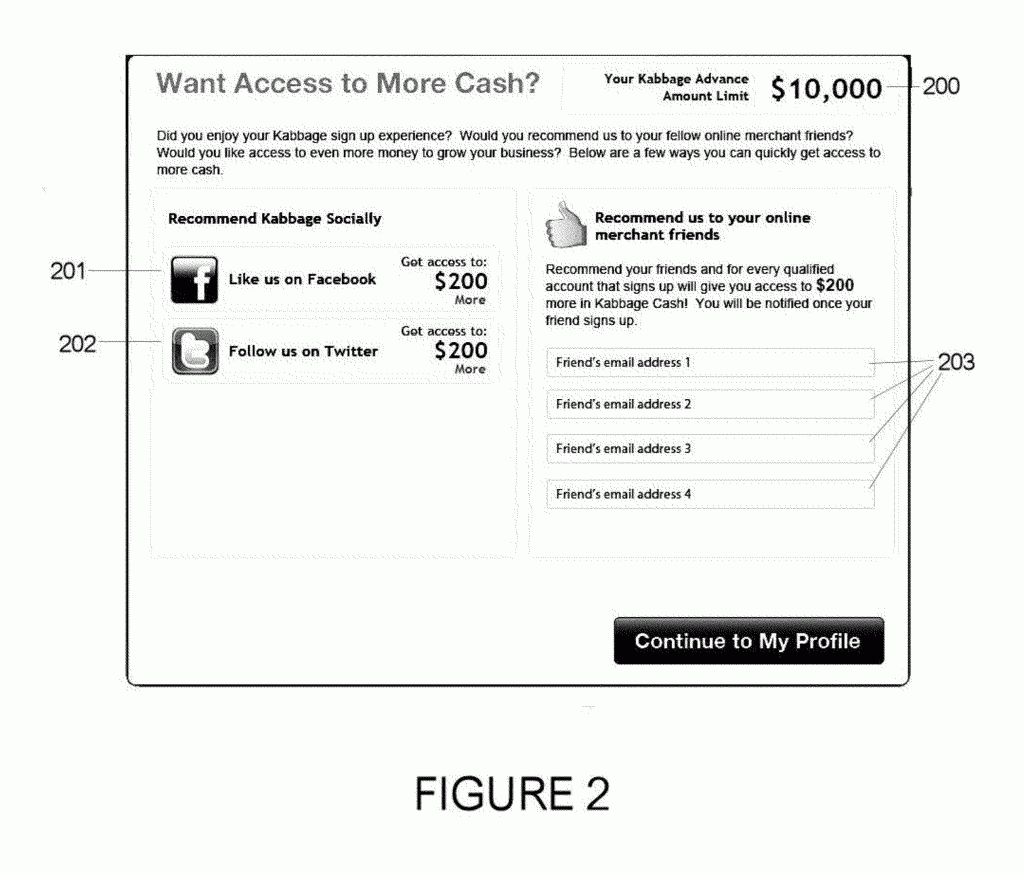

Is PayPal’s Working Capital Program a Mistake?

October 5, 2013 A few weeks ago, PayPal announced the launch of their Working Capital program as a way to help small businesses in need. They classify it as a loan but the explanation for how it works is textbook merchant cash advance. A percentage of each PayPal sale is withheld and applied as a reduction to the merchant’s balance. PayPal joining the booming merchant cash advance/alternative lending market is really no surprise. After all, RapidAdvance just got acquired by the same group that owns Quicken Loans. We’re in a new era of alternative finance.

A few weeks ago, PayPal announced the launch of their Working Capital program as a way to help small businesses in need. They classify it as a loan but the explanation for how it works is textbook merchant cash advance. A percentage of each PayPal sale is withheld and applied as a reduction to the merchant’s balance. PayPal joining the booming merchant cash advance/alternative lending market is really no surprise. After all, RapidAdvance just got acquired by the same group that owns Quicken Loans. We’re in a new era of alternative finance.

PayPal is respected as a payments company but are they ready for the high risk world of merchant cash advance financing? Critics are not so sure. Industry insiders have watched dozens of funding providers jump into the market with aggressive rates, attempt to undercut the competition, and acquire a lot of marketshare. The results are usually disastrous.

For years, journalists believed that the high cost of capital provided by non-bank lenders was fueled by the desire for immense profit. They didn’t understand the risks involved or realize that some funding providers weren’t even turning a profit at all. Last year, Opportunity Fund, a non-profit small business lender revealed that to make loans at 12% APR would fail to even cover costs. The for-profit sector of the industry charges factor rates (different than Annual Percentage Rates) between 1.14 and 1.50, not including fees. I explained this variance once before in The Fork in the Merchant Cash Advance Road.

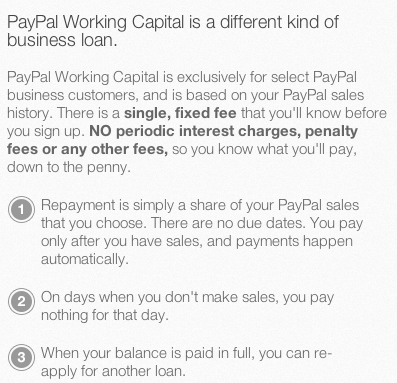

So did PayPal learn anything from an industry that has been in existence for 15 years? It doesn’t look like it:

Doing some simple math (Total to be repaid / Loan Amount), the factor rates range from 1.04 to 1.12, figures that will probably only make sense if their average client has greater than 720 FICO, many years in business, and is virtually perfect on paper and in reality. Perhaps PayPal knows that and will decline 95% of applications or perhaps they believe their clients will buck the trend. I mean, is it possible that a corporate monster like PayPal could make a boneheaded mistake?

A 1.04 deal? Seriously? This has disaster written all over it. There are some people that believe that the losing proposition is intentional…

You can follow the discussion about this on DailyFunder.

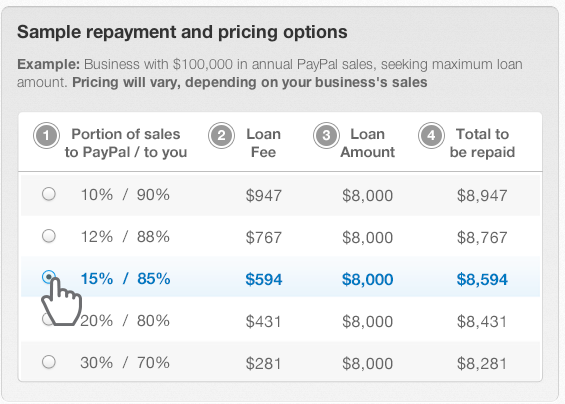

Pop Quiz: Would No Interest Mean No Defaults?

September 21, 2013Bring interest rates down to zero and nobody would default right??? Every single borrower has a risk of delinquency or default irrespective of the interest rate. Everyone.

Read the now defunct ARC Loan procedural guide:

SBA’s ARC Loan Procedural Guide

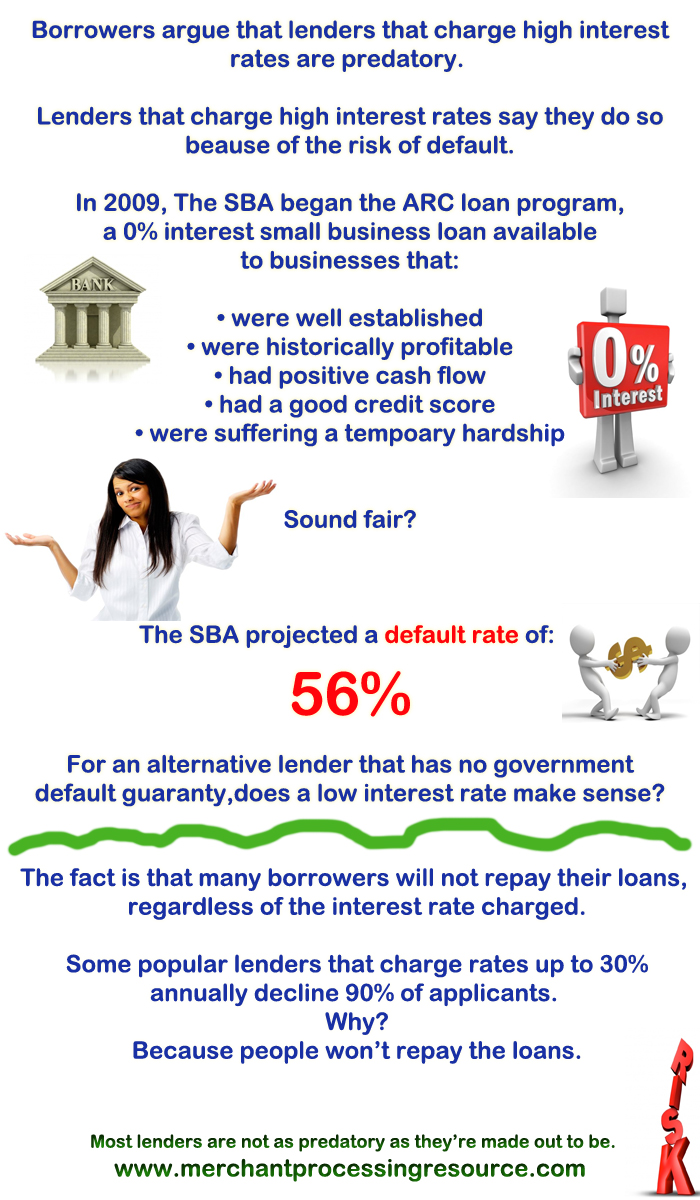

Loans for Likes

September 17, 2013How Kabbage is building a social media marketing empire

Take a look at what Kabbage has cooked up:

Like Kabbage on twitter or Facebook and your approval amount gets extended automatically. This helps Kabbage accomplish two goals:

1. Spread awareness about their brand to the followers of the people Liking and following them.

2. Identify the public social media accounts the business is using so it can monitor what they’re doing.

You can learn about how Kabbage feels about businesses that aren’t using social media in the patent’s summary. Under Description, Section 2:

You can learn about how Kabbage feels about businesses that aren’t using social media in the patent’s summary. Under Description, Section 2:

Social networking is growing at an exponential rate and businesses that are not exploiting social networking sites such as FACEBOOK and LINKEDIN are considered falling behind the times.

So why is this a patentable invention? A merchant’s approval amount is increased automatically by an algorithm that checks to see if a merchant performed the action of Liking or Following. So if you think that’s a great idea and want to do something similar, you’re a bit late. Better Call Saul… I mean Kabbage to license the use of such technology. It works as such:

The above aspects can be obtained by a system that includes (a) approving, by a cash provider, a user for a cash line wherein the user is permitted to receive cash up to the cash line; (b) causing an offer to be displayed on an electronic output device associated with a user’s computer, the offer being to increase the cash line when the user takes a particular action comprising associating the user’s social networking account with the cash provider; (c) determining that the user has taken the particular action; and (d) automatically increasing the cash line.

The term merchant cash advance is explicitly used twice in the patent but it also goes to cover any kind credit line or loan being program. This is actually an incredible patent to be in possession of because it’s such a great idea. Imagine telling a merchant approved for 5k, that they will get an extra $200 just for following you on twitter and another $200 just for liking you on facebook. It may not seem like much on a $250,000 deal but Kabbage does a lot of smaller sized advances where the $400 combined approval bump is a sweet incentive for merchants.

Marketing in this industry is expensive and this is one of the more innovative models I’ve seen.

No End in Sight for Alternative Lending

September 17, 2013 Which one of these three isn’t like the other two?

Which one of these three isn’t like the other two?

- Quicken Loans

- RapidAdvance

- Cleveland Cavaliers

It’s a trick question because as of September 16, 2013, All three are owned by Rockbridge Growth Equity, a Detroit-based private equity firm. RapidAdvance announced the acquisition over the news wire, shocking many people around the industry. The move opens RapidAdvance to the connections and prowess of Dan Gilbert, the 126th richest man in the United States. Gilbert is worth approximately $3.9 Billion, is the founder of Quicken Loans, and he owns 4 sports teams, including the NBA’s Cleveland Cavaliers.

Compare that to On Deck Capital board member Peter Thiel, who is worth $1.9 Billion and is the 309th richest person in the U.S. You may remember Thiel, the co-founder of PayPal and first investor in Facebook as participating in a series D round for On Deck Capital along with Google Ventures back in May.

These are truly some historic times. Two of the richest people on all of planet Earth have stock in the merchant cash advance industry. Does that tell you anything about the direction things are moving in? Think about that one again… Two of the richest men in the world have invested in the merchant cash advance industry.

Four years ago, an influential friend advised me that this industry would be eradicated by 2010. As told through The Bubble That Wasn’t, some people left the business prematurely fearing the best days of alternative lending were over. At present, it looks as if those best days are still yet to come.

The Rockbridge Growth Equity move comes less than a year after Steven Mandis bought into RapidAdvance. He will reportedly stay on as a shareholder.

On Deck Capital

In other news, On Deck Capital announced that they’ve raised another $130 million in debt financing, leveraging themselves out even further. ISOs in the industry report that they’re ON FIRE with approvals. Rumors about a possible IPO on the horizon are starting to pick up again but my sources tell me that isn’t likely to happen with On Deck for another 2-3 years.

Don’t Throw That Deal Away, Factor It

September 3, 2013 As we start off our first blog post in Merchant Processing Resource, I’d like to talk about a deal that we just got a factoring line for:

As we start off our first blog post in Merchant Processing Resource, I’d like to talk about a deal that we just got a factoring line for:

A landscaping company came to SFS because his business was starting really to take off and was beginning to get large contracts to provide masonry and landscaping work. The merchant was approved for a cash advance but it was not enough to cover the funds he needed. He applied to SFS+ for an Accounts Receivable factoring line and was approved for $500,000. The line allowed the merchant to sell SFS+ outstanding invoices for work that was already completed for a large office complex and shopping center. Between the factoring line and the Cash advance line the merchant received $650k in working capital!

He went to his local bank and while the bank said they love the depositing relationship, they have no interest in lending him money. Next stop: his accountant — the accountant said they would have to have a balance sheet for the bank. Well his business did not have 12 months to build his balance sheet he needs to address the opportunity (not a problem) today!

He found us though an SFS ISO and realized that we were a one stop solution for ALL of his cash flow needs.

SFS and SFS+ provided his business with a cash advance and factoring line. So, not only did they address his current opportunity they also enabled him to expand his business as much as he wants, and when his balance sheet is stronger he can go back to the bank.

So how do you know when factoring is a good option??

Ask them: “does your business have receivables?” if they say yes, ask them to submit your cash advance application and their business’ accounts receivable aging reports, we can then give you a quick response on how we can move forward.