Industry News

Marketplace Lending Investors Ponder Loan Defaults, Issues in Harvey’s Path

September 1, 2017On the LendAcademy Forum, a Lending Club investor posted that he had been selling notes belonging to Houston borrowers in anticipation of payment issues stemming from Hurricane Harvey. Other users chimed in with assessments of their own personal exposure, including one who noticed that affected zip codes made up a little under 4% of his outstanding principal. By now, secondary note buyers probably have their radar up to heed caution with these.

Elsewhere in the industry, MCA firm Strategic Funding and lender Breakout Capital both announced that they were suspending debits to businesses they’ve funded in the Hurricane’s path.

A message for our customers located in flood-affected areas of Texas pic.twitter.com/4nc8bjWzg5

— Strategic Funding (@SFSCapital) August 28, 2017

The OCC is also advocating that banks suspend payments in those areas from ATM fees to loans. They should consider “restructuring borrowers’ debt obligations, when appropriate, by altering or adjusting payment terms. Payment extensions should reflect individual borrower situations and generally should not exceed 90 days,” according to a statement.

The Alternative Finance Bar Association Announces September 13th Event

August 31, 2017An announcement from the AFBA:

Download Save The Date PDF

SAVE THE DATE

Location: NYC Bar Association Offices

42 West 44th Street

New York, NY 10336

When: September 13th

Date: September 13, 2017

LOCATION: NYC BAR ASSOCIATION OFFICES

Clark Hill’s Consumer Financial Services Regulatory & Compliance Practice Group is a national leader in the field of consumer financial services law, providing strategic legal counsel to clients in all areas of consumer and small business finance. We provide advice, consultation and litigation services to a wide variety of financial institutions throughout the country. Our exceptional team of lawyers as well as government and regulatory advisors has extensive experience in – and an in-depth understanding of – the laws and regulations governing consumer financial products and services including engagement with the Consumer Financial Protection Bureau and prudential regulators.

Letter From The Editor – July/August 2017

August 30, 2017Happy end-of-summer. It’s been a remarkable year so far.

In this issue, we talked to small business owners about what works and what doesn’t. Several of them advocated for more personal attention and to shift away from old fashioned marketing tactics like cold calling. If you’re a salesperson, you’ll want to read what your clients told us.

On the bank side, the companies disrupting banking are… other banks, ones that have embraced digital technology and partnerships with online lenders. They’re tech companies with bank charters, or at least that’s how they appear. And it’s working for them quite well. To become a better bank, these banks are taking an entirely different approach than their predecessors.

We’ve got a lot more of course and I want to thank everyone that has supported deBanked all these years, whether as a paying advertiser or as a regular reader. One of the most rewarding things for myself personally has been to see copies of this magazine appear in the lobbies of funding companies all over the country as reading material for visitors. That has given us incredible reach, but I think we can reach even farther. Stay tuned for plans we have in 2018. As the industry turns a page, I hope that you’ll continue turning ours.

–Sean Murray

deBanked Golf Outing 2017 Photos

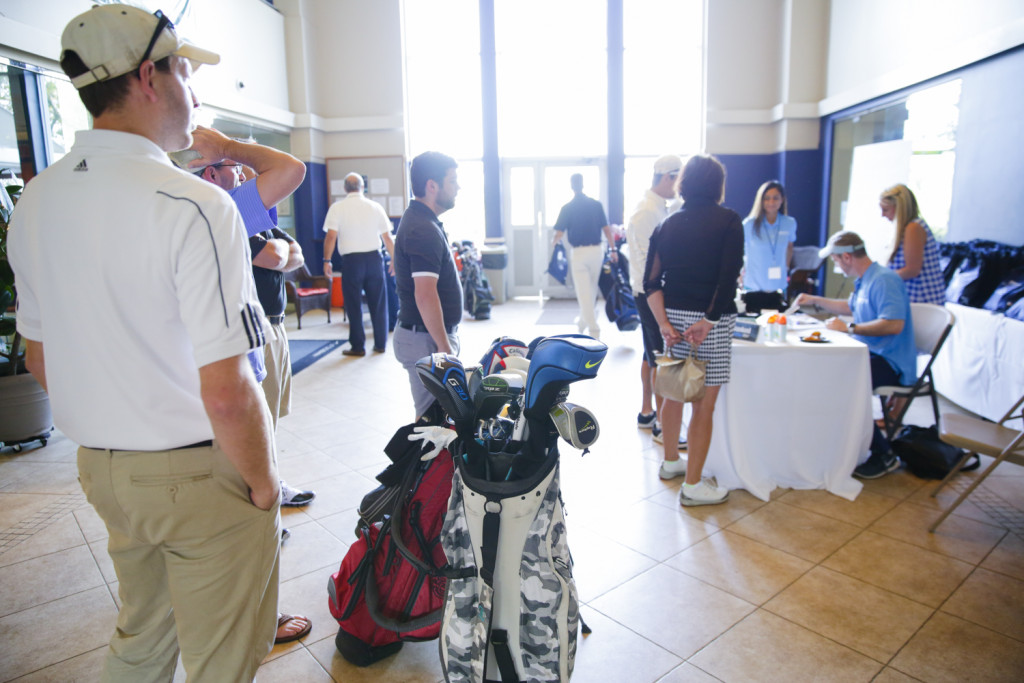

August 29, 2017Thanks to Marine Park Golf Course in Brooklyn, NY for having us! And thanks to all who came and sponsored!

The deBanked Golf Outing 2017 Was a Success

August 28, 2017 Thanks to everyone that attended deBanked’s first ever industry golf outing at Marine Park Golf Course in Brooklyn, NY. And thank you to all the sponsors who helped make it a success!

Thanks to everyone that attended deBanked’s first ever industry golf outing at Marine Park Golf Course in Brooklyn, NY. And thank you to all the sponsors who helped make it a success!

A PHOTO ALBUM IS NOW LIVE

- SOS Capital

- Elevate Funding

- Hudson Cook, LLP

- Yellowstone Capital

- Signature Printing & Consulting

- Grassi & Co

- Central Diligence Group

- Sure Funding Solutions

- Unique Funding Solutions

- Imperial Advance

Official photos from the event should be available soon. In the meantime, follow us on Instagram to see them when they come out.

P.S. The inaugural conference for MCA and business loan brokers is COMING SOON. Visit http://brokerfair.org to receive updates on Broker Fair 2018.

Journalist Barred From Being a Director of a UK Firm

August 21, 2017 George Popescu, owner of Lending Times, and the winner of the 2017 LendIt Awards for best journalist coverage, has been banned from acting as a company director in the UK for 12 years, according to the government’s Insolvency Service. The ban stems from his tenure as a director of a company called Boston Prime.

George Popescu, owner of Lending Times, and the winner of the 2017 LendIt Awards for best journalist coverage, has been banned from acting as a company director in the UK for 12 years, according to the government’s Insolvency Service. The ban stems from his tenure as a director of a company called Boston Prime.

George Alex Popescu (“Mr Popescu”) breached his fiduciary duties to act in the best interest of Boston Prime Limited (“Boston Prime”) and/or failed to ensure that both Boston Prime, as the regulated firm, and him individually, as the approved person, complied with the Financial Conduct Authority (“the FCA”) rules and guidance.

$6.2 million was transferred out of the company to a company named FXDD. Boston Prime’s receiver is presently suing FXDD seeking the return of the funds to the company. Proceedings are ongoing. Mr. Popescu is not under investigation and there are no legal proceedings at this time against Mr. Popescu.

Meanwhile in the US, Popescu has raised millions of dollars for his latest company, Lampix, by conducting an initial coin offering for Pix tokens. Lampix reports having raised 52921.88 ETH to-date, currently valued at more than $17 million.

A month ago, the SEC issued a warning about these kinds of offerings.

“Recently promoters have been selling virtual coins or tokens in ICOs. Purchasers may use fiat currency (e.g., U.S. dollars) or virtual currencies to buy these virtual coins or tokens. Promoters may tell purchasers that the capital raised from the sales will be used to fund development of a digital platform, software, or other projects and that the virtual tokens or coins may be used to access the platform, use the software, or otherwise participate in the project. Some promoters and initial sellers may lead buyers of the virtual coins or tokens to expect a return on their investment or to participate in a share of the returns provided by the project. After they are issued, the virtual coins or tokens may be resold to others in a secondary market on virtual currency exchanges or other platforms.

Depending on the facts and circumstances of each individual [Initial Coin Offering] ICO, the virtual coins or tokens that are offered or sold may be securities. If they are securities, the offer and sale of these virtual coins or tokens in an ICO are subject to the federal securities laws.”

Lampix is not licensed to sell securities and they claim their tokens are not securities.

Catching Up With Marketplace Lending – A Timeline

August 13, 20175/17 – Funding Circle surpassed Zopa in cumulative lending to become the UK’s biggest marketplace lender

5/18 – Breakout Capital announced appointment of Douglas J. Lanzo as EVP and General Counsel

5/22 – The New York State legislature held a joint hearing on online lending

5/25

- OnDeck had the maturity date of its $100M credit facility extended

- China Rapid Finance reported Q1 net revenue of $10.5M

- Prosper Marketplace closed $495 securitization transaction

- SoFi co-founder Dan Macklin announced his departure from the company

5/31 – IOU Financial reported Q1 results, had $1M loss on $4.3M in revenue and lent (CAD) $22.1M

6/2 – Zopa began allowing investors to sell loans that have previously been in arrears

New York State legislators proposed the formation of an online lending task force

6/6 – deBanked and Bryant Park Capital published their Q1 confidence index in which industry CEOs scored their confidence in the continued success of the MCA and small business lending industry at 73.8%, the lowest level since the survey started in Q4 2015. It peaked at 91.7% in Q1 2016.

6/8 – Amazon surpassed $3 billion in loans made to small businesses since their lending program launched

6/9 – RealtyMogul announced that they had exited the residential fix-and-flip market

6/12 – The US Treasury published a report that called for the repeal of Section 1071 of Dodd Frank

6/13

- SoFi applied for a bank charter, specifically an Industrial Loan Company charter

- Lendio announced a pilot agreement with Comcast business

6/14 – Patch of Land expanded its debt facility from $10M to $30M

6/19 – Goldman Sachs’ online lender Marcus surpassed $1 billion in loans made since inception

6/20 – Former Lending Club CFO Carrie Dolan joined Metromile, an insurance company, as CFO LendingTree acquired MagnifyMoney

6/21 – Pearl Capital secured $15M in financing from Chatham Capital Management

6/27

- Square Capital announced that it will pilot a consumer loan program

- Former RapidAdvance CFO Rajesh Rao became the CFO at Beyond Finance, Inc.

6/29

- Funding Circle hired Joanna Karger as US Head of Capital Markets and Richard Stephenson as US Chief Compliance Officer

- Pave suspended lending operations

- Ron Suber, president of Prosper Marketplace, announced that he was stepping down from the company

- The SEC announced that all companies will now be able to submit draft IPO registrations confidentially, a perk previously only reserved for businesses designated as “emerging growth companies” under the JOBS Act.

6/30

- PayPal Holdings Inc announced that it had invested in LendUp

- Yellowstone Capital announced that they had funded $47 million to small businesses in the month of June

7/3 – Funding Circle announced that Sean Glithero had joined the company as its new global CFO

7/5 – Lending Club appointed Ken Denman to its Board of Directors

7/6

- CAN Capital announced that they had been recapitalized and were resuming funding operations

- Orchard Platform and Experian announced a strategic collaboration on data

7/7

- CFPB announced that it was extending the deadline of its small business lending RFI from July 14th to September 14th

7/10

- China Rapid Finance announced that they had made 20 million cumulative loans since inception

- CFPB announced new arbitration rule that effectively bans class action waivers from consumer finance contracts

- Former OnDeck VP of External Affairs and Associate General Counsel Daniel Gorfine, was appointed by the Consumer Future Trading Commission to be Director of LabCFTC and Chief and Innovation Officer

7/11

- dv01 and Upgrade (Former Lending Club CEO Renaud Laplanche’s new company) announced a strategic reporting partnership

- PayPal hired former Amazon executive Mark Britto to lead its lending business

- Fora Financial expanded its credit facility led by AloStar

See previous timelines:

4/6/17 – 5/16/17

2/17/17 – 4/5/17

12/16/16 – 2/16/17

9/27/16 – 12/16/16

Yellowstone Capital Originated $45M in Funding in July

August 1, 2017NJ-based Yellowstone Capital originated $45 million in funding for small businesses last month, according to a company email obtained by deBanked. Two sales reps alone funded 170 deals and 139 deals respectively for a combined $7.45 million.

The monthly volume was only $2 million shy of the $47 million originated in June.