Industry News

Ascentium Capital Surpasses $4 Billion in Originations

April 18, 2018 Texas-based lender Ascentium Capital announced last week that it had surpassed $4 billion in origination volume since the company was founded in 2011.

Texas-based lender Ascentium Capital announced last week that it had surpassed $4 billion in origination volume since the company was founded in 2011.

The company has two key channels of business. The vendor channel, in which Ascentium creates custom finance programs for clients like equipment manufacturers, distributors and resellers. It calls these clients its “vendor partners.”

“We do a lot of our business with vendor partners, typically [a company] selling something to a small business,” said Ascentium Capital CEO Tom Depping.

The other business channel is a direct channel where Ascentium makes direct loans to small and medium sized businesses of up to $250,000. Depping told deBanked that the company’s direct channel makes up about 30 to 40 percent of its business. Not an insignificant percentage. But he said that the company’s primary business is equipment finance via vendor partners.

Ascentium gets its leads from an internal sales team of 120 people and Depping said that he anticipates adding 50 additional sales people this year. Why the significant growth?

“Our award-winning finance platform, elevated levels of efficiencies and our personalized service continue to drive demand for our financial products,” said Depping. “Everything with us is very simple and very fast.”

The company currently employs 250 people with headquarters in Kingwood, TX, near Houston, with smaller offices in Dover, NH and Irvine, CA. Depping also counts 30 to 40 locations throughout the country where Ascentium Capital sales people either work from home or in micro-offices of one to two people.

CAN Capital Hires New CFO

April 17, 2018 CAN Capital has just hired Tom Davidson, a finance veteran, to become its new CFO. Davidson joins CAN Capital from Sierra Auto Finance where he was Chief Financial Officer and Chief Capital Officer. Before that, he worked at GE Capital for 16 years, eventually becoming Chairman and CEO of GE Capital Markets, Inc.

CAN Capital has just hired Tom Davidson, a finance veteran, to become its new CFO. Davidson joins CAN Capital from Sierra Auto Finance where he was Chief Financial Officer and Chief Capital Officer. Before that, he worked at GE Capital for 16 years, eventually becoming Chairman and CEO of GE Capital Markets, Inc.

“Given that we’re growing rapidly and looking to expand our business significantly, we were looking for someone with the kind of experience Tom has,” CAN Capital CEO Parris Sanz said. “Mainly an expert in capital markets [with] great experience and expertise with securitizations, treasury and investor relations. [The decision to hire Davidson] is reflective of our future growth plans and the speed with which we expect to be growing.”

CAN has funded more than $200 million to small businesses since their rebirth in July last year. Between term loans and MCA funding, Sanz said that CAN Capital’s business is about 80 percent term loans and 20 percent MCA.

“It’s rare to have the opportunity to join a company that is a genuine pioneer in its field and also so well-positioned for future growth,” Davidson said. “[Also] what attracted me to CAN Capital is the opportunity to serve the small businesses that form the backbone of the American economy.”

Davidson will be replacing Ray De Palma who is staying on at the company in the role of Chief Accounting Officer. Founded in 1998, CAN Capital celebrates its 20th anniversary this year. It has about 150 employees spread across three offices in New York, Georgia and Costa Rica. The bulk – about 120 employees – are in Georgia. The executive and accounting teams are located in New York and part of the company’s IT team is based in Costa Rica.

Kabbage to Acquire Orchard Platform Markets

April 14, 2018Update 4/26/18: The acquisition is now confirmed

Kabbage is set to acquire Orchard Platform Markets, a provider of lending data and investment advisory services, according to a Bloomberg report yesterday. However, neither company has confirmed this and both companies were unreachable today.

Kabbage is set to acquire Orchard Platform Markets, a provider of lending data and investment advisory services, according to a Bloomberg report yesterday. However, neither company has confirmed this and both companies were unreachable today.

Orchard was founded in 2013 by David Snitkof, Angela Ceresnie, Jonathan Kelfer, Matt Burton and Phil Rosen. Burton and Kelfer both worked previously at Google and Snitkof and Ceresnie worked at Citigroup and American Express. The company has raised nearly $60 million in three rounds, according to Crunchbase, and investors include Spark Capital, Thrive Capital, as well as Vikram Pandit, former CEO of Citigroup and John Mack, former CEO of Morgan Stanley. Indeed, no shabby group.

As this acquisition has not yet been confirmed, the amount Kabbage might be paying for the company is also unknown. According to Orchard’s website, it employs 31 people (including executives) in an office in Manhattan’s Flatiron district, known as a hub for tech startups. The Bloomberg story indicates that co-founders Burton and Snitkof will join Kabbage at its New York office. Founders Ceresnie and Rosen no longer work for Orchard. With headquarters in Atlanta, Kabbage is one of the largest small business lenders in the country and recently launched a new feature of its loan product at LendIt.

Despite the big name investors Orchard had when it started, some suspect the company may have lost momentum. deBanked called a number of leaders in the alternative lending space and none were willing to comment until the acquisition was made certain.

World Business Lenders Responds to the New York Post Story

April 13, 2018

A controversial story published in the New York Post earlier this week about World Business Lenders has drawn a response from the company. The text below was circulated by email to all World Business Lenders employees. With permission, it is being republished here.

——-

As you may be aware, an article appeared earlier this week in a local tabloid which described entirely unsubstantiated allegations against our company and members of its senior management team made by a disgruntled former employee. Because the allegations are as inflammatory as they are baseless, I thought you should hear from me, since I am responsible for the day-to-day operation of the company’s business and ensuring compliance with its policies. Nevertheless, I am accountable to WBL’s Board of Managers. As soon as we became aware of these false allegations, we alerted the Board, including retired U.S. Congressman Edolphus Towns, who chairs the Board committee which focuses on WBL’s reputation in the business community. During his many decades of distinguished service to our country, Congressman Towns chaired the U.S. Congressional Black Caucus and the U.S. Committee on Oversight and Government Reform.

First, the allegations of race discrimination are patently false. I am very proud of WBL’s unwavering commitment to the practice of providing equal employment opportunities to all of its employees and applicants; our company has zero tolerance for employment discrimination or retaliation of any type. And, I want to remind you that, if at any time you feel you are being treated unfairly at work, for any reason, WBL’s policy encourages you to surface and escalate such concerns.

Second, I want to address this disgruntled employee’s outrageous and untrue allegations that WBL defrauded the State of New Jersey. Since we moved to Jersey City in 2016, we have been welcomed with open arms by the State and maintained a cooperative and constructive relationship. WBL has participated in and supported State programs designed to provide employment to some of New Jersey’s most vulnerable residents. We continue to enjoy our partnerships with various State agencies, including our ongoing grant from the Economic Development Authority. To be clear, at no time has any agency of the State of New Jersey expressed any concerns or reservations about our Company or its activities. Rather, we have been commended for our contributions to the economy, both locally and on a state-wide basis.

Finally, I want to assure you that WBL is not in the habit of succumbing to poorly veiled financial demands, and we will not do so here.

– Doug Naidus, CEO

The March/April 2018 Edition Has Shipped

April 13, 2018

The March/April 2018 edition of deBanked Magazine has shipped! The print version is distributed before all of the content is republished online so if you want to be one of the first to read our exclusive stories, make sure you’re subscribed. It’s FREE.

This issue, which will also be distributed at Broker Fair on May 14th, offers tips for more successful marketing, an in-depth discussion about merchants that are behaving badly, and a story that examines the impact of last year’s major hurricanes on the industry. There’s more of course, which is why it’s great to be a free subscriber.

On another note, Broker Fair is now just a month away. I can’t wait to see you there!

Lendio’s New Turndown Program Grows

April 11, 2018 Lendio, the marketplace for borrowers and lenders, announced on Monday that its Turndown program has facilitated nearly $60 million in loans in less than a year since its launch last summer. The Lendio Turndown program allows participating lenders to refer borrowers to the Lendio marketplace that have been declined.

Lendio, the marketplace for borrowers and lenders, announced on Monday that its Turndown program has facilitated nearly $60 million in loans in less than a year since its launch last summer. The Lendio Turndown program allows participating lenders to refer borrowers to the Lendio marketplace that have been declined.

“Instead of just saying ‘No’ to a customer and wishing them the best of luck, we’ve established this Turndown program where a lender can say ‘Unfortunately, [you’re] not a great fit for us, but we work directly with Lendio and they have a marketplace and other loan options,’” Lendio CEO Brock Blake told deBanked.

The lender has an incentive to refer a declined customer to the Lendio marketplace because the lender gets a revenue share if the customer it declined is funded by another lender on the Lendio marketplace.

“We’re very excited about the Turndown program because it allows us to deepen the relationships we have with our lenders…and it also helps [lenders] monetize and recoup some of their marketing spend,” Blake said.

While the Turndown program started in beta about two years ago, it wasn’t launched until the second quarter of 2017. So far, the program has 20 lender partners, some of which are not the same as the 70 participating lenders on the Lendio marketplace platform. Blake told deBanked that he hopes all 70 lenders will join the Turndown program, as well others, including banks.

Blake also said that most people think a “turndown” automatically means that a borrower has across-the-board bad credit. He concedes that this could be the case, but also acknowledged that there are a variety of loan products that have different credit requirements.

“If a borrower comes in for an equipment loan and they are not going to qualify for an equipment loan, then they might be declined,” Blake said. “But they might qualify for a working capital loan.”

Based in Salt Lake City, UT, the company was founded in 2011 and also has an office in New York. Of about 150 employees, 100 work at the headquarters in Salt Lake City and 50 work in New York.

Best Egg Exceeds $5 Billion in Loans

April 11, 2018 Now four years old, the consumer-lending platform Best Egg has delivered more than $5 billion in personal loans. The Wilmington, DE-based lender does not offer business loans. However, Best Egg CEO Jeffrey Meiler told deBanked that they are increasingly making loans to people who are self-employed.

Now four years old, the consumer-lending platform Best Egg has delivered more than $5 billion in personal loans. The Wilmington, DE-based lender does not offer business loans. However, Best Egg CEO Jeffrey Meiler told deBanked that they are increasingly making loans to people who are self-employed.

“Structurally, one of the things that has really been a tailwind to this industry is the whole move to the gig economy and people having income that is less regular,” Meiler said. “It has increased demand for what we provide.”

Meiler is referring to, among others, freelancers, who are essentially one-person businesses. Best Egg specializes in personal loans with repayment periods of either 36 or 60 months. Some loans are used for large purchases while the majority are used for consolidating debt or refinancing.

“We mostly cater to people who want to get out of debt,” Meiler said.

Best Egg does all of its marketing internally and has 280 employees.

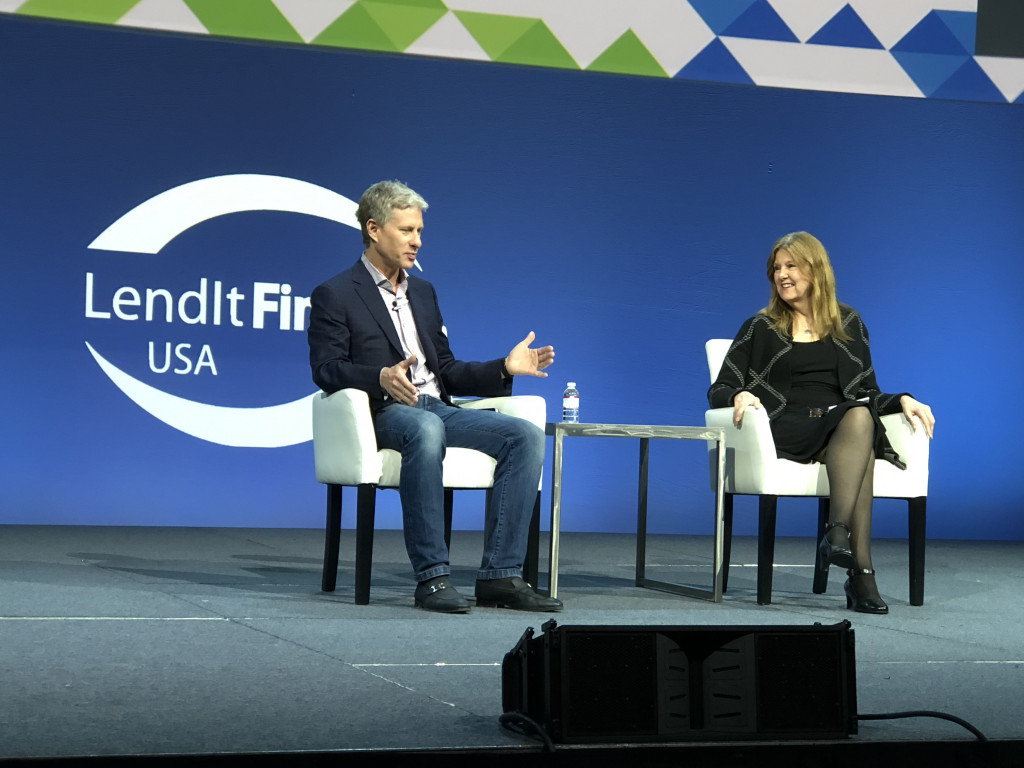

LendItFintech In Photos and Sound Bites

April 10, 2018

when speaking about the increase in mortality rate for people who have faced major financial distress

when interviewed by Jo Ann Barefoot

When asked by Bloomberg Technology reporter Emily Chang if Goldman Sachs would be considered a competitor

when interviewed by Lendio’s Brock Blake

When asked who will win the race for marketshare

When asked if it’s harder to underwrite loans above $50,000

talks business at the company booth

Below: Ocrolus account executive John Lowenthal stands in front of the company booth