Fintech

Chris Larsen on Crypto, Ripple, and ICOs

April 24, 2018 At LendIt Fintech, Ripple co-founder and Chairman Chris Larsen got real in his on-stage conversation with Jo Ann Barefoot. This is what you missed:

At LendIt Fintech, Ripple co-founder and Chairman Chris Larsen got real in his on-stage conversation with Jo Ann Barefoot. This is what you missed:

I think this is a fundamental shift in fintech and what we believe the big thing happening here is the development of a second internet. We call it the internet of value so that value, money, assets will begin moving as quickly and efficiently as data has been moving for the last 25 years

Using SWIFT is like sending a letter. You know, when drop it in the mailbox, you have no idea where it is, if it got there or not. So, getting away from that I think is profound. And what we would say is that, you know, a lot of the backlash from globalization today, it’s not because globalization is bad. It’s essential. It’s that it’s incomplete because globalization needs kind of 3 key systems to be working together and it needs interoperability and data.

I think all new technologies start with a, you know, screw the government, disruption, tear everything down. So, I think that’s natural and then, you know, the internet started that way too and then it has to sort of grow up. And particularly, it’s solving real world problems. Real world problems are always more complicated than that. And then when you switch to finance, this is different. Right? You know, the internet was mostly technology. Mostly. It’s just now kind of crashing into regulatory issues.

I think on some of the other things like ICOs, we’re pretty anti-ICO. I think it’s a bad thing to get involved with from the founder’s perspective because, you know, if you’re a founder and you can raise money many ways today, do you really want to do something where you’re going to have the SEC, you know, kind of threat hanging over your head for 10 years with strict liability? You just don’t want that. You know, that’s a problem.

[..]From building currencies, digital assets, ICOs typically say, “Okay. There’s a currency for this use case and none other.” That’s kind of the opposite of the way it should go. Currencies need to be as liquid as possible. And so, they’re going to have as many use cases as possible. For XRP for example, the kind of early beachhead has been cross border payments, but we see that as just the beginning of something that really has a multitude of use cases. To get as liquid as possible, that’s what drives utility and value at the end of the day. So, I think in all fronts ICOs are problematic and that’s why you’re seeing the regulators crack down on them, not everywhere, but I think they’ll be transformed. They’ll probably look like, you know, IPOs at the end of the day.

Harvesting Inc Uses AI to Assess Credit Risk for Farm Lenders

April 12, 2018 This week, Silicon Valley-based Harvesting Inc launched an Artificial Intelligence (AI)-backed platform that uses satellite images of farms to gauge credit risk for banks that lend to farmers.

This week, Silicon Valley-based Harvesting Inc launched an Artificial Intelligence (AI)-backed platform that uses satellite images of farms to gauge credit risk for banks that lend to farmers.

The technology can be used to capture data on farms in the developing world as well as in mature markets like the US. Harvesting Inc generates “credit scorecards” using satellite imagery of farms and other data points, already in the works in the African market.

“Think of us as someone who calculates the language of agriculture [into] the language of finance,” Garg said.

Garg told deBanked that because small farmers in emerging markets don’t have credit cards, let alone smartphones, they have no credit history and their creditworthiness can’t be evaluated through a traditional Western banking system. That’s where Harvesting Inc comes in. It evaluates a farmer’s asset (his or her farm) in a completely objective way – through satellite images of the crops and by using historical data about past seasons.

Using satellites to assess farms is not brand new. However, Garg said that satellite data has typically been used by farmers in developed countries to see more clearly how their crops are performing. Harvesting Inc’s use of satellite data is meant to better inform lenders (mostly national and regional banks in developing countries) about the farms they have lended to or are considering lending to. In many countries, national banks are required to make loans to farmers. Garg said that in India national banks must have 18 percent of their loans assigned to agriculture.

Harvesting Inc is not a lender. Instead, it sells its credit risk technology mostly to banks in emerging markets. However, Garg told deBanked that some American banks have approached him with interest in their new AI product.

“Banks have processes today,” Garg said, “but we believe [our AI technology] will be able to provide faster and more accurate data.”

Harvesting Inc was founded by Garg in 2016 and has 12 employees. The primary office is in Silicon Valley, with another office in Bangalore, India.

LendItFintech In Photos and Sound Bites

April 10, 2018

when speaking about the increase in mortality rate for people who have faced major financial distress

when interviewed by Jo Ann Barefoot

When asked by Bloomberg Technology reporter Emily Chang if Goldman Sachs would be considered a competitor

when interviewed by Lendio’s Brock Blake

When asked who will win the race for marketshare

When asked if it’s harder to underwrite loans above $50,000

talks business at the company booth

Below: Ocrolus account executive John Lowenthal stands in front of the company booth

Peer IQ Insights for Q1 2018

March 30, 2018Peer IQ released its 2018 first quarter “Lending Earnings Insights,” which analyzes lender performance with a focus on credit performance trends. They analyze data across three main lender segments: Fintechs and Non-banks, Large banks, and Card issuers. Below are some highlights from Peer IQ’s analysis on this year’s first quarter:

Credit re-normalization continues

“Credit re-normalization continues across all major lending groups. Credit performance this quarter is mixed. We observe improvements, and record low delinquencies from ONDK, OMF, and FinTechs in particular. LendingClub expects 31 bps lower charge-offs going forward due to tighter credit standards. At Discover – a bellwether for personal loan performance – the net charge off rate jumped 92 bps YOY to 3.62% – the largest increase in several years.

Card issuers

“Card issuers are increasing loan loss reserves at a higher rate than loan growth, indicating expectations of higher losses going forward. American Express increased loan loss provisions 33% although loan growth was only 14%.”

Banks and FinTech

“Bank FinTech partnerships, and M&A continues. Banks are either partnering with FinTechs or investing in beefing up their technology capabilities in payments, lending, digital banking and wealth management. Banks like JP are partnering with Amazon by rolling out co-branded checking accounts and credit cards. A specter is haunting financial services – the specter of Amazon.”

Lenders Pass the Buck on to Borrowers

“Lenders are taking actions to pass rising rates on to borrowers to protect margins and investor returns. Lenders are also trying to reduce all-in funding costs by reducing the credit spreads on their securitizations.”

A Dialogue with Peter Renton: Cryptocurrency and Beyond

March 2, 2018

deBanked Magazine recently caught up with Peter Renton, founder of Lend Academy, a leading educational resource for the marketplace industry. Through his writing, podcasts and video courses, he’s been helping multitudes of people better understand the industry since 2010. Renton is also the co-founder of LendIt, one of the world’s largest fintech conventions, which recently branched out beyond its marketplace lending focus to include other types of fintech. The flagship U.S. conference will take place April 9 through April 11 in San Francisco. The following is an edited transcript of our discussions.

deBanked: Why did you decide to rebrand LendIt as LendItFintech?

Renton: The main reason is that we have moved beyond the online lending space. While it’s still the core of what we do, it’s not all of what we do anymore. Many of the large online lenders have also moved beyond online lending. Lending is part of financial services, but our attendees want to know what else is important. Our attendees also want to look at other opportunities for expansion. They want to know how other areas of fintech are going to affect their business—topics such as blockchain and digital banking. LendItFintech tells people that lending is what we focus on, but it also makes clear that we’re about more than lending.

deBanked: In addition to your marketplace lending investments, you entered into the cryptocurrency space back in early 2015. Tell us what you’re doing now with respect to cryptocurrency?

Renton: This was not something that I spent much time thinking about back then. At the time, I expected bitcoin to never amount to anything. But I’m interested in financial innovation and I decided to give it a go. I never thought in my wildest dreams that it would get to $10,000. (Editor’s note: In 2017, bitcoin climbed to nearly $20,000; in early February it fell below $8,000 for the first time since Nov. 2017)

I opened up a Coinbase account with $2,000, which got me 10 bitcoins. I have since sold a portion of it gradually as the price of bitcoin went up, and I diversified into a handful of other coins as well. I have recently moved a significant portion of my investment into a privately managed cryptocurrency fund, and I still maintain my Coinbase account too.

deBanked: How are things different now than when you first entered the digital currency market?

Renton: In January 2015, I created my bitcoin account and I don’t think I ever logged in over the next 18 months, or if I did, it was maybe just once or twice. No one was talking about bitcoin back then. It was still on the fringe of fintech. Sure, there were some people focused on it, but it wasn’t part of mainstream media coverage. Then, all of a sudden, it became hot because people love get-rich-quick schemes and hearing about people who hit the big time from nothing. These stories really fuel people’s imagination. Then suddenly bitcoin became one of the biggest phenomena of 2017; no one would have predicted a few years ago that would happen.

deBanked: What are the biggest risks you see with cryptocurrency today and how can investors best overcome these challenges?

Renton: Many people are buying purely on speculation with no thought that bitcoin could go down in price. You hear of people buying bitcoin on their credit card and paying 20 percent interest on that purchase. It’s insane. I feel that cryptocurrencies are here to stay, but I don’t like that they have these massive 20 percent to 30 percent swings in a day. The speculators have helped drive the price up, but they’ve also driven the volatility up and that’s been a bad thing.

deBanked: Do you think cryptocurrency will ever dethrone cash? If so, what will it take to get to that point?

Renton: I feel that some kind of digital currency is inevitable—but whether it’s a Federal Reserve-backed currency or something else remains to be seen. I have an 11-year-old and a 9-year-old and I am confident that at some point in their lifetime there will be no such thing as cash. In China, for example, there are some places where you can’t even use cash. You can go to a street vendor and buy a piece of fruit with your phone. Certainly in the U.S. we’re not there yet, but I think China shows where we are going to be.

Cryptocurrency is only one type of digital cash, and it’s hard to say how it will ultimately fit into the larger picture. To dethrone cash as we know it today, cryptocurrency needs to be a quick and efficient way of transacting, and right now it’s not quick and it’s not cheap.

That said, I believe there will be some kind of digital currency in the future. It will take a long time for the Federal Reserve to say cash is no longer legal tender, but I expect we’ll see some kind of digital currency in the next 10 years for sure.

deBanked: How do you think regulation will change the cryptocurrency landscape? Is it inevitable and, more importantly, do you think regulation of cryptocurrency is necessary to take it beyond the level it is today?

Renton: Right now bitcoin is not systemically important. At a market cap of around $156 billion in early February, if something happens and it completely crashes, it won’t make a dent on the U.S. or world economy. But if bitcoin continues to rise and reaches a market cap of say $16 trillion, and then it falls to zero, that would reverberate around the world. The largest economies that have the most bitcoin would be the most impacted.

At some point governments will step in with regulation. It’s already happening in places like China and South Korea and there are rumors of other governments taking action. I don’t think the largest governments will allow their economy to be at the whim of speculators.

deBanked:deBanked: How do you feel about the SEC stepping into regulate ICOs? Is this necessary to protect investors?

Renton: There are certainly some ICOs that are complete scams while others are obviously violating securities laws. But many ICOs have strong legal teams supporting them and are doing it right now. The SEC should absolutely clamp down on those doing the wrong thing, but my hope is that they don’t overreact and throw the baby out with the bathwater.

deBanked: What about online lending? The industry has gone through a lot of changes in its relatively short history. How do you expect to see the competitive landscape change in the next year or so? What about farther out?

Renton: The online lending space has gone through a lot of changes in its short history. I feel like the biggest trend we’re seeing right now is banks launching their own platforms. Take Goldman Sachs with the Marcus online lending platform, for example. More than anything else that has happened in the history of online lending that is among the most telling for the future, I think. Goldman has gone all in with this effort, and that move woke up all the large banks. Top banks like PNC and Barclays are also launching their own initiatives instead of partnering with others, which was surprising to me. I would have thought there would be more partnerships. There are still some, but several banks have decided to do it themselves rather than partnering. Smaller banks, however, that want to get into the space, will likely partner because they can’t afford to do it themselves. While we have seen a few partnerships develop, I expect we will see many more over the next couple of years.

deBanked: What do you see as the biggest risks for online lenders today? How can they best overcome these challenges?

Renton: As an industry, we have to focus on profitability. Profitability comes down primarily to two things. First, you have to get your cost of acquisition down. Some of the companies that failed recently were never able to get their costs of acquisition down to a manageable level. Underwriting is the second piece. Particularly if you’re a balance sheet lender and you’re not underwriting well, you can’t make money. The pullback in the industry in 2016 occurred because many of the major platforms got a little too aggressive in their underwriting. Investors are still paying for some of those mistakes.

Successful companies are ones that have figured out how to profitably acquire customers and how to underwrite effectively. Most of them have learned their lesson, but in business companies sometimes have short memories. We need to keep a close eye on it.

deBanked: What advice do you have for alternative lenders and funders?

Renton: In addition to paying careful attention to profitability and underwriting, another important piece is having diversified funding sources. You want to make sure that you don’t have one big bank or some other source providing 90 percent of your funding. You should really have different kinds of lending sources. Some loans you can fund through a marketplace, some loans you can fund through your balance sheet. It’s good when you’re not reliant on one particular way of funding your loans.

deBanked: How is regulation likely to impact the online lending industry?

Renton: Having support in Congress for the online lending space is important. Congress hasn’t devoted a lot of attention to it in the past few years, but it’s starting to. The Madden decision—which has the potential to lead to significant nationwide changes in consumer and commercial lending by non-bank entities—has created uncertainty in the industry. In states affected by the decision (Connecticut, New York and Vermont) already there has been less access to credit. I’m hopeful that Congress moves ahead with legislation to override the Madden decision that’s having such an impact in the Second Circuit states. People are worried that it could expand nationwide and Congress needs to act so there’s clarification. There’s too much uncertainty right now.

deBanked: Several platforms have closed their doors in the past year or so. Do you expect to see this trend continue?

Renton: There are companies out there still trying to raise money and struggling to do so. That’s a healthy thing for an industry. You want the strong players to survive and thrive and for the weaker ones to go away.

deBanked: How big do you think an online lender has to be to thrive?

Renton: There’s no doubt that scale is important. If you’re a small player, you have to have some kind of niche in order to acquire customers. If you have that, you have the ability to compete. Even with that sometimes, it’s going to be difficult. It’s a pretty complex business. You need to have a lot of staff for compliance and operations and that can be expensive. When you have high fixed costs, you have to have scale to be able to make a profit. That said, I think there’s room for more than just the ultra-large players in the online lending space. I think there will be plenty of opportunity for strong, well-positioned medium-sized players to compete.

deBanked: What about M&A in the industry?

Renton: Valuations at many of the large platforms are way down from where they were several years ago. As long as valuations stay depressed, I think we could see a big acquisition of a major platform this year. Some of these platforms have millions of customers. Having the ability to pick up such a large number of customers instantly through an acquisition could be compelling for the right buyer, such as a large bank.

deBanked: Is this a good time or a bad time to be an online lender in your opinion?

Renton: It is still a good time to be an online lender. We are expanding access to credit and making the world a better place. I have never been more excited about the industry than I am today.

Ron Suber: ‘This Industry Will Look Very Different One Year From Now’

February 25, 2018 Ron Suber wears many hats. His official LinkedIn profile lists him as President Emeritus and Senior Advisor at Prosper Marketplace. Now you can add a new title to his repertoire – the Magic Johnson on fintech. That’s because when it comes to Suber’s legacy, he’s all about the passing game.

Ron Suber wears many hats. His official LinkedIn profile lists him as President Emeritus and Senior Advisor at Prosper Marketplace. Now you can add a new title to his repertoire – the Magic Johnson on fintech. That’s because when it comes to Suber’s legacy, he’s all about the passing game.

“I really enjoy the assist in basketball more than the score or the dunk and so I’m trying to be that leader of assists in our industry, Magic Johnson, if you’ll let me use that analogy … I want to be him for our industry and help everybody win and help the whole thing be bigger, but you have to give the ball to the people in the position where they can score and that’s what I’m trying to do,” said Suber in a podcast discussion with Lend Academy’s Peter Renton, who is also a co-founder of LendIt.

Since Suber stepped down as president of Prosper, his presence in marketplace lending and fintech only seems to have blossomed, which in hindsight may have been the plan all along. The godfather of fintech, as he’s also known, is in the midst of what he’s dubbed a professional rewiring, one that didn’t prevent him from participating in a podcast with Renton.

During the discussion, Suber didn’t shy away from any topic, fielding questions on everything from his investment portfolio, to Prosper, to travel and his views on marketplace lending and fintech. His travels have taken Suber to Patagonia and the straits of Magellan to his favorite Aussie city of Melbourne. Next up Suber plans to explore Africa, including Rwanda and Tanzania.

Suber on Aussie IPO Credible

Suber on Aussie IPO Credible

San Francisco-based Credible, a consumer finance marketplace for millennials, just raised $50 million in an Australian IPO. Suber, who serves as chairman of the fintech, got to know Credible CEO Stephen Dash a few years ago. When Dash needed to raise money, Suber was the first to work with other fintech influencers including a group in Asia to invest $10 million in the company at a $40 million valuation.

Credible followed up with another equity round before deciding to IPO in Australia, where the market is different versus the United States or Hong Kong.

“We were able to meet with the asset managers, the family offices, and the superannuation funds and some of the pension funds in Asia, Hong Kong in particular, and throughout Australia who were very supportive of Stephen Dash, who is from Australia,” said Suber, adding that Credible was the biggest tech/fintech IPO in Australia last year.

Incidentally, Suber has also met with Australia Treasurer Scott Morrison, who sparked a meeting with Suber, Dash, US cryptocurrency exchange Coinbase and other members of the payments market to discuss how Australia can engage with young US entrepreneurs.

We asked Suber what to expect with crypto and lending, in response to which he told deBanked: “Like the very early days of the internet, there were lots of dot-com companies with high valuations in the hype cycle, little revenue and unclear long-game solutions…think Amazon. Big winners emerged, and the majority lost money on the early bets. The same is true for cryptocurrencies. Enormous winners will emerge. In my opinion, the winners include CoinBase, Ripple and Ethereum.”

Suber on Prosper

While Suber has moved on from an executive role at Prosper, he remains engaged with the company and is close with the leadership team, including CEO David Kimball and CFO Usama Ashraf. Suber’s involved across the board, from customer acquisition, to business development and on the capital markets side of things as well.

While Suber has moved on from an executive role at Prosper, he remains engaged with the company and is close with the leadership team, including CEO David Kimball and CFO Usama Ashraf. Suber’s involved across the board, from customer acquisition, to business development and on the capital markets side of things as well.

“It’s again doing close to $300 million a month in originations, it has $100 million in cash it generates cash each quarter, it has its own securitization channel at this time in addition to the consortium … There’s a lot going on there including some product expansion, so there’s no shortage of things to do with Prosper, which I care a lot about,” said Suber.

Suber on Hindsight Being 20/20

Marketplace lending has had peaks and valleys along the way as it has matured from a nascent segment to essentially a transformational influence on the lending space, with its technology touching everything from the business model, to the borrower to the banks.

But if hindsight were 20/20, there are some things he’d do differently the second time around.

He pointed to Prosper’s acquisition of American HealthCare Lending, which he characterized as a “great decision,” giving the marketplace lender an opportunity to tap the healthcare borrower market. But as in any relationship, you can’t change each other.

“We changed American Healthcare Lending too much and tried to make it into something that it just couldn’t be with the point of sale financing. I think the lesson there is it’s great to do an acquisition, but you have to make sure you execute and keep it fresh and focused and successful once you get it,” said Suber, pointing to the acquisition of Tel Aviv’s BillGuard as yet another example of this.

Prosper also took on too much office space around the country.

“Perhaps we could have outsourced a little more instead of all the hiring. Clearly diversifying committed capital and maybe back then even using some of the capital we raised to do these own CLUB deal securitizations, which Prosper does now very successfully with its balance sheet,” he noted.

Suber also urged the marketplace lending market to showcase its technology and unique abilities as “tech-enabled finance companies” more. As the innovator that he is, Suber suggested there should be greater collaboration among marketplace lenders, comparing it to the airline industry. He explained:

Suber also urged the marketplace lending market to showcase its technology and unique abilities as “tech-enabled finance companies” more. As the innovator that he is, Suber suggested there should be greater collaboration among marketplace lenders, comparing it to the airline industry. He explained:

“So, the airline industry is competitive, they’re competing for dollars and seats and people and talented pilots and the best planes, but the reality is they have to work together, they have to make sure that planes don’t crash and that the industry is on time and does lots of good things together… And that’s really what I think we can do better, a better job of as an industry is really working together, competing, but communicating and making sure everybody lands safely.”

Suber on Marketplace Lending

As the godfather of fintech, Suber is often looked to as a guiding voice on the status of the market. That’s why when he says the industry has advanced in innings, it’s revelatory.

“I think we’re in the home stretch, I think we’ve done the seventh inning stretch,” he said. Suber pointed to Asia, where the market has gone from 3,000 platforms to 50 and in the United States where it’s consolidated from 300 to fewer than 100.

“The mature are maturing,” he said,” pointing to a race in which some platforms are pulling away from others in terms of valuation, volume and the ability to engage the industry.

“The separation will continue,” he said. “The industry will look very different one year from now.”

Suber on His Investment Portfolio

If you’ve ever wondered which investment areas Suber believes represent the next opportunity, look no further. He’s “struck” by financial inclusion, in particularly a telecom play Juvo for which he’s an advisor and in which invested a few rounds. Juvo is looking to serve the unbanked in the developing world where they lack financial identities, internet access and smartphones. The company has partnered with the likes of Samsung.

“We talk a lot in the online lending industry about top down, super-prime and prime and near prime; this is my way of coming from the bottom up with technology and data and finance to be involved in financial inclusion. I’m really quite excited about that one,” said Suber.

He also likes startup Unison and the emerging fractionalization of the home equity market, which he characterizes as “the next big thing.” In addition to Suber, this market has attracted the likes of Marc Andreessen.

Suber has nearly 20 investments in private companies, including payment companies, financial inclusion and lending. He’s also become a debt investor to some online lenders, invoice finance plays among others. “I’ve really enjoyed the debt side of investing as much as the equity side,” he proclaimed.

Suber on Broader Fintech

In addition to marketplace lending, Suber is also a believer in the point-of-sale (PoS) solution and invoice finance companies, which he says are “fixing the way invoicing is financed and making it better, cheaper and quicker.” And in taking an overarching view of the market, he also likes the cleantech, pointing to solar fintech play Mosaic and a company called CleanCapital.

Suber on Rewiring

Suber on Rewiring

Suber is a big believer in rewirement, both in his personal life and in business. He defines it as “redesigning one’s life personally and professionally.” Before he applied it to his career, Suber and his wife Caryn pursued a rewirement in their personal lives, one that included selling their home and material possessions, buying a new home and traveling.

In 2017, he decided to do the same thing professionally to strike a better balance in his life. Since then, he’s developed a color-coded regiment by which to live, separating the hours of the week across categories including exercise = blue, personal = green, work = purple and teaching and managing his family office = red.

“There’s a lot of green on my calendar,” he said.

For those interested in rewirement, Suber has launched a blog on the topic, with the maiden couple of entries documenting the first 360 days and counting.

Many of Suber’s quotes here originated from his interview with Peter Renton. Renton is the co-founder of the LendIt Conference.

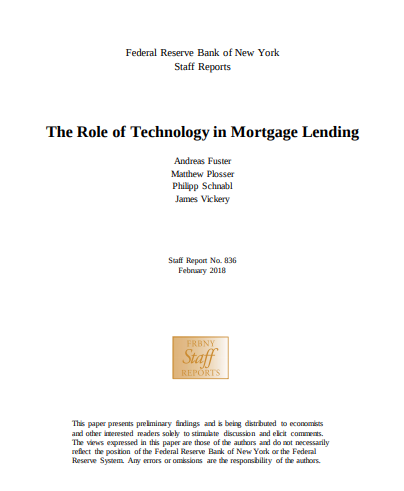

Fed Study Debunks “Lax Screening” Hypothesis Of Fintech Lenders

February 23, 2018 The New York Federal Reserve published the results of their study on the role of technology in mortgage lending. And they bear good news for fintech, that technological innovation has improved the efficiency of financial intermediation.

The New York Federal Reserve published the results of their study on the role of technology in mortgage lending. And they bear good news for fintech, that technological innovation has improved the efficiency of financial intermediation.

Fintech lenders, it turns out, are faster, experience lower default rates, and are more responsive to changes in demand. Faster processing times did not translate into issuing riskier loans, the report concludes.

Fintech lenders were defined as lenders that offer an application process that can be completed entirely online.

The Fed researchers also found little evidence that fintech lenders disproportionately target marginal borrowers with low access to finance. On the Contrary, the data actually shows that fintech borrowing is actually higher among those both older and more educated.

“We find that default rates on fintech mortgages are about 25% lower than those for traditional lenders, even when controlling for detailed loan characteristics,” the report says. “There is no significant difference in interest rates. These results speak against a lax screening hypothesis, and instead indicate that fintech lending technologies may help attract and screen for less risky borrowers.”

The two largest fintech mortgage originators in 2016 were Quicken Loans and loanDepot.

New RealtyMogul CIO Praises the Company’s Avoidance of Land, Hotel and Development Investments

January 23, 2018Los Angeles’ RealtyMogul promoted Chris Fraley from interim chief investment officer to permanent CIO, earlier this month. After the announcement, Fraley told commercial real estate publication, Bisnow, that the company’s “fairly conservative approach” has put it in an optimal position at this point in the current real estate cycle.

“There is certainly a feeling that we are at the top of the cycle given this is one of the longest economic expansions in the past century, from a time perspective,” he told Bisnow. “It is a relief that RealtyMogul has taken a fairly conservative approach by focusing mainly on income investments and light value-add and avoiding traditionally riskier assets like land, hotels and development.”

In 2017, RealtyMogul eclipsed several internal records and finalized transactions holding $566 million worth of capitalization.

Fraley believes that the company can “significantly increase” that number this year.

The Yale grad joined the company in June, bringing over 20 years of experience to the role. Former posts include a tenure as partner at Rockwood Capital, which preceeded the launch of his own real estate investment company, Evolve.

“Being on the operator side of the business really helped me appreciate all the hard work that goes into managing a real estate project,” Fraley said while discussing Evolve with Bisnow. “It has certainly given me greater insight on how to evaluate a potential operating partner as an investor.”

Fraley also shared that when he initially joined the company in an interim capacity in June, he did not intend to stay on full-time.

He gave partial credit for his decision to become a permanent member of the team to the company’s ability to merge research and data with technology.