Fintech

Canada’s Top Lending Leaders of 2021

December 16, 2020 The Canadian Lenders Association released its 2021 Leaders in Lending awards. The association is the voice of Canada’s lending ecosystem and represents more than 100 companies in commercial and consumer lending.

The Canadian Lenders Association released its 2021 Leaders in Lending awards. The association is the voice of Canada’s lending ecosystem and represents more than 100 companies in commercial and consumer lending.

All CLA members are vetted and accredited based on their corporate standards

and values. Their role is to support the highest level of lending in Canada,

servicing a wide spectrum of business and consumer borrowers’ growth requirements.

See previous year’s leading lending companies

See previous year’s leading lending executives

2021 Award Winners:

Lending Woman of the Year

|

Tiffany Kaminsky | Co-Founder of Symend

Tiffany Kaminsky is the co-founder of Symend, a fintech that uses analytics and behavioural science to create individualized debt recovery programs. The startup, which has offices in Calgary, Toronto and Denver, received USD $52 million in funding earlier this year and plans to hire up to 200 more roles in 2021. |

|

Nicole Benson | CEO of Valeyo

Nicole Benson is the President & CEO of Valeyo, a business solutions provider to financial institutions in Canada. Nicole drives every facet of business forward, with a focus on growing, evolving, and innovating Valeyo’s suite of solutions to meet the changing needs of its clients and the financial services industry. |

|

Andrea Fiederer | CMO of goeasy

Andrea Fiederer is EVP & CMO of goeasy, a leader in non-prime financial services with over 2000 employees. Andrea is responsible for goeasy’s overall marketing and brand strategy for both the easyhome and easyfinancial business units. |

|

Elena Ionenko | Co-Founder of Turnkey Lender

Elena Ionenko is the Co-Founder of Turnkey Lender, a loan origination platform. Under Elena’s leadership, the company has entered 50+ local markets, raised over $3.5 million in venture capital and launched regional offices all over the globe. |

|

Minal Shankar | CEO of Easly

Minal is the CEO of Easly, a SR&ED financing firm. This year Minal has doubled Easly’s capital under management & customer base. Prior to leading Easly, Minal was an investment manager for the VC firm Northgate Capital and an associate in the Technology Investment Banking group at J.P. Morgan Chase. Minal holds an MBA from the NYU Stern School of Business. |

Fintech Innovator the Year

|

Flinks

Flinks is a data company that empowers businesses to connect their users with the financial services they want. |

|

REPAY

REPAY is a leading provider of vertically-integrated payment solutions. |

|

VoPay

VoPay seamlessly connects you to the banking ecosystem enabling anyone to offer efficient and simple bank account payment processing. |

|

Fundmore

FundMore.ai is an automated underwriting system that uses machine learning to streamline the Pre-Funding process for loans. |

|

Provenir

Provenir offers a suite of risk analytics tools for lenders to make adjudication faster and simpler. |

Executive of the Year

|

Jason Mullins | CEO of goeasy

Jason Mullins is the President & CEO of goeasy, a leader in non-prime financial services with over 2000 employees. Since joining goeasy in 2010, Jason has helped the company scale to $1 billion in market capitalization with compound earnings growth of 28%. Jason is a recipient of Canada’s Top 40 Under 40 Award. |

|

Wayne Pommen | CEO of PayBright

Wayne Pommen is the CEO and Founder of PayBright, a Canadian leader in the BNPL space. His firm has partnered with 7,000 domestic and international retailers, and has approved over $1 billion in consumer credit. This year PayBright was acquired by Affirm in a $340 million transaction. |

|

Lawrence Krimker | CEO of Simply Group

At just 33 years of age, Lawrence Krimker has built Simply Group into a category leader in home equipment financing. This year his firm acquired competitors Dealnet & SNAP Financial in transactions that totalled over $750 million and brought his firm to $1.45 billion in assets under management. |

|

Andrew Graham | CEO of Borrowell

Andrew Graham is the CEO and Co-Founder of Borrowell, Canada’s first fintech to provide free credit monitoring. This year Andrew launched Borrowell Boost to help the 53% of Canadians living paycheck to paycheck meet their bill payments. |

|

Maria Soklis | President of Cox Automotive

In the 6 years that Maria Soklis has led Cox Automotive Canada, the company has become a category leader in software and financing solutions for consumers and dealers across the country. Maria has also left her mark with initiatives that promote diverse and inclusive workplaces, and this year signed the BlackNorth Initiative CEO Pledge. |

Emerging Lending Platform of the Year

|

Moselle

Moselle is a digital platform that simplifies the importing workflow for small medium business owners. |

|

Moves

Moves is a financial services platform for independent “gig” workers. |

|

Vendor Lender

VendorLender is Canada’s first POS lender for dealers in the equipment finance space. |

|

Lendle

Lendle is Canada’s first interest free credit provider. |

|

goPeer

goPeer helps everyday Canadians to achieve financial freedom through Peer-to-Peer Lending |

Small Business Lending Platform of the Year

|

Merchant Growth

Merchant Growth is a leading Canadian financial technology company that specializes in small business financing. Over the past decade, Merchant Growth has supported Canadian businesses with hundreds of millions of dollars in growth financing. |

|

Loop

Launched this year, Loop builds credit & payment products specifically for online merchants. The company is operated by the LendingLoop team that popularized P2P lending in Canada. |

|

Thinking Capital

Thinking Capital is one of Canada’s best known fintech lenders to the small business sector. This year the firm has forged relationships with multiple Credit Unions and hit $1 billion in loans deployed. |

|

OnDeck

Since its launch in 2015, OnDeck Canada has |

|

Clearbanc

Canadian based Clearbanc is the world’s largest e-commerce funder. Their data-driven approach takes the bias out of decision making. Clearbanc has funded 8x more female founders than traditional VC. |

Consumer Lending Platform of the Year

|

Flexiti

Flexiti is a leader in point of sale financing for retailers and has been named one of Canada’s fastest growing companies two years straight. |

|

CHICC

CHICC is one of the country’s leading rental & homeimprovement financing companies. |

|

Marble Financial

Marble uses fintech to empower Canadians to improve their credit score, manage debt, and budget to achieve financial goals. |

|

PayBright

PayBright is one of Canada’s leading buy now, pay later providers. This year the firm was acquired by BNPL giant, Affirm for $340 million. |

|

goeasy

Canada’s leading alternative financial services provider servicing non-prime Canadians through its easyhome and easyfinancial divisions. |

Auto Lending Platform of the Year

|

GoTo Loans

GoTo Loans is a fintech lender focused on helping consumers access the equity from their vehicle and the leading provider in Canada for automotive repair loans. |

|

Auto Capital Canada

AutoCapital Canada is a national auto finance company that works with dealer partners to help clients finance the purchase of new and used vehicles. This year the firm acquired competitor Rifco. |

|

Carfinco

The Western Canada based lender is a leader in non-prime lending to the auto sector. |

|

Canada Drives

Canada Drives is a leader in fintech auto lending. This year the firm hit over 400 employees and 1 million transactions, servicing consumers across Canada, the US, and the UK. |

|

Clutch

Clutch aims to bring speed and convenience to used car sales by taking the experience completely online. The fintech raised a $7 million round this year from Real Ventures. |

Technology Lending Platform of the Year

|

BDC

Launched only five years ago, BDC’s Tech Group has become a leader in lending to Canadian technology entrepreneurs. |

|

TIMIA

TIMIA is a specialty finance company that provides growth capital to technology companies in exchange for payments based on monthly revenue. |

|

Flow Capital

Flow Capital Corp. is a diversified alternative asset investor, specializing in providing minimally dilutive capital to high-growth businesses. |

|

Venbridge

Venbridge is a Canadian finance company offering non-dilutive venture debt, SR&ED financing, and tax credit consulting services. |

|

SVB

SVB has lead the technology lending movement for 35 years. The firm opened their first Canadian office last year. |

Fintech Vets Make Move to Yardline Capital

December 11, 2020 After Yardline Capital burst into the growth capital space for e-commerce sellers, two fintech vets have recently announced a move to the company.

After Yardline Capital burst into the growth capital space for e-commerce sellers, two fintech vets have recently announced a move to the company.

Seth Broman, formerly Senior Vice President of Business Development at Kapitus, announced he had become Chief Revenue Officer of Yardline Capital.

Dennis Chin, formerly in capital markets for OnDeck, announced on LinkedIn that he had become Head of Strategic Initiatives for Yardline Capital.

On LinkedIn, Broman wrote, “Over the last 14 years, I have seen SMB lending and alternative financing grow and adapt time and time again. Innovation and technology have transformed the industry and continue to do so daily. I have seen firsthand billions and billions of dollars propel SMBs and along with the growth of those companies, the industry itself continues to evolve. With that, I’m very excited to share with my friends, family, colleagues and network that I have joined Tomo Matsuo and Ari Horowitz to build Yardline – providing value-added capital solutions for ecommerce sellers to work smarter & grow faster.”

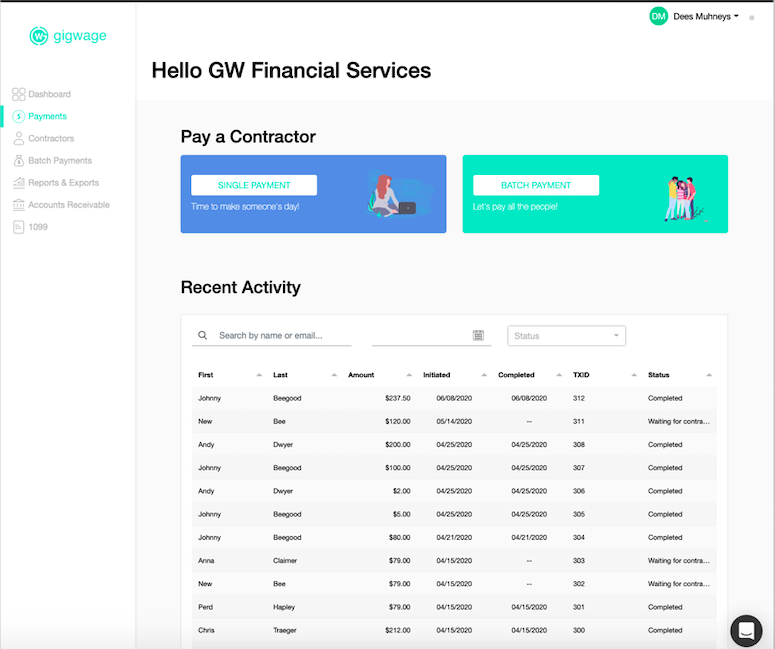

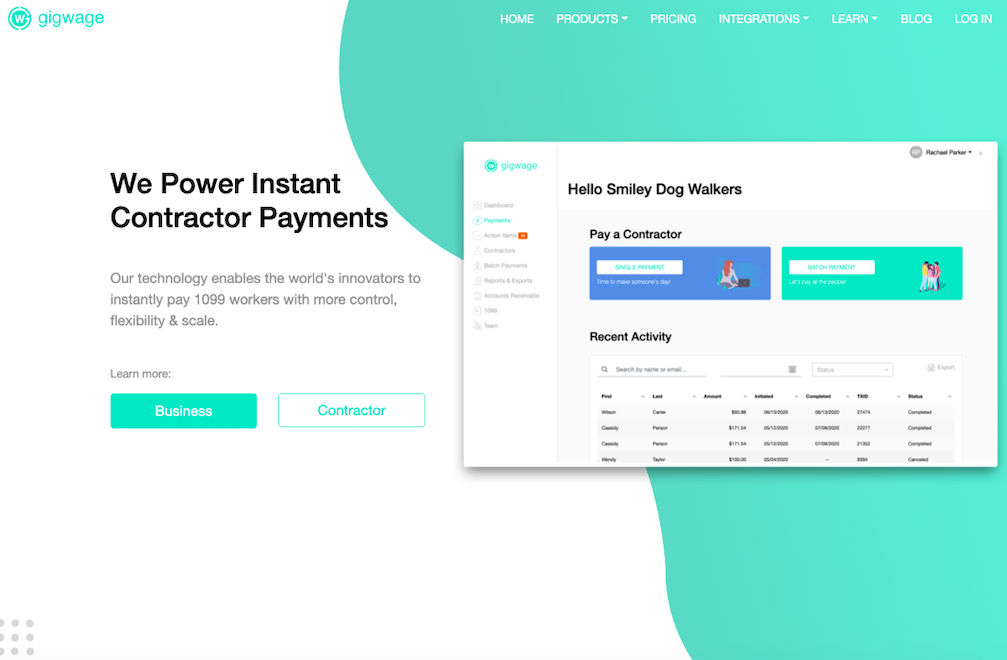

From Sales to Founder: Craig J. Lewis Talks Gig Wage’s $7.5 Million Funding Round

November 27, 2020 Coming to you from the heart of Dallas, Texas is a digital payroll startup, Gig Wage, that received a $7.5 million Series A funding round just last month. The founder, CEO, and writer of The Sport of Sales, Craig J. Lewis, talked about his goal to make it easier for 1099 gig workers to get paid.

Coming to you from the heart of Dallas, Texas is a digital payroll startup, Gig Wage, that received a $7.5 million Series A funding round just last month. The founder, CEO, and writer of The Sport of Sales, Craig J. Lewis, talked about his goal to make it easier for 1099 gig workers to get paid.

Lewis made $10 million in payroll tech sales before going on to lead a firm that has seen 30% month-to-month growth this year, during a pandemic no less.

“We help businesses pay independent contractors, but because we’re so tech-centric, it’s evolved beyond just payroll,” Lewis said. “What we ended up building was financial infrastructure for the modern workforce. We help businesses get money from their customers to their contractors as fast and as flexibly as possible.”

The way Gig Wage does this, Lewis said, is by offering an online platform for the hybridization of payroll, payments, and banking from a single login. Businesses can manage their payroll needs for 1099 workers, then shift to payment needs quickly, through direct to debit, all major cards, bank transfers, and accounts receivables.

“One of the only- the only platform in the world actually that has embedded banking into payroll and payments, which is what kind of allows for this speed and flexibility that we offer,” Lewis said. “We’re like B to B to C: We help the businesses with technology and operational excellence, and because independent contractors are separate from the workplace, we provide tools for them.”

Lewis has years of experience in the payroll space- starting as a salesman for ADP small business payroll products back in 2008. Realizing he had a passion for payroll tech and getting customers the best services possible, Lewis went on to learn anything he could about the industry. Selling $10 million in software while moving across the country, Lewis landed in Silicon Valley, where he studied what it took to start a company.

“I was just awed how they thought about technology and products and company building,” Lewis said. “And I vowed to bring that to the payroll industry.”

Lews joined a startup, learned the Silicon Valley way of creating a company through an African American tech acceleration program. In 2014, Lewis founded Gig Wage to do something disruptive in the payroll space.

As Gig Wage attests, disruption is what the 1099 gig industry needs at the very least. Lewis believed the gig economy was going to keep growing when Gig Wage started. As he watched, the gig economy ballooned into a $2 trillion industry with an estimated 65-75 million person workforce. These workers suffer from an outdated payroll system, losing an estimated 2-20% of their income to flaws in the payments system Gig Wage found.

As Gig Wage attests, disruption is what the 1099 gig industry needs at the very least. Lewis believed the gig economy was going to keep growing when Gig Wage started. As he watched, the gig economy ballooned into a $2 trillion industry with an estimated 65-75 million person workforce. These workers suffer from an outdated payroll system, losing an estimated 2-20% of their income to flaws in the payments system Gig Wage found.

“With the maturation of Uber, Lyft, Postmates, Doordash, Grubhub, Upwork, all of these kinds of gig economy freelancer companies, we had great growth going into 2020,” Lewis said. “In Q1, we were set up to raise our series A, and then March happened, and the terms got pulled off the table.”

But when the dust settled after those first shutdown weeks, Gig Wage looked at the damage and found the skyrocketing unemployment rates and furloughs had only accelerated their growth as a company.

But when the dust settled after those first shutdown weeks, Gig Wage looked at the damage and found the skyrocketing unemployment rates and furloughs had only accelerated their growth as a company.

“The gig economy was right there waiting on the workforce to provide opportunities to earn, and we were positioned perfectly to help people compete for that talent and pay people in a modern way,” Lewis said. “The pandemic has been a huge growth accelerant for us, and we think those tailwinds will only continue.”

Those winds of success came during a time of protest. Amplified in the pandemic’s backdrop, the country was waking up to the unequal disenfranchisement black people faced. Only 1% of black founder entrepreneurs ever receive VC funding, and Lewis said he is proud to have raised a significant round, given that unfair stat.

“With so much controversy and negative energy around black people in general,” Lewis said. “I think putting this positive story out there and showing this black excellence, black tech, I think it’s super important, and it’s been something that I’ve embraced. We’ve been able to be a part of putting something extremely powerful and positive into the market.”

America is finally waking up to realize something Lewis said was obvious, that black people matter, even though it can be controversial to say so. He hopes his success can help others but affirms the funding round was no charity drive.

“This is a great opportunity for us to be clear about the fact that like hey, we’ve been working on this, we’ve built a good business and a good technology,” Lewis said. “This is a big business opportunity for our investors and us. It wasn’t charity, right: This isn’t like, oh he’s black, give him some money.”

The successful funding round shows confidence in the Gig Wage platform from Green Dot, which will allow Gig Wage to offer bank accounts and debit services to independent contractors. Green Dot is one of the only fintechs with a national banking license, Lewis said, and Gig Wage is joining the Banking-as-a-Service direction that the fintech industry is headed.

Beyond payroll, Lewis can’t wait to offer other financial products to businesses as the company grows.

“When you think about the gig economy, it’s important that people get paid fast and flexibly: You’ve got to have the cash to be able to do that,” Lewis said. “We see some unique opportunities to get involved in the lending space down the line as well as we continue to build out our technologies.”

State of Fintech Lending in Canada Report Reveals Key Information for Lenders

November 23, 2020 Smarter Loans, Canada’s loan comparison giant, has published its 3rd annual State of Fintech Lending report.

Smarter Loans, Canada’s loan comparison giant, has published its 3rd annual State of Fintech Lending report.

“As Canadians stayed home longer, adoption of fintech products has accelerated dramatically,” the report says, accelerating trends that had already been developing for years. The data is based on survey results submitted by nearly 2,600 fintech lending customers.

While there are dozens of important takeaways, respondents indirectly signaled how valuable it is to be among the brands that are found first by borrowers.

That’s because loan applicants said that they researched fewer lenders than ever before (35% only researched 1 or 2 lenders before applying) and they spent less time researching lenders than ever before (31% said they spent less than 1 hour researching). Furthermore, 51% of respondents said that they only applied with a single provider.

This approach worked. Of those that got approved, 89% of respondents said that they were satisfied or very satisfied with their loan provider.

The trend should signal to lenders that borrowers may simply come to expect a satisfactory experience regardless of where they apply and that there is tremendous value in simply being the first 1-2 lenders that a prospective borrower considers.

And hint hint, it pays to be easily discoverable online. Fifty eight percent of respondents said they discovered their loan provider through online search.

Click here to view the full survey results in Smarter Loans’ official State of Fintech Lending.

Fintech IPOs Are Back

November 18, 2020Fintech IPOs are back. Affirm, a fintech company whose platform offers “a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app,” is the latest company to file for an IPO.

Affirm’s S-1 was filed earlier today, revealing that they intend to raise $100 million. The company generated $509M in net revenue during its fiscal year ending June 30 and a net loss of $112 million.

| Fintech | Date Filed | Date Public | Amount Raised |

| Affirm | 11/18/20 | ||

| Upstart | 11/6/20 | ||

| Lufax | 10/8/20 | 10/30/20 | $2.36B |

| Ant Group | 8/25/20 | Delayed |

Unrelated to fintech, but still “tech” are pending IPOs for DoorDash and Airbnb.

Upstart Files for $100M IPO – Reveals Financials

November 6, 2020

Upstart, the online personal lender that uses non-traditional data like a college education, job history, and residency to evaluate borrowers, is moving forward with an IPO.

The company revealed its financial statements in an S-1 filed on Thursday. In 2019, Upstart generated $164.2M in revenue and had a net loss of $5M. For 2020 through Sept 30th, revenue was at $146.7M with a net income of $4.5M.

The company said that in 2020, 98% of its revenue was generated from platform, referral and servicing fees that it receives from its bank partners. Their bank partners “include Cross River Bank, Customers Bank, FinWise Bank, First Federal Bank of Kansas City, First National Bank of Omaha, KEMBA Financial Credit Union, TCF Bank, Apple Bank for Savings and Ridgewood Savings Bank.”

Upstart borrowers tend to have limited or no credit history, which is where its AI-driven models with 1,600 variables come into play.

“Our bank partners have generally increasingly retained loans for their own customer base and balance sheet,” the company wrote in its S-1. “In the third quarter of 2020, approximately 22% of Upstart-powered loans were retained by the originating bank, while about 76% of Upstart-powered loans were purchased by institutional investors through our loan funding programs.”

Upstart was valued at $750M during its 2019 Series D.

In 2017, deBanked referred to Upstart as the Tesla of alternative lending.

“You hear so much about how Tesla cars will drive themselves, how Google or Amazon home assistants talk to you to as if you’re human,” said Dave Girouard, Upstart co-founder, in an interview back then. “In lending we are the first company to apply these types of technologies to lending.”

Girouard’s co-founder Paul Gu, who serves as SVP of Product and Data Science, was only 21 when Upstart launched in 2012. He’s now 29.

Anna M. Counselman, the third co-founder, is SVP of People and Operations.

Upstart is planning to raise $100M from its IPO.

Drama, Health Challenges Revealed in CircleUp’s CEO Switch-Up

October 19, 2020 CircleUp, a fintech company that’s raised more than $250M between debt and equity, saw a change in leadership last week, with more than a fair share of transition drama. Co-founder and CEO Ryan Caldbeck stepped down, giving way to President Nick Talwar.

CircleUp, a fintech company that’s raised more than $250M between debt and equity, saw a change in leadership last week, with more than a fair share of transition drama. Co-founder and CEO Ryan Caldbeck stepped down, giving way to President Nick Talwar.

After stepping down, Caldback took to Twitter and Medium, opening up in a 41 tweet story about why he chose to leave. A scathing private letter from Caldbeck to an unknown investor and chair of the board at CircleUp also circulated social media.

“I made many mistakes during this time, thinking I could just grit it out alone,” Caldbeck wrote. “I thought keeping everything to myself would allow me to handle the professional challenges more effectively. My approach was wrong.”

CircleUp is a tech-driven entrepreneurial investment company, known for supplying funding to consumer firms like Halo Top Ice cream. Caldbeck founded the firm in 2012 with Roy Eakin, as a platform to connect entrepreneurs to investors.

On Twitter, Caldbeck shared his internal hardships during the C Series pivot. Facing immense stress at work while his company pivoted, fertility troubles at home, and cancer diagnoses beginning around 2017 and continuing into the present, Caldbeck went from burnout to drawn-out depression.

“There’s no doubt my mental health was suffering during that period,” Caldbeck wrote. “Some think they have no choice but to ‘tough it out’ in front of the teams, customers or investors, despite what’s going on inside their heads because doubt isn’t respected in venture.”

Caldbeck said that the “normal level” of CEO exhaustion was something he thrived on, including catching sleep in the restroom in the spare minutes he had before board meetings. But when his fertility testing found cancer, and his stress brought headaches that were feared to be brain cancer, Caldbeck said even a papercut would set him off.

Simultaneously, a board member at CircleUp was acting so disruptive that Caldbeck later complained that he was throwing the entire team off. Just this past week, Caldbeck sent an email that got shared all over the internet to that board member as advice, and in part retribution for how the investor acted.

According to Caldbeck’s letter, the disrupter invested their way onto the team and treated the rest of the board with disrespect. They talked down clients, disrupted meetings, projected insecurity and paranoia, and forced the sales team to market their stake when they wanted out.

“The data suggests that venting doesn’t actually help mental health- it hurts,” Caldbeck said. “I’m not writing this to vent, I am writing this because I am hopeful it will help future entrepreneurs you invest in.”

While Caldbeck was facing cancer, the board member was reportedly putting down the entire company. Caldbeck said he should have seen a red flag that he didn’t even meet the investor before they were sitting on the board and that many other executives share his negative opinion.

“Your involvement was incredibly difficult for all of CircleUp and our board,” Caldbeck said. “My hope is that over time you can process some of this information below and make the necessary changes if you decide to stay in venture.”

Luckily, his brain scans came back negative, and his cancer was removed by operation, and Caldbeck and his wife had a secound child. However, the 12 to 18 month period of exhaustion had taken its toll. Caldbeck had reached the end of his rope, signified when his five-year-old daughter said, “Daddy, you always look sad.”

In 2019, Caldbeck sent a letter to his board explaining his intent to step down, after serving as CEO since founding in 2012.

After a long transitionary period waiting for a replacement, Caldbeck finally shared his story, hoping to inspire other leaders to be open about their struggles and feel less alone. Nick Talwar, a 20-year industry vet, was hired as president of CircleUp in July. Caldbeck wrote that he is excited for the CircleUp team despite his time of struggle as he becomes the Executive Chairman.

“I feel immensely proud of what we have built at CircleUp,” Caldbeck wrote. “The team is truly extraordinary, and I think the technology (Helio) will transform consumer and private investing. We’ve helped hundreds of entrepreneurs to thrive, and we will help thousands more.”

Avant CEO: Colorado Decision Framework for Bank Fintech Partnerships

October 13, 2020 After three years of litigation, in August, the Colorado “true lender” case settled with an agreement between the fintech lenders, bank partners, and the state regulators. Along with lending restrictions above a 36% APR, the fintech lenders will have to maintain a state lending license and comply with other regulatory practices.

After three years of litigation, in August, the Colorado “true lender” case settled with an agreement between the fintech lenders, bank partners, and the state regulators. Along with lending restrictions above a 36% APR, the fintech lenders will have to maintain a state lending license and comply with other regulatory practices.

The decision has been called unfair regulation and a bad precedent for other similar regulatory disputes across the country.

But James Paris, the CEO of Avant, sees the decision as a victory for fintech lenders. Paris said the decision was an excellent framework for fintech/bank partnerships across the nation and a sign that regulators are finally taking the benefits of alternative finance seriously.

“For us, the case also involved being able to continue to provide these good credit products to deserving customers who maybe weren’t being served as well through some of the legacy providers,” Paris said.

Paris called back to the Madden vs. Midland Funding case in the US Court of Appeals Second Circuit decided in 2015. That case called into question if loans made in fintech bank partnerships in the state of New York were valid at the time of origination. Regulators charged that though national banks can create loans higher than state regulations allow, fintech partners buying those loans to take advantage of higher rates were skirting state regulations.

“The ruling was essentially that the loan would not continue to be valid,” Paris said. “Because the individual state in question, which was New York’s local usury law, would apply because it was no longer a national bank that held that loan after it had been sold.”

The decision called into question loans made in the fintech space. Paris said that the Colorado true lender Case was not about whether the banks were even making loans. Instead, fintech lenders were called the true originators and therefore didn’t have a license that allowed them to make loans at higher rates than the state allowed.

Paris said the decision showed confidence that fintech bank partnerships were not exporting rates, and that by limiting lending to under 36%, regulators were protecting bank fintech partnerships and consumers.

“All of the lending Avant does is under 36%, and that’s been the case for years,” Paris said. “In the space where we do play, from 9% to just under 35%, through our partnership with WebBank, we are confident in running a portfolio extremely focused on regulatory compliance.”

Colorado went from not allowing partnerships at all, to working with fintech companies to developing a set of terms that allowed partnerships to function, Paris said. He added that Avant’s products have always been to customers below nonprime credit, from 550 to 680 Fico scores, serviced by up to 36% APRs.

Paris said he does not know about customers outside of this range, or how they are affected by limiting APR to 36%, but he cited a study done by economist Dr. Michael Turner. Turner is the CEO and founder of the Policy and Economic Research Council (PERC), a non-profit research center.

The study compared lending after the Madden case in New York with how customers can be served after the Colorado true lender case. In the credit market Avant serves, Turner found that customers are better off with access to regulated fintech loans, as opposed to not having access at all.

The study looked at the average borrower credit score, APR, and loan size of Avant and WebBank borrowers, and found that if WebBank loans through Avant were prohibited, borrowers would be forced to access other means of credit, through much higher rates.

“Should WebBank loans be prohibited in Colorado, then we can reasonably expect that some non-trivial portion of the WebBank loan borrower population, as well as prospective future borrowers, will be forced to meet their credit needs with higher cost products,” Turner wrote. “This outcome is financially detrimental for this borrower population, most of whom have no access to more affordable mainstream alternatives.”

Given this data, Paris is happy to comply with the regulation. Without the framework Colorado has provided, Paris said borrowers would be worse off. Paris hopes that this decision will precede other state frameworks because what fintech bank partnerships need the most are consistent regulatory practices.

“I’m hopeful that to the extent there are ongoing concerns around bank models across other states, that this type of safe harbor model that Colorado helped develop is something that others could look to as a precedent or a model. Because I think the more that we can have consistency across the relevant jurisdictions, the better.”