Economy

Intuit: Consumers Expected to Spend 34% Less This Holiday Season

October 21, 2024It’s not all good news with the economy. According to Intuit, a QuickBooks-commissioned survey predicts a 34% drop in consumer holiday spending, an $85 billion decrease from last year.

Of those who plan to spend less this year, more than 6 in 10 say grocery and gas prices are to blame, the survey revealed. Another 4 in 10 say their wages haven’t kept up with inflation over the past year.

Ironically, small business owners are anticipating the opposite trend. Eighty-two percent of business owners surveyed, for example, said that they expect to earn the same or more revenue in total holiday sales than they did last year. Perhaps they need the optimism. Twenty-three percent of business owners surveyed said that if the holidays are not a success, it will make it a really difficult year. Five percent said they might have to close.

And of the revenue they do earn, the majority said it will just go toward paying down business debt.

Meanwhile, 59% of consumers that plan to shop online plan to do so through a business's website directly.

The full report can be viewed here.

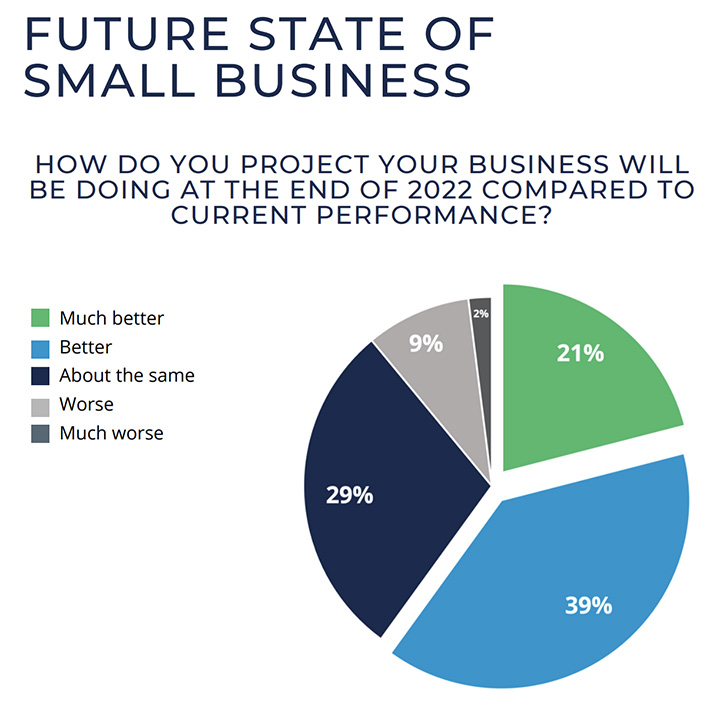

Inflation? So What – SMBs Are Bullish On the Rest of 2022

August 17, 2022Eighty-nine percent of respondents projected that their small business will be doing the same, better, or much better by the end of the year, according to a recent survey conducted by IOU Financial. The majority of those polled actually selected better (39%) or much better (21%). Twenty-nine percent said they expected to be about the same.

The sentiment is significant given that 84% said that they were somewhat concerned or very concerned about rising inflation and 85% said that they were somewhat concerned or very concerned about a possible recession.

This data is in line with responses found from other surveys like the recent NFIB study that determined that inflation was the single most important problem that business owners were facing. But even that study revealed a sense of persistent optimism, similar to the IOU survey, when respondents said that financing and interest rates ranked the lowest on their selected list of problems.

All of which means that the biggest challenge small businesses are facing right now is not viewed as a mortally perilous one. Indeed, 74% of respondents to the IOU survey said that they plan to invest in their business in the next six months.

All of which means that the biggest challenge small businesses are facing right now is not viewed as a mortally perilous one. Indeed, 74% of respondents to the IOU survey said that they plan to invest in their business in the next six months.

“They plan to fund expansion, make equipment or inventory purchases as well as put money into staffing and marketing,” the IOU report states. Only 5% flat out said that they do not plan to invest in their business in the next 6 months. The rest said that they might invest.

The optimism that is there is cautious, however. Seventy-five percent of respondents said that the covid pandemic is not fully over and 32% said that they would rate the current state of their business as somewhat negatively or very negatively.

The damage from the last two years lingers on but business owners are looking at what’s ahead of them and signaling that it’s onward and upward regardless.

The full IOU Small Business Survey can be downloaded here.

Junior Wall Streeters

August 17, 2022 Two years ago, Kevon Chisolm and son Kamari Chisolm paired together to create Junior Wallstreeter, a component of Black Wallstreeter, to empower the youth on financial wellness. The Virginia-based father-son duo are on a mission to give minority kids from disadvantaged backgrounds an opportunity at education in financial literacy.

Two years ago, Kevon Chisolm and son Kamari Chisolm paired together to create Junior Wallstreeter, a component of Black Wallstreeter, to empower the youth on financial wellness. The Virginia-based father-son duo are on a mission to give minority kids from disadvantaged backgrounds an opportunity at education in financial literacy.

“I strongly believe that regardless of your financial situation you deserve a financial education,” said Kevon Chisolm, Esq., Executive Director at Junior Wallstreeter.

Junior Wallstreeter offers a virtual camp in the summer on financial literacy and investing, allowing kids to learn skills in banking, budgeting, credit ratings, and more. The two-week summer camp ranges between $300 and $325, and for kids who may not be able to afford it they can potentially obtain a scholarship.

“So, for 10 days, kids are learning how to track their investments,” said Chisolm, “and we try to get the kids to understand and how to become investors more than consumers. So, I like to say rather than buy a pair of Nike, invest in Nike.”

Learning about finances between ages 10-11 from his dad, Kamari has been well-educated on the importance of financial intelligence. He tries to help his friends with their decision-making on spending and saving money so they can be just as equipped in financial literacy as he is.

“It’s helped me a bunch of different ways. It’s helped me see things on TV from a different perspective,” said Kamari Chisolm, “and it’s helped me teach my friends different things. […] But I think that with the financial literacy knowledge I’ve learned, I’ve helped my friends save money and hopefully encourage them to invest in the stock market so they can make more of their money.”

Unlike other programs, after camp is over kids are able to be a part of Junior Wallstreeter Alumni to make sure kids are practicing the skills they learned. Alumni campers meet throughout the year from September to April-May with different topics to continue this ongoing learning experience.

“We just want to make sure that the kids are still applying the information, that it didn’t just go out the window for the summer camp, so we have this ongoing,” said Chisolm.

Chisolm believes that the biggest misconception people have today about loans is the fact that they are tied to credit ratings.

“I don’t think we really understand the importance of credit and how that plays a role in obtaining a loan, house, car, student loans, anything. I don’t think we understand that,” said Chisolm.

Along with misconceptions on loans, even standard terminology when taking out a loan such as APR, Fixed Interest Rate and Variable Interest Rate may not be common knowledge to the youth and even adults. The 12 year-olds attending the camp may not necessarily need to know how to take out a loan just yet but they do receive a handbook from the program that they can refer back to when the time comes.

“No, [people don’t understand APRs] and that’s why we go over credit card applications. We teach the kids that. So if they’re following along and we give them a student workbook that lets them understand comparing different credit cards, like a credit card loan offer APR, ‘if they offer a higher loan, if they can offer you this,’ this is a how do you determine which credit card is the best,” said Chisolm.

The power of knowledge allows Kevon and Kamari to pass along the information they possess to the youth and adults throughout their journey of making financial education accessible to all.

“This is passionate to me,” said the elder Chisolm. “My love for our people and making a difference and just giving back, right, just work on giving back with the knowledge and tools that I have. We’re not perfect, but we’re just trying to make a difference.”

Thoughts on Inflation, a Recession, and Regulation From Someone Who’s Seen ‘This Movie’ Before

July 7, 2022 “I can tell you that in the US that originators are starting to adjust their underwriting policies,” said David Goldin, CEO of Capify and Head of Originations at Lender Capital Partners, “I don’t know about pricing. I haven’t heard that yet.”

“I can tell you that in the US that originators are starting to adjust their underwriting policies,” said David Goldin, CEO of Capify and Head of Originations at Lender Capital Partners, “I don’t know about pricing. I haven’t heard that yet.”

Goldin, who has been a small business finance chief executive for 20 years, believes that the economy, inflation, and interest rates are front-and-center issues that the industry should be thinking about right now. In the UK, one region that Capify operates in, Goldin said that several small business finance executives there are already talking about raising margin and doing shorter term deals to prepare for the increased risk.

“Some originators are smart enough to be proactive and others are saying, ‘oh we’ll just watch it.’ So it’s either going to take trickling down through the economy globally or defaults to go up for these adjustment to happen,” he said.

During the Great Recession of ’08/’09, Goldin was right in the thick of it as the CEO of AmeriMerchant, one of the first MCA companies in the US. He explained that there’s a notable difference between now versus then.

“One of the things that didn’t exist back then, someone doing a second [position] was like unheard of in 2008,” he said. “Now, what is it now? first, 2nd, 3rd, 4th, 5th? 6, 7, 8, 9. It’s like a horse race. Ten horses in the race in some cases. […] You have to be careful, right? You have to make sure you’re covering your margin by charging enough and going shorter.”

But in a competitive environment where nobody wants to reveal their cards or risk losing business, not every funder is keen to start making changes right now. Goldin said that many funding companies will wait to see if their competitors start tightening up first especially if they’re driven by their ISOs and brokers. The downside of becoming more conservative is that brokers might just decide to take all of their business elsewhere.

But a looming recession isn’t all bad. “There are some positives,” he said. “The positives are the banks do tighten up. It’s just a question of when not if. So, you may get applicants that come to alternative financing that may have never taken or considered these types of products because they got bank financing.”

Complicating the landscape now, however, is that funding companies are wrangling with new state regulations. Goldin is aware of several originators that have temporarily paused business in Virginia, for example, where a disclosure requirement went into effect just last week. The soon-to-be implemented New York and California laws are also causing rumblings about funding suspensions respectively. In each of those states it was “sales-based financing” products that were specifically targeted, a trend that looks sure to continue as states like Maryland, Connecticut, and others are determined to reintroduce disclosure legislation next year.

“I think more and more originators will eventually get away from the MCA model,” Goldin said, “and go more towards the business loan model by partnering with a bank. I think you’re going to see more companies trying to implement bank programs to become full business loans and not deal with all the nuances of a state by state and MCA program.”

Goldin’s point of view, wisdom, and predictions are aggressively sobering. Only three months ago, industry sources were telling deBanked that their outlook for 2022 was optimistic and that the end of covid-era government stimulus suggested that there would be growth for non-bank finance companies. Suddenly the tone has shifted, the stock market has plummeted, and interest rates are rising.

Goldin’s point of view, wisdom, and predictions are aggressively sobering. Only three months ago, industry sources were telling deBanked that their outlook for 2022 was optimistic and that the end of covid-era government stimulus suggested that there would be growth for non-bank finance companies. Suddenly the tone has shifted, the stock market has plummeted, and interest rates are rising.

“I think if you resurveyed originators now, I think you’d get a different response than you did eight weeks ago or even four weeks ago,” Goldin said. “I can tell you right now that capital providers are asking their originators about how they’re making adjusments in this environment…”

Indeed, deBanked did speak with several players just last week and did notice that the general sentiment had shifted to one of concern and caution.

“I think funders should be thinking about redundancy,” Goldin said. “More than ever the best time to raise capital is when you don’t need it. And I don’t know if [funding sources] will pull lines, yes if defaults go up, but they may not be as inclined to enter into new relationships in this environment.” Because of that, now might be the last best opportunity to secure additional credit sources even they’re not necessarily needed, he suggested.

With that, he said that funders should be thinking about tightening up the bottom of their credit profile, increasing their margins, doing shorter term deals, looking for more mature businesses, and working with businesses with higher credit scores.

“I think that those that don’t make credit adjustments, raise margin, and go shorter are going to have their you-know-what handed to them,” he said. “I’ve seen this movie too many times. It doesn’t have to be called a recession. […] It’s all about affordability to repay, and the more debt [the customers] have, and the more their margins are squeezed, or the more their sales go down. That’s when problems begin. You’re less likely to have a problem if you’re only out six months instead of eighteen months. I’ve used this saying a million times: ‘When the ships are too far out to sea and it’s a tidal wave, you can’t get them back.'”

Small Business Finance Industry Ponders Inflation, Changing Economic Conditions Ahead

July 1, 2022 “I think what’s really important is just the same for our businesses and any business, is being able to make sure that as things change, you’re updating and changing what you’re doing,” said Seth Broman, Chief Revenue Officer at Yardline.

“I think what’s really important is just the same for our businesses and any business, is being able to make sure that as things change, you’re updating and changing what you’re doing,” said Seth Broman, Chief Revenue Officer at Yardline.

With the constant changes in the economy, inflation being on the rise, and a rumored recession, businesses providing financing are analyzing whether or not their customers will be able to withstand challenging times ahead.

“For us a big factor is the increased costs of being able to source goods from overseas, for example, the challenges around getting those goods in a timely fashion,” said Broman. “That’s the first thing we saw. And then similarly, in the e-commerce space, you’re seeing brands that aren’t able to sell at the same level as they were beforehand.”

Like Broman, John Celifarco, a Managing Partner at Horizon Funding Group, acknowledges that inflation is directly affecting his customers.

“It’s definitely going to have an effect on the industry as a whole in terms of our clients, I’d say it’s going to affect certain ones more than others, depending upon how their business is structured, and what type of relationship they have with their customers,” said Celifarco.

And with recent concerns for a recession, Celifarco believes this won’t affect a client’s willingness to borrow but rather the ability to get them approved.

“Having seen this in the past, there have been times where the economy has slowed or there’s been a recession, and the customers still want money, but because of the trouble the businesses are having it’s a lot harder to get people approved on the lending side,” said Celifarco.

Not being able to access credit for customers is also an area of concern for Luis Hernandez, CEO of CapLadder.

“There are going to be more cash constraints in a recession. Obviously, funding companies won’t want to take on certain risks so they’ll obviously be more careful on how they disperse those funds just to make sure they’re getting paid back,” said Hernandez.

Hernandez suggests companies should limit hiring and expenses to better weather the storm.

“With the recession looming, and pretty much it is going in this direction, the best practices right now are what’s always been tried, which is, hold on to your reserves. Cash is definitely better in your pocket than out there,” he said.

The Single Most Important Problem that Small Business Owners are Facing

June 16, 2022 Inflation is now ranked as the single most important problem that business owners face. According to a survey conducted by the NFIB last month, 28% of respondents ranked inflation as the biggest problem, beating out nine other categories including poor sales, cost of labor, and taxes.

Inflation is now ranked as the single most important problem that business owners face. According to a survey conducted by the NFIB last month, 28% of respondents ranked inflation as the biggest problem, beating out nine other categories including poor sales, cost of labor, and taxes.

A year ago, only 8% of respondents cited inflation as the most important problem. Small business owners have been forced to raise prices because the supply of their own goods have increased to an all time high. The increase in prices has been more prominently felt in wholesale, manufacturing, retail trades, and construction.

Close behind inflation, 23% of business owners complained that the quality of labor available was actually the most important problem. That was only down 3% from where it was a year ago. Along with all the other problems business owners must deal with, they are now worrying about the quality of their products not being produced at their best. Sixty-one percent of owners reported few or no qualified applicants for the positions they were trying to fill which seems to be why labor quality is currently a point at issue. Thirty-three percent of owners reported few qualified applicants for current open positions and 28 percent reported none.

The least important problem that business owners seemed to be worried about is finance & interest rates, which was listed at 1%. Last year the percentage of that being an important problem was the same at 1%.

Kabbage Survey Shows American SMBs Recovering Post-Pandemic

March 30, 2022

Kabbage from American Express issued the fifth Small Business Recovery Report, an online survey that tracks recovery trends and potential growth of small businesses in the US. Respondents represented industries across retail, marketing, healthcare, financial services, technology, food and beverage, construction, automotive, manufacturing, media, professional services, education, agriculture and more.

After polling 563 small business leaders that included 255 of the “smallest small businesses,” the latest report showcases how many small businesses are doing well in a changing market, as they look beyond challenges over the past two years while simultaneously overcoming the new problems of inflation and supply chain issues.

“Small businesses are preparing for a new type of market. One that’s not driven by the direct impact of COVID-19 – but rather, one determined by the economic aftermath of the pandemic,” said Kathryn Petralia, co-founder of Kabbage. “Economic indicators like inflation will require adjustments, but the new data illustrates how small businesses are making changes and adapting.”

According to the study, small businesses are becoming less concerned about COVID-19’s impact on their operations. The report’s responses showed over 90% of businesses did not have to “stop, slow, limit or shut down” their companies due to the Omicron outbreaks during the holiday season of 2021, while 70% surveyed said they weren’t affected by the variant in any way.

Along with pandemic-induced wounds beginning to heal for small business, respondents to the survey reported their average monthly revenues increased 77% in the past six months, from $47,900 in July 2021 to $84,935 in February 2022. Along with those increases, merchants reported average monthly profits have increased an average of 39% in the same period as well. The study does hint that these growth percentages are heavily weighted toward larger small businesses.

Kabbage says that the smallest small businesses, those with 20 or less employees, reported a 13% increase in average monthly revenues and a 12% increase in average monthly profits from July 2021 to February of this year.

The report touched on hiring rates for smaller merchants, as an initial void of lost workers has been filled. Despite a widespread notion of the job market being wide open, the study found that three quarters of the smallest small businesses said they are not hiring.

The study also found that inflation is increasing prices by an average of 21% across industries. Largely due to increased costs from their vendors and skyrocketing cost of raw materials, smaller merchants are beginning to push these costs on customers.

65% of businesses in the survey said they plan to keep prices high for the next six months, while almost 20% said they plan to raise prices further. Combating increasing costs of their own is an issue in and of itself, and over half (53%) expect their business to be impacted by supply chain issues for up to a year.

CEO of Square Says That Hyperinflation is Happening

October 28, 2021There seems to be consensus the US is experiencing inflation in 2021, but few people of business intelligence are making a rational argument that we’re in the midst of hyperinflation. Such a scenario, if true, might mean that a cup of coffee could cost $200 by next year.

“It’s happening,” tweeted Jack Dorsey, the CEO of both Square and Twitter. “Hyperinflation is going to change everything.”

Hyperinflation is going to change everything. It’s happening.

— jack⚡️ (@jack) October 23, 2021

Perhaps Dorsey’s bearish view on cash, ironic given that his company operates Cash App, has something to do with his bullish views on cryptocurrency. Fifty eight percent of Square’s total net revenue in the 2nd quarter came from Bitcoin.

“While bitcoin revenue was $2.72 billion in the second quarter of 2021, up approximately 3x year over year, bitcoin gross profit was only $55 million, or approximately 2% of bitcoin revenue,” the company said at the end of Q2.

Square made no mention of inflation in its Q2 earnings, nor in the call with analysts that followed. The company makes more than $1 billion in small business loans per year, a business that would likely be impacted by “hyperinflation.”

A hyperinflationary economy would cause strange situations in low interest rate environments in which borrowers pay back far less than what they borrowed on a value basis. If rates are low and loan payments are fixed, the borrower might as well borrow everything they could from every source available and turn it into something that will keep up with price increases.

Dorsey’s comments weren’t a one-off. He doubled down on his prediction just seven minutes later.

It will happen in the US soon, and so the world.

— jack⚡️ (@jack) October 23, 2021

He continued by saying that hyperinflation wasn’t a wish, nor did he think it was positive. He then laughed at Steve Hanke, a well regarded economist at John Hopkins University for condemning his statements.

🤣

— jack⚡️ (@jack) October 24, 2021

If Dorsey is right, and we’re all paying $200 for a cup of coffee in 2022, he would actually be one of the first people to see it happening since so many small businesses, including coffee shops, rely on Square as their POS software.