Business Lending

New York’s Proposed Budget Slips In Sweeping Regulation of Non-bank Business Lending and Finance

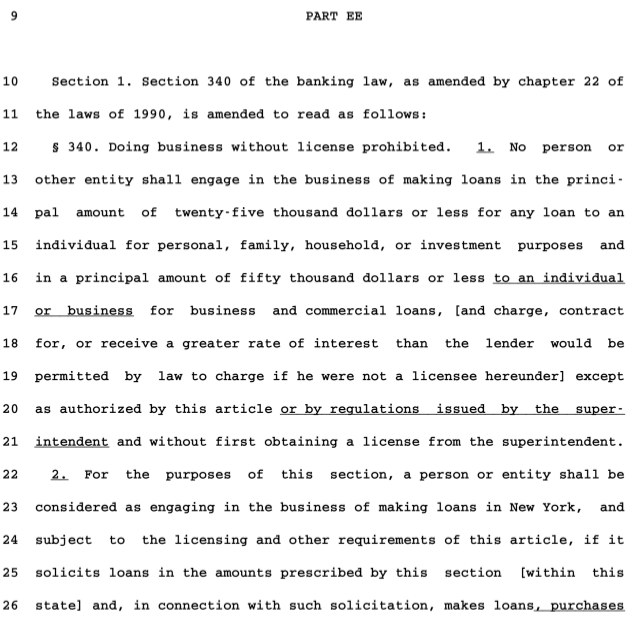

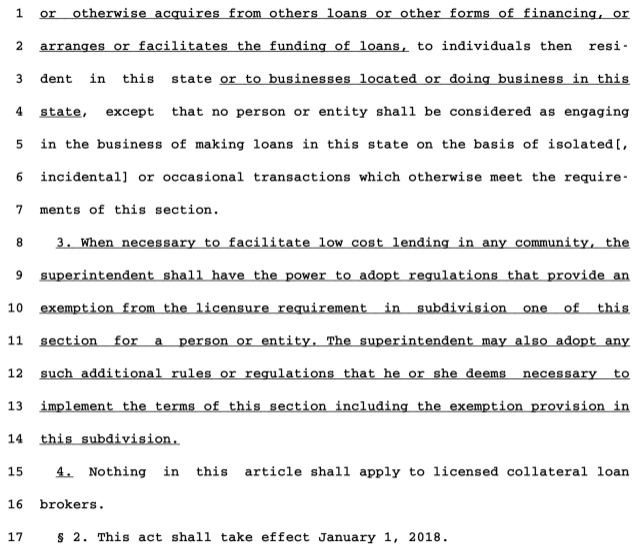

January 28, 2017In New York, Governor Cuomo’s 309-page budget proposal includes a handful of sentences tucked in towards the end (Part EE) that would revise Section 340 of the state’s banking law. And the implications are broad, given that it calls for any person or entity involved in the soliciting, arranging or facilitation of business and consumer loans or other forms of financing to be licensed in order to engage in such activity. It appears that MCA companies as well as business loan brokers and ISOs would be directly impacted.

If it passes, the regulator tasked with overseeing that would be the New York Department of Financial Services. It would be effective January, 2018.

For consumer loans, it applies to loans $25,000 and under. For business financing, $50,000 and under.

Biz2Credit – Citigroup Small Business Loan Partnership Spotted

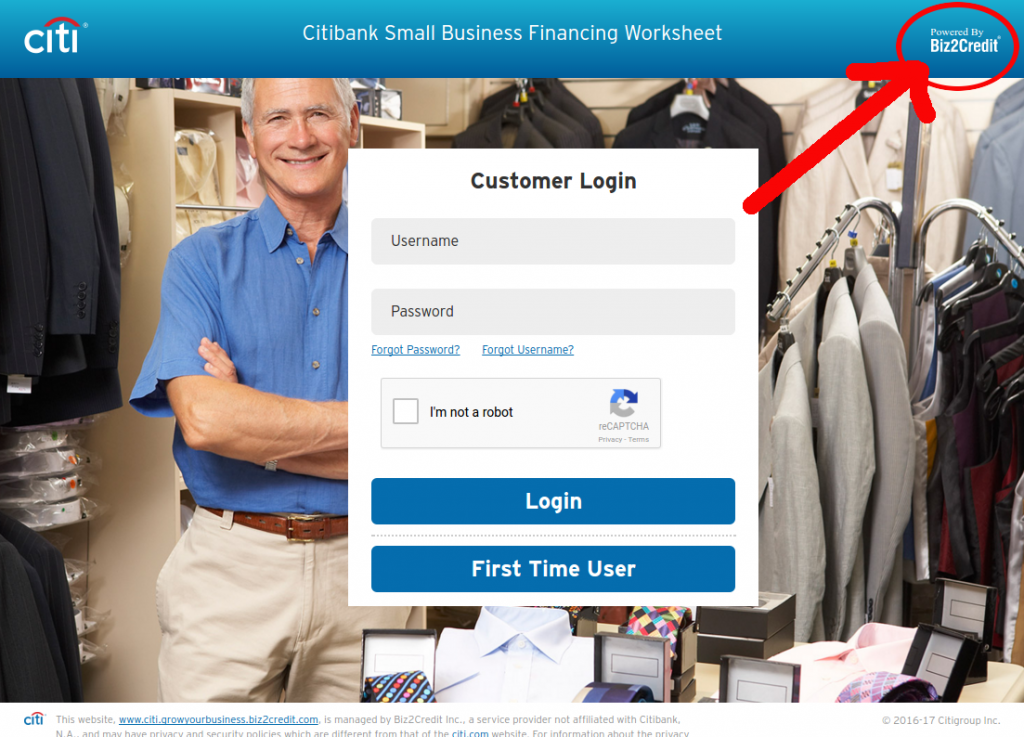

January 27, 2017Business Insider revealed that Biz2credit and Citigroup have quietly partnered up on a website to make small business loans up to $1 million. There was no actual link to it, so we’ve found it ourselves.

The link appears in several areas of Citi’s website under the small business finance category and that brings you here:

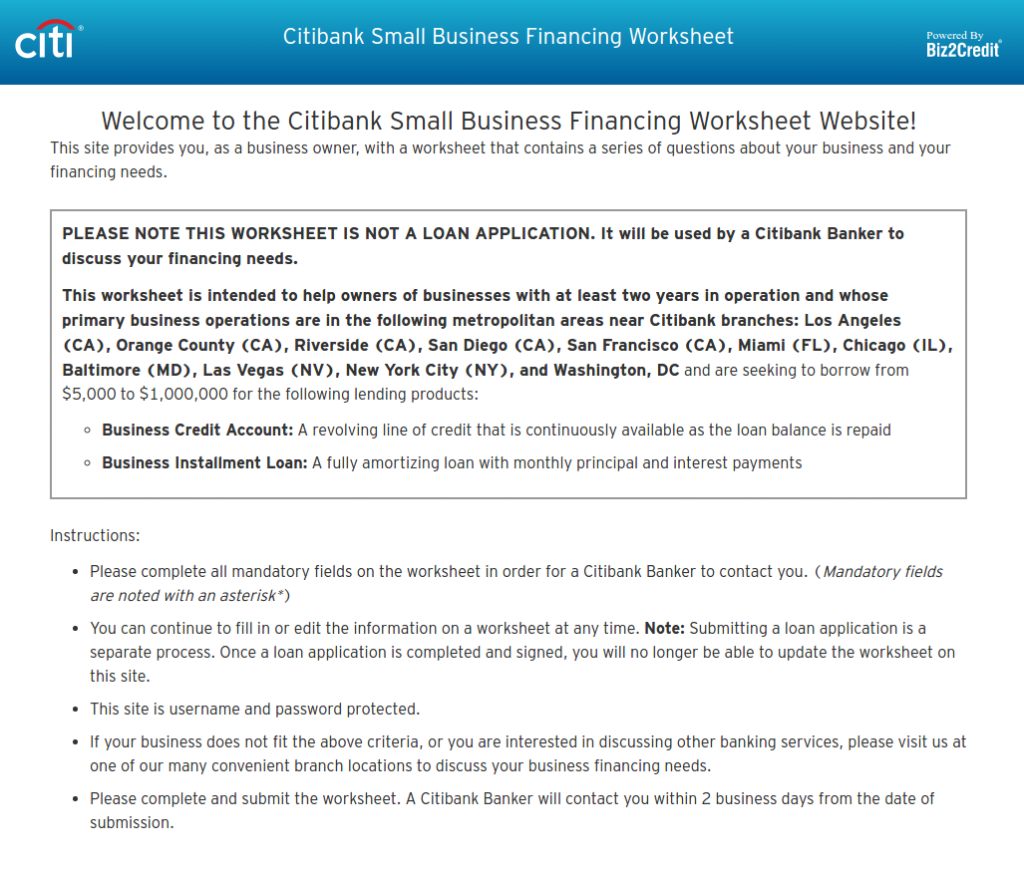

When you go to register, a page pops up insisting that this isn’t a loan application, but rather just a “worksheet” to have a banker from Citi call you within 2 days. “It will be used by a Citibank Banker to discuss your financing needs,” it reads.

The worksheet asks for very basic information such as name, business name, address, annual revenue, and financing requested.

If this doesn’t sound overly advanced, perhaps that’s why it’s being kept on the down low. According to Business Insider, Biz2credit CEO Rohit Arora said they have chosen not to publicize the effort because it’s in the very early stages.

The cat’s out of the bag now…

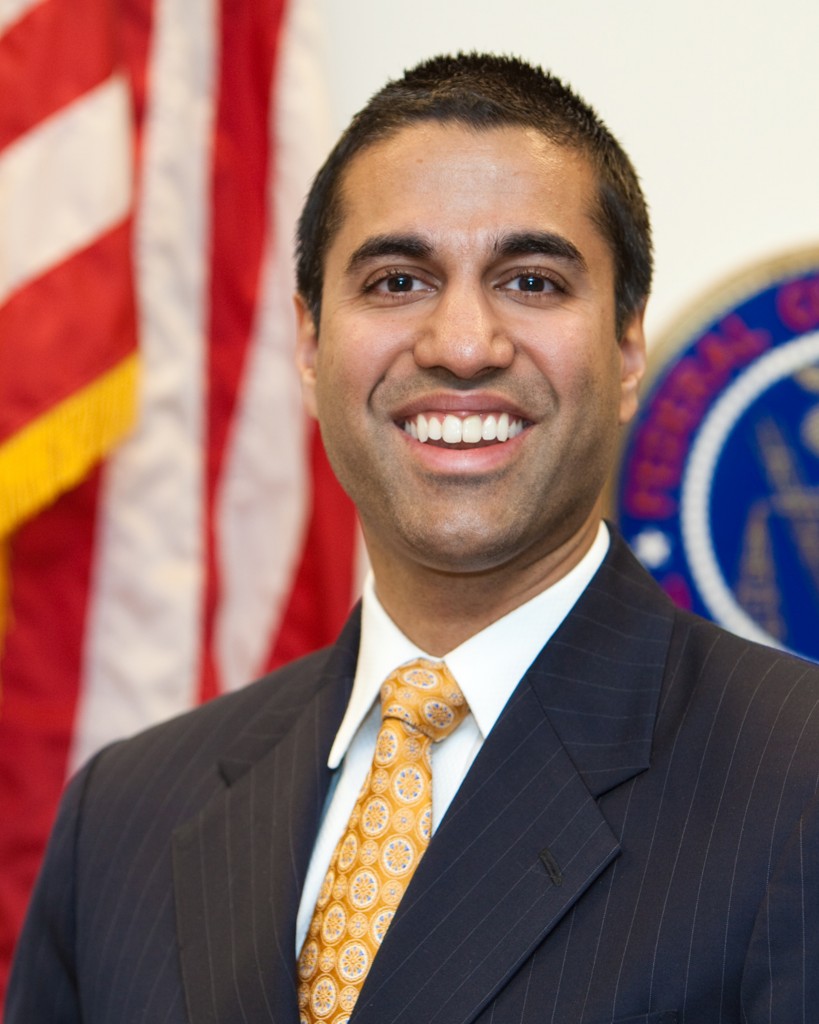

New FCC Chairman Ajit Pai Has Been Critical of Serial TCPA Plaintiffs, Record Shows

January 24, 2017 FCC Commissioner Ajit Pai is the commission’s new chairman, thanks to President Trump. A republican who believes free markets are better for American consumers than highly regulated ones, Pai is likely to offer a sympathetic ear to companies besieged by serial TCPA plaintiffs, a problem that has reached epidemic proportions in the small business finance industry.

FCC Commissioner Ajit Pai is the commission’s new chairman, thanks to President Trump. A republican who believes free markets are better for American consumers than highly regulated ones, Pai is likely to offer a sympathetic ear to companies besieged by serial TCPA plaintiffs, a problem that has reached epidemic proportions in the small business finance industry.

In 2015, when the FCC announced a broader definition of an autodialer under the TCPA, Pai strongly dissented.

Instead, the Order takes the opposite tack. Rather than focus on the illegal telemarketing calls that consumers really care about, the Order twists the law’s words even further to target useful communications between legitimate businesses and their customers. This Order will make abuse of the TCPA much, much easier. And the primary beneficiaries will be trial lawyers, not the American public.”

– Ajit Pai, 2015

If you’ve been threatened or sued by someone for violating the TCPA, you’re not alone. When we researched Smile, Dial and Trial, we reviewed dozens of lawsuits filed against small business finance companies and have since even discovered new ones filed since then.

Why Banks and Alternative Lenders Will Play Ball in 2017

January 23, 2017 The economic recession over the last decade significantly slowed banks’ willingness to approve small business loans, and the impact on small businesses’ ability to get loans from banks is still being felt today. According to the Wall Street Journal last year, big banks have decreased the number of loans to small businesses by more than 38 percent since 2006.

The economic recession over the last decade significantly slowed banks’ willingness to approve small business loans, and the impact on small businesses’ ability to get loans from banks is still being felt today. According to the Wall Street Journal last year, big banks have decreased the number of loans to small businesses by more than 38 percent since 2006.

But the recession helped pave way for another industry – alternative lending – which has significantly improved access to capital for small businesses. According to the Small Business Administration (SBA), the 2016 fiscal year was a record setting year for loans, with more than 70,000 approved that totaled $28.9 billion and supported nearly 694,000 jobs.

The success of alternative lending showed banks the importance of expanding their offerings, particularly with online loans and small businesses. Over eight years removed from the recession, banks are taking notice and rebounding to grant more small business loans and release new financial services. More and more headlines show that banks are shifting their strategies to keep up with America’s technology and alternative lending habits, making 2017 the year banks finally get back into the fray and play ball with alternative lenders to improve the lending process.

For one, banks already have built-in advantages to accomplish this:

- an extremely low cost of capital

- a built in customer base that can be targeted

- visibility into accounts and access to a treasure trove of key data

In 2016, we saw large banks explore three key strategies: build, buy or partner. Let’s look at a few examples of each:

In 2016, we saw large banks explore three key strategies: build, buy or partner. Let’s look at a few examples of each:

Build: Wells Fargo went to market with its own technology in 2014, called Wells Fargo FastFlex for Small Businesses. Opening access to lines of credit, term loans, and SBA loans, Wells Fargo set a five-year goal to extend $100 billion in loans to small businesses. In December 2016, Citizens Bank announced plans to start offering its own digital small-business loans by the middle of 2017.

Buy or License: Instead of building infrastructure, banks can acquire or license off-the-shelf technology. This route is for the financial institutions that don’t believe in building tools themselves or want to move more quickly than their internal development resources will allow. Instead of expanding its suite of offerings on its own, they would rather acquire an existing infrastructure and focus on the top end of the lending market. Kabbage has led the way on the licensing deals by announcing partnerships with ScotiaBank, Santander, and ING.

Partner: Through partnerships, banks can expand their loan offering and quickly leverage other’s technology. Through licensing deals or white-labels, banks can send businesses they decline to work with to alternative lending options to give their customers additional access to small business loans. In December 2015, JPMorgan Chase took this route and partnered with On Deck Capital to provide alternative lending and small businesses loans to its customers. JPMorgan Chase also partnered with LiftFund in October 2016 to fill the remaining gaps in its small business lending services.

It was a resurgent year for banks’ ability to offer small business lending. In fact, going into 2016, American Banker predicted that banks would set their sights on online lending by signing strategic partnerships with the leading platforms. That came true to an extent, but based on recent trends, 2017 will really be the year that banks and alternative lenders start to work together.

No longer content to be sidelined, banks are starting to play ball, and they will continue to do so at an even faster pace. The fact that banks are moving in now and increasing small business loans validates alternative lending. As JPMorgan Chase has showcased, partnerships between banks and alternative lending can offer channels of sales for both parties and improve the small business lending process. The next step is for banks and alternative lending to work together.

New Regulations, Section 1071 of Dodd-Frank Among Them, Temporarily Frozen By Executive Order

January 23, 2017

Update 2/1/17: Disagreements abound over whether or not Trump’s recent regulatory freeze can affect the CFPB. According to the WSJ, part of this stems from the CFPB’s uncertain status as an independent agency after the the recent court decision in PHH Corp v. CFPB. “The CFPB is following a hiring freeze ordered separately by the Trump administration,” the WSJ states. This may be a signal that they do not feel totally insulated.

Section 1071 of Dodd-Frank had expanded Reg B of The Equal Credit Opportunity Act and granted the CFPB the authority to collect data from small business lenders. It’s all-encompassing considering that it oddly defined a small business lender as “any entity that engages in any financial activity.”

Although Dodd-Frank was passed in 2010 and the CFPB created in 2011, Section 1071 has been lying in wait. But just a month ago, the Federal Register said that its implementation was under way, with a pre-rule timetable of March 2017. “The Bureau is starting its work to implement section 1071 of the Dodd-Frank Act, which amends the Equal Credit Opportunity Act to require financial institutions to report information concerning credit applications made by women-owned, minority-owned, and small businesses,” it says.

And that work is no doubt a big undertaking, especially if it is really supposed to cover any entity that engages in any financial activity.

“The amendments to ECOA made by the Dodd-Frank Act require that certain data be collected and maintained, including the number of the application and date the application was received; the type and purpose of loan or credit applied for; the amount of credit applied for and approved; the type of action taken with regard to each application and the date of such action; the census tract of the principal place of business; the gross annual revenue of the business; and the race, sex, and ethnicity of the principal owners of the business. The Dodd-Frank Act also provides authority for the CFPB to require any additional data that the CFPB determines would aid in fulfilling the purposes of this section.”

Fear exists in the commercial finance community that the CFPB will use such data in a misinformed way to levy penalties and exert control over business-to-business transactions even though its statutory power is limited to just the collection of information.

Although the CFPB is still in the information gathering stage on Section 1071, the President’s regulatory freeze is likely only the first step of many to delay or dismantle their rules. And that’s at a minimum. Presently, the CFPB is faced with the threat that Trump will fire its director or abolish the agency altogether. There is strong support for this among Republicans, especially given that a federal court recently held that the CFPB’s structure is unconstitutional. In PHH Corp v. CFPB, the court offered two ways for the agency to come into compliance with its order, either reconfigure into a multi-member directorship or yield the director’s power to the President of the United States. Sitting CFPB Director Richard Cordray rebuffed the order as “wrongly decided” and declined both. His term ends in 2018.

The CFPB’s brash refusal to make concessions or accept court orders has made it a prime target of Trump’s administration. Because of the battles with the agency still to come, it is possible that Section 1071 may not begin to see the light of day for at least another four years.

The Top Small Business Lending Platform Finalists Named By LendIt

January 20, 2017The LendIt Industry Awards has named six finalists for the Top Small Business Lending Platform. They are:

- OnDeck

- Kabbage

- SmartBiz

- StreetShares

- Ascentium Capital

- iwoca

OnDeck you should know by now. They are publicly traded on the NYSE under ticker ONDK. We last sat down with them in October, shortly before they announced a $200 million credit facility with Credit Suisse.

Kabbage was one of the first online small business lenders to truly experiment with complete automation. In the last year the company has partnered with banking giants Santander and Bank of Nova Scotia.

SmartBiz ranked as the number one provider of non-Express, SBA 7(a) loans under $350,000 for fiscal year 2016. An online platform, they generated $200 million in funded SBA 7(a) loans through its bank lending partners during that period.

StreetShares has a strong focus on funding veteran small businesses. The company is also one of a very few to get approved for Reg A+ under the JOBS Act, which allows them to accept investments from unaccredited retail investors (with some limitations).

Ascentium Capital actually funded nearly $900 million to small businesses in 2016 and was acquired by PE firm Warburg Pincus just a few months ago.

iwoca is based in the UK but also operates in Germany, Spain, and Poland. They offer lines of credit to small businesses up to £100,000 with repayment terms of up to 12 months. Interest rates range from 2% to 6% per month. iwoca has raised £46 million through debt and equity.

According to LendIt, finalists for this category were awarded to the top small business lending platform based on a combination of loan performance, volume, growth, product diversity and responsiveness to stakeholders.

A similar category, the greatest Emerging Small Business Lending Platform also had six finalists. They include:

- ApplePie Capital

- Capital Float

- Credibility Capital

- Lendio

- Lendix

- Wunder Capital

More than 30 industry experts will judge and select award winners. You can view all categories, finalists and judges here.

You can also get 15% off the LendIt Conference registration with promo code: Debanked17USA.

WEX and OnDeck Announce Strategic Partnership to Offer Financing to WEX Small Business Customers

January 17, 2017

SOUTH PORTLAND, Maine–(BUSINESS WIRE)–WEX Inc. (NYSE: WEX), a leading provider of corporate and small business payment solutions, and OnDeck® (NYSE: ONDK), a leader in online lending for small business, announced a partnership in which WEX will offer business financing from OnDeck to its small business customers.

WEX is a global, multi-channel provider of corporate payment solutions representing more than 10 million vehicles and offering exceptional payment security and control across a wide spectrum of business sectors. The company and its subsidiaries employ more than 2,500 associates who provide services in the Americas, Europe, Australia, and Asia.

“Our partnership with OnDeck will be a huge benefit to our small to mid-sized business customers who will now have access to new sources of financing,” said Brian Fournier, vice president, fleet channel partner, WEX. “The strategic partnership will enable these customers to take advantage of OnDeck’s leading portfolio of products and services.”

“OnDeck is 100 percent focused on helping small businesses seize opportunities, such as hiring employees, funding marketing, or buying inventory,” said Jerome Hersey, vice president, OnDeck. “Our partnership with WEX, an innovator in the payments marketplace, will enable us to offer more small businesses an unparalleled set of choices to meet their financing needs.”

For more information about WEX’s small business offerings, please visit: http://www.wexinc.com/fleet/small-business/.

About WEX Inc.

WEX Inc. (NYSE: WEX) is a leading provider of corporate payment solutions. From its roots in fleet card payments beginning in 1983, WEX has expanded the scope of its business into a multi-channel provider of corporate payment solutions representing approximately 10 million vehicles and offering exceptional payment security and control across a wide spectrum of business sectors. WEX serves a global set of customers and partners through its operations around the world, with offices in the United States, Australia, New Zealand, Brazil, the United Kingdom, Italy, France, Germany, Norway and Singapore. WEX and its subsidiaries employ more than 2,500 associates. The company has been publicly traded since 2005, and is listed on the New York Stock Exchange under the ticker symbol “WEX.” For more information, visit www.wexinc.com and follow WEX on Twitter at @WEXIncNews.

About OnDeck

OnDeck (NYSE: ONDK) is the leader in online small business lending. Since 2007, the Company has powered Main Street’s growth through advanced lending technology and a constant dedication to customer service. OnDeck’s proprietary credit scoring system – the OnDeck Score® – leverages advanced analytics, enabling OnDeck to make real-time lending decisions and deliver capital to small businesses in as little as 24 hours. OnDeck offers business owners a complete financing solution, including the online lending industry’s widest range of term loans and lines of credit. To date, the Company has deployed over $5 billion to more than 60,000 customers in 700 different industries across the United States, Canada and Australia. OnDeck has an A+ rating with the Better Business Bureau and operates the educational small business financing website www.businessloans.com.

OnDeck, the OnDeck logo, OnDeck Score and OnDeck Marketplace are trademarks of On Deck Capital, Inc.

Contacts

WEX

Rob Gould, 207-523-7429

robert.gould@wexinc.com

or

OnDeck

Jim Larkin, 203-526-7457

jlarkin@ondeck.com

Funding Circle’s New $100 Million Funding Round is a Surprise, But it’s Really Not

January 13, 2017The alternative small business lender that is arguably offering the longest terms with the lowest rates has secured a $100 Million Series F Round, according to an announcement on Wednesday.

With the round led by Accel, the strong sign of confidence contradicts the sentiment felt by many in the US about their business model. In the last few months, several of Funding Circle’s US competitors have suspended operations, shut their doors, or integrated into other companies. Most of the questions we’ve received lately have centered around “who’s next to fall?” not “who’s next to raise $100 million?”

So what’s going on here?

Imagine in an alternate universe that the US government was using Funding Circle’s platform to fund millions of dollars to small businesses, that the US Treasury Secretary was publicly cheering them on, and that they sat on Capitol Hill drawing up new laws that would regulate their industry in a way that would help them succeed, would you bet on them to win?

That alternate universe exists and it’s called the United Kingdom. It’s also Funding Circle’s primary market. Just last week the UK government lent Funding Circle another £40 million on top of the previous £60 million to lend to small businesses amid credit concerns related to Brexit and it’s only one example of how cozy government relations are over there.

That alternate universe exists and it’s called the United Kingdom. It’s also Funding Circle’s primary market. Just last week the UK government lent Funding Circle another £40 million on top of the previous £60 million to lend to small businesses amid credit concerns related to Brexit and it’s only one example of how cozy government relations are over there.

Chancellor of the Exchequer (the US Treasury Secretary equivalent), Philip Hammond, said: “Funding Circle has become a real success story for British Fintech and news that it has attracted £80 million (US $100 mil) of investment is further evidence of the growing importance of this industry. This is another vote of confidence in a UK firm that plays an important role in our economy – helping businesses to grow and create jobs.”

And in a TV interview with Bloomberg, Funding Circle co-founder James Meekings said that the company is working with the government to help draft the regulations that they would have to abide by. Sounds like a nice arrangement.

The UK is still their biggest market but part of their $100 million funding round will be used to further develop their US business, Meekings said on Bloomberg. To date, the company has raised $375 million. Less than two years ago, their private market valuation was $1 billion, more than twice OnDeck’s current market cap. Funding Circle’s valuation in this round was not disclosed.

Funding Circle’s global loan volume these days rivals OnDeck’s. £400 million was lent by Funding Circle in Q4 versus $613 million lent by OnDeck in Q3, setting up the possibility that the former could surpass the latter in volume this year.

Funding Circle’s publicly traded SME Income Fund has also held up pretty well over the last year:

Shortly after announcing their funding round, a trade group they co-founded in the US, the Marketplace Lending Association, welcomed 11 new members. Might Funding Circle eventually gain the same favor in the US that they’ve nurtured in the UK? Would you bet on them?