Business Lending

Shopify Originated $226.9M in MCAs and Business Loans in Q4, Close to $800M For the Year

February 17, 2021 Shopify released its 2020 fourth-quarter earnings on Wednesday, revealing its financial arm’s latest stats. Shopify Capital originated $226.9 million in merchant cash advances and loans to businesses in the U.S., Canada, and the U.K.

Shopify released its 2020 fourth-quarter earnings on Wednesday, revealing its financial arm’s latest stats. Shopify Capital originated $226.9 million in merchant cash advances and loans to businesses in the U.S., Canada, and the U.K.

That is a posted increase of 96% over the same quarter in 2019 but was down 10% from q3. The full year 2020 originations of $794M were nearly double the $430M in 2019.

“Products like Shopify Capital are increasingly sought out by entrepreneurs and small businesses that face unnecessary barriers to access from traditional banks,” Shopify President Harley Finkelstein said in the quarterly earnings call. “Merchant empathy runs deep at Shopify. When traditional businesses were turned away, for the perceived high risk, we financed a record number of merchants when they needed it most.”

“We also introduced Shopify Capital to Canada and to the U.K. in 2020,” Finkelstein said. “To expand where we could help merchants.”

Shopify Capital still lagged behind rival OnDeck in origination volume, who reported a little over $1B in originations for the year.

BlueVine’s CEO on Latest Round of PPP

February 10, 2021BlueVine CEO Eyal Lifshitz took to twitter last night to update customers on the status of this PPP round. Word from around the industry has suggested that approvals have been slower and that in certain situations, additional documentation is being asked for because of the SBA’s heightened scrutiny.

Below is Lifshitz’s consolidated twitter thread.

As a third-generation entrepreneur, my decision to build BlueVine was personal—I believe in and have dedicated myself to small businesses. To the customers reaching out for Paycheck Protection Program support, know that I’ve read your messages and want to update you directly.

When the latest Paycheck Protection Program was announced, we knew we had to step up again and help small businesses. Though the cause was close to our mission, we had to refocus our business completely. If you feel this program has been slower, it has. But for good reasons.

Waiting is frustrating, especially if these funds will make or break your business. There are explanations for the longer wait times, which can actually mean GOOD news for your business. Let me break this down.

The SBA’s program changes were significant, adding Second Draws and other improvements. Every change requires an additional product build and support team training, ensuring we’re compliant and provide the most efficient and effective application process.

The program’s adjustments include serving the hardest-hit businesses (and not large well-known companies). This extra due-diligence means additional documentation and information for us to review. It also means that smaller businesses may have a greater share of the funds.

The previous PPP round was impacted by some fraudulent actors. To prevent funds from getting in the wrong hands, the SBA added more robust requirements. While this added protection is more work and slows things down, it ensures funding remains for those that need it most.

We know the process of reviewing and approving PPP loans was slow at first, but we wanted to ensure we got it right before automating. Since we started, our throughput has more than tripled. If you’re in review, be patient. We haven’t forgotten about you!

I want to emphasize that BlueVine, and me personally, are committed to serving small businesses. We’ve more than doubled our customer support team to better assist you during what I can only imagine has been a brutal year. We see you and are doing everything we can to help.

Over Half of Small Businesses Had Unmet Funding Needs

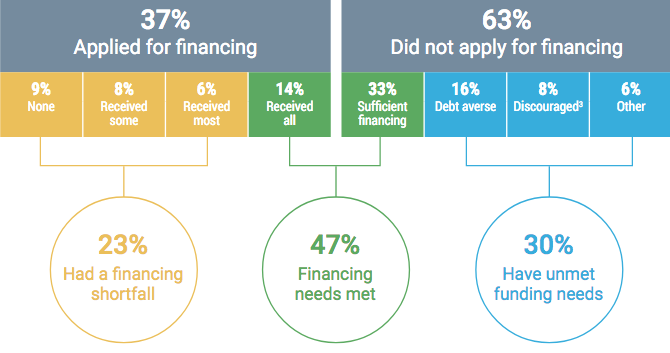

February 8, 2021The Federal Reserve’s analysis of overall funding efforts for all small businesses demonstrates a market of unmet financial needs. In 2020, a total of 47% of firms met their funding needs, while the other half (53%) still needed capital.

23% of firms saw a “financing shortfall.” They were partially approved but still needed more funds. The other 30% have unmet funding needs because they never applied according to the survey- they’re scared of debt, risk-averse, or don’t meet requirements.

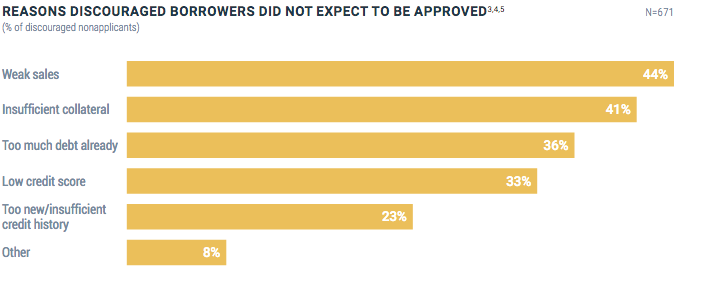

Those that did not apply for funds would have if they were not discouraged by weak sales (44%), insufficient collateral (41%), low credit (33%), and too much debt already (36%).

83% of companies used a bank or small bank as their primary financial service provider, while only 11% said an online lender or fintech was their primary.

Meanwhile, in the funding world, MCAs were only sought by 8% of all funding applicants last year, compared to 89% of firms applying for a loan or line of credit.

Most firms that went for an MCA went with a bank. 85% percent of firms that applied for a loan, credit, or cash advance used a large or small bank. In contrast, only 20% of firms applied to an online lender, falling from 33% since last year.

42% of firms that worked with online lenders or fintech companies were dissatisfied with support during the pandemic. Comparatively, firms that did receive some funding from an online lender were far happier: only 18% were dissatisfied.

Forty-Four Percent of Small Businesses Were More Than $100,000 in Debt in 2020

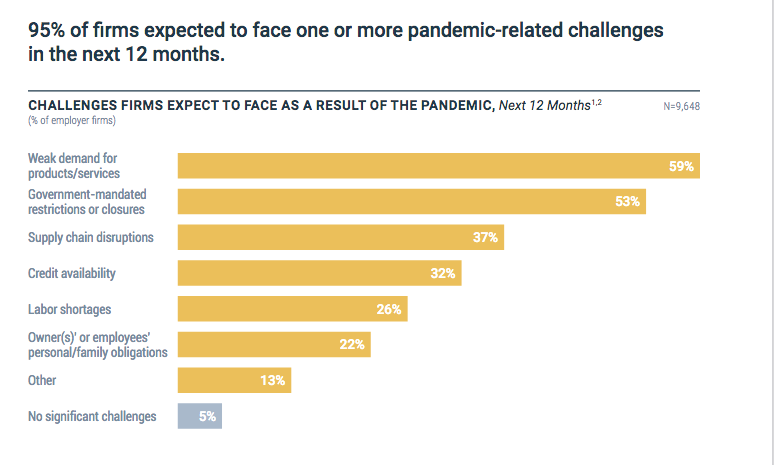

February 5, 2021 Fifty-three percent of firms expected total sales revenues for 2020 to be down by more than twenty-five percent because of the pandemic, according to the latest small business survey published by the Federal Reserve. Eighty-eight percent of firms indicated that sales had still not returned to normal.

Fifty-three percent of firms expected total sales revenues for 2020 to be down by more than twenty-five percent because of the pandemic, according to the latest small business survey published by the Federal Reserve. Eighty-eight percent of firms indicated that sales had still not returned to normal.

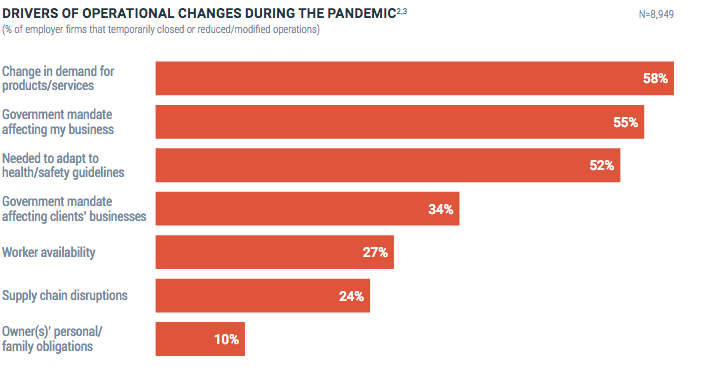

Of those hurt by shutdowns, supply chain troubles, and government shutdowns, 26% percent closed temporarily, fifty-six percent reduced their operations, and 48% percent modified their operations.

Fifty-seven percent of firms characterized their financial condition as “fair” or “poor.”

The struggle to remain open sent firms further into debt. Seventy-nine percent of firms had debt outstanding, an 8% increase from 2019. Debt also increased; the share of firms with more than $100,000 in debt rose from 31% to 44%.

The majority of U.S. businesses believe the next year will be rife with the same struggles as the last. Many believe weak demand, government shutdowns, and supply chain breaks will continue disrupting the world economy.

Overall, firms applied for financing less, from 43% in 2019 to 37% in 2020.

Firms got their funds this year through Government aid programs, and they did so through their pre-existing bank relationships, forgoing alternative funders. Forty-eight percent went through large banks for PPP, 43% to smaller banks. 95% and 83%, respectively, already had a relationship with their large or small bank.

Enova Pleased With The OnDeck Acquisition, Looking to Divest ODX, OnDeck Canada, OnDeck Australia

February 5, 2021 “We’re very pleased so far with the OnDeck acquisition and as we view the economic landscape, we continue to believe that it’s an excellent time to be increasing our focus on SMB lending,” Enova CEO David Fisher said on the company’s Q4 earnings call. Enova originated $120 million in small business loans in December and $95 million in November. The October figure wasn’t specified, but back-of-the-napkin math based on other provided statistics suggests it was about $54 million.

“We’re very pleased so far with the OnDeck acquisition and as we view the economic landscape, we continue to believe that it’s an excellent time to be increasing our focus on SMB lending,” Enova CEO David Fisher said on the company’s Q4 earnings call. Enova originated $120 million in small business loans in December and $95 million in November. The October figure wasn’t specified, but back-of-the-napkin math based on other provided statistics suggests it was about $54 million.

Growing those originations will continue to be their primary agenda as the economy improves, the company said, while the ODX side of the business may be shown the door.

“While ODX has been able to sign some high-profile bank clients, divesting ODX will allow for more efficient use of capital as the business has over 70 employees but less than $10 million in revenue,” Fisher said.

OnDeck Canada and OnDeck Australia may also be on the chopping block.

“The Australian and Canadian businesses are viable businesses in their respective market,” Fisher said, “but are small compared to OnDeck US operations and are unlikely to have a significant impact on Enova’s overall growth. In addition, OnDeck only has partial ownership of those two businesses.”

Meanwile, OnDeck’s portfolio outlook is improving.

“The percentage of OnDeck receivables past due 30 days and more declined during the quarter from 23.2% in closing to 15.6% at December 31,” said Enova CFO Steve Cunningham.

On the call, JMP analyst David Scharf asked when OnDeck would return to quarterly origination levels of $550M to $650M as it had been enjoying prior to the pandemic.

“I mean I think there’s just way too much uncertainty to be able to answer that,” Fisher replied. “I mean, does the vaccine work great and the economy opens up soon or is there a new strain of the COVID virus that requires lockdowns during the summer? I mean, there’s no way to know. But I think there’s a couple trends that are super encouraging for us and we saw great sequential growth as we talked about throughout the call.”

Fisher also added that they’ve seen a bunch of competitors go out of business. “We think we have a lot of share in the market that we don’t think has shrunk and so we think we’re really well positioned as this pandemic winds down,” he said.

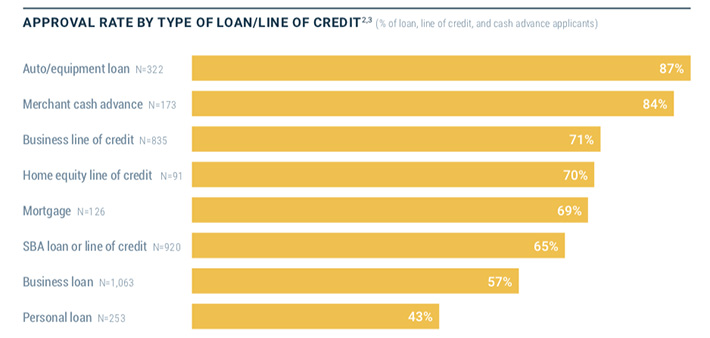

Merchant Cash Advance Approval Rate Was 84% in 2020, Federal Reserve Finds

February 3, 2021Eighty-four percent of applicants that applied for a merchant cash advance in 2020 were approved, according to the latest study published by the Federal Reserve. However, that figure includes the pre-March 2020 covid era.

When MCAs and online loans were blended, for example, the approval rate shrank from 81% pre-March 1st to 70% after March 1st.

Eight percent of all small businesses sought a merchant cash advance in 2020, down slightly from 9% in 2019. Leasing dropped from 9% to 7% and factoring dropped from 4% to 3%. Pursuit of credit cards even dropped, down from 29% to 21%.

There were some downsides for the online lending industry reported.

Only 9% of PPP applicants used an online lender.

Online lenders had the lowest satisfaction rate (43%) for small business credit needs. Credit unions scored the highest (87%).

Net satisfaction with online lenders dropped to its lowest level since 2016.

Small businesses satisfaction with big banks actually grew from 2019 to 2020.

Small businesses were less likely to apply for a business loan or MCA from an online lender in 2020 and more likely to apply for them at a bank in 2020 than they were in 2019.

Eighty-two percent of businesses applied for a PPP loan. Forty-seven percent applied for an EIDL loan.

Banks, perhaps counterintuitively, were the big winners in 2020. That trend could increase as banks and online lenders become the same thing.

StreetShares Discontinues Veteran Business Bonds

February 3, 2021StreetShares, the former online lender that pivoted to Lending-as-a-Service in October, is no long offering its veteran business bond program as a result.

A note on its website says:

“Thank you Veteran Business Bond investors! We have achieved our Bond funding needs. As a result, we have discontinued our offering of Veteran Business Bonds. New Bonds are no longer available for purchase or investment. Your current Bonds continue to earn 5% annual interest. Investors are able to log in to access their accounts.“

An Amazon Capital Lending Loan

February 2, 2021Amazon’s small business lending business is no small operation. deBanked recently viewed a loan agreement between Amazon Lending and an Amazon seller in which the seller received a loan of $300,000 at an annual interest rate of 15.99%.

In 2019, we estimated that the company had originated $1.5B in small business loans, placing them in the #5 slot on our list, but the company is possibly on track to be #1.