Business Lending

BusinessFunding.com Sells for $44,000

February 12, 2024 The world of domain name investors called out a big sale that took place on GoDaddy over the weekend. The domain is businessfunding.com and it reportedly sold for $44,000, according to Namebio which tracks sales when data is available. The whois information does not reveal who the buyer is at this time.

The world of domain name investors called out a big sale that took place on GoDaddy over the weekend. The domain is businessfunding.com and it reportedly sold for $44,000, according to Namebio which tracks sales when data is available. The whois information does not reveal who the buyer is at this time.

Other potentially high value domain names in the small business finance industry include businessloans.com and smallbusinessloans.com, each of which are standalone businesses.

Meanwhile:

loans.com was sold for $3 million 24 years ago and today redirects to the homepage of Bank of America.

businesslenders.com belongs to Business Lenders, LLC, which has since ceased its lending operations.

businesslending.com redirects to a bio page for a big real estate broker.

merchantloan.com redirects to Circadian Funding’s website.

revenuebasedfinancing.com redirects to Lighter Capital’s website.

lenders.com is a page that hasn’t been set up yet.

lending.com doesn’t resolve.

How important is a domain name to a business? Important enough that a business can hardly afford to lose one. And did you hear about the first domain name to ever be used as loan collateral over the blockchain? It just happened recently!

Amazon’s On-Balance-Sheet Business Loan Program Steady

February 11, 2024 Amazon’s business loan program was relatively steady in Q4 if its seller lending receivables are any indication. Those receivables totaled $1.3B, which was in line with where it has been throughout 2023. Compared to Amazon’s overall business, which generated $170 billion in sales in Q4 alone, its in-house lending business is rarely if at all mentioned.

Amazon’s business loan program was relatively steady in Q4 if its seller lending receivables are any indication. Those receivables totaled $1.3B, which was in line with where it has been throughout 2023. Compared to Amazon’s overall business, which generated $170 billion in sales in Q4 alone, its in-house lending business is rarely if at all mentioned.

Part of this is because Amazon has forged ties with third parties to service large swaths of its sellers. These parties include Parafin, Lendistry, and more recently SellersFi.

“Amazon is committed to providing our sellers with flexible and convenient access to capital, regardless of their size,” said Tai Koottatep, director and general manager, Amazon WW B2B Payments & Lending as part of the SellersFi announcement last month. “Through this lending option with SellersFi, we’re able to strengthen that commitment and offer sellers even more opportunities to grow their business.”

“Working with the Amazon Lending team has been an exceptional experience for SellersFi,” said Leonardo Felisberto, Head of Global Business Development and Partnerships at SellersFi during that same announcement. “Their dedication to empowering sellers aligns perfectly with our mission, and together, we’ve unlocked more possibilities for e-commerce entrepreneurs. We’re hopeful this can be another step toward supporting the growth aspirations of online sellers in the US and beyond.”

PayPal Reiterates Tightening of Business Lending Originations

February 8, 2024 After announcing a sudden pullback on business loans and MCAs in Q3 due to higher than expected charge-offs, PayPal maintained that the belt was still tightened in Q4.

After announcing a sudden pullback on business loans and MCAs in Q3 due to higher than expected charge-offs, PayPal maintained that the belt was still tightened in Q4.

“We have taken a prudent and active approach to managing our overall credit risk, tightening originations within our PayPal business loans portfolio,” said PayPal CFO Jamie Miller on the quarterly earnings call. “We are carrying lower credit receivables after tightening originations last year.”

Tightened originations has led to the company being dethroned as the top online unsecured small business lender. PayPal at the very least held that notable distinction in 2019 and 2020 but they’ve since been overtaken by Square Loans and Enova.

Tech Founder Takes Online Business Loan, Grows Massively

February 2, 2024The founder of Testimonial.to took to X to share his story about using a revenue based business loan from Stripe Capital. It worked very well for him. His posts about it are below:

Everyone in the comments missing the point picking on the interest amount. Dude deployed cash to grow his business by $300k ARR.

— Preetam Nath (@hipreetam93) July 27, 2023

Not really to build a business from scratch, but to scale a business that already proved the PMF

— Damon Chen (@damengchen) July 26, 2023

Some marketing expenses and hiring

— Damon Chen (@damengchen) July 26, 2023

I can take $187,300 from Stripe without giving away a single share of my company. The modern-day "VC"! pic.twitter.com/1wiTQsa7KF

— Damon Chen (@damengchen) February 2, 2024

Stripe Capital works similar to how other platforms work in that their product is a loan with MCA-esque features. For example, merchants apply a fixed percentage of their credit card sales toward their loan balance up until the loan is paid in full.

Enova Has Record Quarter for SMB Lending

January 31, 2024Enova logged its biggest quarter ever for small business loan originations, hitting $930M in Q4.

“Strong demand and solid credit performance enabled us to be more aggressive with our marketing, particularly in our SMB business,” said Enova CEO David Fisher during the earnings call. The company’s net charge-off ratio was also down, dropping from 5.5% in Q3 to 4.8% in Q4.

Enova has consistently considered itself to be in a league of its own on the small business lending front, citing most recently that it continues to benefit from a “strong brand presence” and “low levels of competition.”

“Our results are driven by the strength of our talented team, diversified product offerings and world-class machine learning, analytics and technology,” said Fisher during the call. “A combination of these strengths has enabled us to successfully manage the uncertain macroeconomic environment we faced in 2023, growing originations while managing credit to acceptable levels that generate unit economics above our targets. Our unwavering commitment to this balanced approach to growth has allowed us to take share from our competitors in both our consumer and SMB business while effectively managing risk.”

Top Industry Execs Attend Small Business Finance Leaders Summit in Washington DC

January 29, 2024 Fifty top C-level executives attended the Small Business Finance Leaders Summit in Washington DC last week to discuss the economy, small business finance, policy issues, regulatory impacts, and industry best practices. Co-hosted by two major trade organizations, the Small Business Finance Association (SBFA) and the Innovative Lending Platform Association (ILPA), it was invite-only and open to members of both.

Fifty top C-level executives attended the Small Business Finance Leaders Summit in Washington DC last week to discuss the economy, small business finance, policy issues, regulatory impacts, and industry best practices. Co-hosted by two major trade organizations, the Small Business Finance Association (SBFA) and the Innovative Lending Platform Association (ILPA), it was invite-only and open to members of both.

Speakers included US Senator Roger Marshall, Tom Sullivan from the US Chamber of Commerce, Holly Wade from the National Federation of Independent Business, Aaron Klein from Brookings, Will Tumulty from Rapid Finance, Justin Bakes from Forward Financing, Kirk Chartier from OnDeck, and Steve Allocca from Funding Circle, among others.

“As our industry matures, it’s important to provide industry leaders with an opportunity to connect and engage with high-level thought leaders,” said Steve Denis, Executive Director of the SBFA. “We believe our C-level Summit complements the Broker Fair and other industry conferences like Money 20/20 or Nexus. We hope to expand our Summit in June to bring in some new industry voices and will continue to focus on high-end content that is meaningful and strategic for our members and other top industry leaders.”

The organizations are planning another Summit in early June to build upon the success.

Another Small Business Loan Marketplace is Getting a Massive Venue

January 22, 2024 What’s the difference between a typical bank having naming rights to a sporting arena and a fintech lender? The fintech lender will attempt to serve as a one-stop-shop for everything. And that’s important because this October the Intuit Dome will open its doors in Inglewood, California and become the hometown arena for the LA Clippers. Intuit has a lot of brands. According to the NBA, Intuit subsidiaries TurboTax, QuickBooks, Credit Karma, and Mailchimp will all feature prominently in the venue experience. That draws attention to QuickBooks Capital, the company’s small business lending division which is presently generating more than $1 billion a year in loans. Intuit’s got a fallback option for businesses that might not be suitable for them directly, an automated marketplace that connects business owners with other lenders. It’s been so successful that Intuit states they’ve originated more than $2 billion in loans through it.

What’s the difference between a typical bank having naming rights to a sporting arena and a fintech lender? The fintech lender will attempt to serve as a one-stop-shop for everything. And that’s important because this October the Intuit Dome will open its doors in Inglewood, California and become the hometown arena for the LA Clippers. Intuit has a lot of brands. According to the NBA, Intuit subsidiaries TurboTax, QuickBooks, Credit Karma, and Mailchimp will all feature prominently in the venue experience. That draws attention to QuickBooks Capital, the company’s small business lending division which is presently generating more than $1 billion a year in loans. Intuit’s got a fallback option for businesses that might not be suitable for them directly, an automated marketplace that connects business owners with other lenders. It’s been so successful that Intuit states they’ve originated more than $2 billion in loans through it.

This seamless integration of referrals to other lenders is what makes the marketing campaign via arena naming rights so potent. And they won’t be the first ones to do it. SoFi, for example, whose football stadium is in walking distance to the Intuit Dome, just announced its own small business loan marketplace. SoFi Stadium was home to the Super Bowl in 2022 and will be again in 2027. It will also be home to the Olympics in 2028. Not a bad way to get one’s name out there.

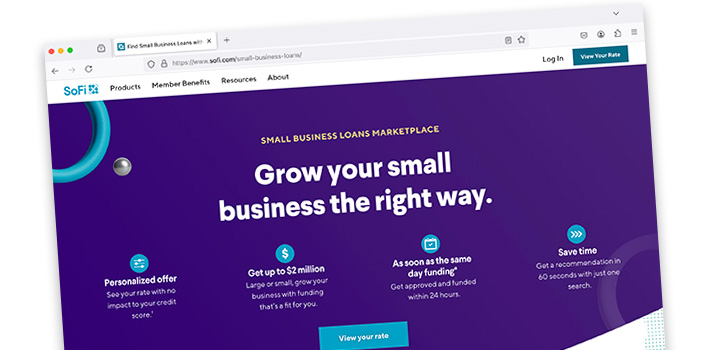

SoFi Launches Small Business Loan Marketplace

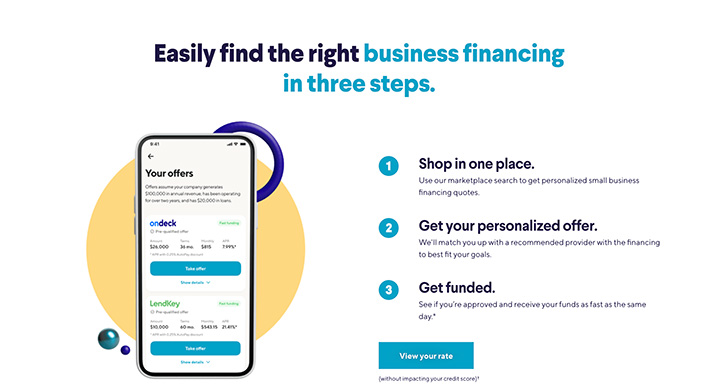

January 18, 2024 SoFi small business customers can now get approved for a loan and funded up to $2 million in 24 hours. Structured as a marketplace where SoFi itself is not the lender, the company announced that “With one quick and simple search, business owners will be connected with SoFi’s network of financial providers who can help them get the capital they need.”

SoFi small business customers can now get approved for a loan and funded up to $2 million in 24 hours. Structured as a marketplace where SoFi itself is not the lender, the company announced that “With one quick and simple search, business owners will be connected with SoFi’s network of financial providers who can help them get the capital they need.”

SoFi had flirted with the idea of small business loans previously and this appears to be their solution.

Judging by SoFi’s marketplace home page, OnDeck and LendKey are at least two of the lenders on the platform. Although the others were not immediately visible, the company said it “will continue to expand its network to include more providers and financial solutions for small businesses.”