business cash advance

The End of an Era

September 19, 2012It’s the end of an era. Sound ominous for a blog that reports on the Merchant Cash Advance (MCA) industry? It shouldn’t. In the last 10 years, MCA firms played in the minor leagues. No one was really paying attention to them and truthfully, a lot of critics didn’t think this business model would still be around. But today it still stands, funders are still funding, and this blog is practically struggling to keep up with the incredible amount of action that is taking place. Coincidentally, 2012 marks the end of the Mayan Calendar. Yes, it’s the end of an era.

MCA Goes From 0 to 60

There were a few big firms in the Mid-2000s (RapidAdvance, Merchant Cash and Capital, Strategic Funding Source, AdvanceMe, etc.) and they’ve all experienced modest success. It was “modest” in the sense that it is nothing compared to today’s standards. The level of play is changing. Wining and dining an Independent Sales Office (ISO) that could bring in $300,000 a month in deal flow used to be all the rage. 300k for one company was 300k less for a competitor. An extra point of commission here or a freebie approval there was enough to make you the big dog in town, at least for awhile. Despite all the supposed innovation and growth, the talent pool remained the same. Lead generators became agents, agents became ISOs, ISOs became syndication partners, syndication partners became funders, and funders became technology companies that were basically clearing houses for groups of funders. If the industry was Sally, Joe, and Tom in 2005, it was still Sally, Joe, and Tom in early 2011, just with new company names or titles. Then everything changed…

Money poured in:

Merchant Cash and Capital Announces $25 Million in new financing 10/4/11

Snap Advances raises $3 Million from TAB bank 11/21/11

Capital Access Network raises $30 Million 2/7/12

RapidAdvance Receives new financing facility through Wells Fargo 4/2/12

1st Merchant Funding | $5 Million re-discount line of credit from TAB bank 6/12

Strategic Funding Source secures $27 million 6/27/12

On Deck Capital raises $100 Million 8/23/12

Kabbage raises $30 Million 9/17/12

Industry insiders loosely redefined what a Merchant Cash Advance was:

Merchant Cash Advance Redefined Merchant Processing Resource 3/25/12

Big companies entered the market:

American Express Announces Their Own Merchant Cash Advance Program 9/22/11

PayPal Pilots Merchant Cash Advance Program in the U.K. 7/13/12

Some funders became licensed lenders in major states such as California:

A New Chapter Opens for Merchant Cash Advance The Green Sheet 6/25/12

Search the California licensed lender registry

New products formed:

FundersCloud creates platform to raise capital and find syndicate partners faster 8/29/12

A charity announces a new way to make subsidized business loans using the split-funding method 9/6/12

These barely scratch the surface of industry events. What used to be a competition to score the local neighborhood ISO has morphed into a race to be the first to partner up with Facebook, twitter, Groupon, and Square. Anyone not moving full speed ahead to integrate technology and social media will be gone in the next 24 months.

May 18, 2012 was the first time we noticed and commented on what was happening. In How The Facebook IPO Affects the Merchant Cash Advance Industry, venture capitalists and Silicon Valley had finally found MCA and there’s no hiding from them. Now it seems all of our far-fetched predictions are not only coming true, they’re happening moments after we predict them. In our last article we instructed everyone to keep their eyes on Kabbage. Six days later they announced they had raised $30 million in new financing and would be expanding overseas. For a company that makes wild claims about the correlation of facebook fans with account performance, all while humorously being named after a boring vegetable, they sure seem perfectly able to threaten the status quo. Nobody dared touch Ebay or Amazon businesses until they came around.

Price

On the cost basis front, the middle ground is eroding even further. We first discussed this phenomenon on April 25, 2011 in The Fork in the Merchant Cash Advance Road. In it, we explained that the combination of competition and defaults were placing downward pressure and upward pressure on price at the same time. Today, there is surging demand for “starter deals” at 1.49 factors that are payable over 3 months at the same time that more and more new lenders are offering 1 year loans at 10%. The low rate, 12-18 month term deals are nothing new. A few funders tried them in the past and most suffered irrecoverable consequences. This is history that the new players didn’t witness.

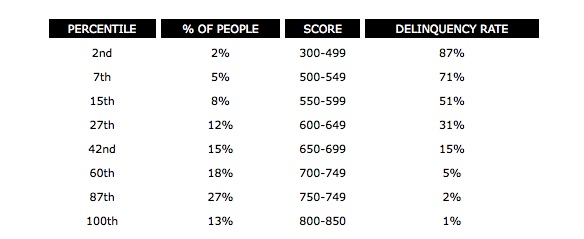

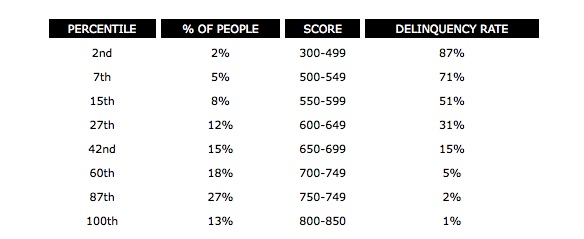

Some outsiders view the MCA industry as a bunch of Wall Street guys that got fat, happy, and disincentivized to lower costs. On the contrary, one only needs to take a single look at this chart to realize that undercutting the entire market isn’t so genius after all. How can a funder survive with extremely low margins when 15% – 71% of their target market is likely to experience problems repaying their loans? These aren’t our stats, these are FICO’s:

Veteran industry insiders know this and acknowledge that the coming tide of low rate financing is a bubble that has burst before. On the DailyFunder, a few folks have offered this insight:

The mca/unsecured loan biz is very risky. It’s all fun and games till deals start going south. My guess is they either adjust rates to match defaults or go out of business. I know first hand that this is not a get rich quick business. It may look like it is from the outside but once you are inside you see the world differently pretty quickly.

[these new low rate deals are] just like On Deck did. When they first came out, they offered 12 month 1.09’s. Then it dropped to 6 month 1.12’s, then 1.18’s. Now you see 1.25’s to 1.35’s offered by them

Governance

On the other side of the cost war is potential federal regulation. At least one D.C. consulting firm is prodding the leaders of the MCA industry to take a proactive approach on self-governance. According to Magnolia Strategic Partners, MCA is on the radar of regulators and members of congress, especially in light of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The new MCA playing field has invited media attention, and not all of it is positive.

The North American Merchant Advance Association is the only organization for industry cooperation but their ability to dictate policies and standards is weak. They receive very little press and their website has been down for weeks. Many argue that they have been effective in minimizing defaults by sharing data on fraudsters. While this does stand to serve the community, it is but a footnote in their orignal intended purpose.

New Barriers to Entry

For the first time ever, potential resellers are facing barriers to entry. Becoming an ISO has long been as simple as owning a phone and purchasing a list of businesses that have used MCA financing before. Today, it’s not that easy. These lists have been sold literally hundreds of times over and called tens of thousands of times over. Pay-Per-Click marketing is dominated by the million and billion dollar firms with money to burn. If John Doe ISO wants to advertise on Google, he better be prepared to compete with the likes of American Express and Wells Fargo. Good luck! Putting skin in the game has also become more of a prerequisite for ISOs to succeed. Funders want to know if a sales agent would put his or her own money into a deal… and then actually commit them to doing just that. The odds are becoming stacked against the undercapitalized and it isn’t likely to change.

In 2009, the most prevalent pitch used by sales agents was to inform prospects that they themselves were “a direct lender” and that anyone else the prospect might be talking to was a broker. “Cut out the middleman and go direct with us,” they’d convincingly argue. This line became less effective when prospects heard this from all five agents they spoke to. Name dropping strategic partnerships will be the new way to build credibility. “We’re partnered with Facebook, twitter, Groupon, and Square,” a sales agent will soon be saying. “Can our competitors make the same claims? Go with us.”

See You On the Other Side

See You On the Other Side

2013 will kick off a single elimination tournament. Funders that didn’t realize 2012 was the end of an era will begin to fade. 2014 will eliminate the weaker firms that remain and by 2015, Merchant Cash Advance will no longer be a term that anyone uses. Big banks and billion dollar technology companies will go on to rebrand all that which the funding warriors of the last decade have worked so hard to establish. MCA will simply assimilate into other financial products. The metaphorical Sally, Joe, and Tom will probably still be in the business, but be working for companies like Capital One, Wells Fargo, and American Express. And as for us…well… we’re going to need something else to talk about. But we’ll keep you posted until that day. 🙂

– Merchant Processing Resource

https://debanked.com

8 Advances Are Better Than 1

September 11, 2012Things just got interesting. Your merchant processing $20,000 a month got approved for $26,000 and it was hard fought. Bad credit and some other issues would normally have forced this deal to go the starter route, but not this time. This time you can reflect back on the past few weeks of sweet talking the underwriter and know that it’s starting to pay off. Maybe it was the fact that you obnoxiously concluded every e-mail to him or her with a <3 or 🙂 just to make them feel extra special even if it was in response to a deal of yours they moronically declined.

I understand why you had to decline my client with 720 credit. We’ll get the next one! <3 :-)

And now this time you’re chalking up a tally on the closer board for a deal that shouldn’t have gotten done…that is until your client claims to have received a contract for $50,000 from another source. “There’s no way that can be true,” you tell them while rolling your eyes in frustration. This always happens at the finish line. Someone comes in and shouts out wild figures just to steal their attention away for a minute. But what if there really was a company offering 250% of processing volume to merchants who teeter on the subprime/starter threshold?

Sure there are ACH funders out there who will step in and say “based on their gross sales we might be able to give this merchant 500% of their processing volume!” and the like, but very few people are doing this from a split processing perspective.

We’ve been speaking with Heather Francis at Merchant Cash Group (MCG) and they plan to formally announce the details of their Fast Funding Equity program in the next couple of weeks. Without going into all qualifying parameters merchants must meet to be eligible, we’ve learned that these advances will be disbursed in 8 fixed monthly installments rather than the entire lump sum upfront. And that’s the catch. Under this program the merchant might be contracted for $50,000 but only receive a deposit for $6,000 today. However, there would be no future “renewal agreements” to negotiate or sign. Additional funds would be sprinkled into the merchant’s bank account on a near constant basis of every 6 weeks.

MCG might not win the deal every time with this program but they’re going to give a lot of account reps a run for their money. We all know the pitch of verbally promising additional funds in 3-6 months from the date of the initial advance, which is based mainly on hope that the account will perform and that the funder won’t play games. Put that up against 7 renewals in writing and it’s fair to say we’ve got a good match on our hands. There are some other special incentives for MCG account reps on the Fast Funding Equity program that are being leaked on the DailyFunder Forum.

———————————

G-Day

Today was G-Day in the Merchant Cash Advance arena. GoDaddy.com’s servers were taken down singlehandedly by a jerk (let’s be real here) in the hacker group known as Anonymous. But this time we couldn’t all point and laugh like when it happened to Sony, Yahoo, or LinkedIn. No, this time thousands of MCA agents, underwriters, and staffers wondered why they stopped receiving e-mails after 2pm EST. This time Internet leads stopped coming in, internal databases stopped responding, and websites stopped loading. This time we learned that almost everyone uses GoDaddy for something no matter how much they brag about their systems and technology.

Today was G-Day in the Merchant Cash Advance arena. GoDaddy.com’s servers were taken down singlehandedly by a jerk (let’s be real here) in the hacker group known as Anonymous. But this time we couldn’t all point and laugh like when it happened to Sony, Yahoo, or LinkedIn. No, this time thousands of MCA agents, underwriters, and staffers wondered why they stopped receiving e-mails after 2pm EST. This time Internet leads stopped coming in, internal databases stopped responding, and websites stopped loading. This time we learned that almost everyone uses GoDaddy for something no matter how much they brag about their systems and technology.

We didn’t take a poll of which companies were affected (we couldn’t because our e-mail was down!), but we did participate in the mass hysteria with several other people that were affected. As this very website went down around 2pm today, we lost contact with our database and e-mail servers. One ISO reported that their website, e-mail, and even their VOIP phones were down (You can have GoDaddy phones?). Another reported that their system was so connected to their GoDaddy servers that they couldn’t even print, scan, or fax! If you’re not a fan of Mondays, today was certainly a good day to make up an excuse to leave early. With systems crashing nationwide, chances are your stapler may not have been stapling right and your boss would have had no choice but to send you home.

Strangely, we have run into the hacker group Anonymous before. Back when they hacked Sony in 2011, they sent a 5 page blistering explanation of why they did it to the U.S. Federal Government. They included a link to our site on page 4 to an area that is now deprecated. That area outlined the basics of PCI compliance. For a week, our analytics showed that most of our web traffic originated from the Department of Homeland Security, Department of Justice, and the FBI. Boy, that was fun. Read that report and see our citation below:

———————————

Who To Beat in 2012

“How’s your month going?” we asked. “Pretty slow, but that’s because it’s August,” said a lot of companies we spoke to. August is typically a slow month in the world of MCA. Account reps go on vacation, small business owners hit the beach, and America subconsciously puts everything on the back burner until after Labor Day. That was quite the opposite for 2 New York based MCA firms, United Capital Source and YellowStone Capital, both of whom reportedly broke single month funding records.

According to YellowStone Capital’s posts on LinkedIn, they funded $11,125,000 in August alone. With that, they gave a special thanks to RapidAdvance, GBR Funding, The Business Backer, Max Advance, On Deck Capital, Promac and Snap Advances.

———————————

Add This To Your Data Points!

Companies that actively work to gain Facebook fans and Twitter followers are 20% less likely to be delinquent on their Merchant Cash Advance. Seriously. Kabbage, a company we mention in blurbs every so often operates independently from the rest of the industry by targeting e-bay sellers, independent Amazon stores, and social media retailers. Some people feel that they are not a serious challenger to the status quo and that their tactics, methods, and headlines are merely shock value fodder for the rest of us to laugh at while we all rant and rave about ACH deals being the hottest thing since Square. The founder of twitter (Jack Dorsey) started Square and it has completely disrupted the payments market that quite frankly was used to disruptions until Dorsey turned everything upside down. We believe Kabbage is a company everyone should keep an eye on.

On another note, our favorite part of Kabbage’s recent press release is actually the level of interest banks are expressing in their business model.

While the firm said it is open to establishing alliances with credit unions, banks have expressed more interest in seeing how they can leverage the technology platform to serve its customers.

-Kabbage

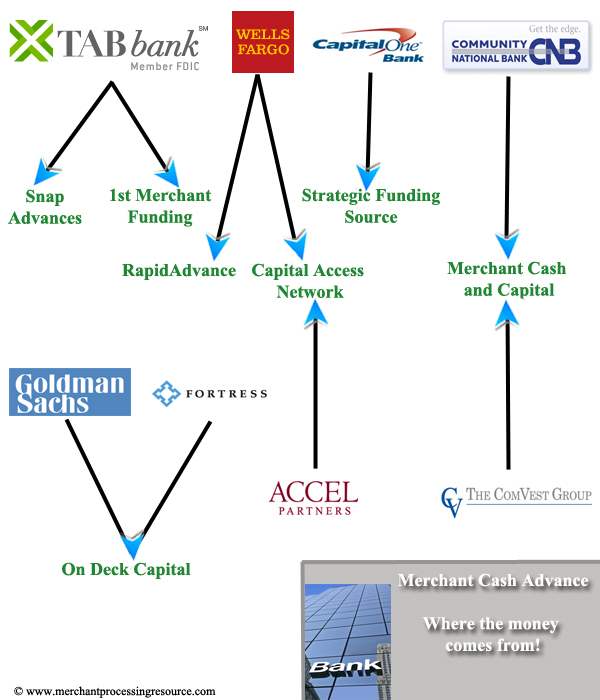

Fresh off our rant about John Tozzi’s recent article in BusinessWeek that concluded Wells Fargo was essentially evil for being involved with MCA companies, we’ve become suddenly self-conscious of what journalists might think. Little do they know that America’s big banks have been joined at the hip with the MCA industry for a while now. Banks are still lending to small businesses, we’re just all doing it on their behalves. TRUTH!

– Merchant Processing Resource

https://debanked.com

Follow The Money – MCA

September 8, 2012John Tozzi of BusinessWeek is just about the only journalist that follows the Merchant Cash Advance (MCA) industry. We use the verb “follows” loosely since he manages to write maybe one article per year on the subject. Rarely flattering, he does at least provide something that other writers do not: Substance. In his lastest piece, Wells Fargo Plays Both Sides of the Cash Advance Debate, Tozzi reminded us of something we’ve failed to address in this blog: big banks aren’t just becoming interested in MCA, they’ve already been involved in it for a long time. It also made painfully clear a message we’ve been trying to communicate for years, that ultra low interest rates are simply not feasible in small business lending.

Tozzi accuses Wells Fargo of sponsoring a small business lender that is directly attacking MCA companies while at the same time financing the companies being attacked. California based Opportunity Fund recently began offering a loan program that is…wait for it…repaid by withholding a percentage of credit card sales. They call it EasyPay and they’ve made no effort to hide their belief that they’ve achieved some kind of higher moral ground by charging only 12% APR. In their press release yesterday, they pounced on the competition:

While similar card-based payment systems exist in the private sector in the form of merchant advance loans, they routinely carry exorbitant interest rates that range from 104-177 percent. By contrast, EasyPay loans carry an annual interest rate of just 12 percent.

-Opportunity Fund

Wells Fargo awarded them cash and their “hypocrisy” is apparently history. Why? Wells Fargo has also backed prominent MCA providers RapidAdvance and Capital Access Network. This might come as news to some people, but not to us. What Tozzi may not realize is the main driver of the MCA industry has been and continues to be…banks. Sorry to break it to the small minority of people that suspect MCAs are part of some shadow banking system. Most small businesses are unaware that their funds may indirectly be coming from Capital One, Community National Bank, or even Wells Fargo!

And let’s come to terms with another hard fact about small business lending. Opportunity Fund is proof that you can charge 12% a year and be guaranteed to lose money. In the BusinessWeek interview: “At that rate, the nonprofit is not covering its costs, says Marco Lucioni, the lending director who created the product. Opportunity Fund subsidizes the loans to keep them cheap.”

Subsidies? Whhaaaaa??? Oh you didn’t know? Opportunity Fund is a registered 501(c)(3), a charity. Don’t get us wrong, we love charity and we think it’s wonderful that small businesses in California may be eligible for an EasyPay loan. We can’t help but be bothered though that a charity is attacking the private sector for charging “too much” when they acknowledge that their own rate of 12% (more than double the allowable interest rate on an SBA loan) is entirely unprofitable. We’ve made this charge over and over and over again. The world we lived in where business loans regularly came in at 5% annually was really just an artificial market caused by the SBA’s agreement to reimburse banks for all defaulted loans. But in the real private sector where there is no tax payer default guarantee, or charitable donors to put downward pressure on cost, it becomes clear that the MCA industry is the free market as it should be.

We also reject the characterization that MCAs are “expensive” since there are literally hundreds of funding companies and a thousand ways to structure a deal. That’s the problem with journalists that only drop in once a year or so, Tozzi has no idea how much has changed. Merchant Cash Advance simply means short-term business financing. The costs may be the equivalent of 1% APR or 200%. It could be a purchase of future sales or a fixed daily repayment loan. It might have everything to do with credit card sales or nothing to do with them at all.

The use of the split-funding method by a charitable business lender definitely highlights just how mainstream the ideas of the MCA industry have become. Hopefully they are prepared to deal with the rapidly evolving technology environment. They just might learn there’s a reason that Wells Fargo is also playing the other side. Companies like RapidAdvance and Capital Access Network are well-oiled machines and are respected by the small businesses that fund them. Tozzi calls this awkward. We think the banks in the diagram would beg to differ…

Follow the money and you’ll see why the MCA industry is a bet anyone would make.

– Merchant Processing Resource

https://debanked.com

Notice: the diagram may illustrate relationships that are out of date and omits that nature of the financing arrangement.

Why You Need FundersCloud – An Independent Review

August 29, 2012Picture this:

You get up in the morning, take a shower, brush your teeth, and hop on to your computer. 73 new e-mails are waiting in your inbox. Ugh! Some of them are saying “Hey buddy, I got this deal that I think you might want to co-fund. Give me a call later and I’ll try to give you a breakdown.” Half of the time when you call these guys back, they’re busy, have already found a participant, or the deal is way too risky for you to be interested in. Fortunately, you don’t really have to deal with this hassle ever since you joined FundersCloud. You close Outlook, log in to the Cloud and check out the menu of fresh deals that have been posted to the site. You read them aloud to yourself as you scroll down the list. “15k in monthly credit card sales, 40k gross, 720 credit, in business 3 years, ooo.. and it’s a restaurant! $10,000 advance for $13,700… I like… I like… oh and $7,000 has already been raised.” You click ‘Bid’, type in $3,000, and click ‘Bid’ again to finalize. That’s it. You’re done. Once the agent closes the deal, your $3,000 is automatically withdrawn, along with the amounts from the other participants to fund the merchant the $10,000. Satisfied, you walk into the kitchen to make toast…

And that’s what FundersCloud has done. Whether you are an independent agent, an ISO, or a funder, deal syndication is now as easy as:

FundersCloud is not the competition. They’re the turbo boost button to the marketplace that already exists. This Cloud doesn’t threaten or replace your existing cloud, system, database, or CRM but rather complements it, integrates with it, and adds even more value to what you already have.

FundersCloud makes funding quicker, smarter, more efficient, and incredibly transparent. This isn’t a paid advertisement. In fact we spent a few weeks on the phone with the FundersCloud team to come up with our own independent assessment. “How does this work? Who reviews this data? How can people trust you?” and so on… We’re actually thankful their team is still accepting our phone calls after our barrage of questioning and requests for details.

FundersCloud makes funding quicker, smarter, more efficient, and incredibly transparent. This isn’t a paid advertisement. In fact we spent a few weeks on the phone with the FundersCloud team to come up with our own independent assessment. “How does this work? Who reviews this data? How can people trust you?” and so on… We’re actually thankful their team is still accepting our phone calls after our barrage of questioning and requests for details.

The reason we believe FundersCloud is the future of syndication is because it allows people to continue syndicating with funders and people they already trust.

Huh?!

Allow us to explain using a fictional example:

Funder 123 encourages friends, agents, and funders to participate in funding certain deals. ISO ABC likes to syndicate some of those deals but not all of them. So the owners of ISO ABC wait and hope that Funder 123 will call them sometimes with a deal that they like. Sometimes they hate the deal. Sometimes they like it. Other times, they play so much phone tag that they miss out on the opportunity. The process takes phone calls, emails, and time, time, time. Not to mention that Funder 123 may make several of these calls to other people to join in on the participation as well.

In a perfect world, ISO ABC would automatically be notified that Funder 123 has approved a deal and is seeking participants. The key factors like credit score, processing volume, batch frequency, gross sales, and other pertinent information would be immediately available. The ISO could then click a button if they wanted to participate and the rest of the process would all be automated. This perfect world exists because this is the FundersCloud model.

Ohhh yea! And it gets better

An agent is tired of submitting his/her deals to 5 funders at once, hoping that one of them will approve it. The funders are tired of the agent doing that too. Because the agent is forced to maximize the odds of approval, there is really no alternative solution than to continue operating this way. FundersCloud resolves the mess.

Hypothetical Agent DEF uploads their deal to the Cloud and selects one company from the vast array of Deal Controllers to verify and underwrite the file. Deal Controllers are typically existing funding providers, companies that have the ability to pay commissions, collect funds back from the merchants, and track the activity. Perhaps Agent DEF’s deal does not accept credit cards but does more than $10,000 a month in gross revenue, something that a lot of companies like to look at now. So Agent DEF selects a funder as the Deal Controller in the Cloud. The underwriters at that funder are then able to access the deal through the Cloud and underwrite it. If the file meets their standards, they Verify it. The funder can then choose to fund 100% of the deal themselves or pledge to fund anywhere from 1% to 99% of it and put the remaining percentage of the approved funding terms up for auction on the Cloud.

The key details of the deal are then immediately posted and viewable to all members of the Cloud. Thousands of people will now see that a funder has verified this deal and is willing to fund part of it. If you trust that funder’s judgment, have participated with them before, or just love funding anything you can get your hands on, you can opt to participate in the deal with them. You’re not flying blind because the credit score, processing volume, gross sales volume, time in business, type of business, and batch count are all there for you to see. Cloud members can’t steal deals because any information that could be used to identify the merchant is not visible.

So why is this better? You’re only submitting your deal to one Deal Controller (funder) through the Cloud, which then allows thousands of agents, ISOs, and funders to participate if the Deal Controller chooses to fund none of it or less than 100% of it. With this kind of system, why the hell would any agent continue to send out their deal to multiple funders and then wait a week to hear back from all of them? The merchant’s credit would get hit 5 times, one of those funders might steal the deal for themselves, and at the end of the day, only 5 people are looking at it. Wouldn’t you rather let one funder Verify your deal and then give thousands of companies and agents the chance to fund it? Seriously…

If the Deal Controller is verifying the deal and can see the full file, what’s to stop them from stealing it?

A contract, a zero-tolerance policy, and a reminder that it’s up to you to choose your Deal Controller. If there are two choices in the Cloud to Verify your deal and one is XYZ Funder and the other is someone you know very well, you can pick the company you like. Many other people may trust XYZ Funder but if you don’t know who they are, then you need not select them. Besides, if a Deal Controller is caught stealing a deal from the agent through the Cloud, they will be banned. The industry is competitive and even though there are many safeguards already in place, FundersCloud will not tolerate anyone who tries to pervert the system.

Is this process difficult for the agents?

We must admit that when it was all first explained to us, some of the terms went over our head. That’s mainly due to the fact that for all the evolution within the Merchant Cash Advance industry, many things are still kind of old-fashioned. For all the systems, databases, and clouds floating around out there now, too much time is spent e-mailing, calling, and meeting up for lunch to discuss the details that we must then go back and enter into these systems, databases, and clouds. Once you sit down and play around in FundersCloud for yourself, you’ll kick yourself for not developing this on your own or curse the Merchant Cash Advance gods for not having introduced this into your life years ago. This process is just as easy for the agent as it is for the other roles.

Agent uploads deal -> Agent chooses Deal Controller -> Deal Controller Verifies Deal -> Cloud members pledge money by placing bids -> funding contract is automatically generated and made available for download to the agent -> Agent closes the deal and uploads signed contract to the

Cloud -> The Cloud automatically pulls the funds from the pledged participants and transfers them to the Deal Controller -> Deal Controller funds the merchant and is responsible for managing the account -> Agent gets paid the commission by the Deal Controller -> Agent makes toast

The deal’s performance is then made available to the involved parties through the Cloud in real time. And since the Deal Controller is obligated to manage the deal on the Agent’s behalf, the Agent retains full control of the deal on renewals. Similarly, participants are given the option to join in on renewals or new participants can be brought in altogether. Many things can happen, but all of them lead to more funding, faster funding, and a system that’s more transparent for all the parties involved.

Your own internal cloud, system, database, or CRM is probably doing wonders for data management within your company. So why resist technology in other areas? FundersCloud isn’t a concept, it’s live. Deals are already being posted, funded, and tracked. Which means, even if you’re skeptical or have a thousand more questions, you need to sign up (it’s FREE) and see this for yourself. We’ve kept tabs on a lot of events in the Merchant Cash Advance industry, and this is one of those moments where we need to pause, join the Cloud, and make toast. Because the toughest part of getting a deal funded in the future, will be deciding if you want White, Rye, or Whole Wheat afterwards.

The FundersCloud Website

– deBanked

https://debanked.com

Note: This article was originally drafted in late April but was on hold while FundersCloud made some key upgrades. We apologize if we left out any of the new cool features.

This Week in MCA

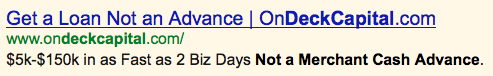

August 23, 2012Days after our founder shared his personal tale of evolution in the Merchant Cash Advance (MCA) business, one of the industry’s largest players secured a financing round that is sure to turn some heads. It’s not every day that someone lands $100 million. New York based, On Deck Capital (ODC) has linked up with some big names, most notably Goldman Sachs. ODC has accomplished a lot and has evidently managed to deliver that same magic number of $100 million in loans to small businesses in the last 10 months alone. Seconds after this post gets published, we anticipate that ODC will let out a giant sigh from their headquarters in NYC. “Why oh why are we featured in an article about Merchant Cash Advance? We’re not a Merchant Cash Advance company,” they’ll remind themselves.

Some people would say that their micro loan program is indeed not an MCA. ODC leaves little room for confusion in their advertising message:

![]()

But in 2012, MCA is not necessarily just the purchase of future credit card sales or even the purchase of any sales. Today, MCA is synonymous with micro financing. Not to mention that ODC got its start by soliciting business from within the MCA industry. Regardless, they’ve created quite a niche for themselves and have earned the praises they receive.

Another fact worth mentioning is that Lighthouse Capital Partners (LCP) is one of the companies involved in the $100 million deal. Didn’t we just finish predicting that California VCs with an affinity for social media were about to dive head first into the world of MCA? Fresh off the wire and just hours after the ODC announcement, a social networking company called Tagged released news of a $15 million deal inked with…LCP. Expect us to cover this Silicon Valley invasion even more as it develops.

———————–

The MCA Forums… let’s talk about it. We all know that certain message board exists out there on the Internet where a handful of industry veterans occasionally visit to chat about deals. But who’s running the forum exactly and how is it really helping us all communicate better? We’ve asked around a bit and no one seems to know who the owner of it is or if he has any affiliation to Merchant Cash Advance at all. Forum fail… but it’s a cycle repeated a lot in this business. Every time there’s a payment processing expo, the MCA guys show up but they’re never the ones hosting the show. It’s much like that with the MCA Forums, where everyone’s visiting it but none of us are at the helm. The MCA Forums have helped the community over the years but there are many that would agree it’s time to take the next step. Capital Stack and Merchant Processing Resource have been working together to create what we hope will be the next phase in MCA industry communication. We want all the big players to play a part in it and to also invite our brothers and sisters in micro finance (micro lenders, asset based lenders, equipment financiers, leasing companies, etc.) to join in with us. We’re calling it ‘The Daily Funder’ and it should be ready to go in a few weeks. We’ve put this video together to reiterate what we just said. 🙂

Want to know more, share an idea, or become a key player in it? E-mail David Rubin at ceo@capitalstackllc.com OR sean@merchantprocessingresource.com.

———————–

The Merchant Cash Advance Warriors fantasy football league is now open. Co-commissioned by Merchant Cash Group and Merchant Processing Resource, we’re aiming to pick up representatives from ISOs and funders around the country for some good old fashioned competition, the friendly kind, but with smack talk allowed. Want to join? Signup is free. Please contact sean@merchantprocessingresource.com or heather@merchantcashgroup.com for a formal invite.

The Merchant Cash Advance Warriors fantasy football league is now open. Co-commissioned by Merchant Cash Group and Merchant Processing Resource, we’re aiming to pick up representatives from ISOs and funders around the country for some good old fashioned competition, the friendly kind, but with smack talk allowed. Want to join? Signup is free. Please contact sean@merchantprocessingresource.com or heather@merchantcashgroup.com for a formal invite.

———————–

Is anyone using Funders Cloud? We’re friendly with one of the owners but haven’t caught up with them in awhile. The platform was designed to be pretty awesome:

– Merchant Processing Resource

https://debanked.com

The Bubble That Wasn’t

August 17, 2012“The smaller the loan, the more likely a lender will deny it. The denial rate for applications for small loans (less than $100,000) was more than twice as high as it was for bigger loans.”

– CNNMoney 8/16/12

In early 2009, a very wise friend of mine gave me a bit of advice. As an ex-stock broker who made his fortune in the 80s, he’d seen his fair share of bubbles. And so he bestowed upon me his wisdom that the Merchant Cash Advance (MCA) industry’s days were numbered. “It’s got 6-8 months left of life in it and then it’ll go away. Everyone’s in freakout mode right now but things will go right back to the way they were and banks will push you right out of a job,” he lectured me. My expression didn’t change, for he wasn’t the first one to sing me this cautionary tale. He continued on, “You’re a nice guy so I suggest in the next few months, you go out and get into another line of work. You can always look at this experience as a wild ride but MCA is a fringe industry borne out of the financial crisis.” I thanked him for looking out for me and went home that night to mull over what he and a few others had been saying.

No one wants to believe their thriving business is part of a bubble that will inevitably burst. But at the same time, no one wants to later on be perceived as that naive fool that couldn’t see an obvious end coming either. And while the career itself seemed honorable and sustainable (helping small businesses get financing), there were a lot of pivotal moments along the way that made me think for a second that at any day I could be told to pack up my stuff and go home because there was suddenly no more demand for MCA.

No one wants to believe their thriving business is part of a bubble that will inevitably burst. But at the same time, no one wants to later on be perceived as that naive fool that couldn’t see an obvious end coming either. And while the career itself seemed honorable and sustainable (helping small businesses get financing), there were a lot of pivotal moments along the way that made me think for a second that at any day I could be told to pack up my stuff and go home because there was suddenly no more demand for MCA.

I am reminded of the time when a Craigslist Ad was answered by over 500 recently laid off mortgage brokers and underwriters. Some had literally been hired to underwrite mortgages, only to be told days later that their division was closing down. Similarly, there were hot shots from the payday loan industry who stopped by to learn what our business was all about. These people looked like they had been punched in the gut and told stories of major success followed by unforeseen ruin as states legislated them out of business overnight. And still others had the mentality that MCA was a get rich quick scheme and went on to run their own funding companies or brokerage offices into the ground within a matter of months. They cursed the MCA gods and the bubble they believed they were a victim of, ignoring the reality that they had poorly managed themselves into oblivion.

As the 6 to 8 month timeline for destruction expired and the light shone on those still standing, I realized I had made the right choice by sticking it out. MCA was not a progeny of the financial meltdown. Heck, the product itself had already been around since the late 1990s and had gained significant popularity around 2005 when other players began entering the market. It also had none of the trademark signs of a bubble. If financing businesses was a bubble, there would be no such thing as banks today. Business financing has been around for literally thousands of years. MCA firms just catered to the ones that banks ignored and by 2008 that included nearly every small business in the country. One could argue that the growth rate of MCA would eventually slow down, supporting the claim with the same wisdom I had heard nearly a year before, that everything would return to “normal.”

Today’s world is anything but the world of yesterday. The unemployment rate in July was 8.3% and according to a survey reported by CNN, “[Today], the option most often sought by businesses — opening a new credit line — face[s] the lowest approval rate at 13%” Banks never did return to their old ways, nor does it seem likely that they will any time soon. Those that doubted MCA’s longevity in 2009, including those who left the industry altogether back then in fear, did not foresee the many roads of evolution that would allow it to thrive.

Years ago, an MCA was easily defined as a purchase of future sales that would ideally be completed in 6 to 9 months. Virtually every provider offered identical terms and costs, which stymied competition and eventually created stereotypes that would come to haunt the image of MCA for quite some time. For a while, America had a hard time envisioning MCA as anything but a 1.38 factor rate that was available to those that fit a certain credit criteria and processed a minimum amount of credit card sales monthly. So imagine the shock some small business owners felt when approved by RapidAdvance, a veteran MCA firm, for a ::gasp:: small business loan. A loan?! could it be? Yes, MCA has been semantically broadened to include many forms of short term lending. And then there’s Florida based Merchant Cash Group that became famous with their Fast Funding program, a financing option for businesses that fell outside the box for traditional MCAs. Some companies don’t even require businesses to accept credit cards as a form of payment. “Credit card sales? Who cares how much they’re doing in credit card sales?!” Would you ever imagine an MCA rep making such a statement in 2009?

MCA is still widely considered to be tied to credit card processing and it doesn’t ever need to officially evolve away from that. Withholding a percentage of sales directly from a payment processor is what initially allowed the many business owners that were horrible at making monthly payments suddenly eligible to receive capital. But for all the changes that have been applied to the financing product itself, something has changed with the companies offering it as well.

Competitors used to be ultra secretive about their practices. An MCA firm could be underwriting an application that another MCA firm funded the day before. Sure, the merchant wasn’t supposed to hop around and do this with more than one company at a time, but the other firm wouldn’t even confirm if they funded them if you asked. One of the great failures of the past was the lack of cooperation amongst the players in the industry. An ‘every man for himself’ mentality hurt more than it helped in a business that was struggling to create its identity in the mainstream world of finance. The North American Merchant Advance Association (NAMAA) sought to correct that through data sharing and the promotion of common standards. Some of the major members have years of experience under their belt including Merchant Cash and Capital, Strategic Funding Source, RapidAdvance, and Merchant Cash Group. These firms have been around the block and back. “MCA bubble? What bubble?,” they’ll say with 100% confidence in their tone.

So why a boring history lesson on MCA today? It’s only fitting on the day that CNN declared the bursting of the social media bubble, that I re-visit a decision I made 3 years ago. “I’m just looking out for you kid,” a mentor once told me. Bad advice for sure. This year, I am noticing many people that left MCA years ago are coming back. After so much time has passed, they are STILL getting in early on something that’s going to be huge, rather than coming back to ‘manage the decay’ (did I just take a swipe at Obama?!). VCs are having a field day trying to get in on it. Accel Partners recently forged an equity deal with Capital Access Network with the ultimate goal of what I’m guessing is to one day go public.

So why a boring history lesson on MCA today? It’s only fitting on the day that CNN declared the bursting of the social media bubble, that I re-visit a decision I made 3 years ago. “I’m just looking out for you kid,” a mentor once told me. Bad advice for sure. This year, I am noticing many people that left MCA years ago are coming back. After so much time has passed, they are STILL getting in early on something that’s going to be huge, rather than coming back to ‘manage the decay’ (did I just take a swipe at Obama?!). VCs are having a field day trying to get in on it. Accel Partners recently forged an equity deal with Capital Access Network with the ultimate goal of what I’m guessing is to one day go public.

The only things bubbly in MCA these days are the excited account reps, underwriters, and support staff that are working to get America’s small businesses humming again. Some have taken to wearing their FUNDED pants 7 days a week. I know I have practically worn mine out.

I’m always struck now by the college grads that ask me if this business is sustainable. Their anxious parents are worried sick that their babies are going to be caught up in some bubble and be out of a job 6 to 8 months from now. To this I offer a few words of wisdom. “Providing small businesses with capital isn’t going away anytime soon. Sure, the product might evolve and the economy will change, but the fundamental demand for short term financing is here to stay. You seem like nice parents so I’d hate to see your kid get involved in some other industry at the end of its life cycle. He or She is getting in early on something big, something long lasting, something that has become a permanent staple of the American financial system.” Good advice for sure.

By: Sean Murray

Founder of Merchant Processing Resource (https://debanked.com)

Began career in the MCA industry in August, 2006

P.S.

The FUNDED pants do exist and were created by Next Level Funding in early 2010.

Merchant Cash Advance Industry is Waiting for its Big Moment

August 25, 2011Originally Posted 7/28/2011

According to an article in ISO&AGENT Magazine, the Merchant Cash Advance (MCA) industry has had significant success but “the companies that fund them acknowledge the cash-advance market is still waiting for its big moment.” This echoes our earlier opinion that a lack of collective marketing is keeping this financial tool from reaching its true potential.

How is it that in an ultra tight credit market that small businesses have not heard of MCA? With lax credit score standards, fast turnaround, minimal documentation, and a flexible method of repayment, it’s absurd that the industry has not reached so many that are looking to borrow. ISO & AGENT points to a negative image crisis and fingers the costs involved as a possible culprit.

The costs are a non-crisis. MCAs would be less expensive if they required collateral, perfect credit scores, fixed terms, ten years in business, and a 3 month underwriting process. If a small business meets those requirements and does not have a time sensitive opportunity they are looking to capitalize on, they should be going to their local bank. But most small business owners either do not meet that criteria or need the funds for a project they have going on today. Hence the product has to be more expensive for it to make sense for the firms providing the funds.

ISO&AGENT claims the industry has been compared to payday loans, an untrue characterization. In fact, that comparison has so rarely been made, that we can pinpoint the exact place they got that from. Inc.com published a very unflattering article on April 1, 2008 titled ‘Thanks, But No Thanks‘, in which they explain MCAs as “the business equivalent of a payday loan.” That was three and half a years ago! The article was not only biased and unfair, but was also written at a time when everything related to Wall Street, banks, or lending was being demonized as the nation sat on the verge of the Great Recession and economic collapse.

Still one can’t help but notice that buried deep within their criticism, is the answer to why MCAs are a tad bit more expensive:

The fact that collateral isn’t necessary is another important part of the MCA providers’ pitch. Entrepreneurs sometimes risk losing their homes if they can’t repay a bank loan, but they have no legal obligation to repay merchant cash advances if their companies fail, as long as they strictly follow the terms of the contract. They can’t encourage customers to pay in cash, for example, and they cannot switch credit card processors (typically, the MCA provider gets paid directly by the processor, rather than by the merchant). “If Diane’s Bistro goes out of business because Lauren’s Bar & Grill opens up across the street, we have absolutely no recourse to Diane, none whatsoever — as long as she follows the clearly defined covenants in our contracts,” says Glenn Goldman, AdvanceMe’s CEO.

And if you had any more reason to suspect MCAs are not as bad they tried to make it out to be, Inc.com published that article on April Fools Day. Case closed.

But there is indeed an image crisis and it’s that many businesses haven’t been exposed to the concept of MCA and thus cannot consider the pros and cons at all.

For instance: Most people can make the case for or against consumer payday loans. They’ve already got loads of information from the media, newspapers, banks, and lawmakers on which to base their argument. It’s become a well known household accepted form of financing. Whether or not payday loans can help the consumer is a separate debate.

That’s the difference. MCA is rarely spoken about by newspapers, banks, or lawmakers. Its presence in the media is limited and as a result we’re referring to stories published over three years ago. We have many friends employed as small business loan officers across the country and the only reason they’re aware of how MCAs work is because we told them. It’s embarrassing. And for an industry that funded over $500 Million last year alone, it really makes no sense.  We blamed antiquated marketing techniques: cold calling, junk mail, useless internet marketing, and spamming. The industry has gotten lazy and has a propensity to market their financing to small businesses that have already secured a MCA. This comes with bold promises of lower rates and other gimmicks. This inner competitiveness leads to both smaller margins and lower conversion rates. It does nothing to grow the industry as a whole.

We blamed antiquated marketing techniques: cold calling, junk mail, useless internet marketing, and spamming. The industry has gotten lazy and has a propensity to market their financing to small businesses that have already secured a MCA. This comes with bold promises of lower rates and other gimmicks. This inner competitiveness leads to both smaller margins and lower conversion rates. It does nothing to grow the industry as a whole.

That’s complemented by carpet bombing the public with an approach their customers learned to ignore a long time ago. Cold calls and junk mail. Really? Yes, really. There will always be a sliver of effectiveness from these methods and the firms that employ them will defend their success to the death. These methods may score some deals and perhaps even work well enough to grow a MCA firm, but it will not lead to the industry’s ‘big moment.’ Same goes for internet spam, poorly constructed articles that serve no purpose other than to boost some company’s SEO, and useless blogs kept by both respectable firms and no-name websites set up to harvest leads. Sure that’s the way of things on the internet these days but there isn’t anything beyond that. There are no mainstream media articles about MCA, forums for business owners where it is actively discussed, nor any public endorsements by anyone of high political or business stature.

Sounds like we have an image crisis on our hands. The Merchant Cash Advance Resource (the site you’re on right now) has been in existence for 1 year. In that time, we’ve made significant additions to the information that can be accessed here. We constantly receive emails from business owners and MCA brokers alike with the hope that we can provide them with an unbiased answer. And guess what? We do just that. By having no commercial affiliation, we give the best advice we can. The e-mail volume has gotten so heavy that our volunteer editors have trouble answering them all. But we try anyway.

And along the way we’ve managed to get some formal offers to convert this resource into a commercial site to generate sales leads. A six figure buyout offer here and there coupled with some lengthy, legalese filled non-disclosure agreements. We say ‘no’ every time. The Merchant Cash Advance Resource is designed to provide information, opinions, critiques, data, guides, and an independent ‘thumbs up’ to an industry that’s destined to do great things for small business.

Why do we spend the time, money, and effort to provide this service? We’re looking at the big picture of MCA. Big picture… Big moment…

And we’re on our way.

deBanked

https://debanked.com

The Fork in the Merchant Cash Advance Road

August 23, 2011Originally Posted on April 25, 2011 at 10:48 PM

The Merchant Cash Advance (MCA) industry is growing, albeit slower than some may have you believe. But it’s moving in two opposing directions, a condition that’s making it tougher to describe the financial product itself in general terms. MCAs are becoming more expensive and a lot cheaper at the same time. HUH? You read that right.

Originally aimed at business owners with poor credit, the risk of default or delinquency was overcome by withholding a percentage of sales revenue directly. As the credit crisis and Great Recession took hold, it attracted businesses of all credit backgrounds and today it’s widely accepted as a lending alternative, rather than a solution to poor credit.

As MCAs pushed forward to compete for customers normally accustomed to bank credit lines, the cost was stiffly resisted. These businesses had a tough time envisioning their financing terms to be anything outside of some percentage over the Prime Rate. Since a MCA is supposed to be structured as a sale, there is no APR equivalent, no timeframe, no amortization, nor any real familiarities of a loan. As the past couple years have passed, the product is more publicly understood, but for it to actually catch on, the costs had to come down. Many funding providers now refer to such high credit, low cost accounts as premium, platinum, preferred, gold, etc.

While the margins earned on high credit accounts shrank, funding providers were dealing with another challenge simultaneously, defaults. Whether the business owner intentionally interfered with their credit card processing or the store went out of business altogether, bad debt in the MCA world was mounting…FAST!

No matter which company ran the figures or how secret these portfolio statistics were, every funding provider came to the same realization. The lower the credit score of the business owner, the greater the chance of a problem. Why this came as any surprise, is a surprise in that of itself. The Fair Isaac Corporation (FICO) will have you know that any individual with a score below 499 has an 87 percent chance of being delinquent on a credit payment within the next 2 years. Delinquent, is defined as a payment of 90 days or more past due.

But wait… if a MCA is not a loan, nor does it depend on the business owner to make payments, then how can there be a risk of delinquency? Intentional manipulation of the revenue flow back to the funding provider can be relatively easy to do. A business owner could use spare POS equipment to accept card payments for which the funding provider is not aware of and therefore prevent the collection of funds. That’s a method known as splitting, and serious consequences can result when discovered. (Read more on what happens in the case of default or deliquency on a MCA in a previous article)

But outside the scope of malice, there’s the traditional reason, the inability to make payments. If the suppliers and wholesales aren’t being paid, then the business isn’t going to have inventory on hand to sell. If the rent isn’t being paid, then there’s not going to be any location to generate these sales. Essentially, the funding provider has a mutual interest in the business being able to satisfy ALL of their obligations, not just the MCA itself.

If there is an 87% chance that suppliers, landlords, or other essential creditors will not be paid on time in the next 2 years, then there’s an excellent probability that the business will be unable to operate at the same level. With no collateral as protection, the MCA industry has adapted to the challenge by raising the cost. Business owners with poor credit can expect funds to be expensive and the terms to be more restrictive. Lower funding amounts, higher withholding percentages, and the sacrifice of any negotiation is the price the MCA industry has set to make funding to the maximum risk group possible. These programs, which are now often referred to as starter advances, don’t work for everyone so the pros and cons should be weighed prior to executing a contract.

Both the premium advances and starter advances have experienced extraordinary growth to the point where they have become niches of their own. There are now starter advance companies and premium advance companies. Funding providers like Strategic Funding Source have taken the product a step further and reportedly did a MCA for an exhibit at the Tropicana Hotel in Las Vegas for $4 Million. Contrast that with deals that are struck for as little as $750. And we can’t fail to mention that some have taken it back to the basics, a loan. ForwardLine in Woodland Hills, CA lends money to businesses which are then repaid in accordance with a predetermined, fixed pace through the card sales. They have reintroduced concepts like APR back to the finance world.

If we continue at the current pace, MCAs will become less expensive, more costly, a lot bigger, and markedly smaller. We’ve come to the fork in the road for what the Merchant Cash Advance industry seeks to brand itself as. Loan alternative? First choice? Backup plan? Is it for smaller businesses or larger ones? Should it go the way of lending or continue to remain a structured purchase of future card sales? Is industry cohesion really necessary or will increased decentralization lead to greater acceptance of this financial product a whole? Will there come a time when America’s big banks swallow the industry up, buy out the existing portfolios, and add this product to their financing arsenals?

These are tough questions. Merchant Cash Advance is evolving, growing, and no longer moving in one direction. While we contemplate our next step, one thing is for certain, there’s no turning back.

– deBanked

www.merchantprocessingresource.com