business cash advance

History of Merchant Cash Advance

January 24, 2013The History of Merchant Cash Advance

Before it was mainstream, it was kind of mainstream. Merchant Cash Advance (MCA) is not new or even relatively new and it definitely isn’t a byproduct of the 2008-09 financial crisis. In fact, in 2007 some people thought the best days of the industry were already behind it. In an August 2007 issue of the Green Sheet, Dee Karawadra expressed reluctance to write about MCA because he believed the subject was stale.

When a GS Online MLS Forum member suggested I write an article on cash advance, I explained my research and said, “I think that boat has come and gone, and I missed it.”

Dee’s article is an excellent snapshot of the feeling of 2007. Excitement was running wild and bold predictions were being made. A lot of the same questions being asked today were asked and answered back then. Those employed in the industry that do not take the time to read up on MCA history are at a disadvantage. And one thing this industry did a great job of, was chronicling all of the events that unfolded.

The Green Sheet

Prior to 2007, The Green Sheet’s forum was the only source for information. It is still filled with threads going back as far as 2003 on the subject. The discussion seems to begin by one user posing the question:

Who thinks a cash advance program, (a loan) on future credit card volume will help themselves get more deals and their merchants operate better?

March 2003

By 2004, MCA was all the rage. Competition began to nibble at AdvanceMe’s monopoly, a monopoly they were rightfully entitled to because they owned the patent on split-funding. Many chose AdvanceMe anyway simply because they had already established a name for themselves.

You might want to check out AdvanceMe. I think they have a superior product and service as well as more money too … that you will be better served by AdvanceMe than you would by any of the other Cash Advance companies of which their [sic] are not that many.

August 19, 2004

And many weren’t even sure what they were selling exactly. Merchant Cash Advance had not yet even been coined as a term:

quick show of hands as to what title you would place on this product… A) Factoring of receivables B) Cash Advance C) something else… Just for the record – I don’t know what to honestly call it.

August 20, 2004

Those that responded called it an unsecured loan, factoring, merchant funding, and cash advance. Some that weren’t even familiar with the concept appeared completely lost in the conversations. It was common to confuse cash advance as meaning to take a cash advance out on an actual credit card. The need for a universal term was badly needed. An industry couldn’t progress forward if no one even knew what the industry was.

A Way to Build and Strengthen Merchant Account Portfolios

But on the subject of giving money to merchants in exchange for more back, programs offered by AdvanceMe and Rewards Network were compared on the merit of the cost to the customer. Since reps viewed MCA as an acquisition tool to obtain merchant accounts or retain them, commissions and renewals were rarely discussed. They were basically a non-factor and some folks from this era carried this mentality straight into the financial crisis age of MCA. Funders advanced merchants not to make money on advances, but to build their own processing residual portfolios and to sell or lease more POS equipment. The loan, cash advance, merchant funding, or whatever it was of the day was a tool to drive business, not a business itself. Right before and during the financial crisis, funding companies began to streamline their focus and suddenly it became all about funding and nothing else.

The MCA industry has remained in that state for about 5 years and some are starting to think that it’s time to evolve. A poster on DailyFunder.com recently ranted that his company can’t grow unless it diversifies, coincidentally citing that MCA would be better served as an acquisition tool. If this happened, history would repeat itself.

This should be a lesson to the MCA industry which is trying to make a product out of something everyone else views as an acquisition tool. Are we just lenders or diversified businesses? We are the former. As such, prices will never come down, margins can only get slimmer.

1/19/2013

In 2004, when the MCA industry was joined at the hip with payment processing, becoming a dedicated funder was a way to stand out from the crowd. But perhaps now that the market is saturated with dedicated funders, it is getting more difficult to build a presence in the market.

Behold! Merchant Cash Advance!

In May 2005, The Green Sheet was forced to label the product when it published a story about Merchant Cash Advances. We’re not claiming that this article coined the phrase, but it is a good approximation of when it started to be called such. A few sentences in, they actually disclaim their own term.

There isn’t even consensus on what to call the product, except that it is most definitely not a loan.

The three word term was not even used in the Green Sheet forums until October 2005, and then not again until March 2006. Soon after, that became the term of choice.

The One and Only MCA Blog

As MCA financing took on a life of its own outside of payment processing, the industry turned to a blog to learn about the unfolding events. From 2007 to 2010, David Goldin, the CEO of AmeriMerchant wrote weekly updates about his firm and experiences. He wrote about his harrowing battle with AdvanceMe. After invalidating their patent, he opened the floodgates for any funder interested in utilizing split-funding. He offered honest opinions and had excellent foresight, forever documenting what it was like for the MCA industry during the financial crisis. Anyone that didn’t get to experience that time firsthand should read it start to finish.

As Goldin’s company grew, he turned his focus to other matters. The North American Merchant Advance Association (NAMAA) was formed on April 29, 2010, a non-profit alliance designed to bring peace and order to an industry that had gone through tremendous turmoil in the last few years. He all but abandoned the blog afterwards.

Free Info for All

Where Goldin left off, I resumed by starting a credit card processing/MCA blog in July 2010 named Merchant Processing Resource (MPR). At that time, I was an MCAer that had toiled away as both the head of an underwriting department and as an account executive. The blog covered a lot of topics and was targeted towards business owners and ISOs simultaneously. I believed there was a vast amount of data that newcomers didn’t have about MCA and set off to share as much as I could without self-promoting a product or service.

By December, my web host (a very simple blog site named Webs.com) informed me that the website was using too much bandwidth for the current package. I upgraded it only to encounter the same problem again 9 months later. The site was forced to transfer to a real host in order to grow and be able to handle the surging stream of visitors. Webs.com’s format was not conducive to transfers and as a result, every article written prior to August 23, 2011 was time-stamped with that very date.

Three History Books

To recap, the Green Sheet and their forums were the places to follow MCA from 2003 to 2007. Goldin’s Blog narrated the story from 2007-2010 and MPR has carried the torch since then. If we go further back, and we believe everyone should, you’ll find that AdvanceMe kind of existed in a world of their own in the late 1990s. In 1999, they funded $9 million. What they were funding annually increased to $200 million by 2006, a time when they had already amassed more than 14,000 clients. These aren’t exactly the humble beginnings of a new industry. These are serious numbers that could arguably support the theory that MCA was already well into the mainstream.

MCA in Black and White

MCA information was publicly available nearly two decades ago via the U.S. patent office. Barbara S. Johnson is listed as the official inventor of split-funding AKA Automated Loan Repayment in documents filed in 1997. There were no forums or bloggers to explain how it worked. There was only this:

Systems and methods for automated loan repayment involve utilizing consumer payment authorization, clearing, and settlement systems to allow a merchant to reduce an outstanding loan amount. After a customer identifier (e.g., a credit, debit, smart, charge, payment, etc. card account number) is accepted as payment from the customer, information related to the payment is forwarded to a merchant processor. The merchant processor acquires the information related to the payment, processes that information, and forwards at least a portion of the payment to a loan repayment receiver as repayment of at least a portion of the outstanding loan amount owed by the merchant. The loan repayment receiver receives the portion of the payment forwarded by the merchant processor and applies that portion to the outstanding loan amount owed by the merchant to reduce that outstanding loan amount.

The Automated Loan Repayment kicked off an industry that would evolve significantly over the next 15 years and yet a payment processor was already doing this to fund merchants as far back as 1992. Litle & Company didn’t call it MCA. That name didn’t even come about until around 2005, but they were the first MCA funder in the country. The makes MCA more than 20 years old.

Been There, Done That

We may have closed a chapter in 2012 when it became evident the product had finally graduated from the minor leagues, but there is a forever long story that preceded it. MCA financing existed before some account reps were even born. Sadly some of these kids talk to prospects today without really even knowing what they’re selling. Then again, in 2004 no one knew what the heck they were selling either. There is still technically no formal name especially since split-funding is no longer the standard. If the poster in 2004 posed the same question today about what to label this product as, there would be just as much disagreement. Business cash advance, merchant financing, ach advance, cash flow loan, ach funding, merchant cash advance, unsecured loan, merchant loan. Nobody really agrees and nobody really even does it the same way as everyone else. It’s all MCA to me and I’ll keep reporting on it for as long as it lasts. And as long as it keeps reinventing itself, there will always be a chance to get in early. Those that read up on the past or were there and experienced it firsthand have a major advantage. History repeats itself in MCA.

You know those butterflies you’re getting about 2013? They were felt before in 1998, 2004, and 2007. MCA was kind of mainstream before it was mainstream. 2012 ignited a spark and some of us know what’s going to happen next. As for the rest of you, brace yourselves. It’s going to be more crazy than you can imagine.

– Merchant Processing Resource

https://debanked.com

If They Were in MCA

January 23, 2013

If Gordon Gekko (Wall Street) was in MCA, he would be that strict underwriter that everyone hates.

On Approvals: “I look at a hundred deals a day. I pick one.”

On making an exception: “I don’t throw darts at a board. I bet on sure things. Read Sun-tzu, The Art of War. Every battle is won before it is ever fought.”

On a phone call with the rep: “You stop sending me information, and you start getting me some.”

On ordering a site inspection: “I want to know where he goes, what he sees, I want you to fill in the missing pieces of the puzzle.”

If Agent Smith (The Matrix) was in MCA…

His thoughts on the underwriting department: “Never send a human to do a machine’s job.”

On a collections call: “As you can see, we’ve had our eye on you for some time now, Mr. Anderson.”

In regards to the secret terminals the merchant is using to avoid repayment: “Find them and destroy them.”

If Michael Scott (The Office) was in MCA…

On what type of merchants to target: “There are four kinds of business: tourism, food service, railroads, and sales. And hospitals/manufacturing. And air travel.”

In response to his ISOs wondering why there is no website to check balances for their merchants: “We can’t overestimate the value of computers. Yes, they are great for playing games and forwarding funny emails, but real business is done on paper.”

Just for fun

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Not Science

January 14, 2013 We’ve published 2 articles recently about UK based lender, Wonga. In both, we expressed awe at their scientific algorithm that makes loans in 15 minutes without human interaction. Now we’re not sure that praise is deserved. A Guardian article recently revealed that their top secret super computer racked up 41% bad debt in 2011 as a percentage of annual revenue. 41%, a number that equates to 76.8 million pounds in write-offs. That’s apparently 4x higher than what it was in the previous year.

We’ve published 2 articles recently about UK based lender, Wonga. In both, we expressed awe at their scientific algorithm that makes loans in 15 minutes without human interaction. Now we’re not sure that praise is deserved. A Guardian article recently revealed that their top secret super computer racked up 41% bad debt in 2011 as a percentage of annual revenue. 41%, a number that equates to 76.8 million pounds in write-offs. That’s apparently 4x higher than what it was in the previous year.

Is this science? Charge a high enough interest rate and you’re bound to find a balance between bad debt and profit. This isn’t science. This is what the average man calls rolling the dice. The problem with this strategy in the US is that most states cap the maximum interest rate so you can’t force a profit by charging an unlimited APR. Besides, there is proof that the worse the economy gets, the more their defaults pile up. Shouldn’t their algorithm factor in an economic downturn? What will their P&L look like in 2012 and 2013?

For years, we’ve made the case that aggressive lenders who make a point to grab market share while boasting of their dominance are the first to get smoked in the market. For some reason we let our guard down on this one. Maybe it had something to do with it being a British company. Believe it or not Wonga is still profitable, but to claim there is some kind of magic behind what they do is wishful thinking. To take a blogger’s words about this:

I’m sure Wonga would much rather it could know in advance who was going to default. Then it could charge its non-defaulting customers a lot less for its service.

Wonga apparently can’t do what it claims it is best at. Congrats on earning a profit Wonga, but here’s some words of advice about lending in the US. Technology is great, but don’t lend without humans. Trust us.

—–

Previous Wonga Posts:

Funding Down to a Science

Made For Each Other?

Surprise! We Are the Market

January 13, 2013Merchant Cash Advance (MCA) is an alternative to a small business loan. Look around. MCA players have spent so much energy on gaining mainstream acceptance, that we’ve become oblivious to reality. We ARE the small business lending market. There are alternatives out there such as credit cards and SBA loans, but they are industries of their own. Small businesses in 2013 really only have one place to obtain fast unsecured short term financing, and that’s here, the MCA industry. That assumes of course that you agree with our definition of MCA, which we stopped limiting to a purchase of future credit card sales some time ago.

Over the past few months, we began to realize that the only small business lenders making headlines are people we know. Is the country that small or does MCA dominate the market that much?

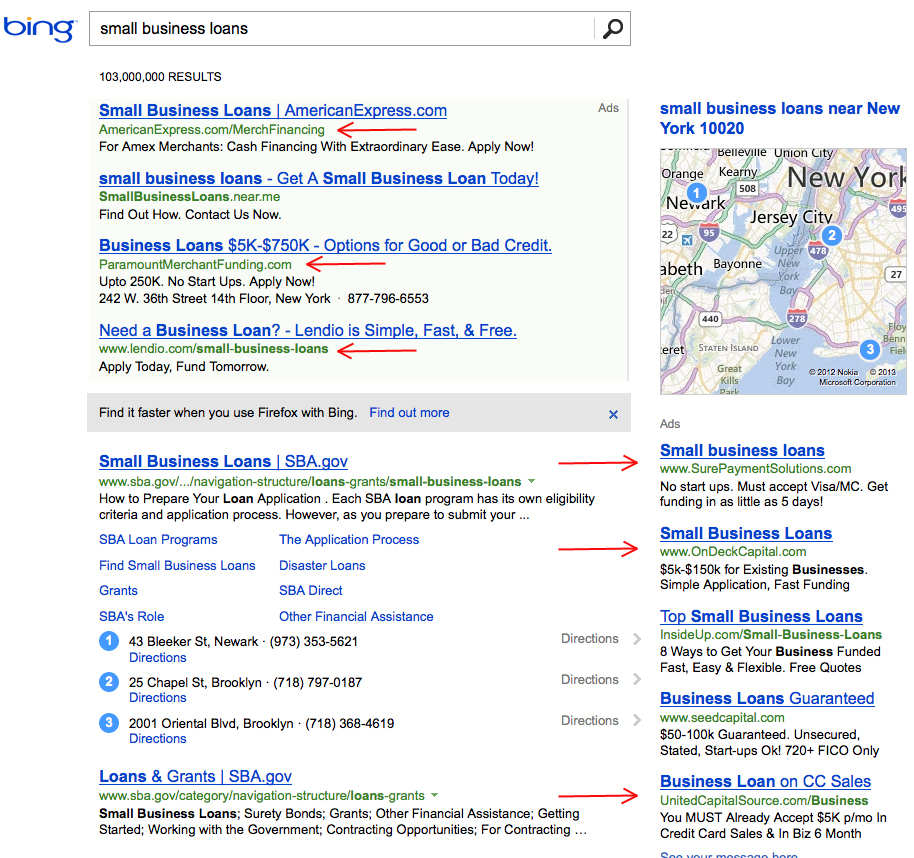

A glimpse at the sponsored advertisements on Bing in the NYC region:

Where are the multi-billion dollar banks? If $15 a click isn’t in their budget, something is wrong, and it may possibly be due to the fact that business loans aren’t on their priority lists.

Lenders, brokers, and bankers on the front lines can’t stop talking about MCA. It is a recurring theme in their columns:

The alternative financing industry is growing rapidly and, I believe, will continue to grow in 2013. These lenders are extremely entrepreneurial and are leaving the banks behind with their speed and use of technology. Many are backed by premier investment banks and Silicon Valley venture capital powerhouses — investors who understand that entrepreneurs and small-business owners are throwing up their hands in frustration over how long it can take to get a loan from a bank, especially if the loan is backed by the S.B.A. More and more businesses are willing to pay the price of the alternative lenders just to be able to get their capital and move on.

-Ami Kassar

The State of Small Business Lending – NY Times 1/8/13

Ami’s Column on NY Times

Cash advance companies, accounts receivable financiers, factors, and micro lenders all have become increasingly more attractive funders for three reasons: flexibility, use of technology, and speed.

-Rohit Arora

Three Reasons for the Rise of Alternative Lending – Fox Business 11/29/12

Rohit’s column on Fox Business

Here’s a dilemma that might have contributed to the growth of MCA… Banks don’t like offering loans and business owners don’t like applying for them if it’s hard:

There’s a large small business segment that needs and wants to borrow on a commercial basis, but their needs are very small. Business owners want $10,000, $20,000 or $30,000 loan–the average is somewhere around $25,000. Traditionally, that’s been a very unprofitable business for a bank. Some banks argue that they are willing to lose money on those loans because they can make it up in deposits. But what happens when the borrower has no deposits? It’s a very tough balancing act.

– The Federal Reserve Bank of San Francisco

A newsletter report that reveals banks lose money on small business loans

Community Investments Volume 8; No 4; Fall 1996

Business owners say the documentation involved is overwhelming. They’ve also found the qualification terms almost impossible to meet.

– Catherine Clifford

Feedback reveals that a burdensome application process and extensive paperwork requirements are enough to discourage business owners even if the loans carry 0% interest.

CNN 1/26/10

Thousands of researchers publish statistics on bank lending every month. Not only do they all contradict each other but journalists that use this data to make bold claims often fail to acknowledge that an increase in bank lending has nothing to do with the applicants, the economy, or the banks themselves. It has to do with the Government. We all know that the SBA will cover the losses banks incur, but there are programs that go one step further. The Federal Government actually bribes banks to make loans. For example, the Small Business Lending Fund is a dedicated investment fund that encourages lending to small businesses by providing capital to community banks. Meaning, covering the losses on defaults doesn’t seem to be enough, so they’ll actually provide the money to make the loans as well.

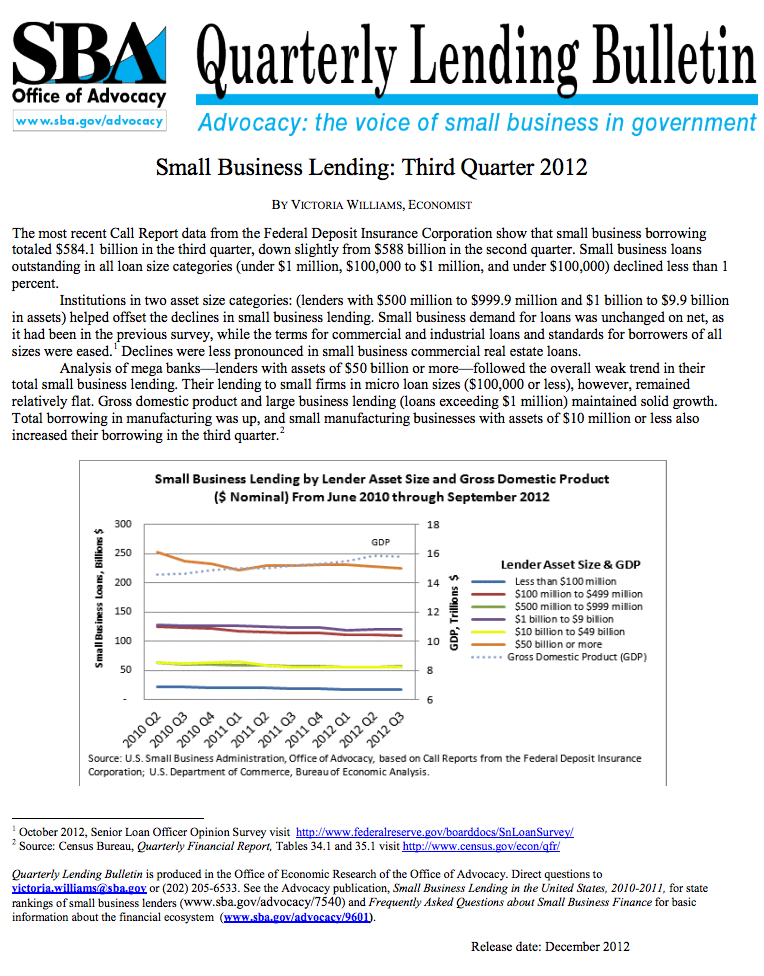

Click to see full size on mobile

According to the SBA, small business bank borrowing totaled $584.1 billion in the third quarter of 2012. That number dwarfs the volume produced by the MCA industry, but its not an apples to apples comparison. A loan of $1 million dollars is within the range of a small business loan by the SBA, an amount atypical (though not impossible) in the MCA world. Banks are also prodded and coddled by the Government so much that it has reached the extent that we dare claim they are an extension of the Federal Government itself. There’s some food for thought for the Occupy Wall Street movement! They also conveniently got bailed out when they were on the verge of failure, a safety net that MCA companies don’t have.

According to the SBA, small business bank borrowing totaled $584.1 billion in the third quarter of 2012. That number dwarfs the volume produced by the MCA industry, but its not an apples to apples comparison. A loan of $1 million dollars is within the range of a small business loan by the SBA, an amount atypical (though not impossible) in the MCA world. Banks are also prodded and coddled by the Government so much that it has reached the extent that we dare claim they are an extension of the Federal Government itself. There’s some food for thought for the Occupy Wall Street movement! They also conveniently got bailed out when they were on the verge of failure, a safety net that MCA companies don’t have.

Subtract the Federal Government’s meddling and there is only one profitable form of B2B lending, Merchant Cash Advance. That is of course again if you accept our definition. There are many young B2B lending firms that claim to be an alternative to MCA, who then go on to describe their product in a manner that is textbook MCA.

Our thesis may be debatable and lacking in concrete proof, but we’re not writing dissertations here. Business owners are increasingly looking to the Internet for loan information and it’s obvious what they’re finding. One would expect a quick Internet search to bring up ads for the billion dollar powerhouses, you know the ones that are given millions to lend out and then millions again when the loans go bad. Instead we find companies owned by friends or friends of friends. The small business loan market isn’t run by anonymous Wall Street kingpins, it’s run by a small community of entrepreneurs that all started from the ground up. Only the community isn’t so small anymore. There was once a handful of MCA companies claiming to be an alternative to a small business loan. Now there are a handful of companies claiming to be an alternative to MCA. It doesn’t take a genius to figure out why that is. After years of fighting to be recognized in the market, something remarkable happened, we became the market itself…

– Merchant Processing Resource

https://debanked.com

The #1 Sales Skill for Small Business Owners

January 10, 2013No matter how well you performed your due diligence before opening the doors at your small business, once you opened them you got a few surprises. And, unless you were in sales before opening your doors, the biggest surprise you got was likely just how difficult it is to “sell.”

Selling is a skill. Now, it’s true that there are “natural born sales people” – but all that means is that they have a talent for selling; they still need to develop their skills. The great thing about skills is that we can learn new skills.

The first skill you need to learn in order to sell successfully is often learning how to change how you think about “selling.” Not sure what we mean by that? If you read the word “zebra” an image of a zebra pops up in your head. Now read the word “salesman” – what image just popped up for you? Most likely not a very positive one.

It might take you a bit of time and effort to get over the prejudices you may have about sales. Unfortunately, as with many things in life, negative experiences we have a tendency to stick to us like glue. To make things even more difficult when it comes to changing attitudes, we also often have a tendency for negative experiences to stick with us much, much longer than positive experiences.

Don’t think that’s true? Here’s a brief exercise to prove our point:

- Write down 10 bad experiences you had with a sales person in less than 3 minutes.

- Write down 10 great experiences you had with a sales person in less than 3 minutes.

We rest our case.

Do You “Hate” Selling?

Let’s face it, if you’ve got a history of “not trusting” sales people it’s going to be pretty tough to feel very good about selling. Successful sales are based on trust and, in order for your customer to trust you, you’ve got to have a strong belief that what you’re doing is of value to your customer. Hard to do if you “hate” sales.

If you hate or are “extremely uncomfortable” about selling those feelings quite likely stem from beliefs you have about the process of selling in general and sales people in particular. For instance:

- Sales people are manipulative.

- Sales people are pushy.

- Sales people lie.

Right out of the box, it is true that some sales people do/are all of the above. But not most – and certainly the Top 5% are about as far away from manipulative, pushy, and dishonest as you can get. Think about it. You don’t want people to buy from you once – you want to create loyal repeat customers who also refer other loyal repeat customers to your business. Certainly the words “manipulative, pushy, and dishonest” aren’t behaviors that are going to result in creating a loyal customer base. That means that all those bad experiences you had with sales people happened when you were buying from “bad” (under-performing, unprofessional) sales people. While it might have looked like they would do anything to make a sale, it was probably because they were desperate to make a sale because they were so bad at it. Sales people who operate like that and are successful are actually the exception and not the rule. They also frequently aren’t successful for very long periods of time.

Right out of the box, it is true that some sales people do/are all of the above. But not most – and certainly the Top 5% are about as far away from manipulative, pushy, and dishonest as you can get. Think about it. You don’t want people to buy from you once – you want to create loyal repeat customers who also refer other loyal repeat customers to your business. Certainly the words “manipulative, pushy, and dishonest” aren’t behaviors that are going to result in creating a loyal customer base. That means that all those bad experiences you had with sales people happened when you were buying from “bad” (under-performing, unprofessional) sales people. While it might have looked like they would do anything to make a sale, it was probably because they were desperate to make a sale because they were so bad at it. Sales people who operate like that and are successful are actually the exception and not the rule. They also frequently aren’t successful for very long periods of time.

Hopefully you’re feeling a bit relieved to find out that learning how to sell does not mean honing skills related to being manipulative, pushy, and deceitful. Most successful, top-performing sales people are the exact opposite. Instead, sales is about solving your customer’s problems and meeting their needs. It’s about having their back and bringing them value even when they don’t buy from you. Why? Because that is how you create trust – and people like to do business with people they trust.

Believing in what you’re doing isn’t the only sales skill you need to learn – but it is definitely the first thing you need to get under your belt, and in a big way. No matter how many sales books you read or seminars you attend, unless you believe in what you’re doing and that your ability to sell is a value to your customer – you run the risk of becoming that manipulative, pushy, less-than-honest image of a sales person you love to hate.

Guest Authored

– Merchant Processing Resource

https://debanked.com

Is Google Your Only Web Strategy?

December 31, 2012Every business wants to be found in search. To most, being found means top placement in Google’s search results for keywords or phrases that are most likely to convert into a lead, sale, or customer. That begs the question… how does one get that top placement?

While many are now accusing Google of monopolizing or manipulating the search results to promote pages and products that earn them revenue, they are still unique in the sense that one simply cannot buy top placement in organic rankings. The Google search system was originally designed to rank pages based on both how many other pages linked to a page and how important those linking pages were. It was a relational system called PageRank that theoretically gave little guys a chance of being ranked alongside or even ahead of major corporations.

When it came to being talked about or linked to from other sites (these incoming links are called backlinks), mega corporations with large sums of money had a tremendous advantage. Media outlets seemed to always be linking to them naturally and they could buy linking ads on websites that didn’t. They could even buy backlinks on irrelevant pages just to up the ante. In 2011, Overstock.com was penalized by Google after one such linking scheme was discovered. Overstock was offering discounts to students and faculty that placed a link to their website on a school web page ending with .edu. It was believed that .edu top level domains (TLDs) carried far more weight than .com, .net, and .org. Overstock tried to capitalize on that.

Where a company ranks in the result listings can mean the difference between success and failure. For the mega corporations, millions of dollars in revenue can be gained by being listed 1st as opposed to 4th. The reality is that searchers tend to click on top results more often, ultimately leading to more sales for the companies that rank well.

According to a study conducted by Slingshot SEO, the top search result is clicked 18.2% of the time, whereas the last result (#10 on the page) is selected 1% of the time. These statistics make a few things clear. If you’re not on the first page, you might as well be in outer space. Additionally, a ranking on the first page must be for a search term or phrase that is frequently searched. Sure, we’re happy to be listed 4th for the search phrase “greatest merchant cash advance company in the world,” since it links to our free directory of verified MCA providers, but since no one is using that search phrase, it really doesn’t matter.

A hypothetical business does research and determines that 100 people per month are entering this phrase into the Google search bar: “I want a merchant cash advance this minute.” It looks promising because it shows that the end user is in buying mode. One could make the case that they are more likely to apply for business financing than a user searching for “the history of merchant cash advance.” 100 searches for the initial phrase might seem like an opportunity, but you have to make an effort to achieve a listing for that keyword, at least that’s what Search Engine Optimization (SEO) gurus will tell you.

All Hail the King

Since Google is the omnipotent dictator that determines where every website falls, there is nothing that can 100% guarantee a website will be visible for the terms and phrases a webmaster wants. There is no shortage of tips, methods, and tricks to boost the odds but all of those things require time, money, or both. Neither will get the webmaster far unless the Search Engine Optimizer (SEOer) knows how to modify a website, analyze search phrases, and implement a strategy to increase rankings. If the SEOer isn’t tech savvy, stay away.

The SEOer’s strategy will likely fall into one of two categories, white hat or black hat, but it’s important to note that wearing any kind of hat is technically a violation of Google’s Terms of Use. It’s easy to label an SEOer that places thousands of irrelevant comments with a backlink on blogs all over the Internet as a black hatter. But contrast that technique with a white hatter that does nothing more than write interesting articles and get them published on other websites with a backlink.

The latter may seem innocuous, but both attempt to manipulate Google’s algorithm and can lead to serious ranking devaluation penalties. A penalty can be crippling for a business that depends on acquiring leads or customers online. Worse yet, the webmaster is not tried before a jury of his/her peers before being sentenced to page infinity for all search terms. This is the downside of the playing field Google creates. John Doe business owner can be listed alongside multi-million dollar corporations and can enjoy that visibility to grow into a million dollar business themselves. But if it is Google that brought him into this world, it is Google that can take him out.

In late April, 2012 Google announced they were cracking down on “blog networks.” This algorithm update became known as Google Penguin and hit the web like a hammer. 3.1% of all english search queries were affected. Penalized webmasters that paid to have self-written articles published on other websites to get the link juice were left wondering how the practice could be a violation. Analogies were used to explain that paying to promote oneself is standard business practice. They likened article marketing to the basic trade of journalism. They argued it was their constitutional right to promote articles without fearing the total loss of business or retribution from Google.

In late April, 2012 Google announced they were cracking down on “blog networks.” This algorithm update became known as Google Penguin and hit the web like a hammer. 3.1% of all english search queries were affected. Penalized webmasters that paid to have self-written articles published on other websites to get the link juice were left wondering how the practice could be a violation. Analogies were used to explain that paying to promote oneself is standard business practice. They likened article marketing to the basic trade of journalism. They argued it was their constitutional right to promote articles without fearing the total loss of business or retribution from Google.

Google’s position though is that it is perfectly okay to link to a friend’s website or to pay to have articles placed elsewhere. They respect that those decisions are not theirs to judge in respect to the global Internet. However, if the intent (or perceived intent!) of these practices is to achieve higher ranking in Google’s search results, then they reserve the right to protect the integrity of their ranking system accordingly. Essentially, anyone can do what they want, but it might affect how things are scored within their private system. So if you don’t care about your valuation in Google, you can use all the linking schemes in the world if you so choose. The problem is that most people do care about their score in Google and many people view Google as the global Internet. Google can argue that they are simply policing their own private system but to millions of web users around the world, they are viewed as policing the Internet.

The Revolution

It’s not their fault. Google’s system was so good and their interface so simple, that millions of people started using it and never went back. They became the Internet. Search engines existed previously but had many flaws. Back then, millions of websites that provided answers to questions or sold solutions for problems went undiscovered to the vast majority of humanity. Google found them, ranked them, and then went on to check them frequently to make sure users were still likely to find what they wanted.

They made the world a better place until the laws of their kingdom began to contradict common sense. For example, it would seem practical for a video game company to buy a banner ad on a video game enthusiast web forum. They could benefit from the targeted traffic and hopefully sell some video games. But at the same time, Google might view this banner link as an attempt to manipulate their algorithm.

To resolve this dilemma, Google created a tagging system to allow their search crawlers to identify which links were paid for and then direct their algorithm to make sure the buyers did not benefit in search from them. This directive was controversial because it forced webmasters that cared about their rankings to worry about the nature of their outbound links. Could a website selling banner ads hurt both the buyer and the seller at the same time? They sure could. If buying and selling backlinks is forbidden, then both parties have something to worry about. Today, it is important to include the rel=”nofollow” attribute in html coded links that are paid for.

To resolve this dilemma, Google created a tagging system to allow their search crawlers to identify which links were paid for and then direct their algorithm to make sure the buyers did not benefit in search from them. This directive was controversial because it forced webmasters that cared about their rankings to worry about the nature of their outbound links. Could a website selling banner ads hurt both the buyer and the seller at the same time? They sure could. If buying and selling backlinks is forbidden, then both parties have something to worry about. Today, it is important to include the rel=”nofollow” attribute in html coded links that are paid for.

Since the majority of web users use Google in some way, the challenge and effort to achieve better placement has become a billion dollar industry. Prestigious advertising firms claim they can improve search placement using white hat guidelines Google itself created. The fact remains that there is no way to be safe, no matter how prestigious, knowledgeable, expensive, or innocuous the SEOer is. Having a page on a website that discusses a topic that another page on the same website already talks about can be grounds for a penalty. Interlinking your pages too much can be grounds for a penalty, discussing too many broad topics can be grounds for a penalty. Writing with imperfect english can be grounds for a penalty. Mentioning your product or service too many times in an article or throughout your website can be grounds for a penalty. Not using enough visual aids such as images or videos can be grounds for a penalty. Adding new content to the website too frequently can be grounds for a penalty.

Everybody’s Doing it

Smart webmasters approach the web like their health. Do everything in moderation. It seems like every year there is a study that proves a correlation between a daily household food item with a certain untimely death. We’ve all heard something like this before: “The study determined that people that eat less than 2 carrots a day are more likely to die before the age of 70 than people that eat 2 or more carrots per day.” It’s the kind of fear mongering that causes someone to worry obsessively about meeting the 2 carrot daily minimum only to get hit by a bus as they cross the street three decades before they turn 70. Webmasters can spend their days worried about how Google will view them and ultimately never be found by their potential customers or they can do what everyone else does and work on getting backlinks and add content to their websites.

Smart webmasters approach the web like their health. Do everything in moderation. It seems like every year there is a study that proves a correlation between a daily household food item with a certain untimely death. We’ve all heard something like this before: “The study determined that people that eat less than 2 carrots a day are more likely to die before the age of 70 than people that eat 2 or more carrots per day.” It’s the kind of fear mongering that causes someone to worry obsessively about meeting the 2 carrot daily minimum only to get hit by a bus as they cross the street three decades before they turn 70. Webmasters can spend their days worried about how Google will view them and ultimately never be found by their potential customers or they can do what everyone else does and work on getting backlinks and add content to their websites.

Is a compliant website that is never found by customers better than a website that has a good run, makes a lot of money, but takes the risk of getting penalized in the end? Some believe it is better to have loved and lost than to have never loved at all. Afterall, an online business that has no web visitors is not really a business is it?

White hatters, the SEOers that wrongly believe they are immune from repercussions argue that their strategies take far longer to create results because they are in it for the long haul. Coincidentally, these long-haul strategies tend to have a high monthly price, do not guarantee results, and cannot predict what changes Google will make in the future. For example, if an SEOer says their slow and steady method will take 6-12 months, the webmaster should understand that the ranking algorithm could change in 5 months. All the work performed could be rendered obsolete in the blink of an eye or worse, devalue the ranking further from where it was originally.

White hatters, the SEOers that wrongly believe they are immune from repercussions argue that their strategies take far longer to create results because they are in it for the long haul. Coincidentally, these long-haul strategies tend to have a high monthly price, do not guarantee results, and cannot predict what changes Google will make in the future. For example, if an SEOer says their slow and steady method will take 6-12 months, the webmaster should understand that the ranking algorithm could change in 5 months. All the work performed could be rendered obsolete in the blink of an eye or worse, devalue the ranking further from where it was originally.

In the quest for a quick fix or even as part of a long-term strategy, SEOers can’t help but notice that websites maintained by news media seem immune to all the rules. They republish countless amounts of duplicate news reports and they buy and sell exposure like its going out of style. In a way, they are a multiplied version of everything Google says not to do. But while they might get tons of traffic from search engines, they are not entirely dependent on them. Big news media has incredible brand name recognition. An individual seeking information about the Fiscal Cliff may simply type “CNN.com” in the browser address bar and bypass Google altogether.

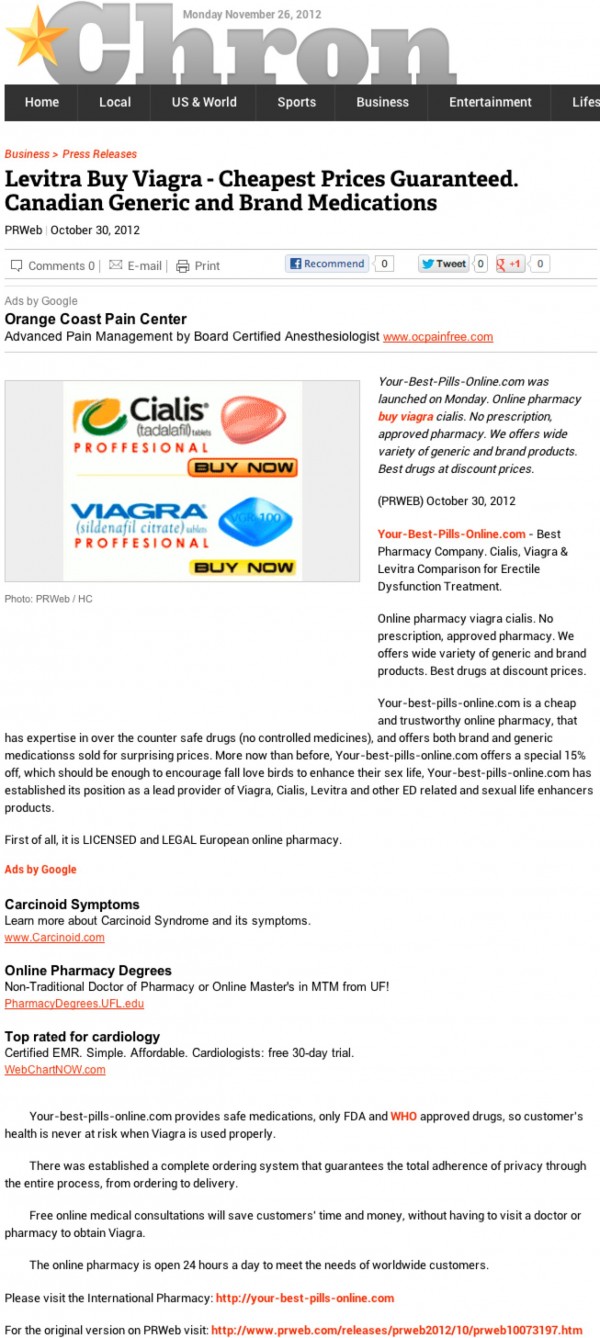

Companies like Reuters, The Wall Street Journal, Fox, and CNN, etc. are highly authoritative and could be categorized as the holy grail of backlinks. If one of the major ranking factors is the importance of the website the link is on, then there is nothing more important than being mentioned by national mainstream news media. The media outlets know the perceived value of their links and are hungry to find new streams of revenue. Thus, an opportunity presented itself to them just as printed newspapers began going the way of the dinosaur. And so they began to peddle link juice.

The age of buying links is not dead and it is now much more difficult for Google to punish the parties involved. Webmasters can pay public relations firms to get a “company press release” published on big news media sites and get the backlink of course. This tactic has been around for years but it has become one of the last great bastions for white hat SEO. Others would argue that social media is the next frontier but for SEOers grinding it out in the trenches, traditional backlinks seem to work better above all else.

Many public relations firms have been warned by Google not to promote the backlinking aspect of their service, but all of them offer some kind of SEO package to target webmasters that are interested in using their service for the purpose of link juice. Searchengineland.com ran a great article that exposed what the press release as SEO tactic revolution has done to the news. (http://searchengineland.com/how-prweb-helps-distribute-crap-into-google-news-sites-140597)

There is now a surge in boring, irrelevant, and oftentimes non-sensical company announcements on big media sites across the Internet. It is a popular SEO method in many fields, making it difficult to find actual industry news amongst the clutter of backlink driven stories.

But if it works, then why stop? That of course implies that it works in the first place. Several days ago, Matt Cutts, the director of Webspam at Google informed inquisitive webmasters that links in these press release articles DON’T COUNT. Helpful SEOers explained to the original poster that most links in press releases have the no-follow attribute added to the links to make sure that they don’t pass juice. Upon our own examination however, we couldn’t find any news media or public relations firm that implements no-follow. It would probably hurt their bottom line if the junk releases they were peddling suddenly didn’t count for anything.

The debate rages on about whether or not the director of Webspam is to be trusted. Is the ranking algorithm as powerful as Google claims it is? Or are they spreading fear and misinformation to make up for their shortcomings? There is a lot of interesting feedback to consider in the comments section of seroundtable’s short article regarding press releases.

In the past, many webmasters have used obvious black hat techniques for favorable placement and gotten burned in the end. Many innocent websites have been caught in the crossfire. Success on the Internet is believed by many to be achieved only by being visible on Google.

The War

Individuals that have never managed a business website in their life have little idea how Google works. They know it will provide them with the answers they’re looking for and rank them in order from best to worst. To everyday users it is nothing short of magic. To an SEOer, being #1 for a search term may mean weeks, months, or years of trial, error, and patience. It requires time, money, or both. It is a tireless quest to become #1 or to die trying. It is the difference between getting 18.2% of visitors for a keyword searched 5,000,000 times a month or 1% of visitors for a keyword searched 100 times a month. It is a battle against not only Google, but against competitors in the same field that are using the same tricks to move up. It is a system that gives little guys a chance to be ranked alongside major corporations. It is way to be found in the sea of a trillion websites. But it is also a dictatorship. Google can sneak into your house in the middle of the night and banish you to page 50 with the accusation that you were buying backlinks. Google can lock the front door of your virtual store to prevent shoppers from getting in. Google can label non-native English speakers as spammmers and silence those that won’t stop writing about the same thing over and over again. This is the challenge with a single company being tasked with policing the entire Internet.

The Perks

There are alternatives out there like Bing and Yahoo, but the problem is that when people go to those sites, they tend to type Bing or Yahoo into Google just to get there. Such is the habit these days for getting anywhere on the web. In 2008, blogger Marshall Kirkpatrick wrote about this phenomenon. He argued that mainstream users of the Internet do not even know how to navigate it. While tons of responders to the article seem to agree, there are plenty of folks that make a compelling case as to why using a search engine is superior to a browser’s address bar.

There are alternatives out there like Bing and Yahoo, but the problem is that when people go to those sites, they tend to type Bing or Yahoo into Google just to get there. Such is the habit these days for getting anywhere on the web. In 2008, blogger Marshall Kirkpatrick wrote about this phenomenon. He argued that mainstream users of the Internet do not even know how to navigate it. While tons of responders to the article seem to agree, there are plenty of folks that make a compelling case as to why using a search engine is superior to a browser’s address bar.

It isn’t easy typing https://debanked.com perfectly if you’re a fast typer, which might explain why a significant portion of our visitors type this url into Google instead. They want to get to the right place the first time even if they type it in wrong. They might not even be exactly sure what our website is called or how to spell it. It’s not uncommon to see incorrect urls somehow end up in our traffic reports anyway.

- Merchant Processing Esource

- Merchant Processing Source

- Merchant Processing Resources

- Merchant Proccesing Resource (2 Cs or 1s)

- Merchant Processor Resource

The list of mistakes continues, but Google points them in the right direction anyway. If this didn’t happen, we might seriously consider rebranding the site with a much shorter domain name. Unfortunately, in mid-2010 when Merchant Processing Resource started, we didn’t give much thought to the difficulty in remembering a 7-syllable name, nor the likelihood of miskeying a single character in a 34 character address (www.merchantprocessingresource.com). This shove in the right direction is a benefit that an address bar can’t offer.

Not Evil?

The user oriented focus of Google arguably ended once and for all on May 19, 2010, the day they went public. While #6 on the list of Google’s official philosophy is that “You can make money without doing evil,” shareholders may have qualms with #1. It states, “Focus on the the user and all else will follow.” This motto doesn’t scream maximum profit. Besides, being public doesn’t allow Google to focus on the user, but instead tasks them with increasing the value of their stock. Of course they can’t earn a profit if they disregard the users altogether and so they are faced with the challenge of maximizing profit without alienating their users.

Adhering to their own philosophy is tricky, not to mention that many state and national governments believe that Google is manipulating the results to promote their own products. Products? one might ask; What possible products does Google have? Oh you mean you haven’t heard of Maps/Earth, Youtube, Zagat, Google Reviews, Google Plus, Gmail, Blogger, Picasa, Google Wallet, Translate, the Droid OS, driverless cars, the Chrome web browser, or the many other products they control?

Google isn’t content with just controlling search. They want to control the entire Internet experience. Companies like Facebook threaten that monopoly and as such Google has made social networking a top priority to counter them. Not evil?

The Google universe is exhausting. Webmasters must do more than just design great websites to continue enjoying the luxury of being found. Paid links must be marked as no-follow, backlinks on bad websites must be disavowed, private pages must be marked as no-index, similar or duplicate content must be avoided, URLs must be descriptive, title tags should be relevant, HTML should be used over Flash, and moved pages should be redirected if for no other reason than to retain the page value of the original URL.

Is There Life After Dea.err…Google?

As we draw near our conclusion, we argue that Google continues to play a large role in Internet Marketing, but advise that Google is not the Internet, no matter how much you’ve come to believe otherwise. There is LinkedIn, Facebook, Twitter, web forums, blogs, email newsletters, and a zillion other places to promote oneself and be found. Too many people fail to utilize the infinite other opportunities to market themselves online simply because they believe ranking in Google is the only way or because they’ve received a penalty and give up. “Getting ranked” has become an all consuming challenge that blinds webmasters from their true goal of attracting customers. People bought products and services online before Google came around. They might make things easier for the average user that believes search results are a product of magic, but in reality they are just one of many systems to find things. They are an imperfect ecosystem that has become tainted by their motivation for profit. And let’s not forget the millions of white hatters and black hatters that are driving the algorithm wild as they seek better placement for themselves or their clients.

Do we care about Google? Certainly, but only about half of our visitors originate from the search engine. People actually see us mentioned on LinkedIn, Facebook, and actual trade publications. And guess what? Those people visit us, bookmark us, and return. There may come a day when Google decides too many incoming links from Facebook is grounds for a penalty, causing outrage among webmasters, a move that might force many to give the social network up, and even disavow it officially. White hatters could end up having to eat their white hats down the road. The whole system of the Internet will no longer seem to make any sense. Maybe a reality check is okay. Perhaps too many hours and megabytes are wasted on trying to gain favor with Google. So much junk exists out there these days that isn’t even meant to be read or followed, but rather exists for the sole purpose of gaining link juice. If a poorly designed website in China links to a good website in the U.S., should the webmaster have to spend time tracking it down, identifying it, and disavowing it just to appease the king? Does this make any sense?

The next time you spend $300-$500 on a press release with carefully crafted link text, think about whether or not Google is really going to reward you with placement for a search term. Their director of Webspam says you’re not going to score any points, yet you may believe otherwise. Consider how else that money could be spent online outside the context of Google SEO. Are you looking to attract customers or simply gain favor with a king that MIGHT lead to customers? Imagine for a minute that Google, Bing, and Yahoo have banished you from being found forever. Would you close up shop or start to think outside the box?

White hatters that read this may be mumbling to themselves that they need not think this way because they have a surefire strategy that works, something along the lines of “Content is King.” This “Content” revolution involves publishing tons of articles to ones website to give the impression to Google that a website is constantly being updated with helpful information. An SEOer will tell you that Google “wants” this. In reality though, this has created a new phenomenon, the practice of webmasters spamming their own websites. The content may be informative, well written, and on-topic but if it’s being done to please Google instead of making sales or helping visitors, then it’s really nothing more than the black hat trick of the day. “Content is King,” that is until it’s not because 100 million websites are doing the same thing, leading to a vast pile of junk in cyberspace.

People forget that the word ‘marketing’ exists in Internet Marketing. They focus their time and effort on Internet Manipulation. They either have systems to make a quick buck or they slowly march onwards towards a promise that can’t be kept. As we approach 2013, it remains true that Google can’t be ignored, but the rest of the global Internet shouldn’t be either. There are billions of people out there that are looking for what you offer and you need to learn how to reach them. Coincidentally, there are 100 million articles on the web that claim they can teach this very trade. 99 million of them exist for the purpose of getting a backlink. That means the information is questionable at best. Take a marketing course, read a marketing book, or hire a marketing consultant. Go back to the basics if you must. Plan for the day where you won’t exist in search even though your business exists in real life. If the moment comes where Google replaces the search results with only paid advertisements or you get penalized because you told all of your friends to link to your website, you can shrug it off. If you want to be in Internet Marketing for the long haul, stop thinking about search. Google can’t be your only web strategy forever.

– Merchant Processing Resource

https://debanked.com

Find tons of great Matt Cutts memes here

A Great Thread That Discusses Business Survival Without Google

Funding Down to a Science

December 21, 2012Account rep: Congratulations, you’ve been approved for $27,000!

Merchant: How did you come up with these figures?

Account rep: It was science. Science did this.

Funny? Maybe not, especially since an underwriting super algorithm may be on its way to the United States. In the days after we posted Made for Each other?, friends, acquaintances, and strangers have been telling us to keep an eye on Wonga’s potential acquisition of On Deck Capital. “It’s not just a european company’s gateway to the US. They’re going to change everything,” a few have said. Aside from their background of being a payday lender, having prestigious VC backing, and the resources to throw a quarter billion dollars at a main street lender in a takeover bid a lot of people didn’t see coming, apparently there is much more to be seen.

Just like MCA in years past, Wonga has worked hard to repel a negative image. Not easy stuff, especially considering they embrace their hefty costs wholeheartedly. Sure, it’s easy to calculate an APR equivalent of a very short term loan and spin whatever number you come up with as the symbol of something evil. If I let a stranger borrow $100 today with the stipulation that they pay me the whole thing back tomorrow plus 1 dollar extra to make it worth my while, would I be evil? That’s an APR of 365%. If I did the same thing with 100 strangers, what are the real odds that all 100 would actually pay me back? Somewhere along the line because of a borrower’s circumstances, bad decisions, or even malicious intent, I’m going to lose the entire $100 I lent out. Others might need more time to pay me back. If one person out of those hundred doesn’t pay back, I break even. If two people don’t pay back, I lose money. If one person doesn’t pay back and another can’t come up with the whole thing, I lose money. You can lend money at 365% APR and lose BIG.

So how do banks manage to charge 4, 7, and 10% APR? Is it just because they’re smarter? No. They don’t make money off loans at these rates either. In the US, interest rates are distorted by government guarantees. Politicians have decided that certain interest rates sound “fair,” then push big banks to lend money at these low unsustainable rates. But of course it doesn’t work and so government agencies sweeten the deal by reimbursing banks for up to 90% of the losses on the borrowers that default. Banks make money on the loan closing fees and other services they sell to the businesses. The loan is the doorbuster offer the bank puts in the storefront window. Once you come inside, they try to sell you on other things so that you don’t walk away with just the loan, otherwise they’re losing money.

So when you hear “banks aren’t lending,” don’t be so surprised. Lending money means giving it away to someone that might not pay it back. That’s a really tough business to be in, no matter how qualified the borrowers are or how good the underwriters are supposed to be.

But somewhere in between the opinions of the Merchant Processing Resource staff and government bureaucrats over what is fair, is a special recipe that determines once and for all what works best. It’s science. Wonga’s lending success is rooted in science and propelled by an advanced algorithm that can systematically calculate risk better than any bank in the world, or so they say.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

Wonga takes a human-free approach, something no MCA provider in North America does regardless of how automated their process may seem. In the UK, their business loan application process takes only 12 minutes and the funds are wired 30 minutes later. That’s it. Their max loan is £10,000 but just think about how that compares to MCA in the US. How much time and overhead is being spent on printing documents, underwriters, conference room meetings to discuss deals, setting up the merchant interview, trying to reach the landlord, trying to get page 7 of a bank statement from 6 months ago and the signature page of the lease, etc. etc. Funders might have had the wrong approach all along.

Wonga’s founder, Errol Damelin believes in data. According to some quotes in The Guardian, Damelin believes interacting with the borrower actually impairs a lender’s judgement.

From the Guardian:

Asking for a loan from a financial institution had traditionally involved making a strong first impression – putting on a suit to see the bank manager – then rigorous questioning, checking your documents and references, before the institution made an evaluation of your trustworthiness. In a way, it was exactly the same as an interview, but instead of a job being at stake it was cash.Damelin found this system old-fashioned and flawed. “The idea of doing peer-to-peer lending is insane,” he says. “We are quite poor at judging other people and ourselves – you get to know that in your life, both with personal relationships and in business. You realise that we’re not as good as we think we are at that stuff, and that goes for almost everybody. I certainly thought I was much better at it.

The 42-year-old entrepreneur grew up in apartheid South Africa, and he believes the experience of living in that country in the 80s has had a significant impact on his outlook. He was active in student politics at the University of Cape Town and marched in civil disobedience protests. So, when it came to deciding who should be lent money, Damelin says he wanted to strip away some of the prejudice – decisions would be taken without a face-to-face meeting; you wouldn’t even speak to an adviser on the phone, because people subconsciously judge accents too. The final call on whether to hand out cash would be based on “the belief that data could be more predictive than emotion”.

According to Wired, Damelin and his team created a system to approve or decline applicants all on its own. They tested it on a site called SameDayCash by using Google Adwords and within ten minutes of their ad going live, their system had already approved its first customer. In its early forms, it wasn’t very profitable from a lending standpoint but it did allow them to collect a massive amount of data.

From Wired

its strategy over this period wasn’t just to disburse money — it was to accumulate facts. For every loan, good or bad, SameDayCash gathered data about the borrowers — and about their behaviour. Who were they? What was their online profile? Did they repay the money on time? The site was feeding an algorithm that would form the basis of Wonga, launched a year after the beta experiment that was SameDayCash.

MCA has utilized Adwords for lead generation for years with mixed success, but few have used it for the purpose of accumulating facts. This isn’t to say that the firms collecting information for the purpose of leads aren’t sitting on treasure troves of data, it’s just that none of it to date has led to 100% computerized underwriting. The MCA industry is quite possibly about to undergo a major shift in how they promote their product on Adwords as a result of Google’s ominous warning a couple weeks ago. New disclosure requirements may change the way consumers respond and apply, ultimately impacting the data collected.

So will european science work in the good ‘ol US of A? If Wonga acquires On Deck Capital, you can bet they’ll try to replicate their success. There is a gigantic market of really small businesses that aren’t getting funded, and even the ones that are, they’re waiting 3-7 days to deal with the paperwork, handle the phone calls, fax documents, complete a landlord verification, and in some cases, deal with a credit card processing equipment change. If On Deck Capital becomes a household name as Wonga is in the UK, a lot of smaller funders are going to get squeezed.

Wonga claims to have a net-promoter score above 90%, a customer satisfaction metric that beats most banks and even Apple Computer. It’s a company that seems to be winning on every front.

Critics will say that the American lending market is big enough for everyone, that the loans Wonga has done traditionally are really small and therefore not in the same league as MCA, or that their own company has something similar or better. We believe however, that if this deal goes through that it’s a bad idea to get comfortable. There are Wonga-like companies in the US already, data fortresses that will soon revolutionize how loans are issued and determine what makes a successful business. New York based Biz2Credit is one such example.

We’ve been right about a lot of things in the last couple years and wrong about some. But we believe it is inevitable that any lender ignoring the automation revolution on the horizon is not going to last very long. Go ahead, brush it aside and convince yourself that this whole Automation thing is just hype as BusinessWeek did in 1995 about the Internet. “Automation? Bah!”

As Damelin told Wired in June, 2011, “For me the epiphany was right there. People were online, looking for a solution to a problem.” Ask any funder using Adwords or pouring work into SEO and they’ll tell you the same thing. People are looking online for money. What happens after they fill out the form on the website is what makes the USA MCA/alternative lending industry different from Wonga.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

If in three years the average small business owner thinks Wonga is the last name of a guy that owns a chocolate factory, we promise to write a jingle that admits we were wrong about them. But On Deck Capital has been around the block and knows the business. They would allow Wonga to skip the learning curve and together could quite possibly nail lending down to a science.

Oompa Loompa do-ba-dee-doo, I’ve got another algorithm for you.

– Merchant Processing Resource

https://debanked.com

There is great feedback to this article in a LinkedIn Group HERE

Fantasy Football Championship Begins Tomorrow

December 19, 2012 The MCA Industry Fantasy football league is finally drawing to a close. If you somehow missed the action this season, twelve companies came together to compete for a grand prize donation to a charity of their choice. Each company, in addition to several non-participants pledged funds to the prize. A total of $7,100 was raised!!!

The MCA Industry Fantasy football league is finally drawing to a close. If you somehow missed the action this season, twelve companies came together to compete for a grand prize donation to a charity of their choice. Each company, in addition to several non-participants pledged funds to the prize. A total of $7,100 was raised!!!

In a winner-take-all format, the two teams competing in the championship this week are:

TakeCharge Capital – Newington, CT

Sure Payment Solutions – New York, NY

A winner will be declared next week. A big thanks to everyone that contributed. 100% of the funds will be donated to the winning team’s charity selection.

- Rapid Capital Funding – $1,000!

- Raharney Capital – $500

- Financial Advantage Group – $500

- Merchant Cash Group – $500

- Sure Payment Solutions – $500

- Meridian Leads – $500

- Merchant Cash and Capital – $500

- NVMS – $500

- United Capital Source – $500

- RapidAdvance – $500

- Capital Stack – $500

- Swift Capital – $250

- Strategic Funding Source – $250

- Entrust Merchant Funding – $250

- Paramount Merchant Funding – $250

- TakeCharge Capital – $100

– Merchant Processing Resource

https://debanked.com