Banking

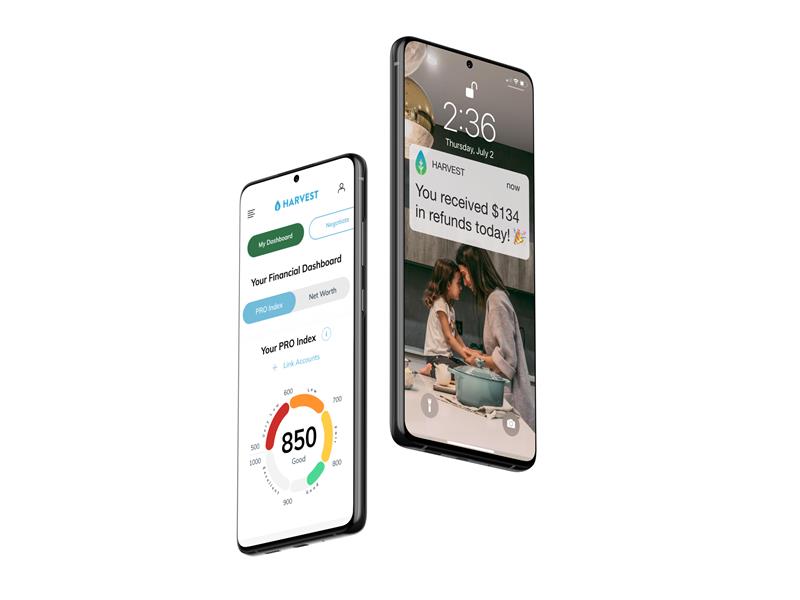

Software That Automatically Fights For Bank Refunds Adds “PRO Index”

October 1, 2020 Harvest fills a unique role in the fintech world. The platform is an automatic banking advocation software that fights on behalf of users for the best deals possible.

Harvest fills a unique role in the fintech world. The platform is an automatic banking advocation software that fights on behalf of users for the best deals possible.

Connect your bank information and the Harvest AI will fight late fees and overdraft fees. Customers are only charged a portion of funds returned, and if the program does not succeed at getting money back, it doesn’t cost the user a cent.

Automatically arguing for better deals, the platform last year saved customers a collective $2 million, and manages $500 million in debt to date.

The brainchild of CEO and founder Nami Baral, Harvest released a new “PRO Index” that builds a credit profile for each customer to pair with information from FICO scores. Harvest created the index to help lenders get better information and for customers to track their financial health. Baral hopes the data will help lenders find a reason to continue credit flowing to those who have hit hard times but still can make their payments.

“In the post-COVID recessionary environment, the creditworthiness of customers continues to plummet,” Baral said. “[Harvest] saw that traditional credit scores do not provide enough of a picture about a customer’s actual worthiness and potential.”

This announcement is not just a press release, but a continuation of the founding premise of Harvest: to help the average American overcome debt and build financial health.

Baral, a Nepali native, came to America during the last financial crisis on a scholarship to study ovarian cancer at Harvard medical school. Expecting the country to be a utopic economic powerhouse, Baral instead saw lost jobs, defaulting mortgages, and debt.

“In many ways, America is one of the most wonderful places in the world,” Baral said. “But at the time it was a complete departure from what I’d hoped the US to be, because what I saw was, people were losing their jobs, losing their homes in the financial crisis.”

She decided to work toward fixing the problems she saw, pivoting to study finance. Graduating with an applied math and economics degree, Baral then trained in investment banking. She worked on an auto-advocation software for a digital advertisement startup that was eventually bought by Twitter.

She decided to work toward fixing the problems she saw, pivoting to study finance. Graduating with an applied math and economics degree, Baral then trained in investment banking. She worked on an auto-advocation software for a digital advertisement startup that was eventually bought by Twitter.

She had seen a company’s growth from IPO to merger and stayed at Twitter for four years. When she left, she began market research, talking to everyday Americans about what they needed to improve their finances.

“In those conversations with people from all over the US, Alaska, Oklahoma, San Francisco, New York everywhere,” Baral said, “I realized that the issues plaguing Americans in the last financial crisis had not gone away.”

Baral said these issues had intensified over this past decade. Incomes were volatile and stagnating, student loans had risen, and the people Baral talked too were getting more and more into debt.

“So I thought what the average American needs today is not another savings product, not yet another investment product,” Baral said. “But something that can help them reduce the debt that they have in their lives. That’s the genesis of Harvest.”

With the addition of the PRO Index, Baral is excited to offer another way Americans can maintain their financial health. She said that during the pandemic, every day could be a challenge for the average American, but the new platform can act as a barometer and compass.

“A lot can change between the time you extend a loan to the customer versus when they have to pay,” Baral said. “We call that Ability-to-pay as-a-service, and that’s where the PRO Index is used, determining: ‘is this customer still healthy? is my overall portfolio still healthy?'”

If the customer is no longer healthy, the info gathered to form the PRO Index, like transactional cash flow data, can supply lenders with information on improving their health. Baral says the platform encourages lenders to keep customers and shows borrowers how to improve their credit standing.

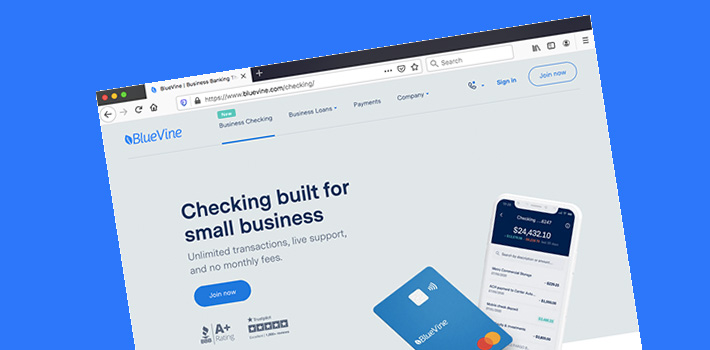

BlueVine is Back and Now With Business Checking Accounts

August 28, 2020 BlueVine, a leading small business lender, has resumed its normal services after generating $4.5 billion in PPP loans to more than 155,000 businesses. The company had continued to offer its normal lending products even while others in the industry paused completely, the company says. Herman Man, the chief product officer, said that BlueVine has also fully launched a small business checking account platform.

BlueVine, a leading small business lender, has resumed its normal services after generating $4.5 billion in PPP loans to more than 155,000 businesses. The company had continued to offer its normal lending products even while others in the industry paused completely, the company says. Herman Man, the chief product officer, said that BlueVine has also fully launched a small business checking account platform.

“Our goal always was to be that small business banking platform,” Man said. “Last year at Money 20/20 we announced we were going to build a small business checking account. Recently, we launched it post-COVID, derailing our plans. We have a breadth of offerings now, and we are that small business platform.”

BlueVine also released a survey this week of more than 800 small business owners to learn what they need most in an ever-changing market. Their findings supported their online product offering. Distressed by COVID-19, the respondents reported an overwhelming interest in reliable customer service, day to day support, and fee-less transactions.

77% of small business owners surveyed reported demand for direct guidance in day-to-day accounting. In the face of an emergency, many respondents noted that banks were more interested in new customers than servicing current customers.

Following this emergency support trend, nearly nine out of ten or 87% of small business owners said access to emergency credit was necessary from the same bank providing them regular service. Accessing credit from the same provider was not just important, but over half or 64% reported it was exceptionally so.

Finally, 58% of business owners reported that a lack of overdraft, monthly, or maintenance fees were the essential features a business checking accounts could offer.

With the launch of a checking account platform, BlueVine can service the needs of these businesses, offering one common platform that connects factoring services, payments services, and now credit and banking services.

“If a small business wanted to take a line of credit and do it on a Friday night, using our algorithm and things that are automated, it could run through our system; if they get approved, money would be transferred into their checking account instantaneously,” Man said. “This isn’t something they have to wait until Monday morning. It will land immediately, so that’s a huge game-changer.”

ODX Introduces New Contact-Free Banking Platform

August 26, 2020 ODX, a banking originations platform, announced the launch of a new service this week—a Digital Account Opening (DAO) experience. With billions of dollars in successfully facilitated loans, the subsidiary of OnDeck made a move beyond origination; to offer banking account solutions.

ODX, a banking originations platform, announced the launch of a new service this week—a Digital Account Opening (DAO) experience. With billions of dollars in successfully facilitated loans, the subsidiary of OnDeck made a move beyond origination; to offer banking account solutions.

Announced Tuesday, the new platform marks another addition to the ODX digital suite that enables financial institutions to reach customers digitally. DAO helps both customers and banks set up checking and savings accounts, filling the need for contactless banking in today’s market.

Brian Geary, the President of ODX, said the DAO’s release is a culmination of over a decade of customer experience merging with the company’s robust technology platform.

“We’re basically hosting the application experience, either web-enabled or mobile-enabled, as well as the workflow platform that is automating and streamlining,” Geary said. “So things like anti-fraud, compliance checks, ID verification, and in the lending case, credit decisioning, all happens on our platform.”

The new platform goes hand-in-hand with the already in place Know Your Customer (KYC) and Anti-Money Laundering (AML) programs proprietary to ODX.

This addition comes at a time when the niche of digital banking has become a necessity. Geary said in the past six months the long laid plans of financial institutions to transition their experience into digital solutions were accelerated by COVID-19. Now institutions and consumers alike are widely adopting contactless commerce.

“When branches closed or were limited in some of their face-to-face interactions, it accelerated that move to digital as well,” Geary said. “So from the customer side there was changing preferences and adoption of digital channels, and from the bank side, they are accelerating investment into digital.”

Independent Community Bankers Express Doubt PPP Can Be Rolled Out As Is

April 2, 2020Update: The interest rate has increased to 1%.

The nation’s voice for community banks, the Independent Community Bankers of America, penned a letter to Treasury Secretary Mnuchin and SBA Administrator Carranza yesterday to urge them to make immediate changes to the planned PPP program slated to be rolled out tomorrow.

The nation’s voice for community banks, the Independent Community Bankers of America, penned a letter to Treasury Secretary Mnuchin and SBA Administrator Carranza yesterday to urge them to make immediate changes to the planned PPP program slated to be rolled out tomorrow.

“We strongly recommend that you make changes to the guidelines before the Program goes live so that it will work as intended by Congress,” the letter states.

It goes on to explain that the proposed .5% interest rate is below the break-even cost for a bank and should be raised to 4% to allow them to break even. Further, that the loan terms of 2 years should be extended to 10 years to alleviate the hardship the short duration will create for small businesses, and that the restrictions on the use of the loan proceeds be amended.

The ICBA also expressed frustration with the lack of detail afforded to documentation required as well as to the uncertainty of how and when the SBA will reimburse them for losses.

European Challenger Bank Revolut Launches in US

March 25, 2020 Yesterday Revolut, the London-based digital-only bank, announced the public launch of its app in the United States. The news came as a surprise to the thousands of potential American customers who signed up to the company’s waiting list with no details of when exactly to expect the bank’s arrival.

Yesterday Revolut, the London-based digital-only bank, announced the public launch of its app in the United States. The news came as a surprise to the thousands of potential American customers who signed up to the company’s waiting list with no details of when exactly to expect the bank’s arrival.

Founded in 2015 and valued at $5.5 billion, Revolut offers customers a debit card and a bank account controlled solely through its app; no brick-and-mortar branches being all the more timely during the coronavirus pandemic. The challenger bank joins its competitors, Monzo, N26, and Chime, in offering more sleeker and streamlined experiences compared to legacy banks.

While the European version of the app allows users to invest in stocks, trade cryptocurrencies, and buy insurance, the US edition will launch with limited capabilities, instead planning to roll out such features when they are available. The reason for this likely being that Revolut has yet to agree to deals with third parties to provide these features through partnerships. However, American Revolut users will be able to receive their salary two days in advance if they share their Revolut bank details with their employer, an ability that has yet to be launched in Europe. As well as this, the US version still offers the expense management, payment alerts, and currency exchange features that are in the European app.

Much like other fintechs who dabble in American banking, Revolut has circumvented the issue of acquiring a banking charter by instead partnering with a domestic bank, such as the New York-based Metropolitan Commercial Bank in this case. As such, accounts are FDIC-insured for up to $250,000.

“As the cost of living increases disproportionately to people’s take-home salaries, now more than ever, people need to know exactly what is coming in and out of their account. They should have the tools to help them manage their money more conveniently and accurately,” Revolut Founder and CEO Nik Storonsky said in a statement. “When spending or transferring money overseas, most people are unaware of the hidden fees that banks are charging them. The world is becoming more connected, and financial services should be supporting this notion, not hindering it.”

Square is About to Become a Real Bank

March 18, 2020

Square is on its way to becoming a bank. The payments and online lending company was approved by both the FDIC and the Utah banking regulator this week to create a de novo “industrial” bank. The company has been trying to accomplish this for more than two years. The news means that Square will likely no longer rely on a relationship with Celtic bank to make loans, while also being able to take on deposits.

The FDIC said in an announcement that, “The bank, Square Financial Services, Inc., will originate commercial loans to merchants that process card transactions through Square, Inc.’s payments system.”

Another fintech company, Nelnet, was also granted approval for an industrial loan charter at the same time.

Square and Nelnet’s move to become a bank is similar to the path taken by LendingClub. Rather than become chartered themselves, LendingClub recently agreed to acquire a chartered bank. However, LendingClub still must wait approximately 12 months for the deal to go through the process of regulatory approval.

2020 and Beyond – A Look Ahead

March 3, 2020 With the doors to 2019 firmly closed, alternative financing industry executives are excited about the new decade and the prospects that lie ahead. There are new products to showcase, new competitors to contend with and new customers to pursue as alternative financing continues to gain traction.

With the doors to 2019 firmly closed, alternative financing industry executives are excited about the new decade and the prospects that lie ahead. There are new products to showcase, new competitors to contend with and new customers to pursue as alternative financing continues to gain traction.

Executives reading the tea leaves are overwhelming bullish on the alternative financing industry—and for good reasons. In 2019, merchant cash advances and daily payment small business loan products alone exceeded more than $20 billion a year in originations, deBanked’s reporting shows.

Confidence in the industry is only slightly curtailed by certain regulatory, political competitive and economic unknowns lurking in the background—adding an element of intrigue to what could be an exciting new year.

Here, then, are a few things to look out for in 2020 and beyond.

Regulatory developments

There are a number of different items that could be on the regulatory agenda this year, both on the state and federal level. Major areas to watch include:

- Broker licensing. There’s a movement afoot to crack down on rogue brokers by instituting licensing requirements. New York, for example, has proposed legislation that would cover small business lenders, merchant cash advance companies, factors, and leasing companies for transactions under $500,000. California has a licensing law in place, but it only pertains to loans, says Steve Denis, executive director of the Small Business Finance Association. Many funders are generally in favor of broader licensing requirements, citing perceived benefits to brokers, funders, customers and the industry overall. The devil, of course, will be in the details.

- Interest rate caps. Congress is weighing legislation that would set a national interest rate cap of 36%, including fees, for most personal loans, in an effort to stamp out predatory lending practices. A fair number of states already have enacted interest rate caps for consumer loans, with California recently joining the pack, but thus far there has been no national standard. While it is too early to tell the bill’s fate, proponents say it will provide needed protections against gouging, while critics, such as Lend Academy’s Peter Renton, contend it will have the “opposite impact on the consumers it seeks to protect.”

- Loan information and rate disclosures. There continues to be ample debate around exactly what firms should be required to disclose to customers and what metrics are most appropriate for consumers and businesses to use when comparing offerings. This year could be the one in which multiple states move ahead with efforts to clamp down on disclosures so borrowers can more easily compare offerings, industry watchers say. Notably, a recent Federal Reserve study on non-bank small business finance providers indicates that the likelihood of approval and speed are more important than cost in motivating borrowers, though this may not defer policymakers from moving ahead with disclosure requirements.

“THIS WILL DRIVE COMMISSION DOWN FOR THE INDUSTRY”

If these types of requirements go forward, Jared Weitz, chief executive of United Capital generally expects to see commissions take a hit. “This will drive commission down for the industry, but some companies may not be as impacted, depending on their product mix, cost per lead and cost per acquisition and overall company structure,” he says.

- Madden aftermath. The FDIC and OCC recently proposed rules to counteract the negative effects of the 2015 Madden v. Midland Funding LLC case, which wreaked havoc in the consumer and business loan markets in New York, Connecticut, and Vermont. “These proposals would clarify that the loan continues to be ‘valid’ even after it is sold to a nonbank, meaning that the nonbank can collect the rates and fees as initially contracted by the bank,” says Catherine Brennan, partner in the Hanover, Maryland office of law firm Hudson Cook. With the comments due at the end of January, “2020 is going to be a very important year for bank and nonbank partnerships,” she says.

- Possible changes to the accredited investor definition. In December 2019, the Securities and Exchange Commission voted to propose amendments to the accredited investor definition. Some industry players see expanding the definition as a positive step, but are hesitant to crack open the champagne just yet since nothing’s been finalized. “I would like to see it broadened even further than they are proposed right now,” says Brett Crosby, co-founder and chief operating officer at PeerStreet, a platform for investing in real estate-backed loans. The proposals “are a step in the right direction, but I’m not sure they go far enough,” he says.

Precisely how various regulatory initiatives will play out in 2020 remains to be seen. Some states, for example, may decide to be more aggressive with respect to policy-making, while others might take more of a wait-and-see approach.

“I think states are still piecing together exactly what they want to accomplish. There are too many missing pieces to the puzzle,” says Chad Otar, founder and chief executive at Lending Valley Inc.

As different initiatives work their way through the legislative process, funders are hoping for consistency rather than a patchwork of metrics applied unevenly by different states. The latter could have significant repercussions for firms that do business in multiple states and could eventually cause some of them to pare back operations, industry watchers say.

“While we commend the state-level activity, we hope that there will be uniformity across the country when it comes to legislation to avoid confusion and create consistency” for borrowers, says Darren Schulman, president of 6th Avenue Capital.

Election uncertainty

The outcome of this year’s presidential election could have a profound effect on the regulatory climate for alternative lenders. Alternative financing and fintech charters could move higher on the docket if there’s a shift in the top brass (which, of course, could bring a new Treasury Secretary and/or CFPB head) or if the Senate flips to Democratic control.

If a White House changing of the guard does occur, the impact could be even more profound depending on which Democratic candidate secures the top spot. It’s all speculation now, but alternative financers will likely be sticking to the election polls like glue in an attempt to gain more clarity.

Election-year uncertainty also needs to be factored into underwriting risk. Some industries and companies may be more susceptible to this risk, and funders have to plan accordingly in their projections. It’s not a reason to make wholesale underwriting changes, but it’s something to be mindful of, says Heather Francis, chief executive of Elevate Funding in Gainesville, Florida.

“Any election year is going to be a little bit volatile in terms of how you operate your business,” she says.

Competition

The competitive landscape continues to shift for alternative lenders and funders, with technology giants such as PayPal, Amazon and Square now counted among the largest small business funders in the marketplace. This is a notable shift from several years ago when their footprint had not yet made a dent.

This growth is expected to continue driving competition in 2020. Larger companies with strong technology have a competitive advantage in making loans and cash advances because they already have the customer and information about the customer, says industry attorney Paul Rianda, who heads a law firm in Irvine, Calif.

It’s also harder for merchants to default because these companies are providing them payment processing services and paying them on a daily or monthly basis. This is in contrast to an MCA provider that’s using ACH to take payments out of the merchant’s bank account, which can be blocked by the merchant at any time. “Because of that lower risk factor, they’re able to give a better deal to merchants,” Rianda says.

Increased competition has been driving rates down, especially for merchants with strong credit, which means high-quality merchants are getting especially good deals—at much less expensive rates than a business credit card could offer, says Nathan Abadi, president of Excel Capital Management. “The prime market is expanding tremendously,” he says.

Certain funders are willing to go out two years now on first positions, he says, which was never done before.

Even for non-prime clients, funders are getting more creative in how they structure deals. For instance, funders are offering longer terms—12 to 15 months—on a second position or nine to 12 months on a third position, he says. “People would think you were out of your mind to do that a year ago,” he says.

Because there’s so much money funneling into the industry, competition is more fierce, but firms still have to be smart about how they do business, Abadi says.

Meanwhile, heightened competition means it’s a brokers market, says Weitz of United Capital. A lot of lenders and funders have similar rates and terms, so it comes down to which firms have the best relationship with brokers. “Brokers are going to send the deals to whoever is treating their files the best and giving them the best pricing,” he says.

Profitability, access to capital and business-related shifts

Executives are confident that despite increased competition from deep-pocket players, there’s enough business to go around. But for firms that want to excel in 2020, there’s work to be done.

Funders in 2020 should focus on profitability and access to capital—the most important factors for firms that want to grow, says David Goldin, principal at Lender Capital Partners and president and chief executive of Capify. This year could also be one in which funders more seriously consider consolidation. There hasn’t been a lot in the industry as of yet, but Goldin predicts it’s only a matter of time.

“A lot of MCA providers could benefit from economies of scale. I think the day is coming,” he says.

He also says 2020 should be a year when firms try new things to distinguish themselves. He contends there are too many copycats in the industry. Most firms acquire leads the same way and aren’t doing enough to differentiate. To stand out, funders should start specializing and become known for certain industries, “instead of trying to be all things to all businesses,” he says.

Some alternative financing companies might consider expanding their business models to become more of a one-stop shop—following in the footsteps of Intuit, Square and others that have shown the concept to be sound.

Sam Taussig, global head of policy at Kabbage, predicts that alternative funding platforms will increasingly shift toward providing more unified services so the customer doesn’t have to leave the environment to do banking and other types of financial transactions. It’s a direction Kabbage is going by expanding into payment processing as part of its new suite of cash-flow management solutions for small businesses.

“Customers have seen and experienced how seamless and simple and easy it is to work with some of the nontraditional funders,” he says. “Small businesses want holistic solutions—they prefer to work with one provider as opposed to multiple ones,” he says.

Open banking

This year could be a “pivotal” year for open banking in the U.S., says Taussig of Kabbage. “This issue will come to the forefront, and I think we will have more clarity about how customers can permission their data, to whom and when,” he says.

Open banking refers to the use of open APIs (application program interfaces) that enable third-party developers to build applications and services around a financial institution. The U.K. was a forerunner in implementing open banking, and the movement has been making inroads in other countries as well, which is helping U.S. regulators warm up to the idea. “Open banking is going to be a lively debate in Washington in 2020. It’ll be about finding the balance between policymakers and customers and banks,” Taussig says.

The funding environment

While there has been some chatter about a looming recession and there are various regulatory and competitive headwinds facing the industry, funding and lending executives are mostly optimistic for the year ahead.

“If December 2019 is an early indicator of 2020, we’re off to a good start. I think it’s going to be a great year for our industry,” says Abadi of Excel Capital.

How Hot Is The Legal Cannabis Industry?

February 24, 2020 One gauge of the commercial excitement over legal weed, medical marijuana and cannabis’s byproducts could be witnessed at the Las Vegas Convention Center in early December where the Marijuana Business Conference & Expo was overflowing with 31,523 attendees.

One gauge of the commercial excitement over legal weed, medical marijuana and cannabis’s byproducts could be witnessed at the Las Vegas Convention Center in early December where the Marijuana Business Conference & Expo was overflowing with 31,523 attendees.

Appealing to that audience—roughly the population of Juneau, Alaska—were more than 1,300 exhibitors who hailed from 79 different countries and touted products and services as varied as advancements in crop cultivation, medicinal breakthroughs, and innovative consumer products like marijuana-laden pastry.

Appealing to that audience—roughly the population of Juneau, Alaska—were more than 1,300 exhibitors who hailed from 79 different countries and touted products and services as varied as advancements in crop cultivation, medicinal breakthroughs, and innovative consumer products like marijuana-laden pastry.

That’s some 30% more than the 1,000 vendors who packed into the Central Hall in 2018 and about double the 678 who were showing off their wares in the smaller North Hall two years ago, reports Chris Day, vice president for external relations at Denver-based Marijuana Business Daily, which follows the cannabis industry and sponsored the Las Vegas trade show.

“In December, 2019,” Day declares, “we did not have to turn people away because we expanded. We had enough room for exhibitors but we needed both halls.” Unable to resist a boast, he adds: “We’ve been the fastest-growing trade show in the country three years running.”

One face in the December crowd was seasoned financial broker Scott Jordan, the Denver-based managing director of the Alternative Finance Network. He was occupying a booth accompanied by two attractive female models in fetching T-shirts emblazoned with the message: “How much would you borrow at zero percent?”

The young ladies’ arresting appearance and the message worked to the extent that “it got people talking,” Jordan says. As for the zero-interest rate, it’s not exactly free money. “I’ve got a product that puts together a line of credit,” he explains, “and after they receive the line of credit, it charges them a fee.”

As a broker, Jordan does the spade work of poring through a cannabis business’s financial statements and business model before he tees up a deal—typically between $250,000 and $750,000—to “a cadre” of 35 lenders in 10 states. He’ll ascertain whether the best funding option should be structured as equipment leasing, a working-capital loan, a revolving line of credit, project financing, or a real estate loan.

One recent cannabis deal that Jordan midwifed involved a “post-revenue, pre-profitability” manufacturing and processing company headquartered in Colorado. The financing, which closed in April, 2019, involved a pair of four-year term loans: one for $400,000 to refinance existing machinery, and a second for an additional $500,000 to acquire new laboratory equipment. Both credits carried interest rates in the “mid-teens,” he says, and were secured by the equipment.

Once the debt financing was in place, the manufacturing operation was “fully functioning,” Jordan reports, paving the way for the company to raise $30 million in venture capital financing. Jordan argues that “even if they pay a 10-20 percent interest rate, it’s better to preserve equity and finance through a normal type of loan. If you need an extraction machine or packaging equipment,” he adds, “why give up equity if you can finance it through debt?”

Jordan’s reasoning appears to sit well with clients and funders alike. Since 2014, he has brokered 85 transactions worth $33 million. He reckons that two out of three deals that he takes to funders meet with success. “My best year was 2015 because there were only a few competitors and I was the only guy on the block,” he says.

As the country steadily decriminalizes and legalizes pot, however, early market entrants like Jordan no longer have the cannabis business all to themselves. Thirteen states have legalized recreational marijuana for adults. These include California, Colorado, Oregon, Washington and Nevada in the West; Illinois and Michigan in the Midwest; and Massachusetts, Vermont and Maine in the East. Hawaii and Alaska permit it and, if you’re over 21, you can legally grow, smoke or ingest weed in the District of Columbia, but it cannot be sold commercially.

An additional 24 states have approved medical marijuana. While research on cannabis’s medicinal properties remains thin—largely because of objections by federal law enforcement—it is being prescribed for a range of maladies, including cancer, glaucoma, epilepsy, Crohn’s Disease, multiple sclerosis, nausea, and pain. [“The marijuana plant contains more than 100 different chemicals called cannabinoids,” according to WebMD. “Each one has a different effect on the body. Delta-9- tetrahydrocannabinol (THC) and cannabidiol (CBD) are the main chemicals used in medicine. THC also produces the ‘high’ people feel when they smoke marijuana or eat foods containing it.”]

Industry data assembled by MJBizDaily reflects both the broad acceptance of legal cannabis use and its increasing commercial popularity. U.S. revenues from legal weed and its byproducts are expected to clear $16.4 billion this year, a 40% growth rate over the $11.75 billion in estimated revenues for 2019. The legal cannabis industry now employs about 200,000 persons in the U.S., about the same number as flight attendants (120,000) and veterinarians (80,00) combined.

For more evidence that the cannabis market is hot look no further than the state of Illinois, where recreational marijuana went on sale Jan. 1, 2020. The Prairie State’s governor also pardoned some 11,000 citizens with criminal records for possession and the sale of low levels of marijuana.

For more evidence that the cannabis market is hot look no further than the state of Illinois, where recreational marijuana went on sale Jan. 1, 2020. The Prairie State’s governor also pardoned some 11,000 citizens with criminal records for possession and the sale of low levels of marijuana.

“We’re showing that sales were close to $3.2 million on the first day of 2020,” says MJBiz’s Day. “Illinois is the big story right now,” he adds. “Anytime a new state opens up in the market, you’re seeing enormous pent-up demand and enthusiasm.”

Even as the cannabis industry takes giant strides toward public acceptance, the plant continues to face hostility from the U.S. federal government, which has criminalized its use for 80 years. Marijuana remains classified by the Drug Enforcement Agency as a Schedule 1 drug, keeping company with heroin, LSD and Ecstasy.

Even as the cannabis industry takes giant strides toward public acceptance, the plant continues to face hostility from the U.S. federal government, which has criminalized its use for 80 years. Marijuana remains classified by the Drug Enforcement Agency as a Schedule 1 drug, keeping company with heroin, LSD and Ecstasy.

That designation has also made it hard for the cannabis industry to engage in simple financial transactions, much less obtain financing. “Despite the majority of states’ having adopted cannabis regimes of some kind, federal law prevents banks from banking cannabis businesses,” Joanne Sherwood, president and chief executive at Citywide Banks, a $2.3 billion-asset bank headquartered in Denver, testified to Congress last summer. “The Controlled Substances Act,” added Sherwood, who is chair of the Colorado Bankers Association, “classifies cannabis as an illegal drug and prohibits its use for any purpose. For banks, that means that any person or business that derives revenue from a cannabis firm is violating federal law and consequently putting their own access to banking services at risk.”

And despite the herculean efforts by the cannabis industry to soften its image, obtaining financing from traditional sources like pension funds, insurance companies and university endowments remains a daunting proposition as well, says David Traylor, senior managing director at Golden Eagle Partners. His four-person, boutique investment fund, which makes equity investments in up-and-coming cannabis companies, relies on wealthy individuals and family offices for the bulk of its funds.

“Capital is hard to come by for this industry,” Traylor says. “From day one, most venture capitalists have been staying out of it. It’s still illegal in many states and their limited partners are endowments like Harvard and Yale, which see marijuana as the antithesis of education.”

Sarah Sanger, chief financial officer at Oak Investment Funds, a real estate investment firm based in Oakland, says: “There’s a great deal of economic activity in California but it’s stymied by the lack of financing and difficulty with changing regulations. It provides an opportunity for really expensive debt from private investors willing to do due diligence.”

That absence of establishment financing has opened up a plethora of opportunities for alternative funders, and not just in agriculture and plant cultivation. While agriculture represents the bedrock of the industry there is no downstream product, of course, without the cannabis leaf— growing and harvesting cannabis is just one stage of the industry’s life cycle.

MJBiz’s Day notes, for example, that that the legal cannabis industry is regulated for safety, so growers must show that “the flower has no molds or contaminants.” That means that crops are subject to rigorous testing and decontamination, which requires both materials and expertise. To process the leaf and develop “infused products” by extracting cannabis-based oils entails the purchase and deployment of costly technology. Packaging and labeling along with tracking systems that, Day says, “are stricter than in other places” are also key components of the farm-to-market supply chain.

Meanwhile, in an ongoing effort to appeal to a fresh cohort of customers, Jordan notes, the cannabis industry continues to develop innovative uses for the plant. “There are so many applications and new products that keep appearing, like ice cream with marijuana, vaporizers, inhalers, and syrup,” he says. “Now, there are mints—something I hadn’t seen before—and different ways to ingest the product and get high and not look like a druggie.”

Jordan Fein, chief executive at Greenbox Capital in Miami, says his firm prefers to fund downstream companies selling cannabis products. “We do agricultural lending but it’s less attractive and harder to qualify the business. It’s not as tangible as a retail business which will have a website and product reviews. The same goes for edibles.”

Jordan Fein, chief executive at Greenbox Capital in Miami, says his firm prefers to fund downstream companies selling cannabis products. “We do agricultural lending but it’s less attractive and harder to qualify the business. It’s not as tangible as a retail business which will have a website and product reviews. The same goes for edibles.”

Recent Greenbox Capital deals in 2019, Fein says, included one with merchant cash advances of $80,000 and $60,000 in growth capital to a Colorado dispensary. The operation put the money to work adding two retail outlets during the year, he says, bringing to four its total number of storefronts. In addition to cannabis flower, the dispensary sells “edibles, tinctures, lotions, and wax concentrates,” Fein reports. Both short term cash advances require regular ACH payments.

Greenbox Capital also made a $135,000 cash advance to a cannabis-testing laboratory in Southern California in August, 2019 for the purchase of sophisticated equipment. The company, he says, is doing $140,000-a-month in revenue and cashflow is strong and on the rise.

“Greenbox is always interested in higher risk deals,” Fein says, noting that banking services remain off limits to legal cannabis firms. “But we fund them for the same reason we fund lawyers and auto sales—things that most others will not do. There’s nothing wrong with risk,” he adds, “as long as you clearly assign a proper value to the deal and price to it.”

Steve Sheinbaum, a New York broker and chief executive at Circadian Funding, has unabashedly climbed aboard the cannabis bandwagon. “The market is exploding and it’s attractive to lenders because it’s a product people can put their hands on,” he says. “If I’m dealing with a grower, I can leverage real estate and usually there’s equipment. If they’re producing, there’s inventory and I can look at the income statement to see what kind of cash flow the business is generating.”

He recently brokered a $10 million loan for a licensed grower and distributor of medicinal marijuana in New England with monthly revenues of $3-$4 million. The credit bore a 17% annual percentage rate and a six-year maturity, he says. The deal was brought to Circadian by a private equity investor who was looking to grow the enterprise tenfold. The deal, which was interest-only, was secured by a second position on real estate and a lien on the borrower’s license. “The lender was comfortable with the interest-only loan,” Sheinbaum explains. “They can refinance in six years.”

He recently brokered a $10 million loan for a licensed grower and distributor of medicinal marijuana in New England with monthly revenues of $3-$4 million. The credit bore a 17% annual percentage rate and a six-year maturity, he says. The deal was brought to Circadian by a private equity investor who was looking to grow the enterprise tenfold. The deal, which was interest-only, was secured by a second position on real estate and a lien on the borrower’s license. “The lender was comfortable with the interest-only loan,” Sheinbaum explains. “They can refinance in six years.”

In another recent deal, Circadian arranged an unsecured merchant cash advance for $300,000 to a Pacific Northwest technology company developing specialty, point-of-sale software for the cannabis industry. The firm showed monthly revenues of $300,000.

“It’s not federally permitted for cannabis firms to take payments from Visa, Mastercard or American Express,” Sheinbaum explains. “But this technology company is using debit or credit cards to pay for cryptocurrency which is stored on a prepaid card which customers can then use to purchase cannabis.”

The tech company had been struggling to find money and Sheinbaum took satisfaction in a deal announcement that went out in an e-mail to the industry. “Funding complicated deals is what gets our blood flowing,” Sheinbaum wrote. “Anyone can get a restaurant or dentist funded. No one needs help with that.”

Manny Columbie, a Miami-based senior funding manager at H&J Capital Group, an Orlando firm, reports funding agricultural and dispensary businesses in California, Colorado and Washington State. In the Evergreen State, he says, he recently provided funding to a woman who owned a marijuana-themed café connected to a cannabis dispensary. The deal went through after examining her recent bank statements and two years of federal tax returns.

“The best thing about lending to people in this industry is their ability to repay,” Columbie says. “They’re never lacking in funds.”

He provided more detail on a deal currently in the works involving a physician in Irvine, California, with an 800-plus credit score from the rating agency Experian and personal tax returns showing $2 million in annual income. The doctor, Columbie says, has been making transdermal patches infused with THC in addition to his medical practice and needs specialized equipment to lower his manufacturing costs to 55 cents per patch. The patches sell for $40-$60 apiece, Columbie says, depending on the THC content.

If the deal goes through and is approved by H&J’s credit committee, the physician would likely be extended a $350,000 loan with a 10-year maturity secured by the Chinese-manufactured equipment. Factoring in the doctor’s excellent credit and other positives, the interest rate on the credit could be as low as 5%-7%.

While the environment for legal cannabis seems to grow more favorable by the day, market participants urge funders to remain circumspect. One remaining fly in the legal cannabis ointment has been the persistence of an illegal black market. Estimates are that as much as 60% to 80% of the marijuana market in California is illicit, says Craig Behnke, an equity analyst at MJBiz.

Law-abiding businesses must also contend with overbearing regulators and high taxation. The California Department of Fee and Tax Administration recently jacked up its excise tax on cannabis to 80%, effective on Jan. 1, 2020.

And the state’s constabulary isn’t helping matters either, notes Sanger of Oak Funds. “There are going to be a lot of operators that end up being losers because of the regulatory environment,” she says. “Law enforcement is using all of its resources to make sure legitimate businesses are following the rules instead of clamping down on black market activity. That makes it harder for legitimate retailers to make money because people are still shopping in the black market.”

The recent collapse of the shares of publicly traded Canadian cannabis companies, which some blame in part on the illicit competition from the black market, also stands as a cautionary sign. Last August, the Motley Fool listed ten “Pot Stocks”—including Canopy Growth and Aurora Cannabis, both of which are listed on the New York Stock Exchange—that together lost a stunning $20 billion in market capitalization.

The drubbing that heedless investors have taken in the Canadian stocks reminds analyst Behnke of the debacle in dotcom stocks back in 2001-2002, but with a big difference. “The dotcoms were a brand-new invention and people had no idea how big the Internet companies would be,” he told deBanked. “But cannabis has been around for a thousand years. I feel like it was a shame on investors and the companies. This shouldn’t have happened.”