ACH Advances

Is Google Your Only Web Strategy?

December 31, 2012Every business wants to be found in search. To most, being found means top placement in Google’s search results for keywords or phrases that are most likely to convert into a lead, sale, or customer. That begs the question… how does one get that top placement?

While many are now accusing Google of monopolizing or manipulating the search results to promote pages and products that earn them revenue, they are still unique in the sense that one simply cannot buy top placement in organic rankings. The Google search system was originally designed to rank pages based on both how many other pages linked to a page and how important those linking pages were. It was a relational system called PageRank that theoretically gave little guys a chance of being ranked alongside or even ahead of major corporations.

When it came to being talked about or linked to from other sites (these incoming links are called backlinks), mega corporations with large sums of money had a tremendous advantage. Media outlets seemed to always be linking to them naturally and they could buy linking ads on websites that didn’t. They could even buy backlinks on irrelevant pages just to up the ante. In 2011, Overstock.com was penalized by Google after one such linking scheme was discovered. Overstock was offering discounts to students and faculty that placed a link to their website on a school web page ending with .edu. It was believed that .edu top level domains (TLDs) carried far more weight than .com, .net, and .org. Overstock tried to capitalize on that.

Where a company ranks in the result listings can mean the difference between success and failure. For the mega corporations, millions of dollars in revenue can be gained by being listed 1st as opposed to 4th. The reality is that searchers tend to click on top results more often, ultimately leading to more sales for the companies that rank well.

According to a study conducted by Slingshot SEO, the top search result is clicked 18.2% of the time, whereas the last result (#10 on the page) is selected 1% of the time. These statistics make a few things clear. If you’re not on the first page, you might as well be in outer space. Additionally, a ranking on the first page must be for a search term or phrase that is frequently searched. Sure, we’re happy to be listed 4th for the search phrase “greatest merchant cash advance company in the world,” since it links to our free directory of verified MCA providers, but since no one is using that search phrase, it really doesn’t matter.

A hypothetical business does research and determines that 100 people per month are entering this phrase into the Google search bar: “I want a merchant cash advance this minute.” It looks promising because it shows that the end user is in buying mode. One could make the case that they are more likely to apply for business financing than a user searching for “the history of merchant cash advance.” 100 searches for the initial phrase might seem like an opportunity, but you have to make an effort to achieve a listing for that keyword, at least that’s what Search Engine Optimization (SEO) gurus will tell you.

All Hail the King

Since Google is the omnipotent dictator that determines where every website falls, there is nothing that can 100% guarantee a website will be visible for the terms and phrases a webmaster wants. There is no shortage of tips, methods, and tricks to boost the odds but all of those things require time, money, or both. Neither will get the webmaster far unless the Search Engine Optimizer (SEOer) knows how to modify a website, analyze search phrases, and implement a strategy to increase rankings. If the SEOer isn’t tech savvy, stay away.

The SEOer’s strategy will likely fall into one of two categories, white hat or black hat, but it’s important to note that wearing any kind of hat is technically a violation of Google’s Terms of Use. It’s easy to label an SEOer that places thousands of irrelevant comments with a backlink on blogs all over the Internet as a black hatter. But contrast that technique with a white hatter that does nothing more than write interesting articles and get them published on other websites with a backlink.

The latter may seem innocuous, but both attempt to manipulate Google’s algorithm and can lead to serious ranking devaluation penalties. A penalty can be crippling for a business that depends on acquiring leads or customers online. Worse yet, the webmaster is not tried before a jury of his/her peers before being sentenced to page infinity for all search terms. This is the downside of the playing field Google creates. John Doe business owner can be listed alongside multi-million dollar corporations and can enjoy that visibility to grow into a million dollar business themselves. But if it is Google that brought him into this world, it is Google that can take him out.

In late April, 2012 Google announced they were cracking down on “blog networks.” This algorithm update became known as Google Penguin and hit the web like a hammer. 3.1% of all english search queries were affected. Penalized webmasters that paid to have self-written articles published on other websites to get the link juice were left wondering how the practice could be a violation. Analogies were used to explain that paying to promote oneself is standard business practice. They likened article marketing to the basic trade of journalism. They argued it was their constitutional right to promote articles without fearing the total loss of business or retribution from Google.

In late April, 2012 Google announced they were cracking down on “blog networks.” This algorithm update became known as Google Penguin and hit the web like a hammer. 3.1% of all english search queries were affected. Penalized webmasters that paid to have self-written articles published on other websites to get the link juice were left wondering how the practice could be a violation. Analogies were used to explain that paying to promote oneself is standard business practice. They likened article marketing to the basic trade of journalism. They argued it was their constitutional right to promote articles without fearing the total loss of business or retribution from Google.

Google’s position though is that it is perfectly okay to link to a friend’s website or to pay to have articles placed elsewhere. They respect that those decisions are not theirs to judge in respect to the global Internet. However, if the intent (or perceived intent!) of these practices is to achieve higher ranking in Google’s search results, then they reserve the right to protect the integrity of their ranking system accordingly. Essentially, anyone can do what they want, but it might affect how things are scored within their private system. So if you don’t care about your valuation in Google, you can use all the linking schemes in the world if you so choose. The problem is that most people do care about their score in Google and many people view Google as the global Internet. Google can argue that they are simply policing their own private system but to millions of web users around the world, they are viewed as policing the Internet.

The Revolution

It’s not their fault. Google’s system was so good and their interface so simple, that millions of people started using it and never went back. They became the Internet. Search engines existed previously but had many flaws. Back then, millions of websites that provided answers to questions or sold solutions for problems went undiscovered to the vast majority of humanity. Google found them, ranked them, and then went on to check them frequently to make sure users were still likely to find what they wanted.

They made the world a better place until the laws of their kingdom began to contradict common sense. For example, it would seem practical for a video game company to buy a banner ad on a video game enthusiast web forum. They could benefit from the targeted traffic and hopefully sell some video games. But at the same time, Google might view this banner link as an attempt to manipulate their algorithm.

To resolve this dilemma, Google created a tagging system to allow their search crawlers to identify which links were paid for and then direct their algorithm to make sure the buyers did not benefit in search from them. This directive was controversial because it forced webmasters that cared about their rankings to worry about the nature of their outbound links. Could a website selling banner ads hurt both the buyer and the seller at the same time? They sure could. If buying and selling backlinks is forbidden, then both parties have something to worry about. Today, it is important to include the rel=”nofollow” attribute in html coded links that are paid for.

To resolve this dilemma, Google created a tagging system to allow their search crawlers to identify which links were paid for and then direct their algorithm to make sure the buyers did not benefit in search from them. This directive was controversial because it forced webmasters that cared about their rankings to worry about the nature of their outbound links. Could a website selling banner ads hurt both the buyer and the seller at the same time? They sure could. If buying and selling backlinks is forbidden, then both parties have something to worry about. Today, it is important to include the rel=”nofollow” attribute in html coded links that are paid for.

Since the majority of web users use Google in some way, the challenge and effort to achieve better placement has become a billion dollar industry. Prestigious advertising firms claim they can improve search placement using white hat guidelines Google itself created. The fact remains that there is no way to be safe, no matter how prestigious, knowledgeable, expensive, or innocuous the SEOer is. Having a page on a website that discusses a topic that another page on the same website already talks about can be grounds for a penalty. Interlinking your pages too much can be grounds for a penalty, discussing too many broad topics can be grounds for a penalty. Writing with imperfect english can be grounds for a penalty. Mentioning your product or service too many times in an article or throughout your website can be grounds for a penalty. Not using enough visual aids such as images or videos can be grounds for a penalty. Adding new content to the website too frequently can be grounds for a penalty.

Everybody’s Doing it

Smart webmasters approach the web like their health. Do everything in moderation. It seems like every year there is a study that proves a correlation between a daily household food item with a certain untimely death. We’ve all heard something like this before: “The study determined that people that eat less than 2 carrots a day are more likely to die before the age of 70 than people that eat 2 or more carrots per day.” It’s the kind of fear mongering that causes someone to worry obsessively about meeting the 2 carrot daily minimum only to get hit by a bus as they cross the street three decades before they turn 70. Webmasters can spend their days worried about how Google will view them and ultimately never be found by their potential customers or they can do what everyone else does and work on getting backlinks and add content to their websites.

Smart webmasters approach the web like their health. Do everything in moderation. It seems like every year there is a study that proves a correlation between a daily household food item with a certain untimely death. We’ve all heard something like this before: “The study determined that people that eat less than 2 carrots a day are more likely to die before the age of 70 than people that eat 2 or more carrots per day.” It’s the kind of fear mongering that causes someone to worry obsessively about meeting the 2 carrot daily minimum only to get hit by a bus as they cross the street three decades before they turn 70. Webmasters can spend their days worried about how Google will view them and ultimately never be found by their potential customers or they can do what everyone else does and work on getting backlinks and add content to their websites.

Is a compliant website that is never found by customers better than a website that has a good run, makes a lot of money, but takes the risk of getting penalized in the end? Some believe it is better to have loved and lost than to have never loved at all. Afterall, an online business that has no web visitors is not really a business is it?

White hatters, the SEOers that wrongly believe they are immune from repercussions argue that their strategies take far longer to create results because they are in it for the long haul. Coincidentally, these long-haul strategies tend to have a high monthly price, do not guarantee results, and cannot predict what changes Google will make in the future. For example, if an SEOer says their slow and steady method will take 6-12 months, the webmaster should understand that the ranking algorithm could change in 5 months. All the work performed could be rendered obsolete in the blink of an eye or worse, devalue the ranking further from where it was originally.

White hatters, the SEOers that wrongly believe they are immune from repercussions argue that their strategies take far longer to create results because they are in it for the long haul. Coincidentally, these long-haul strategies tend to have a high monthly price, do not guarantee results, and cannot predict what changes Google will make in the future. For example, if an SEOer says their slow and steady method will take 6-12 months, the webmaster should understand that the ranking algorithm could change in 5 months. All the work performed could be rendered obsolete in the blink of an eye or worse, devalue the ranking further from where it was originally.

In the quest for a quick fix or even as part of a long-term strategy, SEOers can’t help but notice that websites maintained by news media seem immune to all the rules. They republish countless amounts of duplicate news reports and they buy and sell exposure like its going out of style. In a way, they are a multiplied version of everything Google says not to do. But while they might get tons of traffic from search engines, they are not entirely dependent on them. Big news media has incredible brand name recognition. An individual seeking information about the Fiscal Cliff may simply type “CNN.com” in the browser address bar and bypass Google altogether.

Companies like Reuters, The Wall Street Journal, Fox, and CNN, etc. are highly authoritative and could be categorized as the holy grail of backlinks. If one of the major ranking factors is the importance of the website the link is on, then there is nothing more important than being mentioned by national mainstream news media. The media outlets know the perceived value of their links and are hungry to find new streams of revenue. Thus, an opportunity presented itself to them just as printed newspapers began going the way of the dinosaur. And so they began to peddle link juice.

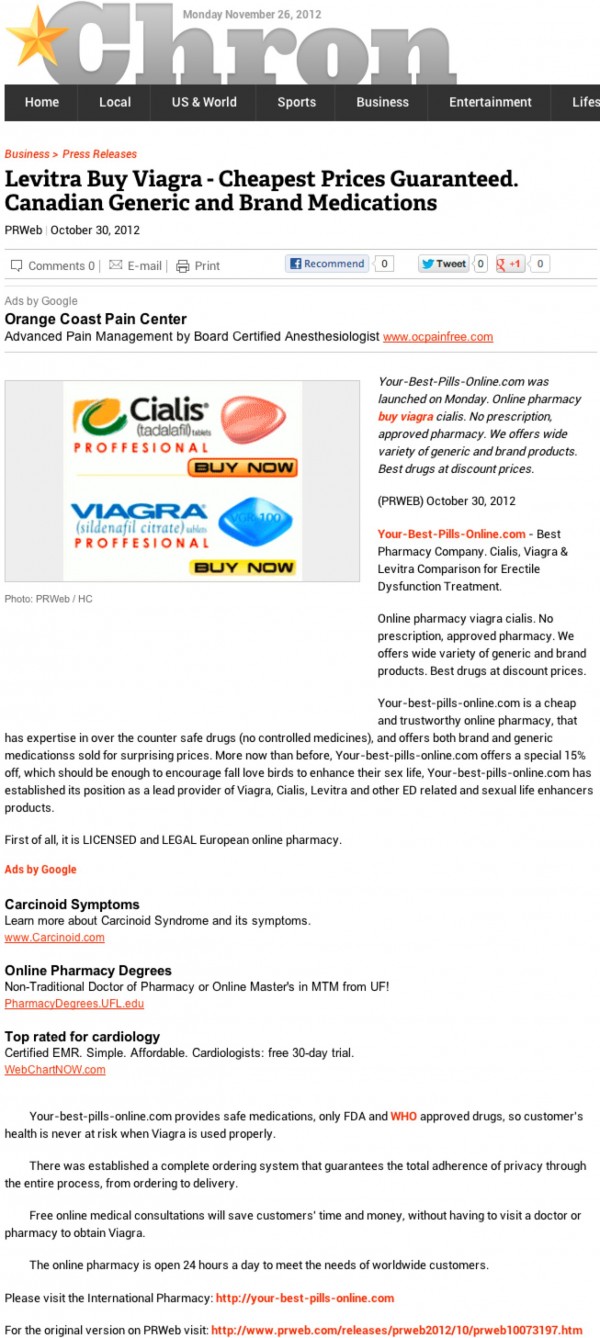

The age of buying links is not dead and it is now much more difficult for Google to punish the parties involved. Webmasters can pay public relations firms to get a “company press release” published on big news media sites and get the backlink of course. This tactic has been around for years but it has become one of the last great bastions for white hat SEO. Others would argue that social media is the next frontier but for SEOers grinding it out in the trenches, traditional backlinks seem to work better above all else.

Many public relations firms have been warned by Google not to promote the backlinking aspect of their service, but all of them offer some kind of SEO package to target webmasters that are interested in using their service for the purpose of link juice. Searchengineland.com ran a great article that exposed what the press release as SEO tactic revolution has done to the news. (http://searchengineland.com/how-prweb-helps-distribute-crap-into-google-news-sites-140597)

There is now a surge in boring, irrelevant, and oftentimes non-sensical company announcements on big media sites across the Internet. It is a popular SEO method in many fields, making it difficult to find actual industry news amongst the clutter of backlink driven stories.

But if it works, then why stop? That of course implies that it works in the first place. Several days ago, Matt Cutts, the director of Webspam at Google informed inquisitive webmasters that links in these press release articles DON’T COUNT. Helpful SEOers explained to the original poster that most links in press releases have the no-follow attribute added to the links to make sure that they don’t pass juice. Upon our own examination however, we couldn’t find any news media or public relations firm that implements no-follow. It would probably hurt their bottom line if the junk releases they were peddling suddenly didn’t count for anything.

The debate rages on about whether or not the director of Webspam is to be trusted. Is the ranking algorithm as powerful as Google claims it is? Or are they spreading fear and misinformation to make up for their shortcomings? There is a lot of interesting feedback to consider in the comments section of seroundtable’s short article regarding press releases.

In the past, many webmasters have used obvious black hat techniques for favorable placement and gotten burned in the end. Many innocent websites have been caught in the crossfire. Success on the Internet is believed by many to be achieved only by being visible on Google.

The War

Individuals that have never managed a business website in their life have little idea how Google works. They know it will provide them with the answers they’re looking for and rank them in order from best to worst. To everyday users it is nothing short of magic. To an SEOer, being #1 for a search term may mean weeks, months, or years of trial, error, and patience. It requires time, money, or both. It is a tireless quest to become #1 or to die trying. It is the difference between getting 18.2% of visitors for a keyword searched 5,000,000 times a month or 1% of visitors for a keyword searched 100 times a month. It is a battle against not only Google, but against competitors in the same field that are using the same tricks to move up. It is a system that gives little guys a chance to be ranked alongside major corporations. It is way to be found in the sea of a trillion websites. But it is also a dictatorship. Google can sneak into your house in the middle of the night and banish you to page 50 with the accusation that you were buying backlinks. Google can lock the front door of your virtual store to prevent shoppers from getting in. Google can label non-native English speakers as spammmers and silence those that won’t stop writing about the same thing over and over again. This is the challenge with a single company being tasked with policing the entire Internet.

The Perks

There are alternatives out there like Bing and Yahoo, but the problem is that when people go to those sites, they tend to type Bing or Yahoo into Google just to get there. Such is the habit these days for getting anywhere on the web. In 2008, blogger Marshall Kirkpatrick wrote about this phenomenon. He argued that mainstream users of the Internet do not even know how to navigate it. While tons of responders to the article seem to agree, there are plenty of folks that make a compelling case as to why using a search engine is superior to a browser’s address bar.

There are alternatives out there like Bing and Yahoo, but the problem is that when people go to those sites, they tend to type Bing or Yahoo into Google just to get there. Such is the habit these days for getting anywhere on the web. In 2008, blogger Marshall Kirkpatrick wrote about this phenomenon. He argued that mainstream users of the Internet do not even know how to navigate it. While tons of responders to the article seem to agree, there are plenty of folks that make a compelling case as to why using a search engine is superior to a browser’s address bar.

It isn’t easy typing https://debanked.com perfectly if you’re a fast typer, which might explain why a significant portion of our visitors type this url into Google instead. They want to get to the right place the first time even if they type it in wrong. They might not even be exactly sure what our website is called or how to spell it. It’s not uncommon to see incorrect urls somehow end up in our traffic reports anyway.

- Merchant Processing Esource

- Merchant Processing Source

- Merchant Processing Resources

- Merchant Proccesing Resource (2 Cs or 1s)

- Merchant Processor Resource

The list of mistakes continues, but Google points them in the right direction anyway. If this didn’t happen, we might seriously consider rebranding the site with a much shorter domain name. Unfortunately, in mid-2010 when Merchant Processing Resource started, we didn’t give much thought to the difficulty in remembering a 7-syllable name, nor the likelihood of miskeying a single character in a 34 character address (www.merchantprocessingresource.com). This shove in the right direction is a benefit that an address bar can’t offer.

Not Evil?

The user oriented focus of Google arguably ended once and for all on May 19, 2010, the day they went public. While #6 on the list of Google’s official philosophy is that “You can make money without doing evil,” shareholders may have qualms with #1. It states, “Focus on the the user and all else will follow.” This motto doesn’t scream maximum profit. Besides, being public doesn’t allow Google to focus on the user, but instead tasks them with increasing the value of their stock. Of course they can’t earn a profit if they disregard the users altogether and so they are faced with the challenge of maximizing profit without alienating their users.

Adhering to their own philosophy is tricky, not to mention that many state and national governments believe that Google is manipulating the results to promote their own products. Products? one might ask; What possible products does Google have? Oh you mean you haven’t heard of Maps/Earth, Youtube, Zagat, Google Reviews, Google Plus, Gmail, Blogger, Picasa, Google Wallet, Translate, the Droid OS, driverless cars, the Chrome web browser, or the many other products they control?

Google isn’t content with just controlling search. They want to control the entire Internet experience. Companies like Facebook threaten that monopoly and as such Google has made social networking a top priority to counter them. Not evil?

The Google universe is exhausting. Webmasters must do more than just design great websites to continue enjoying the luxury of being found. Paid links must be marked as no-follow, backlinks on bad websites must be disavowed, private pages must be marked as no-index, similar or duplicate content must be avoided, URLs must be descriptive, title tags should be relevant, HTML should be used over Flash, and moved pages should be redirected if for no other reason than to retain the page value of the original URL.

Is There Life After Dea.err…Google?

As we draw near our conclusion, we argue that Google continues to play a large role in Internet Marketing, but advise that Google is not the Internet, no matter how much you’ve come to believe otherwise. There is LinkedIn, Facebook, Twitter, web forums, blogs, email newsletters, and a zillion other places to promote oneself and be found. Too many people fail to utilize the infinite other opportunities to market themselves online simply because they believe ranking in Google is the only way or because they’ve received a penalty and give up. “Getting ranked” has become an all consuming challenge that blinds webmasters from their true goal of attracting customers. People bought products and services online before Google came around. They might make things easier for the average user that believes search results are a product of magic, but in reality they are just one of many systems to find things. They are an imperfect ecosystem that has become tainted by their motivation for profit. And let’s not forget the millions of white hatters and black hatters that are driving the algorithm wild as they seek better placement for themselves or their clients.

Do we care about Google? Certainly, but only about half of our visitors originate from the search engine. People actually see us mentioned on LinkedIn, Facebook, and actual trade publications. And guess what? Those people visit us, bookmark us, and return. There may come a day when Google decides too many incoming links from Facebook is grounds for a penalty, causing outrage among webmasters, a move that might force many to give the social network up, and even disavow it officially. White hatters could end up having to eat their white hats down the road. The whole system of the Internet will no longer seem to make any sense. Maybe a reality check is okay. Perhaps too many hours and megabytes are wasted on trying to gain favor with Google. So much junk exists out there these days that isn’t even meant to be read or followed, but rather exists for the sole purpose of gaining link juice. If a poorly designed website in China links to a good website in the U.S., should the webmaster have to spend time tracking it down, identifying it, and disavowing it just to appease the king? Does this make any sense?

The next time you spend $300-$500 on a press release with carefully crafted link text, think about whether or not Google is really going to reward you with placement for a search term. Their director of Webspam says you’re not going to score any points, yet you may believe otherwise. Consider how else that money could be spent online outside the context of Google SEO. Are you looking to attract customers or simply gain favor with a king that MIGHT lead to customers? Imagine for a minute that Google, Bing, and Yahoo have banished you from being found forever. Would you close up shop or start to think outside the box?

White hatters that read this may be mumbling to themselves that they need not think this way because they have a surefire strategy that works, something along the lines of “Content is King.” This “Content” revolution involves publishing tons of articles to ones website to give the impression to Google that a website is constantly being updated with helpful information. An SEOer will tell you that Google “wants” this. In reality though, this has created a new phenomenon, the practice of webmasters spamming their own websites. The content may be informative, well written, and on-topic but if it’s being done to please Google instead of making sales or helping visitors, then it’s really nothing more than the black hat trick of the day. “Content is King,” that is until it’s not because 100 million websites are doing the same thing, leading to a vast pile of junk in cyberspace.

People forget that the word ‘marketing’ exists in Internet Marketing. They focus their time and effort on Internet Manipulation. They either have systems to make a quick buck or they slowly march onwards towards a promise that can’t be kept. As we approach 2013, it remains true that Google can’t be ignored, but the rest of the global Internet shouldn’t be either. There are billions of people out there that are looking for what you offer and you need to learn how to reach them. Coincidentally, there are 100 million articles on the web that claim they can teach this very trade. 99 million of them exist for the purpose of getting a backlink. That means the information is questionable at best. Take a marketing course, read a marketing book, or hire a marketing consultant. Go back to the basics if you must. Plan for the day where you won’t exist in search even though your business exists in real life. If the moment comes where Google replaces the search results with only paid advertisements or you get penalized because you told all of your friends to link to your website, you can shrug it off. If you want to be in Internet Marketing for the long haul, stop thinking about search. Google can’t be your only web strategy forever.

– Merchant Processing Resource

https://debanked.com

Find tons of great Matt Cutts memes here

A Great Thread That Discusses Business Survival Without Google

Funding Down to a Science

December 21, 2012Account rep: Congratulations, you’ve been approved for $27,000!

Merchant: How did you come up with these figures?

Account rep: It was science. Science did this.

Funny? Maybe not, especially since an underwriting super algorithm may be on its way to the United States. In the days after we posted Made for Each other?, friends, acquaintances, and strangers have been telling us to keep an eye on Wonga’s potential acquisition of On Deck Capital. “It’s not just a european company’s gateway to the US. They’re going to change everything,” a few have said. Aside from their background of being a payday lender, having prestigious VC backing, and the resources to throw a quarter billion dollars at a main street lender in a takeover bid a lot of people didn’t see coming, apparently there is much more to be seen.

Just like MCA in years past, Wonga has worked hard to repel a negative image. Not easy stuff, especially considering they embrace their hefty costs wholeheartedly. Sure, it’s easy to calculate an APR equivalent of a very short term loan and spin whatever number you come up with as the symbol of something evil. If I let a stranger borrow $100 today with the stipulation that they pay me the whole thing back tomorrow plus 1 dollar extra to make it worth my while, would I be evil? That’s an APR of 365%. If I did the same thing with 100 strangers, what are the real odds that all 100 would actually pay me back? Somewhere along the line because of a borrower’s circumstances, bad decisions, or even malicious intent, I’m going to lose the entire $100 I lent out. Others might need more time to pay me back. If one person out of those hundred doesn’t pay back, I break even. If two people don’t pay back, I lose money. If one person doesn’t pay back and another can’t come up with the whole thing, I lose money. You can lend money at 365% APR and lose BIG.

So how do banks manage to charge 4, 7, and 10% APR? Is it just because they’re smarter? No. They don’t make money off loans at these rates either. In the US, interest rates are distorted by government guarantees. Politicians have decided that certain interest rates sound “fair,” then push big banks to lend money at these low unsustainable rates. But of course it doesn’t work and so government agencies sweeten the deal by reimbursing banks for up to 90% of the losses on the borrowers that default. Banks make money on the loan closing fees and other services they sell to the businesses. The loan is the doorbuster offer the bank puts in the storefront window. Once you come inside, they try to sell you on other things so that you don’t walk away with just the loan, otherwise they’re losing money.

So when you hear “banks aren’t lending,” don’t be so surprised. Lending money means giving it away to someone that might not pay it back. That’s a really tough business to be in, no matter how qualified the borrowers are or how good the underwriters are supposed to be.

But somewhere in between the opinions of the Merchant Processing Resource staff and government bureaucrats over what is fair, is a special recipe that determines once and for all what works best. It’s science. Wonga’s lending success is rooted in science and propelled by an advanced algorithm that can systematically calculate risk better than any bank in the world, or so they say.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

Wonga takes a human-free approach, something no MCA provider in North America does regardless of how automated their process may seem. In the UK, their business loan application process takes only 12 minutes and the funds are wired 30 minutes later. That’s it. Their max loan is £10,000 but just think about how that compares to MCA in the US. How much time and overhead is being spent on printing documents, underwriters, conference room meetings to discuss deals, setting up the merchant interview, trying to reach the landlord, trying to get page 7 of a bank statement from 6 months ago and the signature page of the lease, etc. etc. Funders might have had the wrong approach all along.

Wonga’s founder, Errol Damelin believes in data. According to some quotes in The Guardian, Damelin believes interacting with the borrower actually impairs a lender’s judgement.

From the Guardian:

Asking for a loan from a financial institution had traditionally involved making a strong first impression – putting on a suit to see the bank manager – then rigorous questioning, checking your documents and references, before the institution made an evaluation of your trustworthiness. In a way, it was exactly the same as an interview, but instead of a job being at stake it was cash.Damelin found this system old-fashioned and flawed. “The idea of doing peer-to-peer lending is insane,” he says. “We are quite poor at judging other people and ourselves – you get to know that in your life, both with personal relationships and in business. You realise that we’re not as good as we think we are at that stuff, and that goes for almost everybody. I certainly thought I was much better at it.

The 42-year-old entrepreneur grew up in apartheid South Africa, and he believes the experience of living in that country in the 80s has had a significant impact on his outlook. He was active in student politics at the University of Cape Town and marched in civil disobedience protests. So, when it came to deciding who should be lent money, Damelin says he wanted to strip away some of the prejudice – decisions would be taken without a face-to-face meeting; you wouldn’t even speak to an adviser on the phone, because people subconsciously judge accents too. The final call on whether to hand out cash would be based on “the belief that data could be more predictive than emotion”.

According to Wired, Damelin and his team created a system to approve or decline applicants all on its own. They tested it on a site called SameDayCash by using Google Adwords and within ten minutes of their ad going live, their system had already approved its first customer. In its early forms, it wasn’t very profitable from a lending standpoint but it did allow them to collect a massive amount of data.

From Wired

its strategy over this period wasn’t just to disburse money — it was to accumulate facts. For every loan, good or bad, SameDayCash gathered data about the borrowers — and about their behaviour. Who were they? What was their online profile? Did they repay the money on time? The site was feeding an algorithm that would form the basis of Wonga, launched a year after the beta experiment that was SameDayCash.

MCA has utilized Adwords for lead generation for years with mixed success, but few have used it for the purpose of accumulating facts. This isn’t to say that the firms collecting information for the purpose of leads aren’t sitting on treasure troves of data, it’s just that none of it to date has led to 100% computerized underwriting. The MCA industry is quite possibly about to undergo a major shift in how they promote their product on Adwords as a result of Google’s ominous warning a couple weeks ago. New disclosure requirements may change the way consumers respond and apply, ultimately impacting the data collected.

So will european science work in the good ‘ol US of A? If Wonga acquires On Deck Capital, you can bet they’ll try to replicate their success. There is a gigantic market of really small businesses that aren’t getting funded, and even the ones that are, they’re waiting 3-7 days to deal with the paperwork, handle the phone calls, fax documents, complete a landlord verification, and in some cases, deal with a credit card processing equipment change. If On Deck Capital becomes a household name as Wonga is in the UK, a lot of smaller funders are going to get squeezed.

Wonga claims to have a net-promoter score above 90%, a customer satisfaction metric that beats most banks and even Apple Computer. It’s a company that seems to be winning on every front.

Critics will say that the American lending market is big enough for everyone, that the loans Wonga has done traditionally are really small and therefore not in the same league as MCA, or that their own company has something similar or better. We believe however, that if this deal goes through that it’s a bad idea to get comfortable. There are Wonga-like companies in the US already, data fortresses that will soon revolutionize how loans are issued and determine what makes a successful business. New York based Biz2Credit is one such example.

We’ve been right about a lot of things in the last couple years and wrong about some. But we believe it is inevitable that any lender ignoring the automation revolution on the horizon is not going to last very long. Go ahead, brush it aside and convince yourself that this whole Automation thing is just hype as BusinessWeek did in 1995 about the Internet. “Automation? Bah!”

As Damelin told Wired in June, 2011, “For me the epiphany was right there. People were online, looking for a solution to a problem.” Ask any funder using Adwords or pouring work into SEO and they’ll tell you the same thing. People are looking online for money. What happens after they fill out the form on the website is what makes the USA MCA/alternative lending industry different from Wonga.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

If in three years the average small business owner thinks Wonga is the last name of a guy that owns a chocolate factory, we promise to write a jingle that admits we were wrong about them. But On Deck Capital has been around the block and knows the business. They would allow Wonga to skip the learning curve and together could quite possibly nail lending down to a science.

Oompa Loompa do-ba-dee-doo, I’ve got another algorithm for you.

– Merchant Processing Resource

https://debanked.com

There is great feedback to this article in a LinkedIn Group HERE

Fantasy Football Championship Begins Tomorrow

December 19, 2012 The MCA Industry Fantasy football league is finally drawing to a close. If you somehow missed the action this season, twelve companies came together to compete for a grand prize donation to a charity of their choice. Each company, in addition to several non-participants pledged funds to the prize. A total of $7,100 was raised!!!

The MCA Industry Fantasy football league is finally drawing to a close. If you somehow missed the action this season, twelve companies came together to compete for a grand prize donation to a charity of their choice. Each company, in addition to several non-participants pledged funds to the prize. A total of $7,100 was raised!!!

In a winner-take-all format, the two teams competing in the championship this week are:

TakeCharge Capital – Newington, CT

Sure Payment Solutions – New York, NY

A winner will be declared next week. A big thanks to everyone that contributed. 100% of the funds will be donated to the winning team’s charity selection.

- Rapid Capital Funding – $1,000!

- Raharney Capital – $500

- Financial Advantage Group – $500

- Merchant Cash Group – $500

- Sure Payment Solutions – $500

- Meridian Leads – $500

- Merchant Cash and Capital – $500

- NVMS – $500

- United Capital Source – $500

- RapidAdvance – $500

- Capital Stack – $500

- Swift Capital – $250

- Strategic Funding Source – $250

- Entrust Merchant Funding – $250

- Paramount Merchant Funding – $250

- TakeCharge Capital – $100

– Merchant Processing Resource

https://debanked.com

Made for Each Other?

December 12, 2012You want fast cash loan? “We have Short term loans online from £1 – £1000 with no fax required. Instant approval, 24 hour self-service account access and 15 minute cash payout guaranteed.” Not exactly the kind of advertising you’d see in the Merchant Cash Advance Industry. It sounds like a payday lender headline, the kind of marketing that critics would jump on and rally regulators to put an end to. It’s the antithesis of what many alternative loan providers that operate in the MCA space have come to stand for. And it could be coming to a theatre near you.

Meet Wonga, an online payday loan company in the U.K. with a representative APR of 4,214%. According to many news sources, they’re looking for an entry point into North America and they may have found one (Watch out Silicon Valley, the Redcoats are coming!). In a deal that would be valued at around $250 million, Wonga is getting cozy with On Deck Capital (ODC). It was only a few years ago that former ODC CEO Mitch Jacobs was warning the public about the high costs of Merchant Cash Advances. It appears their views may be evolving. Not that we have anything against either company, because we don’t. It’s just that when you think of how respected ODC is in the market today, it’s hard to picture them being gobbled up by a company that offers fast cash loans from 1£ and up for a four figure interest rate.

Meet Wonga, an online payday loan company in the U.K. with a representative APR of 4,214%. According to many news sources, they’re looking for an entry point into North America and they may have found one (Watch out Silicon Valley, the Redcoats are coming!). In a deal that would be valued at around $250 million, Wonga is getting cozy with On Deck Capital (ODC). It was only a few years ago that former ODC CEO Mitch Jacobs was warning the public about the high costs of Merchant Cash Advances. It appears their views may be evolving. Not that we have anything against either company, because we don’t. It’s just that when you think of how respected ODC is in the market today, it’s hard to picture them being gobbled up by a company that offers fast cash loans from 1£ and up for a four figure interest rate.

Or maybe this is exactly what we’ve been predicting all along. One of Wonga’s primary investors is Accel Partners, the guys that got in early on Facebook and did a nice deal with Capital Access Network. They are joined by Greylock Partners, a self-described “Leading Silicon Valley Venture Capital Firm,” that coincidentally also invested in Facebook. So what the heck are these two companies doing in the U.K.? It sure looks like they are fulfilling our Silicon Valley Invasion prophesy:

How the Facebook IPO Affects the Merchant Cash Advance Industry 5/18/2012

The Bubble That Wasn’t 8/17/2012

The End of an Era 9/19/2012

Ten Days 9/28/2012

Bloomberg.com’s article about the advanced stage talks between ODC and Wonga came just TWO DAYS after Steven Mandis walked into the room and bought a material stake of the 2nd largest company in the industry, RapidAdvance.

It seems like just yesterday we were all saying something about financing based off of credit card sales, but now? Now… it’s starting to look like you can get fast cash loan 15 minutes, no fax!

This business gets more interesting every day.

—–

Update: 12/13/12

Wonga does make loans to businesses already in the U.K. The application process takes about 12 minutes and funding happens in 30 minutes. This would be a game changer in the U.S. Refer to this article: http://techcrunch.com/2012/05/07/wonga-extends-its-payday-loans-to-small-businesses-in-uk/

– Merchant Processing Resource

https://debanked.com

MCA Playoffs Begin

December 11, 2012 Congratulations to Merchant Cash and Capital, RapidAdvance, Sure Payment Solutions, and TakeCharge Capital for being the 4 teams to make the MCA Industry Fantasy Football League Playoffs.

Congratulations to Merchant Cash and Capital, RapidAdvance, Sure Payment Solutions, and TakeCharge Capital for being the 4 teams to make the MCA Industry Fantasy Football League Playoffs.

The playoffs are 2 weeks long.

Round 1:

RapidAdvance vs. TakeCharge Capital

Merchant Cash and Capital vs. Sure Payment Solutions

Round 2:

Winners of Round 1

Current prize amount to be donated to charity:

Pledged: $7,100

Collected: $6,025

100% of the amount collected will be donated to the winning team’s charity.

Charity candidates remaining:

- Gift of Life Bone Marrow Foundation – Via the Silver Project

- Cystic Fibrosis Foundation

- ALS Association

- Distressed Children & Infants International

A press release announcing the winner and donation is scheduled to go out at the end of this month or early January. If you would like to contribute to the total charity prize and get recognition for it, e-mail sean[at]merchantprocessingresource[dot]com.

Adwords Trouble Ahead for MCA Industry?

December 6, 2012The MCA industry is complicated. Tons of funders purchase future receivables, some do traditional loans, and others operate in a gray area in between. But what will Google make of it? The rules are changing and we predict a lot of funders are going to face a massive challenge in advertising with Google Adwords. See the e-mail that went out:

Dear AdWords Advertiser,

We’re writing to let you know about a change to Google’s advertising policies that might affect your AdWords account.

Beginning in the coming weeks, we will require all short-term loans advertisers to display the following prominently on the landing page:

1. Display the APR. Aggregators/lead generators may provide a representative APR range for their network.

2. Display the implications of non-payment, including the following:

– Financial implications (fees and interest)

– Collection practices

– Potential impact to users’ credit score

– Renewal policy information, including if the renewal is automatic and if there are fees associated with the renewal

– Aggregators/lead generators may provide sample implications from their network to satisfy the above requirements. Implications of non-payment should be grouped together in one location on the landing page.The above must be displayed prominently, meaning the same font type, size, and color as the base text on the landing page. These guidelines apply to lenders, aggregators, and lead generators alike.

In addition, we are updating our policy on consumer advisories. Going forward, payday loan ads (a subset of short-term loans) will only be shown on Display Network sites that are related to payday loans. Ad serving in the Search Network will not change.

When we make this change, Google will suspend all campaigns identified as being in violation of our revised policy. Our system identified your account as potentially affected by this policy change. We ask that you make any necessary changes to your ads and sites to comply, so that your campaigns can continue to run.

We’ve given much consideration to our stance on the advertising of this content and the potential effect our policy decision could have on AdWords advertisers. However, as a business, Google must make decisions regarding the advertising that we accept. As noted in our advertising Terms and Conditions, Google may refuse any ads or terminate ad campaigns at any time, for any reason. You can view our Terms and Conditions at https://adwords.google.com/select/tsandcsfinder.

Sincerely,

The Google AdWords Team

Good luck!

Movember Rocked!

December 1, 2012 Movember: Mo’ Merchants, Mo’ Deals

Movember: Mo’ Merchants, Mo’ Deals

The pre-holiday season is usually big in the Merchant Cash Advance (MCA) industry but this year seemed different. We’ve been saying that we’ve entered a new era for a long time, but it’s finally starting to seem real. It feels like 2007 again in a way, when everybody was getting rich and nobody even knew what the heck they were selling. It took years for account reps to finally stop referring to advances as loans and by then it was too late because the ACH loan industry was born.

E-mails like this don’t happen very much anymore:

You know… the ones where the deal would be blatantly shotgunned to multiple companies at once. The major broker shops would “accidentally” CC everyone instead of BCC to let the funders know who was in charge.

That’s not to say that deals don’t get shopped, Some do, but the circumstances have changed. To minimize the risk of being flooded with bad paper, funders ask resellers to put their money where their mouth is. The syndication game has become THE game in town and it’s led to Super ISO networks like the Factor Exchange. A user on the DailyFunder that seems to be intimately familiar with Factor Exchange is quoted as explaining the model like this:

The “mom and pop” ISOs and “Onesy-Twosey” brokers are backed by one giant ISO network and The Factor Exchange assumes half of the risk by syndicating 50% on nearly ever deal…

The massive volume of FEX submissions to lenders gives the ISOs power to negotiate for better rates and terms, One point of submission reaches 15+ lenders, the merchants credit is only pulled once, and the commission is passed straight through to the ISOs because FEX makes their money from participation.

Companies like this empower the smaller brokerages…

Who Did Mo’ Deals in Movember?

Yellowstone Capital broke their single day funding record… TWICE. This actually happened on back to back days. Executive management reported that they funded approximately $3 million in 48 hours.

Who Got Mo’ Money?

Wall Street wizard and business professor, Steven Mandis acquired a stake in Bethesda-based RapidAdvance. The news is all the more interesting with the fact that RapidAdvance is easily one of the top 5 largest players in MCA. Single individuals don’t exactly just walk through door and buy a stake in companies like this. Mandis is taking on a Strategic Advisor position and it’s our guess Rapid is about to enter another major phase of growth.

Who Got Mo’ Likes?

Merchant Cash and Capital’s (MCC) facebook fan page has gotten thousands of Likes since the third week of Movember when they announced their charity campaign. For every new Like until December 7th, MCC is donating $1 to the American Red Cross to help people that were affected by Hurricane Sandy.

Who Got Mo’ Wins?

RapidAdvance was the first team to clinch the playoffs in the MCA industry fantasy football league for charity. Something tells us that Mandis is behind their incredible winning streak.

Who got Mo’ Leads?

You did if you bought leads from either one of our lead advertising partners, Meridian Leads or SmallBusinessLoanRates.com.

Lendio has also been making a splash on the MCA lead scene with Dave Young being a big contributor on DailyFunder. To discuss pricing, he can be reached at dave.young[at]lendio.com

Who lied Mo’?

According to CNN’s statistics, 247 million people in the U.S. went shopping on Black Friday. That’s equal to the entire American population over the age of 14. Something doesn’t smell right with these numbers. It’s our guess that CNN is using Mitt Romney’s polling experts. 😉

But someone else lied just a little bit Mo’. On Movember 26, 2012, PRWeb published a release that claimed ICOA Inc., a small tech company in Rhode Island was acquired by Google for $400 Million. The release turned out to be a hoax as part of a stock pump and dump scheme. Many critics have been left wondering why PRWeb didn’t do anything to verify its authenticity. Considering PRWeb is such a widely used PR service in the MCA space, we can testify that they’ll pretty much publish anything so long as you pay the fee. Some smaller companies use it as part of their SEO campaigns, which explains why there are so many strange looking releases out there that seem to repeat the same keyword in every sentence.

ABC Funding Co Just announced a program that will help small businesses in need of cash by providing these small businesses in need of cash with a special type of financing that will hep them if they are a small business in need of cash. Not exactly New York Times material…

Will Movember be followed by Make-a-lot-of-Doughcember? We’ll find out!

– Mo’chant Processing Resource

https://debanked.com

MCA History in Honor of Thanksgiving

November 21, 2012

Before fax, e-mail, and e-signatures, merchants used to travel up to 400 miles to fill out a funding application.

The famous response to a British sea captain by John Paul Jones is actually believed to be a misquote. 'Fund' was changed to 'fight' to better preserve his memory but it is theorized that he predicted the birth of Merchant Cash Advance. He died in 1792, two hundred years before the first small business got funded based on their credit card sales

In 1621, the local merchants were funded on the third Thursday of November, just narrowly beating the wire deadline. This feast was almost not possible.

The first underwriters. Yeah... they were British.

The first collections department.

Back then you needed a lot more than just a payoff letter to change companies...

This merchant successfully opened his 2nd location.

This winery just refi'd again last week. $132,292,222,144,923,383,293,819,183,189,380,678 was withheld and credited to the outstanding balance.

Reason for Advance: Need to stock up on more tea inventory.

We apologize if our history is a little off 😉

– Merchant Processing Resource

https://debanked.com