Online Lenders Square Off, Offer The Kabbage In Brooklyn Food Court

April 10, 2019

In a fast gentrifying section of Downtown Brooklyn, online lenders are waging a silent turf war. Each day, hungry consumers flock to DeKalb Market, a subterranean hipster food court where lunch and a drink can cost $17. The maze-like space with retro neon signs and rustic wood countertops offers a dizzying array of cuisines, and with it, the opportunity to indulge in one’s own individual preferences. But if you’re looking for the vendor’s payment machines, you’ll notice an eerie sameness amidst a cacophony of color.

Square processed $85 billion in payments in 2018 and here in DeKalb Market, 75% of the vendors deBanked surveyed relied on Square’s Point-Of-Sale technology. The publicly traded company generated $2.5 billion in payment transaction fees last year alone, but it’s the add-on products like Instant Deposit, Cash Card, Caviar, and Square Capital that are propelling the growth. 244,000 businesses received a loan from Square in 2018 for a total of $1.6 billion. Borrowing is as simple as clicking a few buttons on the POS dashboard, making Square the presumptive lender of choice for businesses in the food court.

But the rankings on a national level say that Square trails behind Kabbage, an online lender with no reliance on a POS system. Kabbage’s growth trajectory has been epic, once a lending service for eBay merchants, the company is now one of the largest online small business lending companies in the United States.

Undeterred by the sea of Square dashboards, billboard advertisements for Kabbage once blanketed the periphery. The ads, which few consumers seemed to gaze at, were clearly meant for the business owners in between the food court and the mall above it. There was also a competitive feel to it, as if Kabbage was subconsciously communicating to Square that they were not alone.

Nowhere to be found was OnDeck, an online lender headquartered a short distance away in Manhattan that does more in loan volume each year than Square and Kabbage. But just because they can’t be seen doesn’t mean they’re not there. Blending into the crowd of consumers, deBanked spots business loan brokers, ones reputed to refer business to alternative capital sources and online lenders, OnDeck among them. 29% of OnDeck’s business in 2018 was attributed to Funding Advisors, an army of independent sales professionals across the country.

But they’re here for lunch just like everybody else, or are they? Their in-person presence may complicate their rivals’ efforts. Can a face and a handshake trump familiar software and the Internet? OnDeck’s $2.5 billion in 2018 loan volume suggests that their diverse sales strategy, including the use of Funding Advisors, has an impact.

Some vendors in DeKalb Market fail and go out of business. Others, like Cuzin’s Duzin, a homemade donut vendor made semi-famous by its feature on a Vice Media TV Show, The Hustle, recently completed renovations and further expanded its business into the nearby Barclay’s Center. Public records show the company just received financing from an equipment leasing company based in Washington State, a possible missed opportunity for the online lenders canvassing the space. Not for long, perhaps, as OnDeck announced it would be entering the equipment finance market this year.

As for Square, the love for the POS product presents a perceived edge. A general manager of Two Tablespoons, another food vendor, told deBanked that he thinks the Square system they rely upon is very easy to use. He said it also creates promotions that allow businesses like them to track customer spending and text a customer (with their permission) if they’ve earned, say, $5 off at a store.

But converting these vendors into borrowers is not guaranteed. Kabbage’s ads could not be found on a recent trip to the food court. And one shop selling burgers there told deBanked that they were aware of the loan product through Square because they use the POS for payments, but that they had no interest in using it to borrow money.

“It’s like a credit card,” she said. “What you take out, you owe. And we choose not to owe.”

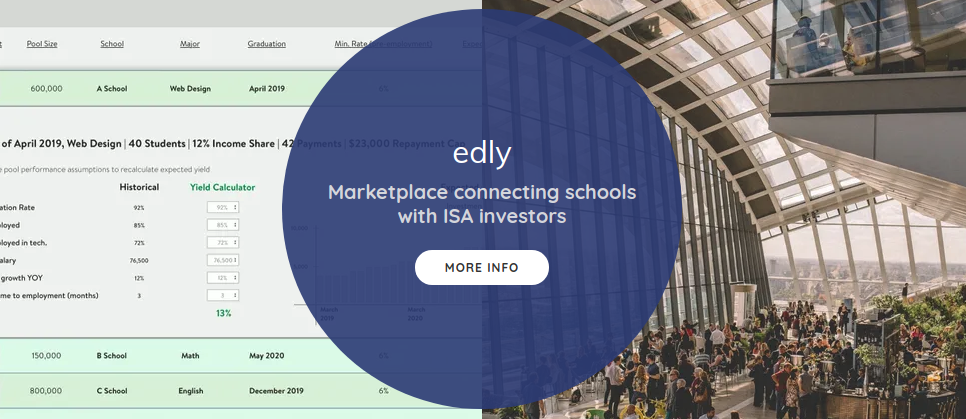

Marketplace Opens for New Student Financing Investments

April 5, 2019 Edly, a new online marketplace that connects Income Share Agreement (ISA) investors, announced last week that a prestigious software engineering school in San Francisco listed $2 million in inaugural ISA trades via the Edly marketplace. The school is called Holberton and offers only two payment programs, an ISA or pay it all upfront. LinkedIn CEO Jeff Weiner and many others who are well-established in tech are closely involved with the school.

Edly, a new online marketplace that connects Income Share Agreement (ISA) investors, announced last week that a prestigious software engineering school in San Francisco listed $2 million in inaugural ISA trades via the Edly marketplace. The school is called Holberton and offers only two payment programs, an ISA or pay it all upfront. LinkedIn CEO Jeff Weiner and many others who are well-established in tech are closely involved with the school.

An ISA is an arrangement where investors front the cost of a students’ college education in exchange for a percentage of their future earnings. According to Charles Trafton, co-founder of Edly, ISAs differ from traditional student loans in three primary ways, all of which protect the student: 1) repayments don’t begin until the graduate starts making above a certain amount of money, 2) repayment is limited to a certain amount of time (usually 8 years) and 3) there’s a cap on the amount that the graduate repays, usually one to two times tuition.

“Today, schools have an incentive to maximize the amount they get from each student on their way in – which usually means maximum borrowing – and then spend as little as possible on the student as he matriculates through the school,” Trafton said. “The school has no skin in the game.”

With the ISA model, the school usually has skin in the game. The Edly marketplace requires that participating schools own part of the ISA. This way, the school’s interest is aligned with the student, and later the graduate. If the students are well trained, then they are likely to succeed in the workplace, earn good money quickly and pay the money owed.

The first ISA program in the U.S. was launched at Purdue University in 2016 and Trafton said there are now 23 programs in the country. His mission with the Edly marketplace is to provide liquidity for these investments and Holberton’s $2 million of ISA trades is its first transaction.

Holberton’s ISAs are set up so that graduates only make payments when their salaries are more than $40,000. But Trafton said that Holberton graduates are usually hired by top Silicon Valley tech companies and they typically make nearly six figures in their first year after graduation.

Computers Continue to Fine Tune Underwriting

April 5, 2019 What’s the present role of computers in the underwriting process?

What’s the present role of computers in the underwriting process?

“It’s faster and more accurate,” CEO of Kapitus Andy Reiser said of the company’s new AI process. “We get thousands of pages a day of bank statements, and we can digitally read it through [our system] and then manipulate that data and analyze it.”

Co-founder of Clearbanc Michele Romanow said they don’t even have underwriters on staff. Instead, they have data scientists who work to improve their automated process.

CEO of Idea Financial Justin Leto said they have a robust AI model. It receives information like credit score, business type and details about other positions the company has; with that, it generates the term, rate and amount for a deal. But at Idea Financial, the human underwriters evaluate this information and make a decision.

“Human underwriting is still a critical part of funding,” Leto said. “There is an art to underwriting. It’s not just a science. It can’t be cookie cutter.”

Kapitus also employs underwriters. Despite continuing improvements to its AI system, Reiser acknowledged that there are always exceptions that require an underwriter, like if a merchant’s credit is extremely low. Also, underwriters generally get involved on deals for $150,000 or more, implying that more careful consideration by a human being has value, particularly when there’s more money at stake.

“There’s been a big uplift in the amount and quality of data available,” said Farrah Lakhani, Director of Growth and Operations for OakNorth Analytical Intelligence, which ultimately makes small business underwriting decisions mostly using AI.

“The more data you give [the AI machine], the better it learns…but you have to give the machine the right data.”

The right data, she explained, is similar enough data so that it can start to detect patterns and irregularities.

“All the data is useless if you’re not getting insights from it,” she said.

As for AI replacing human beings altogether, Lakhani doesn’t believe that will happen. She thinks we will always need human beings to think and reason.

“AI is replacing tasks, not people,” said Alex Jaimes, SVP of AI & Data Science at Dataminr at the Disruption Forum Fintech conference in New York this week. “So if all you do is tasks, then you might lose your job to AI.”

Give Up Equity In Your Business?! Try Alternative Funding Instead

April 4, 2019One thing you can’t get back is your company.

Michele Romanow, a judge on Dragon’s Den, Canada’s version of Shark Tank, realized from the show that a lot of companies should not be pursuing venture capital at all. She recalled a company that was willing to give an investor 25% of their company in exchange for $100,000.

“Why use the most expensive form of capital, which is equity?”

It led her to co-found Clearbanc, a Toronto-based small business funding provider that does their own spin on merchant cash advances. The amounts range from $10,000 to $10 million and their caution against equity capital-raising is explicit.

“No equity, no fundraising, no dilution, no warrants/no covenants, no board seats, and no bullshit” is a pitch prominently displayed on the company’s homepage.

Romanow speaks from experience. In 2014, GroupOn acquired a company she co-founded and she joined Dragon’s Den shortly after at just 29 years old. She’s a serial entrepreneur with a net worth reported to be over $100 million.

VC money may be harder to obtain, regardless, even if an entrepreneur is willing to make the sacrifice. Funding from VCs tends to be unequally distributed geographically. She cited a May 2018 report by PwC and CBInsights that showed that more than half of all VC dollars invested in small businesses and startups during the first quarter of 2018 went to companies in California. And 80% of VC money in that quarter funded companies either in California, New York, Massachusetts or Texas, a trend bucked by alternatives provided by companies like Clearbanc whose backgrounds are much more diverse.

The message has worked. Clearbanc recently announced that it plans to invest $1 billion in 2,000 e-commerce companies within the next 12 months and the company has raised more than $120 million to-date. It probably helps that Romanow is a TV business celebrity. She is now on her fifth season of Dragon’s Den. And as for those pesky VCs? They tend to be big referral partners for Clearbanc. Go figure.

Top Minds in Fintech Came Together in Manhattan Last Night

April 3, 2019 More than 200 people packed into a Manhattan office last night to hear panelists from top fintech companies discuss everything from Artificial Intelligence (AI) in fintech to U.S. regulations to diversity. The event, called Disruption Forum Fintech NYC, was organized remotely by a Poland-based software and technology consulting company called Netguru. This was their third event, following one in Berlin and another in London.

More than 200 people packed into a Manhattan office last night to hear panelists from top fintech companies discuss everything from Artificial Intelligence (AI) in fintech to U.S. regulations to diversity. The event, called Disruption Forum Fintech NYC, was organized remotely by a Poland-based software and technology consulting company called Netguru. This was their third event, following one in Berlin and another in London.

The event took place at the office of Work-Bench, a VC firm, and most panelists during the four panel event discussed regulations in some form or another.

“We have a conversation with customers before thinking about regulations,” said Katherine Kornas, Senior Director of Product at Betterment, an online financial advice company. “I try to free my team of constraints.”

Afterwards, they address constraints and work creatively with them, she said. But at least they know that they started off from a place of trying to solve a problem for the customer.

“Hire a really fun and creative Chief Compliance Officer,” said Melissa Cullens, Chief Design Officer at Ellevest, which provides investing advice geared towards women. “We wanted to create profiles with people’s faces and she said “No.” But then we ended up coming up with a different idea that was also really great.”

Melissa Cullens, Chief Design Officer at Ellevest, Katherine Kornas, Senior Director of Product at Betterment, Sudev Balakrishnan, Chief Product Officer at Stash

One theme was how U.S. regulations have made it difficult for fintech companies to enter the highly coveted U.S. market, particularly when compared to Europe.

“Regulators in the U.S. decided to go after the banks after the [financial crisis in 2008,]” said Arshi Singh, North America Head of Product at Currencycloud, a London-based company that improves B2B payments. “The UK went the opposite way and made it very lax for fintechs so they could compete with banks.”

In the U.S., fintechs must partner with banks to carry out many services and some banks are friendlier to fintechs than others.

Charley Ma, NYC Growth Manager at Plaid, Jody Perla, MD of Global Banking & Payment Infrastructure at Payoneer

Andrew Boyajian, Head of Banking, North America at Transferwise, which makes it cheaper to send money across country borders, said that part of his job is to find U.S. banks that are willing to work with them. He said that some of them are, but other banks still have policies against working with companies like his that deliver bank-like services.

Nicolas Kopp, U.S. CEO at N26, Dan Westgarth, North America General Manager at Revolut, Arshi Singh, North America Head of Product at Currencycloud, Andrew Boyajian, Head of Banking, North America at Transferwise

One panel focused on AI in fintech.

“All the data is useless if you’re not getting insights from it,” said Farrah Lakhani, Director of Growth and Operations for OakNorth Analytical Intelligence, which analyzes data to fund business loans. “I ask ‘How are we doing this faster with this data?’ How does this add to our value proposition? This helps me get through the wall of lingo.”

With regard to the notion of AI replacing human beings altogether, Lakhani said she thinks we all need to get that idea out of our heads.

“You do need human beings to think and reason,” she said.

Regarding the fear that robots may become as human-like as humans, AI specialist and panelist Alex Jaimes joked that he’s met some humans who he could have sworn were robots.

Farrah Lakhani, Director of Growth and Operations at OakNorth Analytical Intelligence, Alex Jaimes, SVP AI & Data Science at Dataminr

With seven offices in Poland, Netguru employs 600 people, a quarter of whom work remotely. They company was founded in 2008 and more than 90% of its business comes from the U.S., the UK and Germany.

Will Millennials Bring Non-banks into Their Finances?

April 1, 2019 Following Apple’s announcement last week of its upcoming Apple Credit Card, one question that comes to mind is: Will people, particularly millennials (now roughly 22 to 37 years old), be up for banking with non-bank companies?

Following Apple’s announcement last week of its upcoming Apple Credit Card, one question that comes to mind is: Will people, particularly millennials (now roughly 22 to 37 years old), be up for banking with non-bank companies?

According to an Accenture survey from five years ago, 34% of millennials said they would bank with Apple if such a product were available. Well, five years later, the product is available and Apple is now hoping to capture that demographic. According to the same survey, even more millennials at the time said they would be open to banking with Amazon or Google, and all with no physical branches.

Sankar Krishnan, Executive Vice President, Banking and Capital Markets, at Capgemini, a technology services and consulting company, said that convenience is most important to millennials.

“Millennials and Gen Y live their lives on smartphones… [and] daily comforts such as Uber, Starbucks, Amazon, Tinder and Netflix, are just a swipe away,” Krishan said in an interview in Forbes last year. “As a result, [they] have become accustomed to a quality digital customer experience where ease of use and inbuilt functionality are front and center.”

The implication is that any digital company with enough visibility and the ability to execute is fair game to enter the banking business. Why not Netflix? But Tinder?

Regardless, most major technology companies, like Amazon, Google, Facebook and Uber, are already in the payments space in one way or another. While potentially jarring at first, it seems that many millennials are ready to allow non-bank brands to become more a part of their finances.

Yet despite all the talk of how millennials are willing to break with convention, almost half of millennials said they would not consider switching to a bank that had no physical branches, according to a January 2019 survey conducted by eMarketer.com, which creates marketing reports.

“Though [millennials] may use branches less than older consumers, they don’t want to forgo the option of going to a physical location,” said eMarketer principal analyst Mark Dolliver. “The step from ‘digital’ to ‘digital-only’ is a big one, and many millennials will be in no hurry to take it.”

Lyft IPO Follows a Foray into Finance Business

March 29, 2019 Lyft had its IPO today in the same week it announced that it was offering a debit card to its drivers. The company announced the launch of “Lyft Driver Services,” a suite of services for Lyft drivers including Lyft Direct, a no-fee bank account and debit card. The Lyft Direct debit card will allow drivers to instantly access their earnings after each ride, according to a company statement on its Medium page. This is an extension of Express Pay, which allows drivers to cash out on their earnings right away, rather than wait for the pay cycle to end.

Lyft had its IPO today in the same week it announced that it was offering a debit card to its drivers. The company announced the launch of “Lyft Driver Services,” a suite of services for Lyft drivers including Lyft Direct, a no-fee bank account and debit card. The Lyft Direct debit card will allow drivers to instantly access their earnings after each ride, according to a company statement on its Medium page. This is an extension of Express Pay, which allows drivers to cash out on their earnings right away, rather than wait for the pay cycle to end.

“The traditional biweekly paycheck falls short of serving today’s workers, and the rising costs of maintaining a bank account disadvantage them further,” Lyft COO Jon McNeill explained in a statement. “Americans pay an average of $163/year in banking fees. Minimum balances are often greater than what many people can save, and most cash-back programs require an above-average credit score. We’re fixing that for our drivers.”

The Lyft Direct debit card has 4% cash-back on select restaurant purchases, 2% on gas, and 1% on groceries. Additionally, Lyft will offer its drivers a no-fee bank account with access to over 20,000 fee-free ATMs. Lyft is working with Oklahoma-based Stride Bank on this program. Stride Bank will manage all of the drivers’ bank accounts.

Last April, Uber released the Uber Visa debit card with Go Bank which also allows drivers to get paid instantly. Like the Lyft Direct debit card, the Uber debit card also gives users cash-back, like 3% on Exxon and Mobil gas, 2% on Walmart purchases and 8% on your Sprint bill.

Uber is no stranger to finance. In fact, the company once offered a product akin to an MCA where drivers were offered money up front in exchange for a percentage of their future fares, according to a deBanked story from 2016. That arrangement was made by Clearbanc. Uber also got into the leasing business with its leasing program, Xchange Leasing. But that was phased out beginning in 2017 due to myriad problems, including losses, an FTC lawsuit that dealt with misrepresenting the program, and an FTC complaint, according to a December 2018 post on The Simple Dollar, a personal finance website. The complaint accused Uber of connecting its drivers with subprime auto companies and dealers that provided interest rates significantly higher than industry averages.

So while Uber offers its drivers a debit card, it has backed away from other financing. With Lyft a step behind, will Lyft stop with this new debit card? Or perhaps learn from Uber’s mistakes and expand into the lending space?

The Lyft stock (NASDAQ: LYFT) started at $72 and closed its first day of trading at $78.29, up 8.7 percent.

Two Cultures Collided, Gently

March 25, 2019

Banks are heavily regulated. Factoring companies are not. The two don’t always mix. So it was interesting last July when Axiom Bank, a regional bank in Florida, acquired Allied Affiliated Funding, a factoring company based in Texas.

Fast forward nine months and the merger of the two companies has been surprisingly easy, according to Axiom CEO Daniel Davis.

“Banking and factoring are two different worlds, two different cultures,” Davis said. “[But] the challenges that we expected didn’t occur.”

Davis explained that the biggest challenge with a bank acquiring a factor is reconciling a bank’s credit risk with a factor’s, which are different because banks are more or less governed by regulatory standards while factors are not.

“Good factoring shops have guidelines too,” Davis said, “and we’re lucky to be involved with Allied which does share that high level of policies, procedures and internal controls.”

Regardless of how well a factor self-regulates, factoring companies have virtually no regulations compared to a bank, and this may give regulators a little pause to see a bank mixing with a factor.

“It is a challenge,” Davis said about merging a factoring company with a bank regarding regulations. “What the regulators want to see you do, whether you’re acquiring a factoring company or entering into a new product or service…what they’re most concerned with is that you’ve put the policies and procedures and risk management in place to actively manage and monitor that business.”

But so far, so good, according to Davis, who said that the factoring business has grown 30% in receivables since the July 2018 acquisition. Allied Affiliated Funding, which has retained its name, is now known as the factoring division of Axiom Bank. The bank has 24 branches throughout Florida, 22 of which are located inside Walmart stores. As far as marketing the relatively new factoring product, Davis said that while they do some brand marketing, the Allied factoring division gets most of its business from referrals, including attorneys and accountants.

He said that they also get referrals from banks. For instance, if a bank’s underwriting standards makes it such that it cannot keep a loan, the bank might send the loan to Axiom for it to be restructured as a factoring deal.