Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

OnDeck Directors Sued in Class Action For Allegedly Withholding “Material Information” From Shareholders To Make Enova Deal Happen

September 8, 2020 An OnDeck shareholder is asking the Delaware Court of Chancery to halt the sale of the company to Enova until OnDeck discloses allegedly material information that would appear to put the landmark deal in an entirely new light.

An OnDeck shareholder is asking the Delaware Court of Chancery to halt the sale of the company to Enova until OnDeck discloses allegedly material information that would appear to put the landmark deal in an entirely new light.

On September 4, Conrad Doaty filed a class action lawsuit against Noah Breslow, Daniel S. Henson, Chandra Dhandapani, Bruce P. Nolop, Manolo Sánchez, Jane J. Thompson, Ronald F. Verni, and Neil E. Wolfson for breaching their fiduciary duties owed to the public shareholders of OnDeck.

According to Doaty, the Enova offer of $90 million ($82 million stock, $8 million in cash) was not even the best bid that OnDeck received but he alleges that OnDeck’s directors and executives took it because they were individually offered “exorbitant personal compensation” including “millions of dollars in severance packages, accelerated stock options, performance awards, golden parachutes and other deal devices to sweeten the offer.”

Doaty makes reference to other bids for OnDeck with specifics including two all-cash offers, one that valued OnDeck at between $100 million and $125 million and one that valued it at between $80 million and $110 million. He says that no explanation for their rejection was disclosed.

Doaty also alleges that OnDeck relied on two sets of financial projections to evaluate a sale of the company, one for all prospective bidders (that projected a quick economic recovery) and another set that was used only for Enova (that projected a slow economic recovery). Doaty’s point is that Enova’s valuation was based on less optimistic data and that OnDeck did not publicly disclose to shareholders the more optimistic version that all the other prospective buyers of the company got to see.

“Most significantly, is that it is not pressing time to sell,” Doaty says. “The company was not facing imminent financial collapse or financial ruin.” He continues by pointing out that the company had $150 million of cash on hand and that it had successfully navigated workouts with its creditors over issues caused by the pandemic.

“Yet as a result of the frantic and unreasonable timing of the sale, the consideration offered for OnDeck is woefully inadequate.”

In addition to “exorbitant personal compensation” promised to the Board members, Doaty argues that a cheap price benefits parties who sat on both sides of the transaction, namely Dimensional Fund Advisors LP, BlackRock, Inc., and Renaissance Technologies, LLC, all of whom are said to hold greater than 5% beneficial ownership interest in both OnDeck and Enova. None of them are named as defendants.

“…even if the exchange ratio is unfair,” Doaty argues, “those institutional investors will still benefit from seeing their positions in Enova benefitted. Non-insider stockholders, on the other hand, will not be parties to the benefit.”

The law firm representing the plaintiff in Delaware is Cooch and Taylor, P.A.

Case ID #: 2020-0763 in the Delaware Court of Chancery.

You can download the full complaint here.

As an aside, deBanked mused two days prior to the filing of this lawsuit that the sales price of OnDeck was so low that early OnDeck shareholders stand to recover less of their investment as a result of this deal than investors in a rival company that was placed in a court-ordered receivership by the SEC.

What is ‘Lending as a Service?’

September 3, 2020I‘ve heard of SaaS, but now there’s LaaS, Lending as a Service. I recently spoke with Timothy Li, CEO of Alchemy, a fintech infrastructure company that offers that and more. You can check it out below!

Section 1071 is Back and The CFPB Wants to Know How Much It Will Cost You to Comply

August 25, 2020 At some point in this century, small business finance companies will be expected to comply with Section 1071 of the Wall Street Reform and Consumer Protection Act that was passed in 2010.

At some point in this century, small business finance companies will be expected to comply with Section 1071 of the Wall Street Reform and Consumer Protection Act that was passed in 2010.

In the wake of the ’08-’09 financial crisis (remember that?!), lawmakers passed the above act that has become colloquially known as Dodd-Frank. Section 1071 gave the Consumer Financial Protection Bureau the authority and the mandate to collect data from small business lenders (and similar companies).

The costs, risks, and challenges with rolling out this law have been discussed on deBanked for 5 years, yet little progress has been made to finally implement it. But it’s starting to move along and the CFPB would now like to know how expensive it will be for businesses to comply.

If you are engaged in small business finance, you should seriously consider submitting a response to their survey. The CFPB is specifically cataloging responses from merchant cash advance companies, fintech lenders, and equipment financiers.

How An Online Lending Hedge Fund Manager Became “Unwound”

August 12, 2020 In 2017, Ethan Senturia, the founder of a defunct online lending company, published a tell-all book about his startup’s rise and fall. He called it Unwound. It’s the fall that stood out. Senturia’s poorly modeled business had been heavily financed by an up-and-coming online lending hedge fund manager named Brendan Ross.

In 2017, Ethan Senturia, the founder of a defunct online lending company, published a tell-all book about his startup’s rise and fall. He called it Unwound. It’s the fall that stood out. Senturia’s poorly modeled business had been heavily financed by an up-and-coming online lending hedge fund manager named Brendan Ross.

I first encountered Ross in 2014 on the alternative finance conference circuit. Ross’s major theory was that small businesses overpay for credit and that the padded cost served as a hedge against defaults and economic downturns.

“The asset class works even when the collection process doesn’t,” Ross said during a Short Term Business Lending panel at a conference in May 2014. “The model works with no legal recovery.”

As an editor, I helped secure a lengthy interview with Ross that Fall. In it, he placed a special emphasis on building “trust.” It’s a word he used seventeen times over the course of the recorded conversation. “Everything is about trust and eliminating the need for it whenever possible,” he proclaimed.

As an editor, I helped secure a lengthy interview with Ross that Fall. In it, he placed a special emphasis on building “trust.” It’s a word he used seventeen times over the course of the recorded conversation. “Everything is about trust and eliminating the need for it whenever possible,” he proclaimed.

Ross stressed that his fund invested in the underlying loans of online lenders, not in the online lenders themselves. “I need to be the owner of the loan. I need it sold to me in a way that is completely clean.”

Ross would eventually connect with Senturia at Dealstruck, an online small business lender whose philosophy seemed to contradict Ross’s mantra of small businesses overpaying for credit. Dealstruck, it would turn out, had a tendency to have them underpay…

Senturia told the New York Times that year that Dealstruck’s mission was “not about disintermediating the banks but the very high-yield lenders.”

It’s a concept that failed pretty miserably. Senturia recalled in his book that “We had taken to the time-honored Silicon Valley tradition of not making money. Fintech lenders had made a bad habit of covering out-of-pocket costs, waiving fees, and reducing prices to uphold the perception that borrowers loved owing money to us, but hated owing money to our predecessors.”

As the loans underperformed, Senturia became aware that the hedge fund backing them, Ross’s Direct Lending Investments, might also be doomed. Senturia recalled an exchange with Ross in 2016 in which Ross allegedly said of their mutually assured destruction, “I am like, literally staring over the edge. My life is over.”

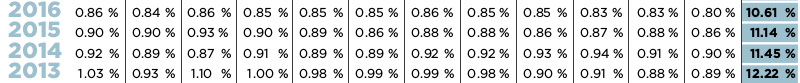

One would expect that in light of that conversation being made public through a book, that investors would question Ross’s report that his fund delivered a double digit annual return (10.61%) the same year his life was over.

Some actually did question it. deBanked received tidbits of information in the ensuing years, always seemingly off the record, that something was not right at Ross’s fund. There was little to go off other than the unlikelihood of his consistently stable stellar returns. Ross had been an especially popular investment manager with the peer-to-peer lending crowd and a regular face and speaker at fintech events. CNBC also had him on their network several times as a featured expert.

All told, Ross managed to amass nearly $1 billion worth of capital under management before his demise.

In 2019, Ross suddenly resigned. His fund, Direct Lending Investments, LLC, was then charged by the SEC with running a “multi-year fraud that resulted in approximately $11 million in over-charges of management and performance fees to its private funds, as well as the inflation of the private funds’ returns.”

Yesterday, the FBI arrested Ross at his residence outside Los Angeles. A grand jury indicted him “with 10 counts of wire fraud based on a scheme he executed between late 2013 and early 2019 to defraud investors…” An announcement made by the US Attorney’s Office in Central California revealed that the charges had been under seal for approximately two weeks prior.

Yesterday, the FBI arrested Ross at his residence outside Los Angeles. A grand jury indicted him “with 10 counts of wire fraud based on a scheme he executed between late 2013 and early 2019 to defraud investors…” An announcement made by the US Attorney’s Office in Central California revealed that the charges had been under seal for approximately two weeks prior.

The SEC simultaneously filed civil charges against him.

No reference is made to Dealstruck in any of it. The Dealstruck brand was later sold to another company that has no connection to Ross or Senturia where it is still in use to this day. Instead, the SEC and US Attorney focus on Ross’s actions allegedly undertaken with another online lender named Quarterspot. Quartersport stopped originating loans in January of this year.

Ross allegedly directed the online lender to make “rebate” payments on more than 1,000 delinquent loans to create the impression that they were current. Quarterspot has not been accused of any civil or criminal wrongdoing.

The SEC included in its complaint that Ross expressed concern about the scale of loan delinquencies.

“…more loans are going late each month than I can afford and still have normal returns, so that the can we are kicking down the road is growing in size,” he wrote in an email. It was dated February 8, 2015.

It’s a sentiment that seems to disprove his early premise that “the asset class works even when the collection process doesn’t.”

Ross is innocent until proven guilty, but an excerpt of an interview with him in 2014 is now somewhat ironic.

“I [understand] that people end up sometimes in the [industry] who have had colorful careers in the securities space. It doesn’t make it impossible for me to work with them,” he said. “But if they had been in the big house for white collar crime, then that is probably a non-starter.”

Real Estate and Funding Deals With Chris Pepe

August 10, 2020I recently spoke with Christopher Pepe, Head of ISO Relations at World Business Lenders. Pepe explained why WBL’s practice of securing loans against real estate has enabled their business to keep lending and to do deals unsecured lenders and MCA providers are not equipped to handle.

You can watch the full interview here:

The SEC Already Suffered a Major Defeat in the Par Funding Battle – But Who is the Real Loser?

August 8, 2020 While the news media, regulatory agencies, and law enforcement are high-fiving each other over the course of events in the Par Funding saga (a lawsuit, a receivership, an asset freeze, and an arrest), there lies a major problem: The SEC already suffered a major defeat.

While the news media, regulatory agencies, and law enforcement are high-fiving each other over the course of events in the Par Funding saga (a lawsuit, a receivership, an asset freeze, and an arrest), there lies a major problem: The SEC already suffered a major defeat.

On July 28th, rumors of a vague legal “victory” for Par Funding circulated on the DailyFunder forum. The context of this win was unknowable because the case at issue was still under seal and nobody was supposed to be aware of it.

Cue Bloomberg News…

In December 2018, Bloomberg Businessweek published a scandalous story about a Philadelphia-based company named Par Funding. And then not a whole lot happened… that is until Bloomberg Law and Courthousenews.com published a lengthy SEC lawsuit less than two years later that alleged Par along with several entities and individuals had engaged in the unlawful sale of unregistered securities.

At the courthouse in South Florida, those documents were sealed. The public was not supposed to know about them and deBanked could not authenticate the contents of the purported lawsuit through those means. According to The Philadelphia Inquirer, the mixup happened when a court clerk briefly unsealed it “by mistake” thus alerting a suspiciously narrow set of news media to the contents. deBanked was the first to publicly point this out.

At the courthouse in South Florida, those documents were sealed. The public was not supposed to know about them and deBanked could not authenticate the contents of the purported lawsuit through those means. According to The Philadelphia Inquirer, the mixup happened when a court clerk briefly unsealed it “by mistake” thus alerting a suspiciously narrow set of news media to the contents. deBanked was the first to publicly point this out.

In court papers, some of the defendants said that they learned of the lawsuit that had been filed under seal on July 24th from “news reports.” Bloomberg Law published a summary of the lawsuit on its website in the afternoon of July 27th.

“It is fortuitous that the Complaint was initially published before it was sealed,” an attorney representing several of the defendants wrote in its court papers. “Otherwise, [The SEC] would have likely accomplished its stealth imposition of so-called temporary’ relief, that would have led to the unnecessary destruction of a legitimate business.”

The day after this, on July 28th, a team of FBI agents raided Par Funding’s Philadelphia offices as well as the home of at least one individual. Rumors about the office raid landed on the DailyFunder forum just hours later, along with links to the inadvertently public SEC lawsuit now circulating on the web.

The day after this, on July 28th, a team of FBI agents raided Par Funding’s Philadelphia offices as well as the home of at least one individual. Rumors about the office raid landed on the DailyFunder forum just hours later, along with links to the inadvertently public SEC lawsuit now circulating on the web.

The New York Post caught wind of the story and published a photo of an arrest that had taken place fifteen years ago, creating confusion about what, if anything, was happening. Nobody, was in fact, arrested.

The SEC lawsuit was finally unsealed on July 31st, along with the revelation that Par Funding and other entities had been placed in a limited receivership pursuant to a Court order issued just days earlier. The receivership order was a massive blow to the SEC. It failed to obtain the most important element of its objective, that is to have the court-ordered right to “to manage, control, operate and maintain the Receivership Estates.” The SEC specifically requested this in its motion papers but was denied this demand and others by the judge who leaned in favor of granting the Receiver document and asset preservation powers rather than complete control of the companies.

The language of the Court order was interpreted differently by the Receiver, who immediately fired all of the company’s employees, locked them out of the office, and then suspended all of the company’s operations which even prevented the inbound flow of cash to the company (of which in the matter of days amounted to nearly $7 million). The SEC did successfully secure an asset freeze order.

In court papers, Par Funding’s attorneys wrote that: “The Receiver’s and SEC’s actions are ruining a business with excellent fundamentals and a strong financial base and essentially putting it into an ineffective liquidation causing huge financial losses. In taking this course of action against a fully operational business, the key fact that has been lost by the SEC, is that their actions are going to unilaterally lead to massive investor defaults.”

The Receiver, in turn, tried to fire Par Funding’s attorneys from representing Par. Par’s attorneys say that the Receiver has communicated to them that it is his view “that he controls all the companies.”

The Receiver, in turn, tried to fire Par Funding’s attorneys from representing Par. Par’s attorneys say that the Receiver has communicated to them that it is his view “that he controls all the companies.”

“The SEC is simply trying to drive counsel out of this case, as an adjunct to all the other draconian relief that they insist must be employed to ‘protect the investors,'” Par’s attorneys told the Court. “Due Process is of no regard to the SEC.”

As lawyers on all sides in this mess assert what is best for “investors,” seemingly lost is the collateral damage that is likely to be thrust on Par’s customers. The Philadelphia Inquirer has repeated the SEC’s contention that Par made loans with up to 400% interest. Bloomberg News has called Par a “lending company” whose alleged top executive is a “cash-advance tycoon.”

A review of some of Par’s contracts, however, indicate that they often entered into “recourse factoring” arrangements. “This is a factoring agreement with Recourse,” is a statement that is displayed prominently on the first page of the sample of contracts obtained by deBanked.

Parallels between the business practices of Par Funding and a former competitor, 1 Global Capital, have been raised at several junctures in the SEC litigation thus far. But some sources told deBanked that in recent times, Par has been offering a unique product, one that is likely to create disastrous ripple effects for hundreds or perhaps thousands of small businesses as a result of the Receiver’s actions (even if well-intentioned).

The “Reverse”

Par offered what’s known as a “Reverse Consolidation,” industry insiders told deBanked. In these instances Par would provide small businesses with weekly injections of capital that were just enough to cover the weekly payments that these small businesses owed to other creditors.

One might understand a consolidation as a circumstance in which a creditor pays off all the outstanding debts of a borrower so that the borrower can focus on a relationship with a single lender. In a “reverse” consolidation, the consolidating lender makes the daily, weekly, or monthly payments to the borrower’s other creditors as they become due rather than all at once. Once the other creditors have been satisfied, the borrower’s only remaining debt (theoretically) is to the consolidating lender.

Par does not appear to have offered loans but sources told deBanked that Par would provide regular weekly capital injections to businesses that could not afford its financial obligations otherwise. Par, in essence, would keep those businesses afloat by making their payments.

Par does not appear to have offered loans but sources told deBanked that Par would provide regular weekly capital injections to businesses that could not afford its financial obligations otherwise. Par, in essence, would keep those businesses afloat by making their payments.

That all begs the question, what is going to happen to the numerous businesses when Par breaches its end of the contract by failing to provide the weekly injections?

As the Receiver makes controversial attempts to assert the control it wished it had gotten (but didn’t), the press dazzled the public on Friday with the announcement that an executive at Par Funding had been arrested on something entirely unrelated, an illegal gun possession charge. The FBI discovered the weapons while executing a search warrant on July 28th but waited until August 7th to make the arrest.

It remains to be seen what the 1,200 investors will recover in this case or what will become of the Receiver in the battle for control, but sources tell deBanked that the authorities are all fighting over the wrong thing.

They should all be asking “what’s going to happen to the small businesses when their weekly capital injection doesn’t come in the middle of a pandemic?”

Enova & OnDeck: Behind The Biggest Deal of 2020

July 29, 2020 Enova CEO David Fisher kicked off his company’s 2nd quarter earnings call on Tuesday and one could tell from the pitch in his voice that he was excited. And why shouldn’t he be? Despite the catastrophe that gripped the nation over the months of April, May and June, Enova still manages to report a consolidated net PROFIT of $48 million.

Enova CEO David Fisher kicked off his company’s 2nd quarter earnings call on Tuesday and one could tell from the pitch in his voice that he was excited. And why shouldn’t he be? Despite the catastrophe that gripped the nation over the months of April, May and June, Enova still manages to report a consolidated net PROFIT of $48 million.

But that’s not even it. After a long introduction about a major acquisition, a rather familiar voice is asked to deliver some prepared remarks.

“Thanks David, I am equally excited…”

It’s Noah Breslow, the CEO of OnDeck. Less than an hour earlier it was revealed that Enova had bought 100% of OnDeck’s outstanding shares for $90 million in a deal paid for almost entirely with stock. And now suddenly he’s here on this call talking about how great it is that the companies are combining forces.

“Following an extensive review of our strategic options, we believe this is the right path forward for our customers, employees, and shareholders,” Breslow says.

That OnDeck has been acquired is no surprise. The devastating impact of COVID in Q1 reveals weaknesses in the company’s business model and the share price drops by 80% from the period of February to July. This all while two of their competitors in the small business lending space, Square and PayPal, experience enormous gains of more than 40%.

In May, Forbes reported grim news, that OnDeck is being shopped around in “what amounts to a fire sale.”

In May, Forbes reported grim news, that OnDeck is being shopped around in “what amounts to a fire sale.”

The rumor creates further despair in an industry that is preoccupied with survival. If this can happen to OnDeck, then…?

The truth is, OnDeck’s momentum had stalled long before COVID. The company walked away from a sale to Wonga in 2012 that had valued them at $250 million and they went on to have a successful IPO in 2014 at a value of $1.32 billion on the selling point that they were a tech company.

But by mid-February of this year, the company’s market cap is down to less than $250 million, turning the clock backwards by about eight years. After losing the partnership with Chase in 2019, OnDeck seemed to have lost its swagger and direction. They planned to pursue a bank charter and do a stock buyback. Then the news pretty much stops.

COVID happens and it hits them hard. The company stopped lending entirely, although they still recorded originations of $66 million in Q2.

As a standalone entity, OnDeck’s upside had greatly diminished. Getting back to where it was pre-COVID may not have been an entirely enticing prospect for investors. Its market cap recently plummeted to less than $50 million and so by the time the Enova price of $90 million is announced, it sounds almost generous. (Knight Capital sold for $27.8M in November).

Enova says that the acquisition increases their concentration in small business lending from 15% to 60%. That puts consumer lending, their historical core business, now in the minority. This is not by accident. On the earnings call, Enova executives say that they believe that “there will be strong demand for capital from small businesses as the economy begins to open back up.” They even believe the opportunity is better than the consumer lending market right now, particularly from a regulatory perspective, they say. Therefore it makes sense to “double down or triple down” on the small business side, they contend.

Enova’s small business lending business was largely spared by COVID. Unlike OnDeck’s brutal Q1, Enova had reported something “very much manageable” thanks to not having “large exposures to entertainment, hospitality and restaurants.”

“Our portfolio has been extremely stable,” Enova says on the call. With the acquisition of OnDeck, the company appears to be gearing up for the opportunity they believe awaits in small business lending right around the corner.

Interview With Chad Otar, CEO of Lending Valley

July 28, 2020I recently spoke with Lending Valley CEO Chad Otar, who told us that not only is his funding company still working remotely, but that he’ll probably never return to an office ever again. Watch below: