Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Success and Lessons Learned From Small Business Finance Industry Vets

December 11, 2025 “In October, the company did $23 million+ and it was our best month ever,” says Eddie DeAngelis, founder and CEO of QualiFi, a full-service business loan brokerage.

“In October, the company did $23 million+ and it was our best month ever,” says Eddie DeAngelis, founder and CEO of QualiFi, a full-service business loan brokerage.

Talk to anyone in the industry and it always seems to be their best month, quarter, or year, but that’s just happenstance since those same people will also tell you—if they’ve been in it long enough—that success is not a straight shot up. They’ll also say that success is defined on their own terms, not by other people’s measures.

In DeAngelis’ case, for example, the origination figure, which comprised a mixture of LOCs, term loans, HELOCs, SBAs, and equipment financing, is all the more celebratory because the company accomplished it with just 13 funding reps at the time.

“It just shows how efficient our business model is,” DeAngelis says, “so that’s the number that I’m really proud of, which is 13 reps.”

Jared Weitz, CEO of United Capital Source, a small business finance marketplace, had a similar perspective, sharing that at one point he had 27 employees and now operates with 17—but the 17 are producing the same output as the 27.

“Ten less people, less expenses, same numbers, higher net margin and profit,” Weitz says. He explained that he spent time dissecting his P&L, structures, and systems to maximize efficiencies to get where he wants to be.

“I’ve always viewed it as ‘am I profitable every year?’” Weitz says. “‘Do I have concentration where, if 3,4, 5, [lenders] in my portfolio go out, am I screwed? Can I grow without body count? Can I create more efficiencies in my business through automations, technologies, different marketing and grow without body count?’ I’ve done that very well.”

Zach Ramirez, CEO of Calldrive, a pay-per-call marketing and consulting company, also has experience running brokerage shops.

“I found that my skillset, I was great at sales. I still am good at sales, but I think my real skill is building operations. I’ll be honest, one of my weaknesses is I’m not really that great at managing big groups of people,” Ramirez says.

In this regard, Ramirez also thought deeply about maximizing efficiencies rather than maximizing headcount, and says that “I found that what I do enjoy doing is building the infrastructure, the marketing, the sales processes, all the metrics and KPIs, and building the CRM and all the automations.”

Between that and his mountain of firsthand experience working at and operating brokerages, Ramirez is often called upon these days as a consultant for ISOs to help fix or improve all of those things.

Chad Otar, CEO of Lending Valley, a revenue-based financing provider, shrugs at the milestone benchmarks some of his competitors tout and explains that it’s not a race for publicity but rather a marathon of good economics. Otar, for example, says his company funds from its own self-funded balance sheet and has no incentive to be anything less than prudent.

“I’m not looking for market share,” Otar says. “I’m just looking for, you know, a calm, collected life at the end of the day.”

Through all the years Otar has been working in the industry, he says he’s seen the cycle of jaw-dropping deals that, while they may still be more expensive than a bank loan, are unlikely to yield a financial incentive for him to risk participating in.

“And I’m like, no, no. I’ll just stick to what I know, stick to what I like,” he says.

All four executives have the benefit of experience under their belts. Otar has worked in the industry for 19 years, Weitz for 20, Ramirez for 16, and DeAngelis for 12.

What they all have in common is a deep love for the game.

“It’s a delight, I love this #$@&*!-ing industry,” Ramirez says.

“I wouldn’t trade it for the world. I love this industry a lot,” echoes DeAngelis.

Weitz and Otar expressed similar sentiments.

DeAngelis, who had a couple of decades’ worth of experience as a traditional business owner in screenprinting and designer fragrance wholesaling, says that he loves talking to business owners, overseeing operations, and building relationships with partners.

Weitz says it’s been a joy to watch long-term members of his team go through their own life milestones, like going from an apartment to marriage to a home to kids.

“They’ve seen growth also, which really also means we’ve shown growth to not just our clients but our staff,” Weitz says. “These are really good recognition signs that we’re doing pretty good, which is also how I define success.”

If you’re earlier on in your career or entrepreneurial journey, know that there are going to be rough times—especially in this industry.

“My very first job selling finance was for [a mentor],” says Ramirez. “I was probably 19 or something, or 20, and he always said, ‘when you build your business, put your blinders on and only focus on your business and you’ll be instantly rich in 20 years.’”

Ramirez says that the march toward success is kind of like going to the gym. There are people who give up on a routine after three months because they think they’ve put in enough time to judge the final outcome and never truly follow through. And then there are those who stick with a routine, realize that they’re incrementally moving toward their goal, and eventually get there. Ramirez says he has been guilty of surrendering too soon in the past and has also fallen victim to shiny object syndrome. In one example of the latter, he said his previous ISO became overly caught up with selling Employee Retention Tax Credits (ERTC/ERC) during COVID, to the point where it overwhelmed and negatively impacted what had been a well-run business.

“It was a waste of time and energy more than anything, but also cash, because I didn’t remain true and focused to my major core expertise or my core area of competency,” Ramirez says. “I think we lost probably over a full year. We went the wrong direction.”

Otar, meanwhile, says he has felt the pressure as a funder in an increasingly competitive environment with demanding brokers. In one example, he says that while he normally sticks to his principles about not doing same-day fundings, he became convinced to make an exception—and it came back to bite him.

“I did a same-day funding and the next morning on the first Decision Logic, there’s four different positions in there already.”

In his view, that completely changed the risk profile of the deal and produced immediate regret. “That’s why I’m not advocating for same-day funding. I am not advocating for [online] checkouts,” he says. “I’m not doing any of that. I’m still sticking to what I know best, and it’s the reason why I have longevity in this industry.”

Otar adds that he is still employing automation, tools, and systems, and running a modern operation, but he thinks very carefully about each decision.

For Weitz, one of the big defining moments in his business was realizing that concentration risk can be existential. In an industry that prides itself on strong relationships, putting too many eggs in one basket can produce unforeseen consequences if a lender or funder disappears. And what are the odds? High enough that it happened to him. In the early days of United Capital Source, two large funding partners ceased operations at the same time, one of which comprised nearly half of his company’s entire portfolio. That not only jeopardized renewals but also the valuable volume bonus relationships he had with both.

“I know plenty of large brokers who make their profits solely from volume bonuses,” Weitz says. Fortunately, he recovered—and it gave him the chance to refactor his strategy to mitigate future fallout.

DeAngelis says that things can go from great to not good at all in a very short time. In one example, he said that six months after being featured positively in a deBanked story in early 2023, his company QualiFi hit such a snag that he had to temporarily take himself off payroll.

“We just ran into this down spurt where we had a really bad month,” DeAngelis says. “We’ve been there before, right? Another month, another really bad month. ‘Okay, so now back-to-back months. What’s going on? June, July, another bad month. Now it’s a bad quarter,’ and we just were spiraling down, like revenues dropping 30%, we’re starting to stress with the bills, like, ‘what the hell’s going on?’”

They knew they didn’t forget how to execute, but they made tweaks where they could. Like Ramirez’s gym analogy, DeAngelis said they didn’t completely change what they were doing—they stayed the course.

“Our answer was to just keep our heads down, just keep pushing, make some changes and start watching what we’re spending and just barrel through and push through,” DeAngelis says. “And then when we got to October [2023], is when things started to turn for us.”

Two years later, that recent $23 million funding month is a milestone that arose from going through the bad to get to the good. The last several months have also come in at over $15 million.

Some founders try to leverage milestones into additional growth before they’re ready, but DeAngelis—who has been down this road before, including with a previous company he started that was acquired by Nav—says it’s become important to look at each portion of the business as its own business. Hiring and onboarding, for example, has become its own structured operation.

“Before when we lost a rep or we needed to hire someone, we’d hire like the first two to come through the door and just put them on the phones, right?” DeAngelis says. “Those days are done. So the hiring process, we’re super selective. We want to make sure it’s a really good fit for the candidate, as much as this is for us, for long-term sustainability.”

DeAngelis has added a few more reps since the earlier-mentioned 13 and is being cautious about how they approach growth from here.

Ramirez, meanwhile, says that sometimes it helps to look at a problem in reverse. A common gripe these days is that the small business finance market is getting too crowded and squeezing margins (and ethics).

“If I look at everything from the perspective of, ‘I’m an ISO, and there’s more ISOs coming in,’ I understand why they would feel threatened,” Ramirez says. “Because… we’re all fighting for the same pool of merchants, essentially. I would respond with, ‘well, why don’t you help them?’ Instead of being fearful, then why don’t you help them? Why don’t you find these other smaller ISOs and help them do business the right way. Consult with them, charge them for that.”

Ramirez’s outlook embraces the spirit that success in the industry is not limited to being the best broker or the best lender, but about spotting opportunities and being brave enough to capitalize on them.

For Weitz, that meant diversifying early on beyond just one product. United Capital Source offers LOCs, HELOCs, SBA loans, term loans, revenue-based financing, equipment financing, and more. The result is long-term client relationships that shift between products as needs evolve—some going back to the company’s inception 15 years ago. Weitz also notes that not all new competition is real competition: his team conducts themselves with a level of expertise and best practices that they believe clearly distinguishes them.

For Otar, seeing a crowd rush into something doesn’t necessarily indicate a real opportunity, at least not economically. Unless the play is for market share or another specific objective, he considers patience and vigilance his advantages.

“I’ve been through the ringer,” Otar says. “I started this a long time ago. I was an opener, I was an originator, I was a collection guy, I was an underwriter, I’ve seen it all. I don’t think there’s one area in this industry that I haven’t been able to cover yet.”

“I’m here for the long run, not overnight,” Otar adds. As part of that, he prides himself on relationships not only with brokers but with every merchant he funds.

“My mom, when I first started, she had said this, ‘there’s three things that you don’t mess around with in people’s lives: their money, their spouse, and their car.’”

Realizing that his business involves one of those three, he has made it his mission to manage it with care.

“If you look at Lending Valley’s reviews, we’re at 5.0 right now, every single one of them. You could give them a call and they’ll be like, ‘Chad is amazing,’ because I try to keep them on with me.”

For DeAngelis, part of success is giving back. For example, they recently started a charity drive in the office where each month a different employee selects a charity and the company donates to it.

“We started with a small donation of like $500 a month,” DeAngelis says. “And it started really catching on, and I loved it, and got everybody involved. And we talk about it every month. Somebody picks a charity, tells us why it’s special to them, and then they give us some updates on it.”

“I just want to say that ever since we started doing that, even when we were struggling, our business just literally made a skyrocket transformation,” DeAngelis adds. “Over the last year, we’ve doubled and tripled and almost quadrupled our fundings and our revenues.”

For Ramirez, he says that “Last year was one of the best financial years of my life.” He used some of the earnings from it to acquire a small telecom company, which has become another valuable component of his overarching strategy. For younger people entering the space, he’s certain that this business is here to stay.

“The industry is not going anywhere,” he says. “Is it going to fluctuate? Is it going to change? Absolutely.”

Weitz, now two decades in, also concludes that by any rational measure, this business will continue to provide opportunities—as long as one evolves with the times.

“People are always going to need homes,” Weitz explains. “People are always going to borrow against assets. Businesses will never go away, ever, ever, ever, and they will also never, ever, ever have enough capital to grow themselves. They’re always going to need an outside source. This is the way the world has worked for a thousand years. So that won’t change. How people access it will change. The cost will change. The products will change. The need will not. So as long as you’re shifting with that, you’re in an industry where that need is still abundant.”

Otar says, “At the end of the day, I’m very happy with what I do every day. It makes me excited to wake up and actually want to go to work. It’s like I don’t have a job per se. They say, ‘if you have something that you love to do every day, it’s not a job.’ It just becomes a habit at this point. And I enjoy my habit.”

Scott Pearson Is Retiring, But His Influence on Alternative Finance Will Remain

December 9, 2025In the footnotes of virtually every legal brief detailing merchant cash advance history is Richard B. Clark v. AdvanceMe. Filed as a class action in 2008 by a restaurateur in Orange County, California, Clark alleged that the merchant cash advance he received was really a usurious loan. When the case settled in 2011 with AdvanceMe admitting no wrongdoing and agreeing to make changes, industry observers were quick to recognize that the outcome paved the way for how to operate an MCA business—then a nascent concept—in a reliably compliant manner. The case even became a front-page story for The Green Sheet, a top trade publication for the payments industry, with the headline A New Chapter Opens for Merchant Cash Advance.

“In the class action’s aftermath, many alternative funding providers indelibly reshaped the way they do business,” the story began. “And the ripple effect has spawned a new wave of innovation in this sector with seemingly unlimited possibilities and merchants as the designated beneficiaries.”

speaks at deBanked CONNECT San Diego in 2023

The case also brought further notability to Scott Pearson, the attorney representing AdvanceMe for Stroock & Stroock & Lavan LLP at the time.

“I think a lot of people thought that after the case was resolved, it demonstrated that the product was viable,” Pearson recently told deBanked, “and a lot of other companies came into that space.”

Pearson had already established himself in this area of law after defending a class action brought by Bistro Executive in 2004 against Rewards Network over similar allegations, which also resulted in a settlement and no admission of wrongdoing. The outcomes of both offered guidance on how to clear up language that might otherwise appear ambiguous in an MCA agreement, such as how to establish that the transactions are not absolutely repayable.

“Now you see that language everywhere. Every agreement has that same language in it, pretty much saying that, essentially, if you go out of business or if you file for bankruptcy, nothing’s owed because you’re buying a slice of the future revenue stream with an MCA,” Pearson said.

Pearson has worked on well over a hundred class actions over the course of a legal career that has spanned more than thirty years, but those two cases are especially remembered in the small business finance industry and have led to many new client relationships. In some ways that was just the beginning. Today, he’s a Partner at Manatt, Phelps & Phillips, a firm with 450 attorneys and consultants that was founded 60 years ago in Van Nuys, California. Pearson has been very active on matters of compliance and regulatory enforcement over the last few years at Manatt where he leads the Consumer Financial Services group. At the end of December 2025, however, he’s hanging up the briefcase and retiring. His impact will be missed. As a regular on the conference speaker circuit and still one of the most highly sought-after attorneys in the space, his influence has been very beneficial to those around him.

Pearson has worked on well over a hundred class actions over the course of a legal career that has spanned more than thirty years, but those two cases are especially remembered in the small business finance industry and have led to many new client relationships. In some ways that was just the beginning. Today, he’s a Partner at Manatt, Phelps & Phillips, a firm with 450 attorneys and consultants that was founded 60 years ago in Van Nuys, California. Pearson has been very active on matters of compliance and regulatory enforcement over the last few years at Manatt where he leads the Consumer Financial Services group. At the end of December 2025, however, he’s hanging up the briefcase and retiring. His impact will be missed. As a regular on the conference speaker circuit and still one of the most highly sought-after attorneys in the space, his influence has been very beneficial to those around him.

Steve Denis, Executive Director of the Small Business Finance Association, said, “Scott has been an invaluable asset to the industry, a lawyer whose insight, integrity, and foresight have helped shape how we all navigate an evolving regulatory landscape. His steady and unmatched expertise have guided countless companies, and his support for the Association and for me personally has been nothing short of extraordinary.”

Lindsey Rohan, President of the Alternative Finance Bar Association, said, “Scott has been a leader in the legal community within this industry for many years. His willingness to take a leading role in establishing best practices has had a significant impact on alternative financing, and we are all better off as a result.”

How Pearson got to where he is today was a combination of hard work and the opportunity to work in an evolving area of law.

“I grew up in Arizona. I went to school in Southern California, and I think being a lawyer was something that was pretty natural for me,” Pearson said. “I was on the debate team in high school and college, for example, and I really wanted to be a trial lawyer.”

He noted that he did not really become a trial lawyer per se, but rather more of a litigator, since the vast majority of his cases were resolved before trial. Fortunately, he did get the opportunity to cut his teeth in a real battle.

“I did a six-week jury trial in New Hampshire in a trade secrets case that was all about electronic evidence and the destruction of electronic evidence, and that case was really a big thing for my career. Probably a lot of my fondest memories are from that case,” he said. “I think just being in a long trial like that is being in combat—not that I’ve been in combat—but it’s kind of like where you just build these bonds with the people on the trial team that will just be there forever.”

In the beginning of his legal career, Pearson worked under two top lawyers, one of whom handled a lot of smaller cases for banks. That provided valuable experience in financial services. He also worked on class actions for a long time until the landscape for those eventually shifted.

“I think when the Supreme Court decided that class action waivers were enforceable, that really had an impact on the amount of class action litigation out there, so that’s when I started doing a lot more enforcement work,” Pearson said.

Compliance work organically followed since he had an established reputation in the subject matter. Being in his shoes has taken tremendous effort, however, one that required six or seven days a week of his time throughout his career. When he was younger, he and his colleagues joked about looking forward to the weekends because it meant they could wear casual clothes to the office. The stereotype about lawyers working obscene hours is all too real.

“We would pull multiple all-nighters, like literally be up for two or three days in a row cranking things out,” Pearson recalled. “And maybe sleep on the floor of the office for an hour.”

The “thrill of battle,” as he termed it, made it easier to tolerate, but he also enjoyed working with people he admired, respected, and learned from. And he didn’t just defend, he also played offense, most notably by playing forward for multiple ice hockey teams in whatever downtime he managed to muster up.

Pearson recounts, “We had a bunch of guys from my law school class studying for the bar exam together, and what we did was we would go to a review course in the morning, then we’d go to the library and do all our homework, and then we went and played roller hockey in this pond in Santa Monica that had this big fountain that had been drained and the edges of the fountain could be like boards.”

One of his friends, who hailed from Minnesota, said he had to take his roller game to the ice, a challenge Pearson accepted and stuck with.

“I used to get up at like five in the morning and go take private lessons learning how to skate a lot better and how to play before I went to work, before I had kids,” Pearson recalled. After a private coach and several clinics later, he’s made the game a lifelong hobby, one among others such as fishing, golfing, and cooking. He still plays in an ice hockey league in the present day.

Despite his departure, Manatt will remain a powerhouse in the financial services space. The firm added the highly regarded Gianna Ravenscroft as a partner this past October. Pearson also noted many distinguished individuals at the firm, including Partners Charles Washburn, Bryan Schneider, and Andrew Morrison, just to name a few, as well as strong surrounding team players including an associate named Eric Knight.

Manatt describes itself as a “multidisciplinary, integrated national professional services firm known for quality and an extraordinary commitment to clients.” Pearson became a partner there in 2019 following partner titles at Ballard Spahr, Seyfarth Shaw, and Stroock & Stroock & Lavan, where he began and spent most of his career starting in 1994.

Manatt’s site says that “while most of [Pearson’s] clients are banks, fintechs, and other financial services companies (including institutional investors), he also does a substantial amount of work in real estate, sports and entertainment, retail, and other industries,” and that he’s “been repeatedly recognized as one of the top consumer finance lawyers in the United States, with clients in anonymous interviews praising his responsiveness and legal acumen.”

“Scott’s contributions to the alternative finance industry have been invaluable,” said Christopher Murray, Managing Member at Murray Legal, who also practices in the small business finance industry and is familiar with his work. “His knowledge of regulatory compliance and litigation is unmatched. It has been a true privilege to work with him and a pleasure to work alongside him. His retirement is a loss for the commercial finance space, but well earned.”

On matters of compliance, Pearson explained to deBanked that even a small startup financial services company should take some basic steps toward compliance—things like carefully drafting agreements and providing proper training for senior management. And as a company gets bigger, it requires a continuous and larger investment into compliance—real compliance. Some founders and executives, for example, can overestimate their preparedness and require professional help to get where they need to be. He’s seen that before. If there’s anything he hopes people take to heart in his coming absence, however, it’s this: remember that your customers are people too.

“When you think about someone on the other side of the phone, think about it being your grandmother or somebody who is maybe a little vulnerable,” Pearson advised. “I think that if you treat people well and if you’re nice to people, I think that ends up really benefiting your business. And I think the more companies that really commit to that, the better off they’ll be because compliance really flows from that basic concept of ‘do the right thing for people.'”

Can You Trust the Funder? Are They a “Secure Funder”?

December 4, 2025When Aquamark debuted earlier this year, their target demographic was brokers that were tired of being backdoored. The product was a unique watermarking tool that could permanently identify a broker’s claim to having originated a document. Brokers liked that sort of thing and the response that Aquamark received from the industry was overwhelming. But what stood out the most to them was the number of funders that also wanted to get involved.

“Since launching, we’ve had funders that genuinely want to do things the right way, reaching out to us, asking things like, ‘how can we do better? How can we be part of the solution?'” said Christina Duncan, Aquamark’s founder.

On the advice of a solid advisor, Duncan was encouraged to exhibit at the B2B Finance Expo in Las Vegas this past October. And the trip paid off. A lot of people had heard of her and Aquamark but had not been formally introduced. Now they were finally talking. There were also people there she knew but had never technically met.

“I was able to meet people that for the last 15 years I’ve either communicated with via phone or in like a FaceTime setting, but not in person,” Duncan said. “So I was able to meet people that I’ve known for so long in person for the first time too.”

The experience increased their momentum and now Aquamark is even announcing a second product, Secure Funder.

The experience increased their momentum and now Aquamark is even announcing a second product, Secure Funder.

“There aren’t any clear guidelines around how files should be handled or what actually makes a funding source secure and trusted,” Duncan said. “And so over the last few weeks, we’ve been collaborating with some pretty major funders on defining what those minimum standards should look like.”

The objective is to perform a unique third party certification to determine if a funder is secure and trustworthy. “Secure Funders” that meet guidelines will get a digital badge and be placed in a premium directory of funders.

In an industry where everyone tells brokers to trust them, funders find themselves competing against others that are making the same promises. Now, this new product aims to serve as an independent source of validation.

“The program was developed as a neutral, third-party initiative,” said Duncan in the official release. “We’re not affiliated with any broker, funder, or lead provider. We simply want to see business owners get the capital they need—without having to worry about where their sensitive information ends up.”

Along with the announcement is a batch of name-brand funders that have already signaled their support to be part of it. The hope is that brokers will see the list of who they’ve certified and have actionable information about who they can trust with their files. Aquamark is encouraging other funders to participate as well.

“I think by the end of next year, my hunch is that if you’re not on the list, you’re probably going to start seeing less business,” Duncan said.

Debunking Jameson Lopp’s Rebuttal on the ‘Jack Dorsey is Satoshi Nakamoto’ Theory

December 1, 2025Back in February 2025, prominent Bitcoiner Jameson Lopp attempted to debunk the theory that Jack Dorsey was Satoshi Nakamoto. Unfortunately, almost all the information he relied on for his arguments were either wrong or required leaps of the imagination. While I addressed this immediately after he posted them here and here, they’re being republished here:

Lopp: “During the time period of 2009 & 2010, Jack Dorsey was not only Chairman of the Board of Twitter, but also the CEO of the fledgling startup Square. It’s quite clear that he was an extremely busy person not only overseeing multiple companies, but traveling around the world meeting important people, doing press interviews, speaking at conferences, promoting philanthropic causes, and more. His activities do not fit the profile of someone who had the time and mental bandwidth to also be building a completely new financial system from scratch while maintaining perfect anonymity.”

Counter:

Twitter: Jack was fired from Twitter in mid-October 2008. He was made “silent” Chairman with no active role in the company and did not return in an active capacity at Twitter until March 28, 2011. So there is no conflict with his role at Twitter as he did not have an official job function there during the time period in question.

Satoshi Nakamoto published the White Paper on October 31, 2008 and sent his last farewell email in April 2011. This reinforces the plausibility that Jack is Satoshi since Satoshi appears right after Jack leaves Twitter and exits right as Jack returns to Twitter. Also, Jack published a reference to the name Satoshi in March 2011, showing that it had been the first tweet ever made by his best friend & love interest (Crystal Taylor) on the beta version of Twitter.

Square: Was Jack too busy launching Square? The company was founded February 11, 2009 and didn’t launch until December 2009. Coincidentally, Satoshi complained about being too busy with work during the same time period.

June 14, 2009 – Satoshi Nakamoto: “Thanks, I’ve been really busy lately.”

July 21, 2009 – Satoshi Nakamoto: “I’m not going to be much help right now either, pretty busy with work, and need a break from it after 18 months development.”

May 16, 2010 – Satoshi Nakamoto: “I’ve also been busy with other things for the last month and a half. I just now downloaded my e-mail since the beginning of April. I mostly have things sorted and should be back to Bitcoin shortly.”

July 8, 2010 – Satoshi Nakamoto: “I’m losing my mind there are so many things that need to be done.”

August 27, 2010 – Satoshi Nakamoto: “Sorry, I’ve been so busy lately I’ve been skimming messages and I still can’t keep up.”

April 23, 2011 – Satoshi Nakamoto: “I’ve moved on to other things. It’s in good hands with Gavin and everyone.”

So if Lopp’s argument is that Jack would’ve been really busy with launching Square then Satoshi complaining about being really busy during the same time period actually reinforces the plausibility of it being Jack.

Lopp: “Jack Dorsey worked with the US Federal Government to visit several countries (Iraq, Mexico, Russia) on behalf of the US tech industry. Does anyone truly believe that Satoshi Nakamoto, who was extremely wary of gaining attention from governments, would be working directly with them?”

Counter: A lot of people truly believe Satoshi worked with the government or was the government. The characterization that Satoshi was “extremely wary of gaining attention from governments” is not based on anything, unless he was referring to the incident in which Satoshi advised people not to donate Bitcoins to WikiLeaks. That incident ironically makes it more plausible that Satoshi was Jack Dorsey because Twitter received a secret court order regarding WikiLeaks (December 14, 2010) a day apart from Satoshi’s last activity on the Bitcoin forum (December 13, 2010). Square was also courting a relationship with Visa, which had made it a policy to restrict funds to WikiLeaks. The Square / Visa partnership was announced on April 27, 2011, four days after Satoshi’s last farewell email.

Lopp: “The first version of the Bitcoin software was Windows only, meaning that Satoshi developed it on Windows. I’m sure Jack used Windows at some point in his life, but he has been a die-hard Apple fan ever since the original iPhone came out. You can find many posts where he refers to various Apple devices he uses. I personally recall speaking with him several years ago and learning that he doesn’t even use laptops or desktops, but sticks to iPhones and iPads. It appears that may have even been true back in 2010. While reading through his 6,200 tweets I saw many referencing Apple products but none regarding Microsoft or Windows.”

Counter: Windows had a 95% share of the entire desktop OS market in 2009. No serious developer that was planning to appeal to mainstream desktop users would’ve developed for anything other than Windows even if they were a “die-hard Apple fan.” Regardless, Jack used Windows, MacOS, FreeBSD, OpenBSD, Blackberry OS, and several flavors of Linux including Gentoo.

Lopp: “I think the best we can do is to show that the person was out and about doing things while Satoshi was known to be sitting at a keyboard.”

Counter: Lopp assumed that posting comments to the internet in 2009 and 2010 required one to be “sitting at a keyboard” despite Jack being a prolific Blackberry user (since at least the year 2000) and later an iPhone user.

Lopp says that Jack can’t be Satoshi because on November 6, 2009 Jack tweeted “Late lunch with @fredwilson” and 5 minutes after that, Satoshi committed code to the Bitcoin SourceForge repository. I’m not sure what this is supposed to imply. Is it not possible that Jack was going to have a late lunch with Fred Wilson but committed code before heading out to do that? Lopp makes the assumption that Jack has to be sitting at the table with Wilson when the tweet is sent for this supposed conflict to be true. Lopp forcing whatever narrow meaning he wanted to tweets to fit his narrative and making the additional assumption that Jack could not post from a smart phone to the internet under the Satoshi name are the basis for his entire rebuttal. Not very good.

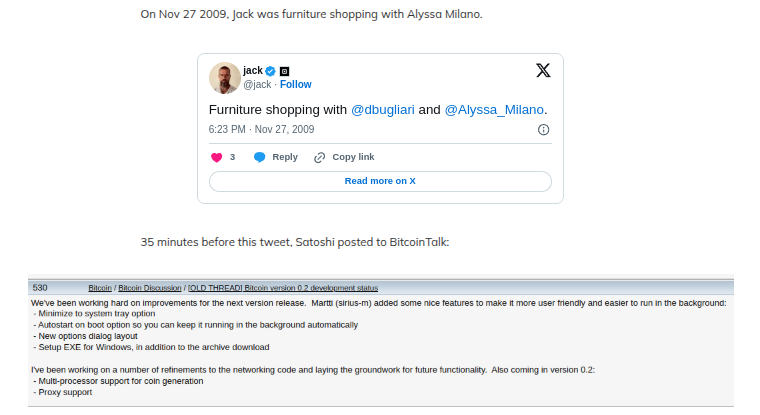

Lopp says that Jack can’t be Satoshi because on November 27, 2009 Jack tweeted that he was furniture shopping with Alyssa Milano and that 35 minutes prior to that Satoshi posted to the forum. Not sure what this is supposed to imply. Satoshi can’t post to a forum and then go shopping? Have people never posted to a forum and then gone somewhere afterwards? Would it not be possible for Satoshi to post to a forum from a phone even if it means he did it while shopping? Ironically, I’ve posted previously about the possibility of Alyssa Milano specifically being in on the Satoshi secret. Not very good.

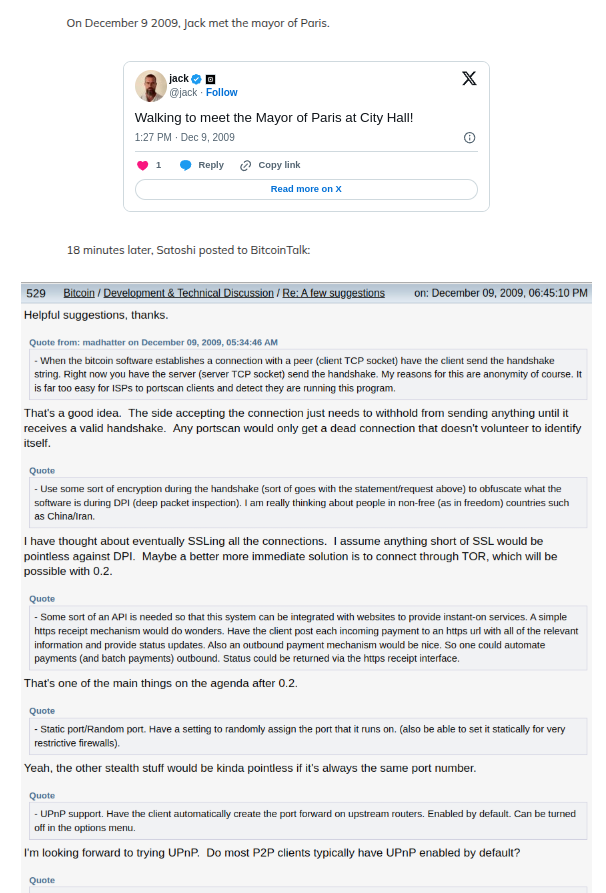

Lopp says that Jack can’t be Satoshi because on December 9, 2009, Jack tweeted that he was walking to meet the Mayor of Paris at City Hall (in Paris) and then 18 minutes later Satoshi posted to the forum. Lopp presumes that Jack was not capable of posting to an online forum while waiting at City Hall to begin the meeting. When did the meeting start? How long did he wait? People post online while they sit and wait for meetings. I have personally sat in government buildings and waited for meetings with officials and passed the time by posting to forums. Why is this considered to be impossible? Answering emails and posts is and was a commonplace thing to pass the time. Not very good.

Lopp says that Jack can’t be Satoshi because he attended a long company meeting on February 26 that ended at 10pm and Satoshi made posts on the forum at 6:17pm and 6:48pm. Okay? He couldn’t have posted before the long meeting? Pretty weak. Not very good.

Lopp says that Jack can’t be Satoshi because on May 20, 2010, Jack tweeted that he was in a car with his brother to go out to dinner with his family and 10 minutes later Satoshi posted to the forum. Was it Jack driving or his brother? Because if it’s his brother, then Jack can post from his phone to the forum while they’re driving. But if it’s Jack driving, then how is he also tweeting? Hmmmm…. Or did they get to the restaurant already and they are waiting and Jack is posting to the forum from the restaurant. I’m still lost on why Jack couldn’t post to a forum from his phone. Why are these things conflicts again? I myself was posting to forums from my phone in 2010. Not very good.

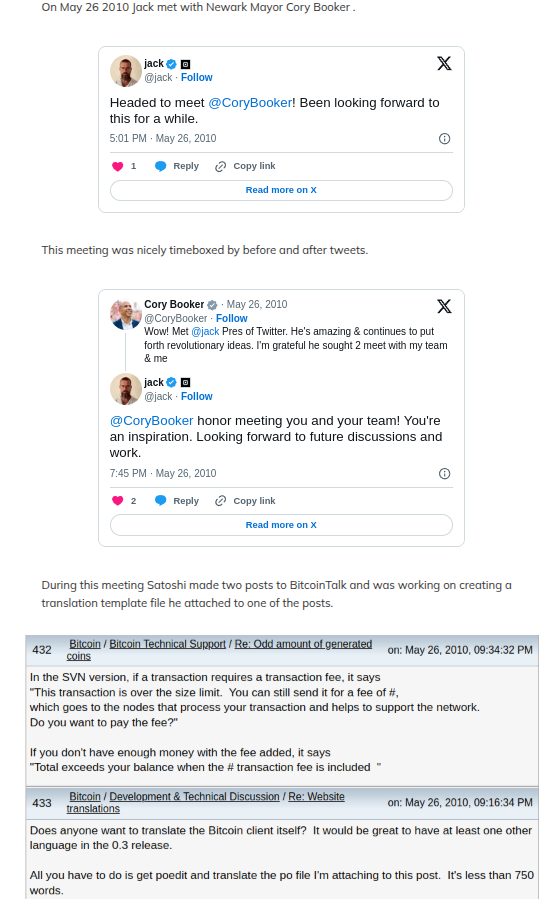

Lopp says that Jack can’t be Satoshi because on May 26, 2010 he tweeted that he was headed to meet Senator Cory Booker at 5:01pm and Satoshi posted to the forum at 5:16pm (with a file attached) and again at 5:34pm. Booker tweets at 7:32pm that he had just met Jack and Jack tweeted at 7:45pm that he had just met Booker. It seems like they actually met late then, perhaps around 7pm. Not sure why it’s considered impossible for Jack to say that he’s headed to a meeting and subsequently post to a forum (with an attachment) before actually being in the meeting itself, which doesn’t appear to have taken place for a while. Maybe Jack left later than he said he was leaving or maybe Jack got there and ended up waiting around for a very long time before the meeting and played on his phone and posted to the forum as people do when they’re bored. Not very good.

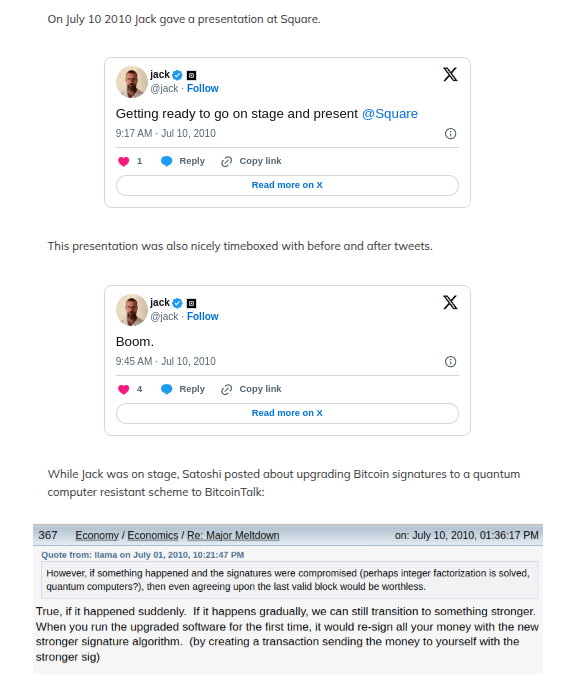

Lopp says that Jack can’t be Satoshi because on Saturday, July 10, 2010, Jack tweeted at 6:17am local time that he was getting ready to go on stage and present Square, followed by Satoshi posting four sentences to the forum at 6:36am local time, followed by Jack tweeting “Boom.” at 6:45am. (The screenshots says 9:17 and 9:45 respectively because they show my timezone) Lopp presumes that “getting ready” means that the presentation, which he believes to be at Square’s headquarters, was starting within minutes or seconds of that first tweet and that the subsequent tweet of “Boom” meant it was over. Satoshi posting in between these times therefore makes it impossible to be Jack.

This presentation was taking place at the Sun Valley Conference in Idaho, an invite-only event for major tech moguls. Jack was even at the Sun Valley on Ice show that evening. There is no evidence I have seen to suggest that “Boom” meant he had finished giving his presentation but Lopp needs us to believe that in order to create a conflict in the timeline to support his argument. Not very good.

Lopp points to the fact that Satoshi posted to the forum precisely during the short window that Jack was meeting with the President of Chile in Santiago on July 14, 2010. Satoshi posted at 9:10pm UTC time on the forum which would have been 5:10pm in Santiago.

Jack:

(1) says at 3:36pm that he’s on the way to meet him and that they will spend an hour together

(2) suggests that their meeting was already over by 5:03pm.

At 4:10pm a tweet goes out from the President’s account about their meeting. It does not confirm they are actually together yet even if it implies they are.

Satoshi posts to the forum at 4:25pm.

Jack signals the meeting is over with a tweet at 5:03. Satoshi posts at 5:10pm local time. While narrowly outside the perceived window, it is outside of it, and we don’t know when the meeting actually ended. It could have been over at 4:45, for example. A tweet at 5:03 doesn’t mean it ended at exactly 5:03.

It is well documented that Jack and the President met but it is not known for precisely how long. It could have been 10 minutes as these are how these things go, particularly with important figures like a head of state. Lopp takes the hour at face value and combines it with his belief that Satoshi did not have access to a cell phone in order to make his debunking work. Besides, couldn’t Jack have typed up his forum post prior to the meeting and then finally posted it after the meeting? Not good enough

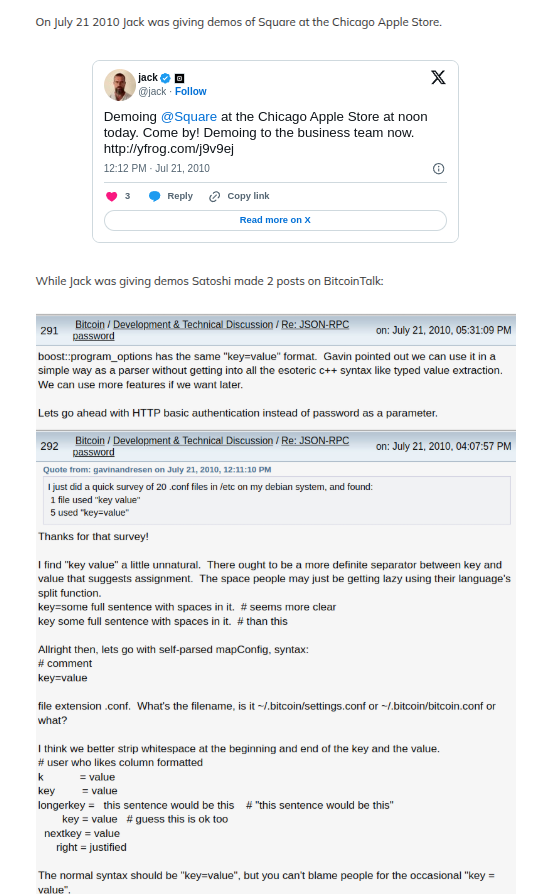

On July 21, 2010, Lopp says that Jack can’t be Satoshi because Jack was at an Apple Store in Chicago where his company was hosting a demo of Square starting at 12 noon all while the forum shows that Satoshi posted at 11:07am and 12:31pm local time that same day. I’m not sure why Satoshi being in a computer store would imply it would be impossible to post a message from a computer or from a phone. The more substantive post of the two that Lopp relied upon was the one that was made an hour before the demo. For this to be a conflict, it would require Jack to literally be doing a Square demo himself during the exact minute of 12:31 when Satoshi posted. Not very good.

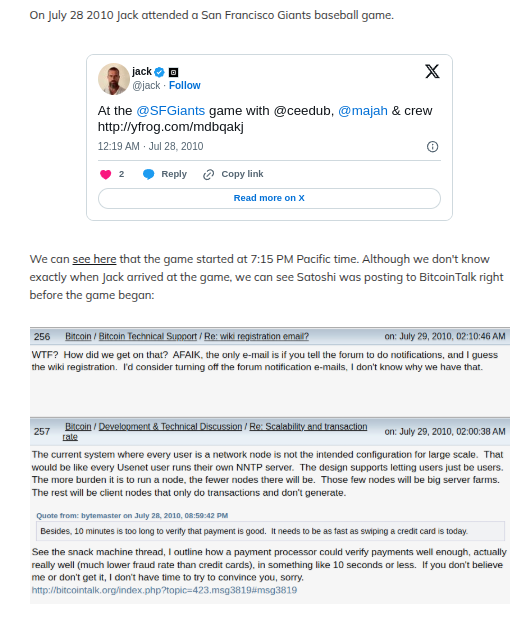

Lopp says that Jack can’t be Satoshi because on July 28, 2010, Jack was attending a baseball game while Satoshi was posting on the 28th. Unfortunately Lopp got the dates wrong. Jack was at the baseball game on the 27th, not the 28th, as evidenced by the 9:19pm PT tweet on July 27, 2010 that he uses as his evidence.

Lopp misread the dates.

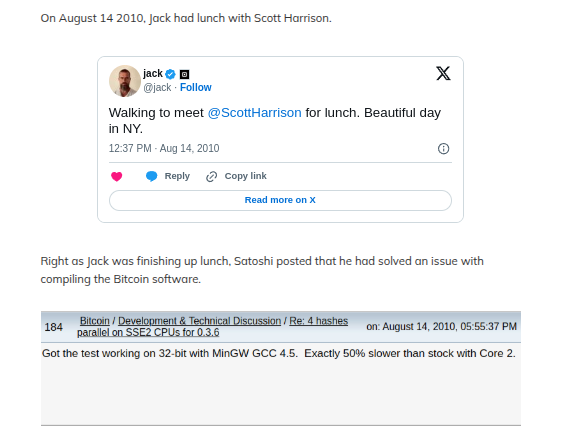

Lopp says that Jack can’t be Satoshi because he tweeted on August 14, 2010 that he was walking to meet with Scott Harrison for lunch and that an hour and 18 minutes later Satoshi posted two sentences on the forum that he had solved an issue with compiling the Bitcoin software. Ok? Which means what? Which means we have to presume that Satoshi had been busy doing this work exactly during the lunch time window and then rushed to post about it immediately to the forum? Satoshi couldn’t have solved it earlier and then posted it on the forum later when he got around to it like right after a lunch meeting? Not very good.

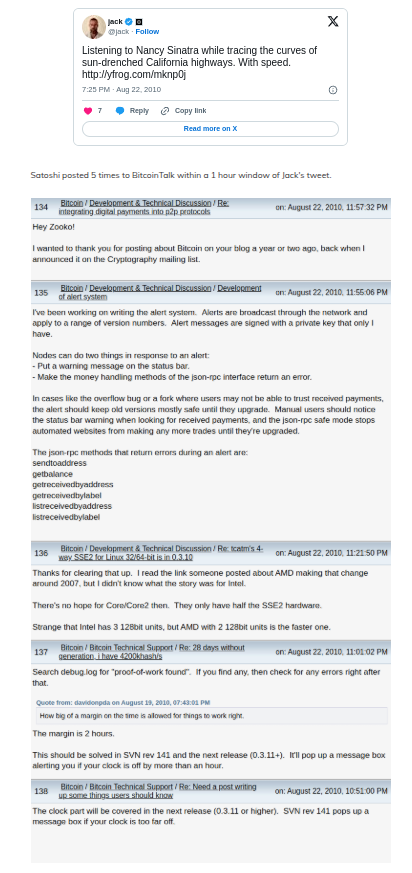

Lopp says that Jack can’t be Satoshi because he tweeted on August 22, 2010 at 4:25pm that he was listening to music while on the highway when Satoshi posted to the forum at 3:51pm, 4:01pm, 4:21pm, 4:55pm, and 4:57pm local time. I like this one to Lopp’s credit because there’s a link in Jack’s tweet to a purported photo of Jack behind the wheel looking out through the windshield. And so the argument here is that Jack can’t be posting to the forum because Jack is too busy driving! But we only know this because Jack is tweeting! And with a photo too? So if Jack is really driving, he is still apparently capable of taking a photo while driving and tweeting while driving, which hurts the case that he couldn’t also be capable of posting to the forum. Or there’s the possibility that someone else was actually driving and he was busy posting to the forum from his phone. Or… that Jack actually made that tweet about being on the highway hours or days after it actually happened. Or it never happened at all and it was online content for engagement or a dream of something nice. But if we give this one the benefit of the doubt and say Jack was really driving at that time, we can’t ignore that the evidence of him driving is a result of him playing on his phone while doing it. These “conflicts” are not very good at debunking Jack as Satoshi because they require leaps of the imagination

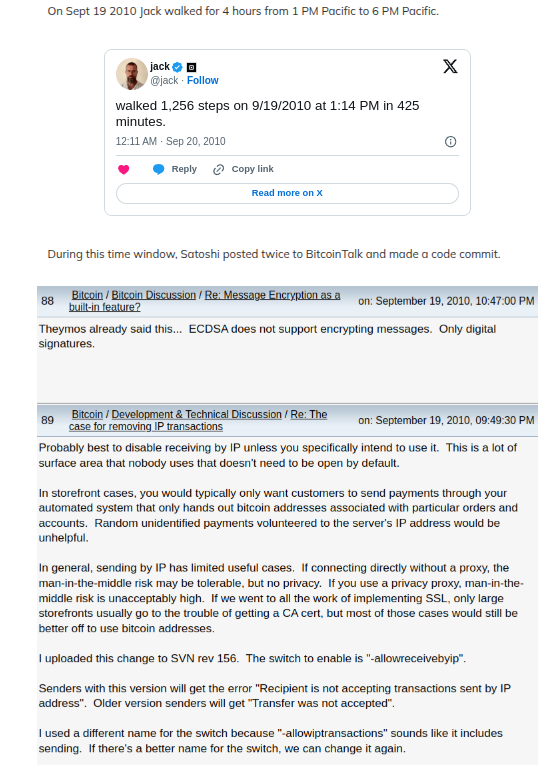

Lopp says that Jack can’t be Satoshi because he tweeted on September 19, 2010 that he walked 1,256 steps in the span of 425 minutes and that Satoshi posted to the forum twice during this time period and made a code commit. I did the math and it seems 1,256 steps is only 0.6 miles and 425 minutes is over 7 hours. This seems to actually support the theory of someone sitting around all day and builds on the case that Jack is Satoshi to make the code commit. Not very good and even supports Jack as Satoshi

Lopp: “I find the aggregate of all the evidence to provide so much doubt that a reasonable person would conclude that it’s far more likely that Satoshi was someone else.”

Counter: Try again.

‘Face-to-Face is a Must In This Industry’: How Julian Hernandez of Idea Financial Earned a Trophy Along The Way

November 24, 2025

“Face-to-face interactions are a must in our industry, and not only through conferences but even though we’re based out of Miami, I’m very familiar with the Long Island Railroad,” said Julian Hernandez, Director of Revenue at Idea Financial.

On multiple occasions, Hernandez has gone from New York City to eastern Long Island and then back again to meet with referral partners. It’s part of his job, meeting face-to-face with ISOs, and working with them to maximize the spread of Idea’s business line of credit products. He says through this experience he’s actually become “best buddies” with the LIRR.

“It’s good for morale, it’s good for relationships. It’s good not only for the reps internally on my end, but I’m sure for the reps on [the ISOs’] end to see and put a face to the lender that they’re always working with,” he said.

Hernandez will go wherever it’s necessary. Just last month that initiative placed him on the opposite side of the country, in a room full of ISOs and competitors that had gathered to play poker on the eve of the big B2B Finance Expo at the Wynn in Las Vegas. For Hernandez, who was born and raised in Colombia and only ever plays poker in a casual setting with friends, he had not gone in with any expectation of winning the friendly tournament. He wanted to network.

“That’s probably one of the main reasons why I wanted to join the tournament,” Hernandez said. “It’s just an opportunity for us, for anyone really that goes to the conference, to connect with either people that they know from the industry, or branch out or meet with new faces in an environment that isn’t so corporate.”

As the cards were dealt and the hands played, Hernandez found himself at the final table of the night and walked away with 2nd place overall, a title that garnered him a trophy and a small prize.

As the cards were dealt and the hands played, Hernandez found himself at the final table of the night and walked away with 2nd place overall, a title that garnered him a trophy and a small prize.

While he was happy to earn the rank of #2, it was the social setting of it all that he felt was the best part.

“It’s more of a relaxed environment where people are just having a good time, playing a game, having a drink, and really just getting to know each other on a personal level,” Hernandez said. “That’s the best kind of way to make relationships, right? It’s kind of like when people always say the best kind of business is made on a golf course.”

But in the two days that followed at B2B Finance Expo, Hernandez and the Idea team that was there along with him were in business mode.

“97% of our business is through ISO channels and through all the relationships we’ve established with brokers in our industry, and we’re looking to expand that further,” Hernandez said, noting that there are big growth plans in the works for 2026.

Idea’s line of credit is not like an MCA or the term loans commonly found around the industry. It’s a true revolving line. After every payment made, it replenishes the line. The process to get approved is quick and easy. Hernandez said that some brokers are shocked by how good it is and that larger businesses, ones that tend to be the most rate sensitive, find it very attractive.

Idea’s line of credit is not like an MCA or the term loans commonly found around the industry. It’s a true revolving line. After every payment made, it replenishes the line. The process to get approved is quick and easy. Hernandez said that some brokers are shocked by how good it is and that larger businesses, ones that tend to be the most rate sensitive, find it very attractive.

When deBanked first covered Idea Financial in 2019, Hernandez had not yet joined the company. He came on board the following year during covid and started in an entry level position. He’s since moved up the ranks and now oversees the entire sales and marketing department, which includes anything from ISO relations to marketing. He cites the team and the structure of how it operates as being the key to success. One of the things he first learned when he started was that Idea Financial was always looking to help businesses one way or another.

“I found my way to Idea Financial and have loved it ever since,” Hernandez said.

And while business and networking are important parts of the job, regardless of where that takes him, he is proud of how well he did in that poker tournament at B2B Finance Expo.

“I was happy with my 2nd place trophy,” Hernandez said. “It’s actually right there,” he exclaimed while pointing at it. “It’s back in my office!”

On The Ground at the Lexington Capital Grand Opening Ceremony

November 18, 2025 “Today, I would like to share three stories from my life and the journey of what it took to get here today. The first story is about love and loss. I was lucky. I found what I love to do early in life. That was being an entrepreneur.”

“Today, I would like to share three stories from my life and the journey of what it took to get here today. The first story is about love and loss. I was lucky. I found what I love to do early in life. That was being an entrepreneur.”

So began the speech made by Frankie DiAntonio, the Founder and CEO of Lexington Capital Holdings & Lexington Estates, at the ribbon cutting ceremony for the company’s new commercial property and headquarters in Port Jefferson Station, Long Island.

On the three acre plot with private parking and 16,000 square feet of office space, hundreds of people including 85 employees, their friends, families, and even funding partners, gathered to celebrate the next chapter of Lexington.

“I started my first company when I was 19 years old,” DiAntonio continued. “It was an auto repair shop. I was so excited about it, I told friends, family and the whole entire community. I did not know how to market or generate leads or even how to acquire customers back then.”

Between the live outdoor DJ, a busy food truck operator, and the cacophony of brokers trying to make or close a deal from their cell phone in the parking lot, the activity caught the attention of locals, including a representative from the town’s chamber of commerce who was eager to welcome them.

Between the live outdoor DJ, a busy food truck operator, and the cacophony of brokers trying to make or close a deal from their cell phone in the parking lot, the activity caught the attention of locals, including a representative from the town’s chamber of commerce who was eager to welcome them.

DiAntonio, who actually began the proceedings outside by playing the National Anthem, walked the crowd through his trials and tribulations of entrepreneurship, much of which had humbled him. Lexington Capital Holdings, however, a small business finance marketplace, has been a huge success four years after it started thanks to the people around him.

“Lexington did not get built by me. It got built by us,” DiAntonio said in his speech, “by every person who walked into my life at exactly the right moment, and standing here today opening the doors to this new home, I’m reminded of the biggest lesson the story teaches, the dots always connect, just not always in the moment. They connect when you look back, when you stand somewhere you once dreamed of, you realize every twist, every friendship, every failure, every blessing in disguise brought you exactly where you needed to be.”

DiAntonio attributed much to his sister Nicollete and old friends who are now key operators at the business. Several of them gave speeches.

DiAntonio attributed much to his sister Nicollete and old friends who are now key operators at the business. Several of them gave speeches.

“Working side by side with Frankie truly is a pleasure and an honor, something I look forward to on a daily basis,” said Lexington COO Frank Lewando during his speech. “He’s my best friend, my mentor and my brother, and I’m proud of him for making this big jump and pushing our company to the next level. I patiently wait to see what’s going on next for us. With the opening up of our first commercial property today, we find a new life and direction for the company.”

Inside the building, Lexington is split into different departments. Among others there are separate sales rooms for SBA lending and its new real estate business, Lexington Estates. Purely by observation, the average age of a “Lexonite” appears to be mid-20s. A few of them said off the cuff to deBanked that working at Lexington is the best thing that ever happened to them.

Inside the building, Lexington is split into different departments. Among others there are separate sales rooms for SBA lending and its new real estate business, Lexington Estates. Purely by observation, the average age of a “Lexonite” appears to be mid-20s. A few of them said off the cuff to deBanked that working at Lexington is the best thing that ever happened to them.

When the big moment was coming to an end, DiAntonio cut the ribbon and was presented with a giant gold key and certificate.

“We knew if we worked hard and we stayed true to each other that we would make it,” DiAntonio said in the lead up to the finale. “The first two years were really tough, and we had some really rough days together. Each day was a dog fight to stay in business. I wasn’t concerned about next year, next month or even next week. I just wanted to survive and advance to the next day. By the grace of God and our hard work and efforts, we ended up funding our first deal in our second month, just a domino effect after that. Our second month we funded $71,000. Our third month we funded $193,000. Our fourth month, $400,000 and modern day, we fund nothing less than $15 million every single month for small to medium sized businesses all across the United States.”

How Alexander Klein Took Home the Gold at B2B Finance Expo

November 14, 2025

“I‘ll be honest, I said to one of my co-workers that was there at the conference with us that ‘I’m going to win,'” said Alexander Klein, an ISO Rep at Simply Funding who did in fact win the official B2B Finance Expo 2025 poker tournament. “I said that a little bit facetiously but I think I had a chance.”

Knowing the odds were technically slim and fully cognizant that the annual conference in Las Vegas is really about business in the end, Klein and others made sure to use the opportunity of the poker tournament, at least initially, to socialize with the rest of the table.

“I focused directly on networking with people,” Klein said. “We’re talking sports, talking life, talking business, that was really where it was at the beginning.”

As he started to win some hands and players got knocked out, the tone changed and the table became more quiet and serious. Competitiveness took over. By the end of the night Klein was the last player standing. That made Klein the winner of a 1st place trophy and a B2B gold bracelet. It was his first tournament win and technically the first tournament he’d ever even played in.

Klein learned poker as a teenager and played in a few real games here and there, but that background was apparently enough to beat out some players at the table that played professionally on the side.

“People were immediately coming up to me, saying, ‘wow, I heard you won the poker tournament!’ Guys that were playing, guys that weren’t playing. It definitely got around a little bit and I got some nice connections through it,” Klein said.

And that’s really what it’s all about for someone in his position, the connections made in person.

“Seeing somebody face to face is the most genuine interaction you can possibly have,” Klein said. “You can show somebody that you’re actually serious, that you can actually provide the things that you’re talking about. It’s also just really about building the relationship, and I think you can only do that face to face.”

Klein said that conferences like B2B Finance Expo provide a critical opportunity to meet the right business partners and that it worked well for him and Simply Funding. It was also a good way to get back into the mix considering Klein had taken a hiatus from the industry during Covid and tried a different career path for a few years. Now he’s back. Having worked as a broker previously but working on the funder side these days, he said he appreciates the experience he earned before because he knows what his own ISO clients have to deal with.

One observation he’s made in that regard is that brokers want to see consistency with the funders they work with.

“[Brokers] don’t want to have a deal that is funded in a certain way and then a very similar deal is declined for whatever reason,” Klein said. “They want to see consistency. They want to see consistency in how efficient you are, how fast you respond, and the types of offers they’re getting on certain types of deals, consistency just in all aspects of the job. As long as you stay consistent in this industry, everyone will appreciate what you do, and you’ll also have better relationships and maintain those relationships.”

At Simply Funding, where his job is to bring in new business and work with current partners on deals, he believes they accomplish the consistency element well.

“I just work on helping our ISOs get the best possible deals, best possible offers, make sure everything’s efficient and running smoothly,” Klein said. Speed is also important, he added.

“I just work on helping our ISOs get the best possible deals, best possible offers, make sure everything’s efficient and running smoothly,” Klein said. Speed is also important, he added.

There’s also a mutual respect for the hustle where he says he finds himself and his colleagues working even faster than he had to as a broker to keep up the level of service. And this type of environment is one he wants to stay in for a very long time.

“I have found something that I feel is a great fit for me, that I can do well, and I see myself being able to do this for years to come,” Klein said. “I know there’s a lot of growth opportunity. The industry is only continuously growing, so there’s always more to do. I have that in my mind every single day. There’s always something more I can do. There’s something I can bring to Simply on a daily basis.”

Meanwhile, Klein’s B2B poker trophy currently resides on his desk in Simply Funding’s Jersey City office. He’s confident that it’s just the first of many.

“Shelf is going to go up, and we’re going to hopefully stack [the trophies] up,” Klein said. “That’s the goal.”

‘Like Family’: How Critical Financing Became One of the Fastest Growing ISOs

October 17, 2025When Farmingdale, Long Island-based Critical Financing (CFI) showed up as the 2,671st fastest growing company on the Inc. 5000 list this year, it was a testament to the company’s many years of hard work. Founded in 2017 by its CEO Brandon Garcia, CFI connects small businesses with a variety of unsecured working capital products.

“[Getting that recognition] was great,” said Garcia. “And I think it’s also a testament to the group that we have. It excites the people that work here too. This is a very stressful job, it’s not easy.”

In CFI’s day-to-day, the sales team finds itself competing against multiple companies on almost every deal that comes across their desks. Small businesses regularly put the pressure on them to get the best rate, the fastest funding, or a combination of both. They say this only increases their drive.

“It has definitely helped us in a way,” Garcia said of it. “I mean who doesn’t want a deal that doesn’t have competition, you can kind of take your time with it, right? But I think when there’s urgency, our guys perform better.”

In the very beginning it was just Garcia himself who had worked in the industry since 2012. He was soon after joined by a former colleague, Robert Menzel, and the two set off to really build up a company. That’s easier said than done, especially in a business where trust is paramount. So they looked within their own circle of friends and family to create a solid foundation.

“I felt it was best that we take care of our own,” Garcia said. “Let’s take care of people that we know that are looking for a new opportunity, and we train them the way that we want them to be trained. We want to give that experience and push it over to them.”

Among those they’ve brought on board to their current headcount of sixteen has been Garcia’s own mother, who works as the company’s head processor. And while they are still actively looking to bring on more people, Garcia said that the number of employees isn’t the ultimate metric of success, but rather the abilities of the ones you do have and the relationships they have with everyone else is the key. On this point, CFI is on pace to surpass $100 million in funding this year. It’s because of their continuous progress and results that they finally got the confidence to apply into the Inc. 5000 and were successful in making it.

“To be able to put that Inc. 5000 sticker in your signature, on the website, it just has a different swag to it,” said Garcia’s partner Menzel, “where it just carries a lot of weight, and even the merchants see that.”

When asked if the end goal was to become a lender themselves, both Menzel and Garcia say they’re happy with what they already do now, which is connect the merchants to the most appropriate source.

“While many competitors chase the close, we lead with transparency and real strategy,” Garcia said. “We act as consultants first. Even if a client doesn’t move forward with us, we want them to walk away smarter and more prepared than when they came in.”

“When you are a lender, you don’t really have that close relationship with other lenders because you’re your own lender,” Menzel said. “You’re not talking to them about deals, how to get deals done, ‘what are they doing? What did they change this month compared to what they’ve been doing, what’s working, what’s not.’ I think having those relationships with the lenders and the lenders’ reps, it’s huge and it makes the job fun, because they’re really all great people that we deal with.”

That closeness is what it’s all about for them.

“We are a group of people who genuinely care about each other,” Garcia said. “We’ve celebrated marriages and welcomed new babies. We hang out on weekends, show up for one another, and create a work environment that doesn’t feel transactional.”

The outcome of that are months where the company is exceeding $10 million a month in funding, and they’re now even more fired up after the Inc. 5000 placement.

“You don’t need this massive shop to be successful in this industry,” Garcia reiterated. “It’s really that simple. You just need the right people. You need to be loyal and just really be truthful with everyone. And good things happen. That’s a big thing for us.”