Related Headlines

| 12/26/2017 | SharpShooter Funding gives back |

Related Videos

Episode 39 - Moving to Miami, Scams, and Rap |

Stories

SBA ‘SmackDown’ In Linda McMahon, As Pick for Administrator Brings More WWE to Small Business Funding

December 8, 2016

President-Elect Trump’s pick to head the Small Business Administration is Linda McMahon, the former CEO of World Wrestling Entertainment (WWE). The publicly-traded company has produced many household names over the years, from The Undertaker to Bret “The Hitman” Hart to The Rock.

In a public announcement, Trump said “Linda has a tremendous background and is widely recognized as one of the country’s top female executives advising businesses around the globe. She helped grow WWE from a modest 13-person operation to a publicly traded global enterprise with more than 800 employees in offices worldwide.”

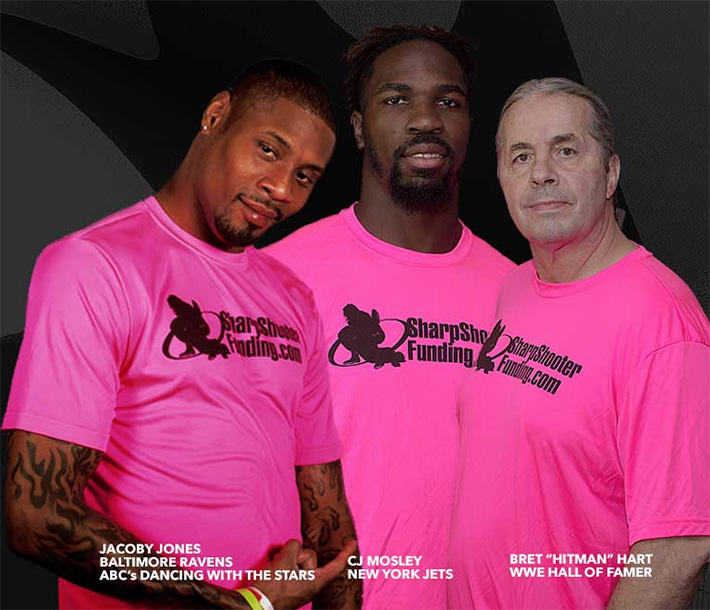

If confirmed by the Senate, McMahon will succeed Maria Contreras-Sweet, who has held the position since 2014 and has had a pretty open attitude about online lenders. The former WWE exec taking her place might find even more common ground with the non-bank finance community given that Bret the Hitman Hart is the official spokesperson for a merchant cash advance company.

Sharpshooter Funding in Canada, which heavily features Hart in their marketing campaigns, is affiliated with First Down Funding, a US-company that also does small business funding. A joint-company press release from earlier this year quotes Hart as saying, “When you sit down and listen to the whole format and how it provides money to much needed businesses and small business owners that need financial support and extra funding. It’s a worthwhile endeavor, and I’m actually very grateful that Paul Pitcher involved me with it so far.”

Meanwhile, McMahon says she is up to the task. “Our small businesses are the largest source of job creation in our country,” she said in an announcement. “I am honored to join the incredibly impressive economic team that President-elect Trump has assembled to ensure that we promote our country’s small businesses and help them grow and thrive.”

LendingMania might be just around the corner in 2017.

2019 Top 25 Executive Leaders in Lending – Canadian Lenders Association – Presented By BMO

November 11, 2019 The Canadian Lenders Assocation (CLA) received 124 nominations for these awards from leaders in lending across the country. The CLA’s goal is to support access to credit in the Canadian marketplace and champion the companies and entrepreneurs who are leading innovations in this industry.

The Canadian Lenders Assocation (CLA) received 124 nominations for these awards from leaders in lending across the country. The CLA’s goal is to support access to credit in the Canadian marketplace and champion the companies and entrepreneurs who are leading innovations in this industry.

The Top 25 finalists in this report represent various innovations in the borrower’s journey from innovations in artificial intelligence powered credit modelling to breakthroughs in consumer identity management using blockchain technologies. These finalists also represent solutions for a wide spectrum of borrower maturity and needs, ranging from consumer credit rebuilding all the way to senior debt placements for global technology ventures.

See The Leading Companies Report Here

See The Leading Executives Report Here

|

Mark Cashin

CEO of myBrokerBee | Ontario After a career in commercial finance and being CEO of Transpor, Mark Co-founded myBrokerBee a mortgage broker platform that provides transparency to private lenders and their clients. |

|

Avinash Chidambaram

CEO of Ario Platform | Ontario Through his experience as Product lead at Interac and Blackberry, Avinash has helped bring together an accomplished and talented group of experts in Data Science, Machine Learning, Security, Software Development to successfully develop this banking services software platform Ario. |

|

Evan Chrapko

CEO of Trust Science | Alberta Evan is the founder and CEO of Trust Science, a leader in organizing alternative credit data. As a saas founder and CEO, Evan has done over 500mm in startup exits. |

|

Kevin Clark

President of Lendified | Ontario Kevin is a recognized leader in the financial services industry with over 30 years of experience. Kevin has helped create the voice of Canada’s SME lending ecosystem through his leadership of Lendified and the CLA. |

|

Jerome Dwight

VP of Cox Automotive | Ontario Jerome established Nextgear Capital in Canada to become the largest specialty finance company in the automotive sector. Jerome is a Globe & Mail 40 under 40 winner and previously lead RBC’s international wealth management, private banking and asset servicing business. |

|

Saul Fine

CEO of Innovative Assessmer | Israel Saul is a licensed organizational psychologist and psychometrician, and a former lecturer in psychology at the University of Haifa. Saul is a global leader in the use of psychometric data for credit scoring and financial inclusion. |

|

David Gens

CEO of Merchant Growth | BC David is the Founder and CEO of Merchant Growth, which grew from its humble beginnings in his apartment to offices in both Toronto and Vancouver. David now leads one of Canada’s largest online small business finance companies. |

|

Bryan Jaskolka

COO of CMI | Ontario Nominated for the 2018 Mortgage Broker of the Year, Bryan Jaskolka is an expert in Canadian mortgage financing with a particular focus on the alternative lending space and mortgage investing. |

|

Peter Kalen

CEO of Flexiti | Ontario Peter is a leader in Canada’s retail financing market. Before founding Flexiti, Peter was in senior leadership positions at Citi, PC Financial, and Sears Canada. Flexiti was recently named #7 on the Deloitte Fast50. |

|

Yves-Gabriel Leboeuf

CEO of Flinks | Quebec Yves-Gabriel Leboeuf is the co-founder and CEO of Flinks. Under his leadership, Flinks has become a Canadian leader in banking data enablement. |

|

Derek Manuge

CEO of Corl | Ontario Derek, also known as the “the quant from Canada” is the founder of the data-driven venture firm, Corl. Corl is one of Canada’s leaders in the use revenue-share financing models. |

|

Keren Moynihan

CEO of Boss Insights | Ontario Keren Moynihan is co-founder and CEO of Boss Insights, a company that uses big data and AI to accelerate lending from months to minutes. With a Joint JD/MBA, Keren has a diverse background as a commercial banker, wealth manager and former founder of an impact startup. |

|

Jason Mullins

CEO of Goeasy | Ontario Jason is President and CEO of goeasy, a publicly listed consumer lender. Jason has lead the company to become one of the largest and most innovative lenders in the country. |

|

Paul Pitcher

CEO of SharpShooter Funding | Ontario After founding First Down Funding, an alternative lending firm for SMEs in Baltimore, Paul expanded his business to Canada through the subsidiary Sharpshooter Funding. |

|

Brendan Playford & Cate Rung

Co-Founders of Pngme | USA Cate, ex-Uber and Brendan, a blockchain and agro-finance entrepreneur are the co-founders of Pngme, an alternative lending platform for financial institutions in emerging markets who serve Micro, Small, and Medium-sized Enterprises. |

|

Wayne Pommen

CEO of Paybright | Ontario Wayne is the President and CEO of PayBright. Wayne is also a director of IOU Financial Inc and of HBC. Previously, Wayne was a Principal at TorQuest Partners, one of Canada’s leading private equity firms, and a management consultant with Bain & Company in the UK, the US, and Canada. |

|

Adam Reeds

CEO of Ledn | Ontario Adam is a pioneer and thought leader in the digital asset backed lending space. Ledn is focused on building innovative financial products in the emerging digital asset space, with a focused mission to help people save more in bitcoin. |

|

Adam Rice

CEO of LoanConnect | Ontario Adam has played a pivotal role in building one of the largest online markets in Canada for unsecured loans. |

|

Mark Ruddock

CEO of BFS Capital | Ontario Mark is an experienced international CEO with two successful exits and over 20 years of experience at the helm of VC backed technology and fintech startups. In 2019 Mark announced BFS Capital’s expansion to Canada with a new 50 engineer data science hub in the heart of Toronto. |

|

Vlad Sherbatov

President of Smarter Loans | Ontario Vlad Co-founded Smarter Loans in 2016 with the goal of helping Canadians make smarter financial decisions. Since then, Vlad has grown the platform into one of the go-to resources for Canadian borrowers. |

|

Steven Uster

CEO of FundThrough | Ontario Steven is the Co-Founder & CEO of FundThrough, an invoice funding service that helps business owners eliminate “the wait” associated with payment terms by giving them the power and flexibility to get their invoices paid when they want, with one click, and in as little as 24 hours. |

|

Dmitry Voronenko

CEO of Turnkey Lender| Singapore Dmitry, CEO and Co-founder of TurnKey Lender, holds a PhD in Artificial Intelligence. Dmitry was recently named SFA’s Fintech Leader of the year. |

|

Neil Wechsler

CEO of Ondeck Canada | Quebec Neil briefly practiced law before becoming President and CEO of Optimal Group Inc. where he grew the company from a start-up to a leading NASDAQ-listed self-checkout and payments company. Neil later co-founded Evolocity, which in 2019 became OnDeck Canada. |

|

Michael Wendland

CEO of Refresh | BC Michael has led Refresh Financial’s rapid growth since its founding in 2013, including a recent ranking of number 40 on Deloitte’s Fast 500. |

Canadian Lender’s Association Awards Leading Executives and Companies

November 11, 2019 Today the CLA announced the winners for its 2019 Leaders in Lending Awards. Highlighting the efforts of exceptional players within the fintech and alternative finance fields, the awards seek to “celebrate the industry and celebrate all the cool fintech things happening in Canada,” according to the CLA’s Strategic Partnerships Director Tal Schwartz.

Today the CLA announced the winners for its 2019 Leaders in Lending Awards. Highlighting the efforts of exceptional players within the fintech and alternative finance fields, the awards seek to “celebrate the industry and celebrate all the cool fintech things happening in Canada,” according to the CLA’s Strategic Partnerships Director Tal Schwartz.

Now in its second year, the Leaders in Lending Awards are split into two categories, with one focusing on the efforts of companies in the industry and the other on individual executives. 2019 will be the first year that the latter of these categories is incorporated. The awards will be imparted to their new owners at the Canadian Lenders Summit later this month, where a special prize will also be given to one winner from each category.

Among the winners in the first category are Borrowell, IOU Financial, and Michele Romanow’s Clearbanc. While making an appearance in the second category are David Gens of Merchant Growth, Paul Pitcher from SharpShooter Funding, Smarter Loans’ Vlad Sherbatov, and Kevin Clark from Lendified.

The criteria for the awards were based upon three tenets, these being a commitment to the “use of advanced fintech solutions” to solve challenges in the lending process, the “implementation of new or innovating lending strategies or business models,” and evidence of successful outcomes following the implementation of new fintech or a new business model.

When asked about possible expansions to the awards in the future, Schwartz was receptive to the idea of covering more ground with the prizes, saying “I definitely think we’ll expand the categories.” Mentioning that there’s a host of niches that are worth highlighting, such as blockchain, psychographic credit scoring, and credit rebuilding, which deserve their day in the sun.

“We have a mandate as a trade group to celebrate the industry,” emphasized Schwartz. And that celebration will be taking place on November 20th at the Canadian Lenders Summit in Toronto.

How Business Financing Has Changed

October 22, 2019 The first thing small business owners think about when deciding to take on funding to grow their business is the ten-year, 3% bank loan that was the standard ten to twenty years ago. The application and approval process was much slower, and if a borrower didn’t fit the mold that mainstream lenders were looking for, approval was difficult. Today, the business loan landscape has changed, and alternative financing methods have captured much of the market. Small business owners who can’t get approved by the banks have access to the funding they need to grow and expand their businesses.

The first thing small business owners think about when deciding to take on funding to grow their business is the ten-year, 3% bank loan that was the standard ten to twenty years ago. The application and approval process was much slower, and if a borrower didn’t fit the mold that mainstream lenders were looking for, approval was difficult. Today, the business loan landscape has changed, and alternative financing methods have captured much of the market. Small business owners who can’t get approved by the banks have access to the funding they need to grow and expand their businesses.

The technology that these alternative lenders use has made small business lending more accessible. Applications are online, underwriting techniques are fine-tuned and often times quicker, and borrowers get personalized offers and service.

More money is going out and more business owners are getting approved.

Changes in loan accessibility

Increased loan accessibility has resulted in more loans, but what does this mean for small business owners? And what are the risks to small business funders?

While alternative lending has opened up more doors for small business owners, as both the industry as a whole and individual lenders move faster, so increases the risk of people taking advantage of the system. Twenty years ago, fewer lenders meant that business owners had fewer options, but on the flip side, it meant that lenders didn’t need to worry as much about dishonest borrowing practices.

Increased competition pushes more lenders to approve more loans faster than ever. After all, if one lender won’t, another may, and the competition is just a Google search away. Unfortunately, this has also resulted in more opportunities for both borrowers and salespeople to take advantage of the system, and one of the largest risks to small business funders and small business owners alike is loan stacking.

What is loan stacking?

Loan stacking is used to refer to borrowers who take out multiple loans from multiple sources within a short window of time without thinking of their business’s long term health, due to the speed and efficiency that the funding occurs in, most business owners do not think twice as it becomes easy to obtain funding. Typically this situation occurs when a borrower can’t get approved for the total amount of money they need, or when a borrower is promised better rates at a future date by accepting the first offer from an overeager salesperson. The biggest red flag for all small business owners is when a promise is made without it being put in writing. If the funder or lender is not willing to put future promises on paper then steer clear of any future funding dealings.

Who is the culprit?

While some small business owners that cannot qualify for the full amount of cash they need may instead obtain multiple smaller loans to satisfy their requirements, others have more malicious intentions. Some borrowers take on funding for their business intending to use those funds for non-business related expenses. Whether it’s to go on vacation, pay down debt, or make a large purchase, this type of loan stacker may not fully understand the consequences of taking on more debt than their business can comfortably handle. During the funding verification calls, prior to funding, any mention of outside use for the funding can have a lasting effect on future funding relations.

An owner whose business is about to go under is another common offender. These borrowers make the decision to accept multiple funded deals, knowing that their business is at the end of its life, take the cash, close their bank accounts, and often declare bankruptcy, leaving the lender with no way to collect.

Finally, a small business owner may choose to lie to the lender about the purpose of the loan, thus convincing the lender to approve them for additional funding. A business loan to help with a larger long term project, like opening a new location that will bring increase revenue. But, when a borrower lies to a lender to get additional funding and thereby stacks loans on top of loans, this can become an issue.

While the borrower is often the offender, this isn’t always the case. Some brokers and salespeople prey on potential borrowers by employing aggressive and unethical sales tactics. “Baiting the borrower with a promise of a better rate down the line, but more importantly offering terms of approval that are unrealistic is a recipe for disaster. It is perfectly fine for any funder or lender to customize approvals to gain long term business relations, but to purposely or viciously offer unrealistic terms in the future, creates a need for a “Small Business Funding Code of Ethics”. Long term funding relationships are created with trust, transparency, and willingness to meet halfway. With the right Code of Ethics in place, the entire Small Business Funding industry can shine above all other financing,” explains Paul Pitcher, managing Partner at First Down Funding and SharpShooter Funding. Often these borrowers have just taken on a loan, probably for less than they had originally wanted, and the prospect of additional funds is quite appealing. The problem is that this often leaves the borrower overstretched, putting all parties at risk.

Understand the risks & signs

Business owners who stack loans are not only affecting the lenders they obtain funding from but are putting both their personal and business finances at risk. “Every business owner must analyze their 30, 60, and 90-day cash flow in order to better serve the purpose and total cost of capital for all rounds of funding” explains Pitcher.

Chances are if a lender doesn’t approve a business owner for the full amount they wanted, it’s because their finances can’t handle more and the lender did not want to put the business in a difficult position. After all, it is in the best interest of the lender for the small business to succeed.

In many cases, a business owner could be personally liable for their debt. However, aggressive brokers looking to quickly cash in on loans commissions put lenders at risk as well. Therefore, funders need to be wary of both deceptive business owners and lenders.

Prevention

When it comes to prevention, most lenders benefit from a three-pronged approach; a strong underwriting system, helpful consumer education, and open communication with the competition. “The most important part of funding deals day-to-day is the strength and volume of business and personal references. When the inner circle of the business owner vouches for them positively, 99% of the time, the deal can fund cleanly and perform,” explains Pitcher.

A strong underwriting system and a solid set of procedures can help lenders make sure they don’t unknowingly enter into a cycle of loan stacking. Experience plays an important role, but if you have a strong understanding of what you’re looking for and perform the appropriate amount of due diligence, you should be able to prevent the majority of loan stacking. Nevertheless, most small business funders already have such systems in place and yet loan stacking is continuously growing problem.

An informed applicant becomes a great borrower. Dealing with a frustrated business owner who can’t get approved for the full amount they want, is never fun. But, educating them about why they can only qualify for a certain amount is a key component in preventing loan stacking and ensuring a borrower isn’t taken advantage of. “The first impression a funder gets from an owner, a hand-signed and dated application, and the organizational skills needed to send over prepared financials and bank statements, can say a whole lot about the business owner’s interests, intentions, and overall health. The more rushed we feel, the less likely we will want to work with that said business,” explains Pitcher.

Finally, chatting with your competition might not seem like a great idea, but maintaining open lines of communication with those in your industry can help spot loan stacking schemes before they get out of hand. Trade shows and other industry events are a good place to network and meet other industry stakeholders.

Closing

Running a small business takes time, persistence, passion, and money. This is why small business owners need funders to be on their side of the court.

Educating and providing borrowers with useful information at the right time can help reduce the risk of loan stacking and helps to maintain healthy accounts.

Spotlight on deBanked CONNECT Toronto

July 30, 2019 As the heat of the Toronto sun split the stones outside, the crowd inside the Omni King Edward’s seventeenth-floor Crystal Ballroom mingled and munched as part of deBanked’s most recent CONNECT event.

As the heat of the Toronto sun split the stones outside, the crowd inside the Omni King Edward’s seventeenth-floor Crystal Ballroom mingled and munched as part of deBanked’s most recent CONNECT event.

The first of its kind to be held in Toronto, the CONNECT series are half-day events that take place in both San Diego and Miami as well. Despite not being as established as the latter two, Toronto proved just as eventful, with a variety of speakers and topics broached, as well as a host of attendees from differing backgrounds making an appearance. It was par for the course for an inaugural deBanked show with the attendance figures being reminiscent of deBanked’s first ever event in the USA, a market that’s 10x the size.

The day was kicked off by entrepreneur, a dragon on the Canadian Dragons’ Den series, and co-founder of Clearbanc, Michele Romanow, whose anecdotes detailed the adventures that accompany the beginning of a startup. Regaling the audience with the story of Evandale Caviar, Romanow began with telling the room of a post-college venture that saw her working tooth and nail to secure a fishing license, studying YouTube fish gutting tutorials that were exclusively in Russian, and getting her hands dirty with the other co-founders when the time came to put their time spent online to use.

But it wasn’t all blood and glory for Romanow, as the tale shifted from one of youthful expansion to one of reflection and acceptance of the unknown. Speaking on the effect of tech giants in various fields, Romanow explained that “we have no idea of how these industries will shape out.” The likes of Uber and AirBnb never planned change the world, just to change a product and thus solve a problem, and their meteoric rises are unpredictable as a result. Iteration, rather than innovation, is what drives a company forward according to Romanow.

But it wasn’t all blood and glory for Romanow, as the tale shifted from one of youthful expansion to one of reflection and acceptance of the unknown. Speaking on the effect of tech giants in various fields, Romanow explained that “we have no idea of how these industries will shape out.” The likes of Uber and AirBnb never planned change the world, just to change a product and thus solve a problem, and their meteoric rises are unpredictable as a result. Iteration, rather than innovation, is what drives a company forward according to Romanow.

And this sentiment was brought further along with the following panel, which featured Vlad Sherbatov of Smarter Loans, Paul Pitcher of SharpShooter Funding, and SEO expert Paul Teitelman, speaking on the trials and novelties of the sales and marketing scene. Offering wisdom on various aspects of the field, the three men covered the need to go beyond the traditional forms of advertising, instead looking outward towards unorthodox methods of marketing; the hardships that come with the grind of a sales job; and the role that SEO can play when raising public awareness of your company; respectively.

“It’s a matter of spreading the word,” one conference goer noted when asked about the sales panel afterwards. “Businesses have to know who we are, and we’re working on that.”

“It’s a matter of spreading the word,” one conference goer noted when asked about the sales panel afterwards. “Businesses have to know who we are, and we’re working on that.”

Similarly, Martin Fingerhut and Adam Atlas discussed the existing legal topics of note to Canadian alternative financing companies, as well as those incoming rulings that may be worth knowing about. Covering both the English-speaking provinces and Quebec, the duo gave a comprehensive crash course on the legal landscape of the industry, highlighting laws unique to the regions. Aaron Iannello of Top Funding considered the talk to be particularly engaging, commending it for relaying information that might otherwise be unknown to American companies.

Following this, Kevin Clark, President of Lendified, took to the stage to talk about the importance of the Canadian Lenders Association (CLA). Saying that in the absence of a regulatory body, the CLA seeks to offer guidance to those companies who are looking for it. Clark asserted that “it’s a good thing for our industry to have oversight from a regularly body,” and that he looks forward to the day when one is established.

Following this, Kevin Clark, President of Lendified, took to the stage to talk about the importance of the Canadian Lenders Association (CLA). Saying that in the absence of a regulatory body, the CLA seeks to offer guidance to those companies who are looking for it. Clark asserted that “it’s a good thing for our industry to have oversight from a regularly body,” and that he looks forward to the day when one is established.

And before wrapping up the speakers for the day, Clark was joined by IOU Financial’s President, Robert Gloer, to discuss contemporary risk management. Covering everything from the next recession to the emergence of AI, the pair, which accumulatively have been in the industry for decades, offered knowledge learnt from years of experience in both the pre- and post-crash eras.

And the prophesizing of what will be the next big episode to shake the industry continued beyond the day’s scheduled agenda as many attendees continued on well into the evening at smaller networking functions offsite.

As the sun started to touchdown on the tips of Toronto’s skyscrapers, the salvo of excited conversation briefly harmonized to produce a singular axiom, that there was an abundance of opportunity in Canada.

“You Can’t Stay Static”: Paul Teitelman and the Building of an SEO Firm

June 30, 2019

How does someone become an SEO expert? How does someone found a successful SEO consultancy firm? For Paul Teitelman, his road to SEO mastery and independence started by admitting he knew nothing about the industry.

How does someone become an SEO expert? How does someone found a successful SEO consultancy firm? For Paul Teitelman, his road to SEO mastery and independence started by admitting he knew nothing about the industry.

Beginning in the late noughties, following his graduation in Marketing Management from Dalhousie University, Teitelman went to an Interactive Advertising Bureau job fair, pitched himself to his soon-to-be boss, and replied, “No! But I’m your man. I’ll learn it all,” when asked if he knew anything about SEO.

Thus began his tenure at Search Engine People, one of Canada’s first Search Engine Marketing companies. Here he entered as a Link Ninja and learned the trade by implementing SEO campaigns for both Fortune 100 and 500 companies as well as for local businesses. From this, he advanced to a managerial position, in which he led teams of SEO specialists who were responsible for ensuring clients would appear at the top of Google search pages. And then, in 2011, Teitelman left Search Engine People to make his own way, becoming the CEO and founder of his self-titled, Toronto-based SEO consultancy firm.

How did the move to independence pan out? Well, as of June 2019 he has hired his 25th employee, his team is kept busy servicing the needs of clients, and he experiments with pioneering SEO strategies and theories within his own blog network. Claiming that his firm offers “the best of both worlds” as a result of him having worked on both ends of the SEO spectrum, Teitelman explains that clients benefit from his offering of the transparency, promptness, and directness that are inherent with small firms; and that he reaps the reward of an agency price tag, a perk that comes with producing consistently successful SEO work.

When asked about how others could follow in his footsteps, he said, regardless of the industry, whether you’re an SEO expert or broker, that “you can’t stay static.” Emphasizing the necessity of having foresight when you leave your old job, Teitelman notes that entrepreneurs need to stay ahead of the curve of trends, be that an update to Google’s search result algorithm or a niche opening in the alternative finance market. As well as this, Teitelman highlighted the importance of being secure in that knowledge that when you leave to make it independently you will have a list of clients to take with you, who’ll keep you from leaving yourself high and dry.

When asked about how others could follow in his footsteps, he said, regardless of the industry, whether you’re an SEO expert or broker, that “you can’t stay static.” Emphasizing the necessity of having foresight when you leave your old job, Teitelman notes that entrepreneurs need to stay ahead of the curve of trends, be that an update to Google’s search result algorithm or a niche opening in the alternative finance market. As well as this, Teitelman highlighted the importance of being secure in that knowledge that when you leave to make it independently you will have a list of clients to take with you, who’ll keep you from leaving yourself high and dry.

And much like how the merchant cash advance scene in Canada has seen an increase in both interest and product knowledge amongst customers over recent years, as has SEO. Subject to myth-making and conjecture as a result of its technical lingo and specialized nature, SEO has long been the victim of misunderstanding according to Teitelman, who says those who are curious about the service “shouldn’t believe everything they read on the internet.”

Going on to say that “the more education customers get, the more exciting the industry becomes,” it’s clear that Teitelman is looking forward to the future of SEO. Time will tell if his offer back in 2008 will be matched by interested industries, curious about the possibilities that SEO promises and willing to “learn it all.”

Paul Teitelman is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SharpShooter Funding Managing Partner Paul Pitcher.

“Do It Better Than How You Learned It”: How Paul Pitcher Came To Be In Canada

June 27, 2019 Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Growing up in Annapolis, Maryland, the Managing Partner at First Down Funding and SharpShooter Funding studied at Severn School and immersed himself in sport. Under the eye of his father, Pitcher began playing basketball and baseball at the age of 4. Golf came later, and it followed him into his young adult life as he played at a collegiate level while enrolled at the University of Tampa, where he studied International Marketing and Finance. And upon graduation, Pitcher landed a job in Washington D.C., working in sales for the Washington Wizards and Capitals.

Sports accompanied him in each phase of his life, so it comes as no surprise that it is entwined with his current business ventures.

After leaving the Regional Sales Manager position he held with the Wizards and Capitals, Pitcher became a broker, eventually establishing First Down in 2012 – seeing it as a solution to a problem many business owners across the country face: acquiring capital. Offering funds via merchant cash advances, First Down provides financial aid to small and medium-sized businesses.

And after enjoying success in the United States, lightning struck on June 6th, 2015. Out of the blue, over 25 Canadian business owners applied for funding from First Down. Chalking it up to ads First Down had placed across social media, Pitcher decided to dive into the new, northern market, but only after consulting with the only Canadian he knew, WWE Hall of Famer Bret ‘Hitman’ Hart.

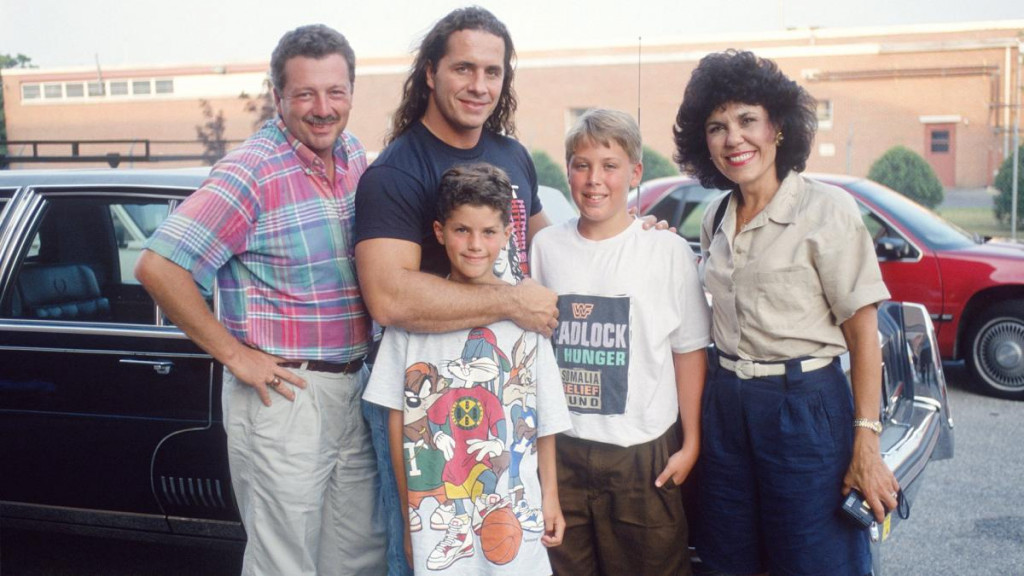

Having met the wrestler in 1993, Pitcher gambled on Hart remembering the 10-years-old kid in the Looney Toons t-shirt that he took a photo with two decades ago. And it paid off. Following discussions of what First Down did and how it met the needs of the Canadian market, Hart partnered with the company and now serves as commissioner to SharpShooter, the Canadian arm of First Down.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

Noting that the spirit and culture of sport has definitely bled into First Down and SharpShooter from both his own personal life as well as the lives of those athletes that are partnered to it, Pitcher affirms that healthy competition is integral to both sport and business.

Believing that it’s just as important to win as it is to develop the environment you are in, Pitcher is in the funding market for the long-run. And it is exactly this that attracts him to Canada. Comparing it to Baltimore in his home state, he sees the Great White North as a region that is less saturated with funding firms like you would find in New York or Chicago, in other words, he sees it as a place of opportunity, where there is room to grow.

Of course, with such opportunity there are growing pains, like the populace’s level of product knowledge as well as the building of trust between business owners and SharpShooter, but Pitcher welcomes it. Emphasizing his love for competition, he calls for more firms like his to enter the market, be they big or small, as according to him, it could only help build upon the culture of non-bank funding that has taken root in Canada.

“Whatever you do, do it better than how you learned it,” are among the final words Pitcher leaves me with, and with the other closing remarks hinting at further expansion beyond Canada, the Managing Partner seems to be living by this maxim. Be it the education he picked up in Tampa, the lessons learnt in sales, or even a chance encounter with a childhood hero, Pitcher appears to be aiming to continually build and expand upon what he has experienced.

Paul Pitcher is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SEO Consultant Paul Teitelman.

Canadian Merchants Show An Appetite For Capital

November 25, 2017In Canada, the average deal size for a merchant is anywhere between $20,000 and $30,000 in funding, depending on who you ask. That’s why when one startup recently funded a $300,000 CAD advance from its balance sheet to a Canadian merchant, the deal turned some heads. While it’s unclear whether this amount could be indicative of a trend unfolding at our neighbors to the North, Canadian small businesses are preparing for some changes in the industry landscape in 2018.

SharpShooter Funding, whose name depicts the famous wrestling move of the WWE’s Bret “The Hitman” Hart, was behind the $300,000 deal with an Eastern Canadian grocer.

If you’re wondering how a merchant funder and WWE legend became partners, chalk it up to a combination of fate and timing. Paul Pitcher, SharpShooter Funding managing partner, has been Hart’s biggest fan since he was a kid. Pitcher got the opportunity to meet his hero when was just 10 years old. It was then that the green shoots of friendship formed, and today the WWE’s Hart is acting commissioner of SharpShooter Funding, having helped to launch the business.

Canadian Merchant Landscape

To get a taste of the Canadian merchant financing landscape, consider that the three top Canadian funders deploy $20 million and $25 million per month combined, explained David Gens, president and chief executive of Merchant Advance Capital, which is included among the top three funders. That’s up from a range of $15 million to $20 million earlier this year.

And while a $300,000 advance may not seem like something to write home about for U.S. funders, it’s a big deal in the Canadian market. The culture among small businesses in the Great White North is different and more conservative than their US counterparts.

“It’s a function of the size of the merchant,” Gens explained. “The typical single-location storefront merchant is going to qualify for $30,000 to $50,000. It takes a larger and more established business, whether it’s a multi-location merchant or a business that is in the B-to-B space, a manufacturer, distributor or wholesaler to be large enough to qualify for large financing.”

Meanwhile there are some changes to small business taxation that are coming down the pike that may influence demand for credit, Gens noted, though the precise shape any changes to the tax law will take remains unclear.

“They will reduce the small business taxation rate on the face of it. But for businesses where they hold cash or need to hold cash, it’s a gray zone as to whether or not they will be able to hold financial assets in those businesses. The government is going after companies that are holding investments. But there’s a gray line as to what is a holding company that is holding an investment and an operating company holding a buffer because of seasonality or cyclical demand. We have yet to see what the rules end up being exactly,” Gens said.

Anatomy of the Deal

In the case of SharpShooter Funding, the grocer merchant originally came to the funder for less than $300,000 but qualified for more, bringing the funder’s tally for a single day’s deals to more than $500,000.

“We never thought we’d hit this milestone in the Canadian market. But the file was right, and the timing was great,” Pitcher told deBanked. Now that they’ve gotten a taste of it, SharpShooter Funding hopes to do more deals of this nature. “For a small funder like us to double the size of a big funder was a big moment for us, especially in the Canadian market,” Pitcher said.

Merchant Advance Capital’s Gens said his company is prepared to take on the risk for deals at even a higher threshold. “Our average is $35,000 to $40,000, and the largest deal we’ve ever done was $600,000. I don’t want to steal their thunder, but there have been larger deals,” said Gens. “A few funders may syndicate when deals get that big, but it’s not an inconceivable size.”

OnDeck, which similarly has Canadian operations, lends up to $250,000 CAD in Canada. OnDeck has extended more than $7 billion in online loans across 70,000-plus customers across the United States, Canada and Australia.

As for SharpShooter Funding, Pitcher said the funder has been on the sidelines for larger deals because they don’t want to grow too fast. He’s been turned off by other funders doing deals within a couple of months of launching and then being forced to close their doors.

“Our capital has always been strong. It’s not that we can’t afford to lend larger amounts. It’s because we want to make sure we’re doing it right from the start,” Pitcher said, adding that SharpShooter Funding has only had its doors open in Canada since June 2015, though its corresponding U.S. business, First Down Funding, has been around since 2012. “It’s been a work in progress, and I love every day of it! We’re only getting started, and I am 100% excited for the future,” he said.

The Canadian grocer reached out to SharpShooter Funding in response to Google advertising. The affiliation with the Bret Hart association didn’t hurt. Pitcher explained there is a seasonality tied to the merchant’s business, evidenced by a couple of months or more each year in which revenue is spotty, that made the grocer unattractive for banks to fund. “That’s why those sized deals are difficult to put out and banks won’t put out, because of seasonality,” Pitcher said.

SharpShooter Funding was not deterred by that. “We were really able to gain in-depth trust and visibility into this merchant from the first call to the last call. There was never a problem with him mixing up stories. Just the honest truth. From his references to his landlord, everyone involved made it clear he was here to work with us and not to play games,” Pitcher said.

Pitcher was impressed by the business owner’s work ethic. “He’s a roll-up-your-sleeves entrepreneur who didn’t borrow $1 million from his father. No bank loans. Six years ago, he rolled up his sleeves and made it work. Now he’s in a situation where banks won’t lend to him. But we will,” he said.

The merchant’s bank statements also made sense to the funder given their consistency, predictability and transparency. “Whenever we ask for finances from someone and that merchant can get them to us in an organized fashion in less than an hour, it speaks wonders. It means they’re honest and ready to play ball. And that’s what we want,” Pitcher exclaimed.

The merchant plans to use the capital for an expansion into a new food product line. If he pays off the advance early the funder will lower the rate.

See Post... sharpshooter funding, thinking capital... |

See Post... sharpshooter funding?... |

See Post... sharpshooter funding... |