Archive for 2021

NYC Taxi Workers Block Brooklyn Bridge, Demand Debt Forgiveness

February 11, 2021 Taxi drivers demanding Medallion debt forgiveness briefly blocked the Brooklyn Bridge Wednesday. The protest, organized by the 21,000-member strong New York Taxi Workers Alliance union (NYTWA), was a release of fury over the astronomical debt they have faced during a global pandemic that has cut ridership by 80%.

Taxi drivers demanding Medallion debt forgiveness briefly blocked the Brooklyn Bridge Wednesday. The protest, organized by the 21,000-member strong New York Taxi Workers Alliance union (NYTWA), was a release of fury over the astronomical debt they have faced during a global pandemic that has cut ridership by 80%.

“Debt forgiveness now,” chanted Union Founder Bhairavi Desai through a megaphone, leading the drivers in a chant. That’s a lot of debt: To get a city-licensed taxi medallion, drivers had to pay inflated prices, up to $1.3M in 2014, before the advent of rideshare apps crashed prices to a fraction of what they were worth.

We shut down the Brooklyn Bridge because only direct action will get us what we need: medallion debt forgiveness now! pic.twitter.com/kmbQlBrOO3

— NY Taxi Workers (@NYTWA) February 10, 2021

In 2021, thousands of taxi drivers are paying up to $600,000 in debt on medallions that are only worth $120-$150k. Last year, Desai testified before the State House Financial Services Committee that Confessions of Judgment were used extensively to take hundreds of thousands in debt from the pockets of taxi drivers.

The day of action started with a gathering of union members at the mayor’s office at 9 am before senior members (62 yo+) testified that the medallion crash stole retirement savings at a City Council Committee on Immigration.

Dozens of taxis then formed a motorcade, blocking the bridge before gathering at the Park Slope home of Senator Chuck Schumer, Democratic Majority leader of the Senate, who NYTWA said is leading negotiations over the stimulus bill.

Protestors could be seen across from the north entrance to Prospect Park to encourage Schumer’s support to push bill H.R. 5617 through Congress. The Taxi Medallion Loan Forgiveness Debt Relief Act will eliminate the need to pay taxes on outstanding medallion debt, the NYTWA website states.

The union also calls for the leveling of taxi medallion debt to $250k per medallion. NYTWA holds that the city helped inflate medallion prices and should assume the leftover debt. The New York Times and Post reported a bailout of that size could top $500M.

Broker in Early Twenties Builds MCA Business in Less Than Three Years

February 10, 2021 Davron Karimov, a 22-year-old MCA broker, went from $10k in debt to collecting $200k a year in commissions. It took less than three years, and Karimov shared his journey on his personal, sometimes chaotic, yet always informative YouTube channel.

Davron Karimov, a 22-year-old MCA broker, went from $10k in debt to collecting $200k a year in commissions. It took less than three years, and Karimov shared his journey on his personal, sometimes chaotic, yet always informative YouTube channel.

The Staten Island native said he first started at a Long Island City shop and quickly made some early deals, eventually leaving to start his own firm, FunderHunt, and recently opened an office in Miami.

But do the YouTube videos help him make deals? Of course they do, Karimov says, and he not only gets deals through his video platform but he also get questions from other MCA brokers who reach out for help.

“Of course, we get people all the time calling in, people that have questions, people in the industry need help with their merchants,” Karimov says. “I started around 2018, and there was no info on YouTube about business funding, a huge void online. I stepped up and thought I could be the one to supply info.”

Nearly three years later, Karimov has built an expanding business while helping others through the struggles of being a broker and CEO in the MCA world. In the last year alone, the pandemic caused applications to explode, Karimov says.

“It’s been better than ever; I’ve never seen so many applications in March and April; they were just soaring,” Karimov says. “And then I’ve never seen so many applications get denied because of the industry at the time everything was shutting down.”

It was a time to capitalize if your shop was strong enough to survive what Karimov called the “dark ages” for MCA. If you survived, you get to reap the reward of a capital-deprived market, he says.

“The whole crisis took out so many funders that were just not good, they probably were supposed to go out of business a long time ago, but this accelerated it,” Karimov says. “It took out all the bad funders and replaced them with people that are solid, fast, and have everyone’s best interest at heart, from the merchant to whoever the ISO is.”

According to Karimov, 2020 solidified who is a real player in the game. Launching a new office himself, Davron says he enjoys sunny days in Miami while it is twenty degrees in-between blizzards in New York. Though snow wasn’t the reason he moved, but instead the funding environment.

“Everyone has been warm and welcoming [in Miami], the government knows what this is, and that’s what we do. We try to educate them: not a lot of people know here about this; it’s like it’s a secret,” Karimov says. “If you go to New York, it’s like everybody knows, there are so many shops there. But here, it’s kind of rare to see someone that knows what a cash advance is.”

Compared to New York’s increasingly restrictive funding ecosystem, the Florida space is open to growth. That’s exactly the environment Karimov hopes to profit from, expanding his business in any way that will be geared toward helping businesses.

“I’m not a huge fan of diversification,” Karimov says. “I like doing one thing. But we opened up an office in Miami; we’re bringing experienced people in and trying to fund deals as fast as possible. We’re maybe looking to develop into offering a debit card, whatever is in the business’s best interest.”

BlueVine’s CEO on Latest Round of PPP

February 10, 2021BlueVine CEO Eyal Lifshitz took to twitter last night to update customers on the status of this PPP round. Word from around the industry has suggested that approvals have been slower and that in certain situations, additional documentation is being asked for because of the SBA’s heightened scrutiny.

Below is Lifshitz’s consolidated twitter thread.

As a third-generation entrepreneur, my decision to build BlueVine was personal—I believe in and have dedicated myself to small businesses. To the customers reaching out for Paycheck Protection Program support, know that I’ve read your messages and want to update you directly.

When the latest Paycheck Protection Program was announced, we knew we had to step up again and help small businesses. Though the cause was close to our mission, we had to refocus our business completely. If you feel this program has been slower, it has. But for good reasons.

Waiting is frustrating, especially if these funds will make or break your business. There are explanations for the longer wait times, which can actually mean GOOD news for your business. Let me break this down.

The SBA’s program changes were significant, adding Second Draws and other improvements. Every change requires an additional product build and support team training, ensuring we’re compliant and provide the most efficient and effective application process.

The program’s adjustments include serving the hardest-hit businesses (and not large well-known companies). This extra due-diligence means additional documentation and information for us to review. It also means that smaller businesses may have a greater share of the funds.

The previous PPP round was impacted by some fraudulent actors. To prevent funds from getting in the wrong hands, the SBA added more robust requirements. While this added protection is more work and slows things down, it ensures funding remains for those that need it most.

We know the process of reviewing and approving PPP loans was slow at first, but we wanted to ensure we got it right before automating. Since we started, our throughput has more than tripled. If you’re in review, be patient. We haven’t forgotten about you!

I want to emphasize that BlueVine, and me personally, are committed to serving small businesses. We’ve more than doubled our customer support team to better assist you during what I can only imagine has been a brutal year. We see you and are doing everything we can to help.

New Functionality For Digital Advertisers

February 9, 2021 Today, we’re announcing a new feature for digital advertisers. Businesses advertising on our website now have the option to login with a deBanked account and track their ad click figures in close to real time.

Today, we’re announcing a new feature for digital advertisers. Businesses advertising on our website now have the option to login with a deBanked account and track their ad click figures in close to real time.

We began to roll this out in January to all ad clients that expressed an interest in it. A press release went out this morning.

It’s one of several things that we’ve been working on for a while. Our clients can also view what their current ads are when they log in, even if it’s more than one campaign.

The data is updated on an automated basis and the identities of the visitors that clicked is kept anonymous. We’re also offering white-labeled deBanked-hosted landing pages as a service to assist with managing the conversion process. As everyone knows, we also have designers that can create the ad artwork itself.

deBanked serves a business-to-business market and I think the elephant in the room is that much of the industry’s referral business is being sourced through our website. We outpace all of our competitors on a page view basis by a long shot and we’ve determined that it would be valuable for our digital clients to track the activity we’re generating, and then if further assistance is needed, facilitate the conversion process as well. We think about it from the user perspective too. We want the user clicking those ads to find whatever it is they’re seeking. We’re ultimately striving for an end-to-end experience where all parties are satisfied.

We’ve also compiled a short FAQ about how to interpret the click data.

You can email questions to info@debanked.com.

Thanks so much for being part of the deBanked universe.

– Sean Murray

Over Half of Small Businesses Had Unmet Funding Needs

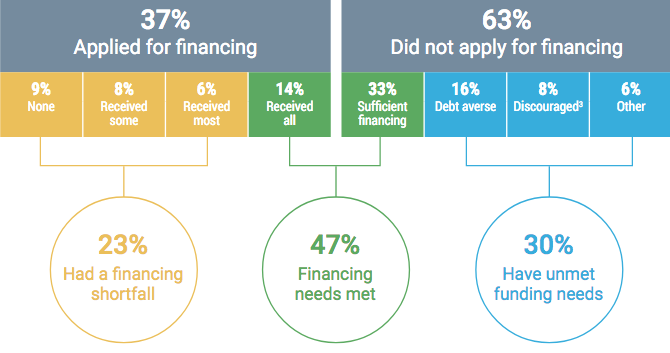

February 8, 2021The Federal Reserve’s analysis of overall funding efforts for all small businesses demonstrates a market of unmet financial needs. In 2020, a total of 47% of firms met their funding needs, while the other half (53%) still needed capital.

23% of firms saw a “financing shortfall.” They were partially approved but still needed more funds. The other 30% have unmet funding needs because they never applied according to the survey- they’re scared of debt, risk-averse, or don’t meet requirements.

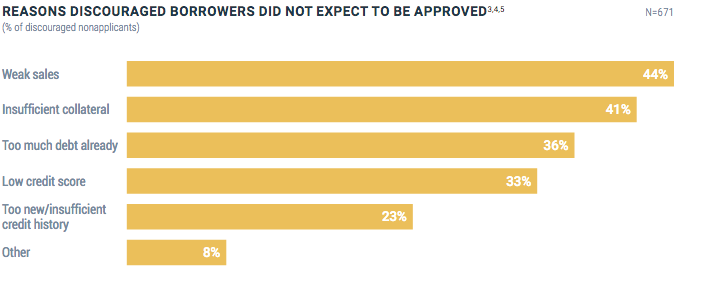

Those that did not apply for funds would have if they were not discouraged by weak sales (44%), insufficient collateral (41%), low credit (33%), and too much debt already (36%).

83% of companies used a bank or small bank as their primary financial service provider, while only 11% said an online lender or fintech was their primary.

Meanwhile, in the funding world, MCAs were only sought by 8% of all funding applicants last year, compared to 89% of firms applying for a loan or line of credit.

Most firms that went for an MCA went with a bank. 85% percent of firms that applied for a loan, credit, or cash advance used a large or small bank. In contrast, only 20% of firms applied to an online lender, falling from 33% since last year.

42% of firms that worked with online lenders or fintech companies were dissatisfied with support during the pandemic. Comparatively, firms that did receive some funding from an online lender were far happier: only 18% were dissatisfied.

Forty-Four Percent of Small Businesses Were More Than $100,000 in Debt in 2020

February 5, 2021 Fifty-three percent of firms expected total sales revenues for 2020 to be down by more than twenty-five percent because of the pandemic, according to the latest small business survey published by the Federal Reserve. Eighty-eight percent of firms indicated that sales had still not returned to normal.

Fifty-three percent of firms expected total sales revenues for 2020 to be down by more than twenty-five percent because of the pandemic, according to the latest small business survey published by the Federal Reserve. Eighty-eight percent of firms indicated that sales had still not returned to normal.

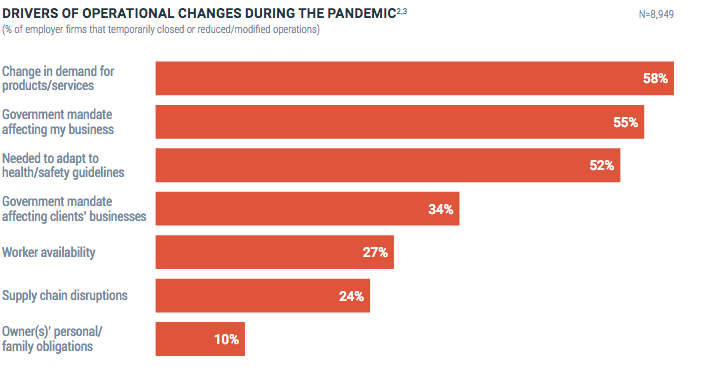

Of those hurt by shutdowns, supply chain troubles, and government shutdowns, 26% percent closed temporarily, fifty-six percent reduced their operations, and 48% percent modified their operations.

Fifty-seven percent of firms characterized their financial condition as “fair” or “poor.”

The struggle to remain open sent firms further into debt. Seventy-nine percent of firms had debt outstanding, an 8% increase from 2019. Debt also increased; the share of firms with more than $100,000 in debt rose from 31% to 44%.

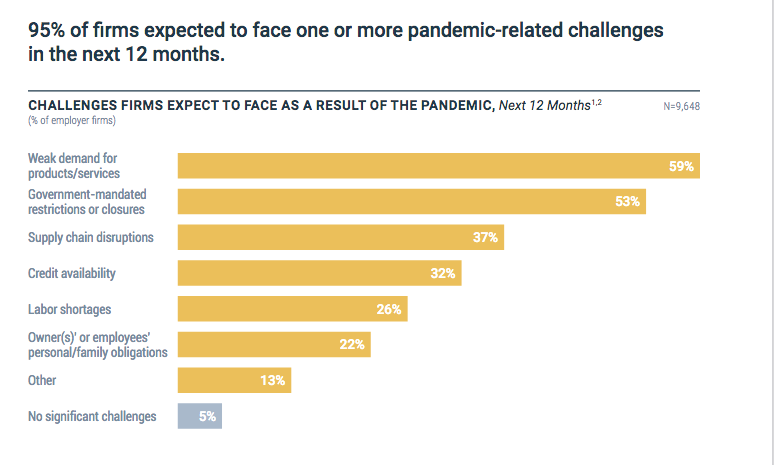

The majority of U.S. businesses believe the next year will be rife with the same struggles as the last. Many believe weak demand, government shutdowns, and supply chain breaks will continue disrupting the world economy.

Overall, firms applied for financing less, from 43% in 2019 to 37% in 2020.

Firms got their funds this year through Government aid programs, and they did so through their pre-existing bank relationships, forgoing alternative funders. Forty-eight percent went through large banks for PPP, 43% to smaller banks. 95% and 83%, respectively, already had a relationship with their large or small bank.

Enova Pleased With The OnDeck Acquisition, Looking to Divest ODX, OnDeck Canada, OnDeck Australia

February 5, 2021 “We’re very pleased so far with the OnDeck acquisition and as we view the economic landscape, we continue to believe that it’s an excellent time to be increasing our focus on SMB lending,” Enova CEO David Fisher said on the company’s Q4 earnings call. Enova originated $120 million in small business loans in December and $95 million in November. The October figure wasn’t specified, but back-of-the-napkin math based on other provided statistics suggests it was about $54 million.

“We’re very pleased so far with the OnDeck acquisition and as we view the economic landscape, we continue to believe that it’s an excellent time to be increasing our focus on SMB lending,” Enova CEO David Fisher said on the company’s Q4 earnings call. Enova originated $120 million in small business loans in December and $95 million in November. The October figure wasn’t specified, but back-of-the-napkin math based on other provided statistics suggests it was about $54 million.

Growing those originations will continue to be their primary agenda as the economy improves, the company said, while the ODX side of the business may be shown the door.

“While ODX has been able to sign some high-profile bank clients, divesting ODX will allow for more efficient use of capital as the business has over 70 employees but less than $10 million in revenue,” Fisher said.

OnDeck Canada and OnDeck Australia may also be on the chopping block.

“The Australian and Canadian businesses are viable businesses in their respective market,” Fisher said, “but are small compared to OnDeck US operations and are unlikely to have a significant impact on Enova’s overall growth. In addition, OnDeck only has partial ownership of those two businesses.”

Meanwile, OnDeck’s portfolio outlook is improving.

“The percentage of OnDeck receivables past due 30 days and more declined during the quarter from 23.2% in closing to 15.6% at December 31,” said Enova CFO Steve Cunningham.

On the call, JMP analyst David Scharf asked when OnDeck would return to quarterly origination levels of $550M to $650M as it had been enjoying prior to the pandemic.

“I mean I think there’s just way too much uncertainty to be able to answer that,” Fisher replied. “I mean, does the vaccine work great and the economy opens up soon or is there a new strain of the COVID virus that requires lockdowns during the summer? I mean, there’s no way to know. But I think there’s a couple trends that are super encouraging for us and we saw great sequential growth as we talked about throughout the call.”

Fisher also added that they’ve seen a bunch of competitors go out of business. “We think we have a lot of share in the market that we don’t think has shrunk and so we think we’re really well positioned as this pandemic winds down,” he said.

Merchant Cash Advance Approval Rate Was 84% in 2020, Federal Reserve Finds

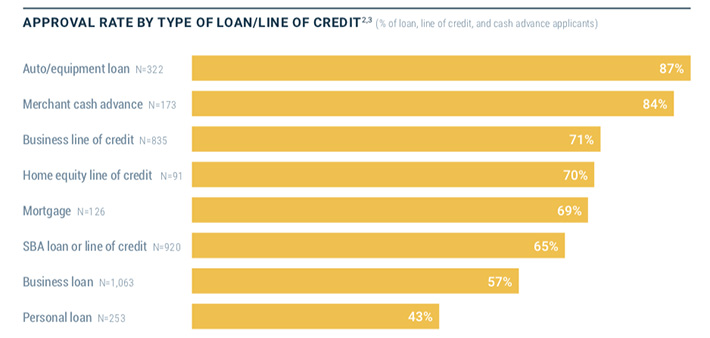

February 3, 2021Eighty-four percent of applicants that applied for a merchant cash advance in 2020 were approved, according to the latest study published by the Federal Reserve. However, that figure includes the pre-March 2020 covid era.

When MCAs and online loans were blended, for example, the approval rate shrank from 81% pre-March 1st to 70% after March 1st.

Eight percent of all small businesses sought a merchant cash advance in 2020, down slightly from 9% in 2019. Leasing dropped from 9% to 7% and factoring dropped from 4% to 3%. Pursuit of credit cards even dropped, down from 29% to 21%.

There were some downsides for the online lending industry reported.

Only 9% of PPP applicants used an online lender.

Online lenders had the lowest satisfaction rate (43%) for small business credit needs. Credit unions scored the highest (87%).

Net satisfaction with online lenders dropped to its lowest level since 2016.

Small businesses satisfaction with big banks actually grew from 2019 to 2020.

Small businesses were less likely to apply for a business loan or MCA from an online lender in 2020 and more likely to apply for them at a bank in 2020 than they were in 2019.

Eighty-two percent of businesses applied for a PPP loan. Forty-seven percent applied for an EIDL loan.

Banks, perhaps counterintuitively, were the big winners in 2020. That trend could increase as banks and online lenders become the same thing.