Archive for 2019

Kabbage Finances US Small Business Customers of Alibaba

January 14, 2019 Kabbage announced today that it has partnered with Chinese e-commerce giant, Alibaba, to provide financing to small businesses that purchase materials on the platform. The financing program, offered by Alibaba and powered by Kabbage, is called Pay Later.

Kabbage announced today that it has partnered with Chinese e-commerce giant, Alibaba, to provide financing to small businesses that purchase materials on the platform. The financing program, offered by Alibaba and powered by Kabbage, is called Pay Later.

“Financing at the point of sale requires a fully automated solution that can handle the immense volume of daily transactions that occur on Alibaba.com,” said Kabbage CEO Rob Frohwein. “We are incredibly impressed with the service and value that Alibaba.com delivers to American businesses and want to do all we can to support their important mission.”

According to the Kabbage announcement, Kabbage had a beta launch of Pay Later in June 2018 and it has so far delivered millions of dollars in financing to American small business. The business to business (B2B) financing product provides lines of credit up to $150,000, and according to Kabbage, each purchase financed via Pay Later creates a six-month term loan for the merchant with rates as low as 1.25% per month. Kabbage also said that there are no fees to maintain the line of credit, no order transaction fees and no early repayment fees.

This partnership is not the first of its kind. In February 2015, Lending Club announced a similar arrangement with Alibaba that offered funding to U.S. small business owners for point-of-sale transactions on the platform. Lending Club offered loans up to $300,000 and had an exclusive relationship with Alibaba for point-of-sale business financing. Kabbage told deBanked that their arrangement with Alibaba is not exclusive. Lending Club did not respond in time to explain their current relationship with Alibaba.

LendUp Gets a Shake-up

January 11, 2019

Among other company news, LendUp announced yesterday that it has formed a separate company called Mission Lane that will be devoted to scaling its credit card business. LendUp will continue to operate under its name and will focus on personal loans, education and savings opportunities, according to the announcement. Along with the division of LendUp, company co-founder and CEO Sasha Orloff is stepping down and is being replaced by Anu Shultes, the former General Manager of LendUp Loans.

“Both organizations are focused on helping get consumers on a path to better financial health,” Shultes said of LendUp and Mission Lane, “one will do this through offering loans, and the other through credit cards. I appreciate the Board’s confidence in me and am excited to lead this fantastic organization,” said Shultes.

According to the company announcement, Orloff, who co-founded the company with Jake Rosenberg, will remain involved in LendUp as a board member and in Mission Lane as an advisor. LendUp’s office is in Oakland, CA while the Mission Lane team is in San Francisco.

“Anu brings the perfect combination of background, skills and vision to her role as CEO,” said Orloff. “She’s an absolutely fearless leader, and she’s the right person to shepherd LendUp through its next stage.”

Shultes didn’t say if the company headcount has changed as a result of the creation of Mission Lane, but she said that they plan to grow both businesses. Former Chief Operating Officer of LendUp is interim CEO of Mission Lane, while the company looks for a permanent CEO.

Additionally, with the creation of the new company, LendUp announced that they had received an investment for an undisclosed amount that will be used to scale Mission Lane. The investment was led by LL Funds LLC and Invus Opportunities.

LendUp provides unsecured loans of up to $1,000 to subprime borrowers who might otherwise go to payday lenders. Last year, Orloff told deBanked that one’s credit score is based primarily on two factors: on-time repayment and access to credit that you don’t use.

“So we design our loans and our card products to help people make sure they’re paying on time and make sure that they’re only using the credit that they need.”

Orloff also said that LendUp places an emphasis on financial education and offers customers more money at lower rates if they take the company’s education courses.

How an SBA Lender is Managing Through the Shutdown

January 10, 2019

As a result of the U.S. government shutdown that started on December 22 of last year, hundreds of thousands of government employees have been working without pay. The shutdown has also temporarily stopped the Small Business Administration (SBA), a government agency, from operating. This means that obtaining an SBA loan, which is backed by the federal government, is no longer an option for American small business owners. (A lender cannot fund an SBA loan without the authorization of the SBA).

While most SBA loans are funded by banks, a fair amount are also funded by non-bank lenders, like Lendistry, for which 60% of its business came from SBA loans last year. In his 20 year career, Lendistry CEO Everett Sands remembers another government shutdown in 2013. According to data collected by The New York Times, the 2013 shutdown lasted 16 days. As of today, the shutdown has lasted 20 days, and the longest shutdown since 1976 was 21 days.

Sands told deBanked that lenders like him are continuing to process the loans. However, they have to wait until the government re-opens before closing on any new loans. Since Sands and other SBA funders can’t close on the loans, they can’t yet generate money from them. Thankfully for Sands, he just recently started expanding his product offering.

“I think we feel a little bit calmer than we would have last year because we [recently] rolled out [new products,]” Sands said. “An express line of credit program, a traditional line of credit, an express term product, and a commercial real estate product. So these products will not only keep us busy, but will allow us to weather the storm.”

Sands said that his team has been calling its borrowers and asking them if they would like to wait for their SBA loan to be processed or apply for a different kind of loan. He said that about half have decided to wait and half have decided to shop for another loan.

While SBA loans have been put on hold, Sands said that a government shutdown like this will likely increase the demand for loans in general, particularly among government contractors who are not getting paid.

“Historically, when there’s been a government shutdown, employees get their backpay. The government contractors do not. They just get delayed and pushed back further,” Sands said. “Generally, when people do not receive money, because the bills do not stop, they’re going to turn to resources…like lending organizations.”

As for SBA loans, once the shutdown is over, there will be a backlog, Sands said. He said that the SBA generally approves their loans in two days or less, but thinks that the approval time will probably move to 5 to 10 days if the shutdown stopped yesterday.

Sands joins most of the country in hoping that the shutdown will end soon. As it relates to his business: “I think it’s important to be able to offer clients all products that should be available to them, [including] the longer term [SBA] products which equals better cash flow. And if you think about it as a lender, you want to put your clients in the best position to pay you back.”

Despite the shutdown, 2018 was a very successful year for Lendistry with SBA lending. The company closed 92 SBA loans totaling $17.5 million and they have only been approved for SBA lending since June 2017, and only in California.

Founded in 2014, Lendistry employs 23 people. They offer loans of up to $1 million to small businesses in a variety of industries from restaurants to healthcare providers.

Trained at OnDeck, LendingFront Founders Help Banks Lend to Small Businesses

January 9, 2019 Yesterday LendingFront announced that it has raised $4 million to help deliver its white label software designed to help banks and other financial institutions lend to small businesses. The company was founded in 2015 by two former OnDeck employees, Jorge Sun and Dario Vergara.

Yesterday LendingFront announced that it has raised $4 million to help deliver its white label software designed to help banks and other financial institutions lend to small businesses. The company was founded in 2015 by two former OnDeck employees, Jorge Sun and Dario Vergara.

Sun was the Chief Credit Officer at OnDeck from 2007 to 2012 and said he was the company’s third hire. Vergara joined OnDeck as its Chief Technology Officer in 2008 and was also among the first to join the company, Sun said. They both left before OnDeck went public in 2014 and took other jobs before reconnecting to create LendingFront together. Sun said that it is very difficult to create a technology company inside a large bank, which is what he tried to do in his job at Capital One, following his time at OnDeck. Vergara was working as VP of Technology at Bonobos, an online clothing company.

As Sun began talking with Vergara about going out on their own, he recalled telling Vergara: “There are no platforms in this space directly created to help lenders become more efficient…We’ve built this once [at OnDeck], let’s build it again. But the difference now is it’s strictly a technology company. We take no risk, we don’t lend. All we’re doing is powering other lenders.”

Sun said that LendingFront is “lender agnostic,” in that they license out their proprietary lending platform to any financial institution, including banks, community banks, leasing companies and Community Development Financial Institutions.

Their customers pay them a licensing fee and the customer, say a bank, sets its own parameters with regard to underwriting. The platform simplifies the underwriting process, but completely allows for customization and design of the customer experience, Sun said.

The idea of helping banks become better online lenders is not completely unique. In fact, the founders’ former employer, OnDeck, recently launched a separate entity called ODX, with the mission of making banks better lenders to small businesses.

But Sun said that while ODX and LendingFront both help banks, there is a difference between the two. He said the difference is that ODX is more of a full service shop acting on behalf of a bank.

“With us, a bank is using our platform like using Excel…versus [using] Excel and then giving it to a different company and saying ‘use Excel on our behalf.’”

Sun said that customers have funded $150 million through the LendingFront platform since they started licensing it out in 2016. They previously raised $1.6 million in 2016 and they employ 24 people in an office in New York.

DataMerch.com Surpasses 20,000 Records Heading into 2019

January 9, 2019DataMerch.com surpasses 20,000 records heading into 2019

DataMerch continues rapid growth and adds many new members and merchant records

Tampa, Jan. 9, 2019 /DeBanked/ — Today, DataMerch.com, an online underwriting database for the alternative financing industry, announced that they have surpassed over 20,000 records in their database. DataMerch has been servicing funders in the alternative financing field since 2015 and has been widely adopted as the industry standard for online screening of merchants.

“We continue to grow our membership and database because our tool is so useful,” said Co-Founder Cody Burgess. “In 2018 we surpassed 60 active member companies with well over 500 individual users within those companies. We also added tools to support better member communication.” When asked what developments to expect looking forward in 2019, Mr. Burgess responded, “We have several projects we are working on to expand our features and membership. We are developing tools to make searching and reporting even easier, and we are planning on adding some additional industry markets to bolster results and relevancy.”

President and COO of IOU Financial Inc., Robert Gloer said, “We’ve been using DataMerch since the beginning and are thrilled with the results. We’ve automated our process where we screen every new application through DataMerch to check if there were issues with competitors in our industry. This allows us to save countless hours of time and money with an additional up-front underwriting tool that is easy to use.”

Management at DataMerch said they will continue to offer world-class support to members and improve the platform.

About DataMerch

DataMerch LLC was founded in 2015 and is designed to help funders determine if a future client of theirs has a bad track record in the alternative finance industry. DataMerch members can scrub their files using DataMerch’s specifically designed FEIN search and enter unsatisfactory businesses into the database. DataMerch currently has over 60 industry-leading subscribed members working together as a community. DataMerch can be accessed at https://www.datamerch.com and contacted for membership at support@datamerch.com

CAN Capital Hires Edward J. Siciliano as Chief Executive Officer

January 8, 2019Atlanta, GA (January 8, 2019) – CAN Capital, a technology-driven small business specialty finance company, today announced the appointment of Edward J. Siciliano as Chief Executive Officer. Siciliano brings over 30 years of experience in commercial financing, sales, marketing and operations.

Siciliano joins CAN Capital most recently from Marlin Business Services, a nationwide provider of commercial financing and depository products. While at Marlin, Siciliano served in roles including Chief Operating Officer, Interim Chief Executive Officer and EVP, and Chief Sales Officer. During that time, he was responsible for turning around Marlin post financial crisis by rebuilding the sales force, adding new products, improving operations, and driving optimal risk-adjusted returns for all segments, resulting in double-digit ROE and more than fivefold growth in originations.

After beginning his career at Xerox Corporation, Siciliano worked at Applied Theory Corporation as SVP of Sales and Marketing and at ALK Technologies, where he also led Sales and Marketing.

“Ed is a proven leader with deep industry knowledge and a strategist who is skilled at driving business growth,” said Gary Johnson, CAN Capital’s Executive Chairman. “Throughout his career, he has served the needs of small businesses while building loyal teams that deliver innovative products and a great customer experience. These skills will be invaluable as CAN Capital finds new ways to deliver on its mission of helping small businesses succeed.”

“It’s rare to have the opportunity to work with a company that is a pioneer in its space, yet has so much growth potential,” said Siciliano. “CAN Capital’s experience, brand recognition, data, and partner relationships make it uniquely positioned to support the expansion of the small businesses that drive the U.S. economy. I look forward to building a leadership team and working together to expand our offerings, invest in talent and technology, and help our customers grow.”

About CAN Capital

CAN Capital, Inc., established in 1998, is the pioneer in alternative small business finance, having provided access to over $7 billion in capital for over 81,000 small businesses in a wide range of locations and different business types. As a technology powered financial services provider, CAN Capital uses innovative and proprietary risk models combined with daily performance data to evaluate business performance and facilitate access to capital for entrepreneurs in a fast and efficient way.

CAN Capital, Inc. makes capital available to businesses through business loans made by WebBank, member FDIC, and through Merchant Cash Advances made by CAN Capital’s subsidiary CAN Capital Merchant Services, Inc. ©2018 CAN Capital. All rights reserved.

Follow CAN Capital on LinkedIn, Twitter and Facebook.

Meet CAN Capital’s New CEO

January 8, 2019 CAN Capital announced this morning the appointment of Edward J. Siciliano as its new CEO.

CAN Capital announced this morning the appointment of Edward J. Siciliano as its new CEO.

“There is still a huge delta between the need for capital for small businesses and the capital that banks are willing to provide,” Siciliano said. “And this creates an enormous opportunity for CAN to expand its business.”

Siciliano comes to CAN Capital from the equipment finance and small business lending company Marlin Business Services, based in New Jersey. He worked there for a decade in several roles including Chief Operating Officer and Chief Sales Officer.

“Ed is a proven leader with deep industry knowledge and a strategist who is skilled at driving business growth,” said CAN Capital’s founder and Executive Chairman Gary Johnson. “Throughout his career, he has served the needs of small businesses while building loyal teams that deliver innovative products and a great customer experience.”

Siciliano is relocating from Princeton, NJ to live near CAN Capital’s headquarters in Kennesaw, GA, near Atlanta. In September 2018, the company announced that it would be moving its finance and executive functions to Kennesaw from New York City. A CAN Capital spokesperson at the time said that Parris Sanz, the former CEO, did not want to move to the Atlanta area for personal reasons. Now, Siciliano said that there is no longer a New York City office, but there is a roughly eight person finance team in White Plains, NY, that will eventually be moved to the Georgia headquarters.

“I really value the work that [Sanz] has done…and we’re going to stay the course out of the gate. However, I’ve been tasked with accelerating the business,” Siciliano said.

In this effort, Siciliano said he will continue to invest in technology, but will also focus on the small business customer rather than a specific product. Instead, Siciliano said that he would like to see CAN Capital expand its product offerings to serve more needs of small business customers.

He also said that he would like to expand the company’s referral partners beyond brokers to include other players such as manufacturers, attorneys and accountants.

For Siciliano, there are two key elements to focus on for any funding company. The first is credit, or underwriting.

“CAN is one of the very few fintechs that lived through 2008, the recession. You get information about your credit portfolio and your credit model in stressful times like that, that is invaluable…I feel like we have great credit models, which will constantly be enhanced and will always be a focus. Your credit model is the Achilles heel of any lending company.”

The other element that Siciliano focuses on is lowering customer acquisition costs. He said he wants to broaden product offerings to attract different and more partners who will, in turn, bring their small business customers to CAN Capital.

Currently, Siciliano said that the company originates $25-30 million a month and 95% of the business is providing working capital and business loans while the remaining 5% is merchant cash advance. CAN Capital works with brokers but also has an internal sales team. There are about 100 employees at the Kennesaw headquarters, including the company’s executive, marketing, and analytics teams. There is also a technology team of about 20 people located in Costa Rica and Siciliano said that the company works with business development people who work independently throughout the country.

Founded in 1998, CAN Capital has provided more than $7 billion to more than 81,000 small businesses.

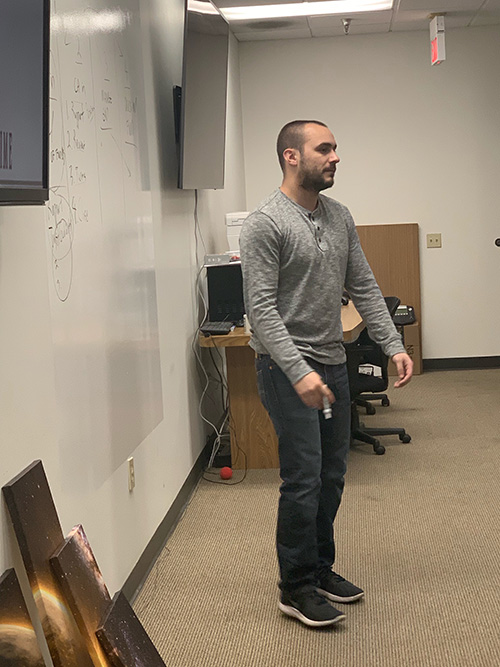

How One Broker Moved from One-Man Home Office to 23 Person Shop

January 7, 2019Zach Ramirez started the brokerage company ZR Consulting from his home in Orange County, CA in June 2018. He was generating leads and making phone calls, often in a hushed voice because he was also looking after his six month old daughter.

“That was difficult, having a baby and with my life savings in the business,” Ramirez said.

But he had three brokers working remotely for him and things were working pretty smoothly. That number was growing by the time deBanked profiled him in August.

His fledgling business was manageable until he got to six brokers. At this point, the 29 year-old Ramirez said his home office was starting to feel like a call center.

“All day, I was answering calls to help them,” Ramirez said. “‘Zach, I have a question about this merchant, Zach, can you help me close this deal?’ It gave me a ton of anxiety.”

Ramirez realized that it would be much easier to manage employees from a brick and mortar space. So he found the company an office.

“Technically, we could have stayed at home,” Ramirez said.

“Technically, we could have stayed at home,” Ramirez said.

And he acknowledges that some brokers can make a nice living working from home.

“But I want to have the biggest ISO,” Ramirez said.

With this as his goal, he said it makes the most sense to have everyone under one roof. If he’s having a large meeting, he wants to know that everyone is paying attention and not driving or playing a video game as they could on a conference call.

“It was difficult to manage salespeople and to track everything, like how many leads we generated in one day? How many leads does it take for me to fund one deal? How much money does the average deal bring me?”

Having his brokers work remotely made keeping track of these numbers even harder. Ramirez still has a couple of people who work for him remotely, but he said that 95% of his employees, or 23 people, now work at their office in Anaheim, CA. Ramirez said that the office was much too big for them with just six people at the beginning.

“We could hear echoes bouncing off the walls,” he recalled.

But now with 23 people, mostly brokers and some support staff, Ramirez is actually planning to expand into an office next door.

“[As we grew in the office,] we just re-invested every penny we earned back into the company,” Ramirez said. “We upgraded our computers and furniture and we put people on W-2s. We gave our employees a 401k right away. I think it’s important to really treat your people right.”

Ramirez acknowledged that he can’t make changes to the business as quickly as he used to. With more than 20 people, he said that costs go up dramatically and therefore decisions have to be much more calculated.

“It takes time to move the ship,” Ramirez said, “and if you’re not careful, everyday can be consumed by the small stuff.”

That’s why he stresses the importance of delegating roles to others.

“It’s the only way to free up your time so you can focus on the bigger picture,” he said.

Now, he said that he very rarely speaks to funders anymore. He has two processors on staff whose job is to organize the paperwork from the brokers and send it to the funders. They organize the company pipeline, he said.

Ramirez said that it can be quite difficult to find the right mix of funders.

“Some funders who you think will be great turn out not to be and other funders who you’ve never heard of turn out to be real diamonds in the rough,” Ramirez said.

And like many brokers feel, Ramirez agrees that when it comes to funders, less is more.

“Having a very precise and small list of funders is incredibly important…because it simplifies your process [and] having a simple process is one of the keys to scaling your business,” Ramirez said.

Ramirez said that a common mistake brokers make is to test out a bunch of brokers all at once. He said that brokers need to try working with new funders intelligently, which means one at a time.

“When you bring on a new lender, you carefully watch every submission to them,” Ramirez said. “You want to make sure they’re not backdooring you. So usually you want to put your phone number and your email address in the contact info so you can catch them if they’re trying to be sneaky. [If they are,] they’ll call asking for the client and you know you only sent that deal to one lender.”

He’ll sometimes then pretend he’s interested and record the call. On about three occasions, he said that he has sent recordings like this to the backdooring lender and he’ll write “this is why I don’t send deals to you.”

Ramirez’s small group of trusted funders are OnDeck, National Funding, BFS, and Orange Advance.

As Ramirez expands, he says he only hires brokers by referral. He said that 90% of his business is short term business loans and MCAs, and 10% is SBA loans and real estate transactions.

Ramirez said that so far, ZR Consulting has originated $15 million in deals since inception and has earned $1.5 million in revenue.