Archive for 2019

For Sale: Three Loan Portfolios Held By Direct Lending Investments

August 19, 2019 The Court-appointed receiver of the now-defunct hedge fund, Direct Lending Investments (DLI), is gearing up to sell three loan portfolios with an aggregate par amount owed of $29.8 million. The portfolios comprise of business loans, consumer loans, and merchant cash advances.

The Court-appointed receiver of the now-defunct hedge fund, Direct Lending Investments (DLI), is gearing up to sell three loan portfolios with an aggregate par amount owed of $29.8 million. The portfolios comprise of business loans, consumer loans, and merchant cash advances.

An official notice of the proposed sale will be published in the Wall Street Journal and other publications. Bids on the portfolios are required to be submitted by August 29th. An auction may be conducted on September 5th.

Updates on the receivership process for DLI can be followed here.

The demise of Direct Lending Investments was sudden. The CEO resigned in March, shortly before the company was charged with a “long-running” fraud by the SEC. The company had apparently suffered a massive loss of investor capital due to a single failed investment. The investment was in VOIP Guardian Partners I LLC, a company that reloaned money to telecom businesses worldwide. VOIP filed for bankruptcy on March 11th.

Turning a New Leaf: Banking Committee Chairman Says It’s High Time for New Cannabis Company Regulations

August 19, 2019 Recent years have seen a surge of popularity for the legalization of cannabis movement across the United States. Beginning with the normalization and legalization of the herb for medicinal use, and then the outright legalization of it in California, Colorado, Oregon, Nevada, Alaska, Michigan, Vermont, Massachusetts, Maine, Washington, and D.C., most states now support legalization in some form (ie. medicinal use being allowed, or at very least access to CBD products) with the exception of three.

Recent years have seen a surge of popularity for the legalization of cannabis movement across the United States. Beginning with the normalization and legalization of the herb for medicinal use, and then the outright legalization of it in California, Colorado, Oregon, Nevada, Alaska, Michigan, Vermont, Massachusetts, Maine, Washington, and D.C., most states now support legalization in some form (ie. medicinal use being allowed, or at very least access to CBD products) with the exception of three.

According to Kris Krane, Co-founder and President of 4Front, a leading multi-state cannabis company, and contributor to Forbes, support for legalization has steadily increased 1-2% each year since the 1970s, with the recent state-wide legalization legislation bumping those figures up. But while support amongst the populace as well as within certain corners of the government has grown, infrastructural support that is regulated by politicians has lagged.

Specifically, since their legalization, cannabis companies have been unable to open bank accounts due to strict federal restrictions. As a result, cannabis companies, the majority of which being small businesses, have a harder time paying employees, vendors, and taxes; find it tough to acquire start-up capital; struggle to finance themselves in the face of unforeseen expenses; and are subject to the increased security risks that come with holding onto high quantities of cash. As well as these repercussions, such federal hurdles lead to many cannabis companies receiving finance via equity investments, to which Krane says, “the owners of cannabis businesses own far less of their companies than they would in any other industry.”

Viewed alongside the growing attitude to “legalize it,” such financial handicapping paints a picture of the industry that is all smoke and no fire. Krane described the situation as “one of the greatest challenges for cannabis businesses today,” but the tide may be turning.

Idaho Senator Mike Crapo (R), who is the Chairman of the Senate Banking Committee and who has historically been an ardent opponent of legalization, appears to have changed his tune on the matter. When asked if legislation would be required to end the barriers faced by cannabis businesses, Crapo responded “I think so, yeah.”

Idaho Senator Mike Crapo (R), who is the Chairman of the Senate Banking Committee and who has historically been an ardent opponent of legalization, appears to have changed his tune on the matter. When asked if legislation would be required to end the barriers faced by cannabis businesses, Crapo responded “I think so, yeah.”

The comment came after Crapo surprised his peers by holding a committee hearing on allowing cannabis businesses to access banks. Which seemed in opposition to his initial anti-legalization view as well as starkly unaligned with his state’s stance, Idaho being one of the three aforementioned states in which all cannabis-related products are outlawed. Nevertheless, Crapo continued on in the opposite direction of his previous convictions after the hearing, saying, “I think all the issues got well vetted. We now need to, I think, move forward and see if there’s some way we can draft legislation that will deal with the issue.”

Conveniently, such legislation is in the works. The SAFE Banking Act of 2019, put forward by Congressman Ed Perlmutter (D), seeks to solve the issue by lifting the red tape surrounding cannabis companies’ lack of access to banking. Support for the bill is growing, and as proven by Crapo, further support could come from unlikely places.

Fellow Republican, Senator Cory Gardner, explained that “merely having the hearing on marijuana banking issues was a ‘historic moment in the Senate’ … It shows that this isn’t just a regional issue, but a national issue that needs to be addressed … There was some criticism that the Republican attendance wasn’t there, but if they wanted to blow it up they would’ve been there. So I look at that as sort of an acknowledgment that this is now just a status quo issue and not something that they’re going to try and interfere with.”

While on the other side of the aisle, Senator Catherine Cortez Masto (D) said that she “would like to see it as a positive step forward. I support doing something in this country for these states that have legitimized marijuana businesses … I have always been concerned about potential money laundering or crimes that are sort of around these all-cash businesses. By having a financial system, it helps.”

Still, despite there being bipartisan support for the SAFE Banking Act the question of Mitch McConnell looms. Being the Senate Majority Leader, McConnell has influence over which legislation reaches the Senate floor for debate. And while McConnell may have borne the title of “Cocaine Mitch” with pride before, the narcotics-tinged buck stops there as the Kentuckian has gone on record saying he would not support the legalization of cannabis.

Still, despite there being bipartisan support for the SAFE Banking Act the question of Mitch McConnell looms. Being the Senate Majority Leader, McConnell has influence over which legislation reaches the Senate floor for debate. And while McConnell may have borne the title of “Cocaine Mitch” with pride before, the narcotics-tinged buck stops there as the Kentuckian has gone on record saying he would not support the legalization of cannabis.

Interestingly, McConnell is a proponent for the legalization of hemp. Saying that hemp is “a completely different plant than its illicit cousin,” McConnell’s view is born from his state’s agriculture-intense economy. “Everything from clothing to auto parts” can be made from hemp – a sentiment once isolated to communes, is now being publicly uttered by one of the most conservative contemporary Republicans.

Nevertheless, Kris Krane remains an optimist about future legislation as “there seems to be a growing consensus that cannabis banking reform is necessary,” likely due to worries over security. Crapo’s change of mind “represents a growing awareness among federal legislators that blocking cannabis businesses from accessing banking services is a security concern, and even members who may not support overall cannabis reform are increasingly willing to help resolve the banking issue. It is looking more and more possible that the Safe Banking Act [sic] could become law in the next year.”

Gold Rush: Merchant Cash Advances Are Still Hot

August 18, 2019

Last year, when Kevin Frederick struck out on his own to form his own catering company in Annapolis, the veteran caterer knew that he’d need a food trailer for his business to succeed.

He reckoned that he had a good case for a $50,000 small-business loan. The Annapolis-based entrepreneur boasted stellar personal credit, $30,000 in the bank, and a track record that included 35 years of experience in his chosen profession. More impressively, his newly minted company—Chesapeake Celebrations Catering—was on a trajectory to haul in $350,000 in revenues over just eight months of operations in 2018. And, after paying himself a salary, he cleared $60,000 in pre-tax profit.

But Frederick’s business-credit profile was so thin that no bank or business funder would talk to him. So woeful was his lack of business credit, Frederick reports, that his only financing option was paying a broker a $2,000 finder’s fee for a high-interest loan.

Luckily, he says, everything changed when he discovered Nav, an online, credit-data aggregator and financial matchmaker.

Based in Utah, Nav had him spiff up his business credit with Dun & Bradstreet, a top rating agency and a Nav business partner. This was accomplished with a bankcard issued to Frederick’s business by megabank J.P. Morgan Chase. Soon afterward, he says, Nav steered him to Kapitus (formerly Strategic Funding Source), a New York-based lender and merchant cash advance firm that provided some $23,000 in funding.

“They led me in the right direction,” Frederick says of Nav. “A lady there (at Nav) helped me with my credit, warning me that the credit card I’d been using had an effect on my personal credit. Then she led me to Kapitus, all probably within a week.”

Now, Frederick has his food trailer. He reports that its total cost—$14,000 for the trailer, which came “with a concession window, mill-finished walls, and flooring” plus $43,000 in renovations—amounted to $57,000. Equipped with a full kitchen—including refrigeration, sinks, ovens, and a stove—the food trailer can be towed to weddings, reunions, and the myriad parties he caters in the Delmarva Peninsula. In addition, Frederick can also park the trailer at fairgrounds and serve seafood, barbeque, and other viands to the lucrative festival market.

Now, Frederick has his food trailer. He reports that its total cost—$14,000 for the trailer, which came “with a concession window, mill-finished walls, and flooring” plus $43,000 in renovations—amounted to $57,000. Equipped with a full kitchen—including refrigeration, sinks, ovens, and a stove—the food trailer can be towed to weddings, reunions, and the myriad parties he caters in the Delmarva Peninsula. In addition, Frederick can also park the trailer at fairgrounds and serve seafood, barbeque, and other viands to the lucrative festival market.

Meanwhile, the caterer’s funders are happy to have him as their new customer. The people at Kapitus, to whom he is making daily payments (not counting weekends and holidays), are especially grateful. “Nav provides a valuable service,” says Seth Broman, vice-president of business development at Kapitus. “They know how to turn coal into diamonds,”

Nav does not charge small businesses for its services. As it gathers data from credit reporting services with which it has partnerships—Experian, TransUnion, Dun and Bradstreet, Equifax—and employs additional metrics, such as cashflow gleaned from an entrepreneur’s bank accounts, Nav earns fees from credit card issuers, lenders and MCA firms.

The company has close ties to financial technology companies that include Kabbage and OnDeck, and also collaborates with MCA funders such as National Funding, Rapid Finance, FundBox, and Kapitus. “We give lenders and funders better-qualified merchants at a lower cost of client acquisition,” says Caton Hanson, Nav’s general counsel and co-founder, adding: “They don’t have to spend as much money on leads.”

As banks have increasingly shunned small-business lending in the decade since the financial crisis, and as the economy has snapped back with a prolonged recovery, alternative funders—particularly unlicensed companies offering lightly regulated, high-cost merchant cash advances (MCAs)—have been piling into the business.

And service companies like Nav—which is funded by nearly $100 million in venture capital and which reports aiding more than 500,000 small businesses since it was founded in 2012—are thriving alongside the booming alternative-funding industry.

Over the past five years, the MCA industry’s financings have been growing by 20% annually, according to 2016 projections by Bryant Park Capital, a Manhattan-based, boutique investment bank. BPC’s specialty finance division handles mergers and acquisitions as well as debt-and-equity capital raising across multiple industries and is one of the few Wall Street firms with an MCA-industry practice. By BPC’s estimates, the MCA industry will have more than doubled its small business funding to $19.2 billion by year- end 2019, up from $8.6 billion in 2014.

Bankrolled by a broad assortment of hedge funds, private equity firms, family offices, and assorted multimillionaire and billionaire investors on the qui vive for outsized returns on their liquid assets, the MCA industry promises a 20%-80% profit rate, reports David Roitblat, president of Better Accounting Solutions, a New York accountancy specializing in the MCA industry. Based on doing the books for some 30 MCA firms, Roitblat reports that the range in profit margins depends on the terms of contracts and a funder’s underwriting skills.

The numerical size and growth of the MCA industry is hard to ascertain, reports Sean Murray, editor of deBanked (this publication), which tracks trends in the industry and sponsors several major conferences. “So much is anecdotal,” Murray says.

Even so, the evidence that MCA companies are proliferating—and prospering—is undeniable. Over the past two years, deBanked’s events, which experience substantial attendance from the MCA industry, have consistently sold out, requiring the events to be moved to larger venues. In Miami, attendance in January this year topped 400-plus attendees, Murray reports, roughly double the crowd that packed the Gale Hotel in 2018.

Similarly, the May, 2019, Broker Fair in New York at the Roosevelt Hotel drew more than 700 participants compared with the sellout crowd of roughly 400 last year in Brooklyn. (Despite ample notice that this year’s Broker Fair at the Roosevelt was sold out and advance tickets were required, as many as 40-50 latecomers sought entry and, unfortunately, had to be turned away.)

The upsurge of capital and the swelling number of entrants into the MCA business has all the earmarks of a gold rush. “Everybody and his brother is trying to get a piece of the action,” asserts Roitblat, the New York accountant.

And there are two ways to hit paydirt in a gold rush. One way is to prospect for gold. But another way is to sell picks and shovels, tents, food, and supplies to the prospectors. “If you can find a way to service the gold rush, you can make a lot of money,” says Kathryn Rudie Harrigan, a management professor and business-strategy expert at the Columbia University Graduate School of Business. “It’s like profiteering in wartime.”

And there are two ways to hit paydirt in a gold rush. One way is to prospect for gold. But another way is to sell picks and shovels, tents, food, and supplies to the prospectors. “If you can find a way to service the gold rush, you can make a lot of money,” says Kathryn Rudie Harrigan, a management professor and business-strategy expert at the Columbia University Graduate School of Business. “It’s like profiteering in wartime.”

As Professor Harrigan suggests, cashing in on the gold rush by servicing it has parallels across multiple industries. Consider the case of Charles River Laboratories, which has capitalized on the rapid development of the biotechnology industry over the past few decades.

As scientists searched for biologics to battle diseases like cancer and AIDS, the Boston-area company began producing experimental animals known as “transgenic mice.” Informally known as “smart mice,” Charles River’s test animals are specially designed to carry human genes, aiding investigators in their understanding of gene function and genetic responses to diseases and therapeutic interventions. (The smart mouse’s antibodies can also be harvested. “Seven out of the eleven monoclonal antibody drugs approved by the Food and Drug Administration between 2006 and 2011,” according to biotechnology.com, “were derived from transgenic mice.”)

In the MCA version of the gold rush, a bevy of law and accounting firms, debt-collection agencies and credit-approval firms, among other service providers, have either sprung to life to undergird the new breed of alternative funder or added expertise to suit the industry’s wants and needs. (This cohort has been joined, moreover, by a superstructure of Washington, D.C.-based trade associations and lobbyists that have been growing like expansion teams in a professional sports league. But their story will have to wait for another day.)

Rather than being exploitative, supporting companies serve as a vital mainstay in an industry’s ecosystem, notes Alfred Watkins, a former World Bank economist and Washington, D.C.-based consultant: “A gold miner can’t mine,” he says, “unless he has a tent and a pickaxe.”

And in the high-risk, high-reward MCA industry, which can have significant default rates depending on the risk model, many funders can’t fund if they don’t have reliable debt collection. Many of the bigger companies, says Paul Boxer, who works on the funding side of the industry, have the capability of collecting on their own. But for many others—particularly the smaller players in the industry—it’s necessary to hire an outside firm.

One of the more widely known collectors for the MCA industry is Kearns, Brinen & Monaghan where Mark LeFevre is president and chief executive. The Dover (Del.)- based firm, LeFevre says, first added MCA funders to its client roster in 2012; but it has only been since 2014 that “business really took off.”

LeFevre won’t say just how many MCA firms have contracted with him, but he estimates that his firm has scaled up its staff 35%-40% over the past five years to meet the additional MCA workload. The industry, LeFevre adds, “is one of the top-growth industries I’ve seen in the 36 years that I’ve been in business.”

He also says, “People in the MCA industry know a lot about where to put money, but collections are not one of their strong points. They need to get a professional. It gives them the free time to make more money while we go in behind them and collect.”

If repeated dunning fails to elicit a satisfactory response, KBM has several collection strategies that strengthen its hand. The big three, LeFevre says, are “negotiation, identifying assets, and litigation.” He adds: “We have a huge database of attorneys who do nothing but file suit on commercial debt internationally. Then we can enforce a judgment. You don’t want someone who just makes a few phone calls.”

Because business has become so competitive, LeFevre says, he won’t discuss his fee schedule. As to KBM’s success rate, he says no tidy figure is available either, but asserts: “Our checks sent to our clients are more than most agencies because of our proprietary collection process.”

Jordan Fein, chief executive at Greenbox Capital in Miami and a KBM client told deBanked: “We work with them. They’re organized and communicate well and they know to collect. They’re on the expensive side, though. I’ve got other agencies that I use that are cheaper.”

Debt-collection firm Merel Corp, a spinoff from the Tamir Law Group in New York, might be a lower-cost alternative. Formed in just the past 18 months to service the growing MCA industry, Merel typically takes 15%-25% of whatever “obligation” it can collect, says Levi Ainsworth, co-chief operating officer.

A successful collection, Ainsworth asserts, really begins with the underwriting process and attention to detail by the funders. “Instead of coming in at the end,” he says, “we try to prevent problems at the start of the process.”

For an MCA firm dealing with an excessive number of defaults, Merel sometimes places one of its employees with the funder to handle “pre-defaults,” for which it charges a lower fee. The collections firm has also built a reputation for not relying on a “confession of judgment.” Now that COJs have been outlawed for out-of-state collections in New York State, Merel’s skills could be more in demand.

Better Accounting Solutions, which has its offices on Wall Street, is another service-provider promising to lighten the workload of MCA firms by providing back-office support. The company is headed by Roitblat, a 36-year- old former rabbinical student turned tax-and-accounting entrepreneur. Since he founded the company with two part-time employees in 2011, it’s ballooned to some 70 employees.

Roitblat does not have all of his firm’s eggs in one MCA basket. His firm handles tax, accounting and bookkeeping work for law firms, the fashion industry, restaurants and architectural firms. Even so, he says, thirty MCA clients— or more than half his clientele—rely on the firm’s expertise, three of whom were just added in June. His best month was January, 2018, when six funders contracted for his services. “Growth in the MCA industry has been explosive,” he says.

MCA accounting work has its own vagaries and oddities. For example, because of the industry’s high default rate, Roitblat notes, a 10%-slice of every merchant’s payment is funneled into a “default reserve account.” And when an actual default occurs, credits are moved from the receivables account to the default reserve account.

Roitblat takes pride that his firm’s MCA work has passed audits from respected accounting firms like Friedman, Cohen, Taubman and Marcum LLP. Moreover, he has helped clients uncover internal fraud and, in one instance, spotted costly flaws in a business model. An early MCA client, Roitblat says, had no idea that “he was losing close to $100,000 a month by spending on Google ads.”

Better Accounting also keeps its rates low. The firm typically assigns a junior accountant to handle clients’ accounts while a senior manager oversees his or her work. “He (Roitblat) does a fantastic job,” says David Lax, managing partner of Orange Advance, a Lakewood (N.J.)-based MCA firm. “They understand the MCA business. And even if your business is small, they can set up the infrastructure and do the work more economically and efficiently than you can. You’d have to create the position of comptroller or senior-level accountant,” Lax adds, “to equal their work.”

Top-notch competence and low rates, Lax says, are not the only reasons he often refers Roitblat’s firm to fellow MCA companies. “The only thing better than their work,” he says, “is the people themselves.”

Whether it’s oil and gas, banking and real estate, construction, health care or high-technology—you name it—lawyers have an important role across nearly every industry. So too with the MCA industry where, as has been shown, there is an especially high demand for attorneys skilled at winning debt-collection cases.

To hear Greenbox’s Fein tell it, a skilled lawyer handling debt collection can write his or her own ticket. A talented attorney, he says, not only retrieves lost money and prevents losses, but enables the funder to “offer the product cheaper than the competition.

“We use a ton of attorneys in 35 states in the U.S. and in Canada,” Fein adds, “and you have no idea how many attorneys we go through until we find a good one.”

Until recently, much of the MCA industry’s success has resulted from a hands-off, laissez faire legal and regulatory environment—particularly the legal interpretation that a merchant cash advance is not a loan. The industry has also benefited from the fact that most credit regulation focused on consumer credit and not on business and commercial financings.

But now, as the MCA industry is maturing and showing up on the radar screens of state legislatures, Congress, regulatory agencies, and the courts, there is heightening demand for legal counsel. In just the past 12 months, California passed a truth-in-lending statute requiring MCA firms not only to clearly state their terms, but to translate the short-term funding costs of MCAs into an annual percentage rate. The state of New York, as has been noted, passed legislation restricting the use of COJs.

Moreover, notes Mark Dabertin, special counsel at Pepper Hamilton, a top national law firm based in Philadelphia, the state of New Jersey is contemplating licensing MCA practitioners. The Minnesota Court of Appeals recently determined in Anderson v. Koch that, because of a “call provision” in a funding contract, a merchant cash advance was actually a loan.

And, Dabertin warns, the Federal Trade Commission, which has the authority to treat a merchant cash advance as a consumer transaction—replete with the full panoply of consumer disclosures and protections—is training its gunsights on the industry. “On May 23,” Dabertin reports in a memo to clients, “the FTC launched an investigation into potentially unfair or deceptive practices in the small business financing industry, including by merchant cash advance providers.”

These pressures from government and the courts will only make doing business more costly and drive up the industry’s barriers to entry. Failing to stay legal, moreover, could not only result in punitive court judgments, but render an MCA firm vulnerable to legal action by their investors.

“It’s inevitable that the industry will evolve,” Dabertin says, and firms in the industry will have to self-police. “They will need to hire counsel and a compliance staff,” he adds. “You can’t just do it by the seat of your pants.”

Princeton Alternative Income Fund Saga Devolves Into SEC Investigation, RICO Lawsuit

August 18, 2019The demise of the Princeton Alternative Income Fund has resulted in several ugly twists and turns. In addition to a slew of lawsuits, the bankrupt hedge fund is also being investigated by the Securities and Exchange Commission. Matthew Cantor, who is serving as the bankruptcy Trustee, cited the SEC’s probe as one of many reasons he filed a RICO lawsuit late last month against individuals and businesses formerly involved with the hedge fund.

Princeton’s trouble snowballed after the very public collapse of Argon Credit of which Princeton was a major investor. That in turn created a conflict with Ranger Direct Lending, a UK fund that had invested in Princeton. The end result is that Argon and Princeton filed for bankruptcy while Ranger was wound down.

Enova’s Small Business Division Garner’s Limelight in Q2

August 16, 2019 Late last month, Enova released its second quarter report for 2019. Generally bearing positive news, the report asserts that the company is in a good position due to increasing demand, growth in various areas, and reductions in financing costs.

Late last month, Enova released its second quarter report for 2019. Generally bearing positive news, the report asserts that the company is in a good position due to increasing demand, growth in various areas, and reductions in financing costs.

Total revenue is up from Q2 2018, rising 13% from $253 million to $286 million, just as net income has risen from $18 million to $25 million.

“We are pleased to report another quarter of solid financial results that exceeded our expectations on both the top and bottom line,” said Enova CEO David Fisher in the earnings call. “Our strong financial performance was driven by solid demand, stable credit, and efficient marketing spend. We continue to demonstrate our ability to produce sustainable and profitable growth and our second quarter results further validate this balanced approach.”

Speaking more specifically about which divisions of Enova have excelled, Fisher highlighted the small business sector, which is composed of Headway Capital and The Business Backer. “NetCredit and our small business financing products were the primary growth drivers during Q2, with domestic revenue up 19% year over year … Our products are clearly gaining traction with customers, resulting in originations increasing 140% year over year, and small business now represents 12% of our book at the end of Q2.”

Jim Granat, Enova’s Head of Small Business Financing, chalked such gains up to “having a great team, a good strategy, and a great company behind us that has the ability to invest in the analytics, tech, and people.” The strategy he speaks of is titled ‘Faster and Easier,’ a modus operandi began by him after his arrival to the company in 2018. It is data-driven and involves incorporating certain individual operations of Headway and Business Backer, and streamlining these processes so that the brands overlap for particular actions. Implemented with the belief that “doing it internally would lead to speed and ease externally,” ‘Faster and Easier’ appears to be working, if one takes Fisher’s comments and the report as affirmation.

“We’ve been working really hard and hopefully the results of that show in the fruits of these efforts,” said Granat. “We are just in the beginning of what we can accomplish, these projects take a while and we are incredibly excited about the second half of 2019, let alone 2020 and beyond.”

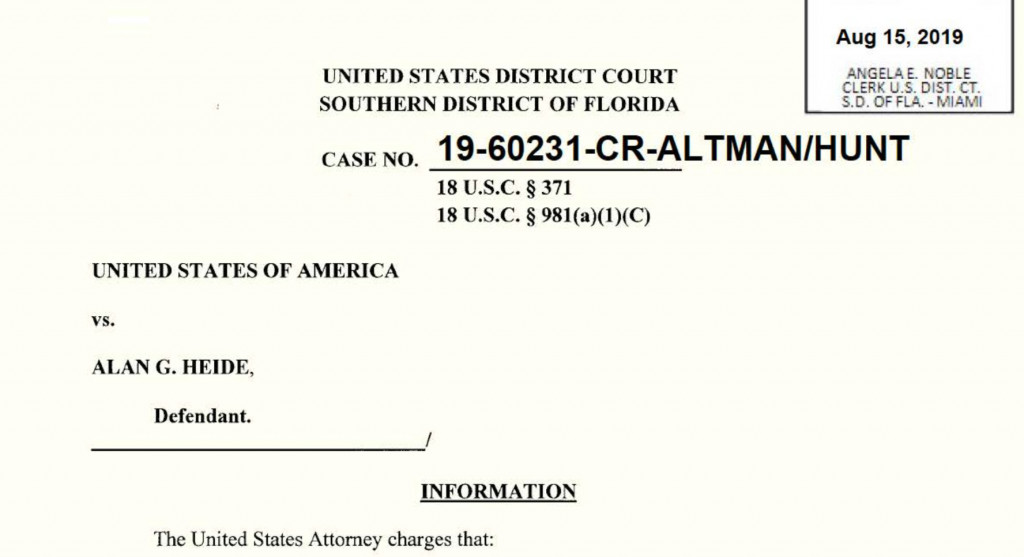

Alan Heide, CFO Of 1 Global Capital, Hit With Criminal Charge & SEC Violations

August 15, 2019

Update: Alan Heide has pleaded guilty to one count of conspiracy to commit securities fraud.

The former CFO of 1 Global Capital, Alan Heide, was stacked with bad news on Thursday. The US Attorney’s Office for the Southern District of Florida lodged criminal charges against him at the same time the Securities & Exchange Commission announced a civil suit for defrauding retail investors.

Heide was criminally charged with conspiracy to commit securities fraud.

According to the criminal complaint:

It was a purpose of the conspiracy for the defendant and his conspirators to use false and fraudulent statements to investors concerning the operation and profitability of 1 Global, so that investors would provide funds to 1 Global, and continue to make false statements to investors thereafter so that investors would not seek to withdraw funds from 1 Global, all so that the conspirators could misappropriate investors’ funds for their personal use and enjoyment.

He is facing a maximum of 5 years in prison.

1 Global Capital CEO Carl Ruderman, who recently consented to judgment with the SEC, has not been charged criminally to-date. However, he is mentioned throughout the pleading against Heide as “Individual #1 who acted as the CEO of 1 Global.”

Civil charges were simultaneously lodged by the SEC.

According to the SEC’s complaint:

Although 1 Global promised investors profits from its short-term merchant cash advances to businesses, the company used substantial investor funds for other purposes, including paying operating expenses and funding Ruderman’s lavish lifestyle. The SEC alleges that Heide, a certified public accountant, for nine months regularly signed investors’ monthly account statements that he knew overstated the value of their accounts and falsely represented that 1 Global had an independent auditor that had endorsed the company’s method of calculating investor returns.

According to an SEC statement, Heide agreed to settle the SEC’s charges as to liability, without admitting or denying the allegations, and agreed to be subject to an injunction, with the court to determine the penalty amount at a later date.

1 Global Capital filed for bankruptcy last year after investigations by the SEC and US Attorney’s Office hampered their ability to raise capital. Ruderman’s recent settlement with the SEC put him on the hook for $50 million to repay investors.

The 2019 Top Small Business Funders By Revenue

August 14, 2019The below chart ranks several companies in the non-bank small business financing space by revenue over the last 5 years. The data is primarily drawn from reports submitted to the Inc. 5000 list, public earnings statements, or published media reports. It is not comprehensive. Companies for which no data is publicly available are excluded. Want to add your figures? Email Sean@debanked.com

| Company | 2018 | 2017 | 2016 | 2015 | 2014 |

| Square | $3,298,177,000 | $2,214,253,000 | $1,708,721,000 | $1,267,118,000 | $850,192,000 |

| OnDeck | $398,376,000 | $350,950,000 | $291,300,000 | $254,700,000 | $158,100,000 |

| Kabbage | $200,000,000+* | $171,784,000 | $97,461,712 | $40,193,000 | |

| Global Lending Services | $232,200,000 | $125,700,000 | |||

| Bankers Healthcare Group | $220,300,000 | $160,300,000 | $93,825,129 | ||

| National Funding | $121,300,000 | $94,500,000 | $75,693,096 | $59,075,878 | $39,048,959 |

| Forward Financing | $75,500,000 | $42,100,000 | $28,305,078 | ||

| ApplePie Capital | $69,700,000 | ||||

| Fora Financial | $68,600,000 | $50,800,000 | $41,590,720 | $33,974,000 | $26,932,581 |

| Reliant Funding | $64,800,000 | $55,400,000 | $51,946,000 | $11,294,044 | $9,723,924 |

| Envision Capital Group | $32,700,000 | ||||

| Expansion Capital Group | $31,300,300 | $23,400,000 | |||

| SmartBiz Loans | $23,600,000 | ||||

| 1 Global Capital | bankruptcy | $22,600,000 | |||

| IOU Financial | $19,200,000 | $17,415,096 | $17,400,527 | $11,971,148 | $6,160,017 |

| Quicksilver Capital | $16,500,000 | ||||

| Channel Partners Capital | $23,000,000 | $14,500,000 | $2,207,927 | $4,013,608 | |

| Lendr | $16,500,000 | $11,800,000 | |||

| Lighter Capital | $16,000,000 | $11,900,000 | $6,364,417 | $4,364,907 | |

| United Capital Source | $9,735,350 | $8,465,260 | $3,917,193 | ||

| Fundera | $15,600,000 | $8,800,000 | |||

| US Business Funding | $14,800,000 | $9,100,000 | $5,794,936 | ||

| Wellen Capital | $12,200,000 | $13,200,000 | $15,984,688 | ||

| PIRS Capital | $11,900,000 | ||||

| Nav | $10,300,000 | $5,900,000 | $2,663,344 | ||

| P2Binvestor | $10,000,000 | ||||

| Seek Business Capital | $8,800,000 | ||||

| Fund&Grow | $7,500,000 | $5,700,000 | $4,082,130 | ||

| Funding Merchant Source | $7,500,000 | ||||

| Shore Funding Solutions | $5,000,000 | $4,300,000 | |||

| StreetShares | $4,967,426 | $3,701,210 | $647,119 | $239,593 | |

| FitSmallBusiness.com | $3,000,000 | ||||

| Eagle Business Credit | $3,600,000 | $2,600,000 | |||

| Everlasting Capital | $2,500,000 | $2,100,000 | |||

| Swift Capital | acquired by PayPal | $88,600,000 | $51,400,000 | $27,540,900 | |

| Blue Bridge Financial | $6,569,714 | $5,470,564 | |||

| Fast Capital 360 | $6,264,924 | ||||

| Cashbloom | $5,404,123 | $4,804,112 | $3,941,819 | ||

| Priority Funding Solutions | $2,599,931 |

LendingPoint Places Seventeenth on Inc. 5000

August 14, 2019 Today Inc. 5000 released is 2019 list of the fastest growing private companies in America, featuring alternative finance company LendingPoint in seventeenth place after it witnessed a three-year revenue growth of 9,265%. LendingPoint offers consumer loans of up $25,000 and provides financing to merchants, service providers, and medical institutions via its LendingPoint Merchant Solutions program.

Today Inc. 5000 released is 2019 list of the fastest growing private companies in America, featuring alternative finance company LendingPoint in seventeenth place after it witnessed a three-year revenue growth of 9,265%. LendingPoint offers consumer loans of up $25,000 and provides financing to merchants, service providers, and medical institutions via its LendingPoint Merchant Solutions program.

This is the Atlanta-based business’s debut on the list and it comes after LendingPoint had a strong twelve months, with it being on track to reach $100 million per month in loan originations by the end of 2019 as well as it being the year the company turned profitable. On top of these, LendingPoint also has plans to expand its operations by hiring an additional 100 people, bringing its Atlanta HQ up to nearly 300 staff members.

In a press release, LendingPoint CEO Tom Burnside claimed that “Our platform saw more originations in 2018 than in 2015, 2016 and 2017 combined [sic], and at the same time our credit performance improved allowing us to facilitate more financing for consumers online and at the point of sale.”

Such growth is attributed by Burnside to LendingPoint’s use of technology. “We started by using data and technology to provide access to credit to underserved [sic], expanded to providing financing options at the point of sale to virtually everyone, and are now working on ways to integrate financing and payments with loyalty using blockchain to protect PII and enhance customer experience.” Such technology makes use of over 10,000 alternative data points, while also using FICO as a weighted factor of their analysis, to determine an applicant’s approval.

“We spend a lot of time cross-tabularizing the data points,” said Mark Lorimer, LendingPoint’s Chief Communications and Public Affairs Officer, when asked about the company’s approach to tech. Confronted by vast amounts of data, Lorimer noted how LendingPoint makes use of its technology to determine the value of different variables, “it really is a matter of taking the data and turning it into information.”

On the subject of LendingPoint’s placement on the Inc 5000, Lorimer told deBanked that the company was “not really surprised” by the news. According to him, his colleagues had been keeping an eye on the performance of those companies who previously placed on the list and were aware of what was required to appear on it, while his CEO has a more exuberant take on it: “It has been quite a ride for the last three years, and we’ve only scratched the surface.”