The Financial Statement Problem

The Banks Know When You Don’t Keep Track

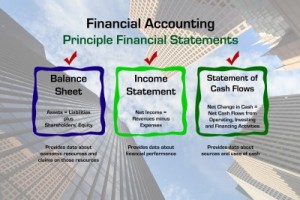

In the land of underwriting, sometimes Assets do not equal Liabilities + Equity. This only happens of course when a Balance sheet is prepared so poorly that it doesn’t even do the fundamental thing, balance… and I’ve seen plenty of these in my career.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

So what is a small business to expect when submitting financial documents for a loan approval?

5 out of 5 bank executives interviewed by Nerdwallet.com complained that too many small business owners don’t keep financial records, rarely update them, or only worry about them during tax season. Their advice? Hire a full-time financial professional. For a small business, this might mean being forced to sacrifice a chef, mechanic, or manager. The trade-off might not be worth it.

The merchant lending industry is a lot more forgiving when it comes to submitting documents. Deals under $100,000 may not require any financial statements at all. Yes, there are options out there specifically for the man or woman that chose a chef over an accountant, but that doesn’t mean they’re encouraging poor record keeping ways, nor does it mean they are blind to bad business practices.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Believe me when I say that there is no lender in the world that is going to be confident in approving a pile of crap, no matter how easy they advertise the approval process is.

My advice? If you can’t make time to organize your books regularly or hire a financial professional, at least build it in to your plans to do it in the future. Bank financing may be out of the question in the interim, but that doesn’t mean you are out of options. Merchant lenders, like the ones listed in our directory can help you. Just make sure you take the the application process seriously. Approving loans without financial statements may make these lenders more open to risk, but they know a bad deal when they see one. Be honest, open, and submit well prepared documentation. That’s the best way to maximize your chances.

Last modified: April 20, 2019Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.