How The PPP Reporting Oversight Harms MCA Companies

July 18, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies.To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

deBanked’s recent story covering the news about how the Small Business Administration (SBA) failed to report many Paycheck Protection Program (PPP) loan charge-offs to credit agencies is a major concern for merchant cash advance companies.

deBanked’s recent story covering the news about how the Small Business Administration (SBA) failed to report many Paycheck Protection Program (PPP) loan charge-offs to credit agencies is a major concern for merchant cash advance companies.

As the deBanked article explained, a new report from the Office of the Inspector General (OIG) found that the SBA did not report 37% of PPP loan charge-offs, and missed deadlines 97% of the time. The OIG report stated that the SBA’s automated system was supposed to report these loans, but it did not always work correctly. As a result, many delinquent borrowers could still get new loans because their bad debt wasn’t reported. The report also pointed out that a large portion of early PPP loan charge-offs were linked to potential fraud, which makes the lack of reporting even more serious.

This oversight could cause real problems for our industry. As an accountant working with MCA companies for over a decade, I understand firsthand how important accurate credit reporting is for making sound and fully informed decisions on which merchants our clients choose to invest in and help advance.

For MCA companies, this incomplete reporting leaves a critical gap in the information that funders rely on. Without accurate credit information, it’s harder to assess the risk of advancing capital to any particular merchant, which can lead to higher chances of defaults and financial losses when you don’t have a complete history that includes any times they’d skipped payments or defaulted. The missing data from the SBA means MCA companies might unknowingly fund high-risk businesses, which ultimately harms the cash advance company itself.

To work through this situation, funders need to take stock of how they evaluate prospective merchants to work with.

First, it’s important to do thorough background checks using multiple sources of information. Relying on just one credit report isn’t enough, especially now that we know there might be gaps. Cross-referencing data from various sources will provide a more complete picture of a merchant’s credit history.

We can also require merchants to provide more documentation and financial information before approving funding deals, removing a complete reliance on credit reporting agencies that have now proven themselves fallible. Pairing up the complete history that they provide along with their credit reports, and continuous tracking of the deal on a strong internal MCA CRM that lets you know of any hiccups, is a proactive approach that helps in making informed funding decisions.

It’s vital to develop strong risk management strategies. This might include setting stricter funding criteria, diversifying the types of businesses we lend to, and keeping enough reserves to cover potential losses. By being cautious and prepared, we can protect our companies from the financial risks posed by incomplete credit reporting, and eliminate our over reliance on that one source of information.

Let’s use this opportunity to ensure we are making the best funding decisions possible, and continue to have healthy companies built on stable foundations.

eBay Brings Back Revenue Based Financing Product

July 12, 2024eBay announced that Liberis had been onboarded as one of its “Seller Capital” partners this week, making it the second official partner after Funding Circle (which was recently acquired). Liberis, homegrown in the UK, expanded to the US in 2020 and offers a revenue based financing product described by eBay as a “Business Cash Advance.” While eBay has partnered with similar companies in the UK for years, eBay customers in the US have seen this before.

In 2010, for example, Kabbage was arguably the first company to offer revenue based financing to eBay customers, which deBanked first covered 13 years ago. And they had it all to themselves until PayPal began to muscle its way in with a similar product starting in 2013. Given that eBay owned PayPal, PayPal held a distinct advantage until the two companies split in 2015. Still, PayPal continued to be the default payment service for eBay until 2018.

Kabbage continued to thrive anyway, evolving beyond the platform at least until covid when Kabbage suddenly imploded and was sold to American Express. PayPal’s working capital product also continued to thrive at least until 2023 when it announced a dramatic pullback after elevated charge-offs.

The result is that in 2024, eBay sellers can now look toward getting funding via Liberis.

“As a pioneer in ecommerce and the home to small businesses in more than 190 markets, eBay understands the challenges small businesses encounter in securing fast, flexible and transparent financing,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay in the official announcement. “eBay Seller Capital is aimed at fueling our sellers’ growth by providing them with tailored financing solutions that meet the unique needs of their businesses. The addition of Business Cash Advance to our suite of offerings in partnership with Liberis enables us to expand capital availability for our sellers on flexible terms – when they need it the most.”

“We understand the unique challenges eBay sellers face when securing financing through traditional means,” adds Rob Straathof, CEO of Liberis. “Through eBay Seller Capital, Liberis will empower sellers with access to fast and responsible financing. We’re thrilled to partner with eBay to support eBay sellers to operate and grow their businesses.”

Why It’s Important To Understand How You Report Syndication Income

June 25, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies.To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

In the world of Merchant Cash Advances (MCAs) where financial reporting is complicated and extremely detailed, understanding how to handle syndication income is crucial. Syndication income, which often includes management fees, plays a pivotal role in the operations of many MCA companies, helping fund deals and enable the business to grow to the next level, while also often (hopefully) proving a lucrative investment for the syndicator.

In the world of Merchant Cash Advances (MCAs) where financial reporting is complicated and extremely detailed, understanding how to handle syndication income is crucial. Syndication income, which often includes management fees, plays a pivotal role in the operations of many MCA companies, helping fund deals and enable the business to grow to the next level, while also often (hopefully) proving a lucrative investment for the syndicator.

It’s essential to grasp the various approaches to recognizing this cash injection and the implications it has on financial reporting. Let’s explore the strategies that MCA companies typically apply and the accounting principles that guide them.

Companies have diverse methods for charging syndicators, each with its own set of nuances. Some MCA companies opt for a straightforward flat fee upfront. Others choose to charge a flat fee as funds are repaid with each payment, and there are those who employ a combination of both – a smaller upfront fee coupled with fees assessed as funds are recovered. Understanding which method you typically use is the first step in accurately recognizing syndication income.

Most MCA companies operate on an accrual basis, where income is recognized when earned, regardless of when funds are received. This approach is predicated on the notion that once a syndication fee is charged, it need not be refunded even if the MCA deal defaults. Consequently, income is recognized at the moment fees are charged.

For instance, if an MCA company charges an upfront syndication fee, that fee is immediately recognized as income. The same principle applies when fees are assessed as funds are repaid – income is recognized in real-time as payments are received. However, it’s important to note that there are exceptions to this rule. In some cases, MCA agreements dictate that if only a portion of the funds is recovered, a corresponding portion of the syndication fee must be refunded. In such instances, income is not recognized until funds are actually recovered, and the syndication fee income is allocated over the duration of the advance.

So, why does this matter, and how does it impact the financial landscape of MCA companies?

First and foremost, it has a direct bearing on financial reporting. Accurate accounting practices are essential not only for internal financial management but also for external stakeholders, including investors, regulators, and auditors. Understanding when and how to recognize syndication income ensures that financial reports reflect the true financial health of the MCA company, both for yourself and the syndicators.

Moreover, the chosen approach to recognizing syndication income affects cash flow. An upfront recognition of income may paint a more favorable cash flow picture, while a deferred recognition approach may better align cash flows with actual funds received from MCA deals. This can impact budgeting, planning, and investment decisions.

Furthermore, it influences the perception of risk and profitability. MCA companies that recognize income upfront may appear more profitable on paper, while those that defer income recognition may appear less so. This can impact investor confidence and the overall attractiveness of the MCA company as an investment opportunity.

Understanding the various approaches and their implications is essential for accurate financial reporting, effective cash flow management, and informed decision-making. Whether income is recognized upfront, as funds are repaid, or deferred until funds are actually recovered depends on the specific terms of MCA agreements and the associated risk and profitability considerations.

Ultimately, the goal for MCA companies is to employ accounting practices that not only comply with industry standards but also provide a transparent and accurate representation of their financial standing. By mastering the art of recognizing syndication income, MCA companies can navigate the intricate financial landscape with confidence and clarity.

Real-time Reconciliations on Revenue Based Finance Deals?

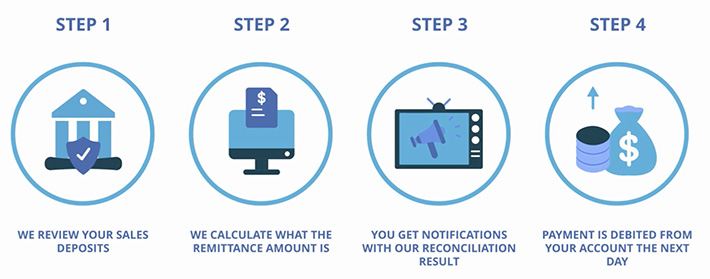

June 25, 2024In the finance world, taking a percentage of a merchant’s sales at the time a sale is consummated is called a split. It’s how revenue based financing often works when the purchased future receivables are card-based. When it’s all revenue, funding providers often rely on a combination of ACH debits and reconciliations, the frequency of which are governed by the contract. On some big e-commerce platforms, like Walmart Marketplace, for example, sales data is monitored in real-time and the appropriate split is debited out from the merchant’s bank account the next day. Some refer to this as a real-time reconciliation.

Real-time reconciliations have been attempted outside of e-commerce ever since Merchant Cash and Capital aka BizFi (RIP) pioneered this 15 years ago, but it was a manual process riddled with challenges that would hardly hold up in today’s technological world. In 2021, revenue based financing provider FundKite introduced its own system, one that was documented by deBanked at the time.

Back then, FundKite CEO Alex Shvarts said, “This product [where debits vary daily based upon true sales] works better for merchants, it works better for portfolios, if you’re actually reconciling and pulling what you’re supposed to, and not what you’re anticipating.”

Three years later, Shvarts still feels the same way and told deBanked that his daily reconciliation method has been a success and is now a leading driver of its business.

“In order to reconcile we must have access to the merchant bank accounts,” Shvarts said. “We use priority technology to do the reconciliation after we have the data. We use a combination of live Logins, Plaid, Decision logic and another piece of code we wrote. Merchants are automatically notified of the reconciliation and adjustment to the payments before we debit the accounts.”

The company touts this system as its edge on its homepage.

“Payments are based on sales, offering protection during slower periods or when no sales occur,” the site says.

Payoneer Funds $80M in MCAs in Q1

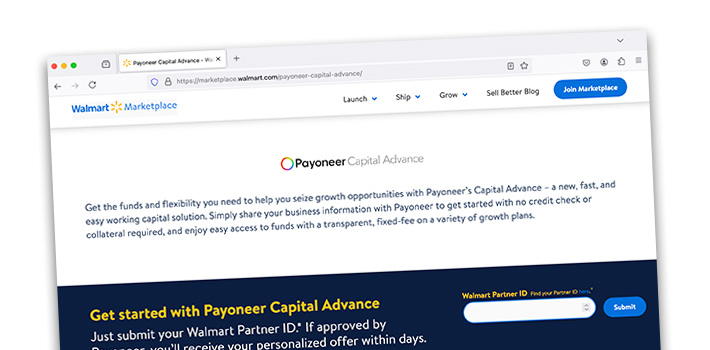

June 17, 2024 Payoneer, the digital payments provider that also offers working capital on e-commerce platforms like Walmart Marketplace, originated $80M in merchant cash advances in Q1, according to the company’s recent quarterly earnings report. While the company did not draw attention to this stat, it appears in its Statement of Cash Flows. Payoneer originated $299M in funding to merchants throughout all of 2023, which would put the company below Funding Circle in terms of annual funding volume.

Payoneer, the digital payments provider that also offers working capital on e-commerce platforms like Walmart Marketplace, originated $80M in merchant cash advances in Q1, according to the company’s recent quarterly earnings report. While the company did not draw attention to this stat, it appears in its Statement of Cash Flows. Payoneer originated $299M in funding to merchants throughout all of 2023, which would put the company below Funding Circle in terms of annual funding volume.

When it comes to Walmart, Payoneer offers up to 140% of a marketplace merchant’s average monthly Walmart volume and factor rates that range from 1.015 to 1.10.

“Payoneer will collect a pre-determined portion of each Walmart payout you receive via ACH bank debit from your bank account,” the website states. “Debits typically take place within 1 business day of each payment received from Walmart.”

The program is not new. The two first announced this relationship in December 2021. At the time, a senior director at Walmart said “Affordable working capital is more important than ever to help our sellers grow their business.”

Lightspeed: ‘We plan to grow our MCA business cautiously’

June 6, 2024 Global e-commerce platform Lightspeed continues to see a lot of potential in the merchant cash advance space. It more than doubled the cash expended to originate MCAs quarter-on-quarter to $18.5M up from $8.3M.

Global e-commerce platform Lightspeed continues to see a lot of potential in the merchant cash advance space. It more than doubled the cash expended to originate MCAs quarter-on-quarter to $18.5M up from $8.3M.

“I’ll start by saying that when we look at our peers that are doing capital and have been doing capital for a long time as a part of their business, they’re giving out about 1% of their GTV (Gross Transaction Value) in merchant cash advance,” said Lightspeed CFO Asha Bakshani in the Q4 2024 FY earnings call. “If we were to do 1% of our GTV, that’s almost $1 billion in merchant cash advance. So, definitely a ton of growth potential for this business.”

Bakshani continued by saying:

What we plan on doing is growing this business very cautiously given the macro. As we’ve said before, we are in the perfect position to underwrite our customers for capital, determine the creditworthiness of our customers and how much they should be underwritten for, and we’ve had great success with the business so far, but again, growing it in a very steady and cautious manner. We don’t expect that we would use our balance sheet for several hundred million of merchant cash advances underwritten.

We’re already in talks with partners. There are lots of interested parties because they recognize that Lightspeed is in a great spot to underwrite customers. So, we’re already in talks with partners today. We have at any given point in time, $50 million to $60 million outstanding from this merchant cash advance business, and that may go up to $100 million, but we’re not planning to leverage our balance sheet for much more than that.

Kris Roglieri To Stay in Prison Indefinitely After Shocking Development

June 3, 2024Add credible threats to murder an FBI agent to the list of scandalous accolades that Kris Roglieri has racked up in recent months. On Monday, prosecutors revealed the rationale behind the unusual demand to have him detained for what is seemingly a white collar crime, and that is that he has become dangerous. According to calls and emails Roglieri had with an unnamed friend, he said would “take out” a judge and a receiver, that he was going to “wack anybody” that went after him, and that he had determined the home address of one of the FBI agents investigating him and that he planned to put a bullet in their head.

“when someone takes everything away from you . . . if I go down, everyone goes down,” he said.

When the FBI became fully aware of the circumstances, he was arrested and taken into custody on May 31 on a single charge of wire fraud. It is likely that more charges will follow given that more than $100 million of the funds he took from customers remain unaccounted for. Nevertheless, prosecutors used the danger he posed to secure his temporary detainment without bail and on Monday he was ordered to remain in prison indefinitely while awaiting trial. He is being represented by a public defender.

Meanwhile, Roglieri’s company Prime Capital Ventures has been in receivership while he himself is in Chapter 7. In the latter case, he was recently ordered to turn over all his assets, including ownership of his businesses. One of those businesses, NACLB, announced prior to the order that it was rebranding to a different name, was still accepting payments from customers, and that it was exciting to still be moving forward.

MCA Businesses Must Protect Themselves Better

May 28, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies.To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

A couple of weeks ago, deBanked covered the story of Mark Csantaveri, a key figure behind three fraudulent companies that defrauded over 50 distressed small business owners with outstanding cash advances–and their cash advance funders–of over $3.4 million.

A couple of weeks ago, deBanked covered the story of Mark Csantaveri, a key figure behind three fraudulent companies that defrauded over 50 distressed small business owners with outstanding cash advances–and their cash advance funders–of over $3.4 million.

Together with his co-conspirators at MCA Cure LLC, LDMS Group LLC, and Evergreen Settlement Group LLC, Csantaveri allegedly set up these fake debt settlement companies to prey on people with cash advance deals in place. Promising a fantastic debt restructuring system that could lower their payments by 80% and under the guise of negotiating with the funders, Csantaveri told his victims to direct the payments meant for their funders to an escrow account. He then promptly forwarded the money to his own personal accounts, leaving the merchants trying to figure out what happened when their funder contacted them asking what happened to their payments.

Happily, Csantaveri and his cronies have been charged for their crimes and face decades of prison and steep fines, but these stories are too common in our industry. Every few weeks we hear of businesses getting cheated and defrauded, and unfortunately rarely are the schemes particularly imaginative or unusually unavoidable. deBanked has been on streak recently, publishing blockbuster features about the underbelly of the merchant cash advance business, and yet despite all the warnings, it just keeps happening over and over again.

Cash advance companies have an obligation to proactively protect themselves. And luckily, there are clear ways to do that.

Preventative Step 1: Clearly communicate with the merchant.

Merchant cash advance is a hungry game, and we’re always chasing the next client, the next close, the next commission. This need for speed is often an asset, but when we’re dealing with clients in perilous financial situations who are desperate for quick fixes, it is extremely unwise to deal with them hastily.

It must be clearly communicated to clients the terms of the deal they are accepting, and what exactly they are committing to. They must be reminded that the only people authorized to negotiate the terms of this arrangement are the two parties that signed it, and there are no “white knight saviors” that have any way of interceding on their behalf. If they’re having trouble meeting their obligations, they should feel comfortable letting their funder know, and both parties can work together on finding a mutually beneficial solution.

Preventative Step 2: Actively monitor your deals.

Making sure to actively stay on top of deals is how to avoid things going sideways.

Thanks to industry-customized CRMs such as MCA-Track, LendSaas and Orgmeter, merchant cash advance companies can keep in regular touch with their merchants, while easily tracking the progress of the deals throughout their term lengths.

For example, MCA-Track allows funders to monitor the bank activity of their merchants to see if they’re putting themselves in further financial entanglements by diverting payments, taking on additional advances, or are having outgoing payments bounced. If a funder sees any of that happening, they can step in and connect with the client to proactively ensure everything is still in order, and if it’s not, iron out any issues before they balloon into a much larger problem.

Embracing the available platforms to remain vigilant, and consistently reviewing the sustained health of your deals can help avoid a lot of stress down the road.

Preventative Step 3: Have a go-to financial professional.

This is the step I am personally passionate about for obvious reasons.

Better Accounting Solutions has had the privilege of serving the cash advance industry for well over a decade, and I’ve been a consistent evangelist for companies to embrace outside financial counsel–particularly those with experience in our business–to avoid getting into these issues in the first place.

Businesses need independent financial experts to ensure transparency, prevent bias, and avoid conflicts of interest. The benefits of using MCA experienced firms (any firm!), instead of in-house accountants, are obvious: it removes the danger of assuming a myopic view of what is happening in the industry only analyzed through the lens of just one company, ensures trust and transparency between funders and syndicators, and prevents misappropriation of funds.

Sometimes businesses settle on using any accounting firm, with no experience in MCA accounting, but that can lead to more issues than you had before they were engaged. The danger lies in you thinking everything is being handled and in compliance with the relevant regulations, when in fact they don’t know how to navigate the challenging financial world of our industry.

The industry as a whole is tarnished when crooks are able to circumvent systems meant to protect us all. Staying financially aware and employing these best practices is the key to ensuring it can’t happen again.