business cash advance

Yes Lender Becomes Fintegra, Brings on Former Federal Reserve Vice Chair

November 15, 2021 Yes Lender is now Fintegra. Along with the name change, the company is bringing on Roger Ferguson, former Vice Chair of the Federal Reserve (1997-2006) in an advisory role. Ferguson is also an investor in Fintegra.

Yes Lender is now Fintegra. Along with the name change, the company is bringing on Roger Ferguson, former Vice Chair of the Federal Reserve (1997-2006) in an advisory role. Ferguson is also an investor in Fintegra.

“Our new name combines ‘fintech’ with ‘integrity’” said Glenn Forman, CEO at Fintegra. [The name] serves as a daily reminder to our customers and colleagues of our mission and values, which we take very seriously.”

The company’s goal is seemingly to write a lot of deals, and get them funded as fast as possible through a fintech application process. According to a press release, the online application can get merchants their funds within 24 hours of their application being submitted.

When touching upon Fintegra’s goals with the rebranding, Forman spoke on a good work environment along with customer-centric business decisions. “We’re committed to putting capital in the hands of entrepreneurs so they can grow their businesses and improve the lives of their customers, suppliers and employees, and we’ll continue to do so in a highly ethical and empathetic way.”

When speaking about the partnership with Ferguson, Forman believes this unprecedented addition will bring equally unprecedented opportunities to this company.

“We’re incredibly fortunate to be able to tap Roger’s wisdom and experience to accelerate Fintegra’s growth. His track record of success and impeccable ethics are perfectly aligned with our brand.”

Forman and Ferguson are looking to rekindle an old working relationship to help Fintegra take off. “While it’s been a few years since we worked together at McKinsey & Company, it feels great to be joining forces again to take Fintegra to new heights.”

deBanked Visits Local Commercial Finance Brokerage – Horizon Funding Group

October 22, 2020deBanked reporter Johny Fernandez visited the storefront office of Horizon Funding Group, a commercial finance brokerage located in Brooklyn. The company is owned by brothers James and John Celifarco.

CAN Capital Hired a New CFO: Here’s His Take On The Company

July 23, 2019 The last 12 months have seen plenty of developments within the offices of CAN Capital. September witnessed the announcement of a new credit facility of $287 million with Varadero Capital. January brought news of the hiring of a new CEO. And now, completing the hat trick is CAN’s employment of John McNeill as its CFO.

The last 12 months have seen plenty of developments within the offices of CAN Capital. September witnessed the announcement of a new credit facility of $287 million with Varadero Capital. January brought news of the hiring of a new CEO. And now, completing the hat trick is CAN’s employment of John McNeill as its CFO.

Coming from years of experience in finance, with firms such as Ocwen Financial and Zume, McNeill is stepping into his role with an optimism normally reserved for those at the offset of a new business. Saying that due to recent restructuring, new hirings, and CAN’s re-evaluation of its position in the market over the previous two years, McNeill believes that the company “feels like it’s a nimble startup.” Albeit a startup that has been in the industry for over 20 years.

Founded in 1998 by a small business owner who struggled to be approved for a business loan, CAN has been cemented as a legacy figure within the alternative finance industry. Having persevered through the ’08 crash as well as other economic hiccups over the past two decades, CAN is uniquely positioned in that it has 20 years worth of experience and data, not to mention the personnel who have stuck around to become veterans as well, to guide them through the current moment of market saturation.

And it is the synergy between these two aspects of CAN, the new and the old, that initially drew McNeill to the company. The opportunity to work alongside people who have decades of experience in the market, as well as those who have only been there a few months longer than himself, led McNeill to view CAN as an anomaly, where it’s “like being the new guy, but with all of the tools of historical experience.”

This freshness tempered by lessons learned in the past is also attributed by McNeill to CAN’s CEO, Edward J. Siciliano, who’s worked in commercial financing, sales, marketing, and operations for over 30 years; and who has aimed to expand operations, both technologically and geographically, since his taking up of the role.

McNeill believes that there continues to be plenty of the market left to expand into, saying there’s “still a lot of opportunities to make money and to help secure funding for businesses across America.”

Back on August 14th, the

Back on August 14th, the  With $1.3 billion funded since 2006, an independent report cited in the registration by Oliver Wyman estimates the untapped market to be between $80 billion and $120 billion.

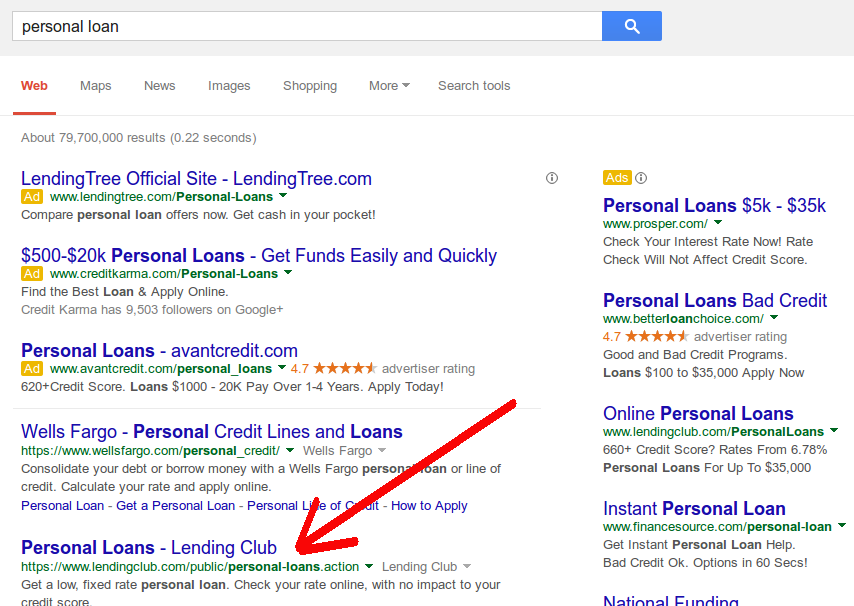

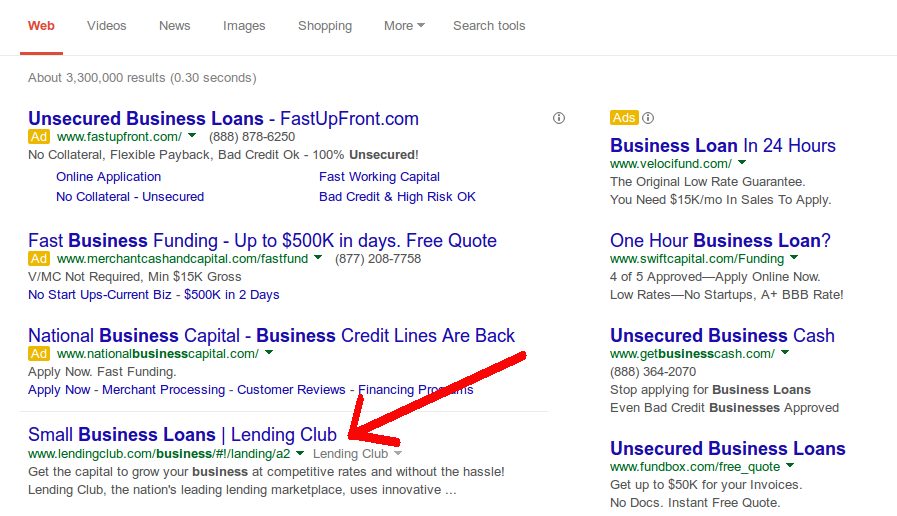

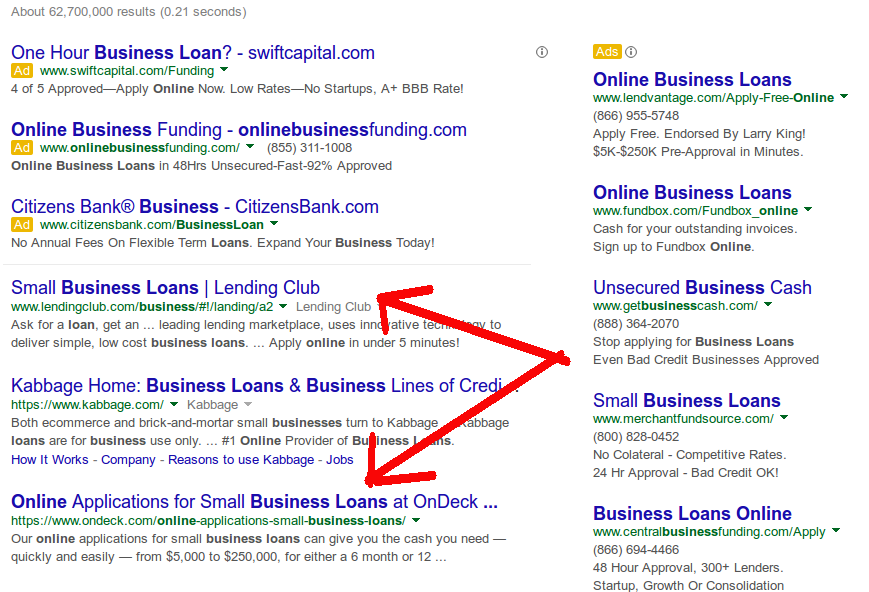

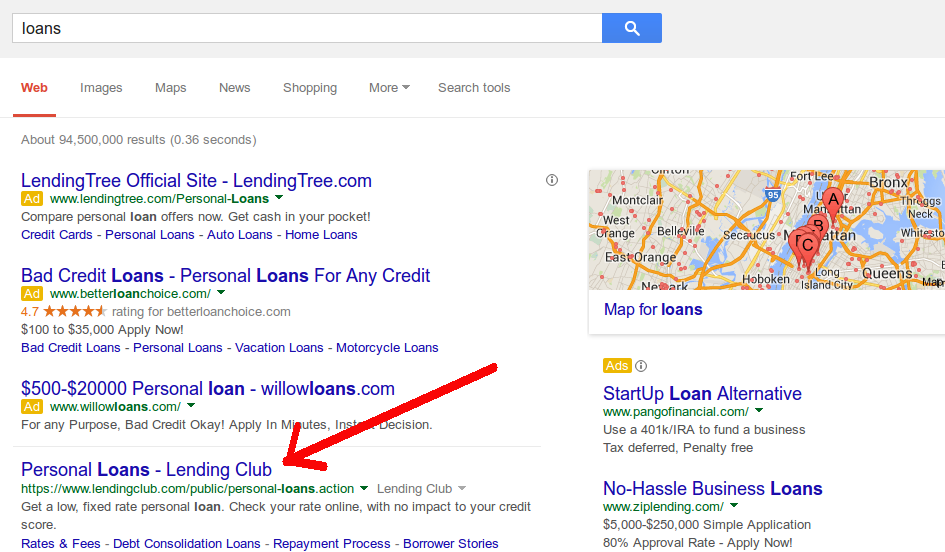

With $1.3 billion funded since 2006, an independent report cited in the registration by Oliver Wyman estimates the untapped market to be between $80 billion and $120 billion.  Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.

Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.  Market Size

Market Size In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

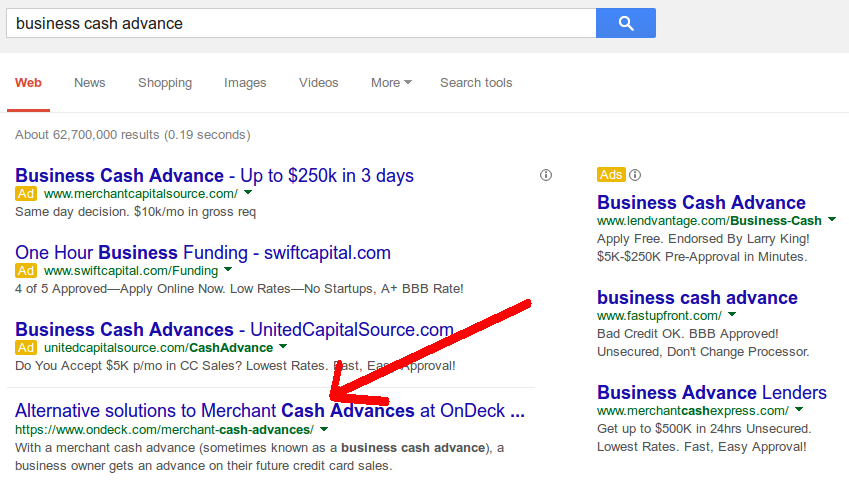

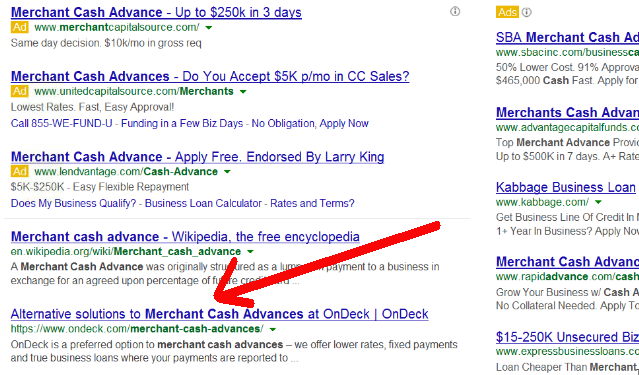

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.  Somebody once called business loans the Cadillac of Credit products and that person is Brendan Ross, the President of Direct Lending Investments (DLI). In a

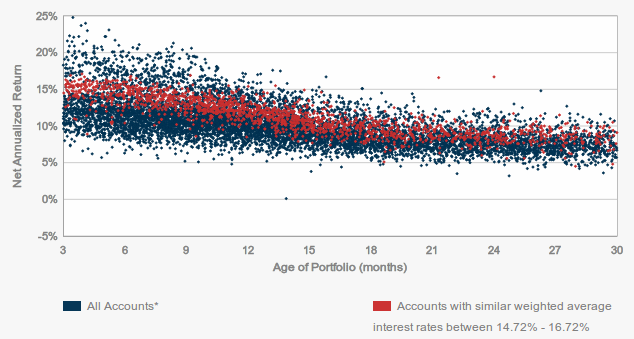

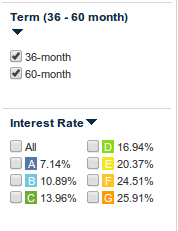

Somebody once called business loans the Cadillac of Credit products and that person is Brendan Ross, the President of Direct Lending Investments (DLI). In a  Investing in G-rated loans with an average annual interest rate of 25% doesn’t mean you’ll get that number or that you can even comfortably expect double digit returns. But you can try… And most do.

Investing in G-rated loans with an average annual interest rate of 25% doesn’t mean you’ll get that number or that you can even comfortably expect double digit returns. But you can try… And most do.