Loans

Prosper Marketplace Originated $2.2B in Consumer Loans in 2024

March 28, 2025 Prosper Marketplace, the last vestige of the P2P lending era, put up a repeat origination performance in 2024 vs 2023. The company originated $2.2B in consumer loans in 2024 and in 2023. That number had hit $3.3B in 2022 as part of the post-covid boom and had come in at only $1.9B in 2021.

Prosper Marketplace, the last vestige of the P2P lending era, put up a repeat origination performance in 2024 vs 2023. The company originated $2.2B in consumer loans in 2024 and in 2023. That number had hit $3.3B in 2022 as part of the post-covid boom and had come in at only $1.9B in 2021.

Only 7% of its originations in 2024 were from the “note channel” aka the peer-to-peer platform.

“We have incurred operating losses in prior years and may continue to incur net losses in the future,” the company disclosed in its annual report. “For the years ended December 31, 2024 and 2023, we incurred net losses of $54.1 million and $106.5 million, respectively. Additionally, from our inception through December 31, 2024, we have had an accumulated deficit of $644.2 million. We believe our liquidity needs for the next twelve months, and for the foreseeable future beyond that period, can be met through transaction fees, servicing fees, net interest income, other revenue, proceeds from sales of loans and securitizations, realized gains from the Credit Card portfolio and Cash and Cash Equivalents.”

Prosper used to compete against LendingClub as a peer-to-peer investment platform. LendingClub, however, discontinued its peer-to-peer business five years ago when it acquired Radius Bank.

Upstart: 91% of loans fully automated

February 19, 2025AI-based online consumer lending company Upstart just wrapped up a strong year, generating a tiny $2.8M net loss on $219M in revenue. Upstart was known for AI in the fintech industry before AI became the buzzword it is now. Ninety-one percent of the company’s loans in 2024 were fully automated with no human involvement, and 93% of instant approvals converted to funded loans.

Notably, a significant amount of their loan volume is generated by direct mail.

“Whenever our models get better, we tend to get more volume from partners, DM — direct mail converts better so that we can actually increase the amount of direct mail we send,” said CEO David Girouard.

While the company halted its earlier plans to add small business loans to its product mix, it still estimates the size of the market in its quarterly presentations. And according to that it’s an $895 billion market annually.

Analysts on the call liked what they heard about Upstart’s 2024 performance.

“2024 was a year of rapid quarter by quarter improvement for Upstart, and the fourth quarter clearly took the cake,” said Girouard. “Considering the weak environment we faced at the beginning of the year, we couldn’t have asked for a stronger finish. In Q4, our business grew dramatically across all our product categories on a sequential basis, delivered Adjusted EBITDA at levels not seen since the first quarter of 2022, and came within a whisker of returning to GAAP profitability.”

Upstart Hit With Another Lawsuit

October 13, 2022A new lawsuit brought by a shareholder of Upstart is also being brought derivatively on behalf of Upstart. That’s because plaintiff alleges that the Directors of the company would otherwise have to sue themselves or the company’s executives for the damage caused, a highly unlikely course of action.

Plaintiff alleges the company or certain directors and executives violated Section 14(a) of the Exchange Act, breached fiduciary duties, were unjustly enriched, abused their control, grossly mismanaged the company, wasted corporate assets, and violated Section 10(b) and 21D of the Exchange Act.

Things are not exactly great in shareholder land. The company’s stock as of May 4th close was $93.57 and is now currently hovering around $24.49. The plunge began when the company released its poorly-received quarterly earnings on May 9th. For a long time, the company had asserted it was not a balance sheet lender, but a shift in economic conditions was causing that to change.

The unwelcome quarterly earnings report was coincidentally timed after Upstart CEO David Girouard had sold more than $200M worth of company stock in the previous 8 month span and co-founder and SVP Paul Gu sold $140M worth over nearly the same time period.

Then, in August, Girouard said, “In the last few months, lenders and institutional credit investors reacted more quickly and abruptly than we anticipated. Despite the fact that our bank partners have seen consistently strong credit performance, meaning portfolios performing at or above plan across quarterly cohorts, several of them have paused or reduced originations due to fear about the future of the economy.”

Plaintiff alleges that false and misleading statements allowed the stock price to be propped up while insiders sold their stock on material non-public information. The full complaint can be viewed here.

This lawsuit is separate from a securities class action filed earlier this year.

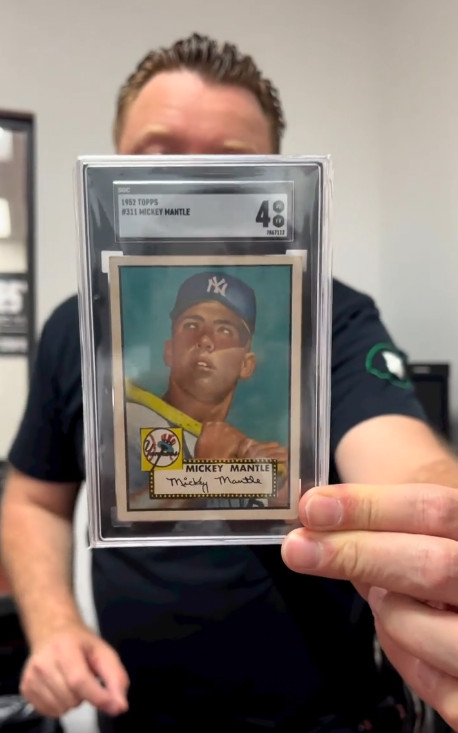

Got a Mantle, Bryant, or Mahomes Card? This Company Wants to Fund You

September 12, 2022 Last month, an anonymous bidder paid $12.6M for a 1952 mint condition Topps Mickey Mantle baseball card, the highest amount ever fetched for a piece of sports memorabilia at an auction. Understandably, the news electrified a fast growing market of collectors, traders, and financiers that predicted the next big asset class wasn’t just going to be real estate or crypto or NFTs, but physical sports trading cards.

Last month, an anonymous bidder paid $12.6M for a 1952 mint condition Topps Mickey Mantle baseball card, the highest amount ever fetched for a piece of sports memorabilia at an auction. Understandably, the news electrified a fast growing market of collectors, traders, and financiers that predicted the next big asset class wasn’t just going to be real estate or crypto or NFTs, but physical sports trading cards.

The value of the Mantle sale came as no surprise to one budding entrepreneur in South Florida. On Instagram, he’d been talking about Mantle cards for weeks, even going so far as to hold up another ’52 Topps Mantle card to the camera to promote what his company can do, which is provide quick cash advances to owners of valuable sports cards.

The entrepreneur’s name is Edward Siegel, CEO of Card Fi. Siegel’s no stranger to the alternative finance space because he spent about a decade in the MCA industry, most recently as the founder of Bitty Advance, which he sold in 2020. Since then, Siegel returned to his roots and early passion of his youth.

“I had a background in sports cards as a collector, you know as a kid, but then in my early twenties, I was promoting card shows at malls,” Siegel said. “I was heavily into the hobby, setting up the card shows and promoting them and doing player appearances where players come in and do an autograph appearance.”

That was back in the late 80s, early 90s, according to Siegel.

When Covid hit and he exited his most recent company, he noticed a massive resurgence in the sports trading card market. His next business ultimately became Card Fi, a company that will evaluate the market value of a card and make an advance against it. There’s obviously risk involved so they take possession of the card for the duration.

“We have to get a hold of these cards and we’re responsible for them and then we vault them in our in-house bank vault,” Siegel said. The cards are stored in a highly secure climate controlled environment. Card Fi shows the vault off frequently in its Instagram videos.

Such a business requires large amounts of capital so Siegel went searching for investors, a pursuit that led him to a unique place, an Instagram Live pitch competition hosted by famed CEO and reality TV star Marcus Lemonis. Siegel entered himself in as a contestant, knowing full well that the odds of even being chosen to present his business to Lemonis were about a million-to-one.

Somehow, he was called up to pitch.

“So [businesses] went on there during the quarantine and you pitched your business,” Siegel explained. “I went on there and I pitched it […] And he understood it and he thought it made sense.”

The moment eventually led to a deal with Lemonis’ company and Card Fi was on its way.

Siegel, meanwhile, dispels the notion that the burgeoning trading card industry or his business hinges upon old vintage cards or that it’s a baseball-card-centric universe.

Siegel, meanwhile, dispels the notion that the burgeoning trading card industry or his business hinges upon old vintage cards or that it’s a baseball-card-centric universe.

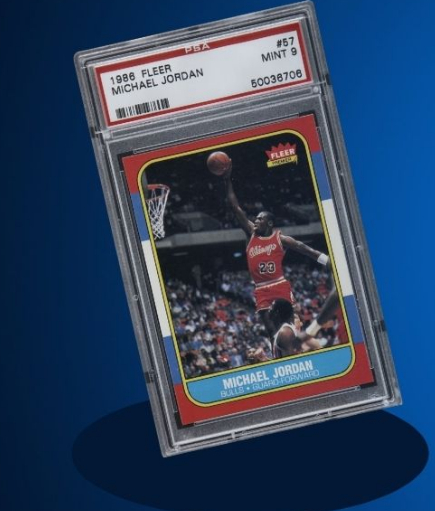

“If we look at it, there’s two different markets, you have the modern card market [where] I would say it’s basketball [that leads the pack],” he said. “For the vintage card market it’s baseball.”

Football is huge as well, he explained. A Patrick Mahomes rookie card, for example, an NFL Quarterback that’s still currently playing, recently fetched $861,000. There are only one of five like it in the world, the scarcity playing a major role in the value. Meanwhile, a Justin Herbert rookie card, an NFL Quarterback who’s only in his third year was already receiving bids above $1 million at the time this story was being written.

“It really depends on the card itself,” Siegel explained. “Some players might be known for having better careers but then you have cards that have more scarcity to them. Something that’s a one of one or maybe a very low populated card and a graded PSA 10 could very well be worth more than a [Michael] Jordan rookie because it has scarcity in it.”

PSA refers to cards that have been verified as authentic and graded on the condition of the card itself. Ten is the highest level a card can receive. Card Fi will only work with graded cards to avoid any funny business when it comes to advancing funds based upon the value.

Siegel explained that Card Fi’s average advance is about $40,000 – $50,000. The max right now is $500,000. There’s a big market for this type of funding it turns out because Card Fi’s much larger rival, PWCC, just raised $175 million to make similar offerings to sports card owners.

Siegel explained that Card Fi’s average advance is about $40,000 – $50,000. The max right now is $500,000. There’s a big market for this type of funding it turns out because Card Fi’s much larger rival, PWCC, just raised $175 million to make similar offerings to sports card owners.

“This financing benefits the market as loans and cash advances have become an increasingly asked-for offering among trading card collectors,” said Chad Fister, PWCC’s CFO in a story that originally appeared on Sportico. “Enabling our clients to access liquidity through a menu of capital offerings is key as trading cards continue to prove themselves to be a valuable tangible asset class.”

For Card Fi, customers that take an advance can track everything through an online portal, including details about their cards, payments, and balance.

“We want to note that we built a full-service automated underwriting and collection platform to where, whether it’s the customer or the broker, they can log into our system and put the description of the card into the system and it’s going to automatically underwrite it and price it out,” Siegel said.

That description sounded like something straight out of the fintech industry of his past, especially the component about brokers.

“Just like the MCA space, we have a whole partnership side, a broker side, where brokers can refer us customers just as an affiliate where they just send the info over,” Siegel said. Similarly, they can earn a commission if a transaction is completed, he explained.

In this industry, brands like Topps, Upper Deck, and Panini have become the bread and butter for Card Fi. Even though it’s all business for Siegel these days, he couldn’t help but mention a particular card he had a personal attachment to.

“My personal favorite card in my collection is the 1965 Topps Joe Namath rookie card,” Siegel said. “Of course being a die hard New York Jets fan, that has to be my favorite card.”

Prosper Marketplace Originated $891.9M in Loans in Q2, Records $42.6M Profit

August 23, 2022 Despite some uncertainty in the lending markets, Prosper Marketplace had a fairly good quarter. The company originated $891.6M in loans in Q2, nearly double the volume over the same period last year. Profitability too was there, coming in at $42.6M, up from a loss of $5.8M in Q2 2021.

Despite some uncertainty in the lending markets, Prosper Marketplace had a fairly good quarter. The company originated $891.6M in loans in Q2, nearly double the volume over the same period last year. Profitability too was there, coming in at $42.6M, up from a loss of $5.8M in Q2 2021.

Notably, Prosper did acknowledge that the fair value of its loans were being affected by an increase in capital markets volatility and benchmark interest rates but neither were enough to hurt the company.

Prosper is a holdout of the peer-to-peer lending era in that it still has a “note channel” for investors. Ninety-one percent of all loans funded in the second quarter, however, were done through the Whole Loan Channel, up from 87% during the same period last year.

Prosper is in the business of originating consumer loans with 3-5 year terms and interest rates ranging from 5.31% to 31.82%.

Need a “Lenda?”

July 13, 2022LendingTree helped Linda get a “lenda.” Former SNL star Molly Shannon, playing Linda, explains to waitress, Brenda, how hassle-free finding a personal loan through LendingTree was for her. The newly released commercial uses assonance to get viewers to understand how easy it is to get the best possible loan. In the commercial, Brenda is under the impression that LendingTree is only for “big spendas” but learns that they will find her a lender despite the circumstances.

Another “Linda lenda” commercial is featured on LendingTree’s home page where Linda tells her niece how they assisted her on a home loan as well. The objective is get viewers to understand how getting a loan can be just as effortless for them as it was for Linda.

New Owner of Loan.eth Says its Worth Millions

June 8, 2022 Less than two months after spotlighting a new domain name market linked to the Ethereum blockchain, the name loan.eth was sold on a secondary market for the equivalent of $45,000. It’s not a website domain like one would expect with a .com or a .net, but rather a crypto wallet address shortener that can double as a screen name and authentication service on web 3.0. That’s just the tip of the iceberg of the utility that a .eth domain can offer.

Less than two months after spotlighting a new domain name market linked to the Ethereum blockchain, the name loan.eth was sold on a secondary market for the equivalent of $45,000. It’s not a website domain like one would expect with a .com or a .net, but rather a crypto wallet address shortener that can double as a screen name and authentication service on web 3.0. That’s just the tip of the iceberg of the utility that a .eth domain can offer.

Although most people may not be familiar with .eth domain names, the new owner of loan.eth, who goes by @BloomCapital_ on twitter, is so confident that such names will be adopted in the future, that he believes the value of this one will be many times what he paid for it.

“Just so it has to be said, Loan.eth won’t be sold for less than $10M,” Bloom wrote. Bloom said he considers loan to be the top .eth name that he has.

Prosper Marketplace Receives Full Forgiveness of Its SBA Loan

May 18, 2022 Three months after the SBA told a Sioux Falls small business lender that it wasn’t eligible for PPP loan forgiveness because it was involved in lending, the same agency approved full forgiveness for one of the nation’s largest consumer lending businesses, Prosper Marketplace.

Three months after the SBA told a Sioux Falls small business lender that it wasn’t eligible for PPP loan forgiveness because it was involved in lending, the same agency approved full forgiveness for one of the nation’s largest consumer lending businesses, Prosper Marketplace.

“On March 21, 2022, we were notified by the SBA that all principal and interest under our PPP loan, totaling $8.6 million, was forgiven through a full forgiveness payment made on March 15, 2022 by the SBA to the lender of our PPP loan,” Prosper reported in its Q1 earnings. The company also announced that it had facilitated $560.6M in Borrower Loan originations in the first three months of this year so far.

Technically, Prosper is a “credit marketplace.” All loans originated through the marketplace are made by WebBank. Prosper facilitated $1.9B in loan originations last year alone.

Prosper was among the lenders that actually turned a profit in 2020, $18.5M to be precise, on $1.5B in loans facilitated.