Uncategorized

Mr. Broker: Stop Helping ME, Compete With YOU

November 29, 2015 To quote comedian Dennis Miller, “I rant, therefore I am.” I know everyone is in the holiday spirit and I surely would hate to kill off that jovial mood, but I thought that it was time for Part Three of my Rants, this time on one of the most crucial elements of our industry, The Brokers.

To quote comedian Dennis Miller, “I rant, therefore I am.” I know everyone is in the holiday spirit and I surely would hate to kill off that jovial mood, but I thought that it was time for Part Three of my Rants, this time on one of the most crucial elements of our industry, The Brokers.

A Look Back At Prior Rants

In Part One I looked at the merchants, and explored some of their questionable behavioral choices. These choices (which a lot of them could be considered flat out stupid) hinder professionals within our industry from truly assisting merchants with their alternative financing needs. These questionable behavioral choices included: not meeting basic deadlines, bank statements being out of order, not being able to find financials, having very bad credit, running the business on overdraft protection, excessive stacking, sending in fake statements/financials, and not disclosing liens, bankruptcies or landlord/mortgage issues.

In Part Two I looked at the funders/lenders and explored some of their questionable practices. These choices hinder broker shops from progressing forward in an industry that’s oversaturated and highly competitive. These choices included: having new deal requirements to keep renewal portfolios, having an incompetent process, allowing merchants to stack, still filing UCCs on good accounts, and 30+ day commission clawbacks.

Stop Helping ME, Compete With YOU

It’s now time for Part Three of the Rants. Mr. Broker, unlike with the merchants and funders where I pleaded with them to “Help ME, Help YOU,” I’m actually going to do the opposite here and plead with you to “Stop Helping ME, Compete With YOU.”

We all know why you are in this industry, you (like myself), believe there is still great opportunity for growth. But some of the things that you do Mr. Broker make it hard for me to figure out if you are competing with me for market share or helping me take market share from you. Please allow me to list some of the things that you do that make it difficult for me to figure out if you are truly against me.

Not Pricing Based On Paper Grade

I understand Mr. Broker, that you believe in the mythical smooth talking, walking, charismatic sales machine, you know, the guy that can sell fire in hell and ice to an Eskimo, but I’m sorry to inform you that no such person exists. If you believe you are going to close your A-paper client by pushing them your 6 month 1.35 factor rate cash advance using your smooth talking skills, then I will not feel sorry for you if your merchant were stolen away by another broker pitching him 6 months at 1.12 – 1.20, which is what I consider to be the proper pricing based on their paper grade.

Forgetting the Endgame

So Mr. Broker, you seem to believe that we are in the lead generation business and not the brokering business. We aren’t paid on lead generation, we are only paid when we successfully broker a deal. To successfully broker a deal, we must find an interested client and match them with a funder that’s interested in funding them. We aren’t paid just to get people to send back an application that we can’t fund anywhere.

So if you propose potential terms without pre-qualifying them just to get an application package back, don’t be surprised if they decide to work with your competitor, the other broker who took the time to pre-qualify them from the beginning.

UCC Marketing

Mr. Broker, it’s understandable that you decided to open up shop in our industry because you heard about something called UCCs, but I know that you will soon figure out that the UCC Boom is Over.

Using Outdated Marketing Tactics

Speaking of UCCs, Mr. Broker why must you only rely on outdated marketing tactics, including UCCs and aged leads, leading to said merchants having 25 calls per week about funding to where they hang up in your face if you even mention you are from a funding company? Do you know that while you fight with 50 other brokers over the attention of one merchant (that doesn’t want to talk to any of you), there’s other brokers out there calling on data that nobody (or very few) people are calling on?

Not Running A Profitable Office

Every business must have a business plan and every business plan must have return on investment (ROI) projections. What are all of the estimated costs that you will have in acquiring a newly funded merchant? What are all of the estimated revenues that will come along with that, such as the new deal commissions, renewal commissions, merchant account conversion residuals, etc? Too many brokers have no idea what their costs are nor estimated revenues are to produce any type of true ROI forecasts. That begs the question, what kind of business are you running, Mr. Broker? It’s a wonder why so many offices fail, they don’t do any planning.

Not Properly Pre-Qualifying The Merchant

Why clog up your funder’s underwriting queue with applicants that have zero chance of being funded because either their cash advance balances are too high, credit scores are too low, bank statements are bad, they are in a restricted industry, or an assortment of other issues? Why not learn the underwriting criteria of your funder and then do efficient pre-qualification on your clients to where you can build a profile of them, estimate their paper grade, and determine if you even have a funder that could review them at this point in time? Or if the merchant is on the cusp of being eligible, help them get to that point. By not pre-qualifying the merchant, all you do is waste your merchant’s time which reduces the chances that they will work with you again in the future.

Submission Hot Shots

This goes with the situation from above. It’s already established Mr. Broker that you might not properly pre-qualify merchants which does nothing but waste their time, but you also hot shot them to 8 lenders. The key here, as mentioned, is that you have to efficiently pre-qualify the merchant to know where they stand and to know the 2 or 3 funders likely to approve them.

Final Word

I rant, therefore I am, as comedian Dennis Miller would say. I surely hope I didn’t kill off your jovial mood this holiday season. This has been the Year of the Broker, and my goal is to help the inexperienced and experienced smaller broker shops. So with that being said, I plead with you Mr. Broker to “Stop Helping ME, Compete With YOU” by no longer repeating these mistakes listed above.

The Telephone Is The Broker’s Best Friend

November 9, 2015 As we enter the second week of November 2015, we are indeed continuing the Year of The Broker, which I believe will not end on Thursday, December 31st at 11:59 p.m., but instead will continue into the year of 2016. As a result, I plan on remaining right here with deBanked to continue the Year of The Broker discussion throughout the entire year of 2016. The mass entrants of new brokers into our space will surely not slow down any time soon, even though only a small percentage of new brokers will actually have some sort of career longevity. For these mass new entrants, they will surely have available a number of different Marketing mediums, but only one (in my opinion) might serve to be the most efficient considering time, costs, access and productivity.

As we enter the second week of November 2015, we are indeed continuing the Year of The Broker, which I believe will not end on Thursday, December 31st at 11:59 p.m., but instead will continue into the year of 2016. As a result, I plan on remaining right here with deBanked to continue the Year of The Broker discussion throughout the entire year of 2016. The mass entrants of new brokers into our space will surely not slow down any time soon, even though only a small percentage of new brokers will actually have some sort of career longevity. For these mass new entrants, they will surely have available a number of different Marketing mediums, but only one (in my opinion) might serve to be the most efficient considering time, costs, access and productivity.

#1.) Indirect Marketing Mediums

– Strategic Partnerships: Will be difficult to establish for new entrants due to established players already having agreements and integrations in place with a lot of the main players. Strategic Partnerships include organizations such as Banks, Credit Unions, Associations, Merchant Processors, etc.

– Mom and Pop Network: Will be difficult to establish for new entrants as there’s only so many sub-agents that could exist at any given time, and they usually (by this point) have already built up close relationships with their Funder Networks and larger Brokerage Houses.

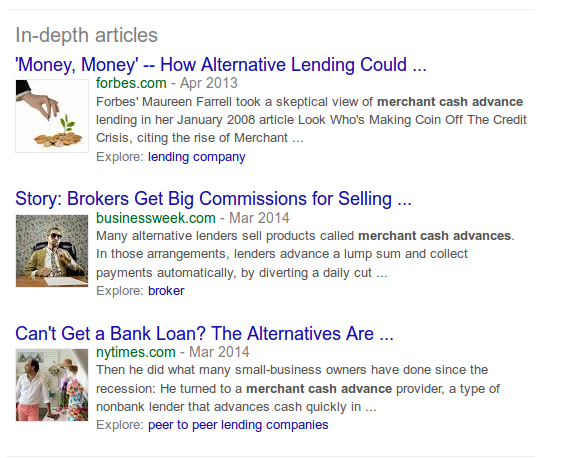

– Indirect Ads and SEO: Will be difficult to establish for new entrants due to the high marketing costs and lower percentage of quality leads that are generated. The fact is that this medium attracts a ton of companies that won’t even qualify for our product, such as a lot of start-ups. Plus established players have pretty much already sealed quality positions and placements with high marketing budgets.

#2.) Direct

– The Mail: Won’t work for most new entrants due to the high cost of postage and packaging. In combination with the low response and conversion rates, for many this medium might not be profitable.

– Email: Only works after speaking with a client and serves as a good form of follow-up, but not good for initial contact as the emails will usually be filtered off as “spam” and one should be very mindful of national and state spam laws in relation to using this medium.

– Fax: Only works after speaking with a client and serves as a good form of follow-up, but not good for initial contact because the medium for initial contact is illegal.

– In-Person: Works decent, however with high gas costs, traffic jams, and other inefficiencies, this should not be used for initial contact, but can be used in conjunction with the Telephone.

……And speaking of the Telephone…….

The Telephone is going to be the most efficient medium used by new entrants and smaller broker shops today due to the following:

- Ease of Access: All one needs is a web based Predictive Dialer from the likes of a CallFire, YTel or Five9.

- Cost and Structure Efficiency: You can pay by the hour usage or pay a flat monthly fee for an unlimited monthly call volume. By the dialer being web-based, there are no IT specifications that you have to control on a daily basis.

- It’s Still Legal For B2B: It’s illegal for B2C in terms of the initial contact, but as of right now, it’s still legal for initial contact on the B2B side.

- Mass Productivity: It’s a great medium where one can work a 10 hour day from 9:00 a.m. to 7:00 p.m. EST, covering the East, Central, Mountain and West coast time zones. Over the course of these 10 hours, one can complete about 40 – 80 meetings with decision makers, as well as leave about 200 – 250 messages for said decision makers with employees or via voicemail.

Telephone Conversion Analytics

Over my time of directly selling both the merchant cash advance and alternative business loan products, I’ve found the following conversion analytics to be in place for new deals, and the following can assist you with your ROI planning:

- For every 15 decision makers that you speak to on a cold call, you should get 1 interested lead, or let’s say a conversion of 6.7% to leads. For a clear definition of a lead, refer to a prior deBanked article of mine here. Calling SIC generic listings can be considered a “cold call”.

- For every 15 decision makers that you speak to on a warm call, you should get 5 interested leads, or let’s say a conversion of 33% to leads. Calling UCCs can be considered a “warm call”.

- For every 15 leads, you should get 3 completed application packages, or let’s say a conversion of 20%. A complete package includes the application and 3 – 6 months of bank statements.

- With an efficiently constructed Funder Network based on Paper Grades of 1-2 Funders for A+, A, B/C, and C/D, you should be getting approved files of about 40%, with a closing ratio of 30%.

Final Word

What will happen if B2B Telemarketing becomes illegal for initial contact just as B2C Telemarketing currently is? Would that likely be the final death blow to new brokers and smaller broker shops in terms of their ability to market efficiently and profitably?

I’m not sure, but as of right now, it’s the most efficient form of Marketing medium for new broker entrants and small broker offices. If it were to ever be taken away (become illegal), I think it might be much harder (if not impossible) for smaller broker shops to survive.

World Business Lenders Acquires Uber Capital, Adds Another Branch

October 2, 2015 Zachary Ramirez, a Branch Manager for NY-based World Business Lenders (WBL) confirmed the company had set up two new branches.

Zachary Ramirez, a Branch Manager for NY-based World Business Lenders (WBL) confirmed the company had set up two new branches.

South Miami-based Uber Capital was acquired and will become a WBL branch. “The founders of Uber Capital, Jessica Fonseca, Tim Fenimore and Tristan Olmedo-Tigertail have joined WBL as Co-Branch Managers,” wrote Ramirez. The company was organized only 8 months ago.

Additionally, WBL has formed a new in-house branch at their 120 W. 45th Street office in Manhattan. “Michael John and his team have joined WBL to establish a new branch designated as the Midtown Branch located at our headquarters location,” Ramirez wrote.

The lender has made scores of small acquisitions this year, particularly merchant cash advance ISOs. As one of the few players in the industry to operate under a multi-branch model, they have no intention of slowing down. “We plan on acquiring many, many more branches in the coming months,” Ramirez posted.

A Return to the Fundamentals? (At Transact 15)

April 3, 2015 The Transact ’15 conference opened to a record crowd and there was no shortage of merchant cash advance players in attendance. Those facts were to be expected. And if you walked in and poked your head around, you might not have noticed anything to be different. Payment processors touted the latest mobile technology and at every turn security systems were being offered to prevent catastrophic breaches of cardholder data.

The Transact ’15 conference opened to a record crowd and there was no shortage of merchant cash advance players in attendance. Those facts were to be expected. And if you walked in and poked your head around, you might not have noticed anything to be different. Payment processors touted the latest mobile technology and at every turn security systems were being offered to prevent catastrophic breaches of cardholder data.

Everything looked normal… except the merchant cash advance companies.

Back to the fundamentals

Early on Wednesday, April 1st, CAN Capital kicked off a product announcement by raffling off free Apple watches. CAN’s new product is called TrakLoan, a revolutionary new loan program that allows merchants to repay via a split percentage of their credit card sales instead of fixed ACH.

April Fools?

The described advantage of TrackLoan is that there is no fixed term and that merchants only pay back at the pace that they generate card sales. Wait, Where have I heard of this before?

After slapping myself across the face a few times to make sure I hadn’t teleported to the year 2005, the rip in the space time continuum grew more apparent at the after parties.

Card processors Integrity Payment Systems, North American Bancard and Priority Payment systems are still among the hottest names in town for splits. The veteran MCA ISOs and funders are still boarding hoards of merchant accounts with them every month and are therefore building multi-million dollar residual portfolios in the process. It makes one wonder why so many people have turned their back on split-deals for the ACH methodology.

Years ago, merchant cash advance was a sideshow value-add that could be used to acquire what really mattered and what was reliably profitable, merchant accounts. Not everyone has forgotten that however.

Over at Strategic Funding Source, Vice President Hellen McQuain is heading up a new merchant services division. In The Business Strategist, an SFS periodical, McQuain speaks the native tongue of the payments industry: EMV, PCI, NFC, etc.. Few, if any, of today’s new entrants in merchant cash advance could identify what those acronyms stand for, let alone explain the current climate of adoption.

Over at Strategic Funding Source, Vice President Hellen McQuain is heading up a new merchant services division. In The Business Strategist, an SFS periodical, McQuain speaks the native tongue of the payments industry: EMV, PCI, NFC, etc.. Few, if any, of today’s new entrants in merchant cash advance could identify what those acronyms stand for, let alone explain the current climate of adoption.

So, is it time to get back to the basics?

Over the last six months, I have heard more gripes from funders about how to align a broker’s interest with theirs, other than by offering the opportunity to syndicate of course. The question comes down to, how can you get a broker to care about the outcome of a deal?

The answer should be obvious. Pay half the commission upfront and the other half as part of an ongoing performance residual. That gives the broker a stake in the outcome without having to syndicate. This is not a novel idea. This was how the entire industry operated from 2005 to 2011.

Might brokers resist such a compensation plan today in an upfront-only world? Maybe. But the greatest resistance I sense from funders, especially new ones, is that automated residual payments are too complicated for their current accounting systems.

That of course begs another question. How can this possibly be? Despite the rapid growth in technology, there is an entire segment of the industry that is ill-equipped to handle transactions that were commonplace and scalable five years ago.

While today’s systems are impressive, there are times when it seems like yesterday’s advanced technology was lost in a great flood, along with all the scientific texts documenting how to build the powerful machines.

To add to this, some of today’s edgy ideas are not new. A monthly payment loan for example is not an innovative idea. Weekly payments might acquire the merchant that wouldn’t do daily payments. And monthly payments might get the merchant that wouldn’t do weekly payments. These stretched out programs might make you popular with merchant cash advance brokers that are used to selling daily payment products, but they’re in no way new. It’s a return to the basics.

In 2015 we may apparently be going full circle.

Dear Ami

November 19, 2013I don’t know Ami Kassar personally, but I read the articles in his NY Times blog, a column dedicated to chastising merchant cash advance companies. In it he yearns for the glory days of 10 year loans at 8% interest for local mom and pop shops. Having been a broker for 3 years myself, believe me when I say I wish rates were lower and terms were longer. It’d be an easier sell. But having also been a very senior underwriter and risk manager, I know exactly why the terms are what they are.

The below post was intended to be a comment on Ami’s latest post, Assessing a Kevin O’Leary Investment on Shark Tank, but it shattered the 1,500 character limit so I’m posting it here. As it was intended to be a comment and not its own post, I did not expand or delve into as much as I wanted.

—-

Ami,

Ami,

We get it. You don’t think expensive capital is right or moral and in a perfect world where small businesses have perfect credit and a 0% likelihood of delinquency or default, there probably wouldn’t be a merchant cash advance industry.

Unfortunately, the reality is that many small businesses are high risk borrowers for one reason or another. This isn’t because a bank says so but because there is substantial data that shows there is a high likelihood of delinquency or default. Almost all of the small businesses that existed in my neighborhood 25 years ago are gone. They were replaced by new businesses, which were replaced by new businesses, which were replaced by new businesses. To say that a store with 2 years in business and 700 credit in my neighborhood is a safe long term investment would be a huge mistake. Residents tired of eating the same food, local bars lost their cool factor, the CD store got replaced by digital downloading, the supermarket got replaced by one that only sold organic food, and Blockbuster Video is gone. The Exxon became Shell which turned into Gulf which got torn down and rebuilt as a bank. New extensions to a mall 3 miles away damaged 40+ retail businesses on Main Street. A failed health inspection killed a restaurant, bad Yelp reviews killed the bowling alley, and the 78 year old master tailor didn’t relate to the new generation of residents. A flood closed a clothing store for 2 months, a fire killed a coffee shop, and a hurricane wiped away a strip mall.

Shall I keep going? Partners had a falling out, a son ran his father’s cafe into the ground, development killed a farm stand, and increasing rent put a barbershop over the edge.

I’m not knocking small business, just acknowledging that it’s one of the toughest things in this country to manage. God bless the people that try and especially the ones that last decades.

You know what else happens with a lot of small businesses? They declare losses for tax purposes and make organizing financial documents secondary to all else. To a lender, there is a layer of risk built upon a mountain of risk.

You cited IOU Central as a shining example of rate fairness, but failed to acknowledge that they are wildly unprofitable and have teetered on the brink of insolvency for a year. IOU Central is a publicly traded company and I mean them no disrespect, but check out their books. Lending isn’t supposed to be charity.

SBA loans and defaults are synonymous with each other. It’s great for businesses, but the poor economics of them fall on the taxpayers.

There is this belief that merchant cash advance companies are predatory, but the rates they charge are what the market has priced as sustainable for both parties. There’s more than a hundred funding companies offering the same product. You want to know why the competition hasn’t dropped rates to 10% APR yet? It’s because they’d all be out of business. Rates have come down a little bit, but there is only so far they can drop. Small business is risky business.

As a broker out on the street shaking the wary hands of shop owners, I understand your frustration with the high cost. Believe me, the merchant cash advance companies wish they could lower the prices too. Some have done so at their own peril and closed up shop. Others are on their way to that point now. Would you rather only a tiny fraction of small businesses get non-bank financing at a rate in line with your comfort level and let the rest burn? Small businesses of all credit types and financial standings for years have cried, “HEY, WHAT ABOUT US?!” and in response, private companies made access to capital possible. Often times the money is expensive, very expensive. You are concerned that small business owners are making a mistake when they enter into these agreements yet you admittedly lock them into these deals yourself. It seems as though some of your clients would rather have the opportunity to do something positive with expensive money than have no opportunity at all.

I can think of few things tougher than running a small business. The way my old neighborhood looks today is proof of that. I barely recognize the place. You know what wasn’t around 25 years ago? Merchant cash advance companies. Who knows what would’ve happened if they all had access to capital despite a less than stellar credit rating. Some of those stores may have grew, evolved with the changing times, or become franchises. Things might’ve been different. We all want lower rates, sincerely we do. Competition will drive it down as far as it can go and there’s plenty of that today. Once we hit the floor, if we’re not there already, you will have to ask yourself this question. Are you living in a perfect world or the real one? Let the small businesses decide if the opportunity they’re given is one they want to take.

After what was one of the wildest two weeks in Merchant (MCA) history, the game-changing news finally subsided, but no one is taking a deep breath. Instead, everyone is busy working their butts off trying to help small businesses grow.

After what was one of the wildest two weeks in Merchant (MCA) history, the game-changing news finally subsided, but no one is taking a deep breath. Instead, everyone is busy working their butts off trying to help small businesses grow.  Recap of the ETA Expo as it pertains to Merchant Cash Advance:

Recap of the ETA Expo as it pertains to Merchant Cash Advance: