small business owners

Coming In From the Cold: Connecting With Prospects

January 29, 2013 A small business owner posted a great question on the LinkedIn group “Small Business Networks for Startups and Entrepreneurs” board:

A small business owner posted a great question on the LinkedIn group “Small Business Networks for Startups and Entrepreneurs” board:

Are cold calls effective? Or is it old school? For a small company, what is the best way to promote the business? Any advice will be greatly appreciated.”

The small business owner who posted this question got more than her fair share of advice and opinions regarding the practice of cold calling. And, while most every single comment had a jewel of truth and wisdom when it comes to cold calling – the comments also conflicted with each other. For example:

“Not only is it old school but its intrusive and offensive.”

“Cold calling is old school indeed but it is still one of the most effective ways to reach prospects.”

So – which is it? Offensive or Effective?

Fortunately for the small business owner uncertain whether to pick up the phone there was one comment that simply rocked. Sandra Hoedemaker owner of ChefinDemand.com an online business coaching service specializing in providing services to personal chefs, posted a completely different perspective and approach to cold calling – something she calls “Connect Calling.”

Connecting is Warm – Cold is…well, Cold

Those commenters who identified cold calling as intrusive and offensive make a good point. Today’s consumer not only isn’t interested in hearing uninvited sales pitches, they can (and quite often do) find unscheduled sales calls as a definite intrusion into an already too busy day.

Sandra notes that she does, in fact, “cold call” and also indicates that these calls are always most successful when she is able to connect with the decision maker. So far her comment sounds like your run-of-the-mill cold calling advice. However, Sandra definitely breaks rank because she goes on to say that she “doesn’t sell on the phone.”

OK, if she’s cold calling, but not selling – what exactly IS Sandra doing when she makes those calls?

Sandra knows prospects aren’t interested in “being sold” – but they are interested in learning real ways to solve their problems and get their needs met. Sandra knows that the best way to do that is to establish her credibility as an expert who knows how to solve common problems and meet the special needs of her niche. How does she do that? She offers to provide them with carefully selected free services. This allows her to:

- Build her email list and then connect with prospects freely because they have invited Sandra to contact them.

- Stay connected to her prospects via blogging, teleclasses, and other virtual events (she’s also in the process of putting video presentations in place.)

Outside of the above, connecting with prospects versus cold calling prospects has resulted in Sandra receiving referrals and she’s also garnered invitations to speak as well. Sandra has successfully used Connect Calling as a tactic to connect with prospects in meaningful ways. She’s taken an “old school, annoying” tactic and turned it into a powerful tool to build a community of prospective buyers.

What is most impressive about her approach is the opportunity to begin to establish trust with prospects via Connect Calling. Offering useful, applicable free services and information allows prospects to begin to build a relationship where Sandra becomes a Trusted Advisor who’s got their back versus someone trying to make a sale. Sounds more like networking than cold calling doesn’t it?

And when those prospects pick up a phone to make a call when they find themselves in need of services Sandra charges for, Sandra’s much more likely to be the one who hears it ring.

Sandra’s business serves a unique niche – but Connect Calling can be a valid, productive, and profitable tactic to market your small business no matter what market you serve.

Guest Authored

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

A New Approach to Providing Employee Feedback for Small Business Owners

January 22, 2013 Sometimes you just can’t figure out how to deal with employees. Take Rebecca your receptionist. She’s excellent with clients, knows exactly what calls to put through and when to take a message, dresses professionally, and gets along with everyone in the office. She can juggle answering multiple phone lines while greeting multiple clients with ease, and is great in a crisis.

Sometimes you just can’t figure out how to deal with employees. Take Rebecca your receptionist. She’s excellent with clients, knows exactly what calls to put through and when to take a message, dresses professionally, and gets along with everyone in the office. She can juggle answering multiple phone lines while greeting multiple clients with ease, and is great in a crisis.

On the other hand, as far as performing her day-to-day duties, you can’t complain as to accuracy, but let’s just say prioritizing isn’t Rebecca’s strong suit. Take ordering office supplies. Sure, you never have to worry whether or not you’re going to run out of paper clips – but not when Rebecca somehow thinks getting the office supply order into the vendor is more important than the unfinished monthly report sitting on her desk – a report you need for this afternoon’s weekly sales meeting.

You’ve tried giving her positive feedback – you’ve tried giving her negative feedback, both to no avail.

Things aren’t always “either or” as in “either the employee’s behavior merits positive feedback OR the employee’s behavior merits negative feedback.” The world we operate in has a tendency not to be that straightforward – especially when we’re talking about human behavior, even more so when the subject is employee behavior. You may think you’re limited to one or the other of these approaches – but maybe what Rebecca needs isn’t feedback – maybe Rebecca needs feedforward.

Paying it Forward

You might have seen the movie “Pay It Forward” where the premise was that whenever anyone did a good deed for you that you should “pay if forward” to three other people. The idea is put forward by a little boy responding to a school assignment to “Think of an idea that could change the world.”

Now, that’s a pretty tall order – but Dr. Marshall Goldsmith professor of executive education at Dartmouth, prolific author, and well-known management thought leader has an idea that just might change the way small business owners approach managing employees. His idea? Instead of providing employees with feedback he proposes a process he calls feedforward.

Traditionally feedback has been “top down” meaning that a manager (top) provides feedback to an employee (down) regarding their performance. Fortunately the field of management has progressed to acknowledging that, while employees can learn from managers, it is also true that managers can learn from their employees. This has led to better communication between management and employees.

However, Goldsmith points out a fundamental flaw within both approaches: they focus on the past instead of the “infinite opportunities that can happen in the future.” Furthermore, Goldsmith asserts that focusing on the past is “limited and static” whereas focusing on the future can be “expansive and dynamic.”

True Balance

The notion that feedback should be “balanced” usually means the attempt to find some sort of balance between how many times you provide an employee with negative feedback versus how many times you provide an employee with positive feedback. It certainly doesn’t take a Ph.D. in psychology to realize that too much negative feedback will most likely be de-motivating whereas too much positive feedback certainly isn’t going to improve an employee’s performance outside whatever it is they are already doing well.

This is where Goldsmith’s approach shines. Instead of struggling to come up with some impossible ratio between negative and positive feedback, the focus shifts to making observations about the past within the context of positively changing the future.

A Feedforward Conversation

Feedforward is not some inapplicable academic approach to managing employees at your small business. Feedforward is a process versus a “reprimand” or “compliment” you give an employee. Feedforward is a two-way conversation. Let’s take a look at what that conversation might look like with Rebecca the receptionist:

Small Business Owner: “Rebecca, I’d like to take a few moments to discuss this month’s report with you.”

Rebecca: “Sure.” (Rebecca is thinking: I wonder what I did wrong?)

Small Business Owner: “Before we begin, I want you to know that the goal of this conversation is to focus on how we can better use this report in the future to help our sales team. What we’re talking about here is what you can do to help make that happen, as well as how I might be able to help you as we move forward. I’d like to use this week’s report as an example we can learn from. How does that sound to you?

Rebecca: “Great.” (Rebecca is thinking: This is weird, I think my boss wants my help, not just tell me what to do.”)

Small Business Owner: “OK, so tell me what you think about how things went this week.

Rebecca: “I guess it was so sort of hurried. I almost didn’t get it done in time.”

Small Business Owner: “Why do you think that was?”

Rebecca: “Well, I had to get the office supply order out which meant I had to take inventory and that took a while.”

Small Business Owner: “Making sure everyone has the supplies they need is important. How do you think you could make certain that those two responsibilities don’t come into conflict in the future?”

Rebecca: “Hmmm…maybe I should change the day I do supply ordering to Mondays. Sales meetings are always on Fridays. That would give me three complete days to devote to the report. We could even plan to go over the report on Thursday morning together to make sure there aren’t any problems or errors.”

Small Business Owner: “I think that’s an excellent idea. You definitely got that priority straight. I’d like you to take a look at your duties and provide me with a schedule that allows you to meet your priorities. Let’s meet at ten next Tuesday to do that.”

Rebecca: “OK, but…” (Rebecca is thinking: She wants ME to set priorities?) “Well, what if I don’t prioritize things correctly?”

Small Business Owner: “We’ll work together on that. You know, Rebecca, you’re the one doing the work. You know what happens in the front office. I’d like to get your take first before I make any decisions as to how we want to prioritize your duties. Does that make sense?”

Rebecca: “It does, and I’ll be sure to do my best.”

– Guest Authored

Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Getting Permission

January 21, 2013 Numbers don’t lie.

Numbers don’t lie.

77% of online consumers surveyed said they want to receive permission-based marketing messages via email. Sounds impressive – but even more impressive when you learn that direct mail came in a distant second with only 9% looking forward to opening their mail box. Interestingly, only 5% preferred text messages. (Source: ExactTarget 2012 Channel Preference Survey)

That’s the good news. After all, email is perhaps the most inexpensive means for small business owners to communicate with consumers. The bad news is – before you can communicate with consumers via email – you’ve got to get their permission (along with their email address.)

Permission-based marketing simply means that you have your customer’s permission to contact them. However, if you’re a small business owner just getting their feet wet it’s likely that 77% of your list isn’t exactly a large number.

Collecting email addresses from customers and clients who have given you permission to contact them is the “Catch 22” and “between a rock and a hard place” of small business email marketing. Obviously purchasing lists of email addresses of consumers who fit the demographic of your customer doesn’t cut it. Emailing someone without their permission to ask for permission to email them just doesn’t make sense – not to mention today’s consumer tends to be totally turned off by businesses that make the attempt. Not too many fans of spam out there.

So, if you don’t have a list – how do you create one?

The Usual Suspects

It would be hard to find anyone with even a smidgen of experience searching the Internet who hasn’t encountered an “opt-in” when visiting a website. An opt-in is nothing more than a form that serves to ask permission to contact the consumer as well as collect their information. Visitors to your businesses’ website can opt-in to receive a variety of marketing messages from you – for example a newsletter, blog posts, or special announcements (such as a sale.) It makes sense to have opt-in opportunities on every page of your website.

Sounds great but, once again, if you’ve got very little traffic on your website, that translates into very little opportunity to build a Mondo email list. If the obvious tactic of including opt-in opportunities on your small business website doesn’t help that much when it comes to building your list – what other tactics can you employ?

Plenty – here are a few:

If you’re a retailer, make it a practice to ask for (and collect) every customer’s opt-in at the point of purchase. The same goes for B2B small business owners. For example, train your receptionist to ask for opt-in when taking calls.

Display an “opt-in sign up” book where customers and visitors to your office will easily find it. Be sure to include information that motivates people to provide you with their permission (i.e. a description of your newsletter, let them know you routinely email discount offers, etc.)

Do it the old fashioned way. It’s likely you’ve got the phone number of most of your customers and clients. Pick up the phone and call to ask for their permission to be contacted via email.

Contact customers and clients who’ve already subscribed. Let them know you’re running a “forwarding contest” and tell them they will be entered into a raffle for each person they forward your email to. Include a link that says something like “Forward to a Friend” (there are email marketing services that can identify which subscribers actually forwarded their email.)

Ask in-person. We are so “virtually” oriented that the obvious can escape us: ask people to opt-in when you meet them in person. This can be at professional and business networking events – even with that person you struck up a conversation with in line at the grocery store.

Partner with a related, non-compete business. Are you a web designer? Partner with a public relations firm and send out each other’s messages.

Include an invitation to opt-in on all printed marketing material. This includes everything from promotional brochures, stationary, and your business card. It also includes printed advertising.

Last, but definitely not least (and perhaps the most obvious) include a link to an opt-in underneath your email signature.

– Guest Authored

Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Surprise! We Are the Market

January 13, 2013Merchant Cash Advance (MCA) is an alternative to a small business loan. Look around. MCA players have spent so much energy on gaining mainstream acceptance, that we’ve become oblivious to reality. We ARE the small business lending market. There are alternatives out there such as credit cards and SBA loans, but they are industries of their own. Small businesses in 2013 really only have one place to obtain fast unsecured short term financing, and that’s here, the MCA industry. That assumes of course that you agree with our definition of MCA, which we stopped limiting to a purchase of future credit card sales some time ago.

Over the past few months, we began to realize that the only small business lenders making headlines are people we know. Is the country that small or does MCA dominate the market that much?

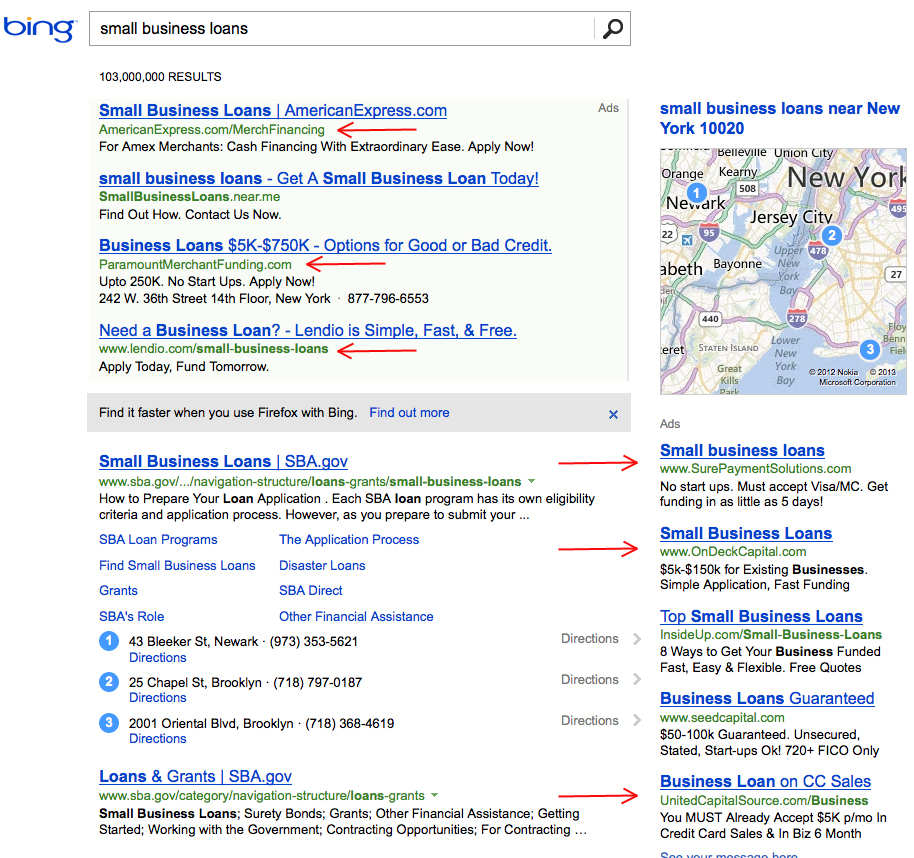

A glimpse at the sponsored advertisements on Bing in the NYC region:

Where are the multi-billion dollar banks? If $15 a click isn’t in their budget, something is wrong, and it may possibly be due to the fact that business loans aren’t on their priority lists.

Lenders, brokers, and bankers on the front lines can’t stop talking about MCA. It is a recurring theme in their columns:

The alternative financing industry is growing rapidly and, I believe, will continue to grow in 2013. These lenders are extremely entrepreneurial and are leaving the banks behind with their speed and use of technology. Many are backed by premier investment banks and Silicon Valley venture capital powerhouses — investors who understand that entrepreneurs and small-business owners are throwing up their hands in frustration over how long it can take to get a loan from a bank, especially if the loan is backed by the S.B.A. More and more businesses are willing to pay the price of the alternative lenders just to be able to get their capital and move on.

-Ami Kassar

The State of Small Business Lending – NY Times 1/8/13

Ami’s Column on NY Times

Cash advance companies, accounts receivable financiers, factors, and micro lenders all have become increasingly more attractive funders for three reasons: flexibility, use of technology, and speed.

-Rohit Arora

Three Reasons for the Rise of Alternative Lending – Fox Business 11/29/12

Rohit’s column on Fox Business

Here’s a dilemma that might have contributed to the growth of MCA… Banks don’t like offering loans and business owners don’t like applying for them if it’s hard:

There’s a large small business segment that needs and wants to borrow on a commercial basis, but their needs are very small. Business owners want $10,000, $20,000 or $30,000 loan–the average is somewhere around $25,000. Traditionally, that’s been a very unprofitable business for a bank. Some banks argue that they are willing to lose money on those loans because they can make it up in deposits. But what happens when the borrower has no deposits? It’s a very tough balancing act.

– The Federal Reserve Bank of San Francisco

A newsletter report that reveals banks lose money on small business loans

Community Investments Volume 8; No 4; Fall 1996

Business owners say the documentation involved is overwhelming. They’ve also found the qualification terms almost impossible to meet.

– Catherine Clifford

Feedback reveals that a burdensome application process and extensive paperwork requirements are enough to discourage business owners even if the loans carry 0% interest.

CNN 1/26/10

Thousands of researchers publish statistics on bank lending every month. Not only do they all contradict each other but journalists that use this data to make bold claims often fail to acknowledge that an increase in bank lending has nothing to do with the applicants, the economy, or the banks themselves. It has to do with the Government. We all know that the SBA will cover the losses banks incur, but there are programs that go one step further. The Federal Government actually bribes banks to make loans. For example, the Small Business Lending Fund is a dedicated investment fund that encourages lending to small businesses by providing capital to community banks. Meaning, covering the losses on defaults doesn’t seem to be enough, so they’ll actually provide the money to make the loans as well.

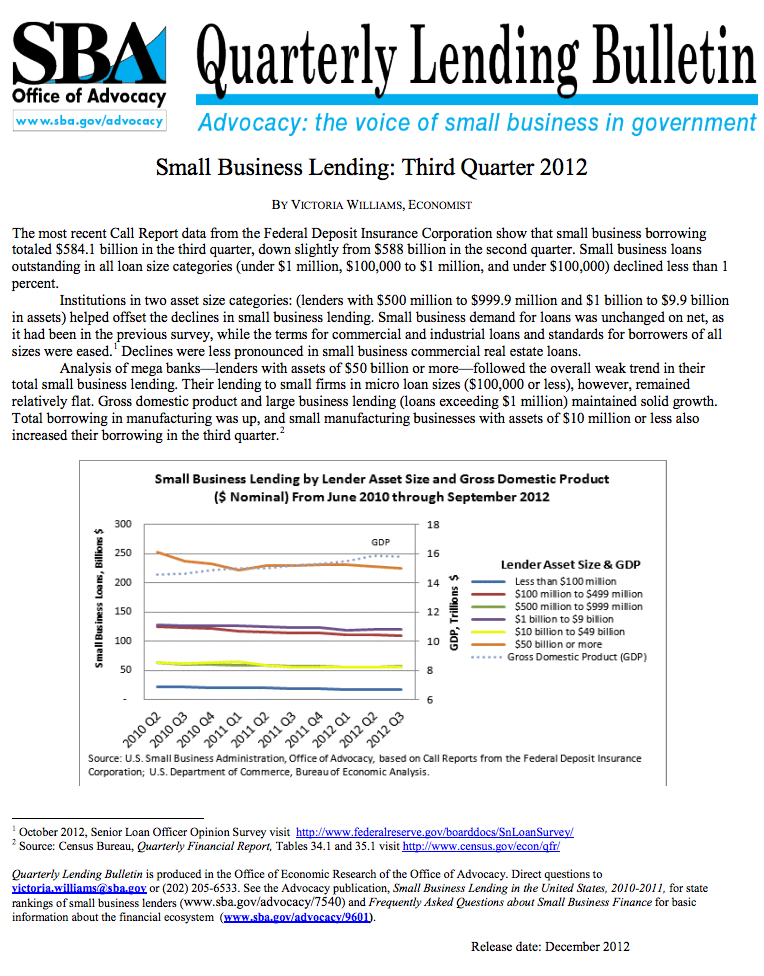

Click to see full size on mobile

According to the SBA, small business bank borrowing totaled $584.1 billion in the third quarter of 2012. That number dwarfs the volume produced by the MCA industry, but its not an apples to apples comparison. A loan of $1 million dollars is within the range of a small business loan by the SBA, an amount atypical (though not impossible) in the MCA world. Banks are also prodded and coddled by the Government so much that it has reached the extent that we dare claim they are an extension of the Federal Government itself. There’s some food for thought for the Occupy Wall Street movement! They also conveniently got bailed out when they were on the verge of failure, a safety net that MCA companies don’t have.

According to the SBA, small business bank borrowing totaled $584.1 billion in the third quarter of 2012. That number dwarfs the volume produced by the MCA industry, but its not an apples to apples comparison. A loan of $1 million dollars is within the range of a small business loan by the SBA, an amount atypical (though not impossible) in the MCA world. Banks are also prodded and coddled by the Government so much that it has reached the extent that we dare claim they are an extension of the Federal Government itself. There’s some food for thought for the Occupy Wall Street movement! They also conveniently got bailed out when they were on the verge of failure, a safety net that MCA companies don’t have.

Subtract the Federal Government’s meddling and there is only one profitable form of B2B lending, Merchant Cash Advance. That is of course again if you accept our definition. There are many young B2B lending firms that claim to be an alternative to MCA, who then go on to describe their product in a manner that is textbook MCA.

Our thesis may be debatable and lacking in concrete proof, but we’re not writing dissertations here. Business owners are increasingly looking to the Internet for loan information and it’s obvious what they’re finding. One would expect a quick Internet search to bring up ads for the billion dollar powerhouses, you know the ones that are given millions to lend out and then millions again when the loans go bad. Instead we find companies owned by friends or friends of friends. The small business loan market isn’t run by anonymous Wall Street kingpins, it’s run by a small community of entrepreneurs that all started from the ground up. Only the community isn’t so small anymore. There was once a handful of MCA companies claiming to be an alternative to a small business loan. Now there are a handful of companies claiming to be an alternative to MCA. It doesn’t take a genius to figure out why that is. After years of fighting to be recognized in the market, something remarkable happened, we became the market itself…

– Merchant Processing Resource

https://debanked.com

The #1 Sales Skill for Small Business Owners

January 10, 2013No matter how well you performed your due diligence before opening the doors at your small business, once you opened them you got a few surprises. And, unless you were in sales before opening your doors, the biggest surprise you got was likely just how difficult it is to “sell.”

Selling is a skill. Now, it’s true that there are “natural born sales people” – but all that means is that they have a talent for selling; they still need to develop their skills. The great thing about skills is that we can learn new skills.

The first skill you need to learn in order to sell successfully is often learning how to change how you think about “selling.” Not sure what we mean by that? If you read the word “zebra” an image of a zebra pops up in your head. Now read the word “salesman” – what image just popped up for you? Most likely not a very positive one.

It might take you a bit of time and effort to get over the prejudices you may have about sales. Unfortunately, as with many things in life, negative experiences we have a tendency to stick to us like glue. To make things even more difficult when it comes to changing attitudes, we also often have a tendency for negative experiences to stick with us much, much longer than positive experiences.

Don’t think that’s true? Here’s a brief exercise to prove our point:

- Write down 10 bad experiences you had with a sales person in less than 3 minutes.

- Write down 10 great experiences you had with a sales person in less than 3 minutes.

We rest our case.

Do You “Hate” Selling?

Let’s face it, if you’ve got a history of “not trusting” sales people it’s going to be pretty tough to feel very good about selling. Successful sales are based on trust and, in order for your customer to trust you, you’ve got to have a strong belief that what you’re doing is of value to your customer. Hard to do if you “hate” sales.

If you hate or are “extremely uncomfortable” about selling those feelings quite likely stem from beliefs you have about the process of selling in general and sales people in particular. For instance:

- Sales people are manipulative.

- Sales people are pushy.

- Sales people lie.

Right out of the box, it is true that some sales people do/are all of the above. But not most – and certainly the Top 5% are about as far away from manipulative, pushy, and dishonest as you can get. Think about it. You don’t want people to buy from you once – you want to create loyal repeat customers who also refer other loyal repeat customers to your business. Certainly the words “manipulative, pushy, and dishonest” aren’t behaviors that are going to result in creating a loyal customer base. That means that all those bad experiences you had with sales people happened when you were buying from “bad” (under-performing, unprofessional) sales people. While it might have looked like they would do anything to make a sale, it was probably because they were desperate to make a sale because they were so bad at it. Sales people who operate like that and are successful are actually the exception and not the rule. They also frequently aren’t successful for very long periods of time.

Right out of the box, it is true that some sales people do/are all of the above. But not most – and certainly the Top 5% are about as far away from manipulative, pushy, and dishonest as you can get. Think about it. You don’t want people to buy from you once – you want to create loyal repeat customers who also refer other loyal repeat customers to your business. Certainly the words “manipulative, pushy, and dishonest” aren’t behaviors that are going to result in creating a loyal customer base. That means that all those bad experiences you had with sales people happened when you were buying from “bad” (under-performing, unprofessional) sales people. While it might have looked like they would do anything to make a sale, it was probably because they were desperate to make a sale because they were so bad at it. Sales people who operate like that and are successful are actually the exception and not the rule. They also frequently aren’t successful for very long periods of time.

Hopefully you’re feeling a bit relieved to find out that learning how to sell does not mean honing skills related to being manipulative, pushy, and deceitful. Most successful, top-performing sales people are the exact opposite. Instead, sales is about solving your customer’s problems and meeting their needs. It’s about having their back and bringing them value even when they don’t buy from you. Why? Because that is how you create trust – and people like to do business with people they trust.

Believing in what you’re doing isn’t the only sales skill you need to learn – but it is definitely the first thing you need to get under your belt, and in a big way. No matter how many sales books you read or seminars you attend, unless you believe in what you’re doing and that your ability to sell is a value to your customer – you run the risk of becoming that manipulative, pushy, less-than-honest image of a sales person you love to hate.

Guest Authored

– Merchant Processing Resource

https://debanked.com

Avoiding Credit Card Fraud

January 7, 2013 Many small businesses that weren’t able to utilize traditional credit card processing services are delighted to find that there are now applications where they can accept credit card payments using a smart phone. However, before you jump on the bandwagon, it only makes sense to do your due diligence as to how to avoid credit card fraud. Just because you can process that card via your cell phone doesn’t necessarily mean you should. You don’t want to get caught holding the bag (and paying for) products after finding out you’ve been “had.”

Many small businesses that weren’t able to utilize traditional credit card processing services are delighted to find that there are now applications where they can accept credit card payments using a smart phone. However, before you jump on the bandwagon, it only makes sense to do your due diligence as to how to avoid credit card fraud. Just because you can process that card via your cell phone doesn’t necessarily mean you should. You don’t want to get caught holding the bag (and paying for) products after finding out you’ve been “had.”

As a matter-of-fact, not matter what services or devices you use to accept credit cards, as a small business owner you need to institute policies and practices to avoid credit card fraud. Here are some of the basics:

When accepting cards in-person at the point of service.

It is amazing at how just asking one simple question, “Can I see some valid ID?” can make all the difference. Always ask for a valid form of picture identification (such as a driver’s license) before accepting a credit card. If the customer isn’t able to provide ID, then DO NOT process their payment. This means asking for the card and identification BEFORE it is swiped. When you have both the card and identification in hand, check the back of the credit card for the customer’s signature and match that signature with the one on their valid ID. Again, if they haven’t signed their card, or the signatures don’t match, don’t process their payment.

Many small business owners may have an issue instituting the above policies with repeat customers if they have not used the policy previously. Now, this is going to be a decision each individual owner needs to make. You may indeed have long-term customers that deserve your trust, but they may not. At the very least, should you decide to accept their payment without a valid ID and/or their signature is missing on the back of their credit card, let that customer know that this is a “one time pass” and they must be able to provide both next time they make a purchase. You might be hesitant to do so, but letting the customer know that you are pursuing this policy to protect your customers. For example, costs associated with theft (including credit card fraud) must be covered by increases in pricing.

When accepting credit card payments over the phone or online.

The best way to avoid credit card fraud when taking payments over the phone or online is to get all the information you can to identify that the person making the order is, indeed, the owner of that credit card. This means reading off the name exactly as printed on the card. It means not only the full credit card number, but also the 3 digit verification number on the back of the card.

Often a purchaser will want the order shipped to another address. This is why you need to ask for both the billing address and shipping address. It is also why having an address verification feature is critical.

Many credit card processing companies monitor purchasing patterns at your place of business. For example, should there be a sudden increase in the number of credit transactions that can serve as a red flag and you will receive an alert. However, taking steps to avoid theft and fraud (not simply credit card fraud, but also shoplifting, employee fraud, etc.) should always be addressed proactively by small business owners themselves.

Guest Authored

– Merchant Processing Resource

https://debanked.com

Funding Down to a Science

December 21, 2012Account rep: Congratulations, you’ve been approved for $27,000!

Merchant: How did you come up with these figures?

Account rep: It was science. Science did this.

Funny? Maybe not, especially since an underwriting super algorithm may be on its way to the United States. In the days after we posted Made for Each other?, friends, acquaintances, and strangers have been telling us to keep an eye on Wonga’s potential acquisition of On Deck Capital. “It’s not just a european company’s gateway to the US. They’re going to change everything,” a few have said. Aside from their background of being a payday lender, having prestigious VC backing, and the resources to throw a quarter billion dollars at a main street lender in a takeover bid a lot of people didn’t see coming, apparently there is much more to be seen.

Just like MCA in years past, Wonga has worked hard to repel a negative image. Not easy stuff, especially considering they embrace their hefty costs wholeheartedly. Sure, it’s easy to calculate an APR equivalent of a very short term loan and spin whatever number you come up with as the symbol of something evil. If I let a stranger borrow $100 today with the stipulation that they pay me the whole thing back tomorrow plus 1 dollar extra to make it worth my while, would I be evil? That’s an APR of 365%. If I did the same thing with 100 strangers, what are the real odds that all 100 would actually pay me back? Somewhere along the line because of a borrower’s circumstances, bad decisions, or even malicious intent, I’m going to lose the entire $100 I lent out. Others might need more time to pay me back. If one person out of those hundred doesn’t pay back, I break even. If two people don’t pay back, I lose money. If one person doesn’t pay back and another can’t come up with the whole thing, I lose money. You can lend money at 365% APR and lose BIG.

So how do banks manage to charge 4, 7, and 10% APR? Is it just because they’re smarter? No. They don’t make money off loans at these rates either. In the US, interest rates are distorted by government guarantees. Politicians have decided that certain interest rates sound “fair,” then push big banks to lend money at these low unsustainable rates. But of course it doesn’t work and so government agencies sweeten the deal by reimbursing banks for up to 90% of the losses on the borrowers that default. Banks make money on the loan closing fees and other services they sell to the businesses. The loan is the doorbuster offer the bank puts in the storefront window. Once you come inside, they try to sell you on other things so that you don’t walk away with just the loan, otherwise they’re losing money.

So when you hear “banks aren’t lending,” don’t be so surprised. Lending money means giving it away to someone that might not pay it back. That’s a really tough business to be in, no matter how qualified the borrowers are or how good the underwriters are supposed to be.

But somewhere in between the opinions of the Merchant Processing Resource staff and government bureaucrats over what is fair, is a special recipe that determines once and for all what works best. It’s science. Wonga’s lending success is rooted in science and propelled by an advanced algorithm that can systematically calculate risk better than any bank in the world, or so they say.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

One of Wonga’s major investors, Mark Wellport, is a knighted renowned immunologist and rheumatologist that has defended Wonga’s methods against regulation. He believes their data-based process and strong motivation to make their borrowers satisfied places them in an entirely different category than payday lenders.

Wonga takes a human-free approach, something no MCA provider in North America does regardless of how automated their process may seem. In the UK, their business loan application process takes only 12 minutes and the funds are wired 30 minutes later. That’s it. Their max loan is £10,000 but just think about how that compares to MCA in the US. How much time and overhead is being spent on printing documents, underwriters, conference room meetings to discuss deals, setting up the merchant interview, trying to reach the landlord, trying to get page 7 of a bank statement from 6 months ago and the signature page of the lease, etc. etc. Funders might have had the wrong approach all along.

Wonga’s founder, Errol Damelin believes in data. According to some quotes in The Guardian, Damelin believes interacting with the borrower actually impairs a lender’s judgement.

From the Guardian:

Asking for a loan from a financial institution had traditionally involved making a strong first impression – putting on a suit to see the bank manager – then rigorous questioning, checking your documents and references, before the institution made an evaluation of your trustworthiness. In a way, it was exactly the same as an interview, but instead of a job being at stake it was cash.Damelin found this system old-fashioned and flawed. “The idea of doing peer-to-peer lending is insane,” he says. “We are quite poor at judging other people and ourselves – you get to know that in your life, both with personal relationships and in business. You realise that we’re not as good as we think we are at that stuff, and that goes for almost everybody. I certainly thought I was much better at it.

The 42-year-old entrepreneur grew up in apartheid South Africa, and he believes the experience of living in that country in the 80s has had a significant impact on his outlook. He was active in student politics at the University of Cape Town and marched in civil disobedience protests. So, when it came to deciding who should be lent money, Damelin says he wanted to strip away some of the prejudice – decisions would be taken without a face-to-face meeting; you wouldn’t even speak to an adviser on the phone, because people subconsciously judge accents too. The final call on whether to hand out cash would be based on “the belief that data could be more predictive than emotion”.

According to Wired, Damelin and his team created a system to approve or decline applicants all on its own. They tested it on a site called SameDayCash by using Google Adwords and within ten minutes of their ad going live, their system had already approved its first customer. In its early forms, it wasn’t very profitable from a lending standpoint but it did allow them to collect a massive amount of data.

From Wired

its strategy over this period wasn’t just to disburse money — it was to accumulate facts. For every loan, good or bad, SameDayCash gathered data about the borrowers — and about their behaviour. Who were they? What was their online profile? Did they repay the money on time? The site was feeding an algorithm that would form the basis of Wonga, launched a year after the beta experiment that was SameDayCash.

MCA has utilized Adwords for lead generation for years with mixed success, but few have used it for the purpose of accumulating facts. This isn’t to say that the firms collecting information for the purpose of leads aren’t sitting on treasure troves of data, it’s just that none of it to date has led to 100% computerized underwriting. The MCA industry is quite possibly about to undergo a major shift in how they promote their product on Adwords as a result of Google’s ominous warning a couple weeks ago. New disclosure requirements may change the way consumers respond and apply, ultimately impacting the data collected.

So will european science work in the good ‘ol US of A? If Wonga acquires On Deck Capital, you can bet they’ll try to replicate their success. There is a gigantic market of really small businesses that aren’t getting funded, and even the ones that are, they’re waiting 3-7 days to deal with the paperwork, handle the phone calls, fax documents, complete a landlord verification, and in some cases, deal with a credit card processing equipment change. If On Deck Capital becomes a household name as Wonga is in the UK, a lot of smaller funders are going to get squeezed.

Wonga claims to have a net-promoter score above 90%, a customer satisfaction metric that beats most banks and even Apple Computer. It’s a company that seems to be winning on every front.

Critics will say that the American lending market is big enough for everyone, that the loans Wonga has done traditionally are really small and therefore not in the same league as MCA, or that their own company has something similar or better. We believe however, that if this deal goes through that it’s a bad idea to get comfortable. There are Wonga-like companies in the US already, data fortresses that will soon revolutionize how loans are issued and determine what makes a successful business. New York based Biz2Credit is one such example.

We’ve been right about a lot of things in the last couple years and wrong about some. But we believe it is inevitable that any lender ignoring the automation revolution on the horizon is not going to last very long. Go ahead, brush it aside and convince yourself that this whole Automation thing is just hype as BusinessWeek did in 1995 about the Internet. “Automation? Bah!”

As Damelin told Wired in June, 2011, “For me the epiphany was right there. People were online, looking for a solution to a problem.” Ask any funder using Adwords or pouring work into SEO and they’ll tell you the same thing. People are looking online for money. What happens after they fill out the form on the website is what makes the USA MCA/alternative lending industry different from Wonga.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

But will a perfected european algorithm work in the US? Americans approach debt and money differently than the rest of the world and small businesses operate in a much more open manner. You never know, the european lab coat wearing scientists could come here and get their butts handed to them. Plenty of smart companies have jumped headfirst into MCA and left after disastrous results. Some veterans that have been in this business a long time will you tell that an impressive resumé, big investors, and a fancy algorithm will help you make it through the first six months. After that, you better know what the hell you’re doing, if you can continue to do it at all.

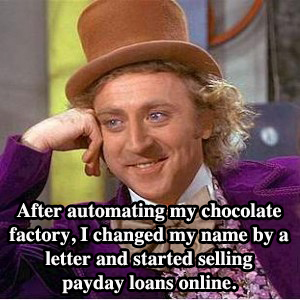

If in three years the average small business owner thinks Wonga is the last name of a guy that owns a chocolate factory, we promise to write a jingle that admits we were wrong about them. But On Deck Capital has been around the block and knows the business. They would allow Wonga to skip the learning curve and together could quite possibly nail lending down to a science.

Oompa Loompa do-ba-dee-doo, I’ve got another algorithm for you.

– Merchant Processing Resource

https://debanked.com

There is great feedback to this article in a LinkedIn Group HERE

Is Print Media Dead? Why Small Business Owners Should Take a Second Look

November 11, 2012 Many small business owners may have thrown out the newspaper with the bath water when it comes to using print media as a marketing and promotion channel for their small business. Number one, most of us are pretty much convinced that print media is dead. Major newspapers that have been around for eons are dead or dying. Print magazines are failing or subscriptions are woefully down. On top of that there are literally hundreds of thousands of online social media specialists and bloggers out there tooting the digital horn not as “the way of the future” – but telling us that the future is now. Any small business owner out there not engaging in social media marketing isn’t only missing the boat, they’re on a sinking ship.

Many small business owners may have thrown out the newspaper with the bath water when it comes to using print media as a marketing and promotion channel for their small business. Number one, most of us are pretty much convinced that print media is dead. Major newspapers that have been around for eons are dead or dying. Print magazines are failing or subscriptions are woefully down. On top of that there are literally hundreds of thousands of online social media specialists and bloggers out there tooting the digital horn not as “the way of the future” – but telling us that the future is now. Any small business owner out there not engaging in social media marketing isn’t only missing the boat, they’re on a sinking ship.

However, small business owners might want to take a second, and much closer, look at whether or not investing in print media still represents an opportunity to achieve a high rate of return for their particular business.

Print Media Can Hit Your Target

The most obvious example is a small local business owner. A business owner who serves a local community with distinct boundaries is targeting consumers and clients within that local jurisdiction. That local community may be at the neighborhood, small town, or even large municipal area. What is common to all local businesses is that oftentimes print media exists that provides a relatively low cost vehicle to promote their small business.

For example, small business owners in small towns are likely to get a pretty big bang for their buck promoting their business in their local small town newspaper. Many of these small town papers provide what could be classified as “hard journalism” reporting on local political and other town issues such as city budget and the like. However, a major focus in small town newspapers tends to be human interest articles that attract local readers. In turn, those articles attract specific types of readers.

For instance, often there will be a column dedicated to subjects such as gardening, cooking, local events, the environmental, the arts, books, and so on. Because the paper is so small, many local newspapers provide a greater opportunity to locate your ad near copy that relates to your small business, or that is read by people you’ve targeted as your most optimal customers or clients. If you’re a local hardware store, an ad located near the gardening article can be very effective. If you’re a local podiatrist or retail store selling running shoes, an ad near an article about a local 10K is a great opportunity. Most neighborhood and municipal newspapers offer this type or similar opportunities for ad placement.

Loyalty and Numbers Matter

Regarding reach of your small businesses’ ad, local print media can be a better option than promoting your local small business online. For one, many of these publications already have a very loyal readership. Any small business owner with even a modicum of experience creating an online presence can appreciate just how much effort, time, and (yes) money goes into creating a strong, loyal, and large following online. While social media is low cost, it isn’t “no cost.” Even if you’re not outsourcing social media activities (i.e. content creation, posting, replying, etc.) – you are paying a huge premium in time.

Equally important is that print advertising in many ways isn’t as limited as social media. You can get a whole lot more information in an ad in your local newspaper than an online banner ad. Additionally, advertising in your printed local publication can actually create more credibility for your small business. Consumers understand that print advertising comes at a cost and tend to assign credibility to businesses using print advertising. Consumers are savvy and know online banner ads can come pretty cheap – a print ad can effectively communicate your small business is both established and reliable.

Ironically, we’re going to provide you with the best argument for taking a second look at promoting and marketing your small business using print media with an online example. On their “About” page here is how one community paper describes themselves:

The College Park Community Paper has been in circulation since 1989. We are a monthly, full color, family friendly newspaper delivering the good news happening in College Park each month. The paper is delivered free of charge by mail to over 7,000 homes and businesses in the 32804 zip code which includes College Park and the Country Club of Orlando. Additional distribution is provided throughout the community and commercial district through the use of newspaper stands and counter top display. Additional exposure is garnered through our website which includes additional material not shown in the print edition.

You’ll also want to take a look at their ad rates here, but we use them as an example for quite another reason: they provide an excellent example of a small business integrating both on and offline channels to promote their small business, which can be not only a balanced approach, but an approach that provides the biggest bang for your buck.

– Merchant Processing Resource

https://debanked.com