small business owners

First Ever Small Business Community Chat: Join in!

March 28, 2013 The Small Business Community on Google Plus recently broke 1,000 members and to make the most of it, we’re kicking off the first ever Small Business Chat. The chat events will be held weekly, and each week it will cover a different topic.

The Small Business Community on Google Plus recently broke 1,000 members and to make the most of it, we’re kicking off the first ever Small Business Chat. The chat events will be held weekly, and each week it will cover a different topic.

The first chat will be on Tuesday, April 2nd at 8pm to 9pm EST in the Google Plus Small Business Community. Please RSVP HERE.

TOPIC:

Come meet and share with likeminded people about how you became an entrepreneur, what makes you tick, wild stories, personal strategies, and more! Thinking about going off on your own? Not sure if you have what it takes? Circle Up and have fun.

Don’t Get Banned by Your Target Market

March 19, 2013 I’ve watched this happen a lot over the last several weeks, particularly on Google Plus. Businesses both large and small join a community, start posting links to their blog and then they get banned. Some are posting crap and others are posting genuinely good content, but the good content is being pushed on people and nobody likes that.

I’ve watched this happen a lot over the last several weeks, particularly on Google Plus. Businesses both large and small join a community, start posting links to their blog and then they get banned. Some are posting crap and others are posting genuinely good content, but the good content is being pushed on people and nobody likes that.

Communities and forums exist for discussion, not for marketers to disseminate their blog posts with titles like 10 ways for small businesses to maximize profits. Now there are a few instances where it makes sense to post a link to your website, but only if it truly results in a healthy engaging debate and shares. If that doesn’t happen, then you’re probably in trouble.

I have actually had to watch a few people I know in financial services get the boot in communities, and there was nothing I could do to help them. Their brands have literally been BANNED from talking amongst their peers and potential customers and that’s probably the worst thing that can happen. I’ve all seen hundreds of small businesses make the same mistake, younger businesses that have finally decided to give social media a shot, only to be shown the door 10 minutes after they jump in. It’s disheartening. Many communities don’t offer a warning, so the best chance to let sometime know the basics of human interaction, is to do it before they join anything. If you were thinking of joining a community or have been banned by one, particularly on Google Plus, I’ve written up a little road map titled: Banned from a Google Plus Community?

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Small Business Loans for Men? Not a Good Idea…

March 18, 2013A man walks into a bank and says “I want to know what kind of programs, discounts, and benefits you offer for men owned businesses.” The bankers exchange glances with each other and reply together, “For men? Sure! We love men!” Sounds a little outrageous doesn’t it? Don’t worry, this doesn’t usually happen, at least not on the Internet. Using Google’s keyword traffic estimator, zero people search for “business loans for men” each month. And why would men search for that? Or rather, why is it that other gender has a tendency to seek gender specific support?

As of the date we used Google’s keyword traffic estimator, the data showed there are approximately 4,650 searches for “business loans for women” each month on average. It seems men want business loans but women want business loans with them in mind. Tweak the query just a little bit more and it reveals that 51,570 people are looking for “grants for women” each month, which equates to an astounding half million inquiries plus a year! So ladies, What makes you look for something so gender specific?

Perhaps it has something to do with the odds having been stacked against them historically. In 2007, only 30% of all privately-owned American firms were owned by women. While that’s not exactly light years away from equality, women owned businesses only accounted for 11% of all firm revenues and just 13% of all firm employment, meaning of course, that their businesses tended to be smaller. Maybe women choose to be smaller and less involved in ownership, or maybe and far more likely it’s because men had been rigging the game for such a long time.

Perhaps it has something to do with the odds having been stacked against them historically. In 2007, only 30% of all privately-owned American firms were owned by women. While that’s not exactly light years away from equality, women owned businesses only accounted for 11% of all firm revenues and just 13% of all firm employment, meaning of course, that their businesses tended to be smaller. Maybe women choose to be smaller and less involved in ownership, or maybe and far more likely it’s because men had been rigging the game for such a long time.

Up until 1988, lenders could deny women credit if they did not have a male relative co-sign for them. The Women’s Ownership Business Act, symbolically named House Resolution 5050, sought to end the lingering discrimination against women. It also:

established the National Women’s Business Council, a public policy advisory body comprised of women business owners and women’s business association representatives. Its mission is to promote initiatives, policies and programs designed to support women’s business enterprises at all stages of development, and to serve as an independent source of advice and counsel to the President, Congress, and the U.S. Small Business Administration on economic issues of importance to women business owners.

I used the word lingering because the 1974 Equal Opportunity Credit Act already made it illegal for lenders to discriminate against applicants on the basis of gender, and at the same time barred discrimination on the basis of race, color, religion, national origin, marital status, and age. Apparently, this wasn’t enough. This law went into effect 39 years ago and still after all this time and additional legislation, women and other disadvantaged groups still don’t have a level playing field. Change has not come easy.

I used the word lingering because the 1974 Equal Opportunity Credit Act already made it illegal for lenders to discriminate against applicants on the basis of gender, and at the same time barred discrimination on the basis of race, color, religion, national origin, marital status, and age. Apparently, this wasn’t enough. This law went into effect 39 years ago and still after all this time and additional legislation, women and other disadvantaged groups still don’t have a level playing field. Change has not come easy.

Even if gender discrimination were to be totally eradicated (and we’re not saying it has or hasn’t been), many women still have their guard up. If they had to choose between a lender promoting loans and a lender promoting their desire to lend to women, the latter would probably offer a bit more comfort. They also seem to know that after years of discrimination that there are actual benefits to being a female entrepreneur these days and they want to take advantage of them. For example, the Women’s Small Business Accelerator of Central Ohio, a non-profit group, offers support specifically for women owned startups. Organizations like this are necessary because equality isn’t achieved just because a law says it’s so. At some point, the group that was disadvantaged needs a boost to capitalize on the equality they’ve finally been given. That’s good news for ladies in 2013 because there’s a lot of organizations out there that are willing to give them that boost.

At the same time, there are lenders that do not offer any incentive at all for women, but don’t discriminate against them either. These lenders tend to advertise in print and on the Internet that they have financing programs just for women and yet they offer no actual edge over male applicants. Instead, these lenders are simply acknowledging that some women are wary of bias, and are making it a point to communicate that women will be accepted equally. Equally is the key word there since if lenders actually deny male applicants in their pursuit to approve more female ones, they will be in violation of the Equal Opportunity Credit Act which protects gender as a class, not women. Tricky eh?

Lenders spend big bucks on marketing financing programs to women, so why don’t they use the same tactic to appeal to men? I mean, considering a Google search of “business loans for men” seems to turn up nothing of relevance, it looks like there’s a vast untapped market to corner. Perhaps men would start searching for programs marketed towards them if there were actual lenders speaking specifically to them. But that is a dangerous road, and one after years of inequality screams lawsuits. Even if lenders did not actually give preferential treatment to men, the appearance of a good ‘ol boys club would probably be enough to make people uncomfortable.

Would you publish an ad with the title, “Fast Business Loans for Whites”? Probably not, even if it was effective in attracting caucasian borrowers. But do a search for “Minority business loans” and you’ll find there’s a lot of programs openly targeting minorities. And just as I suspected, Google reveals that a significant amount of minorities are searching for financial help specifically for them, and not just financial help in general (There are about 570 searches a month for the exact phrase “minority business loans”).

And so it looks as if financial companies have adjusted their target markets at least when it comes to messaging. Lenders that do not custom tailor messaging to specific groups such as women business owners can find themselves having a difficult time competing. Anyone can offer business loans, but if they’re not responding to the personalization that some applicants are seeking, they may be missing out on a lot of potential customers. Personalization should be incorporated into any advertising campaign anyway, so long as it doesn’t rub people it’s not targeting the wrong way.

A television commercial that uses pickup trucks, power tools, and Clint Eastwood would probably entice males to apply for a business loan if that’s what the ad was selling, but it’d be a good way to alienate women, especially given the history of inequality. With nearly a million queries made each year by women seeking either loans or grants, they’re not a market you want to turn off. Saying you’ll help women shows you get it, but saying you’ll help men shows you don’t. But at the end of the day, we’re all equal 🙂

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

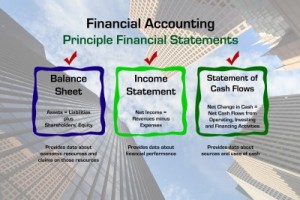

The Financial Statement Problem

February 26, 2013The Banks Know When You Don’t Keep Track

In the land of underwriting, sometimes Assets do not equal Liabilities + Equity. This only happens of course when a Balance sheet is prepared so poorly that it doesn’t even do the fundamental thing, balance… and I’ve seen plenty of these in my career.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

So what is a small business to expect when submitting financial documents for a loan approval?

5 out of 5 bank executives interviewed by Nerdwallet.com complained that too many small business owners don’t keep financial records, rarely update them, or only worry about them during tax season. Their advice? Hire a full-time financial professional. For a small business, this might mean being forced to sacrifice a chef, mechanic, or manager. The trade-off might not be worth it.

The merchant lending industry is a lot more forgiving when it comes to submitting documents. Deals under $100,000 may not require any financial statements at all. Yes, there are options out there specifically for the man or woman that chose a chef over an accountant, but that doesn’t mean they’re encouraging poor record keeping ways, nor does it mean they are blind to bad business practices.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Believe me when I say that there is no lender in the world that is going to be confident in approving a pile of crap, no matter how easy they advertise the approval process is.

My advice? If you can’t make time to organize your books regularly or hire a financial professional, at least build it in to your plans to do it in the future. Bank financing may be out of the question in the interim, but that doesn’t mean you are out of options. Merchant lenders, like the ones listed in our directory can help you. Just make sure you take the the application process seriously. Approving loans without financial statements may make these lenders more open to risk, but they know a bad deal when they see one. Be honest, open, and submit well prepared documentation. That’s the best way to maximize your chances.

Your Life or Your Bank Statements

February 20, 2013“Um, I don’t feel comfortable sending them to you because they’re private.” One of the most interesting things I experienced as a broker and underwriter is the amount of times I heard merchants tell me their bank statements were too private to send in. I understand it’s not exactly the same thing as telling someone your phone number, but if you’re applying for a loan or intend to sell your future receivables, this doesn’t really cross the line as being too personal.

Let’s be honest here, there’s plenty of folks who get defensive over this simply because they’re overdrawn and they don’t want the lender to see it. I’ve heard every trick in the book, “the last 2 months statements are lost and my bank refuses to send me copies”, “I switched bank accounts yesterday and my old bank won’t send me my previous statements now”, or “I’ll send them over as soon as I have 100% final approval on the loan.” These excuses won’t work and they set off red flags with underwriters. Besides, if you lie about something during the application process and then proceed to sign a guarantee on the loan agreement that you’ve disclosed EVERYTHING, then you’ve already placed yourself in breach of contract or worse, you’ve committed fraud.

Let’s be honest here, there’s plenty of folks who get defensive over this simply because they’re overdrawn and they don’t want the lender to see it. I’ve heard every trick in the book, “the last 2 months statements are lost and my bank refuses to send me copies”, “I switched bank accounts yesterday and my old bank won’t send me my previous statements now”, or “I’ll send them over as soon as I have 100% final approval on the loan.” These excuses won’t work and they set off red flags with underwriters. Besides, if you lie about something during the application process and then proceed to sign a guarantee on the loan agreement that you’ve disclosed EVERYTHING, then you’ve already placed yourself in breach of contract or worse, you’ve committed fraud.

But on the flip side, just as many applicants are worried that submitting their bank statements could lead to identity theft. Maybe there is a slight chance it does, but probably only if you’re sending them to someone that already has all of your other identifying information like your social security number. That’s the “interesting” part I spoke of earlier because few people flinch when filling out their social security number on the application. Don’t get me wrong, I’m not trying to induce worry in businesses that want money. What am I trying to say is that waiting until late in the application process to do research on the lender or broker is too late. You need to be 100% confident in the recipient of your personal information before you even fill out the preliminary application on the first day.

When it comes to identify theft, Your social security number, name, address, and date of birth is really all it takes for you to be fully compromised. The rebuttal on the bank statements is always “But I don’t want someone to know my bank account number because then they might try to take money out of it.” Really? Have you ever written a check to someone? Have you ever signed up for direct deposit? Have you ever seen a waste basket full of bank receipts next to an ATM machine? I hate to say it but your bank account information is already public and you probably give it out to people on a daily or weekly basis. Routing numbers are shouted from the rooftops and you can see that for yourself at routingnumbers.org. If someone is going to try to debit money out of your account, your bank statements aren’t really necessary. It’s sad, but it’s true. Financial institutions review and audit businesses that debit their customers, but sometimes bad guys slip through the cracks. Generally if an unauthorized debit does happen, you are not liable for the loss. According to FTC.gov:

When it comes to identify theft, Your social security number, name, address, and date of birth is really all it takes for you to be fully compromised. The rebuttal on the bank statements is always “But I don’t want someone to know my bank account number because then they might try to take money out of it.” Really? Have you ever written a check to someone? Have you ever signed up for direct deposit? Have you ever seen a waste basket full of bank receipts next to an ATM machine? I hate to say it but your bank account information is already public and you probably give it out to people on a daily or weekly basis. Routing numbers are shouted from the rooftops and you can see that for yourself at routingnumbers.org. If someone is going to try to debit money out of your account, your bank statements aren’t really necessary. It’s sad, but it’s true. Financial institutions review and audit businesses that debit their customers, but sometimes bad guys slip through the cracks. Generally if an unauthorized debit does happen, you are not liable for the loss. According to FTC.gov:

Since December 31, 1995, a seller or telemarketer is required by law to obtain your verifiable authorization to obtain payment from your bank account. That means whoever takes your bank account information over the phone must have your express permission to debit your account, and must use one of three ways to get it. The person must tell you that money will be taken from your bank account. If you authorize payment of money from your bank account, they must then get your written authorization, tape record your authorization, or send you a written confirmation before debiting your bank account. If they tape record your authorization, they must disclose, and you must receive, the following information:

The date of the demand draft;

The amount of the draft(s);

The payor’s (who will receive your money) name;

The number of draft payments (if more than one);

A telephone number that you can call during normal business hours; and

The date that you are giving your oral authorization.If a seller or telemarketer uses written confirmation to verify your authorization, they must give you all the information required for a tape recorded authorization and tell you in the confirmation notice the refund procedure you can use to dispute the accuracy of the confirmation and receive a refund.

In the event these rules are violated and a debit happens anyway, the FTC advises this:

If telemarketers cause money to be taken from your bank account without your knowledge or authorization, they have violated the law. If you receive a written confirmation notice that does not accurately represent your understanding of the sale, follow the refund procedures that should have been provided and request a refund of your money. If you do not receive a refund, it’s against the law. If you believe you have been a victim of fraud, contact your bank immediately. Tell the bank that you did not okay the debit and that you want to prevent further debiting. You also should contact your state Attorney General. Depending on the timing and the circumstances, you may be able to get your money back.

It’s important that you know these rules, but it’s twice as important to do a background check on the financial service company before you send them ANYTHING. Your social security number is your crown jewel. Be smart about who you send it to. And as for your mysteriously missing January bank statement? There’s a pretty good chance your story about where it went or why it’s never coming back isn’t going to work. Good luck and safe funding!

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Where’s the Reserve?

February 15, 2013 5 years ago it was merchant account sales. These days it’s all about the average daily ending balance in the business bank account. As the alternative business lending industry evolved, so too did the criteria to qualify, and nothing is more important now than historical cash flow. I spent a lot of time underwriting MCAs and one thing I noticed is that having a significant cash reserve is the exception, not the rule. Many small business owners I’ve encountered rely on overdraft protection just to pay their bills instead of using it as a backup cushion for the extremely rare circumstance that a check clears at the wrong time. The applicants with $1,000, $5,000 or $10,000 in daily reserves are treated very favorably in underwriting because heck, they can probably afford to take on debt. And then there’s the business owners with $20,000, $30,000 or $50,000 stashed away in the business account, a curious rarity that can actually throw up red flags.

5 years ago it was merchant account sales. These days it’s all about the average daily ending balance in the business bank account. As the alternative business lending industry evolved, so too did the criteria to qualify, and nothing is more important now than historical cash flow. I spent a lot of time underwriting MCAs and one thing I noticed is that having a significant cash reserve is the exception, not the rule. Many small business owners I’ve encountered rely on overdraft protection just to pay their bills instead of using it as a backup cushion for the extremely rare circumstance that a check clears at the wrong time. The applicants with $1,000, $5,000 or $10,000 in daily reserves are treated very favorably in underwriting because heck, they can probably afford to take on debt. And then there’s the business owners with $20,000, $30,000 or $50,000 stashed away in the business account, a curious rarity that can actually throw up red flags.

“Why is this merchant applying for capital when they’ve got $30,000 sitting in the account right now? Something doesn’t add up here,” an underwriter might say. But the only thing that doesn’t add up is the fact that so many businesses are running on fumes. We’ve got a few small business owners writing about matters from their perspective on The Frontline, and we took great interest in something written by Chef Angela Bell. As a restaurant owner, she believes it is important to keep a cash reserve equal to a minimum of 3 months expenses. Depending on the size of the restaurant and seasonality, that reserve may need to be able to cover an entire year. This includes rent and salaries!

It seems in practice, this rule is constantly violated. Maybe holding on to extra cash hurts the competitive edge, maybe a cash reserve existed but was consumed during an emergency, or maybe the business just isn’t doing that great. There are a lot of possibilities to explain the disappearance of cash reserves, and I’m not faulting the businesses for being in this situation, but rather pointing out that in my experience, money seems to go out as fast as it comes in.

This isn’t a 2013 problem or a financial crisis problem. It’s a small business problem and one that has been around for decades. It’s why the purchase of future credit cards spawned into existence. The original Merchant Cash Advance (MCA) program wasn’t created to help people with poor credit, it was designed to help the businesses that had no cash reserves. If a business has $2,000 in deposits every day but also $2,000 in withdrawals, there’s a good chance a debt payment will bounce. Even with 750 credit, no bank would ever take the risk on a business like that, and that’s where MCA came in. Assuming the business’s plans were sound, an MCA funder would withhold a percentage of merchant account sales before they were even transferred to the business’s bank account. That eliminated the risk of bounced checks for the funder and put the burden of operating on tight cash flow on the small business. Funders then reduced the strain by withholding less in times of weak sales and more in times of strong sales. The percentage system was the bridge to ensure the relationship was not predatory.

I’ve heard the frustrated replies from a business owner that was declined for weak or negative balances. They often sound something like this “Well, if I had cash I wouldn’t be needing a loan from you now would I?!” I feel for these people, I really do, but their approach to debt is misguided. Debt is not something you take on when you are out of money so you can continue business as usual. Debt is for growth or to be used as a temporary cash flow measure. Banks approve applicants that don’t need money because those that NEED IT are more likely to default.

I’ve heard the frustrated replies from a business owner that was declined for weak or negative balances. They often sound something like this “Well, if I had cash I wouldn’t be needing a loan from you now would I?!” I feel for these people, I really do, but their approach to debt is misguided. Debt is not something you take on when you are out of money so you can continue business as usual. Debt is for growth or to be used as a temporary cash flow measure. Banks approve applicants that don’t need money because those that NEED IT are more likely to default.

MCA was the good faith option for small business owners that cried foul over the banks that wouldn’t lend to them. How could there be NOBODY willing to take a chance on them? And so MCA funding companies came along and did what the masses demanded, but at a cost to compensate them for the significant risk.

Today, there is high demand for merchant loans, loans that are evaluated based on a daily average bank balance and monthly revenue. Many people will get less than they want and others should consider traditional MCA instead. Those few that are at the breaking point and believe a loan will allow them to pay past due bills and keep them afloat are better off not applying at all. And for the rest that are contemplating using the $50,000 cash reserve they built up to expand should seriously consider financing instead to protect their cushion as best they can.

Tomorrow, the health inspector could close your doors, vandals could destroy your valuable assets, or the town could perform massively disruptive construction right outside the front steps that cripples sales for months. If you’re running on fumes, you’ll run out of gas. Always keep the cash reserve tank full and nobody will be able to stop you.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Letters from the Frontline

February 12, 2013 I’ve worked in the alternative business lending industry for quite a while and I’ve noticed something off about many of the marketing campaigns. Some lenders have gotten so caught up in the funding that they’re losing sight of what it’s like to run a small business. Admit it, we’re all a little rusty even if we were once small business owners ourselves.

I’ve worked in the alternative business lending industry for quite a while and I’ve noticed something off about many of the marketing campaigns. Some lenders have gotten so caught up in the funding that they’re losing sight of what it’s like to run a small business. Admit it, we’re all a little rusty even if we were once small business owners ourselves.

I started working as a deli clerk when I was 15 years old and continued to do it part time until my senior year of college when I began waiting tables at a restaurant instead. I could definitely tell you a few things about the daily grind and the epic drama that happens in the back of the house on a Friday night, but it’s been a while since I lived it.

But don’t you own a small business now? Yes, I do. I’ve been a part of two successful Merchant Cash Advance start-ups and I went off on my own full-time near the end of 2011. These days I have vendors, invoices, customers, contractors, accountants, and lawyers to deal with. I have monthly financials to reconcile, servers to monitor, and office rent to pay. But let’s be honest, my experience doesn’t really translate if I’m on the phone with a merchant that just had a waitress quit, a 12-top walk out on the bill, and an oven break, all while a health inspector is doing an unannounced review. Yeah, something about THAT is a little different than my day-to-day routine.

Sometimes we need to take a step back and stop trying to find the algorithm that best calculates FICO scores and monthly cash flow figures and start analyzing small businesses for what they really are. That led us to an interesting idea; Why not have actual merchants spell it out for us? What better way for us to connect with the retailers and service people of the U.S. than to have a two way dialogue right here on MPR?

Starting today, we’re announcing our experimental Small Business Corner, aka The Frontline. A small group of actual retail store owners or managers are going to contribute regularly with stories, tips, and advice about what it’s like for them. I think it will be insightful for us, as well as for the other small business owners that visit our site.

As the alternative business lending industry gets more saturated, shouting from the rooftops that you have “cash available with fast approvals!” isn’t a way to connect with the actual businesses that may benefit from a cash infusion. I’m guessing we’ll learn what does. These contributors are free to write what they want, so there’s no telling what’s in store. We hope you enjoy it.

Visit the Frontline

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Competitive Advantage: Keeping What’s Yours

February 6, 2013 The most effective competitive advantages are the ones you’re able to keep. And one of the most important of your competitive advantages can be your team. When a close partner, associate, consultant, or key employee leaves your organization there can be a really good chance of losing more than the individual qualities, skills, or experience that made that particular person such an asset. In fact, they just might take off ready, willing, and able to share with your competition what it is that makes your company, products, and/or services unique.

The most effective competitive advantages are the ones you’re able to keep. And one of the most important of your competitive advantages can be your team. When a close partner, associate, consultant, or key employee leaves your organization there can be a really good chance of losing more than the individual qualities, skills, or experience that made that particular person such an asset. In fact, they just might take off ready, willing, and able to share with your competition what it is that makes your company, products, and/or services unique.

It’s clear that making sure the only thing an employee leaves with when they empty their desk is a few free office supplies is certainly in the best interests of your small business. This is definitely a case where an ounce of prevention is worth a pound of cure. There are three common means small business owners can put into place to help protect themselves:

- An NDA, or Non-Disclosure Agreement

- A Non-Compete Agreement

- A Non-Solicitation Agreement

Each one of these legal documents shares the goal of protecting the competitive advantages of your small business, but they are different from each other. For instance, a Non-Disclosure Agreement is commonly used when bringing in a consultant. A Non-Compete Agreement is commonly used when a major goal is to prohibit a former employee from working for a competitor within a specific geographical area for a specific period of time. A Non-Solicitation Agreement keeps a former partner or employee from leaving one business and then soliciting other employees to come and work for them.

I’m Just a Small Business – Is this REALLY Something I Need to Concern Myself With?

Certainly not all small business owners need to be concerned about NDA’s, Non-Competes, or Non-Solicitation agreements. However, although you might think of yourself as “just another small business” your business may actually require some of the protections these documents offer. It can be helpful to conduct a “confidentiality audit” to help you determine whether or not to make an appointment with an attorney. For example, here are a few things that warrant protection:

- Trade secrets such as inventions, formulas, or scientific discoveries

- Specialized methods or processes

- Specific Data

- Client and/or Customer Information

Again, you may not think of your business as needing protection. However, it is common for small businesses to fit into categories that may indeed fall prey to damage inflicted by former employees absconding with sensitive and/or valuable information.

Most small businesses are going to have employees who come into regular, consistent contact with clients and customers. What may not be obvious is that, in the course of that contact, those employees develop valuable relationships with those clients. Should such an employee leave your small business, unless you are protected, there is nothing keeping that employee from taking those customers and/or clients (and their business) with them. Your customer base should be protected as it is essentially your most valuable asset.

Advances in technology have also created situations where small business owners will want to protect themselves. Certainly if your small business conducts research and/or develops products it only makes sense to legally protect proprietary and intellectual property. For example, you will want to be sure that you retain the rights to new designs (including the right to obtain a patent) created by an employee. However, proprietary and intellectual property may not be limited to “new” products. For instance, your small business may develop an innovative application for existing technology.

If you are still on the fence regarding whether or not you should contact an expert for advice as to whether or not you might need a Non-Compete, Non-Solicitation, and/or Non-Disclosure Agreement take a moment to answer a couple simple questions:

- Do my partners, associates, consultants, or employees have on-going contact and/or access to sensitive client information and lists that would be of benefit to a competitor?

- Do my partners, associates, consultants, or employees have access to anything that is best kept “secret” from my competitors or that would place my business at risk if the information was made public? (We’re not talking about illegal activity, more along the lines of a “secret recipe” or special way of doing things.)

If you answered yes (or even “maybe”) to one or both of these questions it is better to be “safe than sorry” and make an appointment to receive expert advice from an attorney or other subject matter expert.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android