Regulation

Update on Maryland Commercial Financing Bill

March 20, 2022Maryland’s commercial financing disclosure bill is continuing to move through the state legislature. After debate with potentially affected parties, some changes were made to the bill’s language. The APR requirement on sales-based financing transactions remains in the bill, however.

The bill passed through the Senate unanimously (47-0) and has been referred to the House. The original version in the House had been withdrawn but that was most likely because the members of that chamber anticipated that substantive edits would take place in the Senate. The House will now resume review and consideration of the Senate’s version going forward.

Initiative to Push Maryland Commercial Financing Disclosure Bill Points to New York and California

March 14, 2022 Maryland State Senate bill SB0825 was put up for contentious debate last week. The bill is Maryland’s latest attempt to impose restrictions on a subset of commercial finance transactions.

Maryland State Senate bill SB0825 was put up for contentious debate last week. The bill is Maryland’s latest attempt to impose restrictions on a subset of commercial finance transactions.

State Senator Ben Kramer spoke at length before the Finance Committee, arguing that opposition to the 2022 version of the bill would be fruitless because it was modeled after passed legislation in New York and California. Apparently operating under the impression that such states had settled the issue of calculating an APR on a purchase transaction, Kramer appeared unaware (perhaps intentionally) that both states have been unable to enact their legislations because of critical flaws in their mathematical assumptions. In the case of California, for example, implementation of its disclosure law has been delayed for almost 4 years.

The corresponding Maryland House Bill of this legislation (HB1211) has since been withdrawn.

Senator Kramer has led the push for regulation for three years straight, beginning in 2020 when a related bill he introduced was called “Merchant Cash Advance Prohibition.”

Virginia Passes Landmark Sales-Based Financing Bill

March 7, 2022 The Virginia State legislature unanimously passed HB1027 on Monday, a law aimed squarely at revenue-based financing providers. Virginia Delegate Kathy Tran (D) celebrated the passage on twitter by saying that the law will “protect small business owners from merchant cash advances.”

The Virginia State legislature unanimously passed HB1027 on Monday, a law aimed squarely at revenue-based financing providers. Virginia Delegate Kathy Tran (D) celebrated the passage on twitter by saying that the law will “protect small business owners from merchant cash advances.”

The law will require “a provider or broker of sales-based financing to register with the State Corporation Commission (the Commission) in accordance with procedures established by the Commission,” the legislative summary reads. Furthermore, it will require “a sales-based financing provider to provide certain disclosures to a recipient at the time of extending a specific offer of sales-based financing.”

That is just the tip of the iceberg. The bill’s language changed somewhat since it was first introduced in January.

Despite some industry pushback, there was no opposition to the bill on either side of the political aisle and it passed through both chambers unanimously. Virginia has become the third state, following California and New York, to pass a commercial financing disclosure law.

Today, we had the final vote on my bill HB1027 – it passed unanimously and is headed to the Governor! We’re taking key steps to protect small business owners from merchant cash advances, a predatory financial practice. Thanks to @TCIFiscal @VPLC @rbrexperience for your support! pic.twitter.com/Wv8NRL9SOp

— Kathy Tran (@KathyKLTran) March 8, 2022

Delegate Tran thanked The Commonwealth Institute, the Virginia Poverty Law Center, and the Richmond Black Restaurant Experience for their support in making the law happen. The bill now just needs the governor’s signature to become law.

Connecticut Revives Commercial Financing Disclosure Bill

March 3, 2022The State of Connecticut has resurrected its commercial financing disclosure bill, adding to the pile of states doing the same. Senate Bill 272 is a throwback to earlier versions of legislative drafting in that it contains the term “double dipping.”

The bill was only just reintroduced today, March 3rd, where it has been referred to the Joint Committee on Banking. When it was raised last year, it was met with fierce opposition.

The full text of the bill can be read here.

Even More Commercial Financing Disclosure Bills Emerge Across Additional States

February 9, 2022 It’s not just New York, New Jersey, California, Virginia, and Missouri with disclosure legislation out there anymore.

It’s not just New York, New Jersey, California, Virginia, and Missouri with disclosure legislation out there anymore.

Utah – On Monday, the State Senate introduced the Commercial Financing Registration and Disclosure bill.

Maryland – On Monday, the State Senate introduced the Commercial Financing Transactions bill.

Mississippi – Last week, the State legislature introduced two commercial financing disclosure bills but both died in committee.

The Maryland Bill is the latest iteration of a multi-year campaign to pass legislation aimed at restricting MCAs in the state.

The bill in Virginia is still continuing to advance.

The bills in New York and California have already long ago passed and implementation of them as laws is still underway. The New York Department of Financial Services is expected to provide an updated proposal by the end of next month.

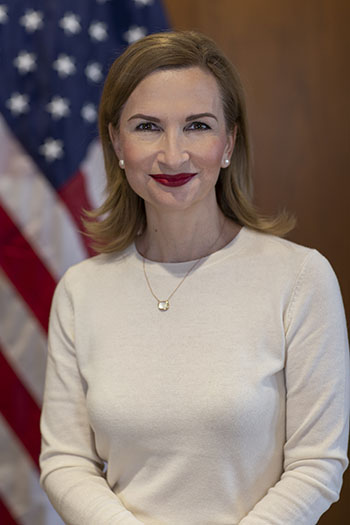

FDIC Chair Says Community Banks are the Backbone of SMB Lending

February 4, 2022 In a Bipartisan Policy Center forum, outgoing FDIC Chairperson Jelena McWilliams spoke on the future of small business lending post-pandemic. According to her, the future of the industry isn’t in brokering different types of products, but rather merchants relying on community banks to develop and provide interpersonal relationships with businesses who are seeking access to capital.

In a Bipartisan Policy Center forum, outgoing FDIC Chairperson Jelena McWilliams spoke on the future of small business lending post-pandemic. According to her, the future of the industry isn’t in brokering different types of products, but rather merchants relying on community banks to develop and provide interpersonal relationships with businesses who are seeking access to capital.

“Small business lending, which is especially important to community banks, will continue to grow,” said McWilliams. “We monitor these developments through our call report data, and we report it on a quarterly basis. Community banks are a real player in the small business lending space. They are a key resource to small businesses needing credit, they are in a niche area. In most cases, they are more successful lending to small businesses than larger banks.”

McWilliams referenced a study that was published by the FDIC in 2020 dubbed the ‘FDIC Community Banking Study’ that found community banks were playing a much larger role in small business lending than larger banks. According to the study that McWilliams referenced, 36% of small business loans are written by community banks; more than double their share of the industry’s total loan products, which is around 15%.

It seems to show that the belief of regulators is that smaller banks can leverage their size to put a face to the loan. Speaking about fintech and its impact on the lending space, McWilliams stressed that a well-rounded financial product has to have a face to it.

“That personal touch community banks bring to the table is what allows them to be really good in this space, and to actually expand relationships between banks and borrowers. So I think that small business lending today I think they are in a very good place.”

McWilliams concluded her comments on the state of small business lending in a reflection of the overall economy, drawing a connection between the financial health of small businesses and the overall economy post-pandemic.

“Of course, you can never have enough credit or capital to have a vibrant economy and more is better as long as its safe and sound and underwritten well, but I would say that for all the concerns we had at the beginning of the pandemic with so many small businesses not being able to survive and shutting their doors down, we are actually on a really good trajectory in small business lending at this point in time.”

Missouri Introduces Commercial Financing Disclosure Bill

January 25, 2022Add Missouri to the list of states proposing mandatory disclosures in commercial financing transactions.

[See: New York, California, New Jersey, Virginia, North Carolina]

Missouri’s SB 963 is different from bills in other states in that it does not seek the disclosure of an annual percentage rate. Adopting a simpler approach, SB 963 would require commercial financing companies to disclose:

1. The total amount of funds provided

2. The total amount of funds disbursed

3. The total amount to be paid

4. The total dollar cost

5. The manner, frequency, and amount of each payment

6. Prepayment costs or discounts

7. Whether or not a broker will be compensated

The bill was introduced by State Senator Justin Brown (R).

New Jersey Reintroduces Commercial Financing APR Disclosure Bill

January 20, 2022 Members of New Jersey’s state legislature are trying for a fifth year in a row to advance a commercial financing APR disclosure bill. Senate Bill 819 was introduced on January 18th. Senate Majority Whip Troy Singleton (D) is the primary sponsor.

Members of New Jersey’s state legislature are trying for a fifth year in a row to advance a commercial financing APR disclosure bill. Senate Bill 819 was introduced on January 18th. Senate Majority Whip Troy Singleton (D) is the primary sponsor.

Similar to what was just introduced in the Virginia legislature, the bill is mainly aimed at “sales-based financing.”

“Sales-based financing means a transaction that is repaid by the recipient to the provider, over time and as a percentage of sales or revenue, in which the payment amount may increase or decrease according to the volume of sales made or revenue received by the recipient. ‘Sales-based financing’ includes a true-up mechanism where the financing is repaid as a fixed payment but provides for a reconciliation process that adjusts the payment to an amount that is a percentage of sales or revenue.”