Regulation

The CFPB’s Small Business Lending RFI Has Already Received Responses

May 28, 2017Three responses to the CFPB’s Request For Information on small business lending have already been submitted and here’s what they say.

Kent Franzen, a career banker, said that the law limiting an underwriter’s access to an applicant’s minority-owned or women-owned business status is “literally impossible.”

“Considering that in every small bank I have worked in or am otherwise familiar with the loan officer is the primary borrower contact, the loan data collector, the primary underwriter, the author of the loan documents, the notary public for collateral documents and the loan servicing agent. This requirement is literally impossible to comply with in a community bank.“

Franzen again in regards to what concerns does he have about the possibility of misinterpretations being drawn by regulators from the collection of data pursuant to Section 1071:

“[…]I am very concerned that the so called disparate impact analysis will be used as a persecution instrument against smaller institutions that present a political expedient target of opportunity. I point out the total absence of new bank charters since Dodd Frank was enacted as proof that the country has already amassed an amount of bank regulation that is slowly choking community banks. The only institutions that thrive under this crushing regulation load are those already too big to fail.”

Jayne Lovig, a loan officer, said this:

“Your request for business lending data collection is duplicating what we are already compliling and submitting to: USDA, SBA, CDFI (Community Development Financial Institutions), OFN (Opportunity Finance Network), and the Microenterprise Census Tracker. Your data collection will compound existing regulatory reporting burdens, and again, DUPLICATES WHAT WE ARE ALREADY PROVIDING TO FEDERAL LENDING AGENCIES. Why explore size standard approaches that are ALREADY defined with EXISTING agency reporting? By coming up with new definitions you will be adding unnecessary confusion. I suggest that since ALL the data you are requesting is ALREADY BEING REPORTED that you interface with the USDA and SBA (who have already “invented the wheel”) and compile the data from them electronically.”

And lastly, 13 trade associations penned a joint letter asking the CFPB to extend the RFI deadline from July 14th to September 12th to allow them adequate time to fully formulate their answers. Those associations are:

American Bankers Association

American Financial Services Association

Consumer Bankers Association

Credit Union National Association

Electronic Transactions Association

Equipment Leasing and Finance Association

Financial Services Roundtable

Independent Community Bankers of America

National Association of Federally-Insured Credit Unions

National Federation of Independent Business

Small Business & Entrepreneurship Council

Truck Renting and Leasing Association

U.S. Chamber of Commerce

Learn more about the purpose of this RFI (which is voluntary) here.

New York Legislature Held A Hearing On Online Lending

May 21, 2017Update: The full video of the 6-hour Monday hearing is below:

Update:

The six-hour marathon hearing mainly focused on non-bank fintech companies and their bank partnerships to make loans. Lending Club, for example, was criticized for marketing their business as a “marketplace” when in actuality their loans are issued to consumers by WebBank. Assembly Member Brian Kavanagh had Lending Club representative Richard Neiman explain bit by bit how their model actually works, and inquired why the company felt it was necessary to partner with a bank in Utah rather than just become a licensed lender in the State of New York. Some of the questions, like that one, were pretty good, but others came across as misguided.

Arlen Gelbard, the EVP and General Counsel for Cross River Bank for example, was harangued for supposedly flouting New York laws. Senator Diane Savino asked Gelbard why his company didn’t have a lending license in New York. Gelbard, confused by the question, explained that his company was already a fully regulated state chartered bank and although the bank is based in New Jersey, there is no law that says they have to move to New York or become licensed to lend there.

NY Department of Financial Services Superintendent Maria Vullo made the strangest leap however by suggesting that the State’s civil usury cap be reduced from 16% to 7%. She based that idea on the presumption that a low Fed Funds rate meant that lenders must be making excess interest on the loans they make. She seemed to be unaware that interest rates on loans incorporated default risk, rather than simply than a lender’s cost of capital alone.

At 10AM on Monday, the NY Senate and Assembly will be holding a hearing on the practices of online lending to determine if action is necessary to protect consumers and small businesses.

According to the official notice, the “hearing seeks to explore the current state of online lending, the impact of online lending on consumers and small businesses in New York State, predatory online lending practices which need to be mitigated, and potential regulatory or legislative action which may be needed to address predatory online lending practices.”

Are You a Loan Broker? You Need to Be Licensed in Vermont

May 12, 2017 Loan broker licensing may have gotten stalled in New York, but in Vermont, it’s the law. Governor Phil Scott made H. 182 official on May 4th, regulating everyone engaged in loan solicitation with prospective Vermont borrowers. Specifically this applies to anyone that:

Loan broker licensing may have gotten stalled in New York, but in Vermont, it’s the law. Governor Phil Scott made H. 182 official on May 4th, regulating everyone engaged in loan solicitation with prospective Vermont borrowers. Specifically this applies to anyone that:

- offers, solicits, brokers, directly or indirectly arranges, places, or finds a loan for a prospective Vermont borrower;

- engages in any activity intended to assist a prospective Vermont borrower in obtaining a loan, including lead generation;

- arranges, in whole or in part, a loan through a third party, regardless of whether approval, acceptance, or ratification by the third party is necessary to create a legal obligation for the third party, through any method, including mail, telephone, Internet, or any electronic means;

- or advertises or causes to be advertised in Vermont a loan or any of the services described in (i) –(iii). This license does not include the authority to engage in the business of making loans.

The loan solicitation law is separate from a Commercial Lender License, which already requires licensing to solicit business loans under $1 million, as it covers:

- Any company or person who engages solely in the business of making commercial loans of money, credit, goods, or things in action and charges, contracts for or receives on any such loan interest, a finance charge, discount, or consideration therefore. Commercial loans do not include a loan or extension of credit secured in whole or in part by an owner occupied one-to-four unit dwelling. [Note: The company’s main office must be licensed as a commercial lender prior to, or simultaneously with, the filing of a branch commercial lender license.]

- Each location, whether located in Vermont or not, desiring to engage in the business of making commercial loans in Vermont must obtain a separate license by filing a Form MU3 through the NMLS.

- A commercial loan solicited or made by mail, telephone or electronic means to a Vermont business is subject to licensing notwithstanding where the loan is legally made. No person may engage in the business of soliciting or making commercial loans by mail, telephone or electronic means in Vermont unless duly licensed.

Brokers and lead generators should take a good hard look at their marketing since it may not matter if the customer ultimately is referred to a non-lender such as an equipment lessor or a merchant cash advance company if loans are even an option among many.

According to the law, each loan solicitation licensee shall include clearly and conspicuously in all advertisements of loans and solicitations of leads, the following statement:

“THIS IS A LOAN SOLICITATION ONLY. [INSERT LICENSEE NAME] IS NOT THE LENDER. INFORMATION RECEIVED WILL BE SHARED WITH ONE OR MORE THIRD PARTIES IN CONNECTION WITH YOUR LOAN INQUIRY. THE LENDER MAY NOT BE SUBJECT TO ALL VERMONT LENDING LAWS. THE LENDER MAY BE SUBJECT TO FEDERAL LENDING LAWS.”

A loan solicitation license cost $1,100.00 (includes a $500.00 Licensing Fee, a $500.00 Investigation Fee; and the $100 NMLS processing fee), according to the government website.

If you’re sending mailers to Vermont businesses, calling them or even marketing to them on the Internet, you should speak with an attorney about both the loan solicitation license and commercial lenders license first.

What You Need to Know About The CFPB and Small Business Lending

May 10, 2017

On Wednesday, the Consumer Financial Protection Bureau (CFPB) held a hearing on small business lending. Here’s why it mattered and what you need to know:

Why: The 2010 Wall Street Reform and Consumer Protection Act, aka Dodd-Frank, empowered the CFPB to collect data on small business lending. The CFPB is just now getting around to rolling this out. The purpose is to facilitate enforcement of fair lending laws and enable communities, governmental entities, and creditors to identify business and community development needs and opportunities of women-owned, minority-owned, and small businesses. In short, to determine if women and minority-owned businesses are operating on a level-playing field when it comes to accessing credit.

Who: “I’m an MCA funder, factor, equipment lessor or other, and this only applies to lenders right”?

Maybe, maybe not. Although Section 1071 makes several references to loans and credit, it doesn’t refer to the companies subject to data collection as small business lenders. Instead it says financial institutions which it defines as “any partnership, company, corporation, association (incorporated or unincorporated), trust, estate, cooperative organization, or other entity that engages in any financial activity.” That sounds incredibly broad.

What: What are they trying to collect?

- the number of the application and the date on which the application was received;

- the type and purpose of the loan or other credit being applied for;

- the amount of the credit or credit limit applied for, and the amount of the credit transaction or the credit limit approved for such applicant;

- the type of action taken with respect to such application, and the date of such action;

- the census tract in which is located the principal place of business of the women-owned, minority-owned, or small business loan applicant;

- the gross annual revenue of the business in the last fiscal year of the women-owned, minority-owned, or small business loan applicant preceding the date of the application;

- the race, sex, and ethnicity of the principal owners of the business; and

- any additional data that the Bureau determines would aid in fulfilling the purposes of this section.

How: Great question. The law says that where feasible the underwriter or analyst isn’t allowed to know if the business is woman-owned or minority-owned and that this information must be captured separately and kept secret from the underwriter. The section is actually called the “NO ACCESS BY UNDERWRITERS” section. Oddly, as this applies to all small business lending, not just faceless transactions, one wonders how an underwriter is supposed to avoid discovering the gender or ethnicity of the applicant. It is possible that in 2009 when this section was drafted, the architects could not imagine a business lending universe that looked beyond FICO scores and balance sheets.

When: It’s still early days. Right now the CFPB just wants to know everything about what these “financial institutions” do and how they do it before they start requiring the data be collected. To that end, they’ve published a Request For Information, seeking voluntary responses so that they can start formulating the data collection framework in a way they believe best.

Where: Where can you read and watch more about this? We’ve got some information on this page here, including a video of the hearing.

What should I do? Should I do anything?

Join an industry trade association. When it came to the proposed regulation in New York, they did most of the heavy lifting. There are many to choose from depending on your business model. In New York though, the regulations were purely proposed. Under Dodd-Frank, the CFPB already has the power to collect data. They’re just finally getting around to using it.

Transcript of CFPB Hearing on Small Business Lending

May 10, 2017Transcript of the CFPB hearing from earlier today courtesy of: https://www.captionedtext.com/client/ViewTranscript.aspx?EventId=3263140&ParticipantId=ad67099c-16c3-40cf-885a-7e0a1468a30f

Event ID: 3263140

Event Started: 5/10/2017 1:50:29 PM ET

Please stand by for real time captions.

We are delighted that you were here and we are delighted that you are in the city of Los Angeles. We are grateful to have the Honorable Mike fewer. City attorney for the city of Los Angeles. The Honorable Commissioner Jan Lynn , Commissioner of business oversight and California’s Attorney General. We are grateful to be representatives of the small business Association and the Federal Reserve.

That we tell you about what you can expect today. You will hear from city attorney Mike fewer and then Commissioner Jan Lynn and the attorney general. You will hear from the consumer bureaus director Richard Cordray. Following the remarks David Silberman the acting deputy director and associate director to four markets and regulations will frame the discussion with the panel of experts. There will be an opportunity to hear from members of the public. Today’s field hearing is being live streamed at Today’s field hearing is being live streamed@consumerfinance.gov.

Let’s get started. Los Angeles city attorney Mike Fuehrer has long been one of California’s lighting — leading lawmakers. As his chief since July 2013. He has brought an innovative problem-solving focus to the office that combines tough and effective execution with creative initiatives to improve public safety and the quality of life throughout the city. His efforts have also sparked change throughout the state and the nation. Under the city attorney’s broad authority Mister fewer has secretly — frequently secured. He announced in historic settlement against Wells Fargo for opening unauthorized customer accounts. He and the CFPB joined forces to get restitution for its customers, put protections and place and in penalties. Previously he served as majority policy leader and chair of the judiciary community worry — he authored the homeowners Bill of Rights. You may now have the floor. [ Applause ].

Thank you. The introduction was longer than remarks. That was generous. Thank you. I want to on behalf of all of us welcome our director Richard Cordray to our city. Just a word about the collaboration. I was extremely proud of the work of our office, some of whose lawyers are here with us today. In pursuing the Wells Fargo littered — litigation. That aesthetic evolution — catalytic affect. And want to underscore, there is no way that litigation could have had the profound impacted has had without the deep collaboration with the consumer financial protection Bureau under Mister Cordray’s leadership. We also worked with the leader of the office of currency. This collaboration was essential. In that regard, I must say while we’re here in Washington, their efforts underway to either diminish the authority of the CFP be or eradicated altogether. I have the opportunity to be in Washington including discussing how we should work together to ensure the continued viability and strength of the CFPB. Director Cordray leadership has been remarkable and it’s been instrumental in protecting consumers across the nation. I would say, anybody who cares about consumer protection should be standing up and loudly denouncing efforts to undermine the CFPB. I did a radio interview this morning cuppa I did get some applause. [ Applause ] that applause was for Richard and his team. I was interviewed this morning on the radio and I was asked, the purpose of which was not about this but the commentator shifted to what was happening here today and said to me, do you think in light of what’s happening in Washington, the attacks on the CFPB , is a Trump administration to business friendly? Given this is the focus on small business, I want to focus on that. We should all be business friendly. That is a key role for government to play. Being business friendly does not mean protecting businesses violate the rules, at the expense of consumers. Being business friendly does not mean protecting businesses who violate the rules who are in competition with those who play by the rules. That’s what being business friendly means, supporting businesses who are playing by the rules to do better. Which is why I am pleased to be here, as we focus on access to capital and other issues that focus on small businesses, especially those in disadvantaged areas of our nation. With this is my special assistant, Capri Bad Axe. — Mattox. Capri is in charge of my office outreach to the business community. We are working to connect businesses that are trying to improve and expand and hire more people, especially in disadvantaged areas to capital and training on how they could do better. I am eager to hear what more we need to know and what more we need to do, to assure that small businesses can succeed, especially in neighborhoods of our city and our nation, where we should be compelled to do better. Everybody who wants a job should have access to a job. Our small businesses are the way that we will assure that an America, we are a nation where the dignity of work is elevated to a place where it needs to be. Thank you Mister Cordray. You will be hearing from two other partners with who I am extremely proud to share this room today. I am eager to learn more today so we can do better. Thank you very much.

Map grant — [ Applause ]

Thank you for your remarks. Our next speaker is Jim Leonard 01. — Commissioner Jan Lynn . She was appointed in 2013 and previously’s served as the Commissioner as the Department of corporations appointed by the Governor in December 2011. Part two that Ms. Selin was that — Commissioner Owen was a manager at Apple ink from 2009 two 2010. Vice president at J.P. Morgan Chase, state director of government industry affairs at Washington Mutual from 2002 through 2008 and executive director of the California mortgage bankers Association from 2000 until 2002. She also has extensive experience in public service. She was acting commissioner of the Department of financial institutions from 1999 until 2000 after serving as deputy commissioner from 1996 to 1999. She also said as exactly director of California investment network program after serving several years as consultant to the Senate, state banking community. Commissioner Owen you have the floor. [ Applause ]

Every time I hear that introduction, I think holy moly I am really old. I will spend a few minutes to think my partners, Mr. Feuer, the attorney general and my partner in crime Director Cordray. I want to give you some data. We have done some data collecting. We get some information that I think is important for you to look at as we discussed this issue the Department of business oversight overseas over 360,000 licensees from banks, credit unions, mortgage lenders, pay day lenders, securities brokers, dealers and investment advisers. Also, we supervise franchisees and we approve proposed state securities permits. Our job is daunting, exciting and rewarding. With my partners, it is truly a challenge I wake up and want to do every morning. In 2015, California’s GDP surpassed $2.5 trillion. Hence, were the six largest economy in the world. That same year our non-bank licensees reported to us that they originated 400 that they originated 412 that they originated $412 billion in loans, in California. That’s more than the total of 35 states GDP. These non-bank lenders make more than 78% of their loans to commercial enterprises. Most of which are small businesses. California is home to more than 3.8 million small businesses. These firms employing 50% of California’s workforce and drive our economy. Our small businesses are respected globally for their innovation and their fortitude. The vast majority employee 500 or fewer workers and collectively make up 99% of all the businesses in California. Two years ago the U. S. small business administration reported California leads the country in several different categories. The number of small business employees, 6.5 million. The number of self-employed individuals, 2.5 million. The number of self-employed minorities, 1.1 million. The number of self-employed women, 900 973,000. According to the U.S. Census Bureau, California leads the nation with 1.6 million minority owned businesses. LA County leads the nation with 55% of local businesses, minority owned, more than half of those by Latinos. California is also proud to be the nation’s greatest number of women owned businesses, nearly 1.5 million. Women owned firms employing more than 1 million people and generate more than 200 222 $222 billion in annual revenue. Women-owned firms is larger than the number of employees, because many are one-woman ventures and many women owned more than one firm or multiple firms. To assist them, the governor created an office to service California’s single point of contact for economic development and job creation efforts, especially for small businesses. Affectionately, this department is called goby is. — Last week to Governor proclaimed May to be the small business month in California. California’s is the nation’s leading market for online landing. We are home to headquarters for several most prominent players in the sector. Lending club, Prosper, a firm, funding Circle and others. I bring up online lending because from 2010 until 2014 companies reported online consumer and small business financing activity increased over 900% to $2.3 billion. State regulators are getting a bad rap. The industry says that a state-by-state regulatory system is too costly and carries too much compliance risk and inhibits innovation. State regulators do not totally agree with these criticisms. I will tell you, we do acknowledge the companies have some legitimate concerns about the state system and we are moving to address them. As the state’s main financial regulator, let me tell you what I expect from the sector as it stands today. In many ways, we treat them no different than any other licensee we expect the same from all of our licensees, compliance transparency accountability, sound financial practices and most important, fair and honest treatment of our consumers. No one should think that they can gouge small business borrowers are any consumers, because they operate online. I know the CFPB agrees that regulators will work hard to keep up with technological innovations and consumer protections will be as sharp and clear as ever. As the bank regulator or financial services regulator, I am committed to serving the needs of California’s small business community and to being a partner to small business stakeholders in California. We welcome your feedback. Call us, call me. Let me know what you are thinking and what we can do to help. Thank you. I look forward to a fruitful day. [ Applause ]

Thank you, Commissioner Owen for the generous remarks. Our next speaker is Xavier Becerra. He is the 33rd attorney general of the state of California and is the first Latino to hold the office in the history of the state. The state’s chief law enforcement officer, Attorney General Xavier Becerra has decades of experience serving the people of California through appointed and elected office. He has fought for working families, the vitality of Social Security and Medicare programs, and issues to combat poverty among the working poor. He is also championed the states economy by promoting and addressing issues impacting job generating industries such as healthcare, clean energy, technology and entertainment. Attorney General Xavier Becerra previously served 12 terms in Congress as a member of the U. S. House of Representatives. While in Congress, Attorney General Xavier Becerra was the first Latino to serve as a member of the powerful committee on Ways and Means. He served as chairman of the house Democratic caucus and was ranking member of the Ways and Means subcommittee on Social Security. Prior to serving in Congress, Attorney General Xavier Becerra served one term in the California legislature as a representative of the 59th assembly District in Los Angeles County. He is a former Deputy Attorney General with the California Department of Justice. The attorney general began his legal career in 1984, working in the legal services offices representing the mentally ill. Attorney General Xavier Becerra, you have the floor. [ Applause ]

I have to make sure I take her wherever I go. I love the way she pronounces my name, Xavier Becerra. I don’t even say it that well. I know that Director Cordray hired her for more than the fact that she can pronounce my name . We are thrilled that you are here representing us on behalf of the consumer financial protection Bureau on the West Coast, the forward leaning movement of America. I want to say a few things, I have to cheer the man who is our quarterback when it comes to providing consumers, whether you are a small business person, an immigrant family trying to navigate your way through this country or you are a recent graduate from college, hoping to open up your rings. Richard Cordray is our quarterback. We should do everything we can to make sure he can take the team down the field and scored touchdowns all of the time for the men and women who want to make America work. If Richard Cordray succeeds as our director of June 20, he is keeping doors open and that’s all we need. You talk to almost anyone and all they want to know, is there some predictability behind what they will do whether it’s taxes, regulations, the business climate — if they have a way of knowing how to get there they will do it. It’s the uncertainty that causes the real difficulties for small businesses. Richard Cordray is a guy who make sure that that door remains open and we can all shoot for that point on the horizon. We have an obligation to help our quarterback comic he has been spectacular even under some of the most difficult circumstances. I am thrilled that Mike Feuer is my partner in crime. That word is used often, in this case it is really true. I love committing crime with Mike Feuer. He knows how to do it well. We are very fortunate in Los Angeles to call him our city attorney. He is served us in so many different places. He does it so well. Whenever I am with Mike Feuer, I feel like the marathon runner that just came in the top 10 and Mike is the Ironman contestant who does the triathlon like nothing and just passes me by. It’s hard to keep up with them, he is the best. Commissioner Owen, thank you for what you do for giving us the perspective so that we need to know why California is so important not just to us but to the nation. You have made it clear why the numbers count, but why the people make the numbers count. I just want to mention the micro, it is this, it’s you if you have a business, if you do spend — defend small businesses or people like my parents who started their own business, not knowing what they were getting into. My father had a sixth grade education my mother did not come until she was a teenager. They did it. They knew the micro of starting a business. They bought a small house and they rented it and then they bought another and rented it. Before you know it, they were making more in retirement than when they were both working. I consider myself a small businessperson. Island for my parents. I know this, I don’t have time to navigate everything going on in the business world. It’s like “Ghostbusters”, who are you going to call? When it comes time to making sure your business is doing okay, Consumer Financial Protection Bureau and Richard Cordray is who you call. We need them to be there for us every step of the way. The Attorney General’s office will do everything to partner with the consumer financial protection Bureau with our partners at the state level, Commissioner Owen and all those at the state who work on behalf of the people and with our city attorneys and district attorneys who try to protect does daily. We need your help. This is where these types of workshops and forums are so important. The get to connected to the people who are willing to help. My job is to enforce the laws for 40 million bill bill — people in the state of California. We have a very robust consumer protection division in the Attorney General’s office. One of the people who are just hired to be my special assistant, dealing with the issues involving consumers is Ellie Bloom, whom I stole from the Consumer Financial Protection Bureau. Yes. She is here. I also have Alyssa I had of the external affairs, so we can reach out to people and find out what you need us to know. Under the Constitution of the state, I have the authority to begin independent investigations of any activity where Californians are impacted and harmed. I intend to use that authority to the hilt. On behalf of the people of this country, who are like my parents, who worked very hard and were able to establish a business and now I’ve done so much to make it — in the past college was unknown to the family and to make it in the past, that forever we will only dream of being able to do things for our kids and make it something that’s in the past to believe like my father as a young man could not walk into a restaurant because of a sign that said no dogs or Mexicans allowed. That is all in the past. California’s forward leaning. One of the reasons we have succeeded is because we do not stop, we do not look back, we understand this is a tough place to do business. Our environment makes it difficult for businesses to establish her, our air and water are tough to keep clean. We must impose requirements on the gasoline we pump into our cars on how much we can put into this LA basin before gets a polluted your kids cannot go out and play or they get asthma. 40 million people, that is tough to organize. All of that we do, we’re high-cost state and we are high quality as well. That requires a lot of effort on the part of all those willing to work with quarterback Richard Cordray to make sure we keep those doors open. That’s our job. No that you got the Chiefs on form is — chief law enforcement officer of Los Angeles with you, the person the Governor has appointed to make sure businesses have the opportunity to have those doors open and Commissioner Owen with you. Know that the Attorney General is willing to work with them and with you but most importantly, I will do everything I can to make sure that regardless of Washington we don’t abandon our quarterback at the can — Consumer Financial Protection Bureau . We know what success means when you have Richard Cordray fighting for you. We won’t stop scoring and we will work with Richard Cordray to make sure everyone in America benefits the way California has by having a forward leaning policy in the way we do with consumer issues and help our people. Thank you, Director Cordray. They think all my colleagues and I thank you for knowing it was important to be here this morning. Have a great day. [ Applause ]

Thank you, Attorney General Xavier Becerra. I am now extremely pleased to introduce Richard Cordray. Prior to his current role he led the CFPB’s enforcement office, he served on the front lines of consumer protection as Ohio’s Attorney General. In this role he recovered more than $2 billion for Ohio’s retirees, investors and business owners and took major steps to protect its consumers from fraudulent foreclosures and financial predators. Before serving as Attorney General, he served as an Ohio State Representative, Ohio Treasurer and Franklin County Treasurer. Director Cordray . [ Applause ].

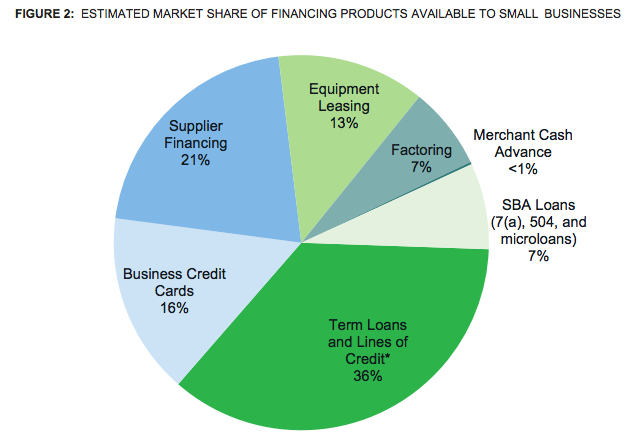

Thank you. My football career peak in the seventh grade, I do remember Vince Lombardi saying that when the going gets tough the tough get going. It’s great to be here with three of our closest and most productive and for me personally, our most dear partners anywhere in the country. I think them all for being here. I think them and their teams for the work they have done, are doing and will continue to do with us to stand up for Americans who expect and deserve the right kind of support and protection for their government officials. Thank you. Thank you all for coming it’s good to hear — be here today the Consumer Financial Protection Bureau is announcing an inquiry into ways to collect and publish information about the financing credit needs of small businesses. Especially those owned by women and minorities. We are aware of the role they play in the our lives. Small businesses dropped the — drive the economic engineering. It is estimated they’ve created two out of every three job since 1993 and they now provide work for almost half of all employees in the private sector. We perceive large gaps in the public’s understanding of how well the financing credit needs of these entrepreneurs are being served. As you probably know, the Congress provided the consumer bureau with certain responsibilities in the area of small business funding. There is a strong logic behind this. When I served as the Ohio Attorney General we recognize the need to protect small businesses in nonprofits by accepting and handling complaints on their behalf, just as we did for individual consumers. And approach that proved to be very productive. The line between consumer finance and small business finance is quite blurred. We heard that at a roundtable this morning with community and consumer advocates. Or than 22 million Americans are small business owners and have no employees. According to data from the Federal Reserve, almost 2/3 of them rely on their business as their primary source of income. This is embedded in many people’s lives. Congress has charged the consumer bureau with the responsibility to administer and enforce laws including the equal credit opportunity act. Unlike others, it governs not only personal learning but some commercial lending as well. We have now conducted a number of supervisor examinations and small business lending programs at financial institutions. Through that were learning about the challenges they face in identifying areas where risk may exist and were assisting them developing the property to manage that risk. In the Dodd Frank Wall Street Reform and consumer priest — protection act Congress took a further step to learn more about how to encourage and promote small businesses. To determine how well the market is functioning and facilitate enforcement of the fair lending laws, Congress directed the Bureau to develop regulations for financial institutions that went to small businesses, to collect information and report. The request for information will be released and asks for feedback to help us understand how to carry out this directive in a way that is careful, thoughtful and cost-effective. We have considerable enthusiasm for this project. In my own case, I’ve seen how small business financing can have a number — economic impact. I will tell you a story, when I served as a treasure of Ohio, we had a reduced interest loan program to support job creation and retention by small businesses. The way the program worked was that the state could put money on deposit with banks at a below market rate of interest in this deposit will send link to the same size loan to a small business and a correspondingly below-market rate. This link to posit has been authorized more than 20 years earlier but it had fallen into the disuse. At its core, the program maintenance. Small businesses are often in need of financing to update and expand. Often not at large amounts of money, if they can get an expensive financing they can fertilize their ideas for growth and be more successful. We diagnosed this program and found after its initial success it had become too bureaucratic. We heard from both banks and businesses that the program which was the paper-based was so slow and cumbersome, nobody wanted to bother to use it. We changed it. We put the process online, rebranded it and made specific commitments to those who wanted to participate. We told them they could fill out an application and less than 60 minutes and promised they would have a yes or no answer within 72 hours. That was not easy. It required very close coordination with the bank that took heart. We did it and the Grow no program took off. Only $20 million was advocated but in two years we deployed more than $350 million helping 1500 small businesses create and retain 15,000 jobs across the state. It was also exciting to see how the businesses were able to use the loan funds. I can recall a construction business that needed a loan to about — bike a piece of equipment. They got the money, the got the equipment and they thrived. I recall a manufacturer that needed money to turn their factory sideways to utilize more space and employ more people. We found the put, revenue and jobs. I recall a company in Western Ohio that started as a caterer and begin to make their own tents for events. They recognize they might succeed is tentmakers and needed financing to bid on a project with the U. S. Defense Department. We got them that loan, they got the bid and they were named as one of the 500 fastest growing businesses of the year. The moral of this story is business opportunity, especially those for small businesses often hinge on the availability of financing. People have immense reserves of energy and imagination. Nowhere is that more true than in the state of California. Human ingenuity is the overwhelming power that allows human beings to reinvent the future and make it so. These forces unleashed what Joseph Schumpeter called the gales of creative construction a constantly mold our economic life. Innovation has sharpened our nations edge for generation after generation. When credit is unavailable, creativity is stifled. To make the meaningful contributions that are capable of making to the economy, small businesses particularly women and minority owned need access to credit. Without it they cannot take it vantage of opportunities to grow. With small businesses so deeply woven into the nation’s economic fabric it is essential that the public along with small business owners themselves can have a more complete picture of the financing that is available to this Key Center — sector. We are releasing a white paper today that lays out the limited information we currently have about key dimensions of the small business lending landscape. According to census data and depending on the definition use, there an estimated 27,600,000 small businesses in the United dates. We estimate that together they access $1.4 trillion, that’s trillion not billion in credit. Businesses owned by women and minorities play an important role in the space. Women-owned businesses account for over one third, 36% of all non-farming private sector firms. The 2012 survey of business owners, the most recent indicates that women-owned firms employed more than 8.4 million people and minority owned firms employed more than 7 million people. Those are huge numbers by comparison in 2014 fewer than 8 million people were employed in the entire financial services sector. That was the big paragraph on the facts and figures, I was inspired to get through it by you Commissioner Owen. When small businesses succeed they send ripples of energy across the economy and throughout our communities. 2013 study by the Federal Reserve Bank of Atlanta found that counties with higher percentages of the workforce employed by small businesses showed higher local income, higher employment weights and lower poverty rates. In order to succeed they need access to financing to smooth the cash flows for current operations, meet contingencies and invest in their enterprises to take advantage of opportunities, as they arise. Another study found the inability to obtain financing may have prompted one in three small businesses to trim their workforces and one in five to cut benefits. Unfortunately, much of the available data on small business lending is to dated or two spotty to paint a full picture. Especially, those owned by women and minorities. We do not know whether certain types of businesses or those in particular places may have more or less access to credit. We do not know the extent to which mall business lending shifting from banks to alternative lenders. Nor do we know the extent to which the credit constraints that resulted from the great recession persist and to what extent. The beige book produced by the Federal Reserve is a survey of economic conditions that contains huge amount of anecdotal information about business activity around the country. It has no systematic data on how small businesses are fearing and whether they are being held back by financial constraints. Given the importance of small businesses to our economy and the critical need to access financing if there are to prosper and grow the Porton to fill in the blanks and the how-to’s on how they can engage. That is why Congress required institutions to report about applications in accordance with regulations to be issued to the consumer bureau. That is why we are here today. The inquiry we are launching is the first step towards crafting this mandated rule to collect and report on small business lending data. To prepare for the project we’ve been building an outstanding team of experts in small business lending. We are enhancing our knowledge and understand based on our equal credit opportunity act complaints work with small business lenders just helping us learn more about the credit application process, existing data collection processes and the nature and extent and management of fair lending risk. We have learned more work on the reporting of home loans under the home loans mortgage act which has evolved considerably. At the same time, we recognize a small business lending market is much different from the mortgage market. It’s more diverse in its range of products and providers which range from large banks and community banks to Marketplace lenders another emerging players and the Ventech space communities play an outsized role in making credit available. Unlike the mortgage market, many small business lenders have no standard underwriting criteria or widely accepted models for scoring. For these reasons and more we will proceed carefully as we work toward meeting our responsibilities. We will seek to do so in ways that minimize the burden’s on industry. I request for information released focuses on several issues, we wanted to determine how best to define small business for these purposes. Despite the importance of these firms to our economy, the surprisingly little consensus on what constitutes a small business. The small business administration and overseeing federal contracting sometimes looks at the number of employees, receipts and applies different thresholds for different industries. For our part the consumer bureau thinks about how to put — develop a definition that’s can this — consistent and can be tailored to the purposes of collecting data. We looking at how the lending industry define small businesses and how that affects the credit application process. Having this information will help us develop a practical definition that advances our goals and aligns with the common practices of those Inland to small businesses. Second, we want to learn more about where small businesses seek financing in the kind of loan products made available to them. Our research tells us term loans, lines of credit and credit cards of the all-purpose products used most often by her small businesses. They make up an estimated three fourths of the data in the small business finance a market, excluding the financing of merchants for service providers extend to their customers to finance purchases. We want to find out if other important financing sources are being tapped by small businesses. Currently we have limited ability to measure accurately of the prevalence of wonders in the products they offer. We also want to learn more about the roles that Marketplace lenders, brokers, dealers and other third parties may play in the application process. At the same time, we are exploring whether it’s specific types of institution should be exempt from the requirement to collect and submit data on small business funding. We are seeking comment about the categories of data on small business lending that are currently used, maintained and reported by financial institutions. In the statue, Congress identify specific uses of information that should be collected and reported. Include the amount and type of financing applied for, the size and location of the business, the action taken on the application and the race, ethnicity and generate — of the owners. The reporting of this information would provide a major boost in understanding small business funding. At the same time, were sensitive to the fact that various institutions may not currently be collecting and reporting all of this information. We understand that the changes imposed will create implementation and operational challenges. We will look into clarifying the precise meaning that some of these require dellavedova — data elements to make sure they are understand and reported. We will be considering whether to add a small number of additional data points to reduce the possibility of misinterpretations or incorrect conclusions working more limited information. To this and were seeking input on the kinds of data different types of lenders are currently considering in their application process as well as any technical challenges posed by collecting and reporting this data. We will put all of this information to work and think carefully about how to fashion the regulation mandated by Congress. Finally come of the request for information seeks input on the privacy implications that may arise from disclosure of the information that’s reported on small business funding. The law requires the consumer bureau to provide the public with information that will enable communities come a government entities and creditors to identify community development needs and opportunities for small businesses come especially those owned by women and minorities. We are also authorized to limit the data dismay public to advance privacy interest. We will explore options to protect the privacy of applicants and followers and the Compostela — confidentiality. The announcement we are making today and the work we are doing cure reflect central tenants of the consumer financial protection Bureau. Were committed to evidence-based decision-making. We aim to develop rules that need our objectives without creating unintended consequences or burdens. We went to see a financial marketplace that offers fairness an opportunity not just to some, but to all. The marketplace it does so without regard to race, ethnicity, gender or any other element of our fabulous American mosaic. Small businesses are powerful they supplied jobs, teach skills and service backbones of the community. We need to meet obligation to develop data that will shed light on their ability to access much-needed financing. It is essential to their growth and prosperity and therefore to the growth and prosperity of us all. What Cicero observed an agent Rome, still holds true today. He said, nothing so cements and holds together all the parts of our society is faith or credit. Our communities depend on both of these precious things just as much today. As we launch this inquiry want to remind you that we value the feedback we get. We take it seriously, consider carefully and integrated into our thinking and our approach as we figure how to go forward with his work. We ask you to share thoughts and experiences to help us get there. We thank you for joining us here today. Thank you. [ Applause ]

Thank you Director Cordray. I would now like to invite the panelists to take the stage. While they are doing so, I will introduce them. David Silberman is the bureaus act in director and associate director to her. Cheryl Parker Rose Sirs at the assistant director for the bureau’s office of intergovernmental affairs. Grady Hedgespeth serves as the assistant director for the bureau’s office of small business lending markets. Our guest panelist include Elba Schildcrout , East Los Angeles Community Corporation . Makin Howell , Main Street Alliance . Josh Silver, Kate Larson , U.S. Chamber of Commerce . Todd Hollander , Union Bank and Robert Villareal , CDC Small Business. David.

Thank you. I can still say good morning but just barely. I am David Silberman the acting deputy director and associate director for research marketing regulations. It’s a pleasure to be here and share this portion. As you’ve heard, we will hear from a number of respected panelist consumer advocates and industry participants. Each panel member will give us some background and provide perspective. We will then post questions to our panelist and engage in discussion. The panel discussion will be followed by public testimony. Before we begin, let me frame the issues we will talk about. Is Director Cordray noted, and as we discussed today in the white paper we released. Small businesses play a key role in fostering community development and fueling economic growth both nationally and in their local communities. To do so, these businesses and particularly women and minority owned be fair and equal access to credit to allow entrepreneurs to take advantage for the opportunities for growth. As the director explained in section set 10.7 one of the Dodd Frank act Congress amended the equal credit opportunity attack to require institutions to compile, maintain and report information concerning credit applications made by small businesses. Congress directed the bureau to it — issue a regulation to govern and report. The purpose is twofold, to facilitate enforcement of the fair lending laws and second to enable communities, governmental entities and creditors to identify needs and opportunities of women-owned, minority owned and small businesses. Is Director Cordray explained were in the early stages and were focused on outreach and research. Today’s hearing and the our five we issued our them Porton steps as we seek to enhance our understanding of the 1.4 train dollars small business financing to discharge our abilities. As context, I will provide — invite our panelist. They will each of 10 minutes for a statement and we will moderate a discussion with the panelists. We will start on my far left, Elba Schildcrout , East Los Angeles Community Corporation .

I am privileged to be here. I’m thinking of my mother on Mexican mothers today. I am privileged to be here and while we came here from Guadalajara. At East Los Angeles Community Corporation , we advocate for economic and social justice in the greater LA area by building grassroots leadership, developing affordable housing in providing access to economic development opportunities for low and moderate income families. In 2013 we began working with local businesses to preserve the vitality of the small business community. Our commercial corridor project is part of a strategic effort towards responsible community economic development by developing leadership connecting Rick and Morty businesses with technical assistance and hosting monthly meetings. We are empowering our business community to take ownership and be involved in their community. In 2015, we held a shared vision of economic stability and inclusive 50 for all residents including two brick-and-mortar businesses, street vendors and mariachi groups. To help them thrive, they need new resources such as micro-lending and lines of credit. Many rely on friends and families limited resources for loans. The also need case management to ensure they can make use of resources that already exist, such as technical assistance for writers and others doing business to support — business support services. It is through this relationship building with small business owners who are primarily Latino, immigrant, and women that we have learned of their needs and challenges. Some of these challenges have been difficult in getting credit from banks, especially small loans under $250,000, some of these owners need anywhere from $5000-$10,000 to get started. They also need data transparency to show which lenders are making loans and to which groups and where they are being made. We think things should partner and do joint outreach and address specific needs such as language access. The data should be segregated for Latino and other groups. Small business owners need greater protections to prevent discrimination. We’re excited and supportive of tran 20 ‘s efforts — tran 20 — we’re excited and we thank you.

Makini Howell , Main Street Alliance .

Hello. I am a member of the Main Street Alliance of Washington coalition of 2000 small business owners. I have been running my family’s business for 13 years. We have been in business for a total of 40 years, were a food service. I am six vegan restaurant concepts in Seattle. I employ over 40 people. I offer health coverage, I start my minimum wage at $15 an hour. I have grown our family business from grossing $200,000 in last year we close to $3 million. I did nothing without a bank loan. When I went into apply for a loan, I don’t know if it was because I was a woman or if it was because I was black. It could be any number of things that are risks for a banker. I understand when I speak to consultants that they had no concept of why it wasn’t doing stake and people would ask if I would ask fish. My menu is 100% plant-based. Anyone of these things I can understand would be a reach, not only did we succeed but I toured as Stevie Wonder’s personal chaff — chef in 2015. Nothing was possible without lending. We have to change our understanding around what can be successful. As opposed to framing it is let us collect data and let some well deserving minorities and women in, people of color and women are the majority of people that are providing jobs. They are the majority that are small business owners. Bankers and banks have to change their framing around who is deserving and who actually can provide jobs for the community. Small businesses are the engine of the economy. The engine of the economy currently is being run by people of color and by women. That Pinkie Master change. That lending will then change along with what is happening in Washington. Someone told me when you go into a bank they decide right away whether they will lend to you. That I dress well enough, Amite fallen off, — the change has to come from understanding who helps to run the economy. I would still love to get a small business loan. I haven’t tried because they don’t need money and I am 13 years in. I am attractive to a lender at this point that I don’t need money now. I needed money then. I won’t ask a bank for money now, in order to get to where I am, I had to use predatory lending, cash advances, my father gave me $10,000. I did get one from a community lender that took me months of rewriting my business plan to get that. It’s a challenge and I feel I would’ve been a $6 million company if I had gotten the lending necessary at the beginning. I had the education and the support necessary from the banks. That’s my story. Thank you.

Thank you. Josh Silver.

Good morning I’m senior advisor of the National Community Reinvestment Coalition. I thank you for this hearing today. There are some lending’s those lenders on the panel that may be encouraged to give you a loan after this. I think there are well-intentioned lenders. Last week USA Today reported a survey showing improved small business confidence. Things are looking up for small businesses after the great recession. Not so fast. The survey was sparse and on which businesses were surveyed. Research shows that women minority owned and very small-businessess experience difficulties growing because barriers accessing credit. Considered the following, women-owned firms are significant force but they remain small. 90% of women-owned small businesses have no employees other than the owner. Part of the difficulty women faces lack of credit. Just 5% of women-owned businesses use bank loans to start their businesses compared to 11% of mail and businesses. Minorities also faced difficulty starting and growing a small business. Nonminorities are twice as likely as minorities to own employer businesses. If minorities owned businesses at the same rate as nonminorities, our country would have 1 million additional employer businesses and more than 9.5 million additional jobs. Surveys have found that African American small businesses are more likely than a why don’t business to not apply for credit, due to fear of rejection. And CRC researchers from the smallest businesses, those with revenues below $1 million at the most trouble accessing credit. In 2010, 8% of these businesses received loans compared with 20% of all small businesses. Access to credit is critical yet inequalities in access contribute to overall inequality. NCRC found in a report that in 2010, the business funding let an economically distressed counties in Appalachia was 44% of national rates. The Woodstock Institute found that in Los Angeles and San Diego, businesses and minority census tracts were 31% of all businesses but they received only 21% of the loans under $100,000. A variety of reasons exist for these disparities, some due to the characteristics is also do two on — discrimination. In section 10.71 of the Dodd Frank act it will be on — they will draft a predecessor appearing in bills in the future. It requires data collection from lending institutions regarding demographic characteristic of small businesses including race and gender into report the data publicly. The active data collection and dissemination is a powerful motivator for lenders to increase responsible lending to underserved businesses. As Director Cordray says, former justice Louis Brandeis talks about sunlight and the electric light of data disclosure. No lender wants to be highlighted for shirking any part of the community and they want to get up to speed with the lenders that are doing a better job. Use data for a spur of competition. We have saying that data drives a movement for economic justice. In the arena, better data will respond — result in more employment and more wealth building in underserved communities. Isn’t that what we are about? Making capitalism work. Thank you.

Thank you. Kate Larson, U.S. Chamber of Commerce Good afternoon. As a proud Trojan I’m happy to be here today and LA. I would like to thank the Bureau for holding this hearing on this important issue and especially to Grady for their outreach over the past few months. They have been fantastic. We are excited to engage with them on the request for information. As previously mentioned, I’m the director at the U.S. Chamber of Commerce , the largest business Federation representing more than 3 million companies. We represent all small businesses and lenders. We have a unique perspective of seeing the entire picture of small business market and how it affects the end-users. More than 96% of business come when he said fewer than 100 employees. Small businesses are the lifeblood of our economy. Not only to produce goods and services we depend on but to create jobs, provide stability to millions of Americans. Remarkably, 28 million mainstream institutions account for over half of the sales of the United dates, 55% of all jobs in the country and are responsible for 65% of all new job creation. I’m sure you can all recite these data. It is hard to overstate the importance of credit for small businesses and support their inventory, open locations and hire more employees, manage downturns and otherwise push forward. We asked the Bureau to conduct a comprehensive sound report on potential barriers to small business lending in the United it’s including regulatory burdens that it may fully understand the credit products used by small businesses, inform forthcoming rulemaking to ensure it promotes, not inhibit small business funding and propose a tailored rule to include not only necessary business and products but also fulfilling the well-meaning purpose of statute. We hope the SPA will also lend their expertise in this area. Unfortunately, small business lending is not fully recovered from the great recession. The most recent small business credit survey that was mentioned jointly conducted by the Federal Reserve banks found cash flow remains a challenge for small firms, only half of applicants were seen — received financing and 18% received nothing. 32% had to delay expansion as a result of the shortfall. 21% had to reach into their personal finances. This is not okay. Much of this and I know we will all have differing opinions. We think it’s due to post crisis over regulatory overhaul and increasingly risk adverse financial institutions, that have to meet safety and soundness and know your customer requirements when issuing alone. Asked — as we begin the fact-finding process we hope to consider the true spirit of the statute and include in the definition to be tailored to only the most vulnerable populations, specifically the SBA definition of 500 employees does not seem small at this juncture. Every small business has different needs and approach credit differently. This market is different than the mortgage lending and data collection is not close to the home mortgage disclosure act. It’s a misnomer. The needs are different and small business lending is a complex market with many sources. Depending on the needs of the small business, owners may turn to friends and family, home equity lines of credit, credit cards, SBA loans,’s private loans or a combination of multiple sources. Larger and middle-market firms get more complicated. This is why the definition needs to be tailored. Employee training will be incredibly complicated, given the sources of business credit. Home-equity credit officers issuing a HELOC, flight attendants and a credit card, a trucking company offering leasing for trucks, retail clerks offering branded credit cards, they may not understand they will have to capture small business lending data. Without a firewall, — it will be difficult to create a firewall between the employee accepted credit application and the one making the underwriting decision. Without a firewall institutions will violate the equal credit opportunity act. That will be more difficult at smaller institutions. Business representatives applying for loan, if this applies to more than just the owner of the business, may not have the information to create confusion and prolonged credit application. They may not know how much they have for annual revenue or the other data points. It is unfeasible for lenders to know if the business changed in status. That is a hurdle. It will be impossible for institutions to report individual credit transactions. My wonderful mother who drove 2 1/2 hours to be here is a small business owner. If she’s buying something on a credit card for her business, is that also going to be the same thing as home goods? That is difficult way if you are going credit by credit transaction. In conclusion, we think the Bureau for soliciting information but stressed the importance of the Bureau conducting a sound, robust study on the roadblocks inhibiting small business lending, including potential regulatory considerations. To understand where small businesses are attaining credit and where they are not, ensure the rulemaking will not curtail the sources and an environment where access to small business credit is constrained, it’s imperative we energize that marketing encourage growth. I appreciate the opportunity to stuff I and thank the Bureau for its approach. Look forward to working together and I’m happy to answer any questions.

Thank you. Todd Hollander from Union Bank.

Hello. I am also currently serving as the chairman for the small business community for the consumer bankers Association and a serve on the California bankers Association. I’m proud to represent all the groups in this testimony. We wish to express our appreciation for the collaborative and transparent manner in which the CFPB — tran 20 is under Katy — undertaking these rules. The environment, private lending groups and lenders share a common goal. We want to provide loans to small businesses to help generate jobs, tax revenues and economic growth and prosperity. Lent to all market segments without bias or discrimination enable identification of business and community development needs, ensure regulatory has the ability to hold lenders comfortable and avoid saddling lenders with rules that are unnecessarily costly to implement and execute and that could generate misleading data or curtail access to needed capital. In terms of the current small business lending environment the CBA seen signs of improvement. Members say charge-offs and delinquencies have decreased from the great recession and are currently at all-time lows. SBA programs are still vital. In 2016 they had to record your exhausting their appropriation of $30 billion. From the peak in 2008, small business lending saw a steady decline until early 2011. Small business lending has seen sharp decline, while the Elba Schildcrout proved it is still significantly less than prior to the downturn as evidenced by utilization rates. Historically, 40%. I’ve been doing this for almost 30 years, I’ve worked for large banks and I’ve worked for community banks. Between those you could, usually when you loan to a large population you could set your watch by 40% utilization in that population. After 2008, we saw those rates come down and businesses weren’t borrowing what they had available. Postrecession we have more conservative population of business owners then we had going in, they felt the pain of firing people they felt the pain of downsizing and those things. Not only is the lending environment important, the optimism that businesses feel when they are confident, they feel economic growth and borrow and by and do all the things they need to do. Small business credit card utilization is also declined yearly since 2008 but one. New accounts have been well below levels in the past. FDIC numbers reported decline from 2008. In our view, there’s a miss conception that the decline and small business lending. If banks don’t lend money we don’t make money. Our job is to deploy capital and we want to continue to do that. We noted a decline in demand on such loans. The next her to will be the 10.71 action while the CBA supports the goals we believe they should keep in mind that although it mandates the role it is not a can to data collection on others — lending products such as mortgages. The CFPB needs to take great care in the creation of these regulations. We are pleased to see that they are pursuing formal information gathering processes to ensure it is well-informed which will enable it to put forth regulations that the mandated proffering requirements while avoiding costly and burdensome regulations that could be drier cost and less credit available. Specific to the challenges the notion that some old that business lending parallels nicely to residential mortgages is misplaced. Residential lending has the same collateral type and business collateral types can vary. Residential lending has with rare exceptions, consumers as applicants and businesses have all sorts of applicants limited liability sky missiles — sole proprietorship’s, all of these things run the gamut of borrowing and lending business owners have a much shorter and varied duration than mortgages. 3 to 5 years as opposed to 1530 years. — The address of the business had come up with have to unofficial owner the applicants to be debated and have no easy answer. Residential mortgages typically have wanted to borrowers. Small businesses have multiple borrowers, large partnerships, and that also runs the gamut. These challenges must be considered when constructing these loans and it’s daunting and twofold. Determining which data fields to collect that will yield meaningful conclusions from the small business lending community is likely to be more challenging. In light of these issues and current lending trends, to streamline credit processes in order to extend credit with greater speed to qualified applicants, the CBA and member institutions cannot stress enough the importance of a well-balanced to avoid overly extended data requirements. While the CFPB has discretion under 1071, in order to issue fair and achievable rules the result in these meaningful useful data, they may need to request from Congress changes to certain aspects of the rule. Examples of well-meaning definitions or requirements are outlined in the rule, but must be made optimum. First, primary address of the business whether it serves a business minority for the address of the borrowers regardless of the location. The definition of minority women, necessitates the determination of both ownership and earnings allocation. Access to this data including incidental access, unlike the mortgage-based is thickly prohibited for underwriters and in the event they do not those they do have access mandates disclosure to applicants. This is impractical and unnecessary. Thank you for the opportunity to testify and we look forward to continuing to work with you for a successful outcome.

Thank you. Robert Villareal . That’s what I said.

Thank you to all of you. We appreciate you coming to Southern California and Los Angeles. It’s important that you are here, in the city 50% of the businesses are minority owned and in the county it’s 55%. That’s five years old and we know those numbers have changed. It’s a greater amount. I am with CDC Small Business were headquartered in San Diego, that city that gave you that football team that you did not want. [ Laughter ] I am also the Executive Vice President there and the CEO of the bank or small business CDC of California that’s part of the CDC small business family. CDC Small Business finance is a 39-year-old company we are certified development company. We provide the SBA 504 product real estate lending product. We partner with banks such as Union Bank, we as an agent to 40% in the small business only puts 10% down. We’re NSBA community event is under. That is a program that allowed mission based lenders such as ourselves to do is seven a loans — the gentleman to my left created that when he was with the SBA and it’s had a wonderful impact on the small business and minority communities. SBA lenders do lesson 4% of their loans to African Americans across the country. Community advantage lenders to 13% of their loans to Latinos and African-Americans. It’s been a great program. We are the largest organization that does the both — we work in the states of California, Arizona, and Nevada. We are an economic development organization. While we’ve done $13 billion in lending, most of it is been through the commercial real estate area, $2 billion has gone to women, minority and veterans. To our non-504 program we are a micro-lender and at one point we had three different CD FIs and we have done $70 million in lending, particularly in Southern California. I am to the right of the banker. Might take will be different than that industry, I think it’s important that we are here. I think it’s important that those in the audience are here. I look forward to hearing from everyone in regards to why we’re here and why can 71 is important. Let me give you three reasons why I think it is important and why, as a state attorney Xavier Becerra said we need our quarterback and we need his support. Racial discrimination still exists. There was a study done by Utah State, BYU and Rutgers published in the Washington Post in June 2014, they took nine individuals, three African-Americans, three Latinos and three in close and gave them the exact same resume. Just them the same and went into banks. There was clear differentiation in the way the people of color were treated. It still exists in the world. More recently, I think Josh quoted the Woodstock Institute patterns of disparity that was done in January, they looked at Chicago, LA and San Diego and lumped in Los Angeles. He talked about the lack of lending in those census tracts. If there had been lending to the amount of small businesses in those census tracks that were of color, that was a 1.6 that was a $1.6 billion opportunity that was lost, for those census tracts in communities of color. Y 1071 is critical, all we have is that we can look at CRA, we don’t know who is getting or what individual’s are getting the loan. In 2015, there was $4.7 billion — this is reportable on the website. In the same year the SBA there were 750 loans for $136 million. In terms of units, the SBA was let’s then .5% — I’m looking at Michael and I was told him it was 4% and in dollars it was less than 3%. There was 99% of the loans going out in the County of Los Angeles, we don’t know who they went to. We can look at the census tracks and say they are praying all but — predominately minority, we can’t find out who they went to and with 1071, we will find out who applied and what happened to those individuals when they did not get the loan. I am for the folks here — I implore the folks here and my colleagues, this is important and it will take a lot of work. We must come to an agreement. It is very important that we take this mandated rule and implemented. We look forward to working with everyone here to get that done.

Thank you.

Thank you to all of the panelists. Might colleague Grady Hedgespeth and Cheryl Parker Rose will now ask the panelists some questions for further discussion. I get the first question Robert, talk about the challenges that financial institutions face when extending commercial credit to small businesses, particularly minority and women-owned.

I will try to be brief. There are lenders and there are a lot of reasons. I will base it on my 12 years of experience working at CDC small business, I had conversations with my colleagues and CDC Small Business finance just had a report done on Latino small businesses in the state of California . It was done for us by the national Association for Latino community asset builders and hopefully that will be public at the end of the month. While all small businesses face similar challenges, entrepreneurs that are women or are people of color have particular challenges. One is, record-keeping or financial documentation or it’s the lack there of. There could be a variety of reasons, maybe they are cash-based but it comes down to financial literacy. When I say that, I’m not saying that small businesses are financially illiterate. Far from that, with the challenge is that lenders whether you are a Union Bank or a small business finance have certain criteria and documentation that we require. We put people through some awful loops for a loan at the SBA. A lot of folks don’t have the background. Since mothers were used, I will use my father who came with a sixth grade education and ran two very successful businesses. He never received a loan from a bank. He never could have put together the documentation that I know my company asks for from someone. He was not financially literate, he just did not understand the way the system work. As lenders, it’s working with the small business and working around and educate and have the patience to get them through the process. Is a mission-based lender, we put money into paying business advisors to help individuals with that. The second one is also what’s known as a thin credit file or poor credit. Experience did a study that was released in September of last year that showed businesses, minority owned businesses, their business score was five points lower than a nonminority and their personal credit score was 15 points lower. A lot of lenders, one of the first questions asked will be what is your credit score? There is a threshold and if you are not at 680 and you are at 679, a lot will ask you to leave or they will not finance you. That is the challenge as lenders, how do we work with those that have a poor credit, that does not completely dictate their ability to pay and how do we look at other factors. The third and fourth are combined, I have learned from individuals and we have seen it, it takes just about as much money to underwrite and process and $50,000 loan than a $500,000 loan. If you are a profit driven organization, who are you lending to? As a mission-based lender we will work with those that want $5000 or $10,000, how do we build efficiencies with that and how do we deal with fintech? Those competitors are charging 94% and we of refined Tensed — refinance loans, how do we do that when they can answer someone in minutes and finance them within days. That’s difficult and that’s a challenge for reputable lenders who are trying to do right and treat people with respect.

Cheryl.

Josh, what are some of the current barriers to understanding the small business lending landscape?

Thank you Cheryl, current barriers lack of data. Longer answer, 1071 will mandate — I’m sorry it’s hard to swallow and talk at the same time.