MPR Authored

Alternative Lending: Big Government and Big Data

May 7, 2014– Professor Michael Barr at LendIt 2014

One of the clear themes of the LendIt 2014 conference was that borrowers are willing to pay extra for speed and convenience. Regulators have taken note of this trend but they’re still supportive of the alternative lending phenomenon anyway. Truth be told, the government is acting like a weight has been lifted off its shoulders. Ever since the 2008 financial crisis, the feds have prodded banks to lend more, but they’ve barely budged, especially with small businesses. Non-bank lenders have relieved them of the stress and all they need do now is make sure everybody plays nice.

One of the clear themes of the LendIt 2014 conference was that borrowers are willing to pay extra for speed and convenience. Regulators have taken note of this trend but they’re still supportive of the alternative lending phenomenon anyway. Truth be told, the government is acting like a weight has been lifted off its shoulders. Ever since the 2008 financial crisis, the feds have prodded banks to lend more, but they’ve barely budged, especially with small businesses. Non-bank lenders have relieved them of the stress and all they need do now is make sure everybody plays nice.

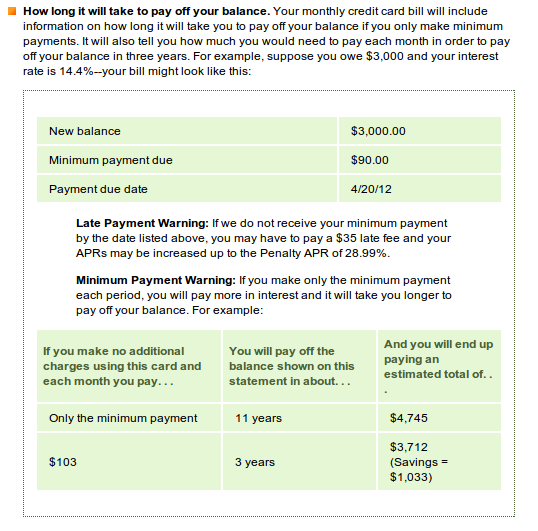

Professor Michael Barr, a former US Treasury official, key architect of the Dodd-Frank Act, and Rhodes Scholar, believes the best way forward is to empower consumers. That’s something lenders can accomplish through education and transparency. On transparency, he cited many of the commendable practices that credit card companies and mortgage companies have implemented, but did not fail to note that these were forcibly instituted through regulation (Hint hint…).

When a LendIt attendee asked Barr to name someone in the alternative lending industry that is a great role model for transparency, Barr answered by saying, “I haven’t seen anyone in the industry doing things the way I would do them in regards to education and disclosure.” On the path towards transparency, “the potential is not yet realized,” he added.

While it sounded as if he favored eventual regulation of alternative lending, he offered all in attendance advice to prevent it. “Take the high road to prevent regulatory interest,” he said.

Barr’s sobering presentation also covered the Consumer Financial Protection Bureau (CFPB) and the role they might play in alternative lending, if any. Payday lenders and debt collectors were their primary supervisory targets he said, but added the “the CFPB has the flexibility in the marketplace to address problems before they occur.” That flexibility essentially gives them jurisdiction over whatever they decide they want to be in their jurisdiction.

Sophie Raseman, the Director of Smart Disclosure in the U.S. Treasury Department’s Office of Consumer Policy appealed to the industry in a different manner. “Small businesses are at the heart of the economy. We want to serve you [alternative lenders] better so that we can better serve them,” Raseman pleaded. As part of that, she came bearing gifts, a reminder that the federal government had loads of data available via APIs at http://finance.data.gov. The government wants to make sure we have access to as many tools as possible, most likely to help drive borrowing costs down. If you need to verify someone’s income, Raseman recommended the IRS’s Income Verification Express Service.

The Income Verification Express Service program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. The IRS provides return transcript, W-2 transcript and 1099 transcript information generally within 2 business days (business day equals 6 a.m. to 2 p.m. local IVES site time) to a third party with the consent of the taxpayer.

The irony with this service is the two business day timeline, though I haven’t confirmed if that’s still the case. Delays and archaic data aggregation methods are the exact things alternative lenders are trying to overcome. Kabbage comes to mind as the length of time it takes for them to go from application to funding can be as quick as 7 minutes, a time frame I found to be reality after watching the demonstration by Kabbage’s COO, Kathryn Petralia.

Kababge’s blazing speed is made possible by access to big data, which made Petralia an excellent choice to have on the Big Data Credit Decisioning Panel. She was joined by Noah Breslow of OnDeck Capital, Jeff Stewart of Lenddo, and Paul Gu of Upstart.

Stewart, whose company lends internationally presented the idea of mining not just data on social networks, but the photographs on them. One possibility was measuring whether or not borrowers appeared in photographs with other borrowers known to be bad, or whether or not they hung out with undesirables such as ex-convicts. He was a big believer in association risk, speculating that friends of bad borrowers also made them more likely to be bad borrowers themselves.

Breslow of course said you have to be careful with the noise of social media as there can be a lot of false signals. Does that mean there are big data problems then? Upstart’s Paul Gu said, “we have small data problems” in reference to why there seems to be so much trouble evaluating applicants that have little to no credit history. Gu believes that basic information such as where a borrower went to college, their major, and their grades can be used as an accurate predictor of payment performance and his company has acquired the data to back that up.

Breslow of course said you have to be careful with the noise of social media as there can be a lot of false signals. Does that mean there are big data problems then? Upstart’s Paul Gu said, “we have small data problems” in reference to why there seems to be so much trouble evaluating applicants that have little to no credit history. Gu believes that basic information such as where a borrower went to college, their major, and their grades can be used as an accurate predictor of payment performance and his company has acquired the data to back that up.

Somewhere along in the discussion though the meaning of automation got twisted. OnDeck for instance has an automated process, yet humans play a role in 30% of the loan decision making. Does that mean they are not actually automated? Breslow clarified that aggregating data from many different sources using APIs and computers was automation and that there was still a role for humans. The goal is to make sure that humans aren’t doing the same things that the computers are doing.

“The world’s greatest chess human can beat the world’s greatest chess algorithm,” said Lenddo’s Stewart. “Humans should be pulling what the algorithms can’t think of,” added Breslow. He presented an example of an applicant satisfying all of an algorithm’s criteria but sending up a red flag at the human level. “Why would the owner of a New York restaurant live in California?” Breslow asked. That’s something an algorithm might get confused about. It might mean nothing or it might mean something.

“The world’s greatest chess human can beat the world’s greatest chess algorithm,” said Lenddo’s Stewart. “Humans should be pulling what the algorithms can’t think of,” added Breslow. He presented an example of an applicant satisfying all of an algorithm’s criteria but sending up a red flag at the human level. “Why would the owner of a New York restaurant live in California?” Breslow asked. That’s something an algorithm might get confused about. It might mean nothing or it might mean something.

“Algorithms are probabilistic,” Stewart reminded the audience. They spell out the likelihood of repayment, they don’t guarantee it.

For Kabbage, algorithms and automation have been instrumental in allowing them to scale. “I don’t need to hire a lot more people to serve a lot more customers,” Petralia explained.

“Let the data speak for itself,” Breslow proclaimed. And there is a lot of statistically interesting data. “People with middle names perform better than people without them,” added Breslow.

For Gu, borrowers with degrees in Science, Technology, Engineering, and Mathematics fare better than their academic peers, though he wouldn’t reveal which major is #1. That information, while probably available to OnDeck, likely plays little or no role. “There is a lot more data to analyze on the business side than the consumer side which is why [things like] the social graph is a little less relevant,” Breslow said.

In the end, lenders don’t need to go on a wild data goose chase to learn all about their prospective clients. Kabbage applicants for instance are asked to provide their online banking credentials in the very first step of the applications. “A lot of people would be surprised as to the amount of data borrowers are willing to share,” Petralia proclaimed. Indeed, many alternative business lenders and merchant cash advance companies are analyzing historical cash flow activity using third party aggregating services like Yodlee, something that requires the client’s credentials.

During Kabbage’s earlier demonstration, some members in the audience worried that factors such as deposit activity could be gamed. Petralia assured them that their algorithm was sophisticated enough to detect manipulation and at the same time explained that they analyzed far more than just deposit and balance history.

Perhaps all this technology though has gone overboard. Is it possible to predict performance just based on what the applicant says? Believe it or not, “the language someone uses is an indicator of default probability,” Stewart said. But even that kind of detection has become automated. “Lenddo uses semantic analysis. People tend to use different words when they’re desperate.”

Who knows, a year from now getting a loan might be as easy as picking up your phone and saying, “Siri, send money.” Just make sure to delete all the photos of you hanging out with criminals off your phone first. A lender might use them against you.

LendIt Conference: The State of Alternative Business Lending

May 6, 2014 Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

The biggest challenge the wider alternative lending industry faces is awareness and understanding. Those happen to also be two of Suber’s three edicts for growth. The third is education. Just because alternatives are available today doesn’t mean that potential borrowers know about them or feel comfortable enough to use them. Today we are competing against the old way of thinking.

Revolution?

Other products in the new “share economy” have encountered a similar struggle. Several presenters today cited Uber as having revolutionized the way people use taxis. “A long time ago, people used to stand on corners and hold out their hand to get a cab, but that’s all changed,” was the oft-paraphrased proof that age-old industries were falling like dominoes. But as a New York City resident, I hadn’t quite noticed a change at all. Hailing cabs off the street is still very much the norm. It is only by sheer coincidence that I used Uber for the very first time to travel to JFK airport on my way to this conference.

I first encountered Uber a year ago when an acquaintance dazzled me with his ability to summon a car using an app on his phone. It was then that I became aware, but I did not understand how it worked. It took me 12 months to get comfortable enough to try it myself, and the experience was okay I guess if you discount the fact that my driver went through the E-ZPass lane without actually having an E-ZPass. Needless to say, that led to a major holdup that caused me to almost miss my flight.

If it took me a year to get past the confusion of hailing a cab from my phone, I can only imagine what potential borrowers must think when told they can raise money from their peers, the crowd, or a lender that requires payments to be made every single day.

Perhaps most telling about the awareness challenge, is that many people I’ve spoken to at LendIt had never heard of a 16 year old product known as merchant cash advance. That speaks volumes about how much more work merchant cash companies still have to do in order to gain mainstream awareness.

Even those fully aware were not entirely certain about how to define the product. In the Online Lending Institutional Investors Panel, merchant cash advance was briefly discussed as a topic but it was almost entirely spoken in the context of being something that OnDeck Capital does. That would come as disheartening news to OnDeck since they have spent considerable resources in positioning themselves as anything but a merchant cash advance company. Confusion over what somebody is or isn’t will probably increase especially as alternative lenders from different industries start to compete for the same clients.

Funding businesses instead of people

Brendan Ross, the President of Direct Lending Investments, and the moderator of the Short Term Business Lending panel pointed out that a dentist could pursue two different loan options and get completely different results. With excellent credit a dentist could expect to land a 3-5 year personal loan at 7-8% APR on a P2P platform. If he were to apply for the loan using his dental practice though, he could expect to incur costs over 25% and get nothing longer than 2 years.

Ross, who was a very active moderator, subscribes to the belief that businesses are overpaying for credit. Unlike the consumer loan space, there hasn’t been price compression. The cost of business capital remains high, perhaps higher than what is necessary to turn a reasonable profit. Ross argued that the padded cost serves as a hedge against defaults and economic downturns. “The asset class works even when the collection process doesn’t,” Ross said. “The model works with no legal recovery.”

Building on that premise, Ross asked the panelists if an increase in defaults were simply the cost of doing business towards automating the underwriting process.

Stephen Sheinbaum, the CEO of Merchant Cash and Capital argued that just the opposite had occurred, that automation had led to a decrease in defaults. Others on the panel confirmed a similar outcome, though Rob Frohwein of Kabbage admitted they could potentially weather higher defaults through automation by offsetting it against decreased infrastructure costs.

Noah Breslow of OnDeck echoed something similar to Frohwein in the Small Business Term Lending Panel. He asked this question, “Do underwriters add value or not?” and followed up by saying that 30% of their deals were still manually underwritten, usually the deals that are larger.

Is full automation right around the corner?

The debate between humans and computers in risk analysis is a featured segment in the third issue of DailyFunder that is being mailed out this week, but there is another angle that is seldom discussed, whether or not customers want automation. Breslow said today that, “if customers want full automation, we are prepared to deliver it.” They’ve learned over time that “many customers want someone to talk to at some point in the transaction.” Rohit Arora, the CEO of biz2credit expressed much of the same in a recent interview with DailyFunder’s Managing Editor Michael Giusti.

The only dissenting voice was Gary Chodes, the CEO of Raiseworks who seemed to be of the belief that human involvement in underwriting was nothing short of ridiculous. He stated that, “if you look back over the last 20 years, the loss rates on business loans under 24 months has been really low.” To him, that data seemed to be proof enough that complete automation could and should be achieved, though he admitted to performing back-end checks such as landlord verifications. They currently have no physical underwriters however.

Is there a transparency problem?

Tom Green, a VP of LendingClub shared an interesting tale. While trying to convince potential borrowers to ditch a merchant cash advance in favor of a LendingClub business loan, they get pushback on the cost of their money. The reason being? Some borrowers think they’ve already got a great deal or at least a better deal than what LendingClub is offering. The problem stems from the borrower’s belief that the holdback percentage set up in their future revenue sale (the most common way a merchant cash advance is set up) is the APR.

Merchant Cash Advance Companies pay cash upfront in return for a specified amount of a businesses’s future sales. They collect these sales by withholding a percentage of each credit card transaction or bank account deposit until the agreement is satisfied in full. On a dollar for dollar basis, the cost of these programs typically range from 20%-49%, but on an APR basis, substantially higher. The holdback % is not even a factor in the APR. Green said they’ve learned that some small business owners are not sophisticated when it comes to finance.

Merchant Cash Advance Companies pay cash upfront in return for a specified amount of a businesses’s future sales. They collect these sales by withholding a percentage of each credit card transaction or bank account deposit until the agreement is satisfied in full. On a dollar for dollar basis, the cost of these programs typically range from 20%-49%, but on an APR basis, substantially higher. The holdback % is not even a factor in the APR. Green said they’ve learned that some small business owners are not sophisticated when it comes to finance.

Ethan Senturia, the co-founder of Dealstruck would probably agree. Earlier today he said, “you need to speak the borrower’s language.” Some understand APR, some don’t. “Dealstruck offers more than just APR comparisons to borrowers,” Senturia said. “Whatever helps them understand.”

When the OnDeck Capital model and merchant cash advance model were questioned as possibly being bad for borrowers, Tom Green was quick to clarify. “There are different capital needs that small businesses have,” he said. And “there is a trade-off between the length of the term and the risk.”

OnDeck Capital’s clients are not entrepreneurs born yesterday. “The typical customer has been in business for 10 years,” Breslow said. Their deals are “structured to protect through daily and weekly payments in addition to the interest rates we charge,” something he reminded everyone was “not single digits.”

Still, transparency issues remain in business lending. Sam Hodges, the Managing Director of Funding Circle explained that when he was previously a small business owner, there were hardly any lenders willing to provide him with an amortization schedule. Ashees Jain, a managing partner of Blue Elephant Capital Management admitted he would find it hard to justify the high rates of merchant cash advance if asked by a regulator, so he’d rather not invest in that market. When it comes to those types of transactions, they “don’t want to have to explain themselves” at some point in the future.

Scott Ryles, the managing member of Echelon Capital Strategies, LLC commented on OnDeck capital’s model as unbelievable. “The arbitrage is huge,” Ryles said. And Eric Thurber the managing director of Three Bridge Wealth Advisors believes that alternative business lenders are at odds with themselves. “They always talk about their risk management,” Thurber said, but he feels that players in that industry are concerned with how much market share they have. That conflicts with risk management in his opinion.

They pay or they don’t

At the end of the day Ashees Jain said as far as unsecured loans go, “borrowers pay or they don’t.” The recovery process on secured loans can be 12-18 months Jain said, a statistic cited by Brendan Ross earlier in the day.

It’s clear at LendIt that there are a lot of products available, but Ryles summed it up nicely. In the consumer space, all the volume is in the 36 month installment loans, he reckoned. For businesses it’s merchant cash advance. “It’s an awareness thing,” Ethan Senturia said in regards to getting businesses to use alternative lending sources.

It is indeed. Awareness, education, and understanding…

Securitization Begins in Alternative Business Lending

May 1, 2014 It’s official, alternative business loans can now be pooled up and sold off to investors. On Wednesday, OnDeck Capital announced a $175 million transaction made possible by issuing fixed rate notes backed by their loans.

It’s official, alternative business loans can now be pooled up and sold off to investors. On Wednesday, OnDeck Capital announced a $175 million transaction made possible by issuing fixed rate notes backed by their loans.

Their Class A notes were rated BBB by DBRS while the Class B notes received a BB.

According to DBRS, BBB grade are of “Adequate credit quality. The capacity for the payment of financial obligations is considered acceptable. May be vulnerable to future events.”

BB grade are “Speculative, non-investment grade quality. The capacity for the payment of financial obligations is uncertain. Vulnerable to future events.”

While it’s popular to refer to alternative business lending as highly speculative and fraught with risk, it’s notable that a highly respected ratings agency would not officially bestow OnDeck’s loans with a label to match that. A single B would’ve signified a highly speculative investment and CCC, CC, and C would signal danger. But OnDeck’s Class A notes are up to snuff as investment-grade level material.

OnDeck has been dogged by critics over the last few years, most of whom are their competitors. The argument goes that their practice of undercutting the rest of the industry on rates is doomed to fail. Those theories are bolstered by the very public knowledge that they have yet to turn a profit. Back in March, CEO Noah Breslow was quoted in the Wall Street Journal as saying they were “imminently profitable“, an optimistic yet openly ambiguous indicator of where they stand. Since they are not a publicly traded company, they are not required to disclose their financial statements.

While DBRS serves to validate OnDeck’s policies and approach, word that they had achieved “investment-grade” status did little to pacify their critics. Yet, for a company that places a remarkably heavier focus on credit modeling and technology infrastructure than the majority of their peers, there is always the possibility that OnDeck is actually as smart as they want everyone to believe. Four months ago it was reported that “fifty-six of their 225 employees have backgrounds in math, statistics, computer science, or engineering.” Contrast that with some of the small and mid-sized players that are largely focused on ISO recruitment and sales.

While I haven’t seen a prospectus in its entirely, I’ve learned there are quite a few ground rules in place for these notes. For one, these loan pools have to be diversified. That means no secretly packaging up all the loans in a risky zip code in Nevada and selling them off as a BBB rated note. There are concentration limits in place to reduce risk. Below are the maximum thresholds allowed in a pool based on their location:

Obligor Located in California 20.0%

Obligor Located in Florida 15.0%

Obligor Located in New York 15.0%

Obligor Located in Texas 15.0%

Obligor Located in Any Other State 10.0%

If a concentration limit is exceeded, the issuer is required to maintain additional credit enhancement. I’m not surprised at all that California, Florida, New York, and Texas are singled out. In addition to being among the most populous in the country, they are the heaviest users of alternative business loans and merchant cash advances. There’s also the theory that Floridians are statistically the least likely to repay a loan, as openly discussed in The Joy of Redlining, a controversial assessment borne out of the peer-to-peer lending crowd.

If a concentration limit is exceeded, the issuer is required to maintain additional credit enhancement. I’m not surprised at all that California, Florida, New York, and Texas are singled out. In addition to being among the most populous in the country, they are the heaviest users of alternative business loans and merchant cash advances. There’s also the theory that Floridians are statistically the least likely to repay a loan, as openly discussed in The Joy of Redlining, a controversial assessment borne out of the peer-to-peer lending crowd.

There are other concentration limits to adhere to such as the OnDeck Score range (not FICO score range), size of the outstanding principal, industry type, and repayment time frame.

Notably, recognition and acceptance of the proprietary OnDeck Score in concentration limits is a major achievement for them. Breslow previously referred to the OnDeck Score as “the Main Street equivalent of FICO” in American Banker.

Additionally, OnDeck’s reliance on ISOs/brokers for originations is shrinking. In 2013, their direct marketing channel accounted for 43% of their deal flow, compared to only 12% back in 2010. This is a step in the right direction for them financially as broker commissions are on the rise. Increasing the direct marketing percentage will serve as a hedge against increasing third party origination costs.

So what’s next?

For now, OnDeck Capital can enjoy the liquidity gained through securitization and focus on more important things like growth and profitability. Profits are a must in the current IPO environment. Payment company Square had their IPO hopes dashed when word of their losses were leaked to the Wall Street Journal. That came as a shock to the general public. Meanwhile everybody already has an idea of where OnDeck stands, sort of. They’re either brilliant or doomed to fail. I’d say an independent assessment that they’re capable of issuing investment grade notes, increases their odds of brilliance.

Whatever your feelings, they have set a powerful precedent for secuitization. As these notes were reportedly oversubscribed, investors will be looking to their competitors for a taste. OnDeck just whet the appetite. Additional securitization in this industry could be right around the corner. One might say it’s… imminent.

CAN Capital Still King – $4 Billion Funded

April 29, 2014While college kids across the country are creating alternative lending platforms in their dorm rooms, industry king CAN Capital announced today that they have provided small businesses with more than $4 billion. That puts them on pace to be funding approximately $1 billion a year. ($3 billion milestone back in March 2013).

Word apparently leaked out on DailyFunder ahead of time, drawing several members to tip their hats on the achievement.

As of March 31, Lending Club had also surpassed the $4 billion mark, but with a major distinction, it was almost entirely consumer loans. In the business space, CAN Capital remains on top after 16 years, which sadly makes them older than some of the kids writing code in this industry.

In a lot of ways, code has become the new focal point of alternative lending. There’s sex appeal in having a NASA-worthy underwriting algorithm right now and everybody’s getting caught up in it, some at their own peril.Why stop at a hundred data points when you can have a thousand? Screw it, why not TEN THOUSAND?!

While strong on technology, CAN originates like a boss, having funded over 55,000 small businesses. The tech side is challenging enough for some companies, but it’s the difficulty in marketing that catches many entrepreneurs off guard. In Alex Binkley’s requiem of a defunct startup, Funding Community, he detailed the challenge in generating interest. Who you attract is not always who you’re looking to fund in business lending.

In 2014, there’s no shortage of sexy buzzwords dazzling investors, yet it’s a 1990’s era funding company that continues to dominate. Three out of four eligible customers return to them for additional funds according to their report. Having survived Y2K, the dot com bust, and the financial crisis, they are proof that it takes a lot more than fancy code and a catchy name to master the risky world of business lending. With 16 years worth of data, it may take until 2030 for this year’s new entrants to truly know what they know. $4 billion says a lot but it’s standing tall through both the good times and bad that makes all the difference.

—–

Photos borrowed from HBO’s Silicon Valley series.

What if there were Trigger Leads?

April 27, 2014 Just recently, a user in DailyFunder’s forum complained that a deal of his had been poached by a competitor. There’s nothing new about that story, but it is what followed that drew interest. He was in the process of renewing his client for additional funds, when out of the blue popped up a competitor that called his client to tell them not to sign the contract they had in their hands until they heard his better offer.

Just recently, a user in DailyFunder’s forum complained that a deal of his had been poached by a competitor. There’s nothing new about that story, but it is what followed that drew interest. He was in the process of renewing his client for additional funds, when out of the blue popped up a competitor that called his client to tell them not to sign the contract they had in their hands until they heard his better offer.

As it was suspiciously timed and curiously specific, he decided to reach out to the alternative lending community for their thoughts. One possible conclusion offered was that the competitor was being fed trigger leads.

Trigger leads?????????????????

Forget UCCs folks. UCCs detail transactions that have already happened and we’ve all seen what they’ve done to the merchant cash advance and alternative business lending industry. Companies are scared to file them now. But what if all of your competitors were notified every time one of your deals was submitted to underwriting? You get the app signed, you submit the file, and the next day 10 companies have called your client to offer them a better deal on funding than whatever terms you were about to offer. What gives?

Popular in the mortgage industry, the credit bureaus can actually sell credit inquiry data to lenders. So imagine every time credit gets pulled on a deal, the merchant’s info is sent out to your competitors for a fee.

Dave Sullivan explains Trigger leads below:

There was no way to tell for sure if that was what happened in this situation, and I’ve yet to hear of trigger leads being used in the alternative business lending industry but if someone was getting them, I’m sure they’d want to keep their source top secret.

Can you imagine what kind of chaos would ensue if this became commonplace in our industry?

😉

Square Bears Attack

April 21, 2014It was the PR nightmare that wouldn’t end. With Easter Sunday still warm on everyone’s minds, bloggers went for the jugular over Square’s acquisition rumors. Whether based on fact or fiction (nobody seemed to know for sure), Alistair Barr, Douglas Macmillan, and Evelyn Rusli of the Wall Street Journal single-handedly hit Jack Dorsey’s famous payment company with a fresh dose of healthy skepticism. With that came the revelation that Square had lost $100 million in 2013, a dangerously large figure for a company that is apparently plagued with shrinking margins, not growing ones.

What was happening behind the scenes at Square differed in dramatic context depending on which news site you read. Some writers claimed Square executives were considering a well thought-out strategic acquisition in light of a liquidity shortfall, while others insinuated that Jack Dorsey had last been seen raging drunk at a Market Street Starbucks wearing nothing other than flip flops. He reportedly told spectators that a 2% swipe fee was impossible and then he fled out the back door as four Baristas tried to wrestle him down.

When an IPO was taken off the agenda in February, some analysts wondered if their historic rise had come at a cost. In the Wall Street Journal article, it was alleged that the company was potentially less than a year away from insolvency. The quote was, “During the first quarter of 2014, a Square executive told a potential acquirer that the company had nine months before it would hit a predetermined ‘cushion’ of funds set aside as a last resort.” Thanks to the new credit facility they landed this month of nearly $200 million, they should have no problem with cash flow.

But questions remain. People supposedly close to Square confirm that the company had practically begged Visa and Google to acquire them. Though there were stiff denials from all parties throughout the day, it made for some enticing headlines. Square Bears were out in droves today:

But questions remain. People supposedly close to Square confirm that the company had practically begged Visa and Google to acquire them. Though there were stiff denials from all parties throughout the day, it made for some enticing headlines. Square Bears were out in droves today:

Square Is Losing Millions Of Dollars And Wants To Sell – Huffington Post

Why Square Needs To Sell Itself And Do It Quickly – Forbes

Mobile payment startup Square plans sale as losses widen – Reuters

Did Jack Dorsey Do the Math on Square – UpStart Business Journal

Square denies sell-out plans; all eyes on the dicey-looking financials – ZDNet

Mobile-Payments Startup Square Discusses Possible Sale

Company Faces Wider Loss, Less Cash; Google Considered Potential Acquisition – Wall Street Journal

What should also be of note is Square’s recent venture into the merchant cash advance business, which in practice should be a major liquidity drain. One has to wonder if this is a good time to position themselves as a working capital provider when they’re hemorrhaging cash from their payments operations. Besides, providing funding to micro-merchants in return for a split of their future card sales is an incredibly risky business model. One thing the established players in that market have learned is that it’s really easy to lose money if you don’t know what you’re doing.

I sure hope they know what they’re in for. Otherwise Dorsey might really run off drunk to Starbucks.

Business Lending Ain’t Easy

April 16, 2014 I was fortunate enough to stumble upon a marvelous post by Alex Binkley, one of the co-founders of the now defunct Funding Community. In his Blog, Binkley shares the details of a wild 18 month ride in the world of business lending. P2P lending was going great for consumers, so why not businesses? What followed is a lesson that anyone interested in alternative business lending needs to read.

I was fortunate enough to stumble upon a marvelous post by Alex Binkley, one of the co-founders of the now defunct Funding Community. In his Blog, Binkley shares the details of a wild 18 month ride in the world of business lending. P2P lending was going great for consumers, so why not businesses? What followed is a lesson that anyone interested in alternative business lending needs to read.

I’ve copied some of the quotes I think are most relevant below:

On ACH processing:

we were trying to find a way to make our payment processing both inexpensive and simple. Many ACH (bank transfer) companies wanted to charge us high fees because our type of transaction was considered “high-risk” for chargebacks, so instead we started working with a relatively new payment processor called Dwolla. Now, Dwolla does ACH transactions cheaper than just about anyone else, but that cheapness comes with a price. For us, it was ease of use.

On the quality of businesses:

So after our first couple weeks we had just about funded all of out first set of loans and we were furiously trying to get new ones signed up. Here was the rub though. We started to get a little bit of inbound interest, but frankly most of those businesses were in rough shape. When we looked at a small business making gross revenue of $1,000 a month looking for a $10,000 loan we just could not see how our lenders were going to be repaid. Of course this was not every business we were looking at, but it was a huge percentage.

On selling the product:

A total of 83% of Lending Club’s loans are for refinancing existing debt. How amazing is that? You don’t have to convince someone to take on new debt, you just have to be able to convince them you can offer a better deal than their current debt. On top of that, you can piggy back on other lending companies’ credit analysis. Our company was built on the idea that the credit markets were too lean for small business, which means that we were built on the idea of originating new debt as opposed to financing old, a much more challenging (and expensive) proposition.

On origination fees as a revenue driver:

Because all of our loans were 9-month loans and we were trying to keep total cost down to borrowers we felt we could not charge origination fees nearly that high.

On ancillary opportunities in business lending:

One aspect of our model we were pitching to investors was that small business lending is very different than consumer lending. When you make a loan to a consumer you really don’t have a lot more to offer that consumer (except maybe more loans). When you make a loan to a business or theory was that you then had the ability to sell a lot of ancillary products to that business.

On not having state of the art technology to track loan repayment and performance:

We started to get questions and concerns about what was happening with peoples’ money. It was all safe and was all being put into the loans intended, but because the transparency was not there some lenders became very concerned.

Business lending ain’t easy…

Read the entire story on Binkley’s blog.

Alternative Lending Took Over Transact 14 (PHOTOS)

April 13, 2014Think the payments industry is just about banks and hardware companies? Think again! The ETA conference continuously hosts the largest gathering of alternative lenders and merchant cash advance companies year after year. Below are some photos from the Transact 14 show:

The Money Team AKA Merchant Cash Group were out in force.

Noah Breslow and Paul Rosen of OnDeck Capital

American Finance Solutions having fun at their booth:

Booth 339 at ETA still rocking the show at 100% pic.twitter.com/V8SMqhhpOZ

— AFS (@AFSBusinessLoan) April 10, 2014

Seth Broman of Merchant Cash and Capital showing off CAMS

Renier showing off Swift Capital’s 1 hour funding program

Seth Broman (MCC), myself (deBanked), Matthew Washington (Fora), Michael Hollander (NLF), and Andrew Mallinger (Fora) roughing the frozen tundra of Minus5 Ice Bar

Mitch Levy (AmeriMerchant) and myself.

Strategic Funding Source is all business…

We had such a great time meeting you all at #ETATRANSACT by @ElecTranAssoc! Can't wait until next year! pic.twitter.com/V3b6ybtTBw

— Strategic Funding (@SFSCapital) April 11, 2014

I spy RetailCapital

Working the ETA show #transact14 pic.twitter.com/FQzaDfA0j9

— RetailCapital (@RetailCap) April 9, 2014

Everyone’s shoes were shiny thanks to IOU Central

CAN Capital went big as usual

We're sponsoring the today's CEO roundtable at #ETATRANSACT – come check us out after at booth #825! pic.twitter.com/Xz3l38CVlp

— CAN Capital (@CANCapital) April 10, 2014

Attendees were all like

There were sweet views from the parties hosted by North American Bancard and Priority Payments, but what happened at them stayed in Vegas. 😉

Want to be included? Send me your photos or links to your photos! e-mail me at sean@merchantprocessingresource.com.