MPR Authored

Is Awareness of Alternative Lending Still Low?

July 4, 2014 Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist.

Prosper’s President Ron Suber and LendingClub’s CEO Renaud Laplanche have previously explained that there is still a large opportunity for growth because most people still don’t know non-bank lending options exist.

As cited on LendingMemo, Renaud Laplanche admitted the reason they are even considering an IPO is “to use it as an opportunity to raise awareness for the company.” He continued by saying that they don’t need capital so the purpose of their IPO aspirations “is a lot of free advertising.”

In casual conversations with business owners, friends, and new acquaintances I’ve asked if they’ve ever heard of merchant cash advance, p2p lending, or companies like OnDeck Capital and LendingClub. The answer is almost always ‘no’.

That means there is still a lot of work to do.

In this CNBC interview Funding Circle acknowledges that many business owners aren’t aware of alternatives and explains what makes them different.

Does Culture Make a Difference?

June 30, 2014I came across this video that describes the work culture of Kabbage, an Atlanta-based business lender. It’s strikingly different from the way many of the MCA and business lending companies in New York operate.

Though New York is well-known for its medieval dungeon-like office environments, especially for smaller companies just getting started, do it too long and you start to believe that offices are like that everywhere.

What do you think? Is the Kabbage work environment more conducive to productivity and growth?

Alternative Lending Advances: Go Ahead and Eat My Lunch

June 28, 2014Yesterday it was reported that the well-known peer-to-peer loan platform LendingClub had dubbed Morgan Stanley and Goldman Sachs to work on their IPO later this year. Going public would advance the legitimacy of the wider alternative lending industry and solidify its place in the mainstream.

The Wall Street Journal states, “As the most visible company in the growing space, Lending Club’s IPO will likely be watched carefully by a number of other firms such as OnDeck Capital Inc.”

Many folks have asked me if I syndicate and technically I do, just not in merchant cash advances. For one, that opportunity is largely reserved to brokers and institutional investors, neither of which currently describes me.

Instead I dabble in LendingClub-issued personal loans and I adhere to one major ground rule, I don’t lend to business owners.

While that rule might seem to stand in stark contrast to what I preach (support for alternative business lending), there is a reason I won’t do it on LendingClub’s platform:

1. The rates LendingClub charges to business owners are too low (about 6-26% APR)

1. The rates LendingClub charges to business owners are too low (about 6-26% APR)

2. The terms are too long relative to the risk (3 or 5 year terms)

Earlier this year the Federal Reserve conducted a study that found “[p2p] loans for small business purposes were more than two-and-a-half times more likely to perform poorly.” They also acknowledged that “lending to small businesses is generally considered to be riskier and more costly because small firms have higher failure rates and are more vulnerable to downturns in the economy.”

Therein lies my dilemma, the risk that loans to business owners at those rates will result in a net loss. As a lender, I happen to be in the unique position of trying not to lose money. I know such thinking is greedy, antiquated, and close-minded but I welcome those with opposing philosophies to eat my lunch.

In a recent Bloomberg article, writer Pat Clark put the high interest business lending community on notice by touting Opportunity Fund’s 15% APR EasyPay business loans. Of course by booking an average of only 5 loans a month, their model is not built to scale. Compare that to for-profit alternative lender CAN Capital, whom has funded more than 55,000 small businesses since inception.

Opportunity Fund’s VP of Small Business Lending Marco Lucioni is quoted in the article as follows, “If you have taken out a merchant cash advance, I guarantee you that our refinance program will save you money and could even cut your payments in half.”

Their revolutionary system works for one reason, they are not a for-profit business. Opportunity Fund is a California-based charity. Less than two years ago Lucioni admitted to another Bloomberg writer, “EasyPay is a real loan, with a fixed simple interest rate that works out to be about 12 percent on an annual basis. At that rate, the nonprofit is not covering its costs.” He continued, “Opportunity Fund subsidizes the loans to keep them cheap.”

I have a difficult time with tidbits like “not covering costs” and “nonprofit organization”. As an individual lender on a platform like LendingClub I am forced to make a significantly less informed decision than the one Opportunity Fund is afforded. LendingClub only tells me simple things like credit history of the business owner, how much debt they have, and how much their monthly salary is. In short, I am not privy to the 2,000 data points that OnDeck Capital has at their disposal, a lender that charges significantly more than the California-based nonprofit.

If Opportunity Fund is substantially more informed and admittedly losing money at an annualized rate of 12%, why should I as an individual retail investor expect better results at the same or lower rate?

And just how short is Opportunity Fund coming up on covering their costs? Is it a lot or a little? It might not be outlandish to suppose that the break-even point lies in the 20% or 30% interest range… or even higher.

Above all, Opportunity Fund’s EasyPay loan program began in 2010, meaning there is no data on their performance in a recessionary economy.

This supports the case that in purely prosperous times, the odds of turning a profit on a 3-year loan to a small business owner at 12% or less is at best unfavorable. And when realizing that terms of 3 years and longer increasingly expose lenders to an economic downturn and higher loss ratios, I can only reach one conclusion; I cannot lend to small business owners at low rates over long terms and expect my investment to be safe.

To put this into additional perspective, prior to 2009, merchant cash advance companies believed they hedged the risk of economic uncertainty by limiting the amount of time their capital was outstanding to 6-9 months. They were wrong. The impact of a major recession was swift and devastating. The loss rate climbed so fast that many merchant cash advance companies declared bankruptcy.

For a time, the lesson learned was that 6-9 months of exposure was too long, not that it was too short. Indeed, 2010 and 2011 birthed an entirely new breed of merchant cash advance products, programs where capital exposure was limited to only 2-4 months. These products still exist today and are widely considered to be the profit center in the alternative business lending industry.

With the Great Recession far behind us, many new entrants to business lending have written off the long term risks. Suspiciously, default risk today has shifted from balance sheet lenders to peers, the crowd, and charitable donors.

LendingClub for example has no exposure to defaults as they are nothing more than a platform for investors and individuals like myself to lend to consumers.

Opportunity Fund is a subsidized nonprofit.

As you continue down the list of alternative business lenders, you’ll notice the trend is the same. Lower rates with longer terms offered by companies bereft of default risk. Curious, isn’t it?

Small business owners, journalists, and loan brokers tasked with securing the best terms for their clients are cheering this trend on. Who can blame them? It’s easy to get caught up in the excitement of technology-driven innovation and lower rates in a new world devoid of traditional banks. It’s absolutely a good thing for business owners. But today’s platform lenders dangle interest earning opportunities that beat savings account rates a hundred times over and sing a song that longer terms are in investors’ own interest. Are you willing to bear the risk they urge you to take?

I participate in LendingClub’s platform loans. To date, I’ve contributed to more than 800 of them. But I refuse to believe that a long term business loan at 6% is somehow a good investment when a competitor is:

1. charging double while still losing money in a stable economy

2. has access to more underwriting data than me

3. a nonprofit

If OnDeck Capital has spent years of mathematical research to get short term business loan rates down to 54% APR on average, why should the average John Doe retail investor reasonably expect to do well on vastly longer term loans with substantially reduced rates?

As the alternative lending industry advances, they don’t want peers, the crowd, and donors to ask themselves that question.

It’s a “pay no mind to the man behind the curtain” scenario. That guy’s just somebody that had to bear the liability of his own underwriting decisions. They fixed that issue by making it your problem. Fund faster, earn less, ignore history, and extend terms over longer periods of time. What could possibly happen?

Eight years ago I got my start in the merchant cash advance industry as none other than an underwriter. I know a bad deal when I see one. They’re not as obvious to everyone else.

I’ve said it a million times and I’ll say it again, business lending is fraught with risk. Eat my lunch and you won’t live past dinner.

Is Larry King a Funding Spokesman?

June 25, 2014This commercial is making the rounds on TV and some folks are wondering if this is indeed Larry King. I think it is:

The commercial states that Larry King is a remunerated endorser of LendVantage and his face is all over their promotional materials like facebook.

Is it him? Follow the thread on DailyFunder.

Making Cents of Short Term Business Lending

June 22, 2014Where do you see yourself in 5 years? Perhaps you’ve seriously planned what you’ll be doing in mid-2019 or maybe you at least have an idea of how things will play out. It’s only a half a decade after all so how hard could it be to foresee the future?

Surely all of us saw the DOW surging 5 years ago and got rich right?

Did New Yorkers factor Hurricane Sandy into their 5 year plan back in 2009?

It’s only 5 years, what could possibly happen to a small business in that time?

As I recently logged onto LendingClub to invest in consumers loans, I began to wonder just how safe the 60 month terms were. Not that I have a lot of options since LendingClub only offers 3 or 5 year terms, but the latter is unquestionably risky. The borrower might look good now, but where in the heck will they be in 5 years? I can’t even begin to guess.

Mortgages, student loans, and car leases aside, I can think of very few reasons to use a 5 year loan from a personal perspective, mainly because that’s an extremely long commitment. For a small business, such a term far exceeds the rationale behind “working capital”, the reason oft-cited by businesses seeking less than $200,000.

The Small Business Administration’s website speaks of this:

Businesses that are seasonal or cyclical often require more working capital to stay afloat during the off season. Although your company may make more than enough to pay all its obligations yearly, you must ensure you have enough working capital at any one time to meet your short term obligations. For example, a company may do significantly more business over the holidays, resulting in large payoffs at the end of the year. However, the company must have enough working capital to buy inventory and cover payroll during the off season as well, when revenues are lower.

Working capital may come in handy for something like inventory for which the business probably expects to sell it all off in less than a year. Can you imagine still making monthly payments in 2019 for inventory you bought with a loan in 2014?

I bet this guy can’t:

And if the financial picture looks great and they have a long term need, why not go out 5 years?

Verizon replaced Washington Mutual. But a Verizon store, that will last forever…

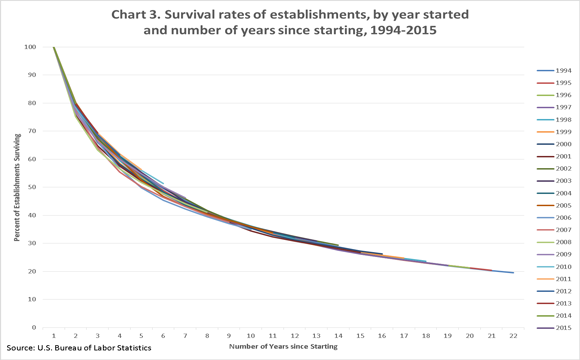

Only 41.1% of retail businesses live to experience their 5th birthday.

And even then when business types are aggregated, making it past year 5 doesn’t ensure lifelong success. Don’t confuse established with safe:

In fact, even borrowers are opting for shorter term loans with higher interest rates than long term loans with lower interest rates. Part of that is due to the lower net dollar cost paid for the loan said OnDeck Capital CEO Noah Breslow in an interview with Peter Renton:

5 years ago I used to spend way too much time on Instagram. Oh wait, no I didn’t… there was no such thing as Instagram.

What do you think is the best bet for this CD store? A 3-6 month working capital loan or a 5 year term loan?

Giving a borrower a lengthy repayment term ensures they will be able to pay you back right?

Above is the result of my $25 contribution towards a 5-year LendingClub loan issued on May 16th. They missed the very first payment. I’m really looking forward to the next 59 months…

In 2019, everything will be business as usual, won’t it Madam President…

As short term business lending critics herald the emergence of 3-5 year term business loans, I think it’s important to remember that they are catering to a market that likely has different goals. Long terms are often not appropriate for borrowers with working capital needs. The CEO of RapidAdvance, Jeremy Brown discussed this in an article he wrote for DailyFunder more than a year ago.

Our industry is based on providing working capital to merchants. By its very definition, working capital is less than 12 months. Longer term deals are permanent capital, even when they are repaid over 15-24 months.

As a borrower, the very idea of committing yourself to monthly payments 5 years from now should be considered very seriously. The average length of a marriage prior to a divorce is 8 years. For past or future divorcees, a 5 year loan is more than half as long as a marriage!

Alternative lenders should be asking themselves if they really have the data and underwriting skills necessary to make accurate predictions that far out in the future. Working capital underwriting models are not applicable as long term assessments.

If you’re going to make 5 year business loans, make sure to take advantage of Google maps. Take a look back at the business location and the ones surrounding it over the last few years. You may not feel so safe about your investment…

Exponential Finance

June 15, 2014 Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Exponential Finance brought together leading experts to inform financial services leaders how technologies such as artificial intelligence, quantum computing, crowdfunding, digital currencies, and robotics are impacting business. And my mind = blown.

Some tweets to hold you over:

Robots may be coming to a bank near you: http://t.co/r0PlWUrYqU #xfinance pic.twitter.com/WYWUhZIUaD

— CNBC Social Team (@CNBCSocial) June 10, 2014

"The more data you produce, the more organized crime will consume." Goodman’s Law. #xfinance Be prepared!

— Exponential Finance (@xfinance) June 11, 2014

"Banks charge 32B in overdraft every year…that's almost as much as the gov. spends on food stamps." – Customers Bancorp CEO at #xfinance

— CNBC Social Team (@CNBCSocial) June 11, 2014

"It is no coincidence that Satoshi Nakamoto published this paper [on Bitcoin] during the financial crisis." #xfinance pic.twitter.com/a9eCWO7OXi

— CNBC Social Team (@CNBCSocial) June 11, 2014

Robots are going to steal your finance job:

I also had the chance to do a Q&A with a longtime prominent U.S. Congressman. The next issue should be available in about 3 weeks.

Access to Capital – A Dose of Reality

June 15, 2014So much for a lack of transparency… While sitting directly next to Maria Contreras-Sweet, the head of the Small Business Administration, OnDeck Capital’s CEO corrected U.S. Senator Cory Booker’s comments about the APR of their loans. High teens? Not so, said Noah Breslow who explained their average 6 month loan has an APR of 60% even while costing only 15 cents on the dollar.

Why is access to capital so expensive? Rob Frohwein, the CEO of Kabbage said that up until recently his company was borrowing funds at a net rate of more than 20% APR. In order to turn a profit, they had to lend at a rate much higher than that.

Great info about democratizing #Access2cap for #smallbiz w/ @CoryBooker @RutgersU. More info @SBAgov pic.twitter.com/qxCu2tbW4z

— Maria ContrerasSweet (@MCS4Biz) June 13, 2014

.@rohitfounder and Sen. @Corybooker at Access to Capital New Jersey #Access2cap pic.twitter.com/FRfoAH2CjU

— Biz2Credit (@biz2credit) June 13, 2014

The Access to Capital small business panel included:

Maria Contreras-Sweet – Head of the U.S. Small Business Administration

Noah Breslow – CEO, OnDeck Capital

Rohit Arora – CEO, Biz2Credit

David Nayor – CEO, BoeFly

Rob Frohwein – CEO, Kabbage

Paul Quintero – CEO, Accion East

Rohan Matthew – CEO, Intersect Fund

Jonny Price – Senior Director, Kiva Zip

Jeff Bogan – SVP, LendingClub

Steve Allocca – Global Head of Credit, PayPal

Jay Savulich – Managing Director of Programs, Rising Tide Capital