Making Cents of Short Term Business Lending

Where do you see yourself in 5 years? Perhaps you’ve seriously planned what you’ll be doing in mid-2019 or maybe you at least have an idea of how things will play out. It’s only a half a decade after all so how hard could it be to foresee the future?

Surely all of us saw the DOW surging 5 years ago and got rich right?

Did New Yorkers factor Hurricane Sandy into their 5 year plan back in 2009?

It’s only 5 years, what could possibly happen to a small business in that time?

As I recently logged onto LendingClub to invest in consumers loans, I began to wonder just how safe the 60 month terms were. Not that I have a lot of options since LendingClub only offers 3 or 5 year terms, but the latter is unquestionably risky. The borrower might look good now, but where in the heck will they be in 5 years? I can’t even begin to guess.

Mortgages, student loans, and car leases aside, I can think of very few reasons to use a 5 year loan from a personal perspective, mainly because that’s an extremely long commitment. For a small business, such a term far exceeds the rationale behind “working capital”, the reason oft-cited by businesses seeking less than $200,000.

The Small Business Administration’s website speaks of this:

Businesses that are seasonal or cyclical often require more working capital to stay afloat during the off season. Although your company may make more than enough to pay all its obligations yearly, you must ensure you have enough working capital at any one time to meet your short term obligations. For example, a company may do significantly more business over the holidays, resulting in large payoffs at the end of the year. However, the company must have enough working capital to buy inventory and cover payroll during the off season as well, when revenues are lower.

Working capital may come in handy for something like inventory for which the business probably expects to sell it all off in less than a year. Can you imagine still making monthly payments in 2019 for inventory you bought with a loan in 2014?

I bet this guy can’t:

And if the financial picture looks great and they have a long term need, why not go out 5 years?

Verizon replaced Washington Mutual. But a Verizon store, that will last forever…

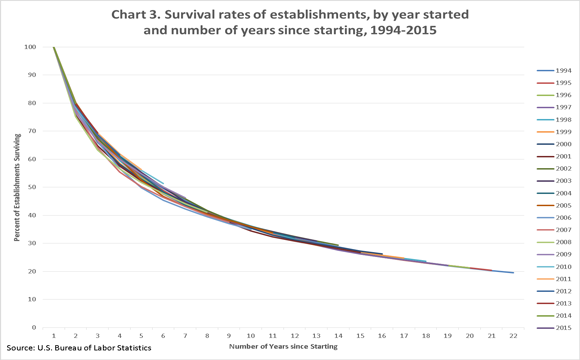

Only 41.1% of retail businesses live to experience their 5th birthday.

And even then when business types are aggregated, making it past year 5 doesn’t ensure lifelong success. Don’t confuse established with safe:

In fact, even borrowers are opting for shorter term loans with higher interest rates than long term loans with lower interest rates. Part of that is due to the lower net dollar cost paid for the loan said OnDeck Capital CEO Noah Breslow in an interview with Peter Renton:

5 years ago I used to spend way too much time on Instagram. Oh wait, no I didn’t… there was no such thing as Instagram.

What do you think is the best bet for this CD store? A 3-6 month working capital loan or a 5 year term loan?

Giving a borrower a lengthy repayment term ensures they will be able to pay you back right?

Above is the result of my $25 contribution towards a 5-year LendingClub loan issued on May 16th. They missed the very first payment. I’m really looking forward to the next 59 months…

In 2019, everything will be business as usual, won’t it Madam President…

As short term business lending critics herald the emergence of 3-5 year term business loans, I think it’s important to remember that they are catering to a market that likely has different goals. Long terms are often not appropriate for borrowers with working capital needs. The CEO of RapidAdvance, Jeremy Brown discussed this in an article he wrote for DailyFunder more than a year ago.

Our industry is based on providing working capital to merchants. By its very definition, working capital is less than 12 months. Longer term deals are permanent capital, even when they are repaid over 15-24 months.

As a borrower, the very idea of committing yourself to monthly payments 5 years from now should be considered very seriously. The average length of a marriage prior to a divorce is 8 years. For past or future divorcees, a 5 year loan is more than half as long as a marriage!

Alternative lenders should be asking themselves if they really have the data and underwriting skills necessary to make accurate predictions that far out in the future. Working capital underwriting models are not applicable as long term assessments.

If you’re going to make 5 year business loans, make sure to take advantage of Google maps. Take a look back at the business location and the ones surrounding it over the last few years. You may not feel so safe about your investment…

Last modified: April 20, 2019Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.